Top-10 High Growth Paints And Coatings Market Report

Published Date: 02 February 2026 | Report Code: top-10-high-growth-paints-and-coatings

Top-10 High Growth Paints And Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Top-10 High Growth Paints And Coatings market, covering detailed insights into market size, trends, segmentation, and regional performance from 2023 to 2033. It provides a comprehensive view of the industry's future growth and challenges.

| Metric | Value |

|---|---|

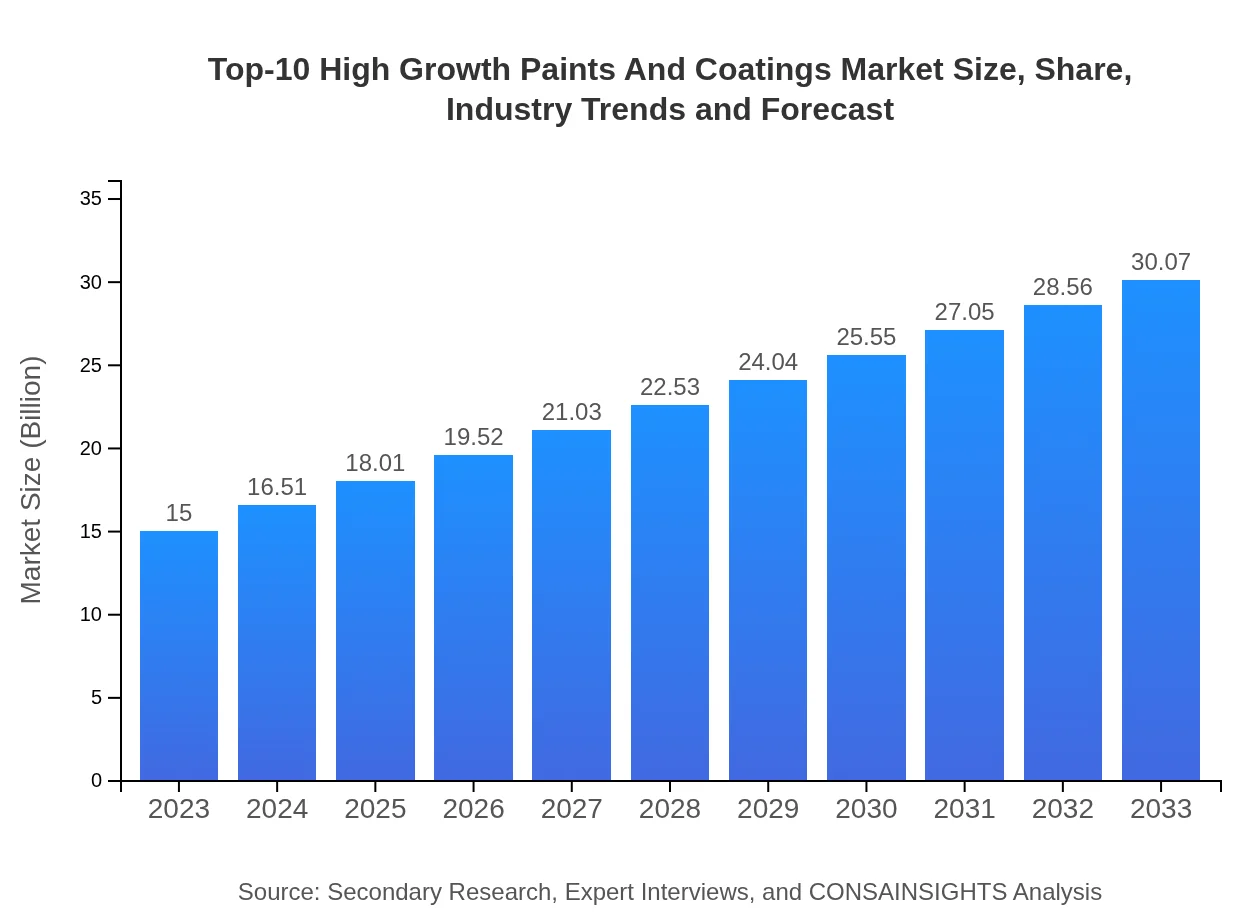

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $30.07 Billion |

| Top Companies | AkzoNobel, BASF SE, PPG Industries, Inc., Sherwin-Williams Company, Dupont |

| Last Modified Date | 02 February 2026 |

Top-10 High Growth Paints And Coatings Market Overview

Customize Top-10 High Growth Paints And Coatings Market Report market research report

- ✔ Get in-depth analysis of Top-10 High Growth Paints And Coatings market size, growth, and forecasts.

