Top Trends In The Agricultural Biologicals Market Report

Published Date: 02 February 2026 | Report Code: top-trends-in-the-agricultural-biologicals

Top Trends In The Agricultural Biologicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the agricultural biologicals market, focusing on emerging trends, market size, and growth projections for the period from 2023 to 2033. It offers valuable insights into various segments, regional dynamics, and technological advancements shaping the industry.

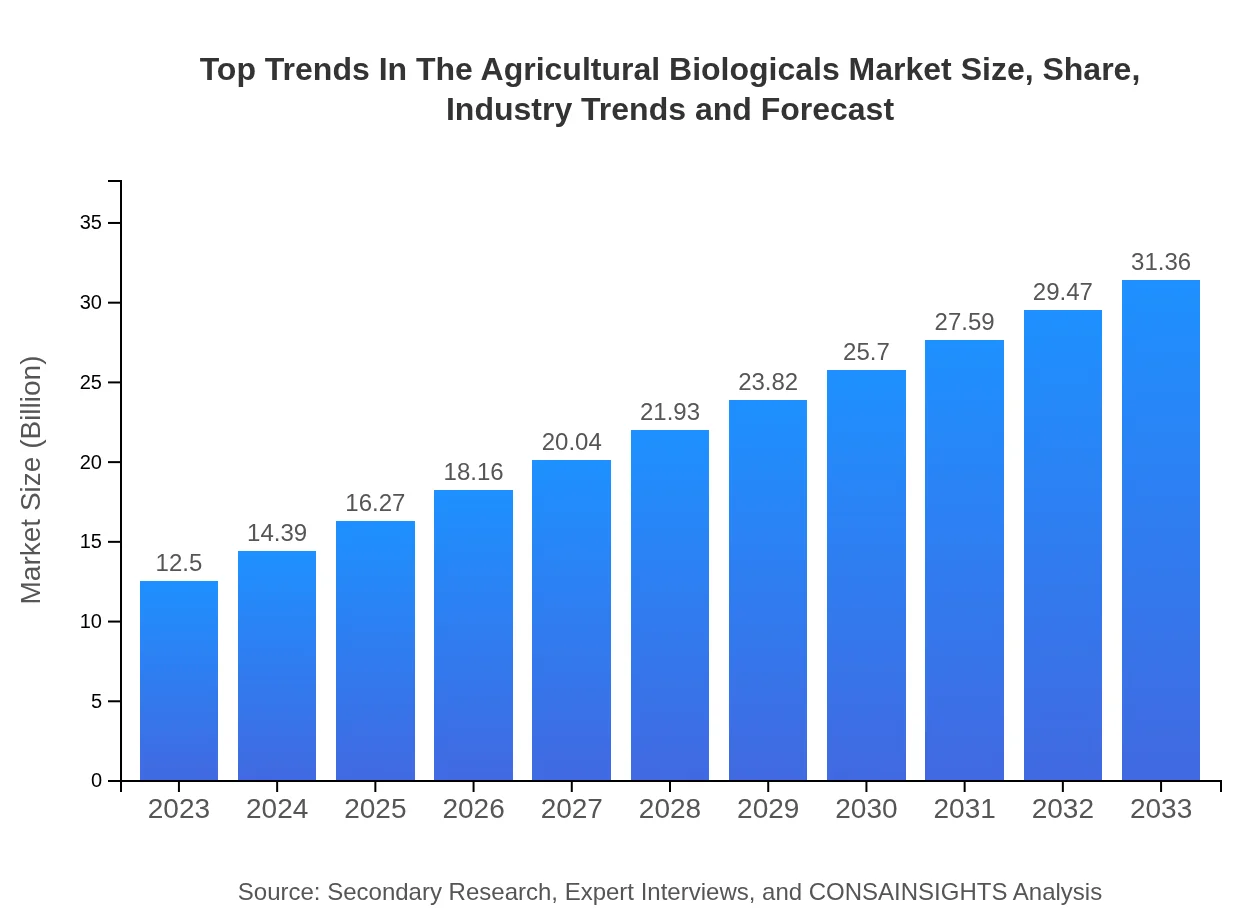

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $31.36 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, FMC Corporation, Novozymes A/S |

| Last Modified Date | 02 February 2026 |

Top Trends In The Agricultural Biologicals Market Overview

Customize Top Trends In The Agricultural Biologicals Market Report market research report

- ✔ Get in-depth analysis of Top Trends In The Agricultural Biologicals market size, growth, and forecasts.

