Tonic Water Market Report

Published Date: 31 January 2026 | Report Code: tonic-water

Tonic Water Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tonic Water market, highlighting trends, size, segmentation, and regional insights from 2023 to 2033, aimed at delivering essential data for stakeholders.

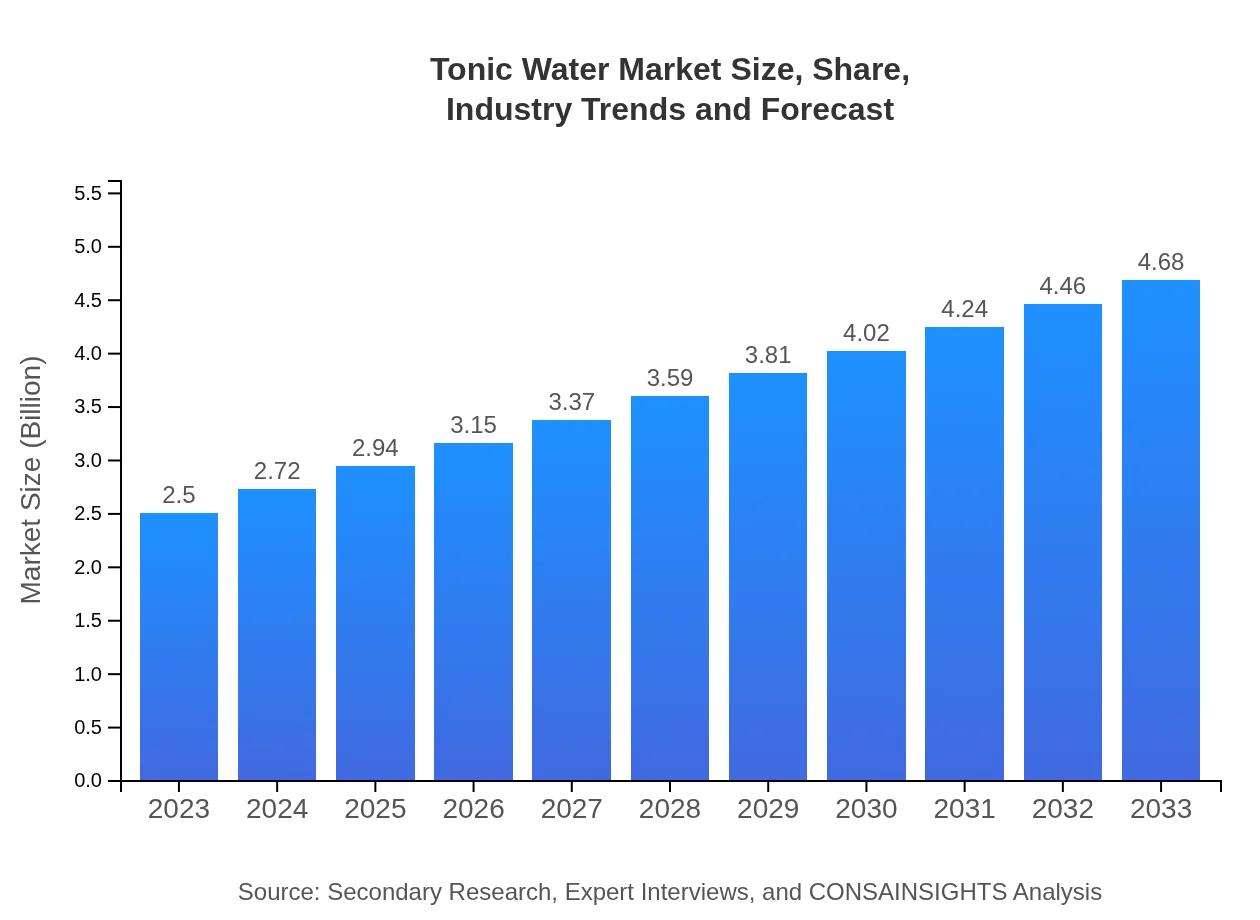

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $4.68 Billion |

| Top Companies | Fever-Tree, Schweppes, Q Mixers, Thomas Henry, Mediterranean Tonic Water |

| Last Modified Date | 31 January 2026 |

Tonic Water Market Overview

Customize Tonic Water Market Report market research report

- ✔ Get in-depth analysis of Tonic Water market size, growth, and forecasts.

