Top-10 Care Chemicals Market Report

Published Date: 02 February 2026 | Report Code: top-10-care-chemicals

Top-10 Care Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Top-10 Care Chemicals market, outlining key industry insights, market size, growth projections, and regional analyses for the years 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

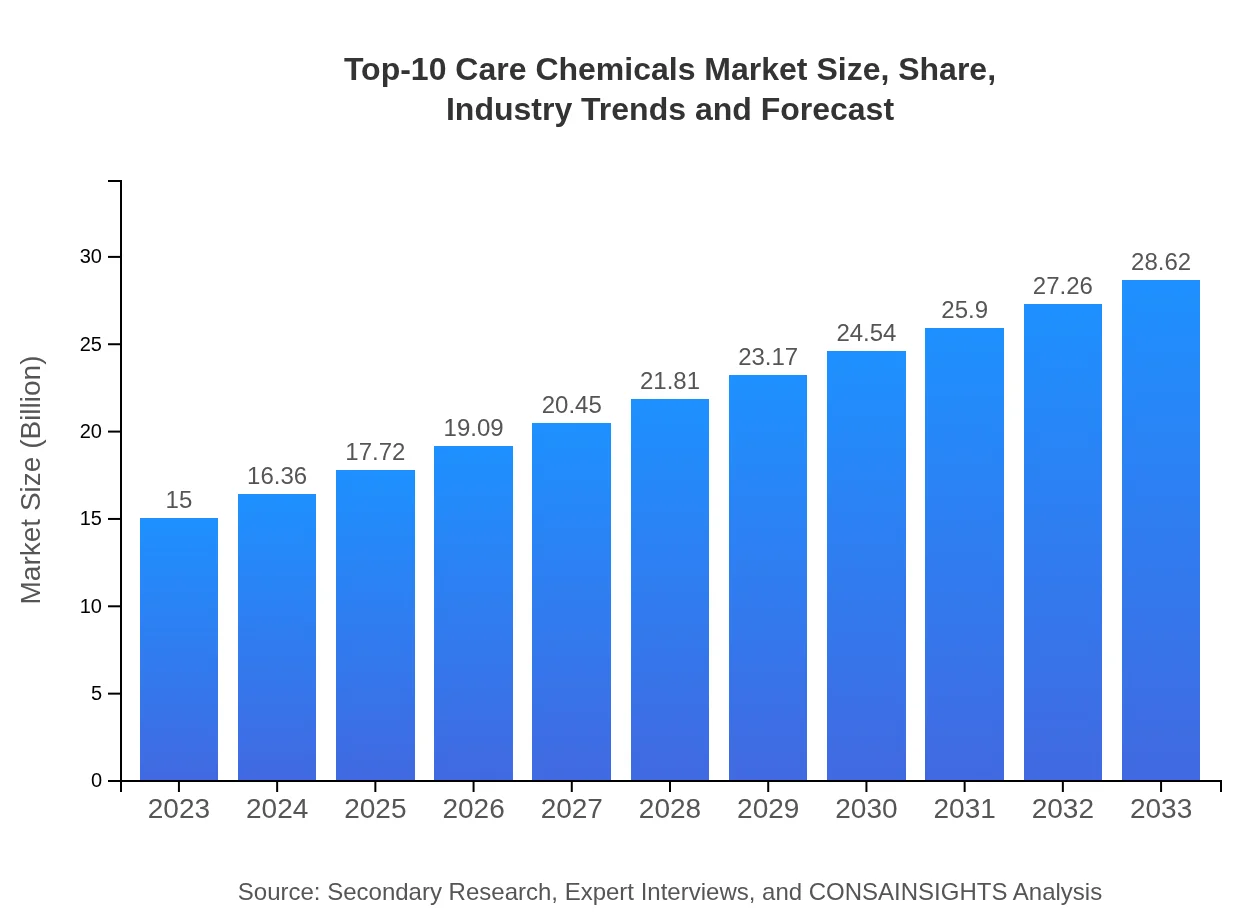

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $28.62 Billion |

| Top Companies | BASF, Evonik Industries, Dow Chemical Company, Huntsman Corporation, Solvay |

| Last Modified Date | 02 February 2026 |

Top-10 Care Chemicals Market Overview

Customize Top-10 Care Chemicals Market Report market research report

- ✔ Get in-depth analysis of Top-10 Care Chemicals market size, growth, and forecasts.

