Top Drive Systems Market Report

Published Date: 22 January 2026 | Report Code: top-drive-systems

Top Drive Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Top Drive Systems market, offering insights into market trends, size, and regional performance. Covering the forecast period from 2023 to 2033, it examines various segments and key players shaping the industry.

| Metric | Value |

|---|---|

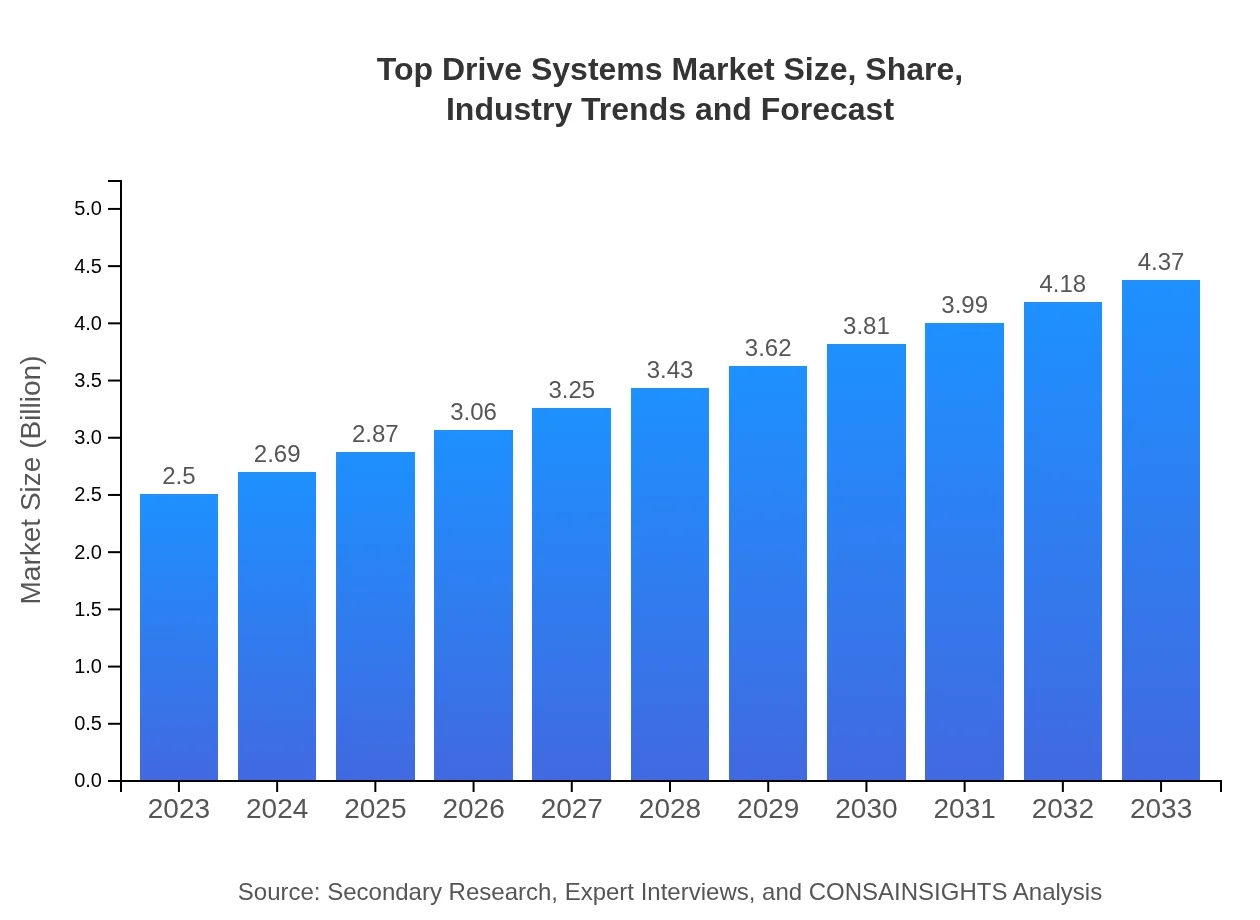

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $4.37 Billion |

| Top Companies | Schlumberger Limited, Halliburton Company, Baker Hughes, Weatherford International |

| Last Modified Date | 22 January 2026 |

Top Drive Systems Market Overview

Customize Top Drive Systems Market Report market research report

- ✔ Get in-depth analysis of Top Drive Systems market size, growth, and forecasts.

