Top-10 High Growth Composite Material Market Report

Published Date: 02 February 2026 | Report Code: top-10-high-growth-composite-material

Top-10 High Growth Composite Material Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the top 10 high-growth composite materials from 2023 to 2033, highlighting market size, industry trends, regional insights, and key players. The report aims to deliver actionable data and forecasts to stakeholders invested in this thriving sector.

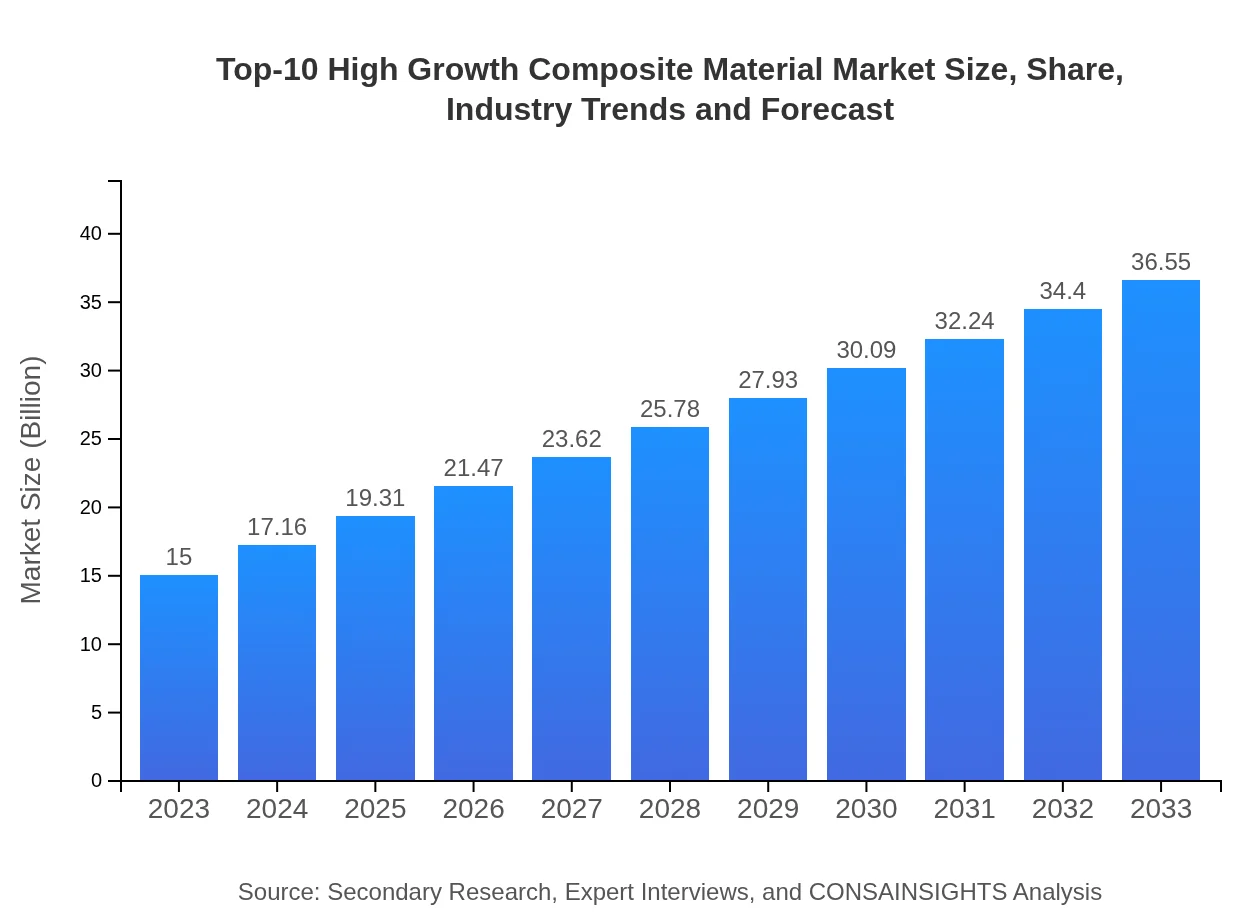

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $36.55 Billion |

| Top Companies | Hexcel Corporation, Teijin Limited, Mitsubishi Chemical Holdings Corporation, Dow Inc., SGL Carbon SE |

| Last Modified Date | 02 February 2026 |

Top-10 High Growth Composite Material Market Overview

Customize Top-10 High Growth Composite Material Market Report market research report

- ✔ Get in-depth analysis of Top-10 High Growth Composite Material market size, growth, and forecasts.

