Top-10 Pumps And Motors Market Report

Published Date: 22 January 2026 | Report Code: top-10-pumps-and-motors

Top-10 Pumps And Motors Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive overview of the Top-10 Pumps and Motors market, including detailed analysis, insights into market trends, forecasts for 2023-2033, and vital data related to market size, segmentation, and regional performance.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

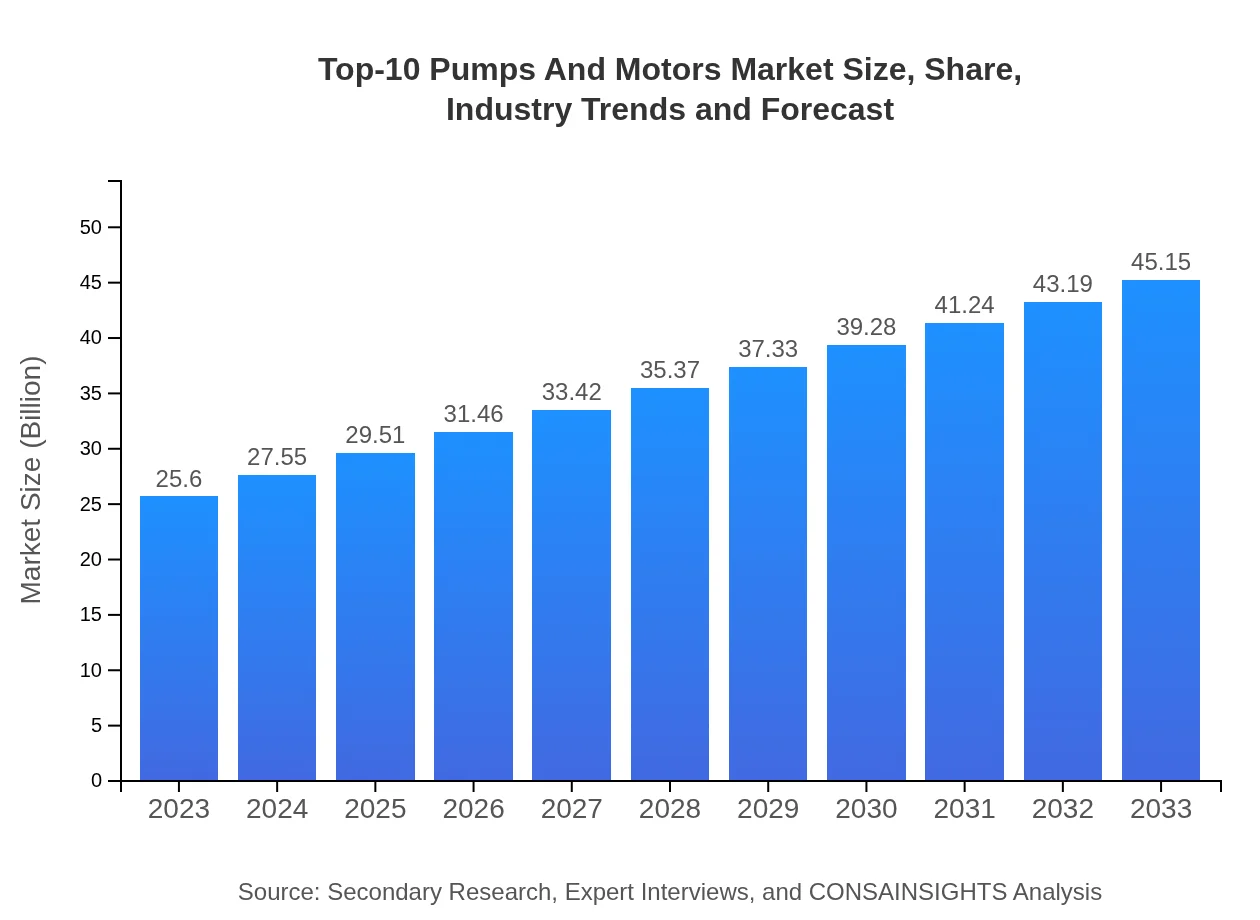

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $45.15 Billion |

| Top Companies | Grundfos, Flowserve Corporation, Xylem Inc., KSB AG, Ebara Corporation |

| Last Modified Date | 22 January 2026 |

Top-10 Pumps And Motors Market Overview

Customize Top-10 Pumps And Motors Market Report market research report

- ✔ Get in-depth analysis of Top-10 Pumps And Motors market size, growth, and forecasts.