- ✔ Understand Top Drive Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top Drive Systems

What is the Market Size & CAGR of Top Drive Systems market in 2023 and 2033?

Top Drive Systems Industry Analysis

Top Drive Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top Drive Systems Market Analysis Report by Region

Europe Top Drive Systems Market Report:

The European market is set to grow from $0.68 billion in 2023 to $1.18 billion in 2033, with increasing focus on sustainable drilling practices as the region pivots towards renewable energy sources.Asia Pacific Top Drive Systems Market Report:

In the Asia Pacific region, the Top Drive Systems market is anticipated to grow from $0.52 billion in 2023 to $0.90 billion by 2033, showcasing increased investments in exploration projects and infrastructure development.North America Top Drive Systems Market Report:

North America represents a significant market, projected to rise from $0.84 billion in 2023 to $1.46 billion by 2033, aided by advanced drilling technology adoption and shale gas exploration activities.South America Top Drive Systems Market Report:

The South American market is expected to expand from $0.15 billion in 2023 to $0.26 billion in 2033, driven by a growing emphasis on oil and gas exploration amidst fluctuating global commodity prices.Middle East & Africa Top Drive Systems Market Report:

The Middle East and Africa region is projected to see growth from $0.32 billion in 2023 to $0.57 billion by 2033, supported by ongoing investments in oil and gas projects despite economic fluctuations.Tell us your focus area and get a customized research report.

