Tokenization Market Report

Published Date: 31 January 2026 | Report Code: tokenization

Tokenization Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tokenization market from 2023 to 2033. It includes insights into market size, growth trends, segmentation, and key players, offering valuable data for stakeholders to make informed decisions.

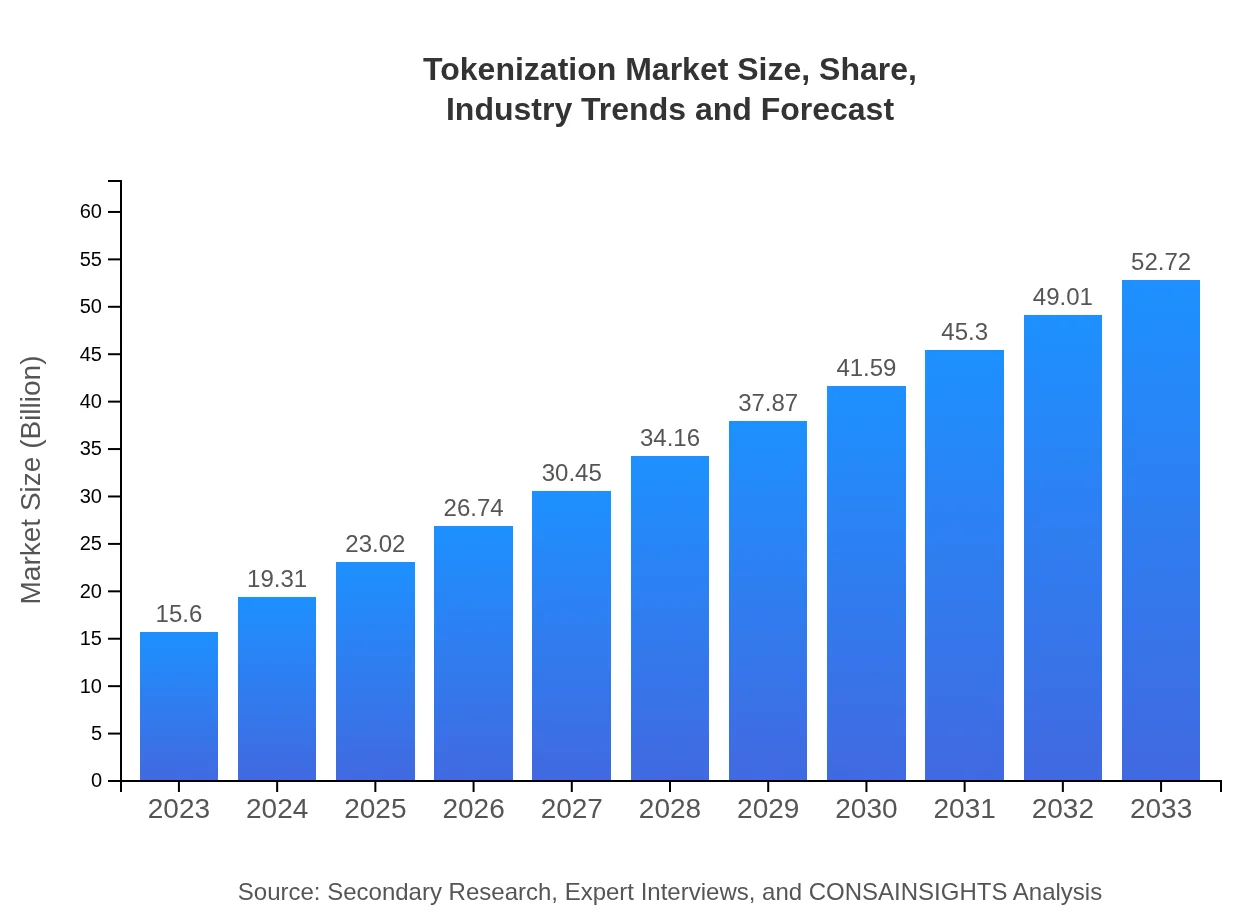

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 12.4% |

| 2033 Market Size | $52.72 Billion |

| Top Companies | TokenEx, Thales Group, IBM, Protegrity |

| Last Modified Date | 31 January 2026 |

Tokenization Market Overview

Customize Tokenization Market Report market research report

- ✔ Get in-depth analysis of Tokenization market size, growth, and forecasts.

