Top-10 Plastics Market Report

Published Date: 02 February 2026 | Report Code: top-10-plastics

Top-10 Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Top-10 Plastics market, including market size, growth trends, segmentation, and regional insights from 2023 to 2033. It aims to equip stakeholders with valuable data to inform their decision-making processes.

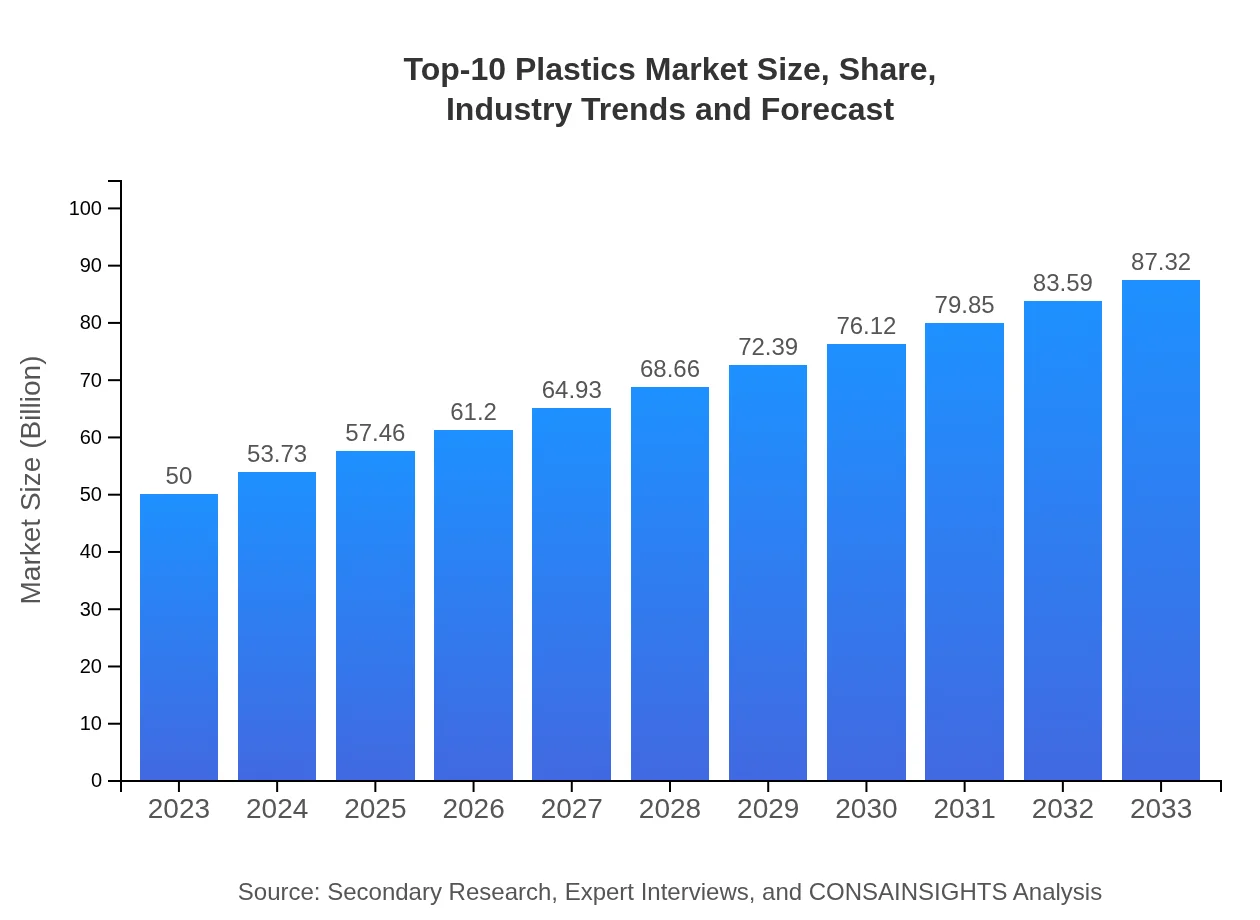

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $87.32 Billion |

| Top Companies | BASF, Dow Chemical, ExxonMobil, DuPont, SABIC |

| Last Modified Date | 02 February 2026 |

Top-10 Plastics Market Overview

Customize Top-10 Plastics Market Report market research report

- ✔ Get in-depth analysis of Top-10 Plastics market size, growth, and forecasts.

