Topcoat Market Report

Published Date: 02 February 2026 | Report Code: topcoat

Topcoat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Topcoat market, covering insights on market size, growth trends, segmentation, and regional dynamics from 2023 to 2033.

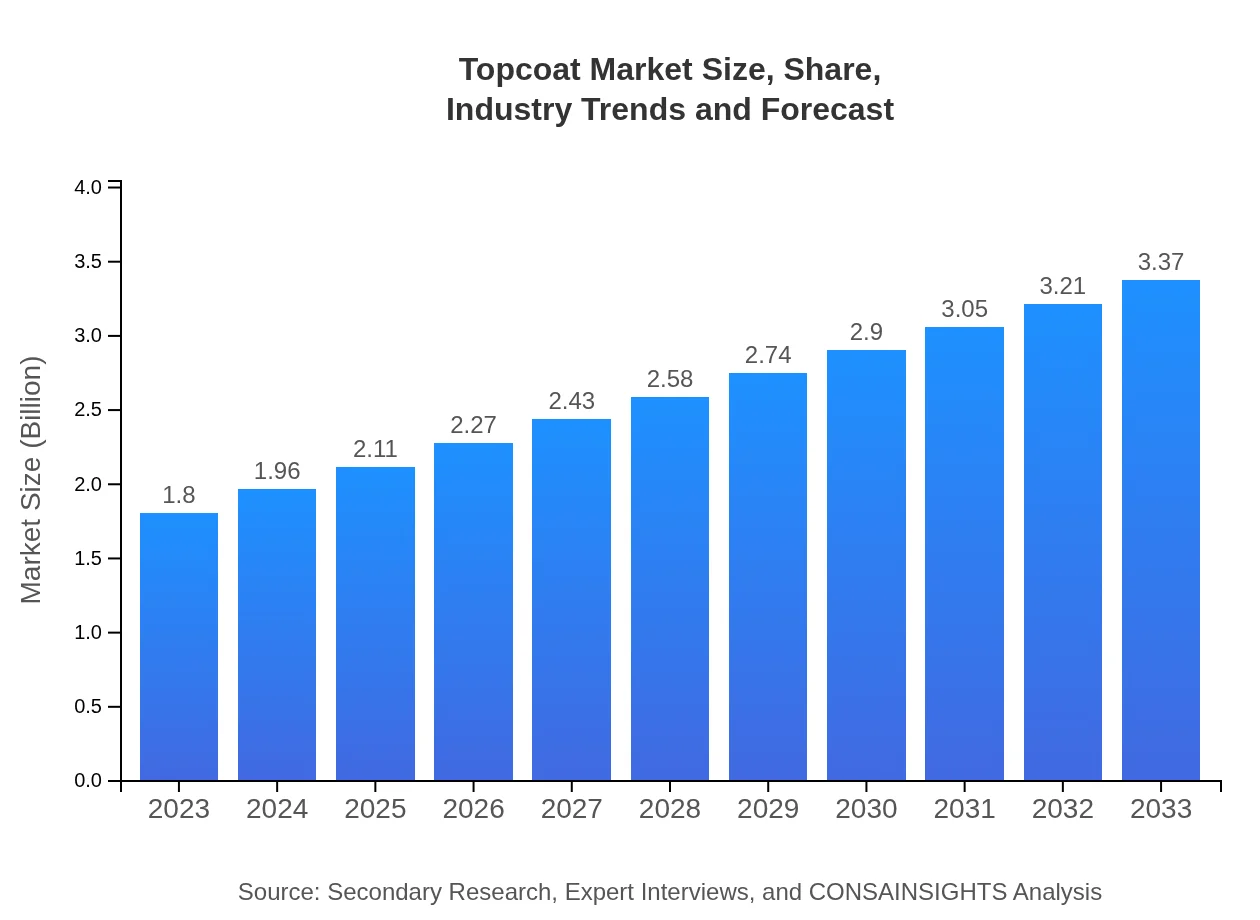

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $3.37 Billion |

| Top Companies | AkzoNobel, PPG Industries, Sherwin-Williams, BASF |

| Last Modified Date | 02 February 2026 |

Topcoat Market Overview

Customize Topcoat Market Report market research report

- ✔ Get in-depth analysis of Topcoat market size, growth, and forecasts.