- ✔ Understand Top-10 High Growth Paints And Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 High Growth Paints And Coatings

What is the Market Size & CAGR of Top-10 High Growth Paints And Coatings market in 2023?

Top-10 High Growth Paints And Coatings Industry Analysis

Top-10 High Growth Paints And Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 High Growth Paints And Coatings Market Analysis Report by Region

Europe Top-10 High Growth Paints And Coatings Market Report:

Europe’s market size was $4.52 billion in 2023, with expectations of reaching $9.06 billion by 2033, driven by a strong emphasis on eco-friendly products and low-VOC paints amid existing health and environmental issues that influence consumer preferences.Asia Pacific Top-10 High Growth Paints And Coatings Market Report:

In the Asia Pacific region, the market size was approximately $2.72 billion in 2023 and is forecasted to reach $5.44 billion by 2033, highlighting a strong growth potential. This growth is attributed mainly to rapid urbanization and increased construction activities in countries like China and India.North America Top-10 High Growth Paints And Coatings Market Report:

In North America, the market size reached $5.83 billion in 2023, expected to grow to $11.68 billion by 2033. The region is focusing on green technologies and sustainable solutions, aided by stringent environmental regulations fostering innovation in the paints and coatings sector.South America Top-10 High Growth Paints And Coatings Market Report:

South America accounted for a modest market size of $0.23 billion in 2023, projected to double by 2033 at $0.46 billion. Factors driving growth include infrastructural developments and increasing household spending on home improvement.Middle East & Africa Top-10 High Growth Paints And Coatings Market Report:

The Middle East and Africa region's market size stood at $1.71 billion in 2023, anticipated to increase to $3.42 billion by 2033. Growth is driven by advancements in construction technologies and rising demand for decorative and protective coatings in various applications.Tell us your focus area and get a customized research report.

