Top-10 Military Cns Technologies Market Report

Published Date: 03 February 2026 | Report Code: top-10-military-cns-technologies

Top-10 Military Cns Technologies Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Top-10 Military Cns Technologies market for the period 2023-2033, covering market size, growth trends, segmentation, and regional insights.

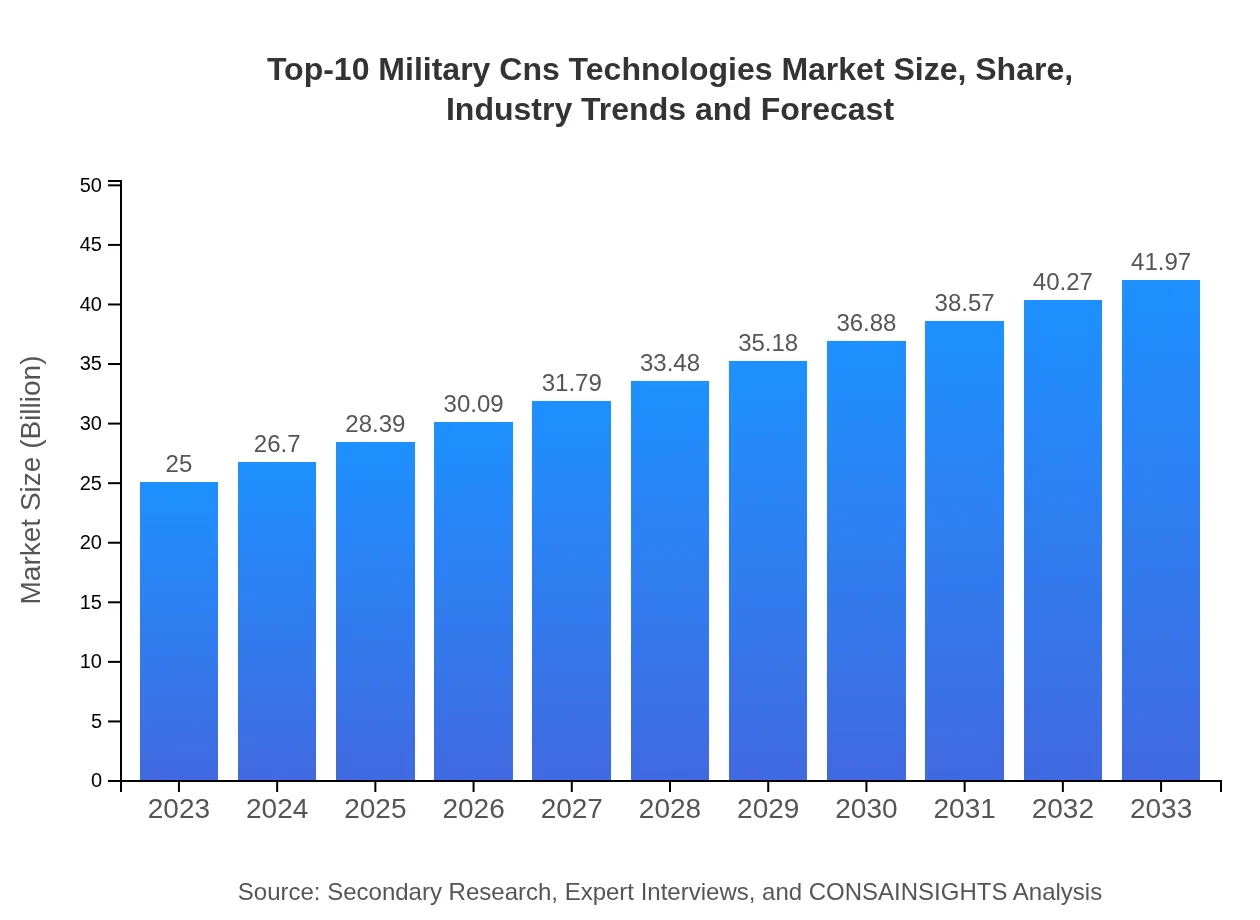

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $41.97 Billion |

| Top Companies | Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, General Dynamics Corporation |

| Last Modified Date | 03 February 2026 |

Top-10 Military Cns Technologies Market Overview

Customize Top-10 Military Cns Technologies Market Report market research report

- ✔ Get in-depth analysis of Top-10 Military Cns Technologies market size, growth, and forecasts.