- ✔ Understand Topcoat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Topcoat

What is the Market Size & CAGR of the Topcoat market from 2023 to 2033?

Topcoat Industry Analysis

Topcoat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Topcoat Market Analysis Report by Region

Europe Topcoat Market Report:

Europe's Topcoat market is expected to increase from $0.62 billion in 2023 to $1.16 billion in 2033, highlighting sustainable product trends and regulations favoring eco-friendly alternatives. The automotive and construction sectors in countries like Germany and the UK are vital for market buoyancy due to their high-quality standards and significant innovation practices.Asia Pacific Topcoat Market Report:

The Asia Pacific region is expected to witness significant growth in the Topcoat market, with market size projected to increase from $0.34 billion in 2023 to $0.63 billion in 2033. This growth is fueled by the booming construction and automotive sectors in countries like China, India, and Japan. The rising disposable incomes and shift towards urbanization are also contributing to the demand for high-quality coatings.North America Topcoat Market Report:

The North American Topcoat market is anticipated to grow from $0.60 billion in 2023 to $1.13 billion by 2033. The region is characterized by a well-established automotive industry and significant aerospace manufacturing, which necessitate high-performance coatings. Innovations in technologies like low VOC topcoats are enhancing market opportunities, driven by stringent regulatory requirements regarding environmental concerns.South America Topcoat Market Report:

In South America, the Topcoat market size is projected to grow from $0.16 billion in 2023 to $0.29 billion in 2033. The expanding construction sector and increasing investments in infrastructure development are prime factors driving market growth. Additionally, there is a rising demand for decorative coatings within the furniture and automotive markets, aligning with growing consumer preferences for aesthetic value.Middle East & Africa Topcoat Market Report:

In the Middle East and Africa, the market is expected to grow modestly, with an increase from $0.08 billion in 2023 to $0.16 billion in 2033. Increasing construction activities driven by urban development and investments in public infrastructure are pivotal growth drivers. Furthermore, although the aviation sector is a smaller segment, it is expected to grow due to rising tourism and transportation demands.Tell us your focus area and get a customized research report.