- ✔ Understand Tokenization's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tokenization

What is the Market Size & CAGR of Tokenization market in 2023?

Tokenization Industry Analysis

Tokenization Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tokenization Market Analysis Report by Region

Europe Tokenization Market Report:

In Europe, the market is set to expand from $4.08 billion in 2023 to $13.80 billion by 2033. The growth in this region is supported by the GDPR and other data protection initiatives, promoting the need for effective tokenization to secure personal data against breaches.Asia Pacific Tokenization Market Report:

In 2023, the market size in the Asia Pacific is expected to reach $3.13 billion, projected to grow to $10.59 billion by 2033. The region's growth is fueled by increasing digital payment transactions, heightened cybersecurity concerns, and a push for compliance with data protection regulations.North America Tokenization Market Report:

North America's market is forecasted to grow from $5.27 billion in 2023 to $17.82 billion in 2033. The regional growth is driven primarily by stringent regulatory requirements, technological advancements in payment processing, and the presence of leading technology firms capitalizing on security improvements.South America Tokenization Market Report:

The South American Tokenization market size is projected at $1.51 billion in 2023, reaching about $5.11 billion by 2033. Economic growth and a burgeoning fintech sector are key drivers, alongside adoption rates of digital payment solutions that necessitate improved data security measures.Middle East & Africa Tokenization Market Report:

The market in the Middle East and Africa is expected to grow from $1.60 billion in 2023 to $5.40 billion by 2033. Rising awareness of cybersecurity risks and the rapid expansion of e-commerce platforms in the region are significant factors driving the adoption of tokenization solutions.Tell us your focus area and get a customized research report.

