Top-10 Bioprocess Technology Market Report

Published Date: 31 January 2026 | Report Code: top-10-bioprocess-technology

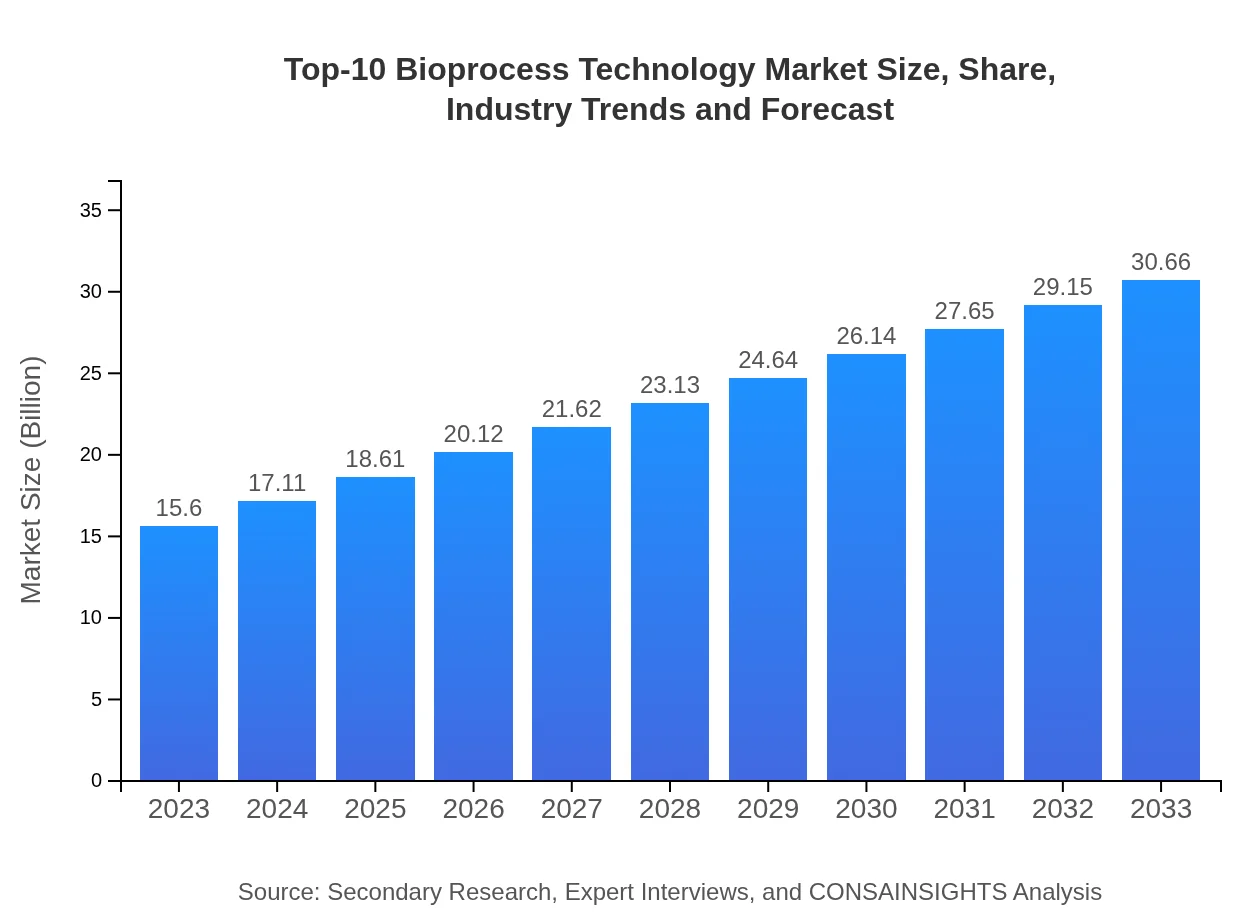

Top-10 Bioprocess Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Top-10 Bioprocess Technology segment from 2023 to 2033. It covers market trends, sizes, significant players, and forecasts to help industry stakeholders make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.66 Billion |

| Top Companies | Thermo Fisher Scientific, Sartorius, GE Healthcare, Merck KGaA |

| Last Modified Date | 31 January 2026 |

Top-10 Bioprocess Technology Market Overview

Customize Top-10 Bioprocess Technology Market Report market research report

- ✔ Get in-depth analysis of Top-10 Bioprocess Technology market size, growth, and forecasts.

- ✔ Understand Top-10 Bioprocess Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 Bioprocess Technology

What is the Market Size & CAGR of Top-10 Bioprocess Technology market in 2023 and 2033?