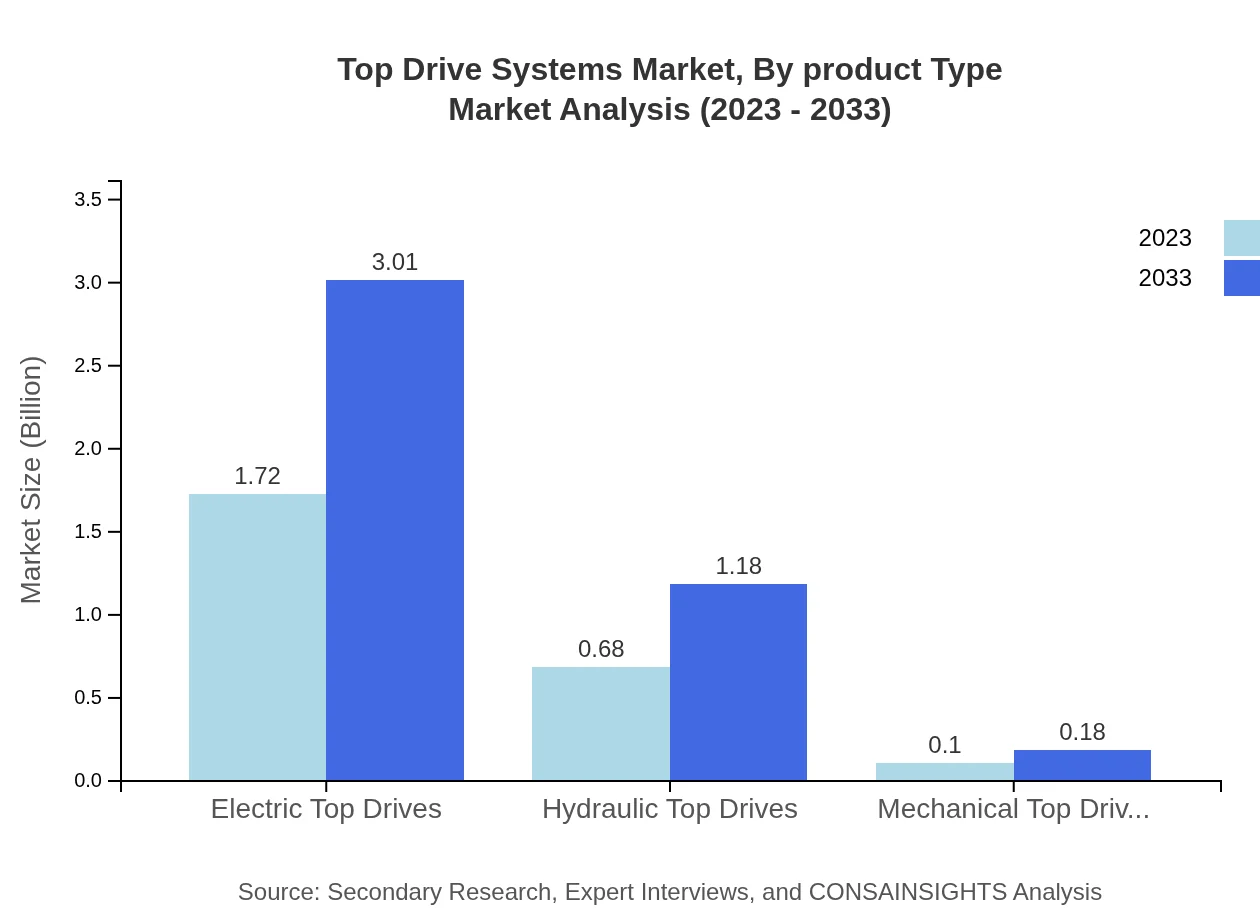

Top Drive Systems Market Analysis By Product Type

The market for Top Drive Systems by product type is dominated by Electric Top Drives, which are expected to grow from $1.72 billion in 2023 to $3.01 billion in 2033, accounting for 68.89% share. Hydraulic Top Drives and Mechanical Top Drives follow, exhibiting steady growth attributed to their reliability and ease of maintenance.