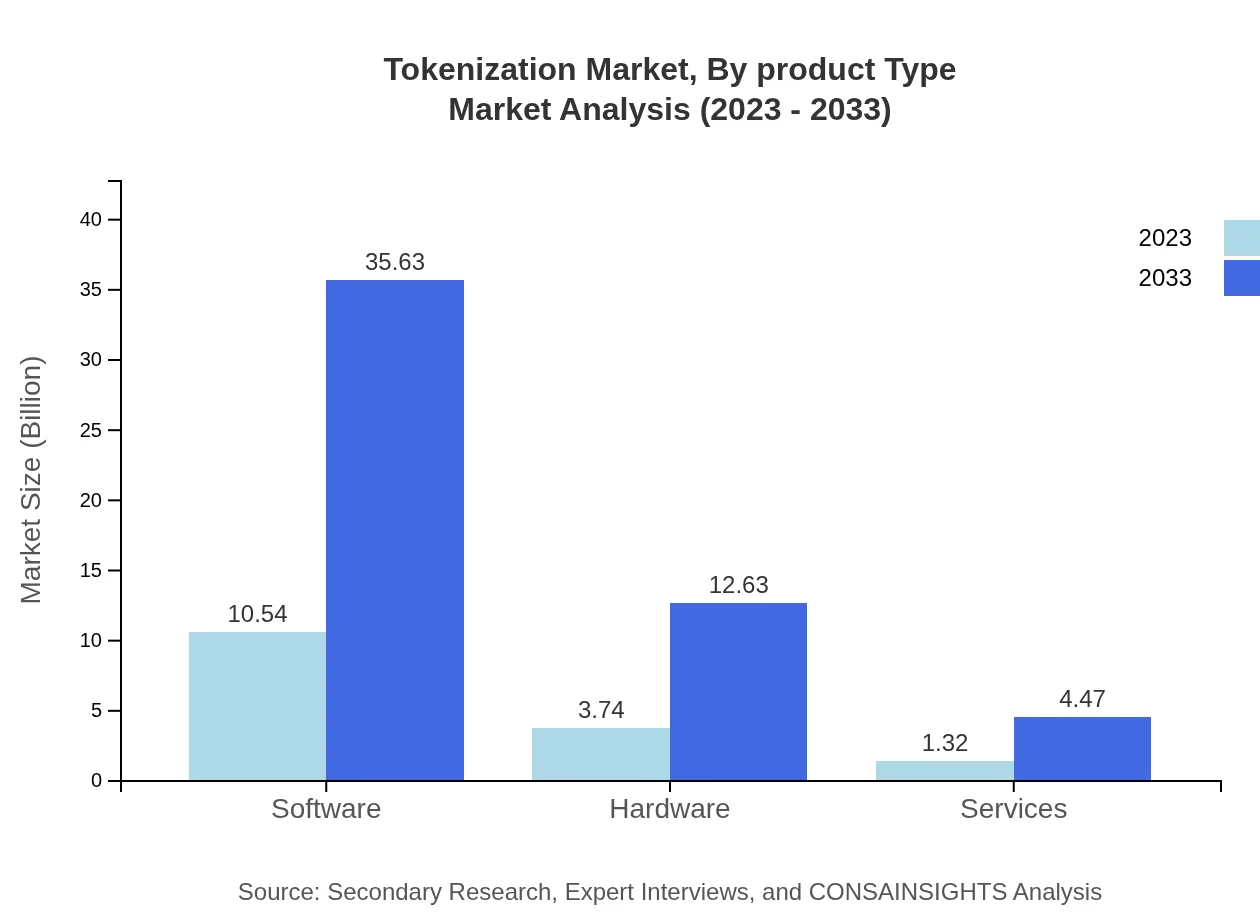

Tokenization Market Analysis By Product Type

Software is expected to dominate the Tokenization market, reaching $10.54 billion by 2033, while hardware will grow to $3.74 billion in the same year. The software segment provides greater flexibility and integration for businesses aiming to bolster security for sensitive data.