- ✔ Understand Top-10 Pumps And Motors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-10 Pumps And Motors

What is the Market Size & CAGR of Top-10 Pumps And Motors market in 2023?

Top-10 Pumps And Motors Industry Analysis

Top-10 Pumps And Motors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-10 Pumps And Motors Market Analysis Report by Region

Europe Top-10 Pumps And Motors Market Report:

Europe's market for pumps and motors is expected to grow significantly, from $6.76 billion in 2023 to $11.92 billion by 2033. The traction in this region is largely influenced by stringent regulatory policies promoting energy efficiency and environmental safety.Asia Pacific Top-10 Pumps And Motors Market Report:

The Asia-Pacific region is rapidly emerging as a powerhouse for the Top-10 Pumps and Motors market, with an expected market size of $9.74 billion by 2033, up from $5.52 billion in 2023. The growth is driven by rising industrialization, urbanization, and infrastructural projects in countries such as China and India.North America Top-10 Pumps And Motors Market Report:

North America is one of the leading markets for pumps and motors, anticipated to increase from $8.66 billion in 2023 to $15.27 billion in 2033. The growth is bolstered by ongoing industrial advancements, including renewable energy projects and enhanced water conservation technologies.South America Top-10 Pumps And Motors Market Report:

In South America, the market is projected to grow from $2.00 billion in 2023 to $3.52 billion by 2033. The demand is primarily supported by the region's increasing investment in public utilities and agricultural enhancements.Middle East & Africa Top-10 Pumps And Motors Market Report:

In the Middle East and Africa, the market is projected to rise from $2.66 billion in 2023 to $4.70 billion by 2033, driven by increasing investments in infrastructure and industrial projects to support economic growth.Tell us your focus area and get a customized research report.

