Total Station Market Report

Published Date: 22 January 2026 | Report Code: total-station

Total Station Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a thorough analysis of the Total Station industry, encompassing market size, segmentation, and regional insights, along with trends and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

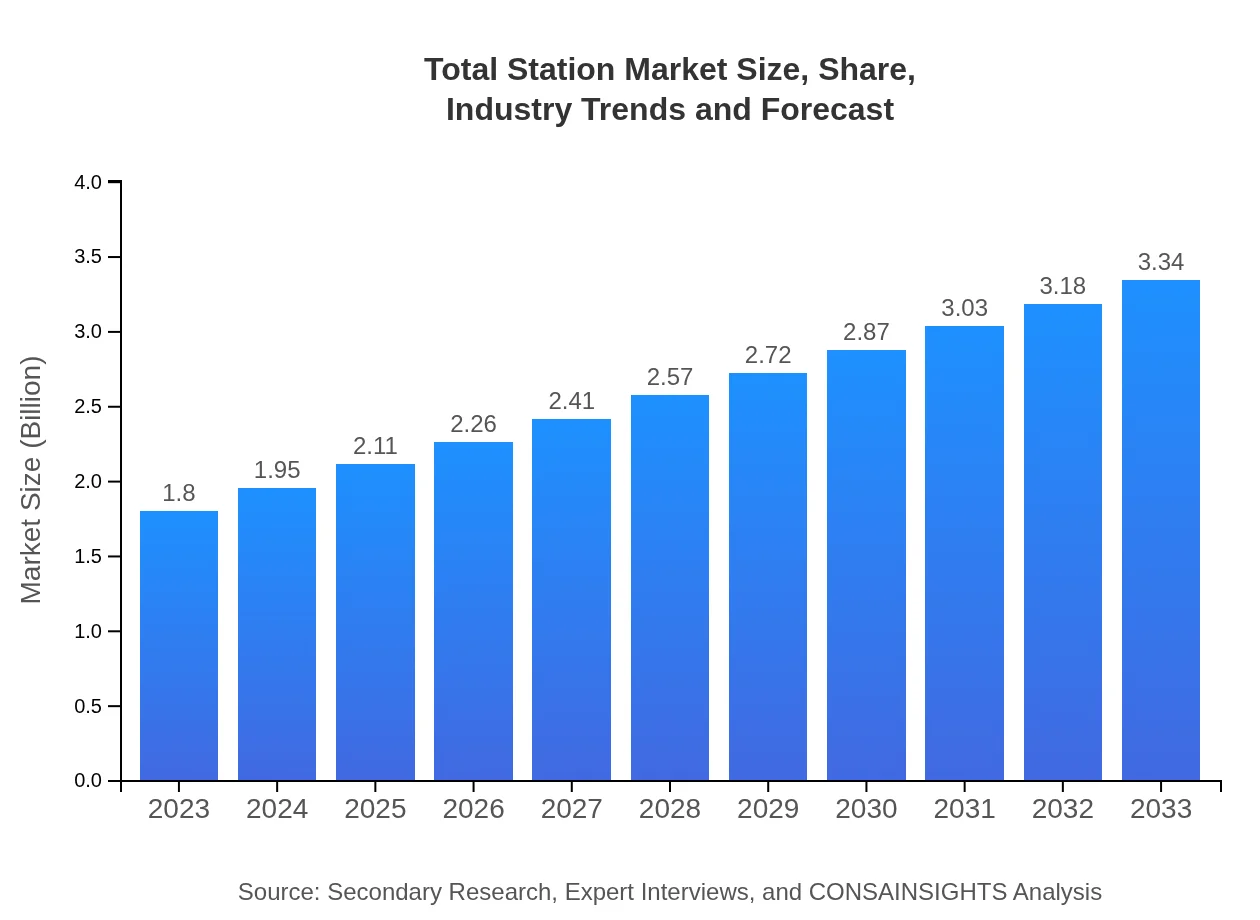

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Leica Geosystems, Topcon Corporation, Trimble Inc., Sokkia, Nikon-Trimble |

| Last Modified Date | 22 January 2026 |

Total Station Market Overview

Customize Total Station Market Report market research report

- ✔ Get in-depth analysis of Total Station market size, growth, and forecasts.