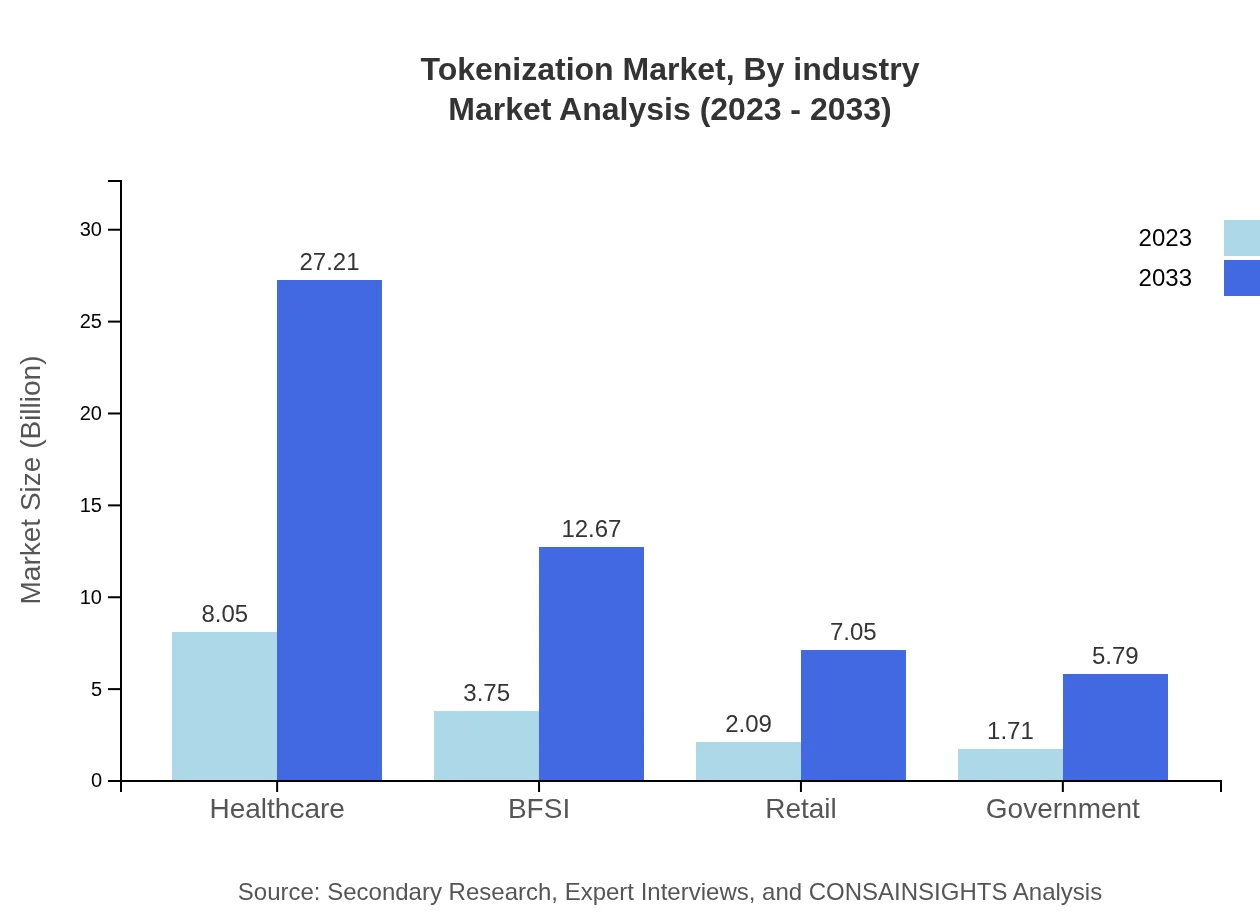

Tokenization Market Analysis By Industry

The healthcare segment is projected to lead the Tokenization market, with a size climbing from $8.05 billion in 2023 to $27.21 billion by 2033. BFSI follows closely, anticipated to increase from $3.75 billion to $12.67 billion during the same period, highlighting the critical need for secure data handling in financial transactions.