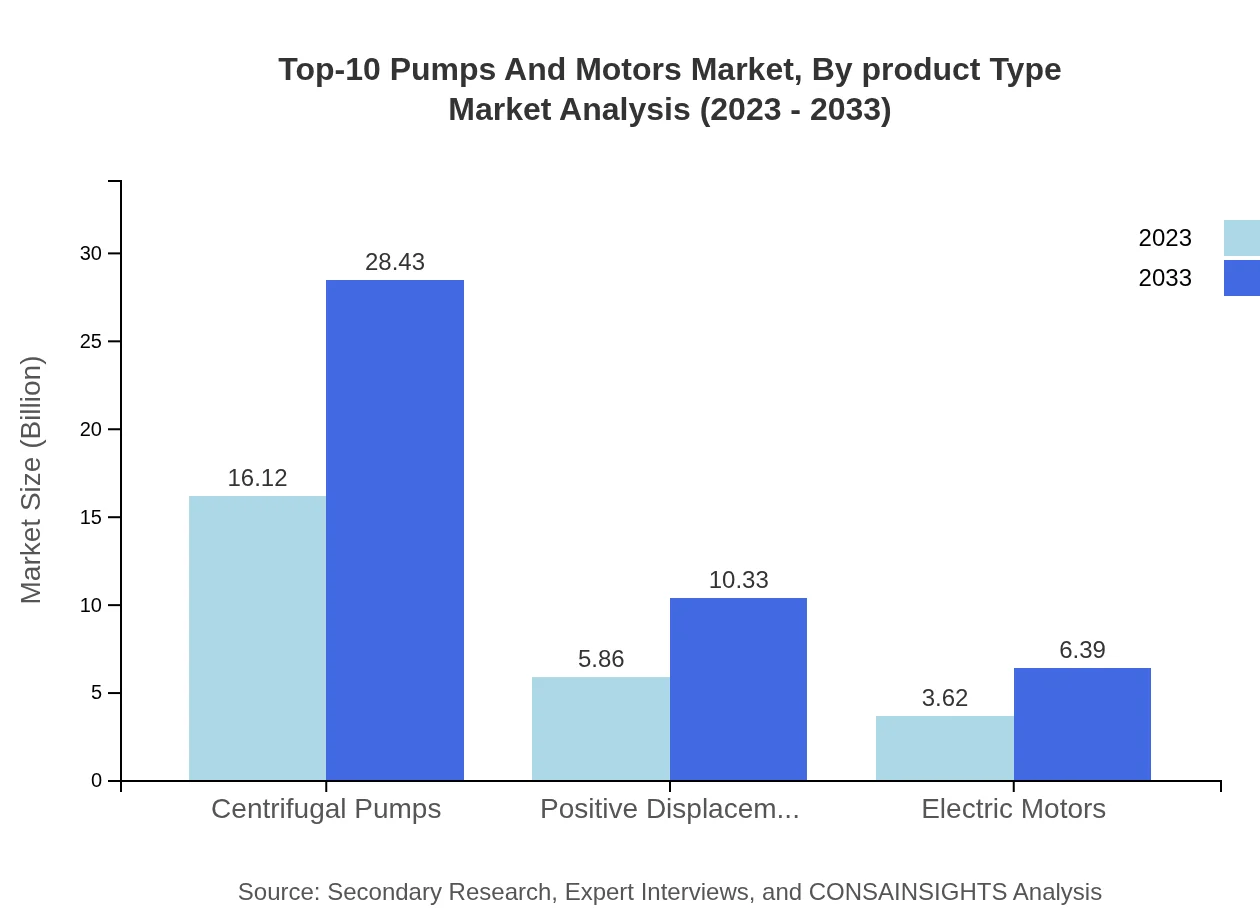

Top-10 Pumps And Motors Market Analysis By Product Type

Centrifugal pumps dominate the market with a projected size of $16.12 billion in 2023, anticipated to grow to $28.43 billion by 2033. Positive displacement pumps also hold a significant share with a market size of $5.86 billion in 2023, expected to reach $10.33 billion by 2033. Electric motors are crucial for driving efficiency and are projected to grow alongside these products.