- ✔ Understand Top-10 High Growth Composite Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 High Growth Composite Material

What is the Market Size & CAGR of Top-10 High Growth Composite Material market in 2023?

Top-10 High Growth Composite Material Industry Analysis

Top-10 High Growth Composite Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 High Growth Composite Material Market Analysis Report by Region

Europe Top-10 High Growth Composite Material Market Report:

Europe's market, at $3.93 billion in 2023, is projected to grow to $9.58 billion by 2033. The presence of key automotive manufacturers and stringent environmental regulations position Europe as a leader in composite material usage.Asia Pacific Top-10 High Growth Composite Material Market Report:

In 2023, the Asia-Pacific region holds a market value of $3.23 billion, projected to grow to $7.87 billion by 2033. The growth stems from rising manufacturing and automotive industries, primarily in China and India, leveraging composites for enhanced production efficiency.North America Top-10 High Growth Composite Material Market Report:

North America, valued at $4.82 billion in 2023, is anticipated to reach $11.75 billion by 2033. The region's aerospace and automotive sectors are major contributors, driven by technological innovations and regulatory pressures for lighter, more efficient materials.South America Top-10 High Growth Composite Material Market Report:

South America had a market value of $1.17 billion in 2023, expected to rise to $2.84 billion by 2033. The increasing investments in infrastructure and automotive sectors are fuelling composite demand, providing growth opportunities.Middle East & Africa Top-10 High Growth Composite Material Market Report:

In 2023, the Middle East and Africa market stands at $1.85 billion, growing to $4.51 billion by 2033, spurred by increasing infrastructure projects and oil sector investments promoting lightweight composite applications.Tell us your focus area and get a customized research report.