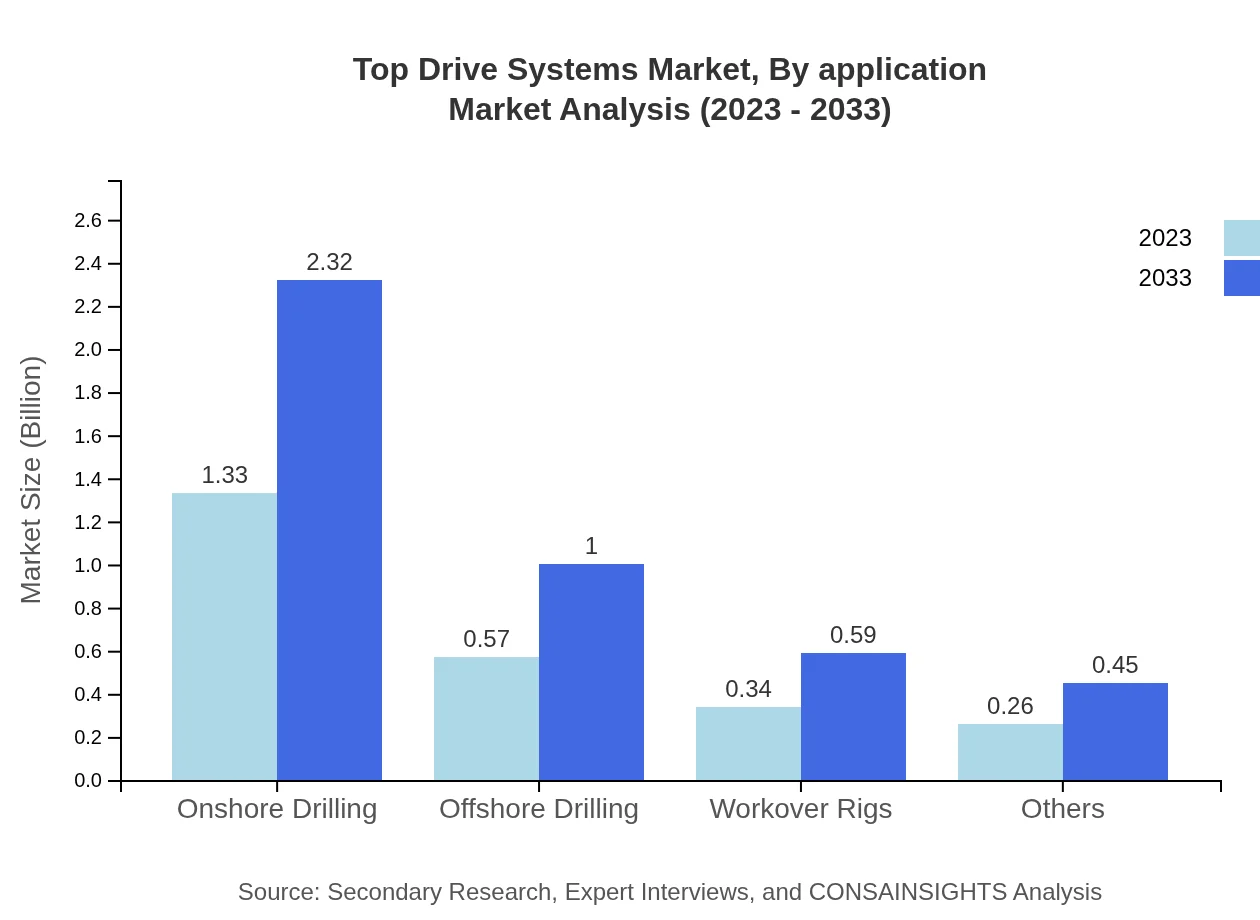

Top Drive Systems Market Analysis By Application

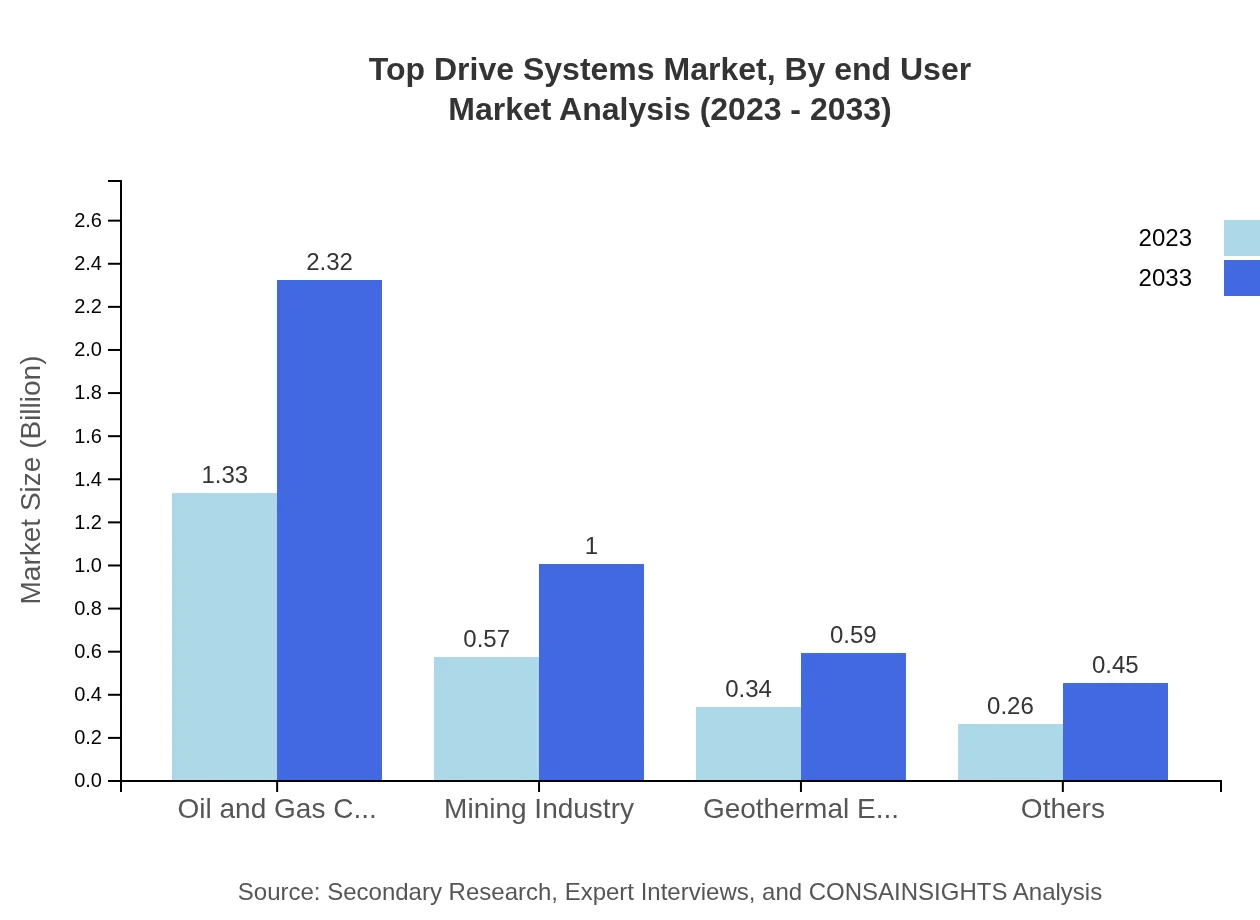

The application of Top Drive Systems is predominantly within the Oil and Gas Companies sector, estimated at $1.33 billion in 2023, growing to $2.32 billion by 2033, capturing 53.23% market share. The Mining Industry and Geothermal Energy sectors also represent significant growth areas, further diversifying the market landscape.