- ✔ Understand Top-10 Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 Plastics

What is the Market Size & CAGR of Top-10 Plastics market in 2023 and 2033?

Top-10 Plastics Industry Analysis

Top-10 Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 Plastics Market Analysis Report by Region

Europe Top-10 Plastics Market Report:

Europe presents a market size of $13.47 billion in 2023, forecasted to reach $23.52 billion by 2033. The region is focusing on stringent regulations concerning plastic usage and sustainability, propelling innovations and alternative materials.Asia Pacific Top-10 Plastics Market Report:

The Asia Pacific region is a major contributor to the Top-10 Plastics market, with a market size of approximately $10.72 billion in 2023, expected to grow to $18.73 billion by 2033. The region is driven by robust manufacturing infrastructure and high demand from the packaging and automotive sectors.North America Top-10 Plastics Market Report:

North America, with a market size of $17.92 billion in 2023, anticipates growth to $31.29 billion by 2033. The market growth is propelled by advancements in recycling technologies and a shift towards sustainable practices in the plastics industry.South America Top-10 Plastics Market Report:

In South America, the market size is projected to expand from $4.30 billion in 2023 to $7.51 billion by 2033. The region is seeing increased investments in infrastructure and construction, leading to higher demand for various plastic products.Middle East & Africa Top-10 Plastics Market Report:

The Middle East and Africa's market is poised to grow from $3.58 billion in 2023 to $6.26 billion by 2033, with developments in industrialization and modernization of infrastructure playing a vital role in market expansion.Tell us your focus area and get a customized research report.