- ✔ Understand Tonic Water's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tonic Water

What is the Market Size & CAGR of Tonic Water market in 2023?

Tonic Water Industry Analysis

Tonic Water Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tonic Water Market Analysis Report by Region

Europe Tonic Water Market Report:

In Europe, the market size is estimated at $0.83 billion in 2023, expected to reach $1.56 billion by 2033. The region is a significant player in the tonic water market due to a well-established cocktail culture and a preference for premium brands.Asia Pacific Tonic Water Market Report:

In 2023, the Tonic Water market in the Asia Pacific is valued at $0.48 billion, with expectations to grow to $0.89 billion by 2033. This growth is driven by increasing disposable income and a growing cocktail culture among urban consumers, particularly in countries like China and India.North America Tonic Water Market Report:

North America holds a market size of $0.82 billion in 2023 with an anticipated growth to $1.53 billion by 2033. The trend towards craft beverages and health-conscious mixers, along with a strong demand for low-sugar options, is fueling this expansion.South America Tonic Water Market Report:

The market in South America is currently valued at $0.10 billion in 2023 and projected to reach $0.19 billion by 2033. The rise of premium brands and cocktail bars in urban settings is propelling growth, despite challenges in distribution channels.Middle East & Africa Tonic Water Market Report:

The Tonic Water market in the Middle East and Africa is valued at $0.28 billion in 2023, projected to grow to $0.52 billion by 2033. This region is experiencing a rising trend in the consumption of flavored and craft tonic waters, catering to a younger demographic attracted to sophisticated mixing options.Tell us your focus area and get a customized research report.