- ✔ Understand Total Station's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Total Station

What is the Market Size & CAGR of Total Station market in 2023?

Total Station Industry Analysis

Total Station Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Total Station Market Analysis Report by Region

Europe Total Station Market Report:

The European Total Station market is set to grow from $0.52 billion in 2023 to approximately $0.97 billion by 2033. The presence of advanced technological infrastructure, emphasis on sustainable development, and ongoing construction projects significantly elevate the market potential in this region.Asia Pacific Total Station Market Report:

In 2023, the Asia-Pacific Total Station market is valued at approximately $0.34 billion, expected to grow to $0.63 billion by 2033. The region's growth is fueled by a booming construction sector, increased urbanization, and governmental initiatives supporting infrastructure development. Countries like China and India are at the forefront, driving technological advancements and demand for accurate surveying tools.North America Total Station Market Report:

In North America, the market is estimated at $0.67 billion in 2023, projected to escalate to $1.24 billion by 2033. The United States and Canada are leading players due to a robust construction sector, an increasing number of infrastructural projects, and widespread adoption of electronic Total Stations.South America Total Station Market Report:

The South American Total Station market is estimated to reach $0.08 billion in 2023 and is projected to grow to $0.15 billion by 2033. The region's growth is primarily driven by ongoing investments in infrastructure and mining activities, requiring highly accurate surveying equipment to optimize operations.Middle East & Africa Total Station Market Report:

The Middle East and Africa (MEA) market is valued at $0.19 billion in 2023, expected to rise to $0.35 billion by 2033. The UAE and Saudi Arabia are pivotal due to their substantial investment in infrastructure and construction, establishing a strong demand for precise surveying equipment.Tell us your focus area and get a customized research report.