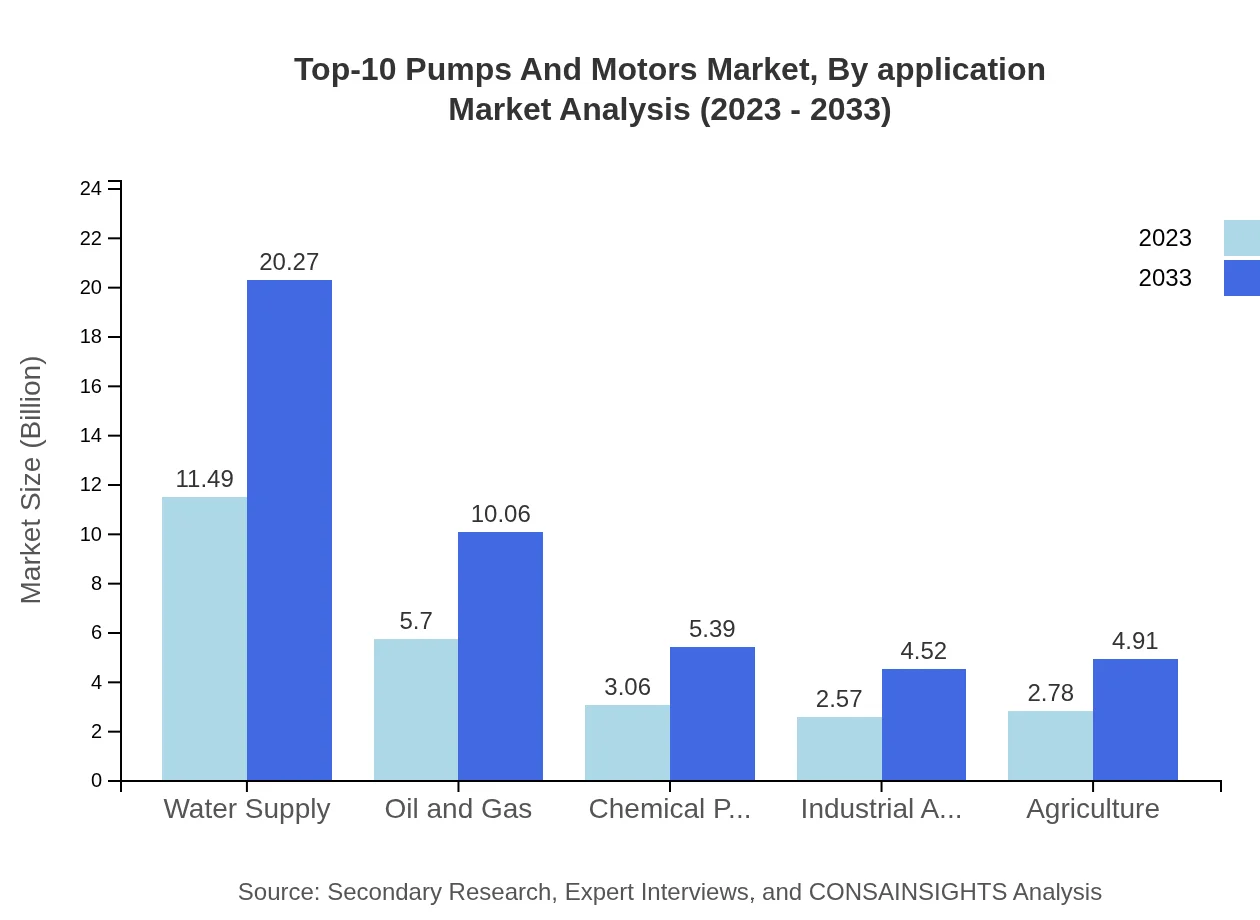

Top-10 Pumps And Motors Market Analysis By Application

The municipal application is projected to be the largest segment, with a size of $11.49 billion in 2023, expected to reach $20.27 billion by 2033. The agriculture sector is also critical, with an increase expected from $2.78 billion in 2023 to $4.91 billion by 2033, underscoring the importance of water management.

