Top-15 Petrochemicals Market Report

Published Date: 02 February 2026 | Report Code: top-15-petrochemicals

Top-15 Petrochemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Top-15 Petrochemicals market, including insights into market size, growth trends, industry challenges, and future forecasts from 2023 to 2033.

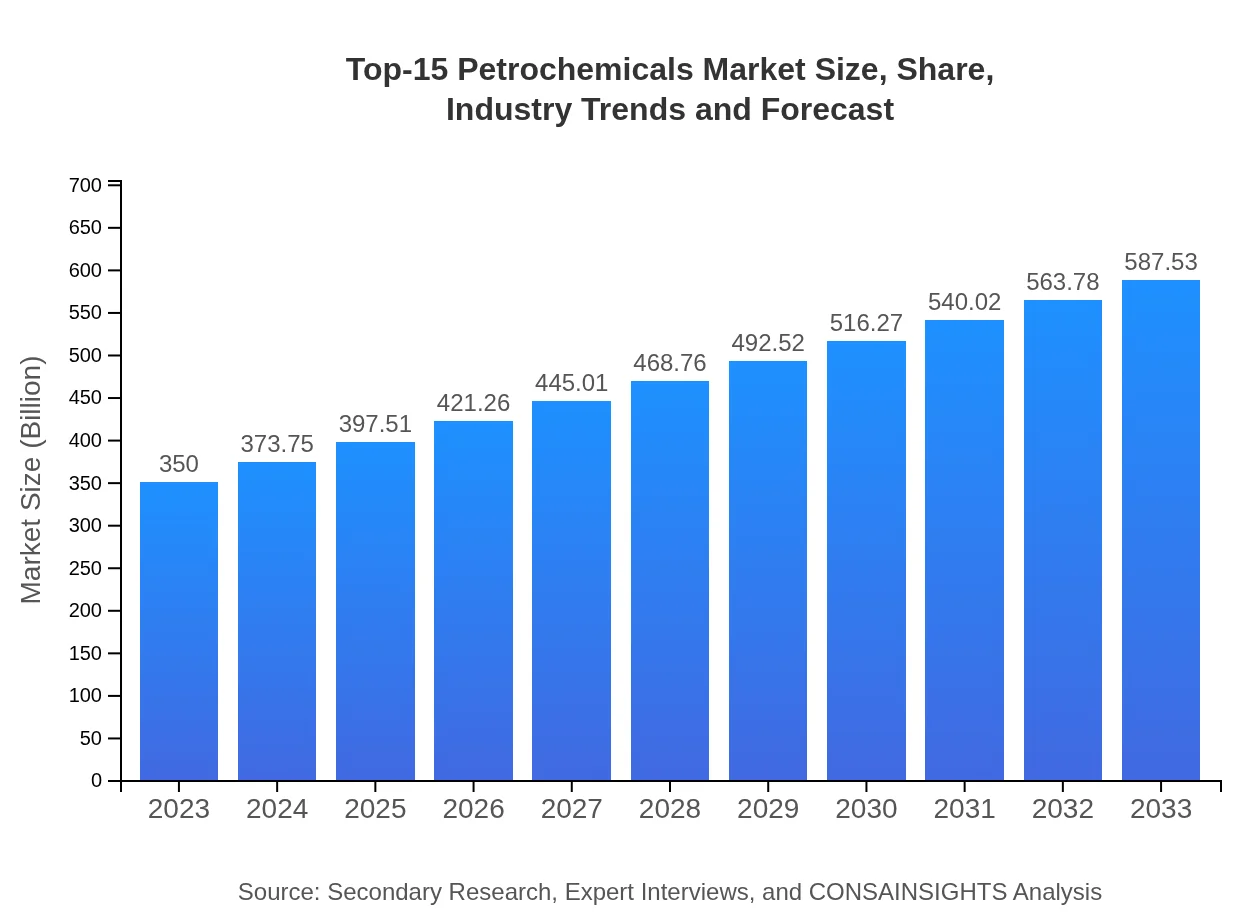

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $587.53 Billion |

| Top Companies | BASF SE, SABIC, ExxonMobil Chemical, Dow Inc. |

| Last Modified Date | 02 February 2026 |

Top-15 Petrochemicals Market Overview

Customize Top-15 Petrochemicals Market Report market research report

- ✔ Get in-depth analysis of Top-15 Petrochemicals market size, growth, and forecasts.