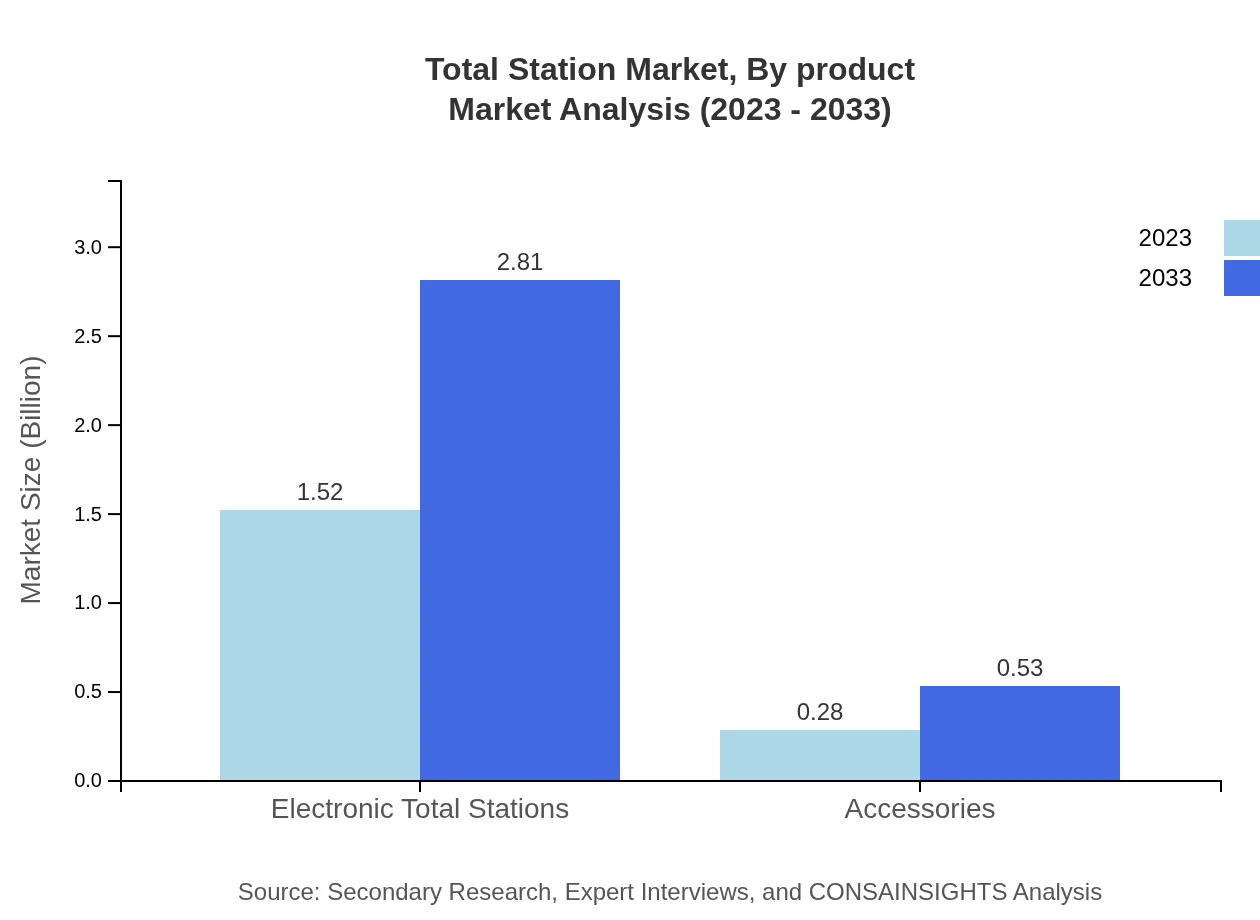

Total Station Market Analysis By Product

Electronic Total Stations dominate the Total Station market, accounting for 84.23% of the total market size in 2023 and projected to maintain the same share in 2033. Accessories, including tripods and batteries, represent a smaller segment, growing from $0.28 billion in 2023 to $0.53 billion by 2033, holding about 15.77% of the market share.