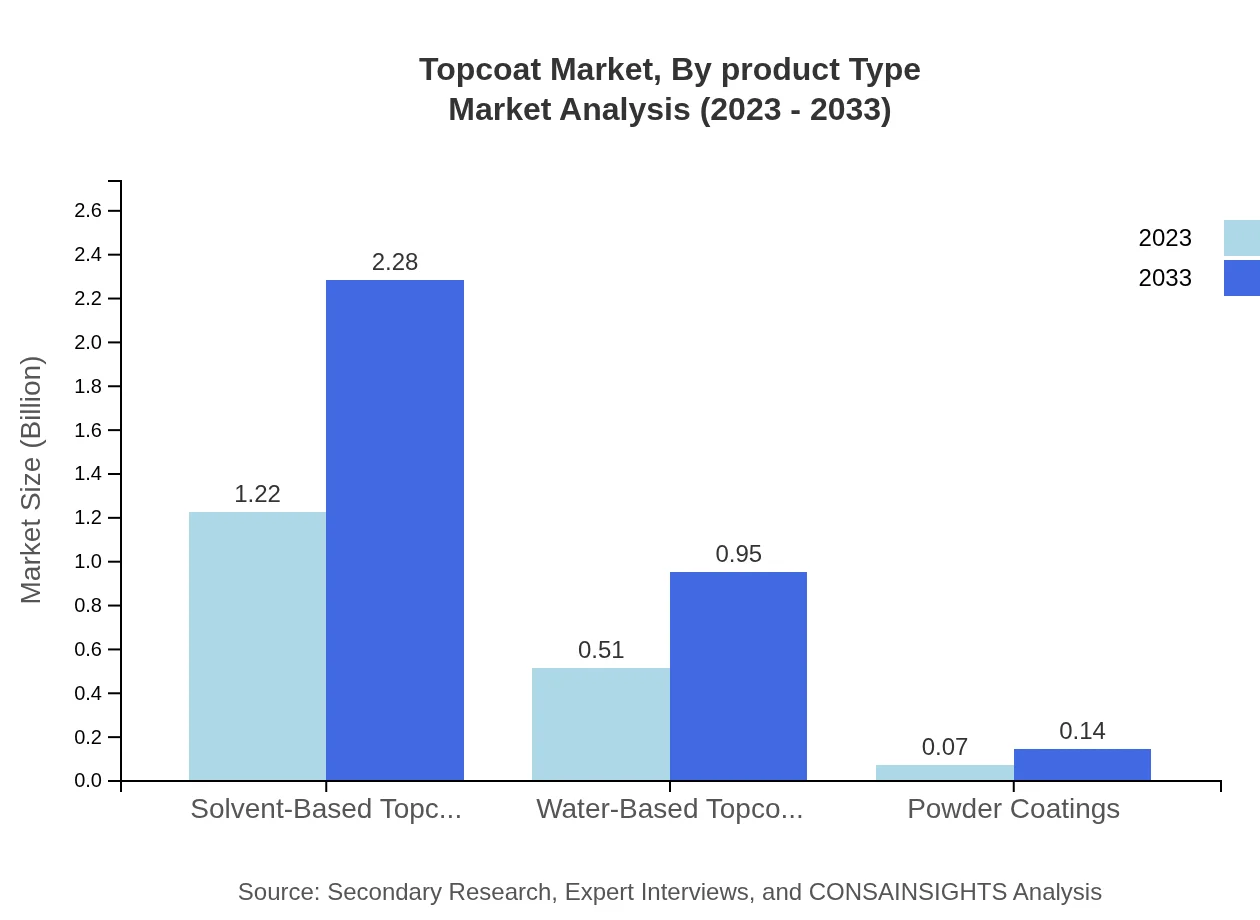

Topcoat Market Analysis By Product Type

The Topcoat market, segmented by product type, includes solvent-based, water-based, and powder coatings. Solvent-based topcoats held the largest market share in 2023, valued at $1.22 billion with a 67.57% share, and are projected to reach $2.28 billion by 2033. Water-based topcoats, aligning with eco-friendly trends, are set to grow from $0.51 billion in 2023 to $0.95 billion in 2033. Powder coatings, though smaller, are emerging segments with potential growth.