- ✔ Understand Top-15 Petrochemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top-15 Petrochemicals

What is the Market Size & CAGR of Top-15 Petrochemicals market in 2023?

Top-15 Petrochemicals Industry Analysis

Top-15 Petrochemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top-15 Petrochemicals Market Analysis Report by Region

Europe Top-15 Petrochemicals Market Report:

The European market is set to increase from USD 108.57 billion in 2023 to USD 182.25 billion by 2033. A strong focus on sustainability and stringent regulations on emissions are influencing petrochemical production. Investment in bio-based alternatives and innovations in recycling processes are gaining traction among European companies.Asia Pacific Top-15 Petrochemicals Market Report:

The Asia Pacific region is projected to witness substantial growth, expanding from USD 70.84 billion in 2023 to USD 118.92 billion by 2033, driven by increasing industrialization and urbanization. China and India are leading this growth, with rising manufacturing prowess and consumption rates of petrochemical products. Enhanced infrastructure development and government initiatives supporting the petrochemical sector play a critical role.North America Top-15 Petrochemicals Market Report:

North America is forecasted to grow from USD 113.23 billion in 2023 to USD 190.07 billion by 2033. The U.S. has a well-established shale gas industry, providing a competitive edge for domestic petrochemical producers. Additionally, the growing automotive and consumer goods industries are significant drivers, alongside advancements in recycling technologies.South America Top-15 Petrochemicals Market Report:

In South America, the market is expected to grow from USD 10.96 billion in 2023 to USD 18.39 billion by 2033. Countries like Brazil are witnessing a rise in demand for petrochemicals in packaging and construction, primarily attributed to economic recovery and investments in infrastructure. Sustainable practices in production are emerging as a priority.Middle East & Africa Top-15 Petrochemicals Market Report:

The Middle East and Africa region is expected to grow from USD 46.41 billion in 2023 to USD 77.91 billion by 2033. The availability of abundant oil reserves offers a favorable landscape for petrochemical production. Countries like Saudi Arabia and the UAE are focusing on expanding refining and petrochemical capacities, thereby boosting regional market dynamics.Tell us your focus area and get a customized research report.