- ✔ Understand Top-10 Military Cns Technologies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 Military Cns Technologies

What is the Market Size & CAGR of Top-10 Military Cns Technologies market in 2023?

Top-10 Military Cns Technologies Industry Analysis

Top-10 Military Cns Technologies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 Military Cns Technologies Market Analysis Report by Region

Europe Top-10 Military Cns Technologies Market Report:

The European market is set to expand from $7.72 billion in 2023 to $12.96 billion by 2033 as nations increase collaboration on defense technology projects amid rising geopolitical tensions.Asia Pacific Top-10 Military Cns Technologies Market Report:

In 2023, the Asia Pacific region holds a market size of approximately $4.40 billion, projected to grow to $7.39 billion by 2033. Countries like China and India are increasing their military expenditure significantly, driving the technology adoption.North America Top-10 Military Cns Technologies Market Report:

North America leads the market with a size of $9.35 billion in 2023, anticipated to grow to $15.69 billion by 2033. The U.S. military's focus on advanced Cns technologies for global operations propels this growth.South America Top-10 Military Cns Technologies Market Report:

The South American market, valued at $2.34 billion in 2023, is expected to reach $3.93 billion by 2033 due to expanding defense budgets aimed at modernizing military capabilities and addressing regional security challenges.Middle East & Africa Top-10 Military Cns Technologies Market Report:

In the Middle East and Africa, the market is valued at $1.19 billion in 2023, with projections reaching $2.00 billion by 2033, largely driven by regional conflicts and the necessity for enhanced defense mechanisms.Tell us your focus area and get a customized research report.