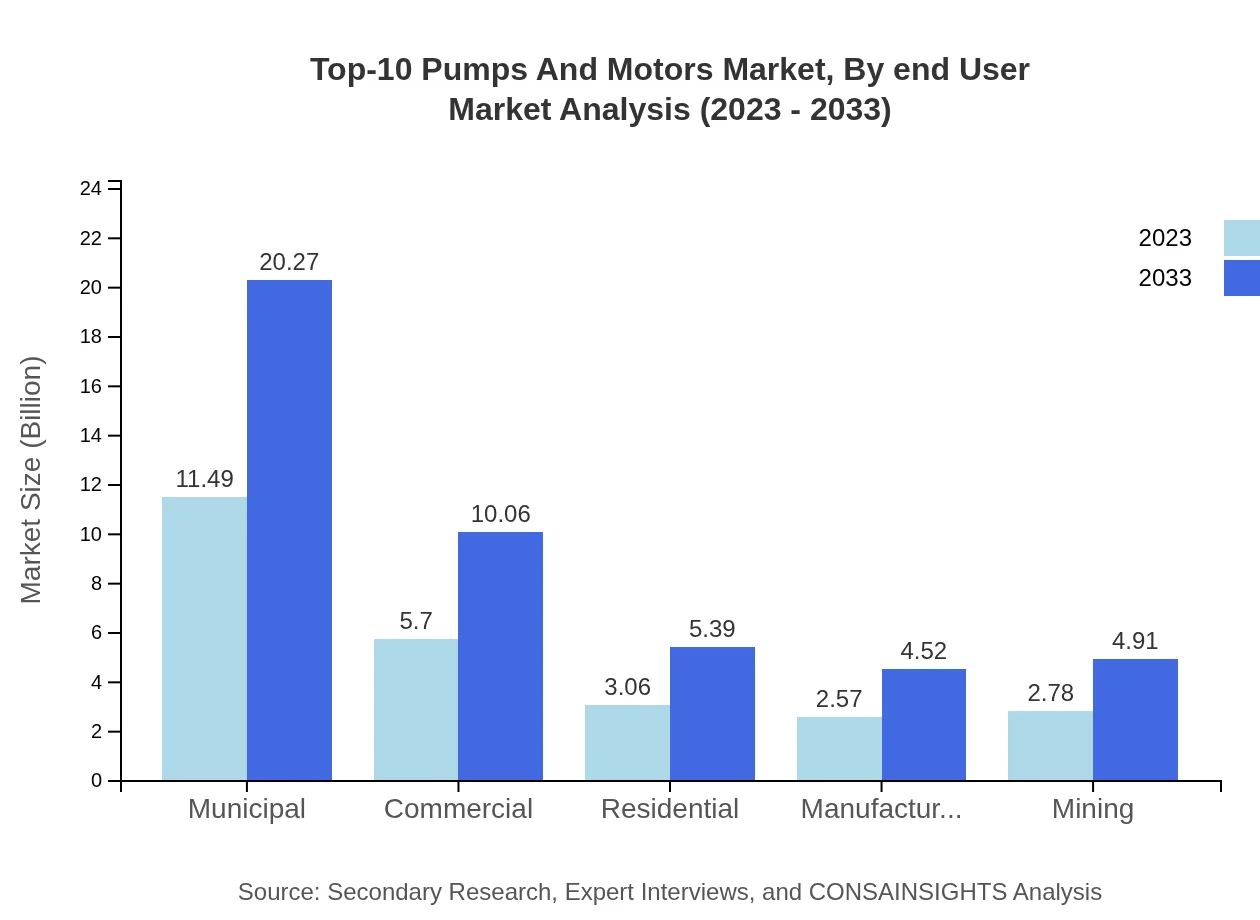

Top-10 Pumps And Motors Market Analysis By End User

Major end-user industries include water supply, manufacturing, and oil & gas, reflecting diverse demand drivers. The oil & gas segment is projected to grow from $5.70 billion in 2023 to $10.06 billion by 2033, indicating robust infrastructural and operational expansion.