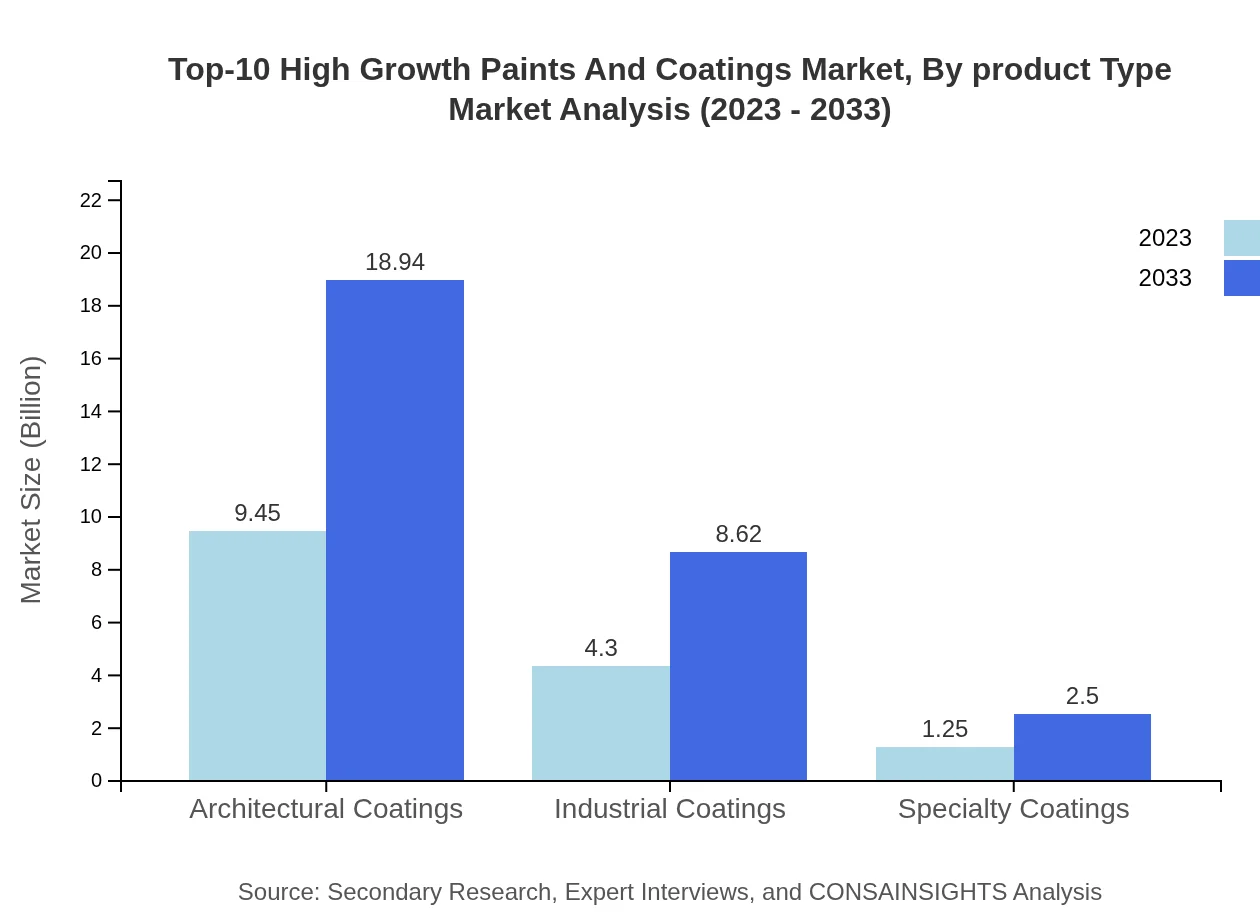

Top-10 High Growth Paints And Coatings Market Analysis By Product Type

The primary segments in the paints and coatings market include water-based coatings, solvent-based coatings, and powder coatings. Water-based coatings dominate the market, holding a 63.01% share in 2023, with sizes approximating $9.45 billion this year and potentially reaching $18.94 billion by 2033. Solvent-based coatings comprise 28.66% of the share with a market size of $4.30 billion in 2023, while powder coatings represent 8.33% with a size of approximately $1.25 billion.