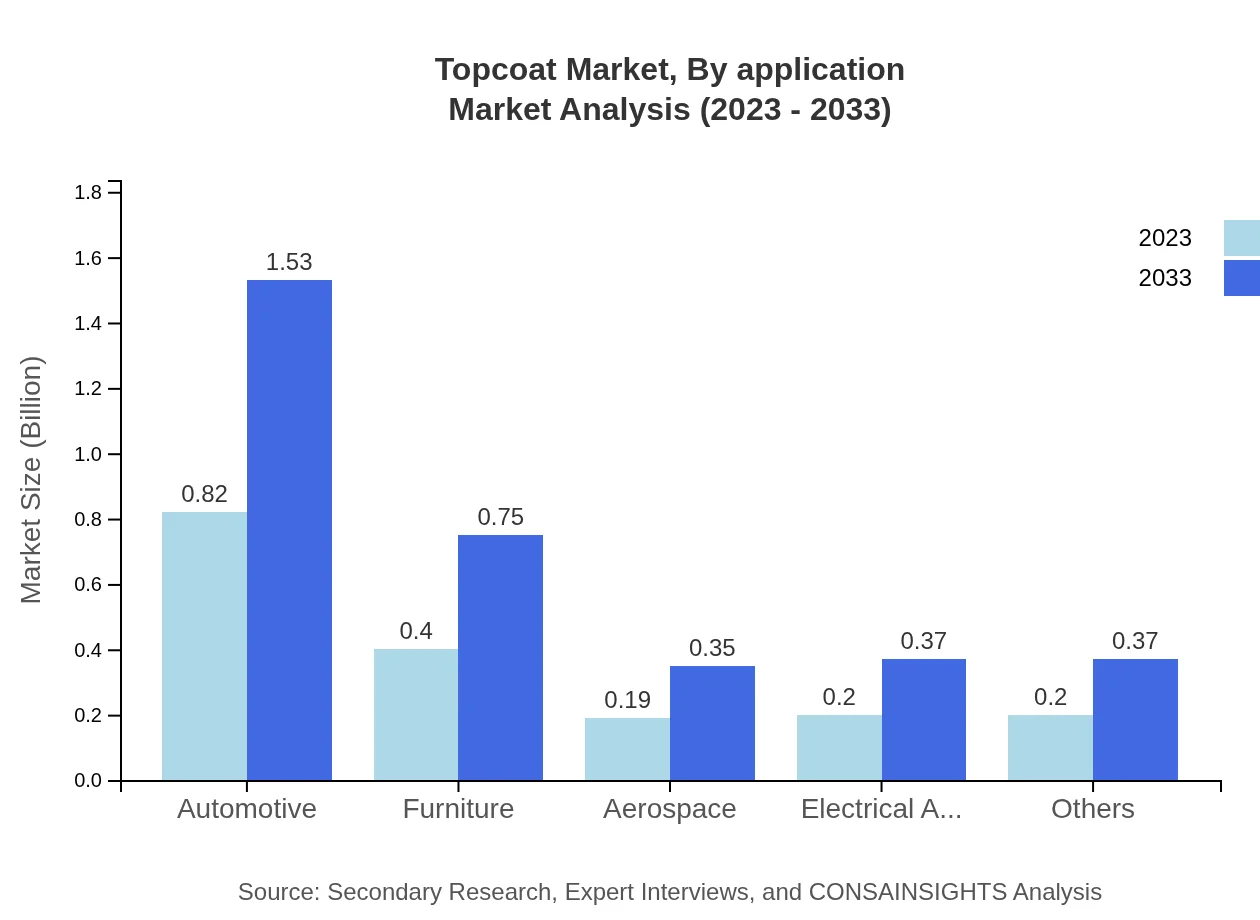

Topcoat Market Analysis By Application

The application-based segmentation includes automotive, furniture, aerospace, and electrical appliances. The automotive segment leads, accounting for $0.82 billion in 2023, and is projected to grow to $1.53 billion by 2033. The furniture sector follows closely, expected to rise from $0.40 billion to $0.75 billion during the same period due to heightened consumer spending on home decoration and improvement.