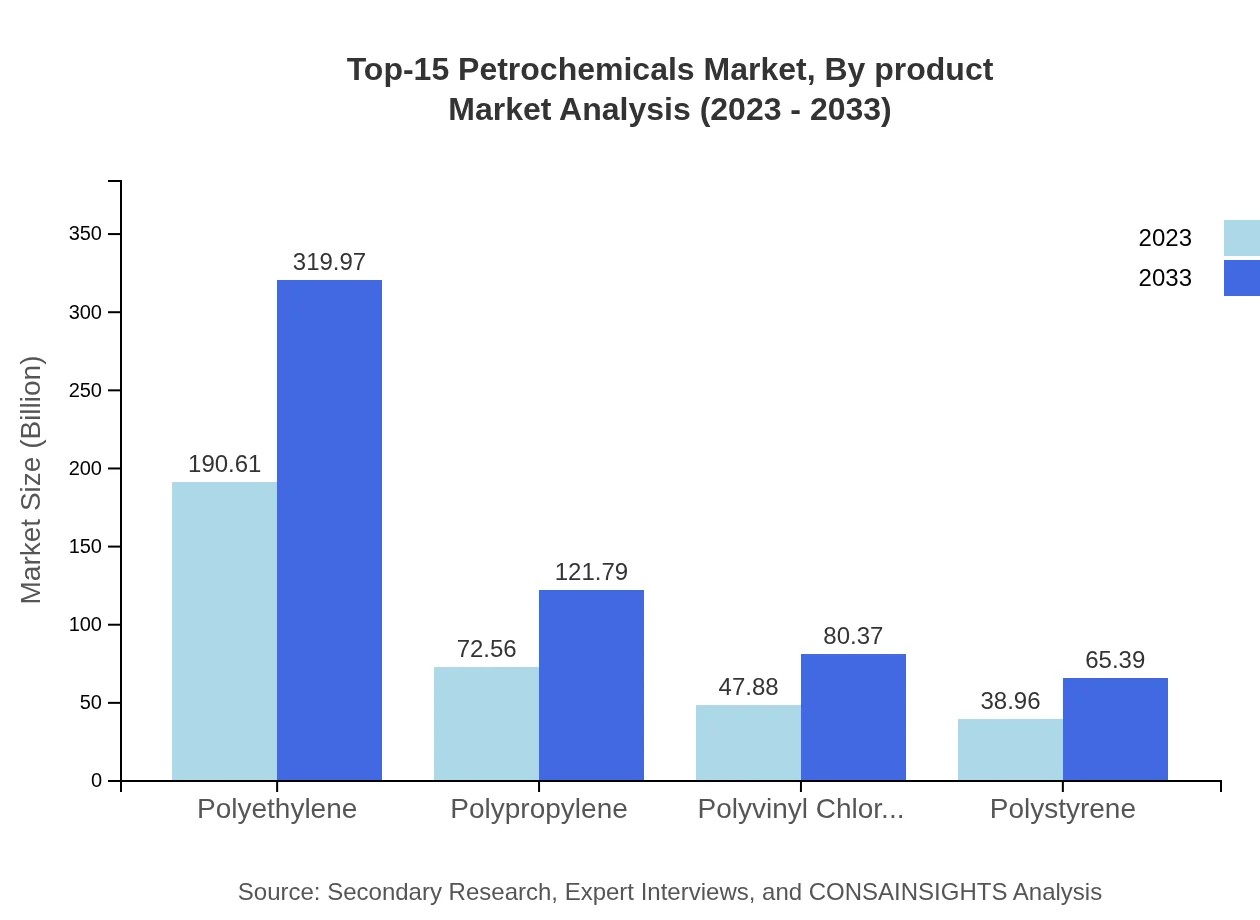

Top-15 Petrochemicals Market Analysis By Product

The product segmentation includes polyethylene, polypropylene, and polystyrene, with polyethylene dominating the market due to its extensive use in packaging, film applications, and containers. Polypropylene follows closely, primarily utilized in automotive and consumer goods. The market for these products is expected to expand significantly, driven by rising demand across various sectors.