- ✔ Understand Top Trends In The Agricultural Biologicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Top Trends In The Agricultural Biologicals

What is the Market Size & CAGR of Top Trends In The Agricultural Biologicals Market in 2023?

Top Trends In The Agricultural Biologicals Industry Analysis

Top Trends In The Agricultural Biologicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Top Trends In The Agricultural Biologicals Market Analysis Report by Region

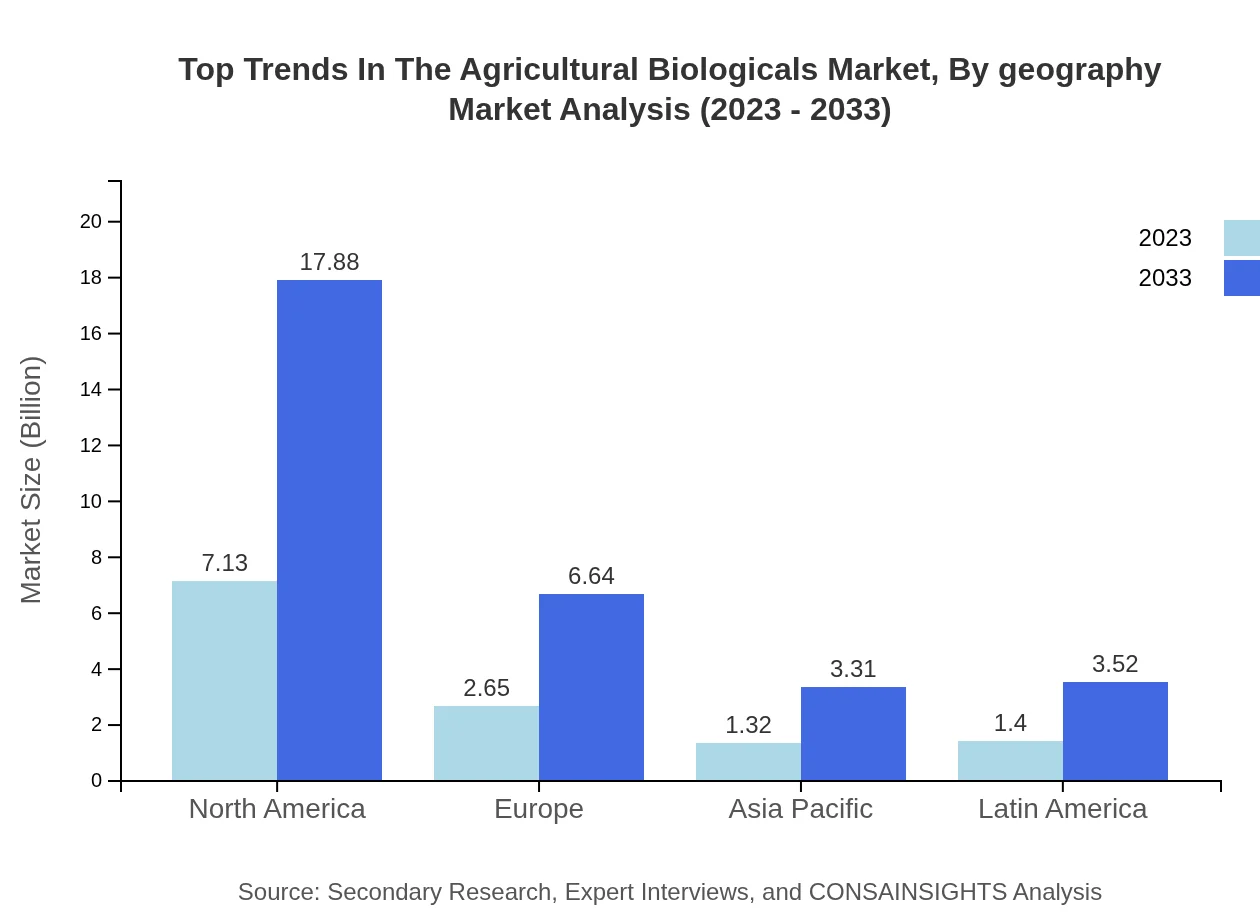

Europe Top Trends In The Agricultural Biologicals Market Report:

In Europe, the market size for agricultural biologicals was $3.68 billion in 2023, with projections of $9.24 billion by 2033 (CAGR: 9.52%). The region's strict regulations against harmful chemicals and a strong preference for organic products support this growth.Asia Pacific Top Trends In The Agricultural Biologicals Market Report:

In 2023, the agricultural biologicals market in the Asia Pacific was valued at $2.43 billion, projected to grow to $6.10 billion by 2033, reflecting a CAGR of 9.66%. The region's growth is driven by increasing population and demand for food, along with government initiatives promoting sustainable agricultural practices.North America Top Trends In The Agricultural Biologicals Market Report:

North America's agricultural biologicals market was valued at $4.49 billion in 2023 and is anticipated to reach $11.26 billion by 2033 (CAGR: 9.60%). The strong presence of key market players, alongside advanced agricultural practices, significantly drives market growth in this region.South America Top Trends In The Agricultural Biologicals Market Report:

South America had a market size of $0.34 billion in 2023, expected to grow to $0.86 billion by 2033, with a CAGR of 9.49%. The expansion is due to rising awareness of organic farming and sustainable agriculture amidst changing environmental policies.Middle East & Africa Top Trends In The Agricultural Biologicals Market Report:

The Middle East and Africa had a market size of $1.55 billion in 2023, estimated to grow to $3.90 billion by 2033, with a CAGR of 9.48%. The focus on technological advancements and agricultural sustainability supports market progress in this diverse region.Tell us your focus area and get a customized research report.