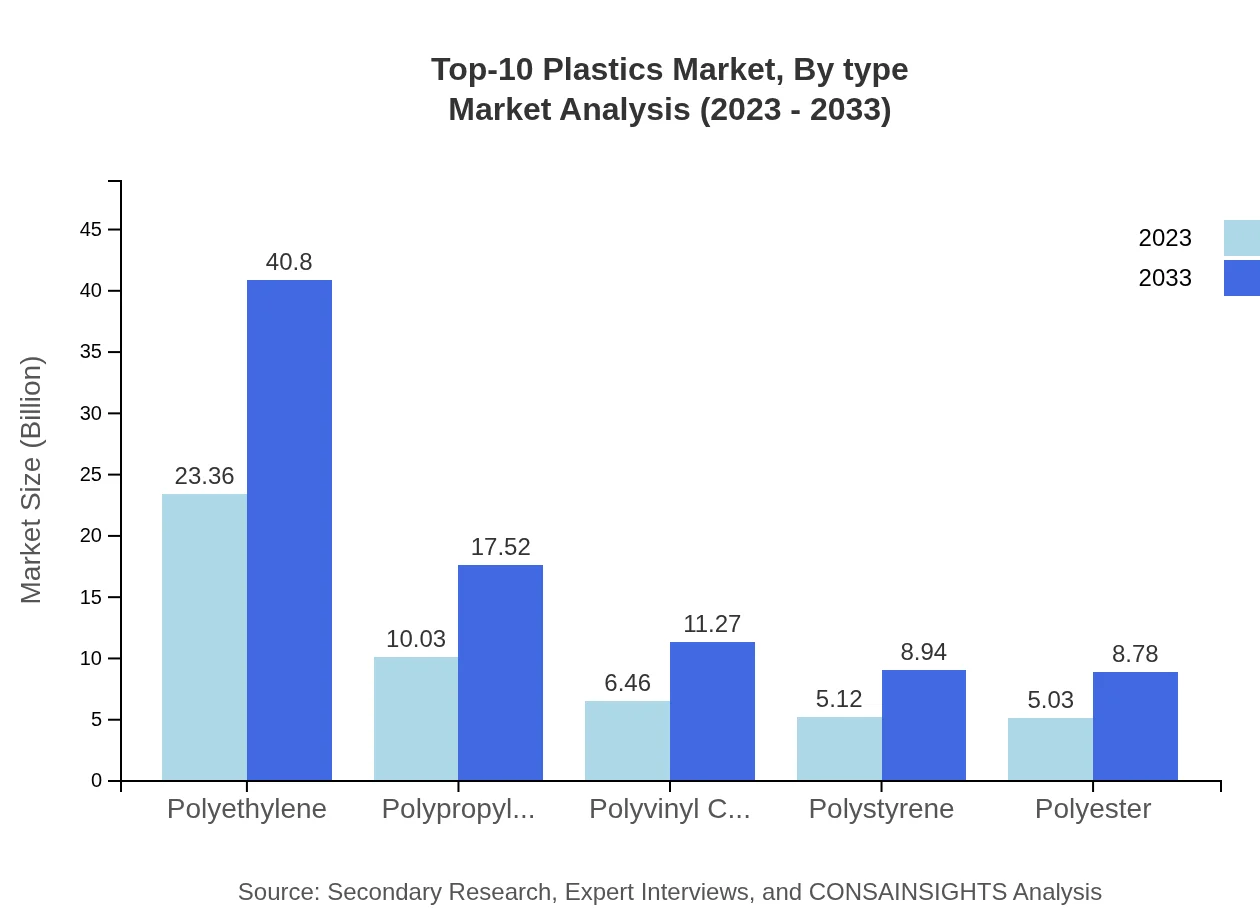

Top-10 Plastics Market Analysis By Type

The segment analysis by type indicates that Polyethylene leads the market, with a size of $23.36 billion in 2023, projected to grow to $40.80 billion by 2033. Polypropylene follows with significant contributions from the automotive industry, alongside other materials like PVC and Polystyrene, which show steady growth in demand.