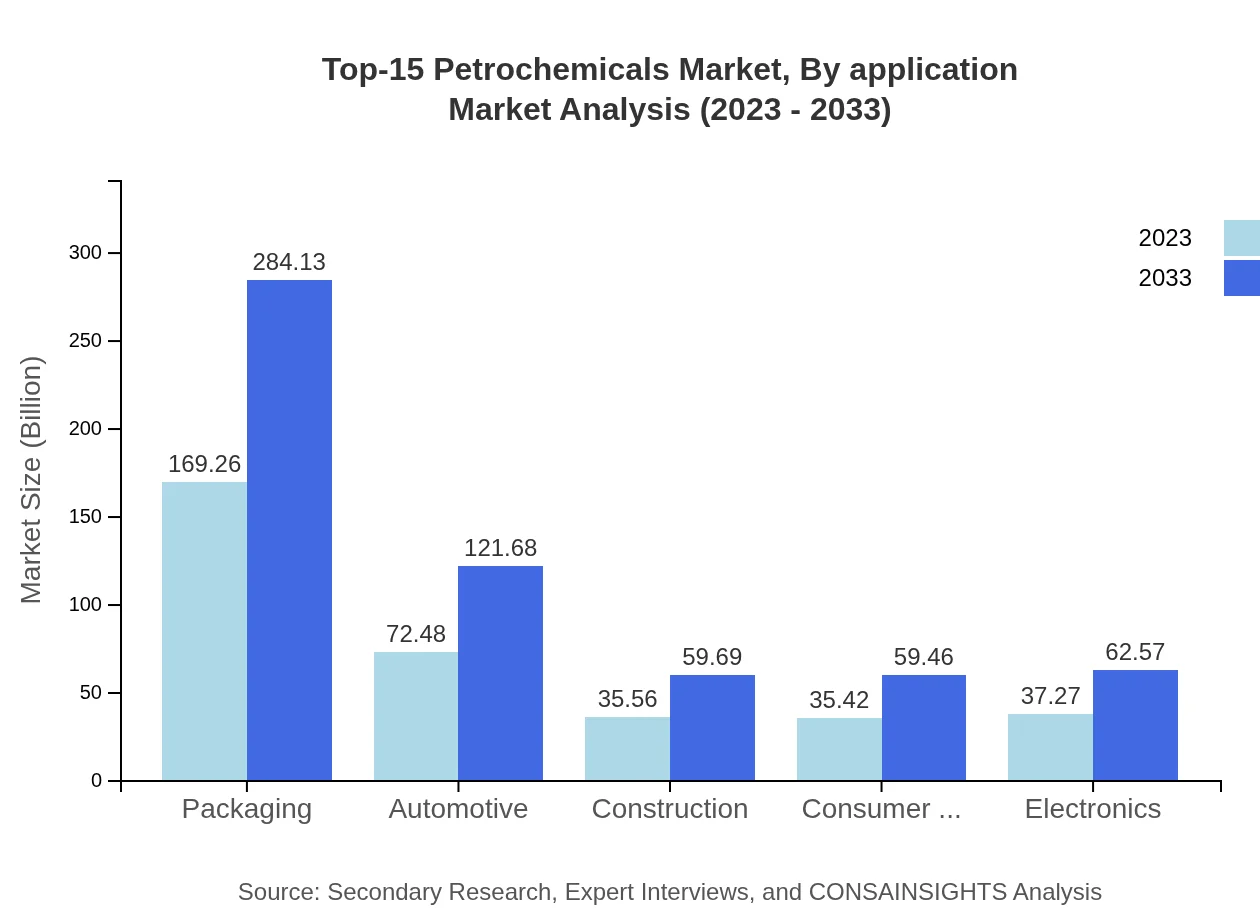

Top-15 Petrochemicals Market Analysis By Application

The packaging industry holds the largest share of the market, leveraging the lightweight and durable properties of petrochemical products. Automotive applications are growing rapidly due to the trend towards lightweight materials, enhancing fuel efficiency. Other significant applications include construction and electronics, further diversifying the market landscape.