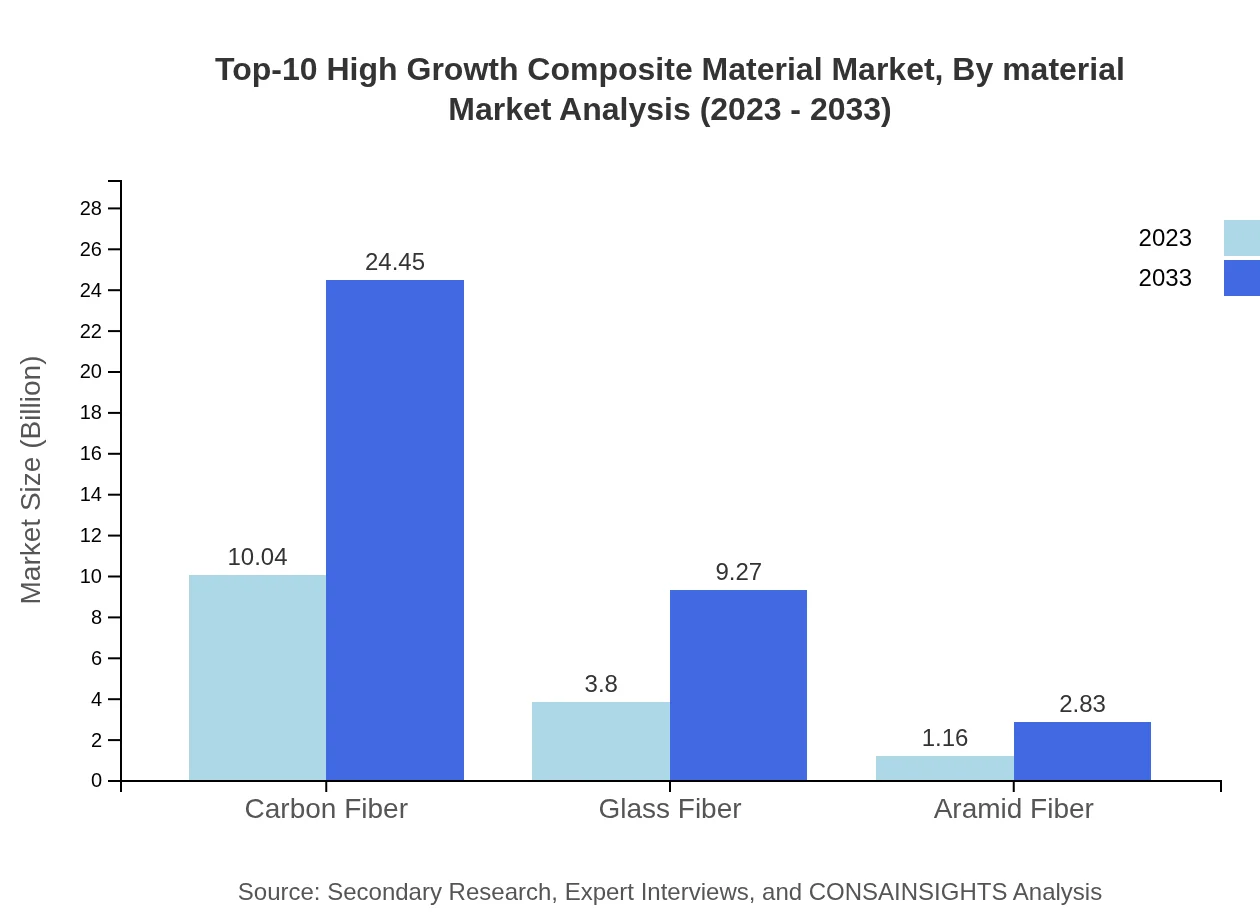

Top-10 High Growth Composite Material Market Analysis By Material

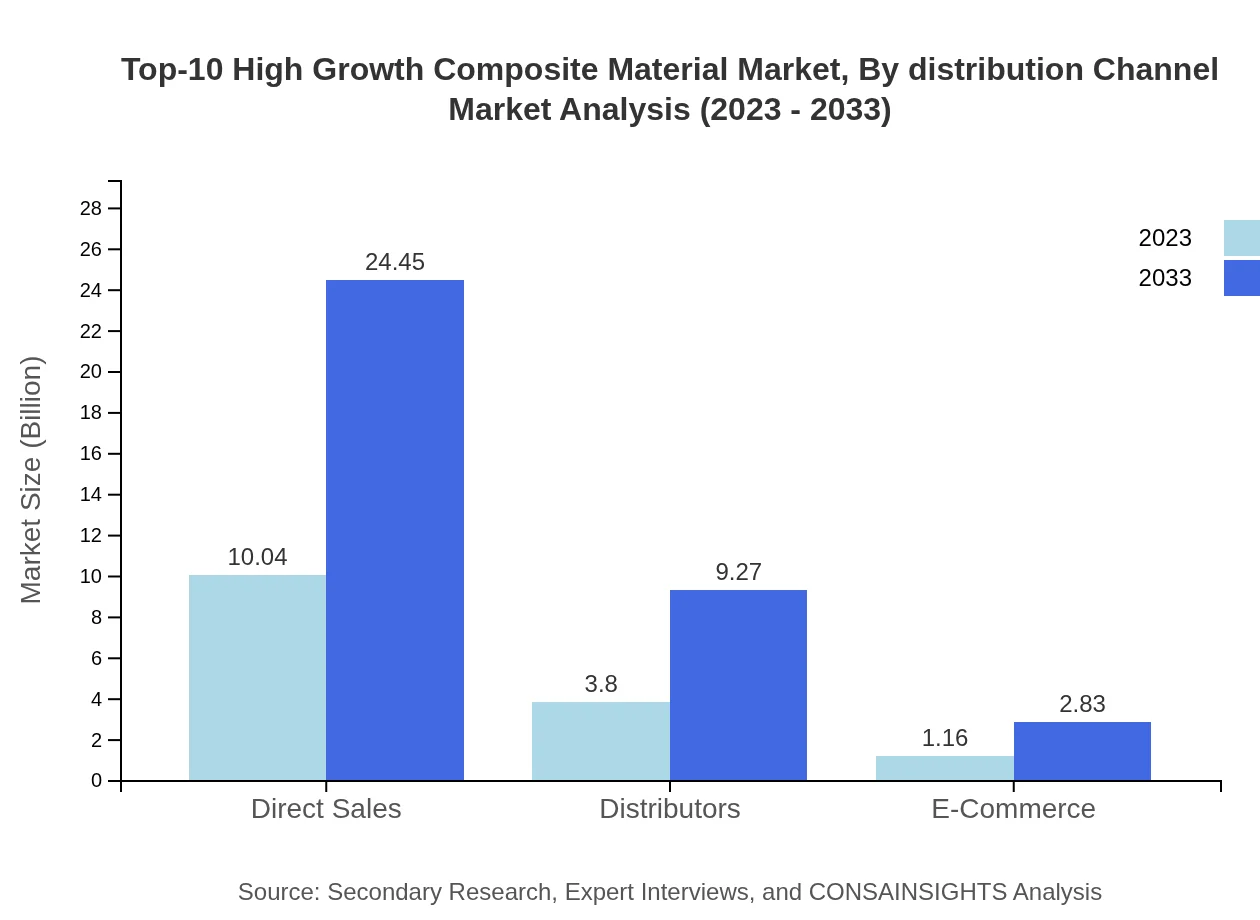

Carbon fiber is the leading segment with a market size of $10.04 billion in 2023, expected to surge to $24.45 billion by 2033. It holds a significant market share of 66.9%. Glass fiber, with a size of $3.80 billion, will grow to $9.27 billion, maintaining a market share of 25.36%. Aramid fiber accounts for $1.16 billion, poised to reach $2.83 billion, holding a share of 7.74%.