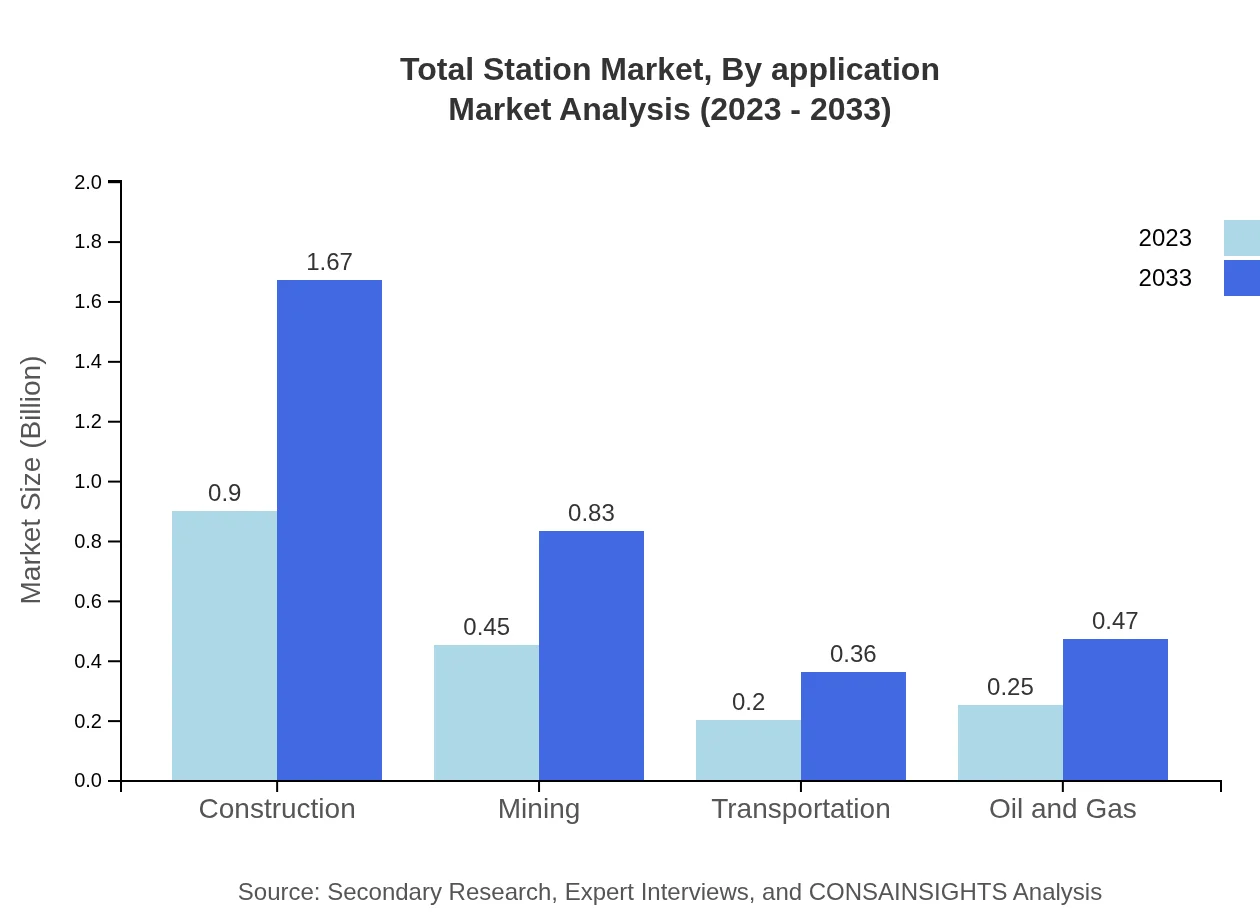

Total Station Market Analysis By Application

The construction segment is the largest application segment, contributing 50% of the total market in 2023 and expecting to rise to 50% by 2033. Other applications include mining (25%), where precision in geological surveys is critical, and transportation (10.9%), which requires accurate measurements for planning and routing.