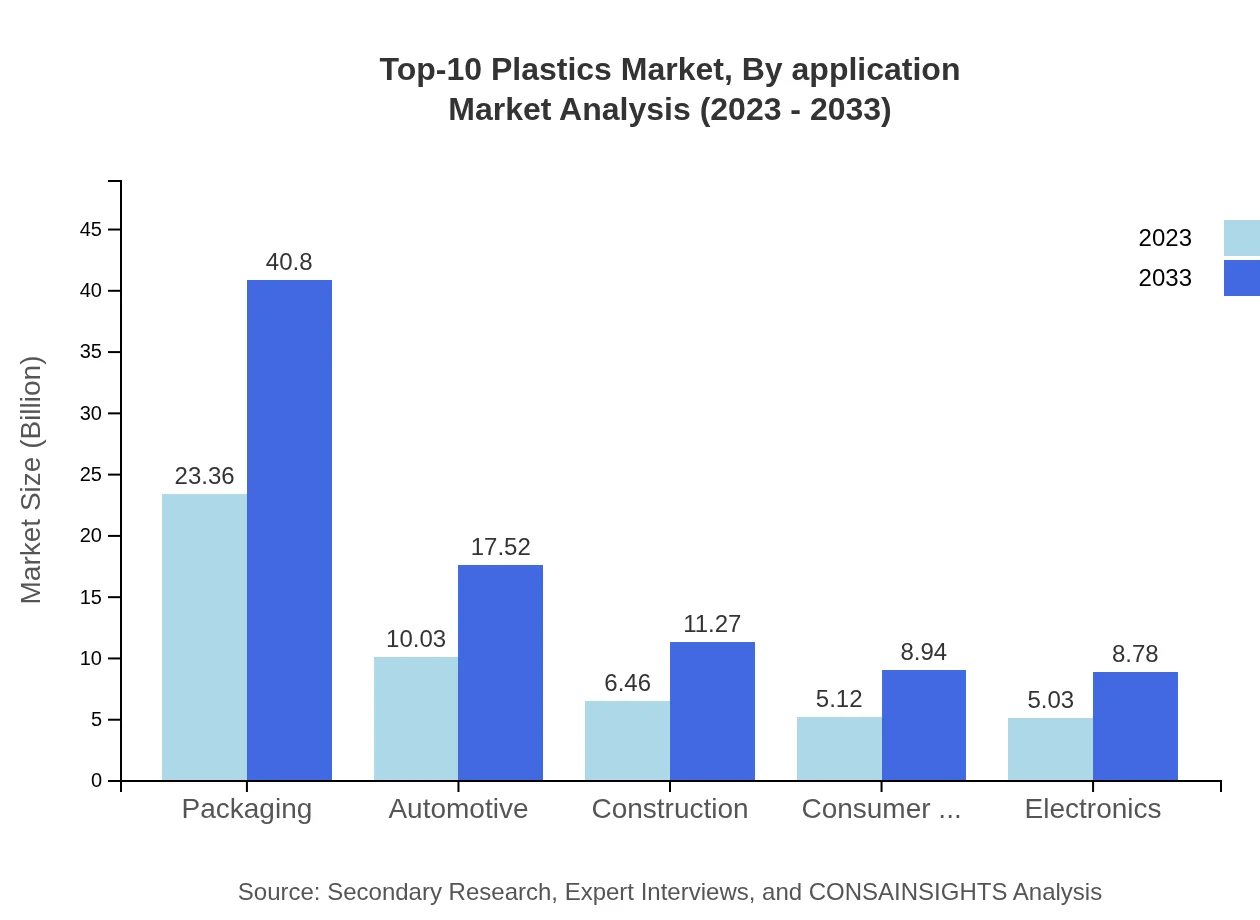

Top-10 Plastics Market Analysis By Application

Packaging remains the dominant application segment, representing a substantial share due to its versatility. The automotive sector, electronic products, and construction activities are substantial end-users, each witnessing robust demand for specific plastic types, reflecting the overall market growth trajectory.