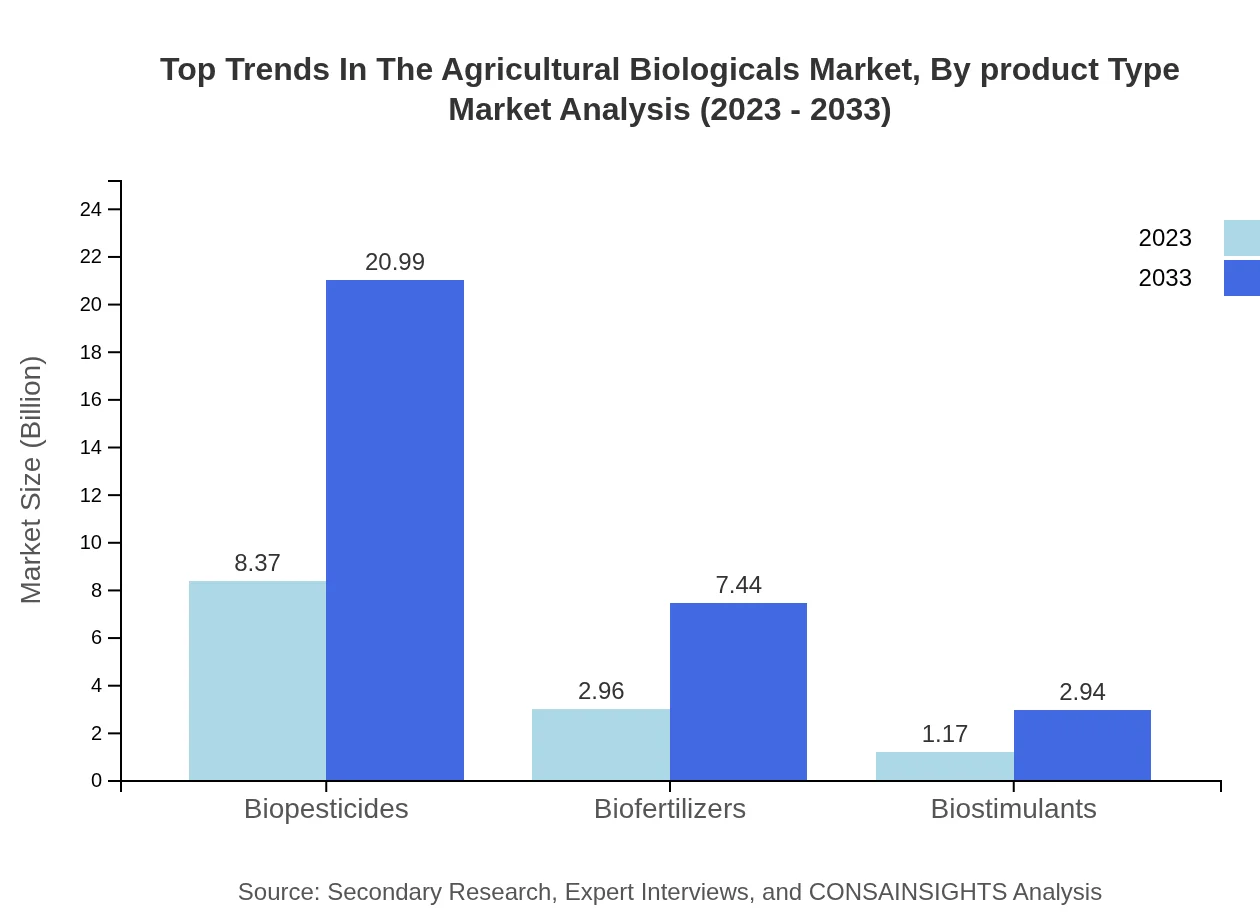

Top Trends In The Agricultural Biologicals Market Analysis By Product Type

Biopesticides dominate the market, accounting for $8.37 billion in 2023 and projected to reach $20.99 billion by 2033 (CAGR: 9.52%). Biofertilizers follow with a size of $2.96 billion in 2023 expected to grow to $7.44 billion by 2033 (CAGR: 9.50%). Biostimulants play a smaller but growing role, with a market value of $1.17 billion in 2023 and an anticipated growth to $2.94 billion by 2033 (CAGR: 9.33%).