- ✔ Understand Top-10 Care Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 Care Chemicals

What is the Market Size & CAGR of Top-10 Care Chemicals market in 2023?

Top-10 Care Chemicals Industry Analysis

Top-10 Care Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 Care Chemicals Market Analysis Report by Region

Europe Top-10 Care Chemicals Market Report:

In Europe, the market size is set to expand significantly from $4.63 billion in 2023 to $8.84 billion by 2033. Leading trends include the demand for clean beauty products and stringent regulatory standards governing chemical use.Asia Pacific Top-10 Care Chemicals Market Report:

In the Asia Pacific region, the market size is projected to grow from $2.96 billion in 2023 to $5.66 billion by 2033. This rapid expansion is driven by the rising middle-class population, increasing disposable incomes, and a growing demand for personal care and cosmetic products.North America Top-10 Care Chemicals Market Report:

North America presents a robust market with a projected growth from $5.13 billion in 2023 to $9.80 billion by 2033. The increase is driven by high consumer spending on personal care products and innovative formulations by leading brands.South America Top-10 Care Chemicals Market Report:

The South American market is relatively smaller, expected to rise from $0.18 billion in 2023 to $0.34 billion by 2033. Growth factors include increasing urbanization and consumer awareness regarding personal and home care.Middle East & Africa Top-10 Care Chemicals Market Report:

The Middle East and Africa market is expected to grow from $2.09 billion in 2023 to $3.99 billion by 2033. Increased local manufacturing and rising awareness about personal care products are contributing factors to this growth.Tell us your focus area and get a customized research report.