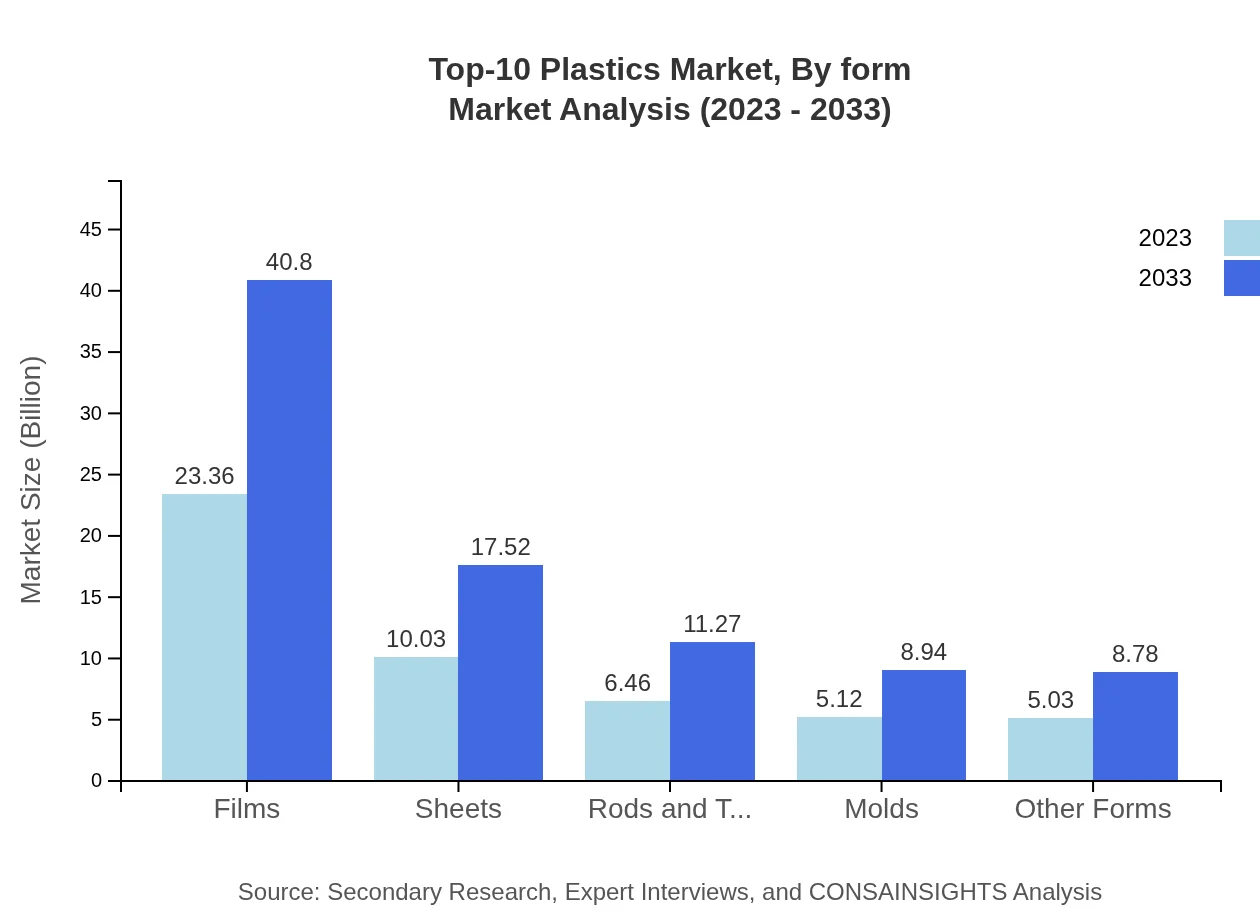

Top-10 Plastics Market Analysis By Form

Focusing on form, products like films, sheets, rods, tubes, and molds are consistently utilized across industries. Films and sheets specifically account for a significant portion of the market, responding to needs in packaging and construction, respectively.