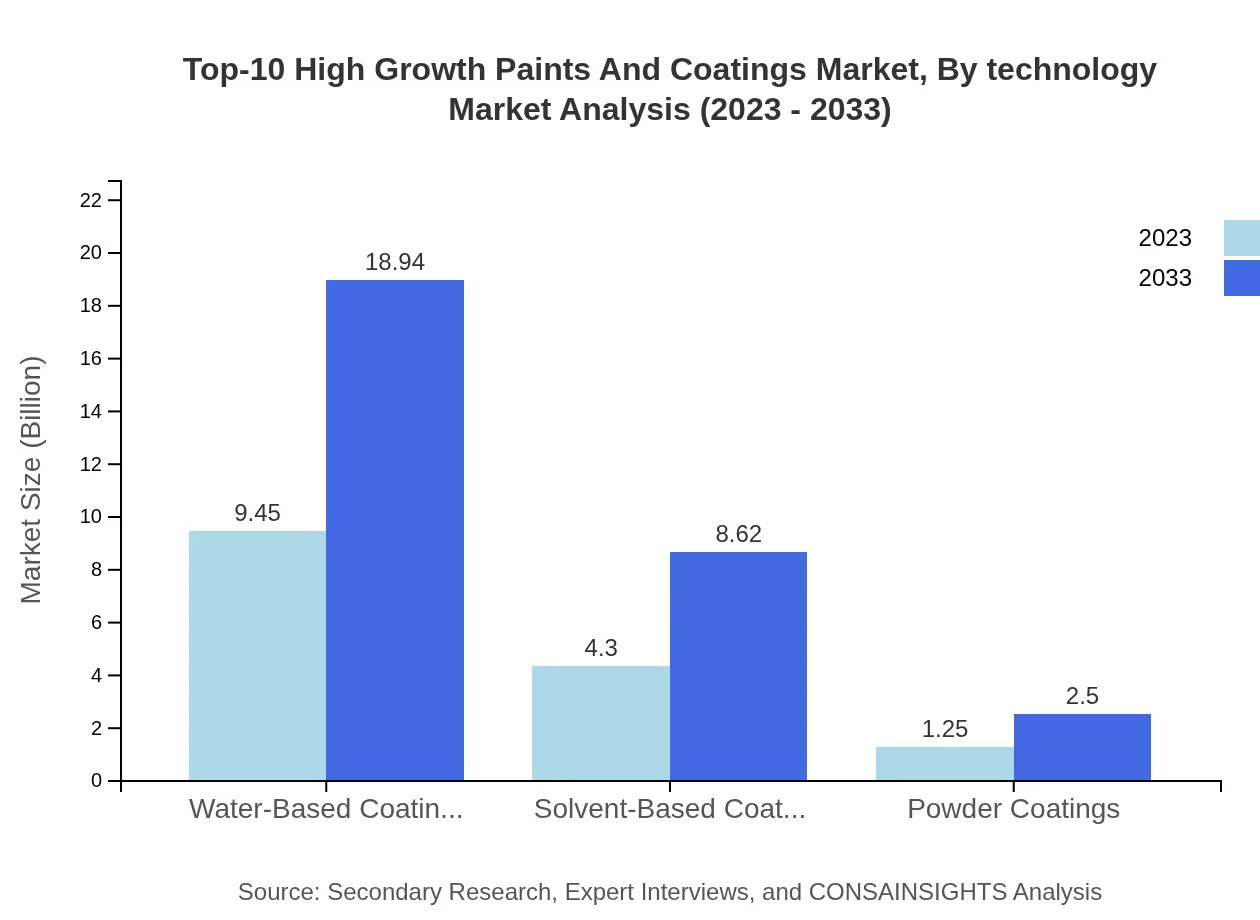

Top-10 High Growth Paints And Coatings Market Analysis By Technology

Technologically, the market is segmented into conventional and advanced technologies. Advanced technologies, including smart coatings and nanotechnology, are gaining traction due to their enhanced performance and multifunctionality. This segment is expected to witness significant growth as the demand for energy-efficient and environment-friendly products rises.