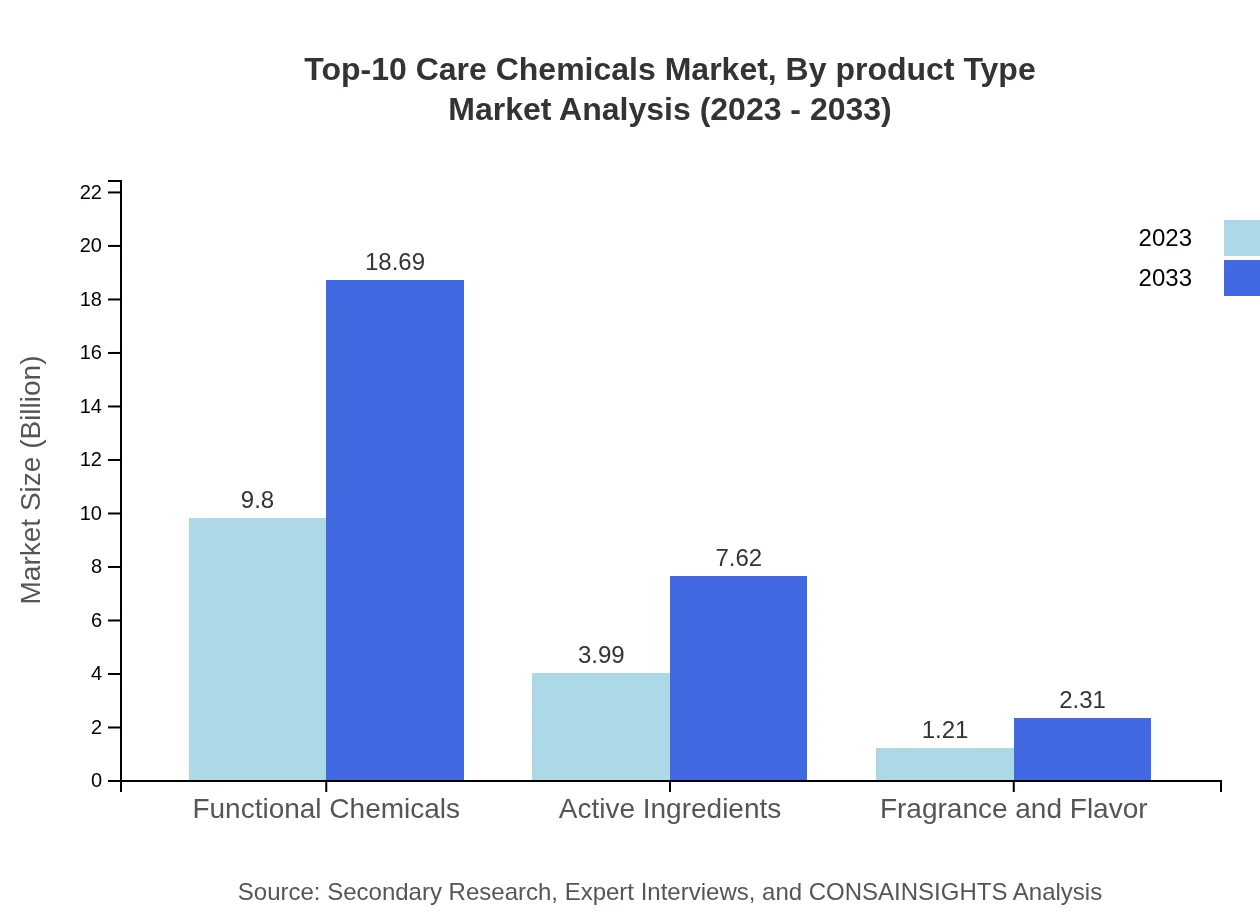

Top-10 Care Chemicals Market Analysis By Product Type

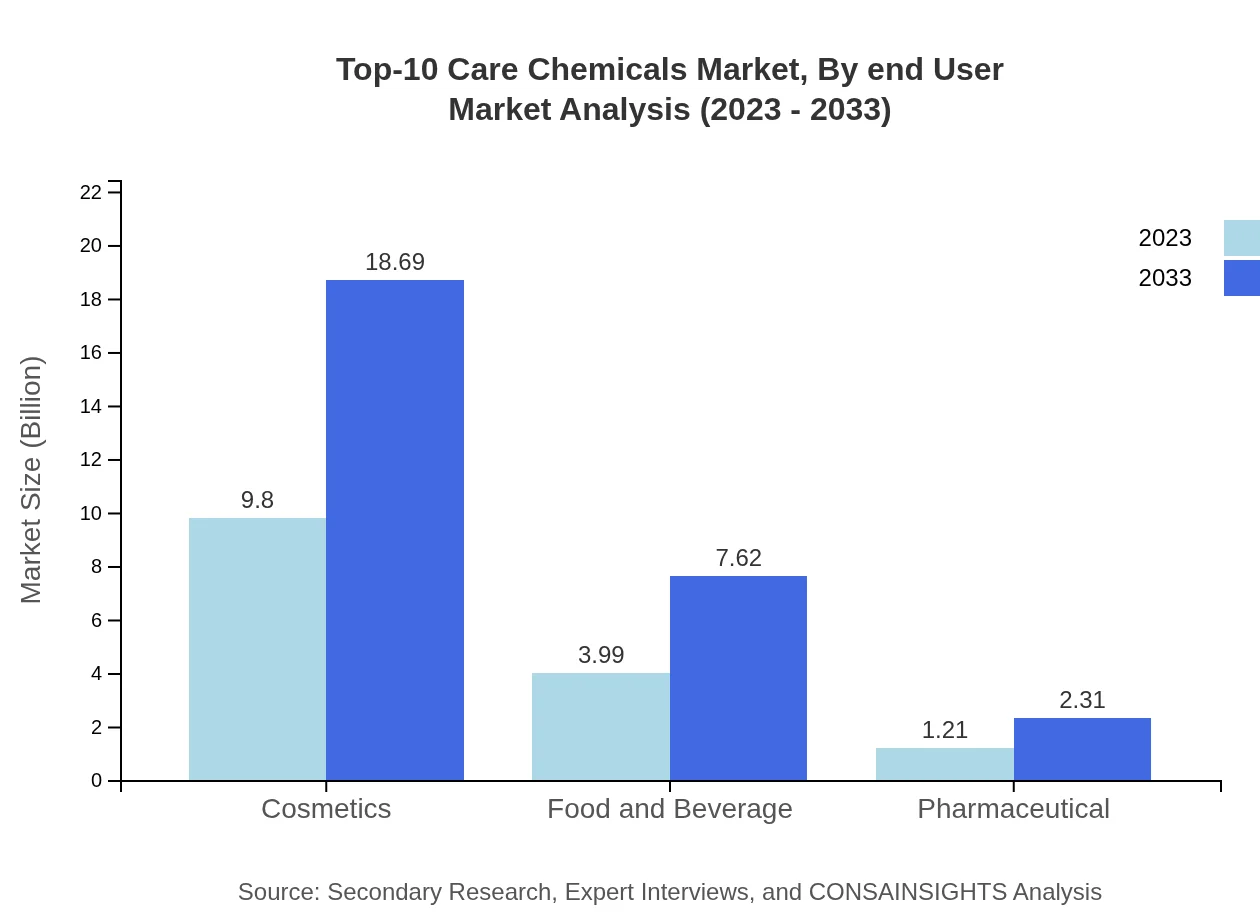

The product types in the Top-10 Care Chemicals market include Cosmetics, Food and Beverage, Pharmaceuticals, Personal Care, Household, and Industrial chemicals. Cosmetics contribute significantly with a market size of $9.80 billion in 2023, expected to double to $18.69 billion by 2033.