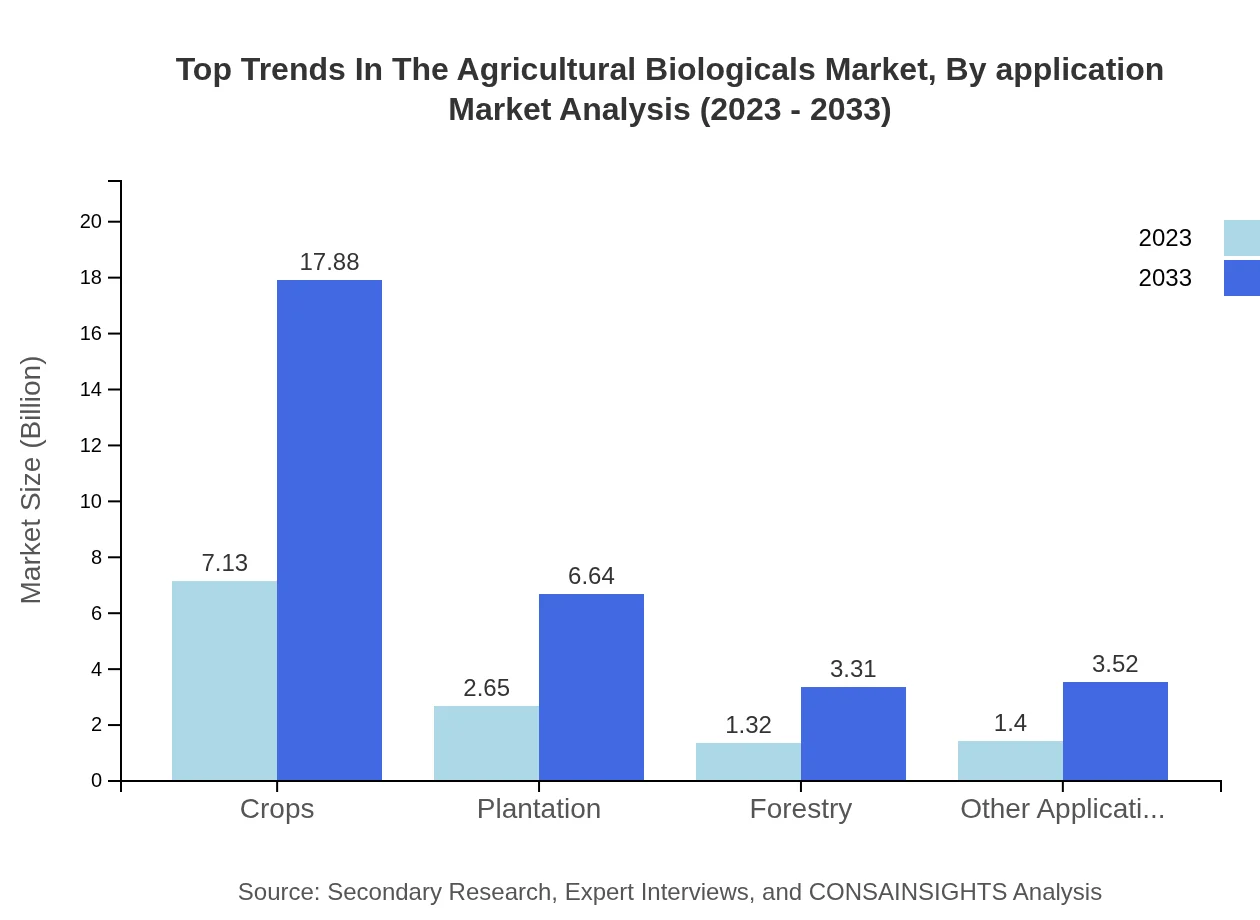

Top Trends In The Agricultural Biologicals Market Analysis By Application

The crops segment holds the largest share, valued at $7.13 billion in 2023, projected to expand to $17.88 billion by 2033 (CAGR: 9.52%). The plantation segment is valued at $2.65 billion with prospects of reaching $6.64 billion by 2033. Forestry and other applications show promising growth rates as well, indicating a broadening usage of agricultural biologicals across diverse farming systems.

Top Trends In The Agricultural Biologicals Market Analysis By Geography

The evolutionary trends in the agricultural biologicals market across various regions underline the growing acceptance of natural products over synthetic alternatives. North America leads, followed by Europe, due to robust regulations favoring sustainable practices. The APAC region is rapidly catching up, indicating a significant shift towards bio-based solutions.