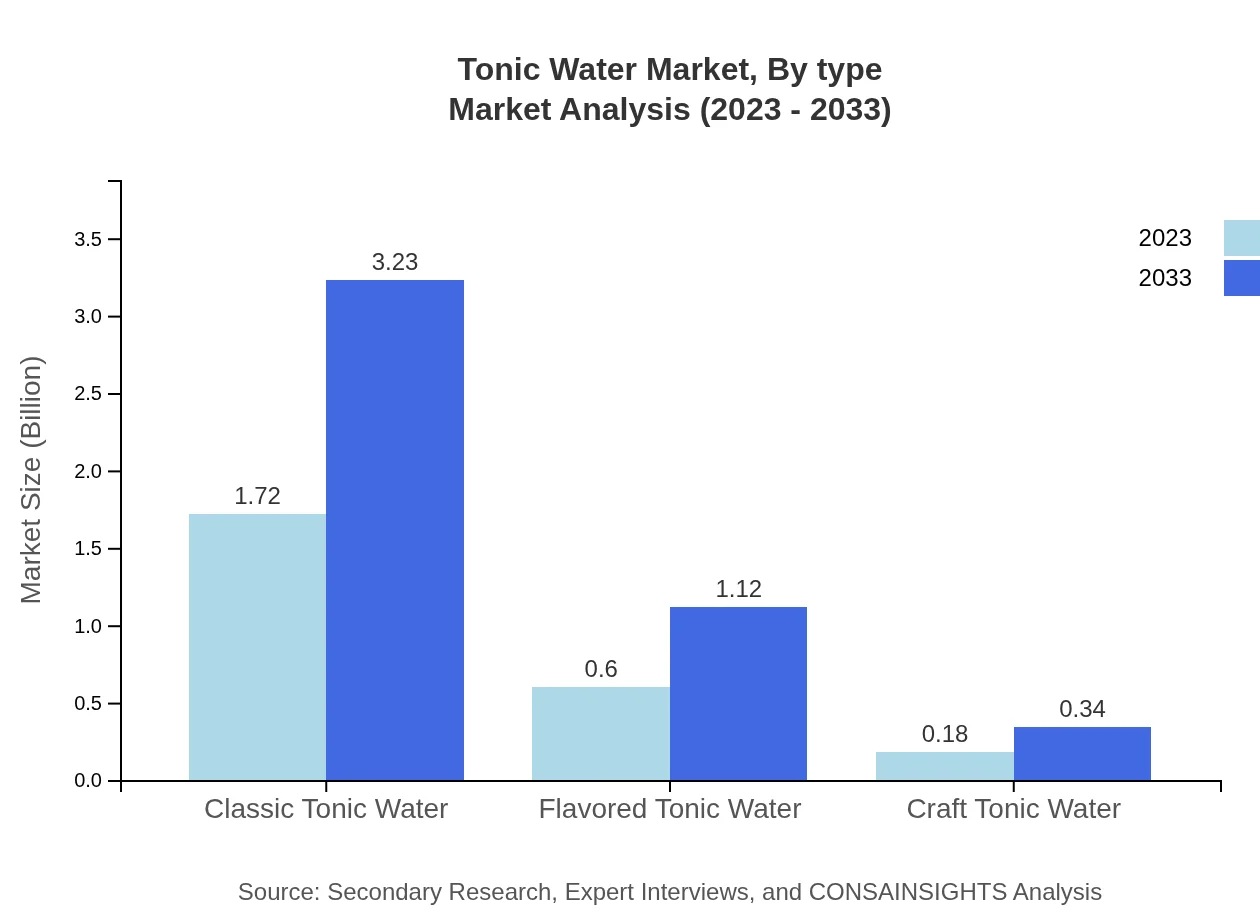

Tonic Water Market Analysis By Type

Classic Tonic Water dominates the market with a size of $1.72 billion in 2023 and projected to grow to $3.23 billion by 2033, holding a significant market share of 68.95%. Flavored Tonic Water follows with a market size of $0.60 billion in 2023, set to increase to $1.12 billion by 2033 (23.88% share), and Craft Tonic Water, although smaller, is projected to grow from $0.18 billion in 2023 to $0.34 billion by 2033 (7.17% share).