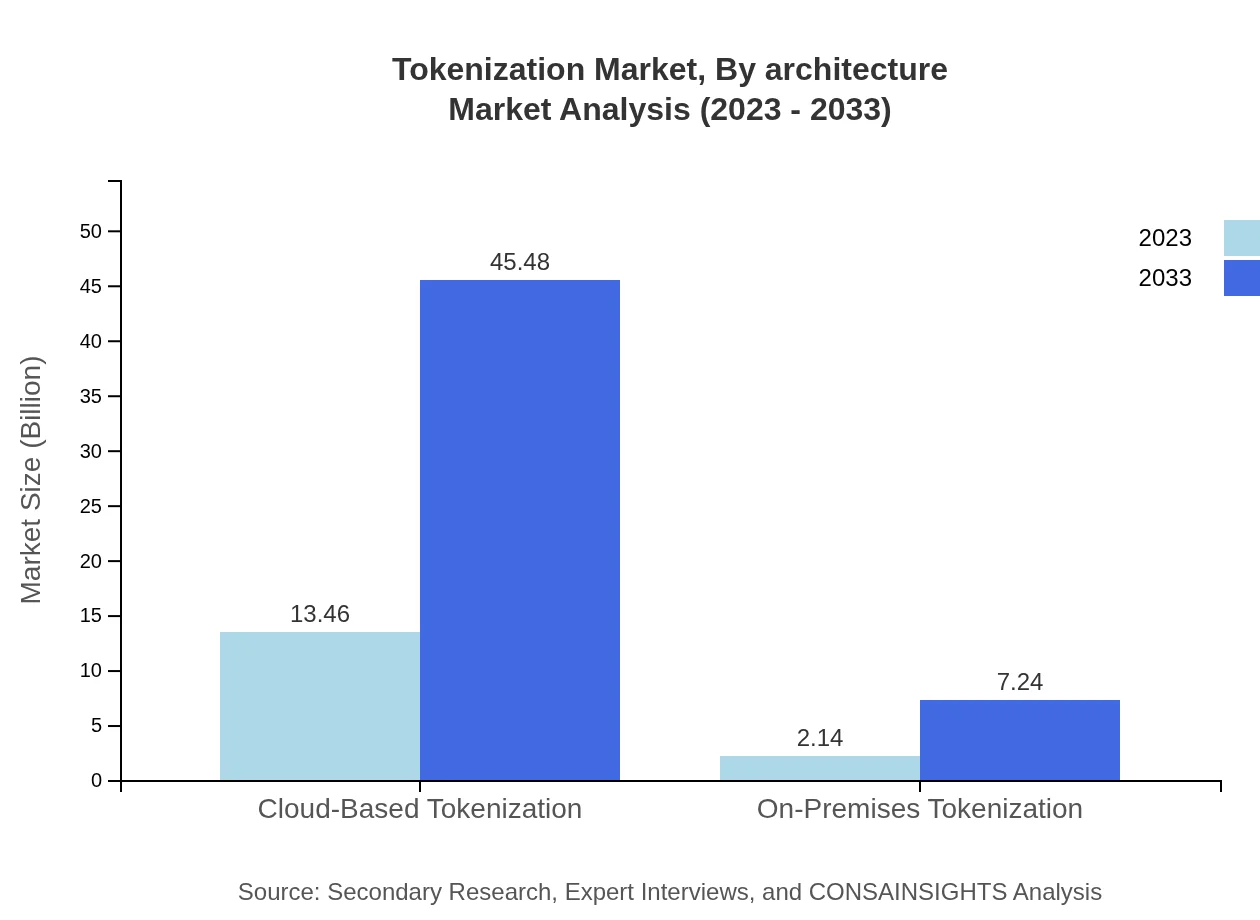

Tokenization Market Analysis By Architecture

Cloud-based Tokenization, forecasted to grow from $13.46 billion in 2023 to $45.48 billion by 2033, is preferred for its scalability. In contrast, on-premises solutions will see slower growth, expected to rise from $2.14 billion to $7.24 billion.