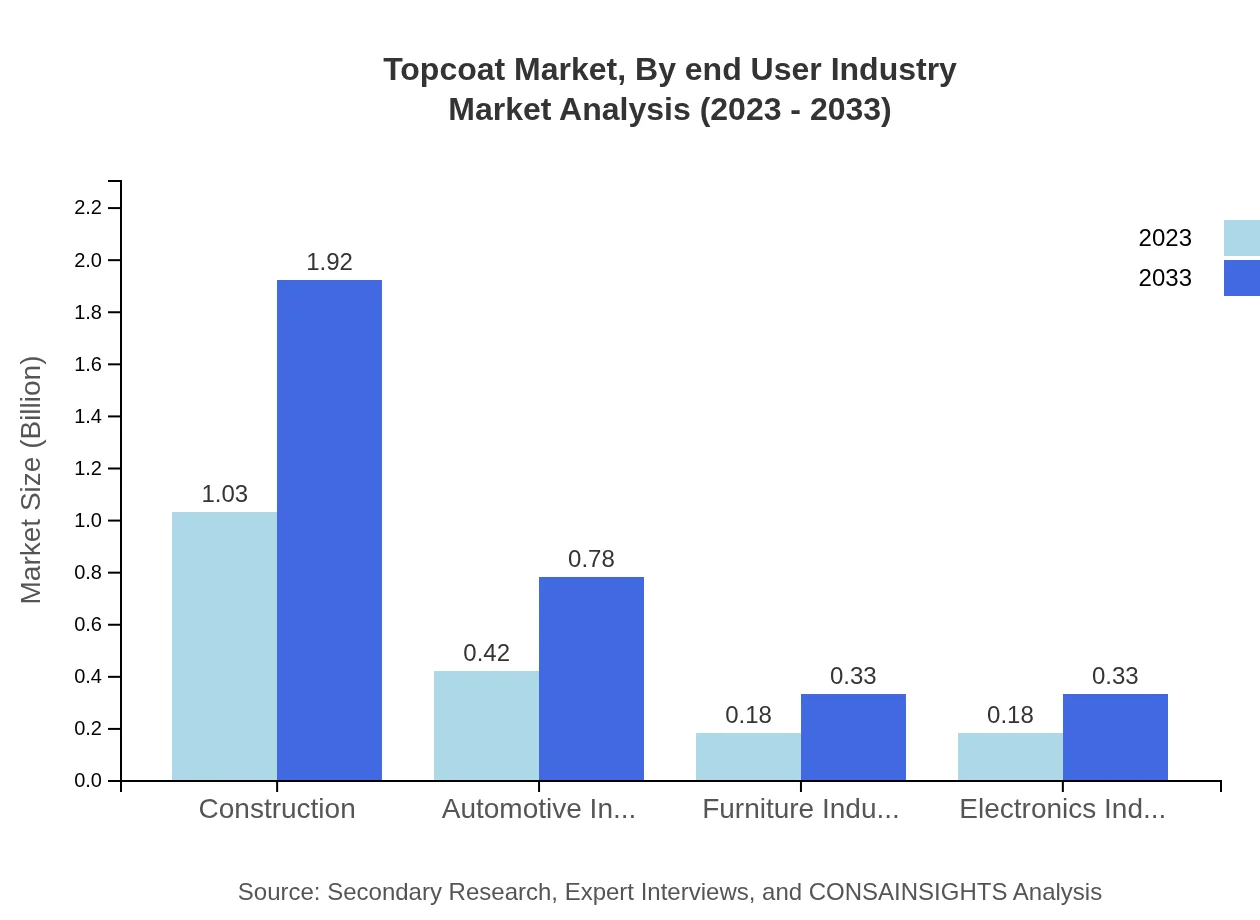

Topcoat Market Analysis By End User Industry

In terms of end-user industries, construction is the largest segment, anticipated to grow from $1.03 billion in 2023 to $1.92 billion by 2033. The automotive, furniture, and electronics industries are also significant contributors, emphasizing the essential nature of high-quality protective and decorative coatings across multiple sectors that require durability and aesthetics.