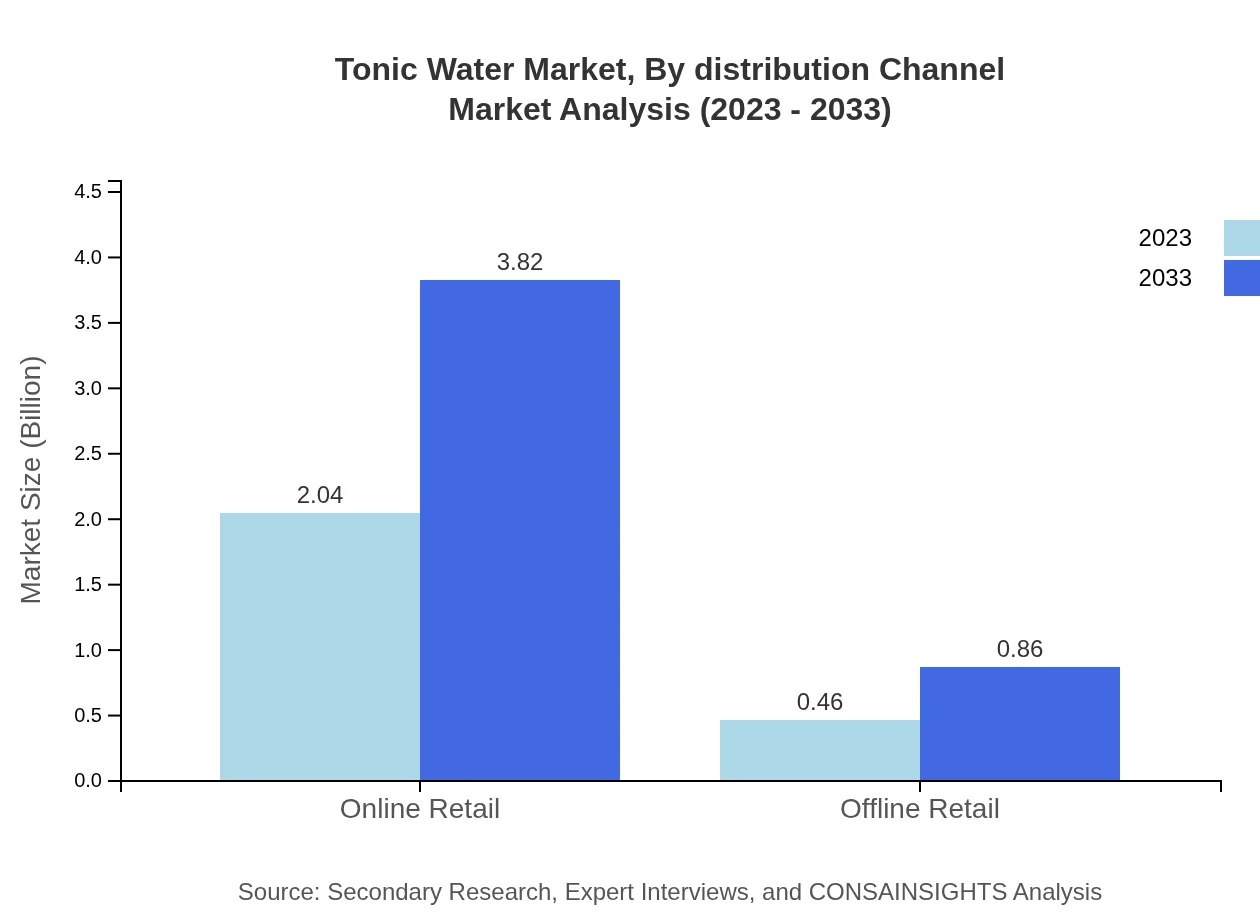

Tonic Water Market Analysis By Distribution Channel

The market is heavily skewed towards online retail, which accounts for $2.04 billion in 2023 and is expected to grow to $3.82 billion by 2033 (81.63% share). Offline retail, while also relevant, is smaller at $0.46 billion in 2023, set to grow to $0.86 billion by 2033 (18.37% share), as consumers increasingly prefer the convenience of online shopping.

