Track And Trace Solutions Market Report

Published Date: 31 January 2026 | Report Code: track-and-trace-solutions

Track And Trace Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Track And Trace Solutions market, featuring insights on market size, segmentation, regional analysis, and industry trends, with forecasts from 2023 to 2033.

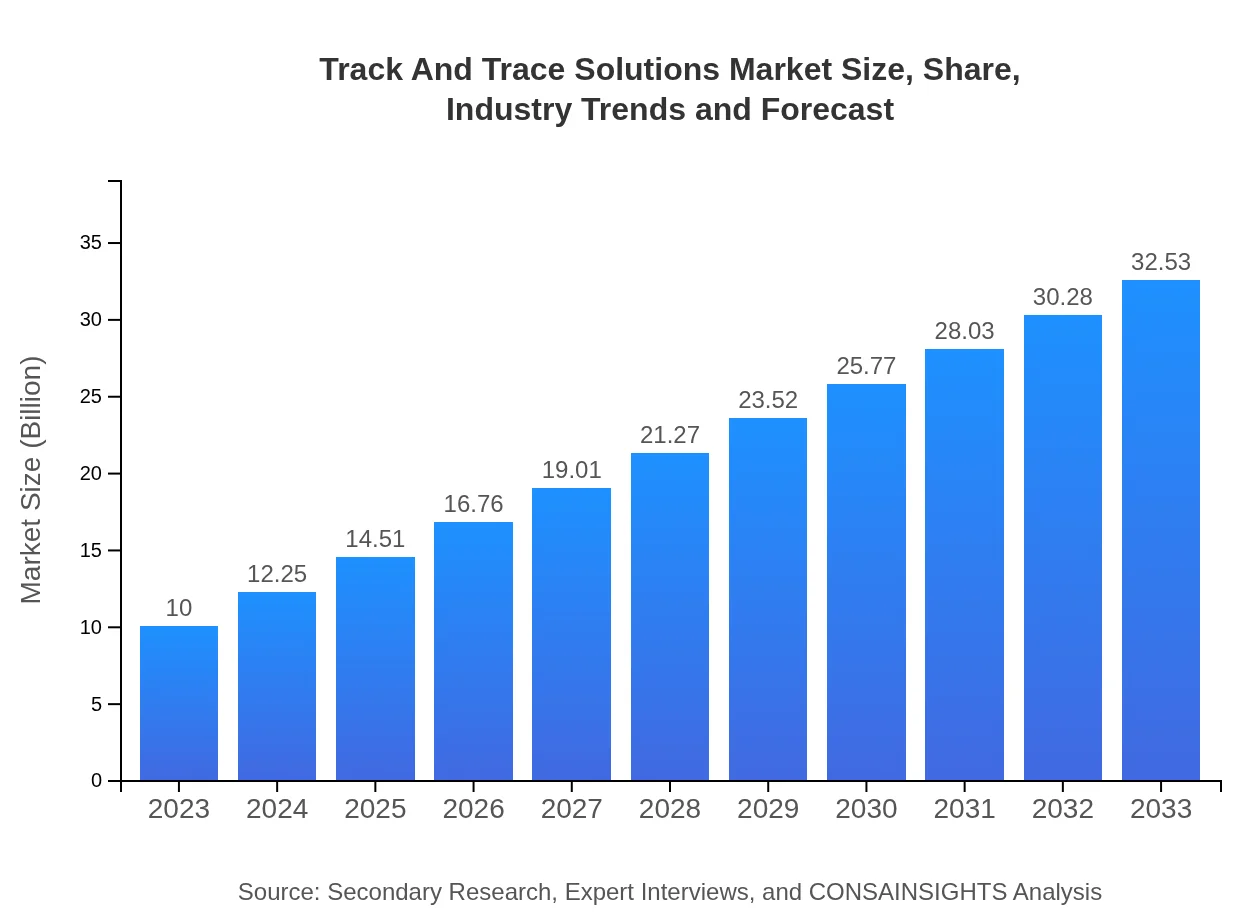

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | Zebra Technologies, Savi Technology, Mysupplychain, Siemens |

| Last Modified Date | 31 January 2026 |

Track And Trace Solutions Market Overview

Customize Track And Trace Solutions Market Report market research report

- ✔ Get in-depth analysis of Track And Trace Solutions market size, growth, and forecasts.

- ✔ Understand Track And Trace Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Track And Trace Solutions

What is the Market Size & CAGR of the Track And Trace Solutions market in 2023?