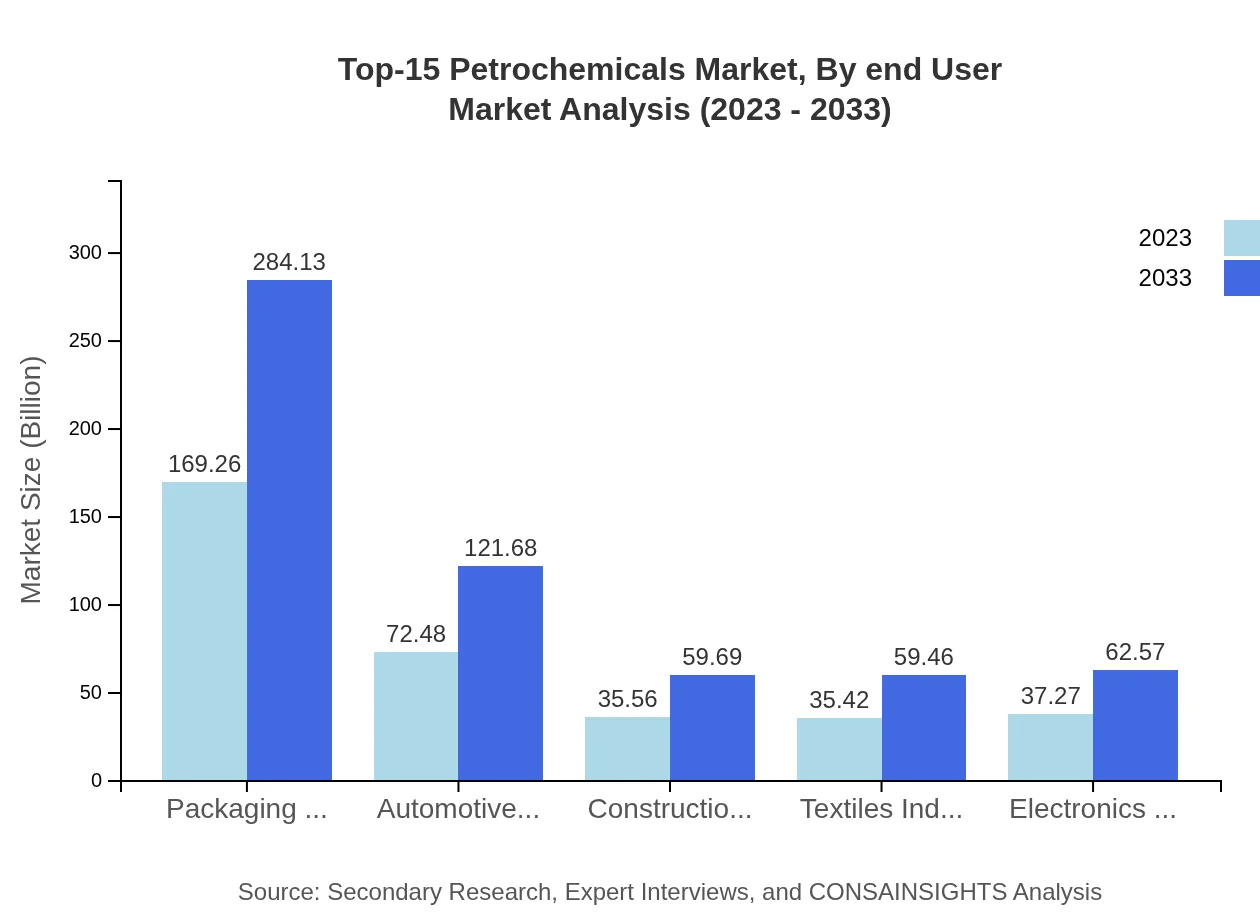

Top-15 Petrochemicals Market Analysis By End User

Key end-users include automotive, packaging, construction, and electronics. Each sector demands specific petrochemical products that cater to their unique characteristics. The automotive industry is transitioning toward sustainability with increased adoption of lightweight and recyclable materials, significantly impacting the demand for petrochemicals.