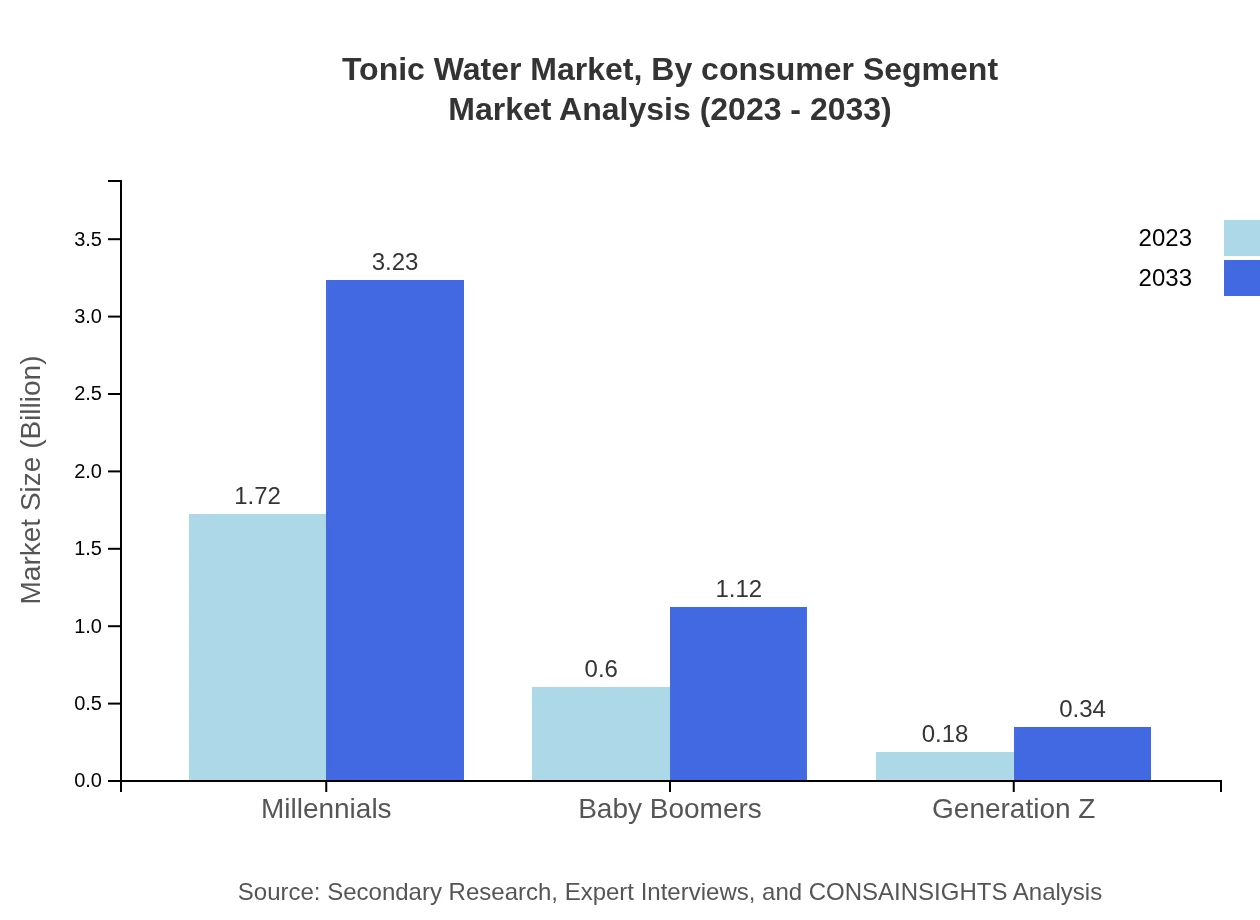

Tonic Water Market Analysis By Consumer Segment

Millennials lead the market with a size of $1.72 billion in 2023, forecasted to rise to $3.23 billion by 2033, making up 68.95% of the market share. Baby Boomers are not far behind, currently at $0.60 billion, projected to reach $1.12 billion by 2033 (23.88% share). Generation Z holds a smaller yet growing segment, from $0.18 billion in 2023 to $0.34 billion by 2033 (7.17% share).