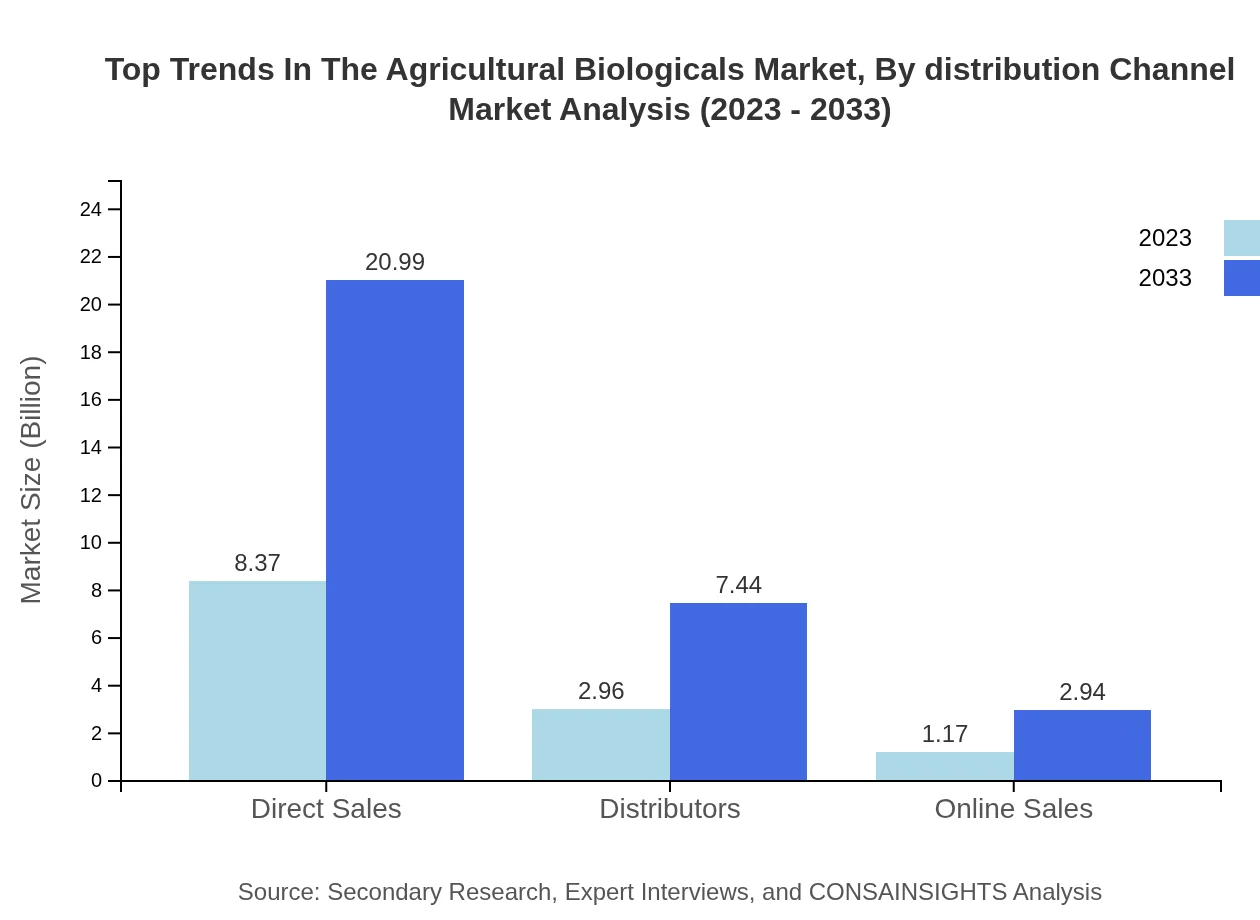

Top Trends In The Agricultural Biologicals Market Analysis By Distribution Channel

Direct Sales lead with a market size of $8.37 billion in 2023, expected to reach $20.99 billion by 2033, while distributors hold a value of $2.96 billion growing to $7.44 billion. Online channels, though smaller, are emerging as vital growth contributors, particularly among younger, tech-savvy farmers.