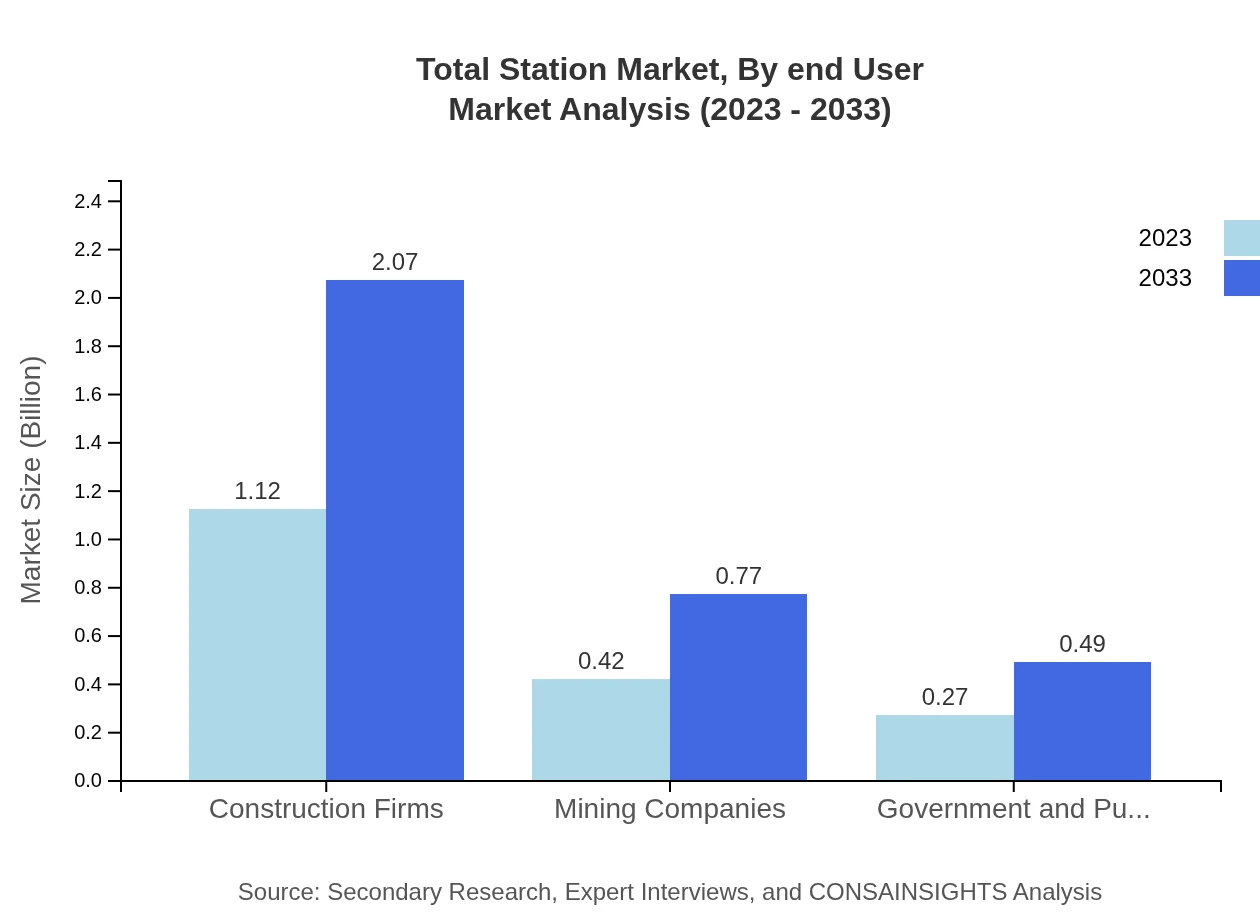

Total Station Market Analysis By End User

Construction firms account for the largest share of the Total Station market by end-user, responsible for 61.95% of consumption in 2023, projected to remain stable through 2033. Mining companies, government agencies, and the public sector are also significant end-users, reflecting rising levels of infrastructure development and investment.