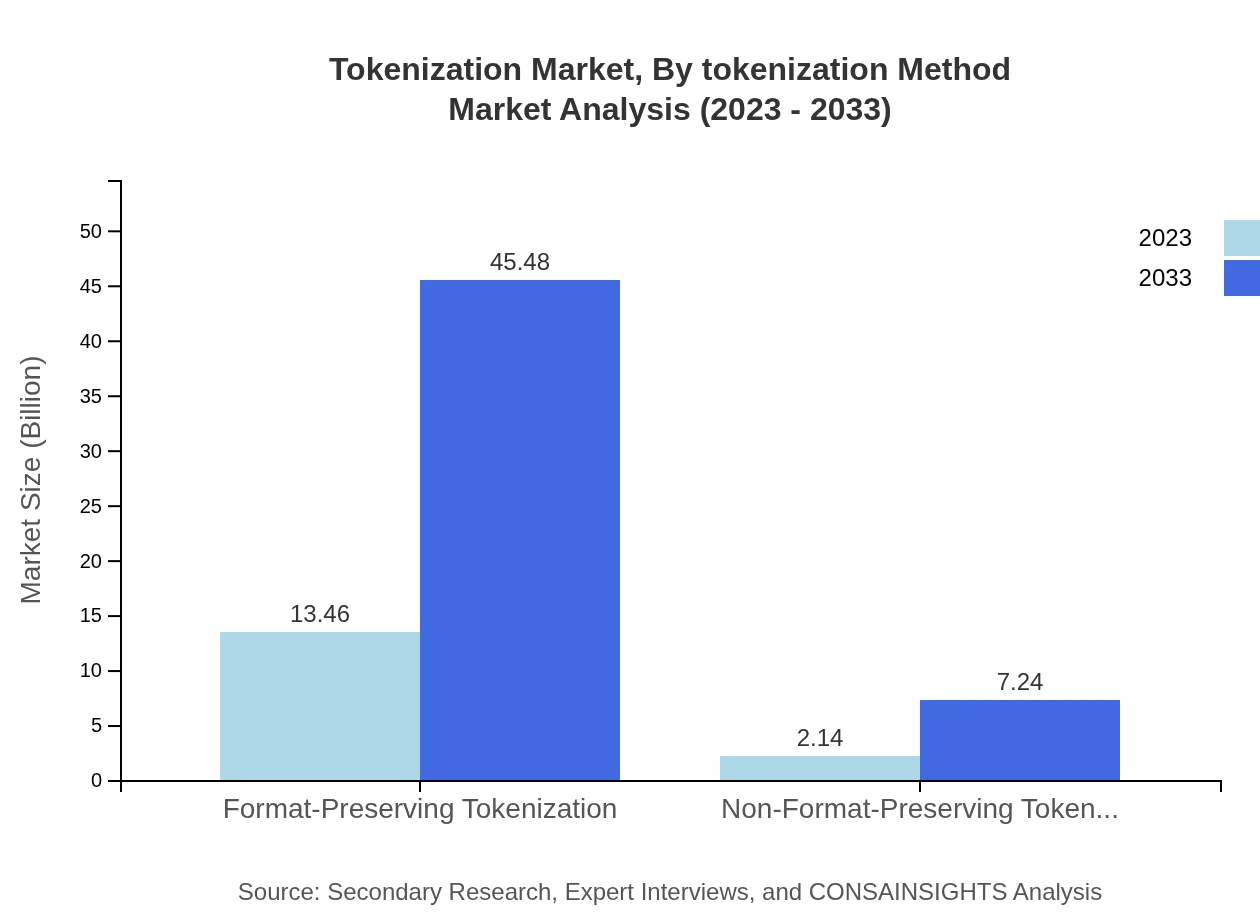

Tokenization Market Analysis By Tokenization Method

Format-preserving tokenization dominates market shares, anticipated to remain at 86.27%. Non-format-preserving tokenization is projected to grow moderately, from $2.14 billion in 2023 to $7.24 billion by 2033.