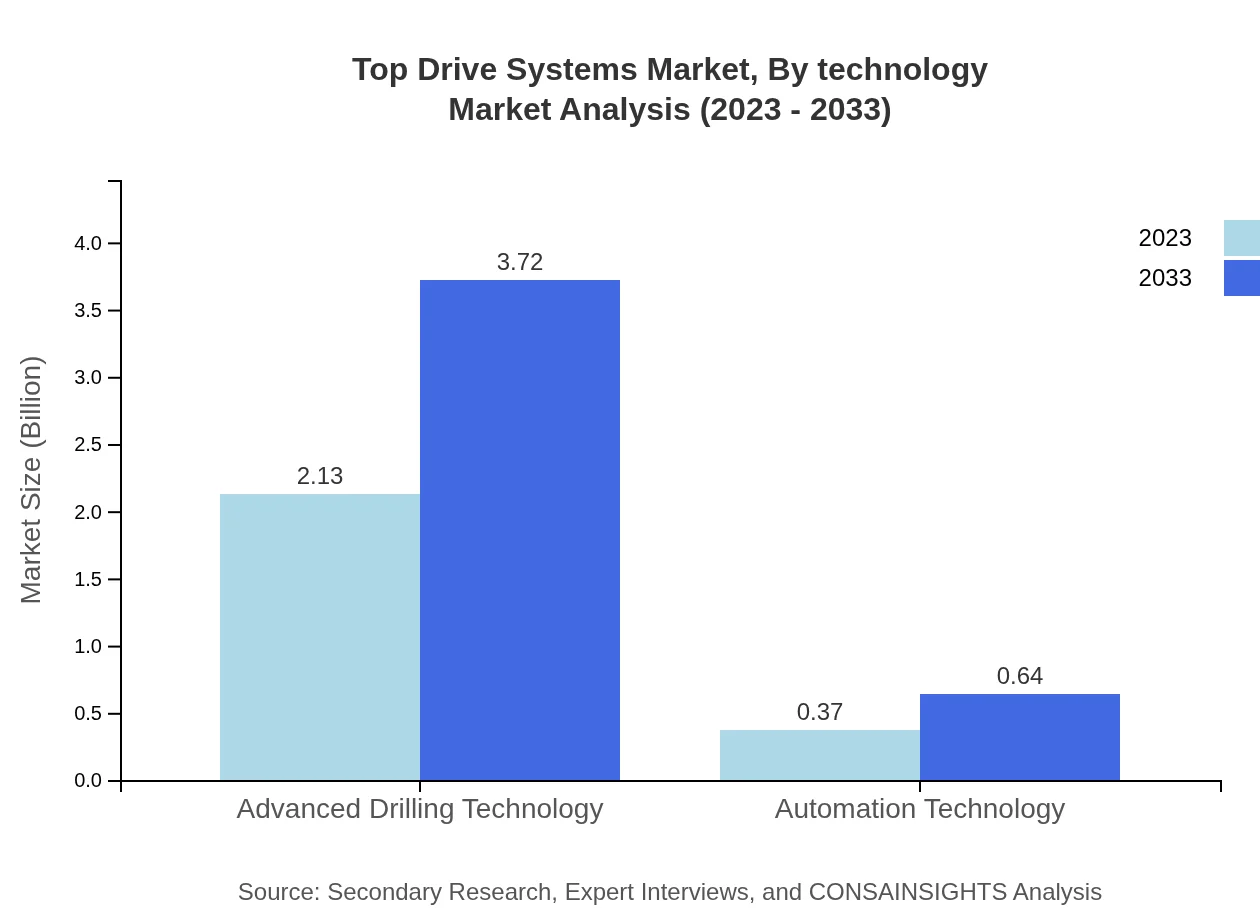

Top Drive Systems Market Analysis By Technology

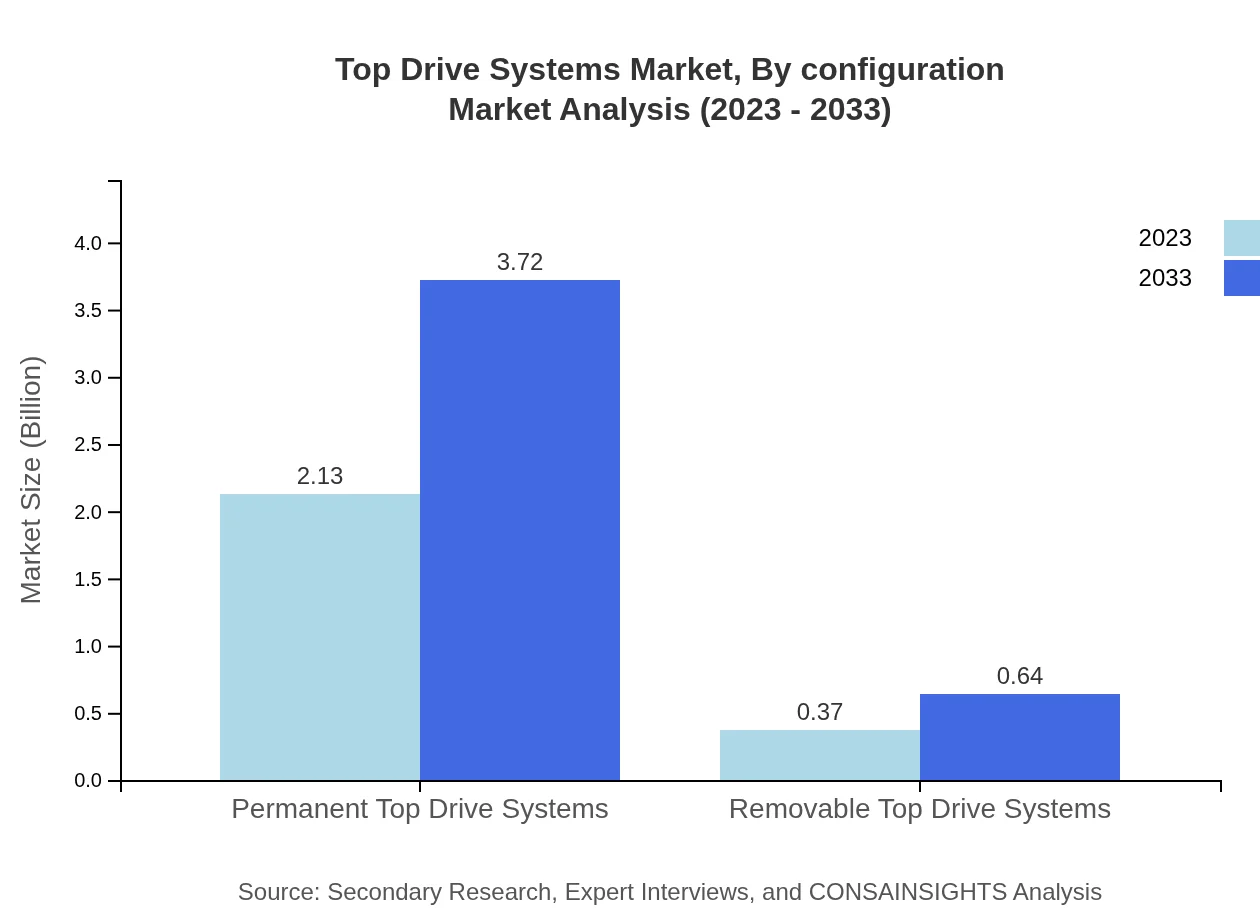

Technological advancements such as Automation and Advanced Drilling Technologies are reshaping the Top Drive Systems market. These segments are expected to see robust growth, with Advanced Drilling Technology anticipated to increase from $2.13 billion to $3.72 billion by 2033, holding an 85.31% market share.

Top Drive Systems Market Analysis By End User

End-users in the oil and gas industry continue to dominate the Top Drive Systems market. The integration of Top Drive Systems in offshore and onshore drilling contributes significantly, with respective shares of 53.23% and 22.89% expected through 2033.

Top Drive Systems Market Analysis By Configuration

Permanent Top Drive Systems are expected to lead, with a market size of $2.13 billion in 2023, increasing to $3.72 billion by 2033, showcasing an 85.31% market share due to their operational efficiency and reduced downtime.

Top Drive Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top Drive Systems Industry

Schlumberger Limited:

A leading provider of technology and services for oil and gas research, Schlumberger specializes in drilling, production, and reservoir management.Halliburton Company:

Known for its innovative approaches in energy services, Halliburton offers extensive solutions in drilling and completion technologies.Baker Hughes:

Baker Hughes is a GE company that provides solutions in oilfield services and equipment, with a focus on data-driven drilling technologies.Weatherford International:

Weatherford focuses on optimizing drilling operations and reducing costs through its advanced top drives and drilling systems.We're grateful to work with incredible clients.

FAQs

What is the market size of top Drive Systems?