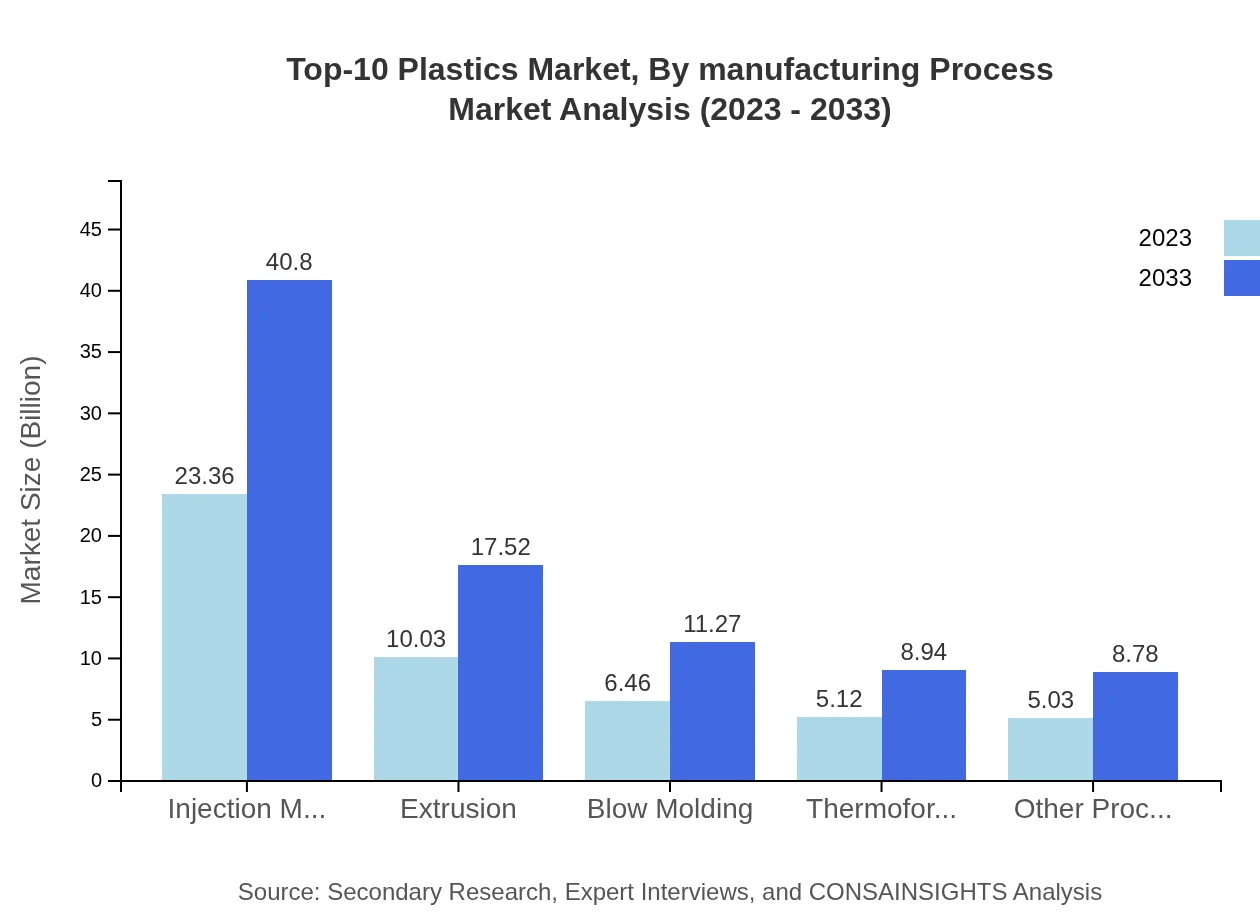

Top-10 Plastics Market Analysis By Manufacturing Process

Injection molding is the leading manufacturing process, prevalent due to its efficiency and versatility, especially in producing intricate designs. Other processes like extrusion and blow molding also serve crucial roles across various applications, contributing to the diverse product landscape of the plastics market.