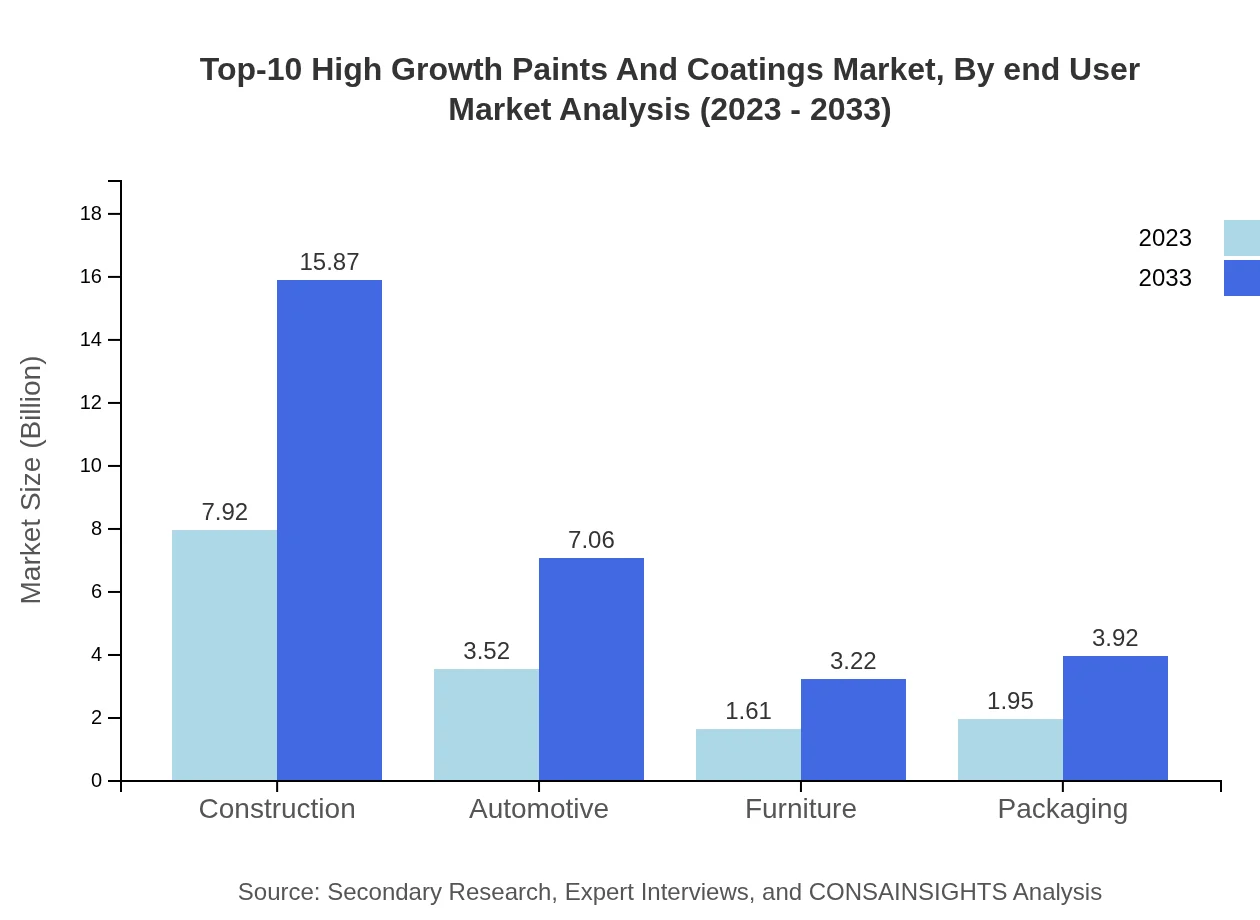

Top-10 High Growth Paints And Coatings Market Analysis By End User

Key end-user industries include construction, automotive, furniture production, and packaging. The construction industry is the largest, with a market size of $7.92 billion in 2023, expected to grow to $15.87 billion by 2033, maintaining a consistent share of 52.78%. The automotive sector follows, holding a 23.47% market share with sizes projected at $3.52 billion in 2023 and $7.06 billion by 2033.