The global top drive systems market is projected to grow from $2.5 billion in 2023 to a significantly larger sum by 2033, with a compound annual growth rate (CAGR) of 5.6%. This growth indicates robust demand across various segments.

What are the key market players or companies in the top Drive Systems industry?

Key players in the top drive systems market include major oil and gas companies, specialized equipment manufacturers, and technology providers focused on drilling innovations. Their competitive strategies are essential for shaping market dynamics.

What are the primary factors driving the growth in the top Drive Systems industry?

Growth in the top drive systems industry is primarily driven by increased oil exploration activities, advancements in drilling technology, and rising demand for efficient drilling solutions in energy sectors, particularly in oil and gas.

Which region is the fastest Growing in the top Drive Systems?

The North America region is expected to experience significant growth, expanding from $0.84 billion in 2023 to $1.46 billion by 2033. This growth is fueled by increased drilling activities in the region.

Does ConsaInsights provide customized market report data for the top Drive Systems industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the top drive systems industry, providing in-depth analysis, regional insights, and data for various segments to suit client requirements.

What deliverables can I expect from this top Drive Systems market research project?

Deliverables from the market research project include comprehensive reports, detailed analysis on market trends, forecasts, segmentation insights, and strategic recommendations essential for stakeholders to make informed decisions.

What are the market trends of top Drive Systems?

Key market trends include an increasing shift towards automation in drilling, a growing emphasis on sustainable practices, and advancements in electric and hydraulic top drive technologies influencing industry dynamics.