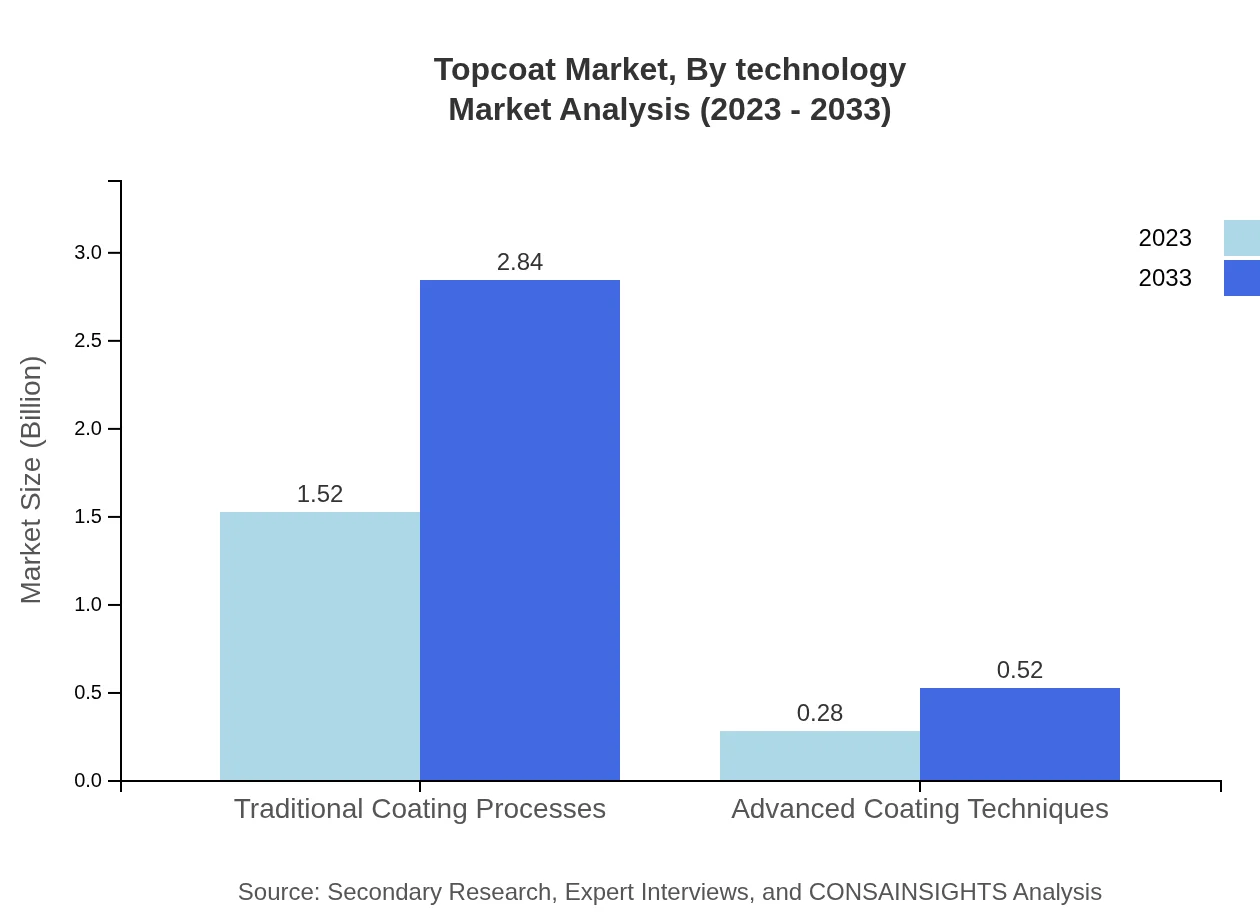

Topcoat Market Analysis By Technology

Advanced coating technologies are reshaping the Topcoat market. Traditional coating processes account for a significant share, with $1.52 billion in 2023, projected to remain stable. However, advanced techniques such as electrostatic spray and UV-cured coatings are gaining traction due to their efficiency and environmental friendliness, contributing to innovation in the field.