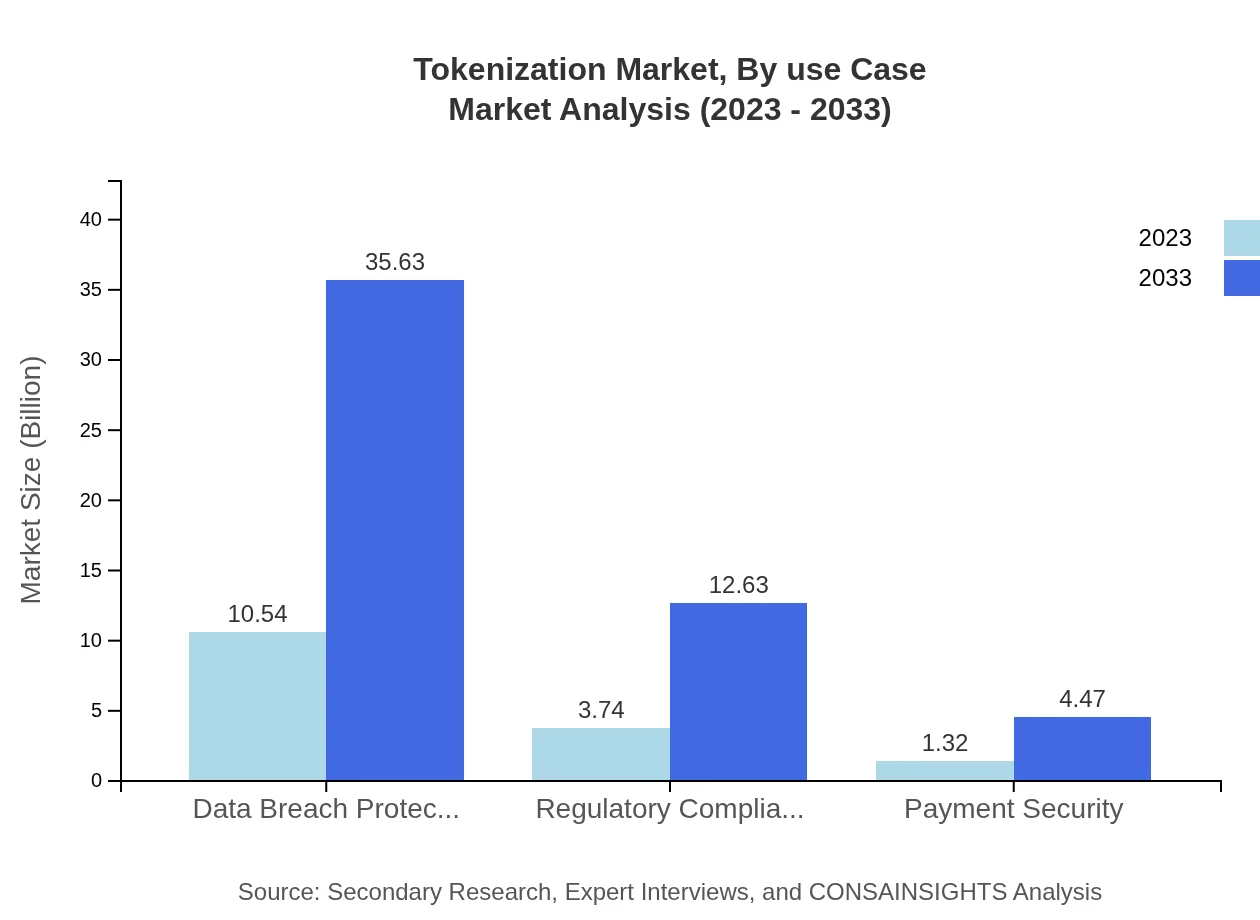

Tokenization Market Analysis By Use Case

The demand for data breach protection services is expected to significantly lead within the market, occupying 67.57% in 2023 and growing to support the anticipated increase in cyber threats and data regulations compliance requirements.

Tokenization Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tokenization Industry

TokenEx:

A leading provider of tokenization as a service, specializing in secure data tokenization and compliance with regulatory standards.Thales Group:

Global cybersecurity leader, offering robust tokenization solutions to secure sensitive data for various industries, including finance and healthcare.IBM:

Innovative tech giant with tokenization solutions integrated within its broader data protection offerings, helping enterprises secure sensitive information.Protegrity:

Provider of data security and tokenization solutions, focused on protecting sensitive enterprise information across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of tokenization?

The global tokenization market is valued at approximately $15.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 12.4% through 2033. This growth is indicative of increasing demand across various industries.

What are the key market players or companies in this tokenization industry?

Key players in the tokenization market include notable entities such as Thales Group, Gemalto, TokenEx, and Data Protectors, which specialize in providing advanced security solutions across diverse sectors like BFSI, healthcare, and retail.

What are the primary factors driving the growth in the tokenization industry?

Growth in the tokenization industry is primarily driven by rising concerns over data breaches, increasing regulatory compliance requirements, and the need for secure payment processing. Technological advancements in cybersecurity also contribute significantly to market expansion.

Which region is the fastest Growing in the tokenization?

The Asia Pacific region is experiencing rapid growth, with market size projected to increase from $3.13 billion in 2023 to $10.59 billion by 2033, driven by the increasing adoption of digital payment solutions and heightened security concerns in the region.

Does ConsaInsights provide customized market report data for the tokenization industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the tokenization industry. Clients can request personalized insights, including market trends and forecasts suited to their business needs.

What deliverables can I expect from this tokenization market research project?

Deliverables from the tokenization market research project typically include comprehensive market analysis reports, regional breakdowns, competitive landscape assessments, and insights into emerging trends, enabling informed strategic decisions.

What are the market trends of tokenization?

Current trends in the tokenization market illustrate a shift towards cloud-based solutions, with 86.27% of the market share. Regulatory compliance and data security are becoming increasingly critical, driving investments in innovative tokenization technologies.