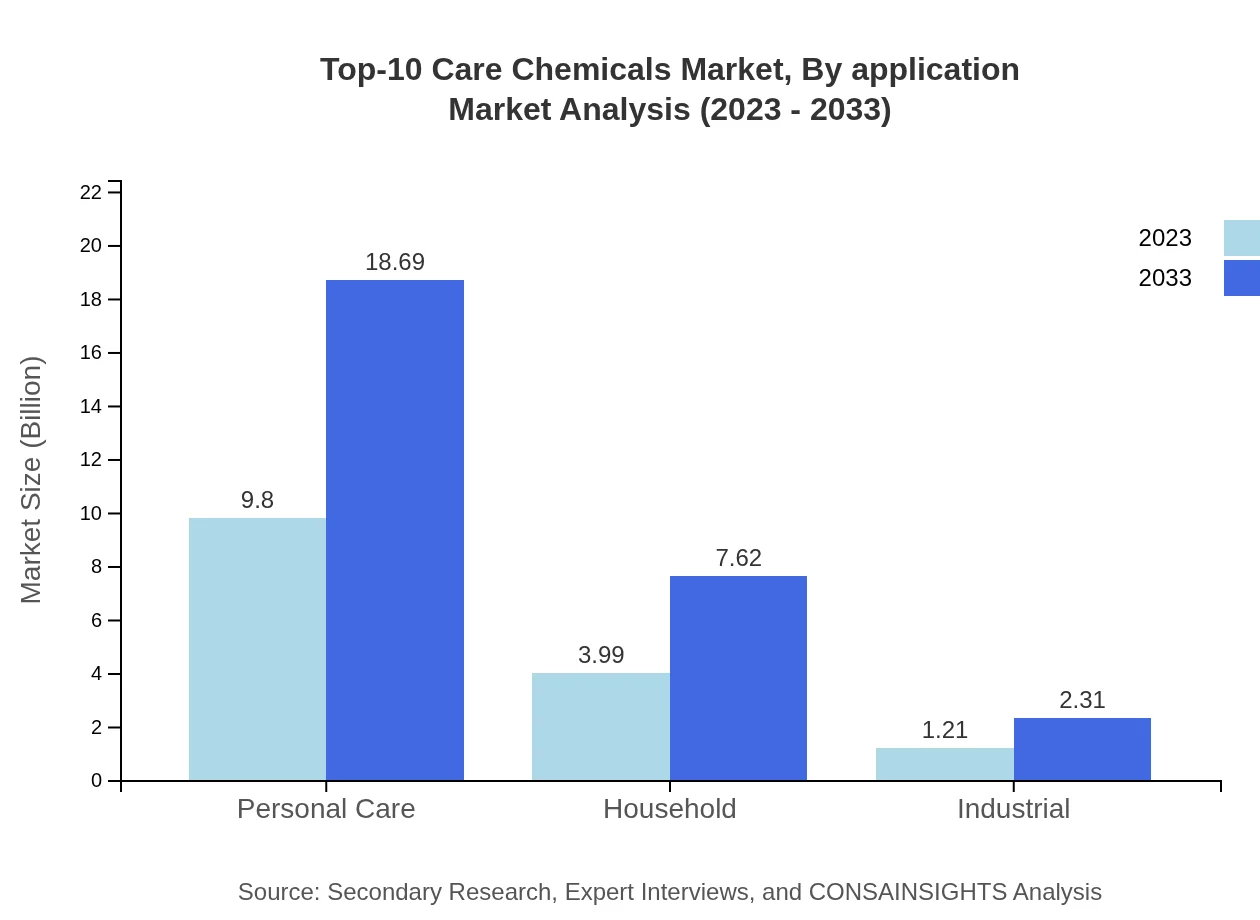

Top-10 Care Chemicals Market Analysis By Application

Applications of care chemicals encompass a wide array of sectors such as cosmetics, personal care, food preservation, pharmaceuticals, and household cleaning solutions. Each application holds distinctive growth windows, with personal care and cosmetics collectively holding a 65.31% market share in 2023.