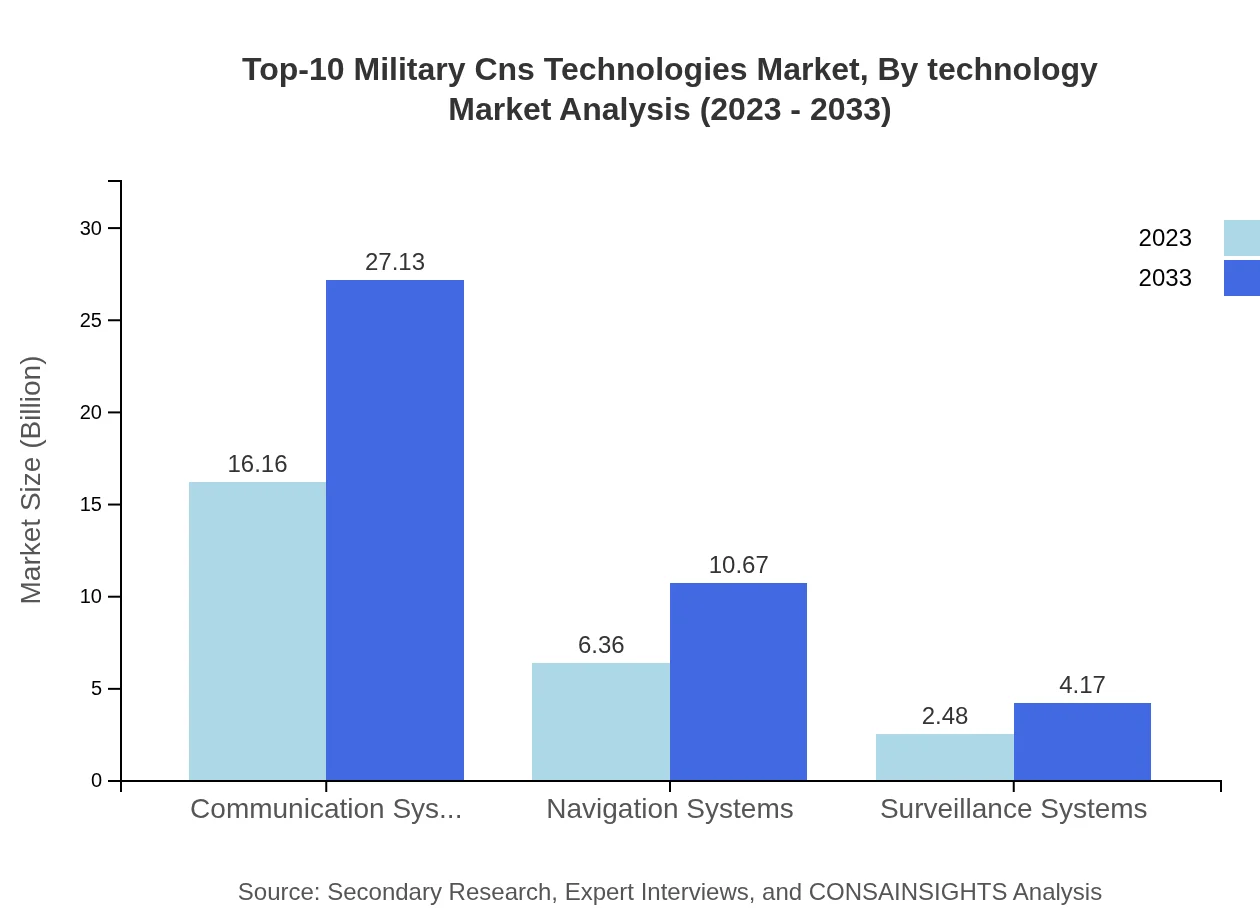

Top-10 Military Cns Technologies Market Analysis By Technology

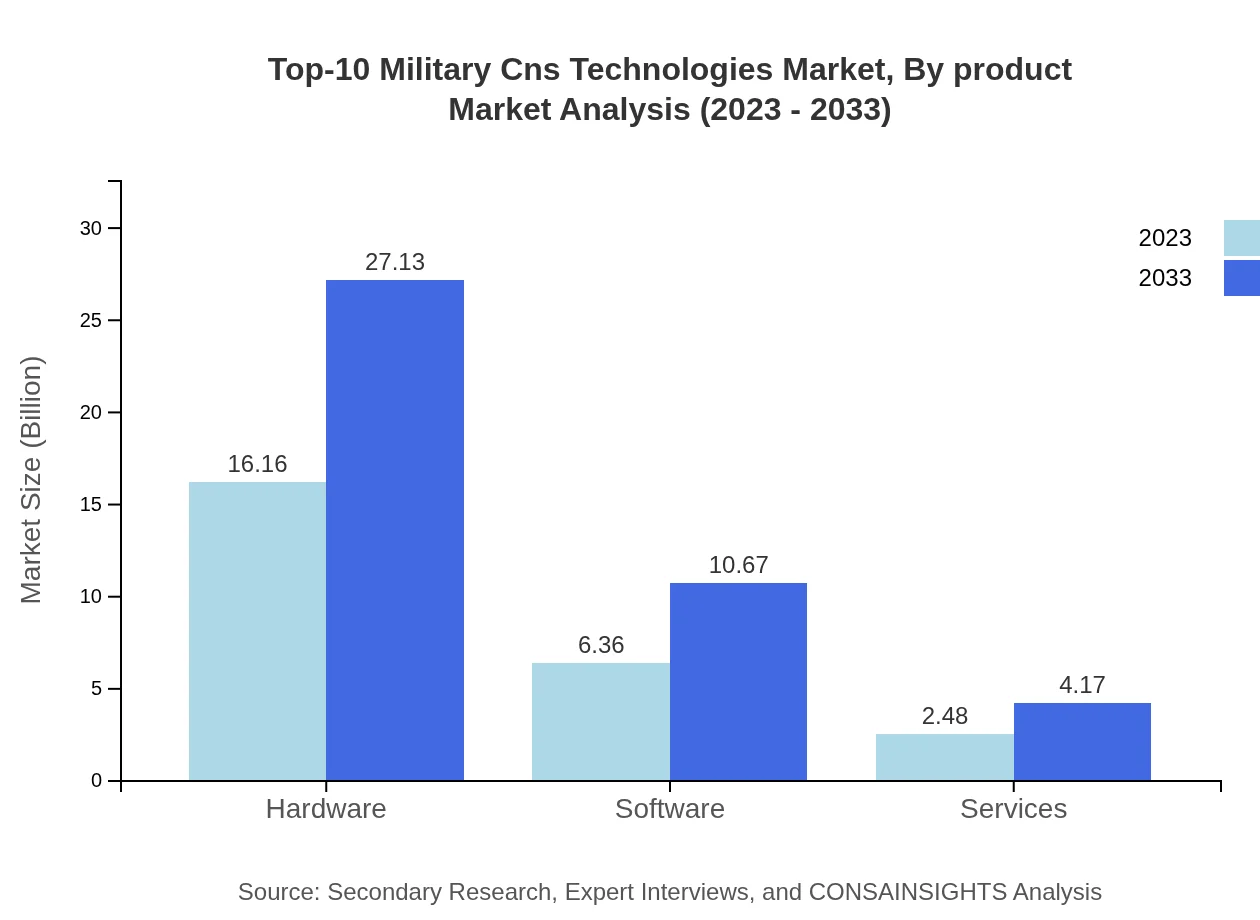

In 2023, the hardware segment dominates the Top-10 Military Cns Technologies market with a size of $16.16 billion and a market share of 64.64%. It is projected to grow to $27.13 billion by 2033. Software and services hold market sizes of $6.36 billion and $2.48 billion respectively in 2023, expected to reach $10.67 billion and $4.17 billion by 2033.