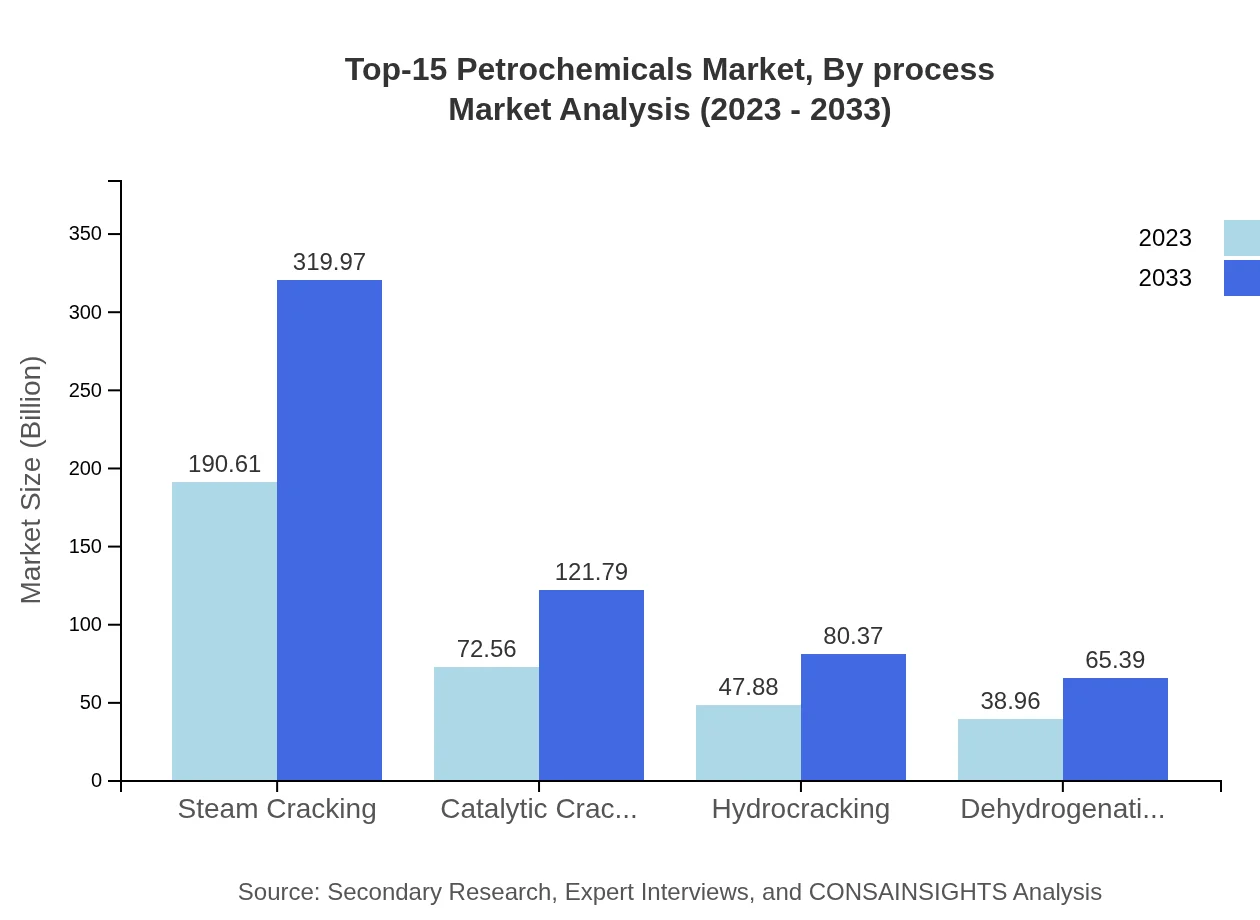

Top-15 Petrochemicals Market Analysis By Process

Processes such as steam cracking and catalytic cracking dominate the market. Steam cracking leads in production volume, contributing significantly to the supply of ethylene and propylene, which are essential feedstocks for various petrochemical products. Catalytic cracking is increasingly utilized for converting heavy feedstocks into lighter, more valuable products.