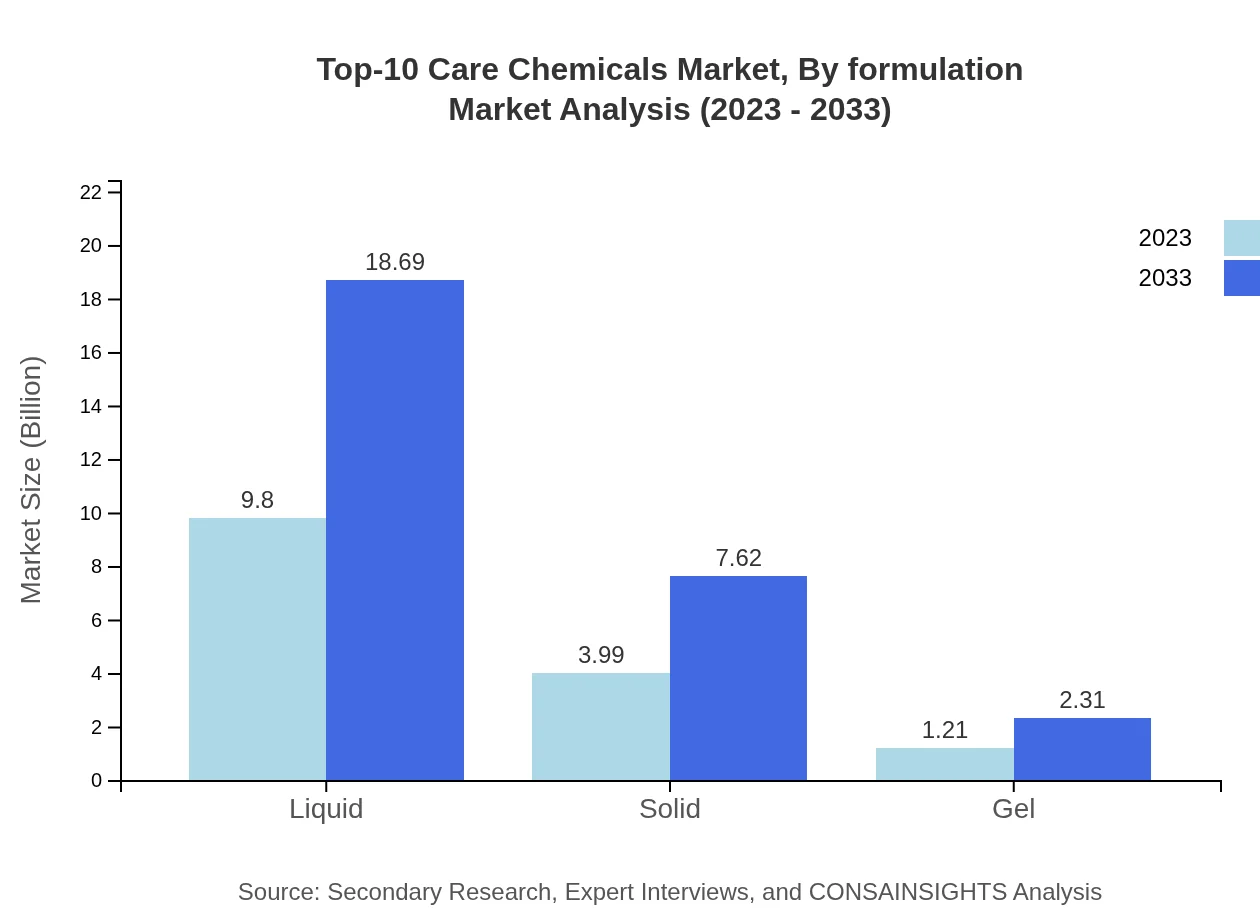

Top-10 Care Chemicals Market Analysis By Formulation

Formulations in the care chemicals market range from liquid, solid, to gels. The liquid formulations dominate the market with a size of $9.80 billion in 2023, as they are predominant in the cosmetics and personal care segments.

Top-10 Care Chemicals Market Analysis By End User

End-user segments encompass sectors such as Beauty and Personal Care, Food and Beverage, Household Cleaning, and Pharmaceuticals. The beauty and personal care sector is anticipated to maintain its leadership, contributing significantly to the overall growth of the market.

Top-10 Care Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 Care Chemicals Industry

BASF:

BASF is a global leader in the production of chemicals and is pivotal in innovating care chemical solutions, especially in terms of sustainability and quality.Evonik Industries:

Evonik specializes in specialty chemicals, providing innovative solutions in personal care and cosmetics driven by technological advancements.Dow Chemical Company:

Dow offers a wide range of care chemicals for various industries and is known for its commitment to innovation and sustainable practices.Huntsman Corporation:

Huntsman focuses on advanced materials and specialty chemicals, particularly in the personal care segment, enhancing product effectiveness.Solvay:

Solvay is a leading international chemical company, recognized for its innovations in care chemicals, contributing to sustainable product development.We're grateful to work with incredible clients.

FAQs

What is the market size of Top-10 Care Chemicals?

The global Top-10 Care Chemicals market is projected to reach a size of $15 billion by 2033, growing at a CAGR of 6.5% from a baseline of $15 billion in 2023. This indicates significant growth potential in the care chemicals sector.

What are the key market players or companies in the Top-10 Care Chemicals industry?

Key players in the Top-10 Care Chemicals industry include major firms specializing in personal care, cosmetics, and industrial applications. These companies are pivotal in driving innovation and market expansion, ensuring competitive advantage in various segments.

What are the primary factors driving the growth in the Top-10 Care Chemicals industry?

Growth in the Top-10 Care Chemicals industry is driven by increasing consumer demand for sustainability, innovation in product formulations, and the expansion of personal care and cosmetic markets, which boosts the utilization of various care chemicals.

Which region is the fastest Growing in the Top-10 Care Chemicals?

The Asia-Pacific region is anticipated to be the fastest-growing market for Top-10 Care Chemicals, with market size increasing from $2.96 billion in 2023 to $5.66 billion by 2033, reflecting a robust growth trajectory in consumer demand.

Does ConsaInsights provide customized market report data for the Top-10 Care Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Top-10 Care Chemicals industry, enabling clients to gain detailed insights and targeted strategies for their current and future market goals.

What deliverables can I expect from this Top-10 Care Chemicals market research project?

From the Top-10 Care Chemicals market research project, expect comprehensive reports, market trend analysis, segmented data by type and region, forecasts, and actionable insights to support decision-making and strategy development.

What are the market trends of Top-10 Care Chemicals?

Current trends in the Top-10 Care Chemicals market include a shift towards biodegradable and eco-friendly products, increasing customization of formulations, and a rise in demand for active ingredients across personal care and food sectors, driving innovative solutions.