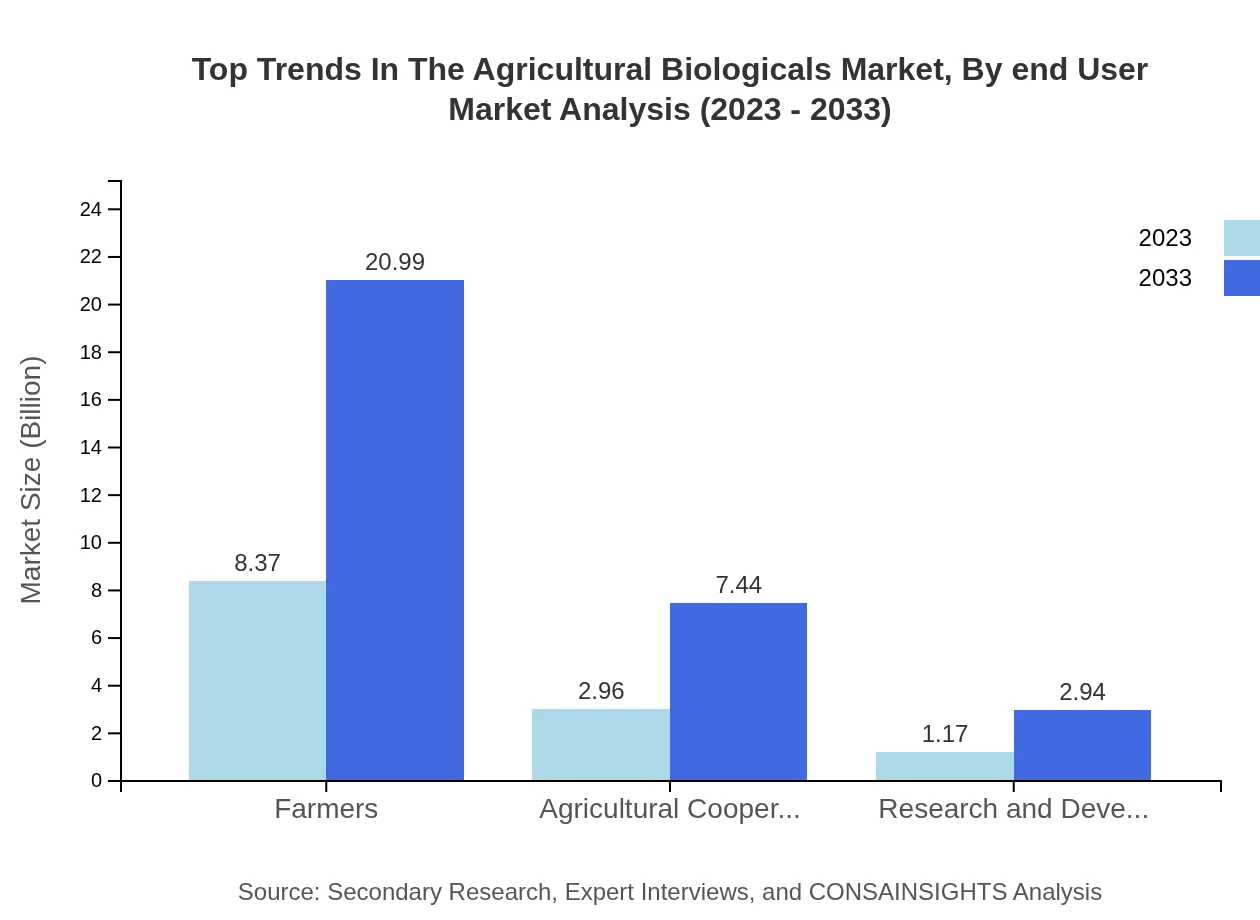

Top Trends In The Agricultural Biologicals Market Analysis By End User

Farmers are the predominant end-users with an extensive market share of $8.37 billion in 2023, projected to grow to $20.99 billion by 2033. Agricultural cooperatives and research institutions constitute significant segments, with respective shares of $2.96 billion and $1.17 billion, showcasing the collaborative efforts in this industry.

Top Trends In The Agricultural Biologicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Top Trends In The Agricultural Biologicals Industry

BASF SE:

A leading global chemical company with a strong portfolio in agricultural biologicals, including biopesticides and biofertilizers, committed to innovation and sustainable practices.Syngenta AG:

Specializing in crop protection and seeds, Syngenta actively develops agricultural biologicals, focusing on enhancing agricultural productivity while ensuring environmental safety.Bayer AG:

Bayer is a global enterprise with core competencies in the fields of health care and agriculture, leading in developing sustainable agricultural solutions.FMC Corporation:

FMC specializes in crop protection solutions, providing advanced technological innovations in agricultural biologicals.Novozymes A/S:

A biotechnology company focusing on enzymes and microorganisms, developing innovative biofertilizers and biostimulants that enhance crop yield and soil health.We're grateful to work with incredible clients.

FAQs

What is the market size of top Trends In The Agricultural Biologicals?

The agricultural biologicals market is currently valued at approximately $12.5 billion and is projected to grow at a CAGR of 9.3% from 2023 to 2033, indicating robust expansion in demand and innovation.

What are the key market players or companies in this top Trends In The Agricultural Biologicals industry?

Leading companies in the agricultural biologicals market include Bayer AG, BASF SE, Syngenta AG, and FMC Corporation, known for their advancements in biopesticide and biofertilizer technologies.

What are the primary factors driving the growth in the top Trends In The Agricultural Biologicals industry?

The growth is primarily driven by increasing demand for sustainable agriculture, the need for alternatives to chemical pesticides, and growing awareness regarding environmental impacts among consumers.

Which region is the fastest Growing in the top Trends In The Agricultural Biologicals?

The North America region is the fastest-growing market, expanding from $4.49 billion in 2023 to $11.26 billion by 2033, driven by technological advancements and strong regulatory support.

Does ConsaInsights provide customized market report data for the top Trends In The Agricultural Biologicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the agricultural biologicals industry, enabling targeted insights for strategic decision-making.

What deliverables can I expect from this top Trends In The Agricultural Biologicals market research project?

Expect comprehensive reports including market size, growth forecasts, competitive analysis, regional insights, and strategic recommendations, providing a detailed overview of the agricultural biologicals landscape.

What are the market trends of top Trends In The Agricultural Biologicals?

Key trends include increased adoption of biopesticides, innovations in biofertilizers, and a strong shift towards regenerative agriculture practices, enhancing sustainability and environmental stewardship.