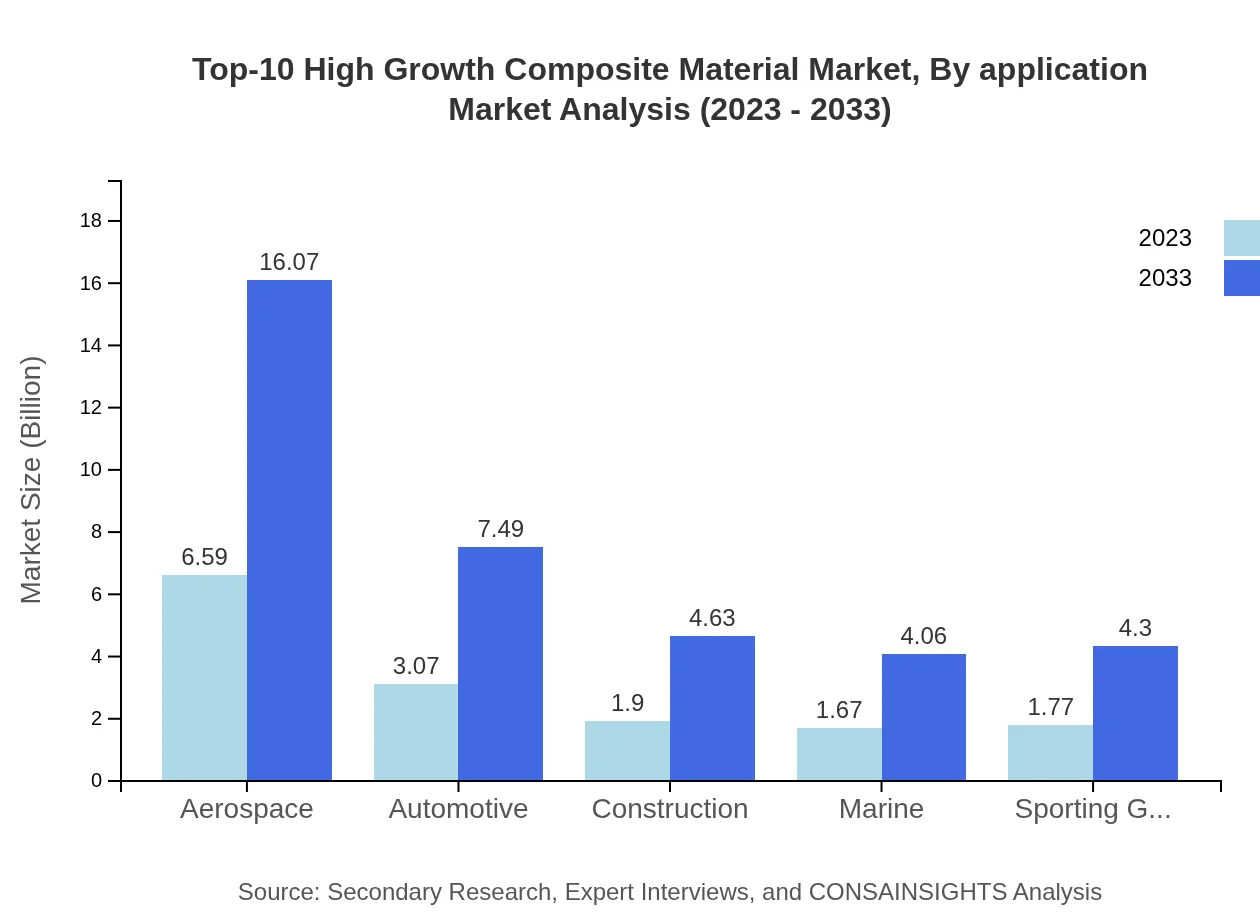

Top-10 High Growth Composite Material Market Analysis By Application

Aerospace leads the applications segment at $6.59 billion in 2023, anticipated to grow to $16.07 billion, with a strong share of 43.96%. Automotive follows at $3.07 billion, forecasted to reach $7.49 billion, representing 20.5%. Other applications include construction, marine, transportation, and consumer goods, each demonstrating substantial growth prospects.