Top-10 Bioprocess Technology Industry Analysis

Top-10 Bioprocess Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 Bioprocess Technology Market Analysis Report by Region

Europe Top-10 Bioprocess Technology Market Report:

The European market is set to grow from 4.30 billion USD in 2023 to 8.46 billion USD by 2033. The region’s strong regulatory framework and high investment in healthcare and biotechnological research underpin this growth.Asia Pacific Top-10 Bioprocess Technology Market Report:

The Asia Pacific region is projected to grow from 3.05 billion USD in 2023 to 6.00 billion USD by 2033, driven by increasing investments in biopharmaceutical research and development, coupled with a growing demand for more efficient bioprocessing technologies.North America Top-10 Bioprocess Technology Market Report:

North America is anticipated to see significant growth from 5.86 billion USD in 2023 to 11.52 billion USD by 2033 with the presence of major biopharmaceutical companies and continued innovation in bioprocessing technologies driving market expansion.South America Top-10 Bioprocess Technology Market Report:

The South American market for bioprocess technology is expected to expand from 1.44 billion USD in 2023 to 2.83 billion USD by 2033. This growth will be supported by increased agricultural biotechnology initiatives and government funding.Middle East & Africa Top-10 Bioprocess Technology Market Report:

The Middle East and Africa region is estimated to grow from 0.94 billion USD in 2023 to 1.85 billion USD by 2033 as advancements in biotechnology and pharmaceuticals emerge as priority sectors for many governments.Tell us your focus area and get a customized research report.

Top-10 Bioprocess Technology Market Analysis Bioreactors

Global Bioprocess Technology Market, By Product Market Analysis (2023 - 2033)

The bioreactor segment dominates the market, holding a market size of 9.49 billion USD in 2023 and expected to grow to 18.65 billion USD by 2033, accounting for 60.83% of the total bioprocess market. Its significant market share reflects its crucial role in biopharmaceutical manufacturing and biotechnology research.

Top-10 Bioprocess Technology Market Analysis Downstream_processing_equipment

Global Bioprocess Technology Market, By Application Market Analysis (2023 - 2033)

Downstream bioprocessing equipment is projected to grow from 3.39 billion USD in 2023 to 6.66 billion USD by 2033, capturing about 21.73% of the market. This segment's importance lies in its ability to effectively purify and concentrate bioproducts after the initial production process.

Top-10 Bioprocess Technology Market Analysis Separation_techniques

Global Bioprocess Technology Market, By End-User Industry Market Analysis (2023 - 2033)

Separation techniques are expected to increase in market size from 2.72 billion USD in 2023 to 5.35 billion USD by 2033, representing 17.44% market share. This reflects the demand for efficient techniques in various applications, including food and beverage, pharmaceuticals, and environmental sciences.

Top-10 Bioprocess Technology Market Analysis Fermentation_technology

Global Bioprocess Technology Market, By Technology Market Analysis (2023 - 2033)

The fermentation technology segment is evidenced to maintain high growth rates, moving from a size of 8.61 billion USD in 2023 to 16.92 billion USD by 2033, fueled by its extensive use in biopharmaceutical production and sustainable practices.

Top-10 Bioprocess Technology Market Analysis Biopharmaceuticals

Global Bioprocess Technology Market, By Geography Market Analysis (2023 - 2033)

The biopharmaceuticals segment constitutes a major share, with market values of 8.61 billion USD in 2023 and doubling to 16.92 billion USD in 2033. This is indicative of the growing reliance on biotechnology for effective drug development and manufacturing.

Top-10 Bioprocess Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 Bioprocess Technology Industry

Thermo Fisher Scientific:

Thermo Fisher Scientific is a global leader in serving science with a diverse range of laboratory products, including bioprocess equipment that enhances the efficiency and scalability of biotechnology production.Sartorius:

Sartorius is a leading global pharmaceutical and laboratory supplier, specializing in bioprocess solutions that drive optimal productivity and regulatory compliance in drug development.GE Healthcare:

GE Healthcare provides technologies and services to the life sciences industry that improve patient outcomes and operational efficiencies in bioprocessing.Merck KGaA:

Merck KGaA is a significant player in the biotechnology sector, offering a wide array of tools and technologies for the development and manufacturing of biopharmaceuticals.We're grateful to work with incredible clients.

FAQs

What is the market size of top-10 Bioprocess Technology?

The top-10-bioprocess-technology market is currently valued at approximately $15.6 billion, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033, indicating robust growth potential in the sector.

What are the key market players or companies in this top-10 Bioprocess Technology industry?

The key players in the top-10-bioprocess-technology industry include prominent biopharmaceutical firms, biotechnology companies, and specialized equipment manufacturers, who collectively drive innovation and market growth through advanced technologies and solutions in bioprocessing.

What are the primary factors driving the growth in the top-10 Bioprocess Technology industry?

Growth in the top-10-bioprocess technology industry is primarily driven by increasing demand for biopharmaceuticals, technological advancements in bioprocessing systems, and the surge in biotechnology projects for drug development and production.

Which region is the fastest Growing in the top-10 Bioprocess Technology?

North America is currently the fastest-growing region in the top-10-bioprocess-technology market, expected to grow from $5.86 billion in 2023 to $11.52 billion by 2033, fueled by extensive research and manufacturing capabilities.

Does ConsaInsights provide customized market report data for the top-10 Bioprocess Technology industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the top-10-bioprocess-technology industry, accommodating the unique needs and goals of clients for focused insights and analysis.

What deliverables can I expect from this top-10 Bioprocess Technology market research project?

From the top-10-bioprocess-technology market research project, clients can expect comprehensive market analysis, trend assessments, competitor evaluations, and actionable insights delivered in detailed reports and presentations.

What are the market trends of top-10 Bioprocess Technology?

Current trends in the top-10-bioprocess-technology market include increasing automation in bioprocessing, a shift towards sustainable practices, and enhanced focus on personalized medicine, all contributing to industry evolution.