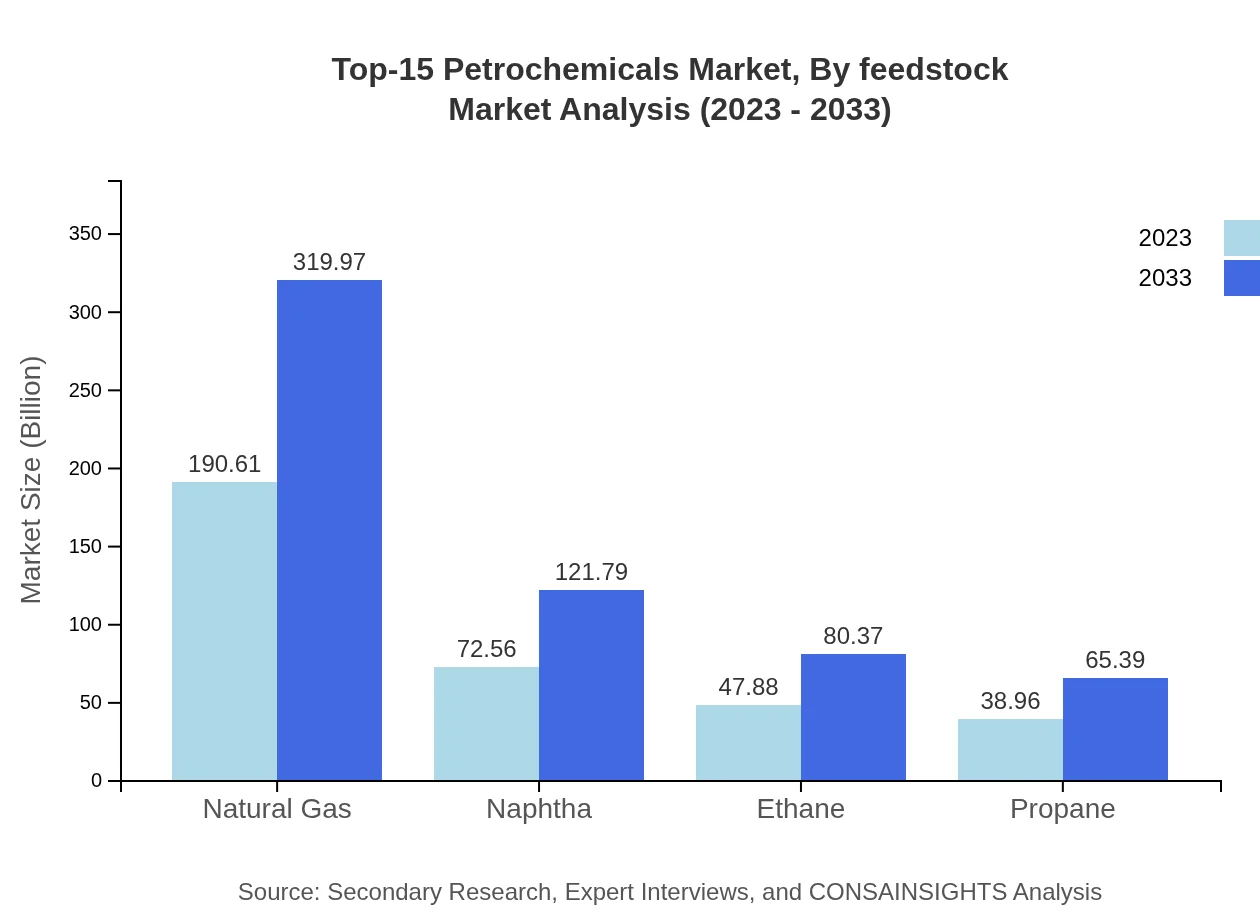

Top-15 Petrochemicals Market Analysis By Feedstock

Key feedstocks include natural gas, naphtha, ethane, and propane. Natural gas is the preferred feedstock due to its cost-effectiveness and lower environmental impact. The shift towards alternative feedstocks is also gaining momentum as companies aim to reduce dependencies on traditional sources and enhance sustainability.

Top-15 Petrochemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top-15 Petrochemicals Industry

BASF SE:

A leading chemical company based in Germany, BASF SE focuses on sustainable development and innovation in its petrochemical product lines, serving multiple industries globally.SABIC:

As a major player in Saudi Arabia, SABIC specializes in diversified petrochemicals and advanced materials, prioritizing innovation and sustainability in production processes.ExxonMobil Chemical:

A division of ExxonMobil, this company is a driving force in the petrochemical sector, offering a wide range of products and striving for greater energy efficiency in operations.Dow Inc.:

Dow is a key player known for its vast portfolio of materials science products, with a strong commitment to sustainability and innovation in the petrochemical space.We're grateful to work with incredible clients.

FAQs

What is the market size of top-15 petrochemicals?

The market size of the top-15 petrochemicals industry is projected to reach approximately $350 billion by 2033, growing at a CAGR of 5.2% from 2023 to 2033.

What are the key market players or companies in this top-15 petrochemicals industry?

Key players in the top-15 petrochemicals industry include major corporations such as Dow Chemical, BASF, ExxonMobil, and Saudi Basic Industries Corporation (SABIC), which drive innovation and market development.

What are the primary factors driving the growth in the top-15 petrochemicals industry?

The growth in the top-15 petrochemicals industry is driven by increasing demand from various sectors such as packaging, automotive, and construction, alongside technological advancements in production methods.

Which region is the fastest Growing in the top-15 petrochemicals?

The Asia Pacific region is identified as the fastest-growing market for top-15 petrochemicals, expected to grow from $70.84 billion in 2023 to $118.92 billion by 2033.

Does ConsaInsights provide customized market report data for the top-15 petrochemicals industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications within the top-15 petrochemicals industry to meet unique research needs.

What deliverables can I expect from this top-15 petrochemicals market research project?

Deliverables include comprehensive market analysis reports, data segmentation by region and product type, trend forecasts, and competitive landscape assessments within the top-15 petrochemicals sector.

What are the market trends of top-15 petrochemicals?

The current trends in the top-15 petrochemicals market include a shift towards sustainable practices, rising utilization of advanced technologies, and increased focus on recycling within the petrochemicals industry.