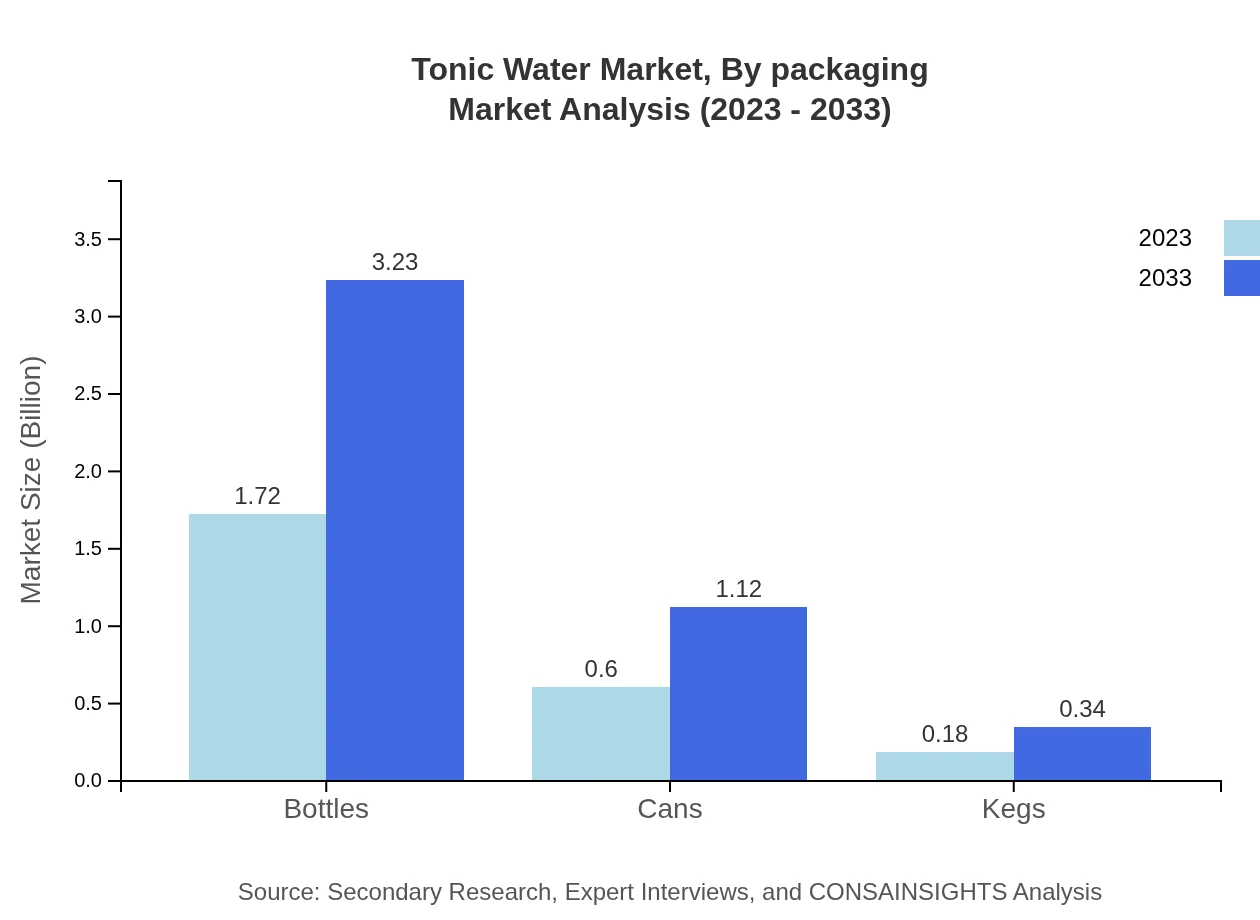

Tonic Water Market Analysis By Packaging

Bottled Tonic Water represents the majority with a market size of $1.72 billion in 2023, expected to grow to $3.23 billion by 2033 (68.95% share). Cans are also performing well, currently valued at $0.60 billion, anticipated to grow to $1.12 billion (23.88% share). Kegs represent a niche part of the market, currently at $0.18 billion and projected to reach $0.34 billion (7.17% share) by 2033.