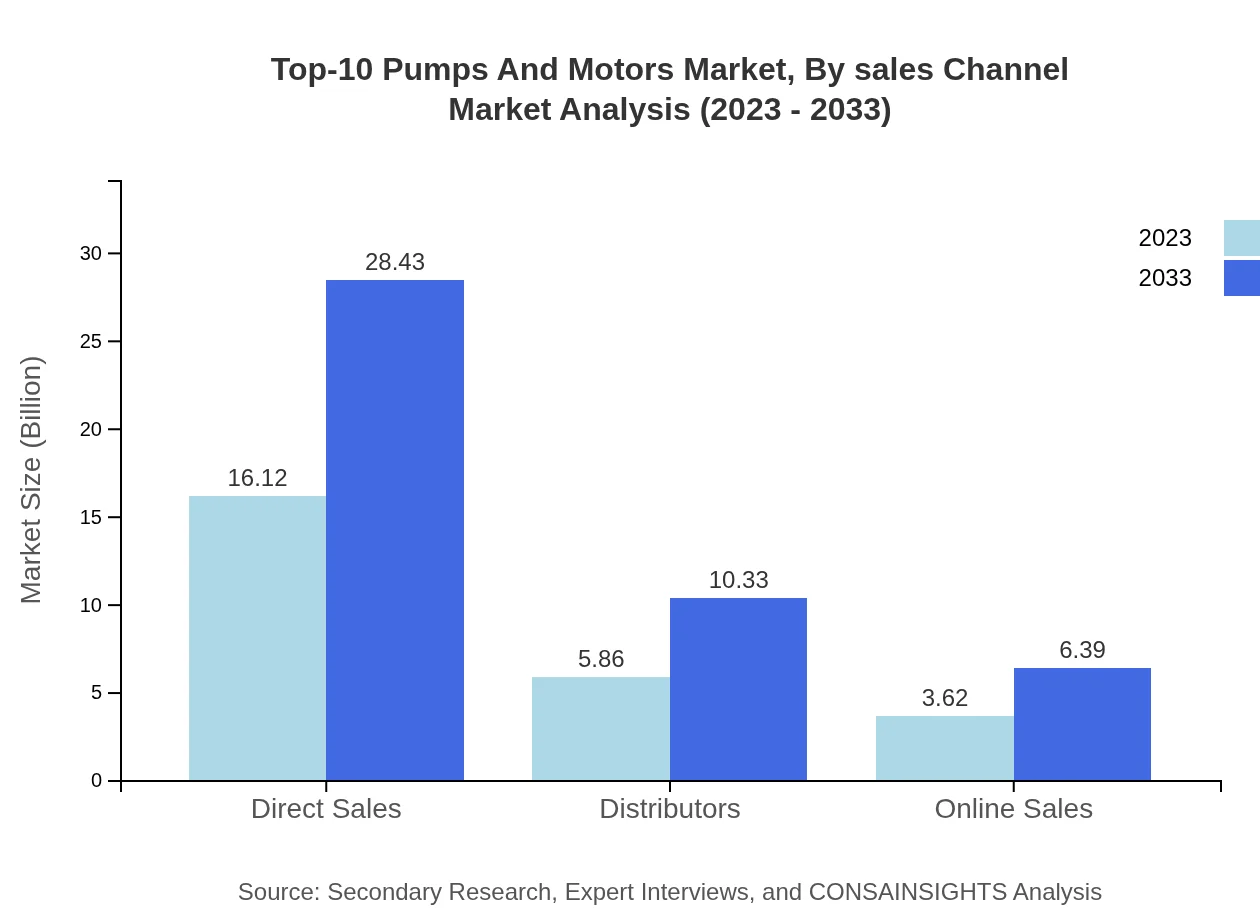

Top-10 Pumps And Motors Market Analysis By Sales Channel

Direct sales dominate the market, estimated at $16.12 billion in 2023, expanding to $28.43 billion by 2033. Meanwhile, online sales are projected to grow from $3.62 billion to $6.39 billion, highlighting the shift in purchasing behaviors.