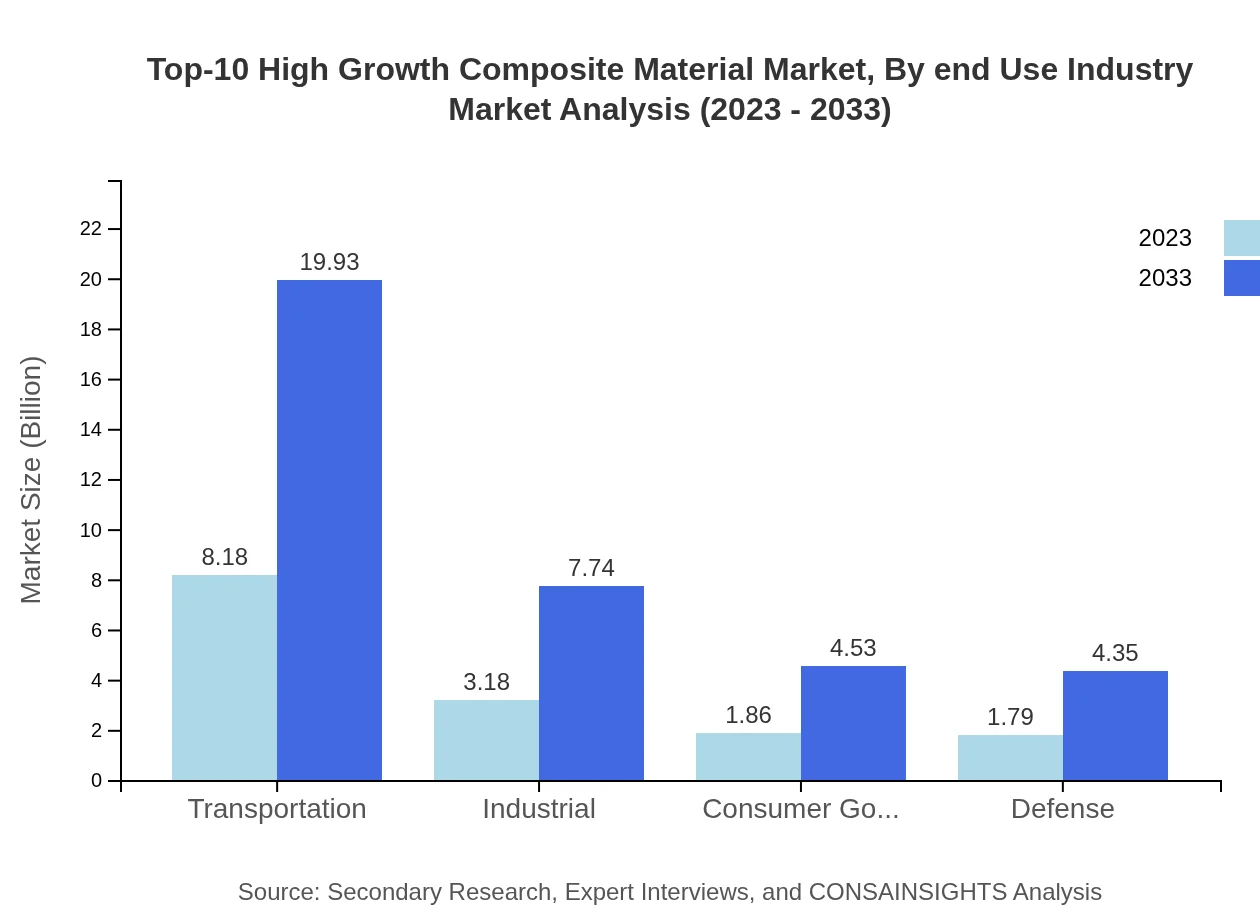

Top-10 High Growth Composite Material Market Analysis By End Use Industry

The transportation sector commands the industry with a $8.18 billion market value in 2023, projected to hit $19.93 billion. Other key sectors include industrial applications at $3.18 billion, and consumer goods at $1.86 billion, both indicating strong growth trajectories.