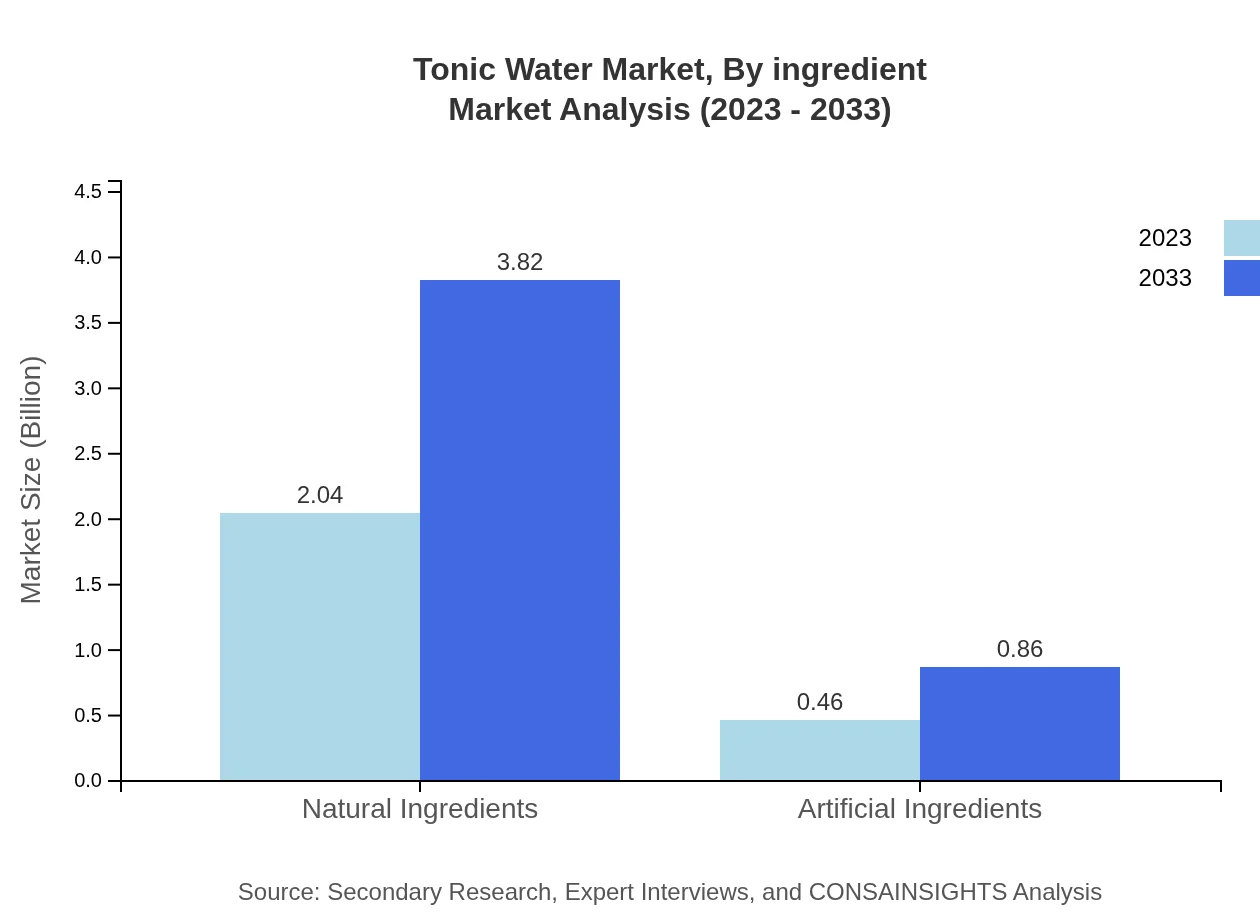

Tonic Water Market Analysis By Ingredient

Natural Ingredients dominate the Tonic Water market with a value of $2.04 billion in 2023, forecasted to reach $3.82 billion by 2033 (81.63% share). Products using artificial ingredients are valued at $0.46 billion, expected to grow to $0.86 billion (18.37% share). This indicates a significant consumer preference for natural alternatives.

Tonic Water Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tonic Water Industry

Fever-Tree:

A premium mixer brand known for its high-quality tonic waters, Fever-Tree has revolutionized the market with its natural ingredients and strong marketing strategies, becoming a market leader globally.Schweppes:

As a historic player in the beverage industry, Schweppes produces a wide range of tonic waters and has a strong presence across numerous regions, noted for its classic tonic water offerings.Q Mixers:

Known for its craft mixers, Q Mixers is recognized for using high-quality ingredients and innovative flavor combinations, catering to the growing demand for premium mixers in the U.S. market.Thomas Henry:

This brand from Germany specializes in premium mixers and tonic waters, and has gained a following due to its unique recipes and commitment to quality, increasing its presence in bars and restaurants.Mediterranean Tonic Water:

Focusing on the Mediterranean flavor profile, this brand emphasizes natural botanicals and has found a niche within the craft and premium segments of the tonic water market.We're grateful to work with incredible clients.

FAQs

What is the market size of tonic water?

The global tonic water market is valued at approximately $2.5 billion with a CAGR of 6.3%. This growth reflects rising consumer interest in premium mixers and the cocktail culture thriving worldwide.

What are the key market players or companies in the tonic water industry?

Key players in the tonic water market include major beverage brands like Fever Tree, Canada Dry, and Schweppes, showcasing competitive innovation and branding, which significantly influence market trends and consumer preferences.

What are the primary factors driving the growth in the tonic water industry?

Driving factors include the increasing popularity of craft cocktails, a shift towards premium products, and the growing trend of health-conscious consumption, leading consumers to favor beverages with natural ingredients.

Which region is the fastest Growing in the tonic water market?

The fastest-growing region is projected to be Europe, with market size increasing from $0.83 billion in 2023 to $1.56 billion by 2033, demonstrating a strong consumer base for tonic water products.

Does ConsaInsights provide customized market report data for the tonic water industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs in the tonic water industry, providing insights that align with unique business strategies and market conditions.

What deliverables can I expect from this tonic water market research project?

Deliverables include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, and consumer behavior insights, ensuring stakeholders have the necessary data to make informed decisions.

What are the market trends of tonic water?

Current trends include an increasing demand for flavored and craft tonic waters, with innovations in packaging and distribution methods, highlighting shifts towards online retail channels and home mixology.