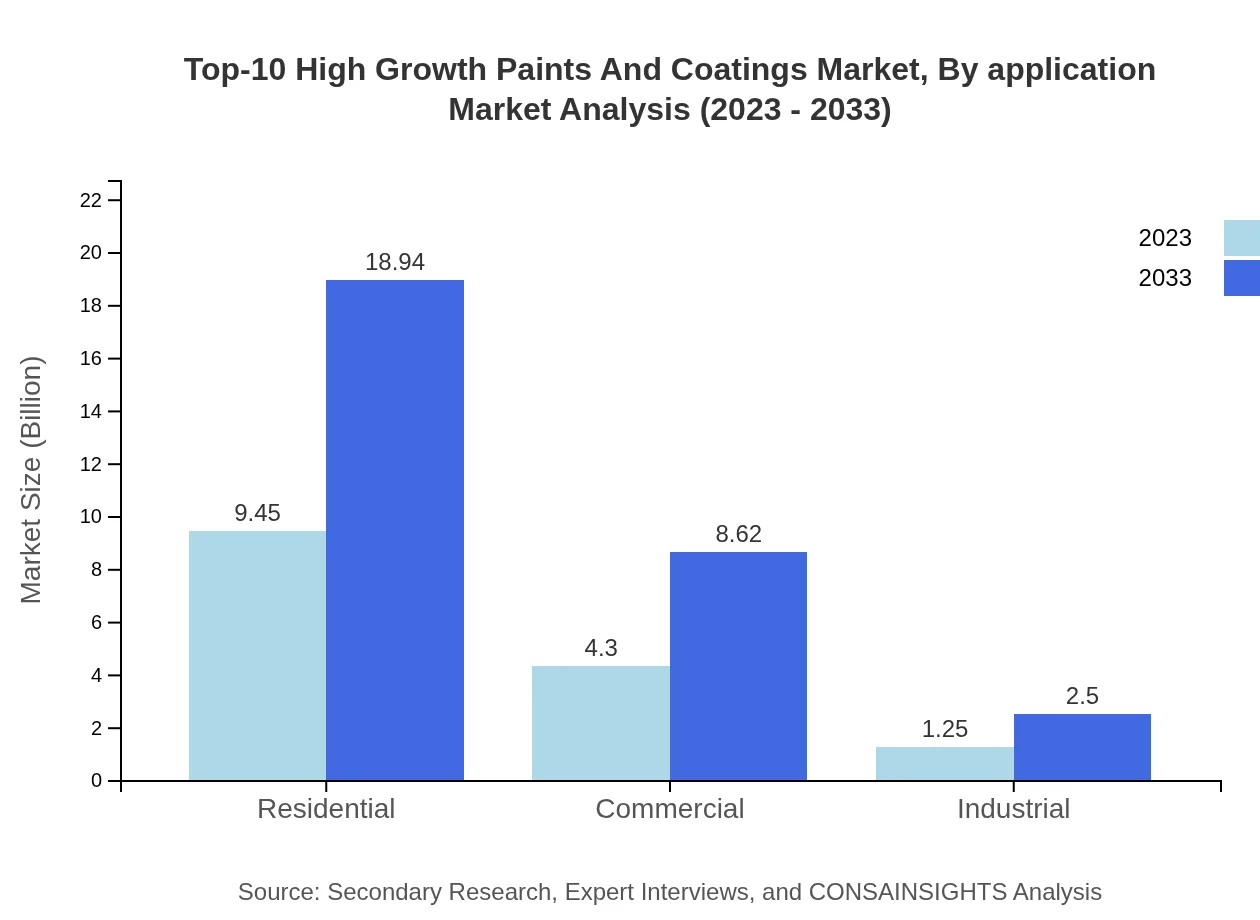

Top-10 High Growth Paints And Coatings Market Analysis By Application

The application segments comprise residential, commercial, and industrial. Residential applications hold the largest share at 63.01%, with market sizes of $9.45 billion in 2023 and $18.94 billion by 2033. Commercial applications represent 28.66% with $4.30 billion in 2023, while industrial applications consist of 8.33% and are expected to grow in tandem with industrial development.

Top-10 High Growth Paints And Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 High Growth Paints And Coatings Industry

AkzoNobel:

AkzoNobel is a leading global paints and coatings company known for its innovation and sustainability efforts across diverse segments.BASF SE:

BASF SE is a key player in the global market, offering a wide range of chemicals, including paints and coatings, with a focus on performance and sustainability.PPG Industries, Inc.:

PPG Industries is a global supplier of paints, coatings, and specialty materials, recognized for its extensive product portfolio and commitment to customer satisfaction.Sherwin-Williams Company:

Sherwin-Williams is a prominent name in the paints and coatings industry, offering high-quality products tailored for different applications.Dupont:

Dupont is an innovative leader in material science, providing a wide array of solutions including advanced coatings that outperform traditional options.We're grateful to work with incredible clients.

FAQs

What is the market size of top-10 High Growth Paints And Coatings?

The global market for top-10 high-growth paints and coatings is projected to be valued at $15 billion in 2023, with a compound annual growth rate (CAGR) of 7%. By 2033, this market is expected to expand significantly, pointing to robust industry potential.

What are the key market players or companies in this top-10 High Growth Paints And Coatings industry?

Key market players include major paint manufacturers and specialty coating companies that dominate in sectors like automotive, construction, and industrial applications. Their investments in innovation and sustainability further define market dynamics and competitive landscapes.

What are the primary factors driving the growth in the top-10 High Growth Paints And Coatings industry?

Growth drivers include rising construction activities, increased demand for durable and eco-friendly products, and technological advancements. The push for sustainable solutions and a shift towards water-based coatings are also vital in shaping industry trends.

Which region is the fastest Growing in the top-10 High Growth Paints And Coatings?

North America is identified as the fastest-growing region, expanding from $5.83 billion in 2023 to an estimated $11.68 billion by 2033. This growth is propelled by infrastructure developments and a surge in residential and commercial projects.

Does ConsaInsights provide customized market report data for the top-10 High Growth Paints And Coatings industry?

Yes, ConsaInsights offers tailored market report solutions designed to meet specific client needs. This includes-depth analysis of market dynamics, competitive landscapes, and regional insights crucial for strategic decision-making.

What deliverables can I expect from this top-10 High Growth Paints And Coatings market research project?

Expect comprehensive deliverables including detailed market analysis, trend forecasts, competitive intelligence reports, and segmentation insights. Add-on services like consulting and data visualization options are also available to enhance usability.

What are the market trends of top-10 High Growth Paints And Coatings?

Market trends include a shift towards sustainable coatings, innovations in high-performance products, and an emphasis on the architectural segment. Additionally, increased automation in manufacturing processes and digitalization remain pivotal for industry growth.