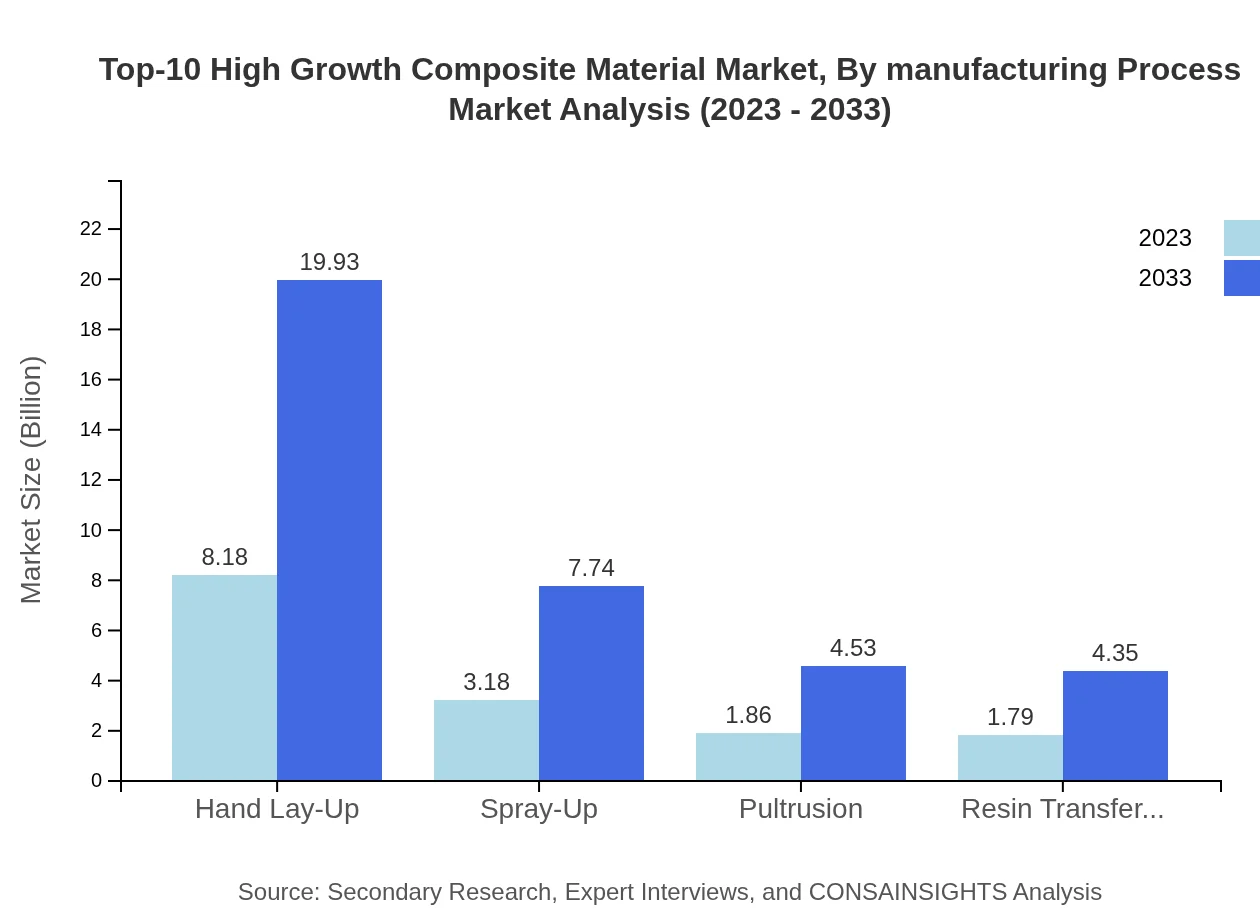

Top-10 High Growth Composite Material Market Analysis By Manufacturing Process

The hand lay-up process dominates with a size of $8.18 billion in 2023, growing to $19.93 billion. Other significant processes include spray-up and resin transfer molding, contributing to the overall increased efficiency in composite production.

Top-10 High Growth Composite Material Market Analysis By Distribution Channel

Direct sales account for the largest segment at $10.04 billion in 2023, expected to rise to $24.45 billion. Distributors and e-commerce sales also show a notable presence, emphasizing the diverse channels through which composite materials are procured.

Top-10 High Growth Composite Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 High Growth Composite Material Industry

Hexcel Corporation:

A leading manufacturer of advanced composite materials primarily for aerospace, defense, and industrial applications.Teijin Limited:

A global player in the production of high-performance fibers and composite materials, focusing on sustainability and innovation.Mitsubishi Chemical Holdings Corporation:

Offers a wide range of composite materials, particularly for automotive and industrial applications, emphasizing performance and reliability.Dow Inc.:

A chemical company that provides specialty materials including advanced composites used in aerospace and automotive sectors.SGL Carbon SE:

Specializes in carbon-based products, providing innovative composite solutions for a range of applications.We're grateful to work with incredible clients.

FAQs

What is the market size of top-10 High Growth Composite Material?

The global top-10 high growth composite material market is valued at approximately $15 billion in 2023, with a projected CAGR of 9% until 2033, reflecting robust development across various industries leveraging composite materials.

What are the key market players or companies in this top-10 High Growth Composite Material industry?

Key players in the composite materials market include companies specializing in advanced composites such as Hexcel Corporation, Toray Industries, and Mitsubishi Chemical, each contributing significantly to innovation and market growth.

What are the primary factors driving the growth in the top-10 High Growth Composite Material industry?

Growth drivers for the composite materials market include technological advancements, increased demand in aerospace and automotive sectors, and the shift towards lightweight, high-strength materials for better performance and sustainability.

Which region is the fastest Growing in the top-10 High Growth Composite Material?

North America is expected to emerge as the fastest-growing region in the composite materials market, with an increase from $4.82 billion in 2023 to $11.75 billion by 2033, implying a robust development trend.

Does ConsaInsights provide customized market report data for the top-10 High Growth Composite Material industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the top-10 high-growth composite material industry, enabling businesses to make informed decisions based on detailed analytics.

What deliverables can I expect from this top-10 High Growth Composite Material market research project?

Deliverables from this market research project include comprehensive reports with market size estimates, growth rates, competitive landscape analyses, segment breakdowns, and insights on trends and forecasts through 2033.

What are the market trends of top-10 High Growth Composite Material?

Current market trends include increased adoption of carbon fiber composites in automotive and aerospace applications, as well as innovations in manufacturing processes, all leading to enhanced performance products targeting specific industry needs.