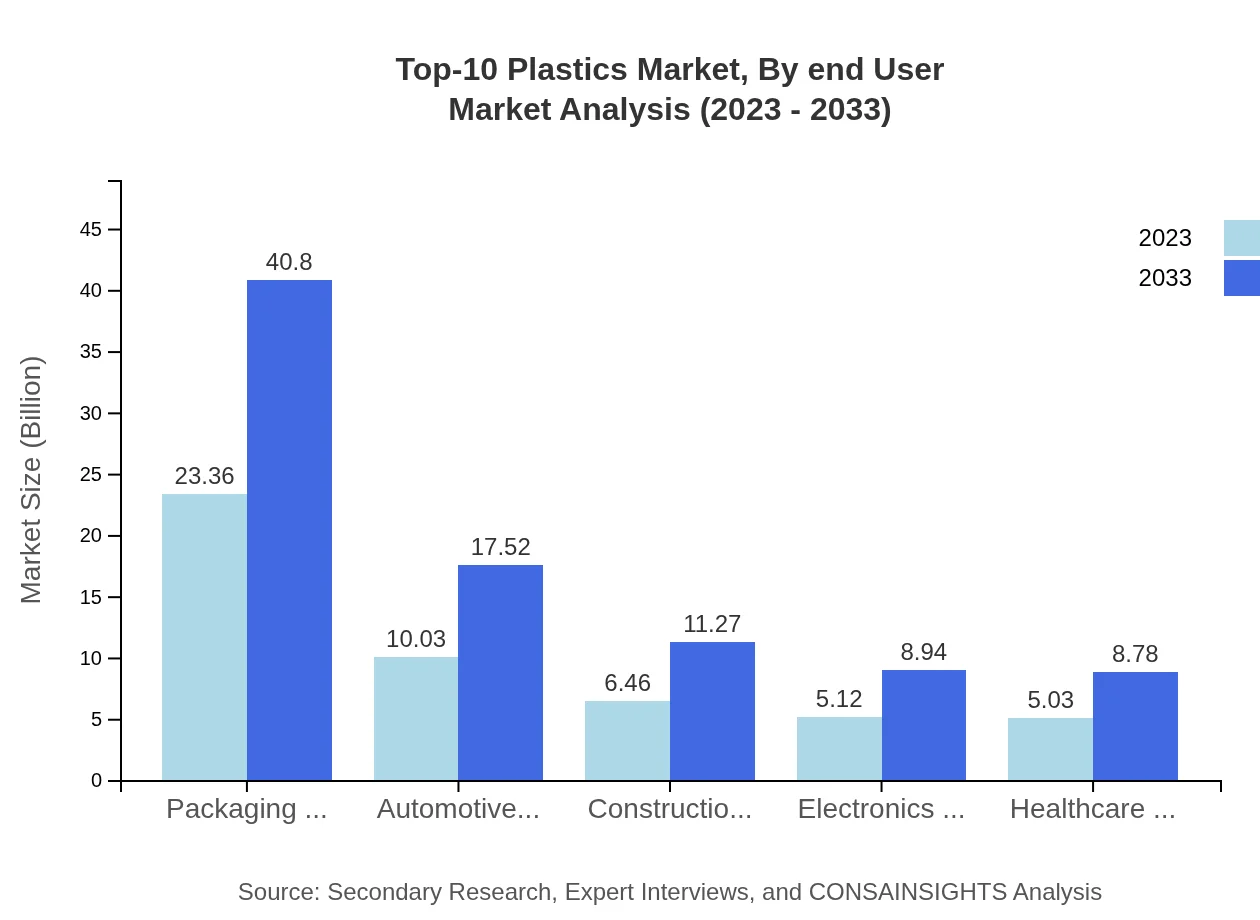

Top-10 Plastics Market Analysis By End User

The end-user industry analysis shows that packaging, automotive, and construction are the top consumers of plastics. Their demand is driven by ongoing projects and the need for durable, lightweight materials in manufacturing, which in turn propels the overall plastic markets.

Top-10 Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 Plastics Industry

BASF:

BASF is one of the world's leading chemical companies, heavily investing in sustainable plastic solutions including bioplastics.Dow Chemical:

Dow Chemical is known for innovation in plastic production and is heavily involved in developing advanced polymer technologies.ExxonMobil:

ExxonMobil is a major player in the petrochemical industry, providing a wide range of polymers and setting industry standards.DuPont:

DuPont specializes in advanced materials and is focusing on sustainability initiatives and high-performance plastics.SABIC:

SABIC is a global leader in the plastics market, offering innovative plastic products tailored for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of top-10 Plastics?

The global Top-10 Plastics market is projected to grow from $50 billion in 2023 to significant levels by 2033, with an expected CAGR of 5.6%. This growth highlights the increasing consumption and application of various plastic materials.

What are the key market players or companies in this top-10 Plastics industry?

Key players in the top-10 plastics industry include major corporations such as ExxonMobil, BASF, Dow Chemical, and SABIC among others. These companies dominate through innovation and strategic investment in sustainable plastic solutions.

What are the primary factors driving the growth in the top-10 plastics industry?

Key drivers of growth in the top-10 plastics industry include rising demand from the packaging and automotive sectors, technological advancements in polymer production, and the increasing emphasis on lightweight materials for energy efficiency.

Which region is the fastest Growing in the top-10 plastics?

The Asia Pacific region is the fastest-growing market for top-10 plastics, expected to expand from $10.72 billion in 2023 to $18.73 billion by 2033, fueled by a booming industrial base and increasing urbanization.

Does ConsaInsights provide customized market report data for the top-10 plastics industry?

Yes, ConsaInsights offers customized market report data tailored to the top-10 plastics industry, focusing on specific segments, regional insights, and emerging trends as per client requirements.

What deliverables can I expect from this top-10 plastics market research project?

Expect comprehensive deliverables from the top-10 plastics market research project including detailed reports, market forecasts, competitive analysis, trend assessments, and actionable insights tailored to your business needs.

What are the market trends of top-10 plastics?

Emerging trends in the top-10 plastics market include a shift towards bio-based and recyclable materials, advancements in plastic manufacturing technologies, and increasing regulatory pressures focused on reducing plastic waste.