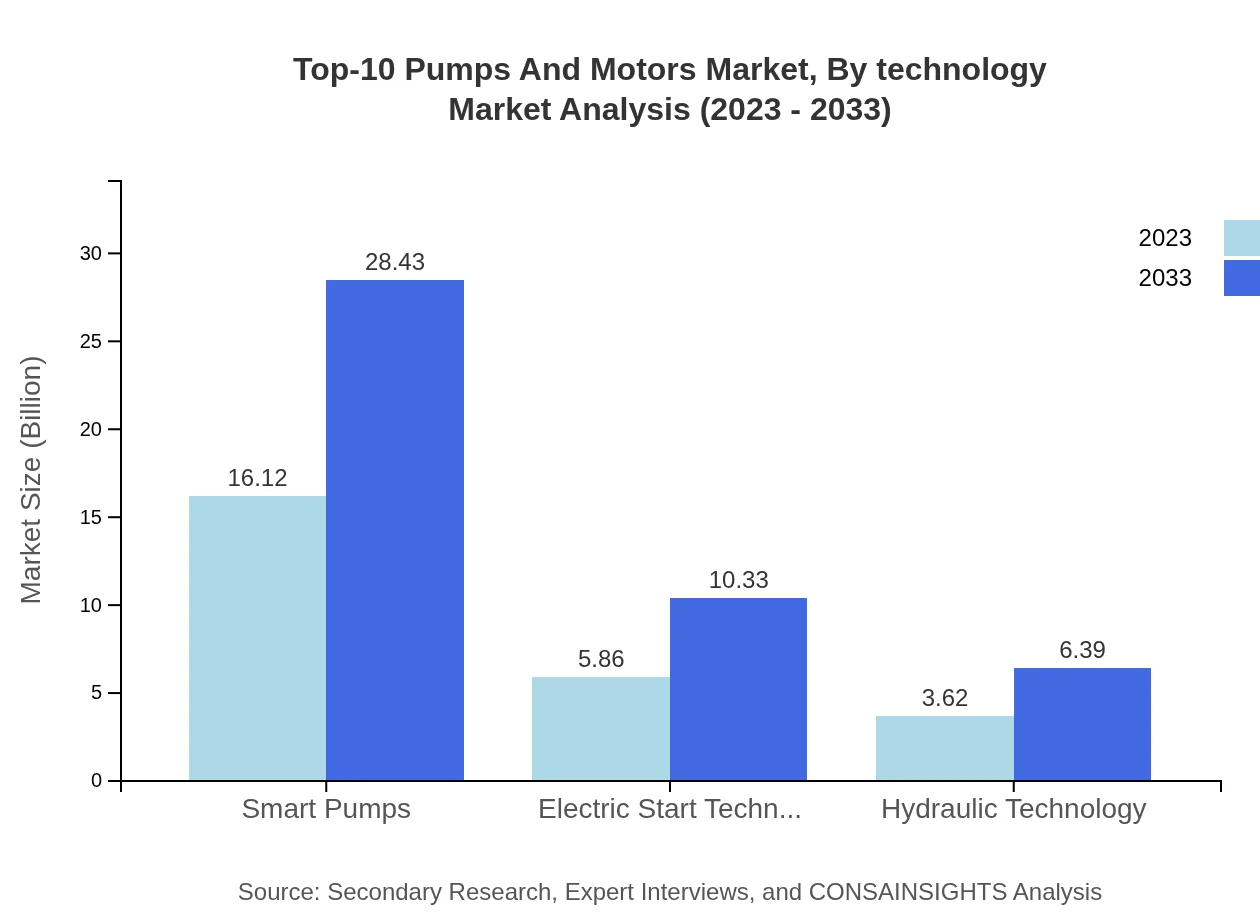

Top-10 Pumps And Motors Market Analysis By Technology

Technological advancements have led to the popularity of smart pumps, which will grow substantially from $16.12 billion in 2023 to $28.43 billion by 2033. Advancements in electric start technology and hydraulic technology also indicate a trend toward efficiency-enhancing solutions.

Top-10 Pumps And Motors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-10 Pumps And Motors Industry

Grundfos:

A leading manufacturer specializing in advanced pump solutions known for energy efficiency and sustainability across various applications.Flowserve Corporation:

An innovative provider of fluid motion and control products that serve the global oil, gas, chemical, and water-processing industries.Xylem Inc.:

A major player in water and wastewater technologies, focused on helping customers manage water effectively with a commitment to advanced solutions.KSB AG:

Known for its high-quality pumps and valves, KSB AG serves various sectors, including building services and water resource management.Ebara Corporation:

A manufacturer specializing in pumps and fluid handling equipment, particularly recognized for its eco-friendly technology.We're grateful to work with incredible clients.

FAQs

What is the market size of Top-10 Pumps and Motors?

The Top-10 Pumps and Motors market is valued at $25.6 billion in 2023, with a projected CAGR of 5.7% over the next decade, indicating substantial growth in demand across various applications and industries.

What are the key market players or companies in this Top-10 Pumps and Motors industry?

The leading companies in the Top-10 Pumps and Motors market include global brands known for innovation and quality, which dominate the segments of centrifugal pumps, positive displacement pumps, and electric motors, showcasing competitive dynamics.

What are the primary factors driving the growth in the Top-10 Pumps and Motors industry?

Key growth drivers in the Top-10 Pumps and Motors industry include increased industrialization, urbanization, and advancements in pump technologies, along with rising demand in sectors like water supply, oil and gas, and agriculture.

Which region is the fastest Growing in the Top-10 Pumps and Motors?

The fastest-growing region in the Top-10 Pumps and Motors market is North America, with a market increase from $8.66 billion in 2023 to $15.27 billion by 2033, reflecting enhanced investments and infrastructure developments.

Does ConsaInsights provide customized market report data for the Top-10 Pumps and Motors industry?

Yes, ConsaInsights offers tailored market reports for the Top-10 Pumps and Motors industry, enabling clients to access specific data, insights, and forecasts that meet their unique objectives and business strategies.

What deliverables can I expect from this Top-10 Pumps and Motors market research project?

From this market research project, you can expect comprehensive reports, including market size analysis, growth forecasts, segment insights, and competitive landscape evaluations tailored to the Top-10 Pumps and Motors industry.

What are the market trends of Top-10 Pumps and Motors?

Market trends in the Top-10 Pumps and Motors industry indicate a shift towards smart pump technologies and energy efficiency, alongside increased demand for centrifugal and positive displacement pumps driven by evolving consumer needs.