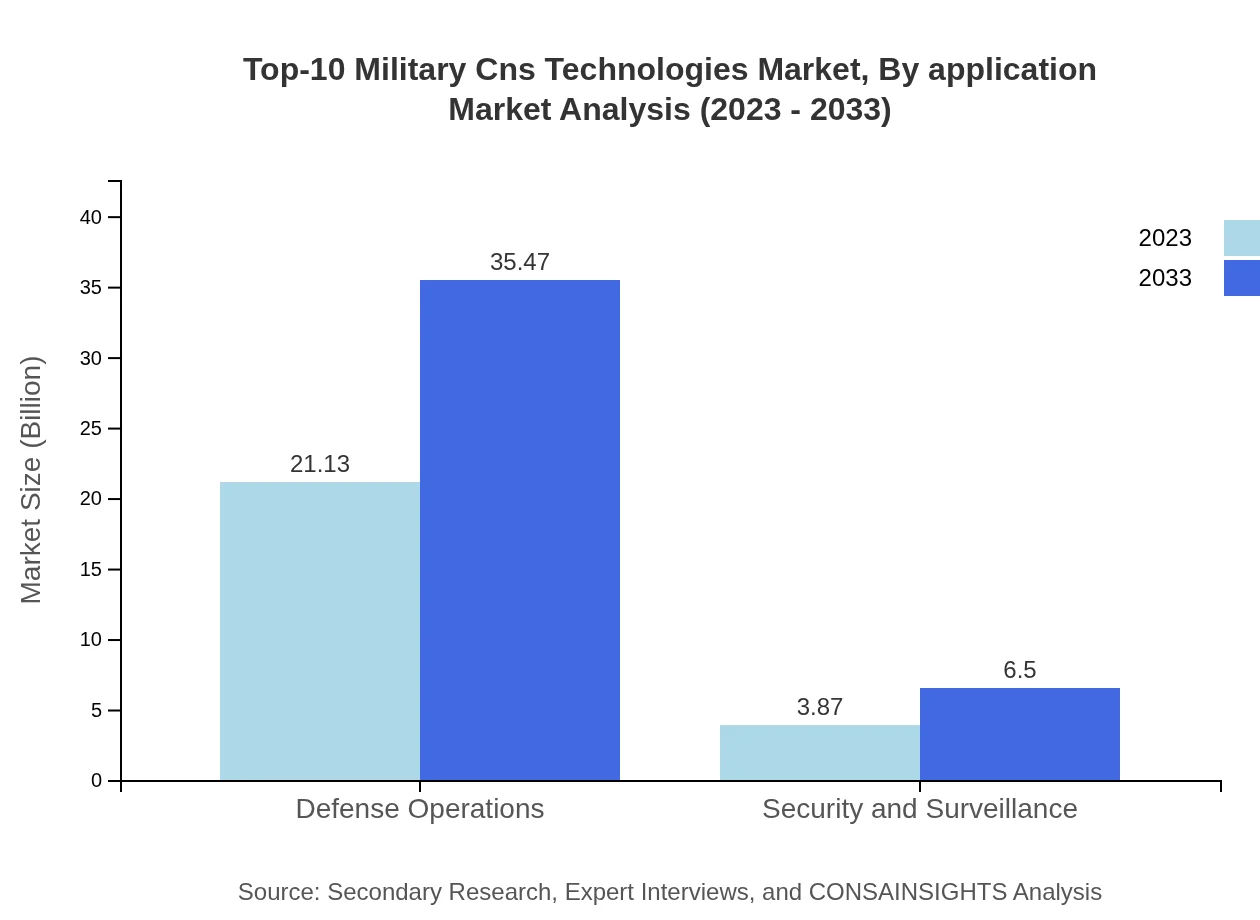

Top-10 Military Cns Technologies Market Analysis By Application

Defense operations constitute a significant market component with a size of $21.13 billion in 2023, growing to $35.47 billion by 2033, indicative of the need for enhanced operational capabilities.