Total Station Market Analysis By Region

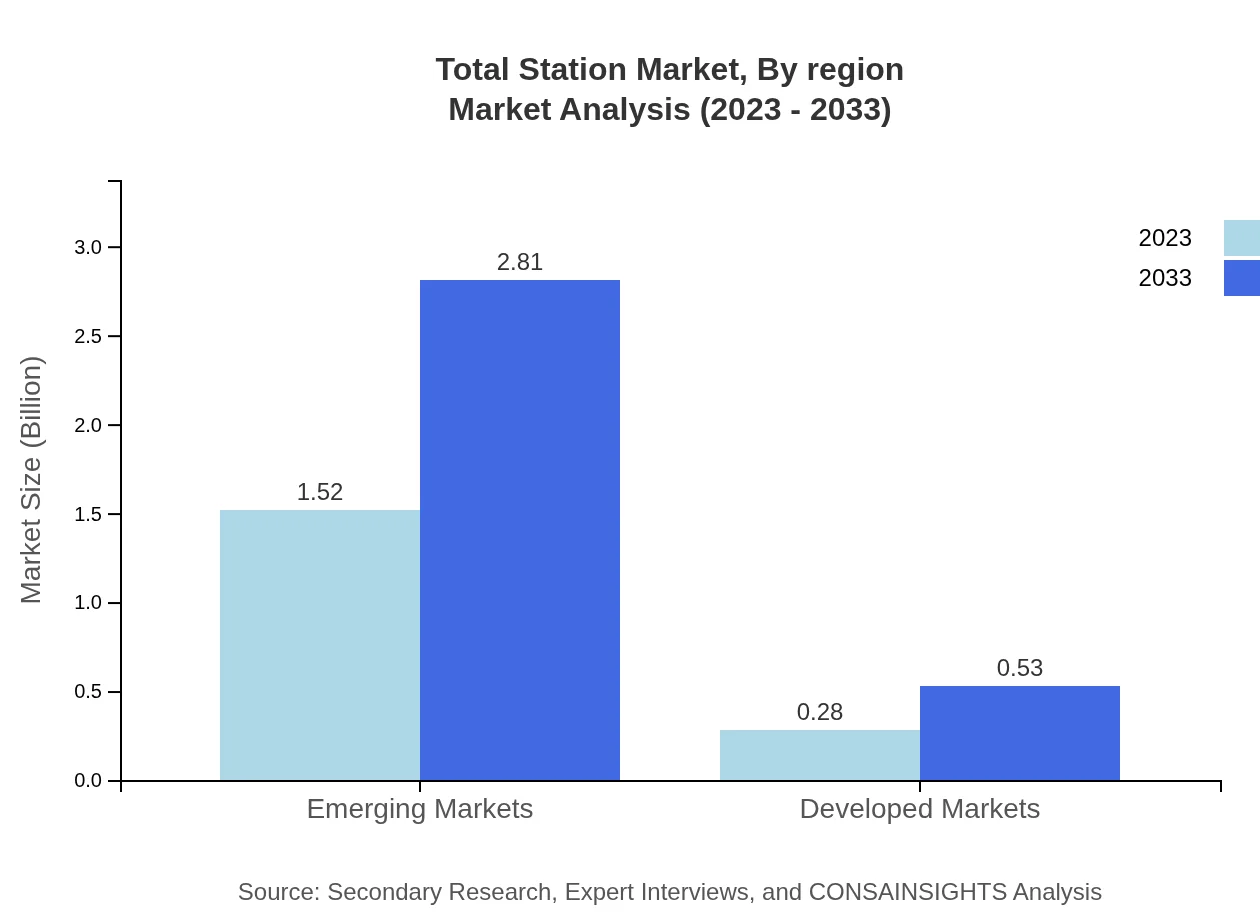

The Total Station market exhibits regional variations in growth attributable to differences in construction activity, government spending, and technological adoption. Emerging markets demonstrate significant growth potential, driven by increasing urban infrastructure, while developed markets maintain steady growth owing to saturation in construction.

Total Station Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Total Station Industry

Leica Geosystems:

A leader in measurement and surveying solutions, Leica offers a wide range of Total Stations known for their precision and durability.Topcon Corporation:

Topcon provides advanced positioning solutions, including electronic Total Stations, which are popular in the construction and surveying sectors.Trimble Inc.:

A major player in the field of positioning technologies, Trimble’s Total Stations are recognized for their user-friendly interfaces and software compatibility.Sokkia:

Known for quality surveying equipment, Sokkia manufactures a range of Total Stations suited for diverse surveying applications.Nikon-Trimble:

Nikon-Trimble provides high-quality Total Stations that leverage optical technologies and digital innovations to meet industry demands.We're grateful to work with incredible clients.

FAQs

What is the market size of total Station?

The total station market is valued at approximately $1.8 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033, reflecting robust growth as demand for precision measurement instruments rises.

What are the key market players or companies in the total Station industry?

Key players in the total station market include established companies that specialize in geospatial technologies, surveying instruments, and construction equipment. The market consists of prominent manufacturers, innovative technology firms, and distributors working to enhance total station capabilities.

What are the primary factors driving the growth in the total Station industry?

The growth in the total station market is driven by increasing construction and infrastructure projects, advancements in surveying technology, demand for high-precision equipment, and the adoption of total stations in emerging markets for land surveying.

Which region is the fastest Growing in the total Station market?

The Asia Pacific region is the fastest-growing in the total station market, expected to expand from $0.34 billion in 2023 to $0.63 billion in 2033, driven by urbanization and increased infrastructure investment.

Does ConsaInsights provide customized market report data for the total Station industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the total-station industry, providing comprehensive insights, detailed analysis, and data-driven recommendations based on client requirements.

What deliverables can I expect from this total Station market research project?

Deliverables from the total station market research project include detailed market analysis, growth forecasts, competitive landscape, regional insights, and segment-wise breakdowns to help in strategic decision-making.

What are the market trends of total Station?

Market trends in the total station industry include increased automation in surveying technology, integration of IoT, a shift towards electronic total stations, and growing preference for advanced functionalities in precision measurement equipment.