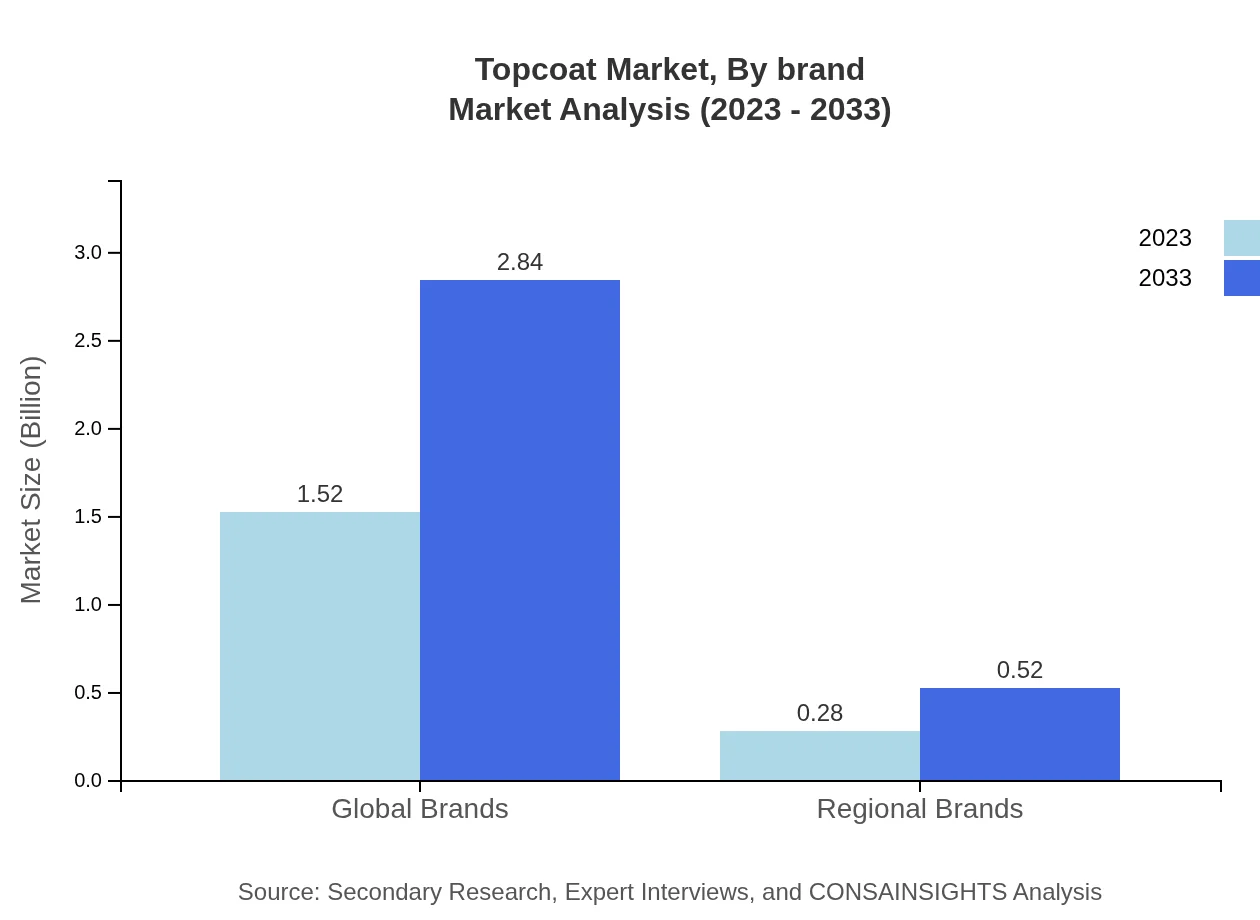

Topcoat Market Analysis By Brand

The Topcoat market is notably dominated by global brands, which held a size of $1.52 billion in 2023, maintaining an 84.47% market share. As brand recognition plays a crucial role in consumer preferences, regional brands, while smaller at $0.28 billion in 2023, are expected to grow, emphasizing local manufacturing and customer customization.

Topcoat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Topcoat Industry

AkzoNobel:

Globally recognized for innovative coatings, AkzoNobel leads in sustainability and product development in the topcoat market.PPG Industries:

A major player known for its wide array of coatings, PPG Industries specializes in protective and decorative coatings across multiple industries.Sherwin-Williams:

Focusing on high-performance coatings, Sherwin-Williams is a key leader in the North American market, enhancing customer solutions and product offerings.BASF:

As a chemical company, BASF provides innovative coatings with a strong emphasis on sustainability in the topcoat segment.We're grateful to work with incredible clients.

FAQs

What is the market size of Topcoat?

The topcoat market is projected to reach $1.8 billion by 2033, growing at a CAGR of 6.3%. This growth reflects increasing demand across various sectors and applications, indicating a robust market trajectory.

What are the key market players or companies in the Topcoat industry?

Key players in the topcoat industry include major coatings manufacturers, focusing on sustainable solutions, innovation in coatings technologies, and expanding product portfolios to capture market share.

What are the primary factors driving the growth in the Topcoat industry?

Growth in the topcoat industry is driven by rising infrastructure projects, demand for automotive refinishing, and advancements in coating technologies. Sustainability concerns in manufacturing also compel companies to invest in eco-friendly topcoats.

Which region is the fastest Growing in the Topcoat industry?

The fastest-growing region in the topcoat market is Europe, anticipated to expand from $0.62 billion in 2023 to $1.16 billion by 2033. Asia Pacific follows closely with a significant increase, reflecting favorable economic conditions.

Does ConsaInsights provide customized market report data for the Topcoat industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs in the topcoat industry, catering to particular segments, regional markets, and unique insights for informed decision-making.

What deliverables can I expect from this Topcoat market research project?

Deliverables from the topcoat market research project include comprehensive market analyses, trend reports, regional breakdowns, competitive landscape assessments, and actionable insights tailored to specific client requirements.

What are the market trends of Topcoat?

Current trends in the topcoat market include a shift towards water-based and eco-friendly products, increasing demand for advanced coating techniques, and enhanced aesthetic features in automotive and furniture applications.