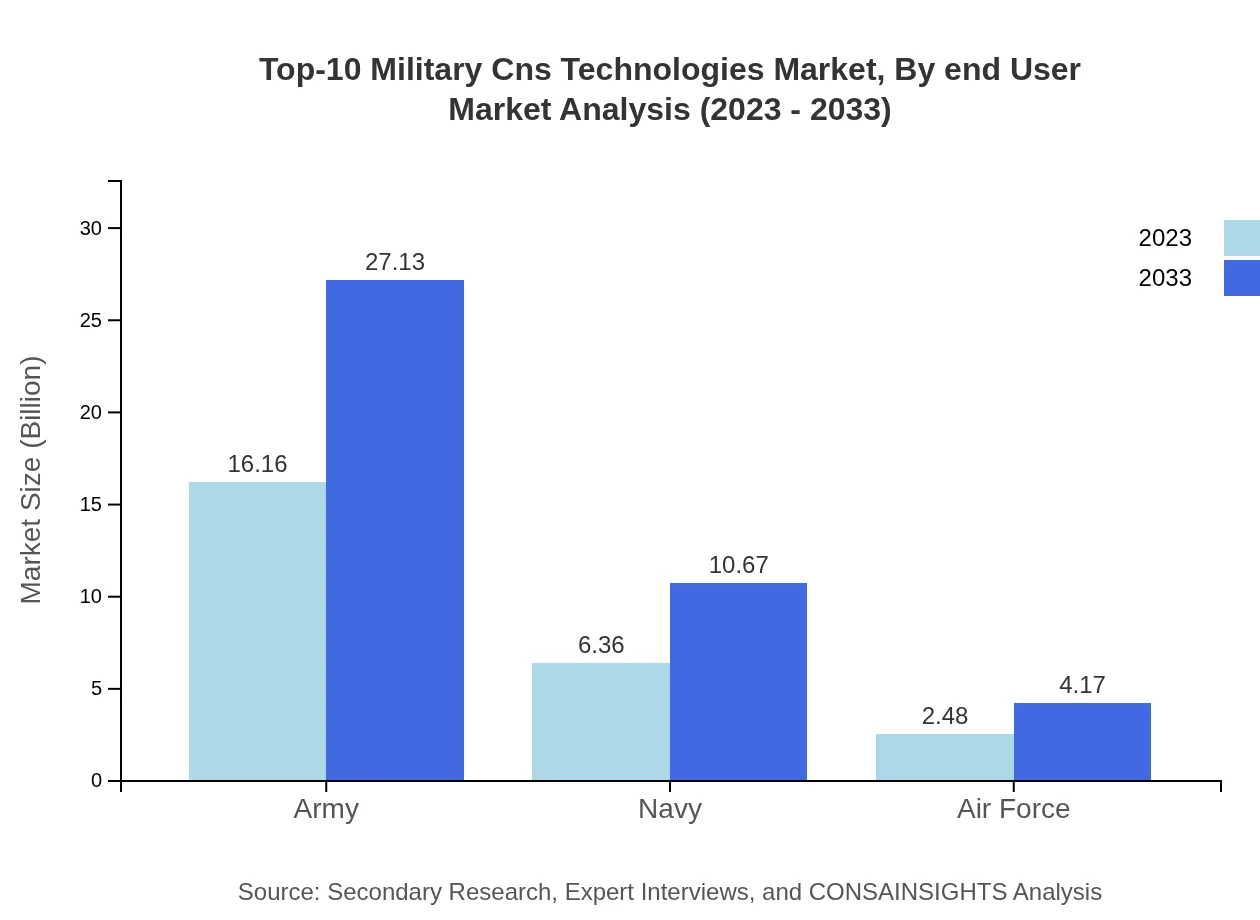

Top-10 Military Cns Technologies Market Analysis By End User

The Army leads in market share, with a size of $16.16 billion in 2023, while the Navy and Air Force maintain shares of $6.36 billion and $2.48 billion respectively, reflecting distinct procurement strategies across branches.

Top-10 Military Cns Technologies Market Analysis By Product

Communication and navigation systems are essential products, with revenues from communication systems reaching $16.16 billion in 2023 and expected to contribute significantly to future market growth.

Top-10 Military Cns Technologies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 Military Cns Technologies Industry

Lockheed Martin Corporation:

Lockheed Martin is a key player in military technologies, providing advanced communication, navigation, and surveillance systems integral to military operations.Raytheon Technologies Corporation:

A leader in cybersecurity and advanced defense technologies, Raytheon plays a crucial role in developing transformational military solutions.Northrop Grumman Corporation:

Northrop Grumman specializes in unmanned systems, advanced sensors, and cybersecurity technologies, influencing modern military operations.General Dynamics Corporation:

General Dynamics delivers technology solutions and services for various military applications, focusing on strategic defense enhancements.We're grateful to work with incredible clients.

FAQs

What is the market size of top-10 Military Cns Technologies?

The top-10 military CNS technologies market is valued at $25 billion in 2023, with a projected growth at a CAGR of 5.2%, reaching approximately $40 billion by 2033.

What are the key market players or companies in this top-10 Military Cns Technologies industry?

Key players in the top-10 military CNS technologies industry include defense contractors, technology firms, and software developers specializing in military applications, emphasizing innovation in hardware and software systems.

What are the primary factors driving the growth in the top-10 Military Cns Technologies industry?

Growth drivers include increased defense spending, technological advancements, need for enhanced security systems, and rising geopolitical tensions necessitating better military capabilities.

Which region is the fastest Growing in the top-10 Military Cns Technologies?

North America is the fastest-growing region in the military CNS technologies market, expected to grow from $9.35 billion in 2023 to $15.69 billion by 2033, followed by Europe.

Does ConsaInsights provide customized market report data for the top-10 Military Cns Technologies industry?

Yes, ConsaInsights offers customized market report data, allowing clients to receive tailored insights that meet specific research requirements and focus areas in the military CNS technologies sector.

What deliverables can I expect from this top-10 Military Cns Technologies market research project?

Deliverables include comprehensive reports, market forecasts, competitive analysis, and insights on trends and opportunities within the top-10 military CNS technologies market.

What are the market trends of top-10 Military Cns Technologies?

Current trends include the integration of AI and machine learning in defense systems, increased cybersecurity measures, and a focus on enhancing communication and navigation technologies.