Track And Trace Solutions Industry Analysis

Track And Trace Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Track And Trace Solutions Market Analysis Report by Region

Europe Track And Trace Solutions Market Report:

Europe represents a strong market for Track and Trace Solutions, beginning at $3.30 billion in 2023 and projected to grow to $10.73 billion by 2033. The European Union's rigorous regulations around product safety, particularly in pharmaceuticals, are influencing significant investment in traceability systems to ensure compliance.Asia Pacific Track And Trace Solutions Market Report:

The Asia Pacific region held a market value of $1.78 billion in 2023 and is projected to grow to $5.78 billion by 2033. The rapid expansion of the pharmaceutical and food sectors in countries like China and India, along with increasing regulatory compliance, drives this growth. Technological advancements and a growing emphasis on supply chain integrity further contribute to this market surge.North America Track And Trace Solutions Market Report:

North America, valued at $3.67 billion in 2023, is expected to reach $11.94 billion by 2033. The heightened regulatory frameworks related to product safety and supply chain transparency in the pharmaceutical and food industries are significant growth drivers. Additionally, the presence of major key players in this market bolsters innovation and expansion.South America Track And Trace Solutions Market Report:

In South America, the Track and Trace Solutions market recorded a value of $0.71 billion in 2023, forecasted to increase to $2.30 billion by 2033. The region is gradually adopting strict food safety regulations, enhancing the demand for robust tracking solutions. Initiatives towards improving supply chain transparency are expected to propel growth.Middle East & Africa Track And Trace Solutions Market Report:

The Middle East and Africa are anticipated to grow from a market size of $0.55 billion in 2023 to $1.79 billion by 2033. This region is experiencing an increase in regulations related to consumer safety in industries like food and pharmaceuticals. As local industries adapt to global supply chain standards, adoption of Track and Trace Solutions is set to rise.Tell us your focus area and get a customized research report.

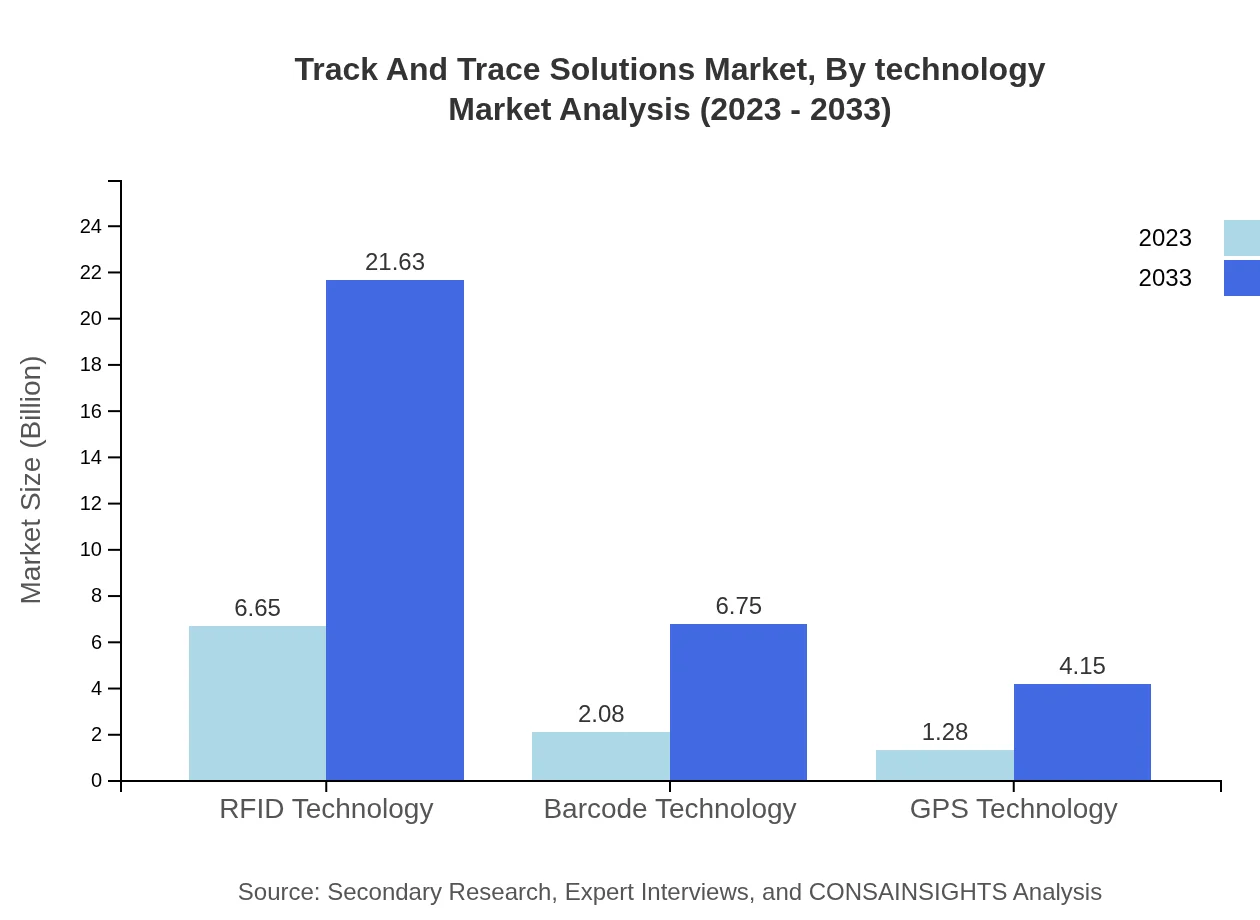

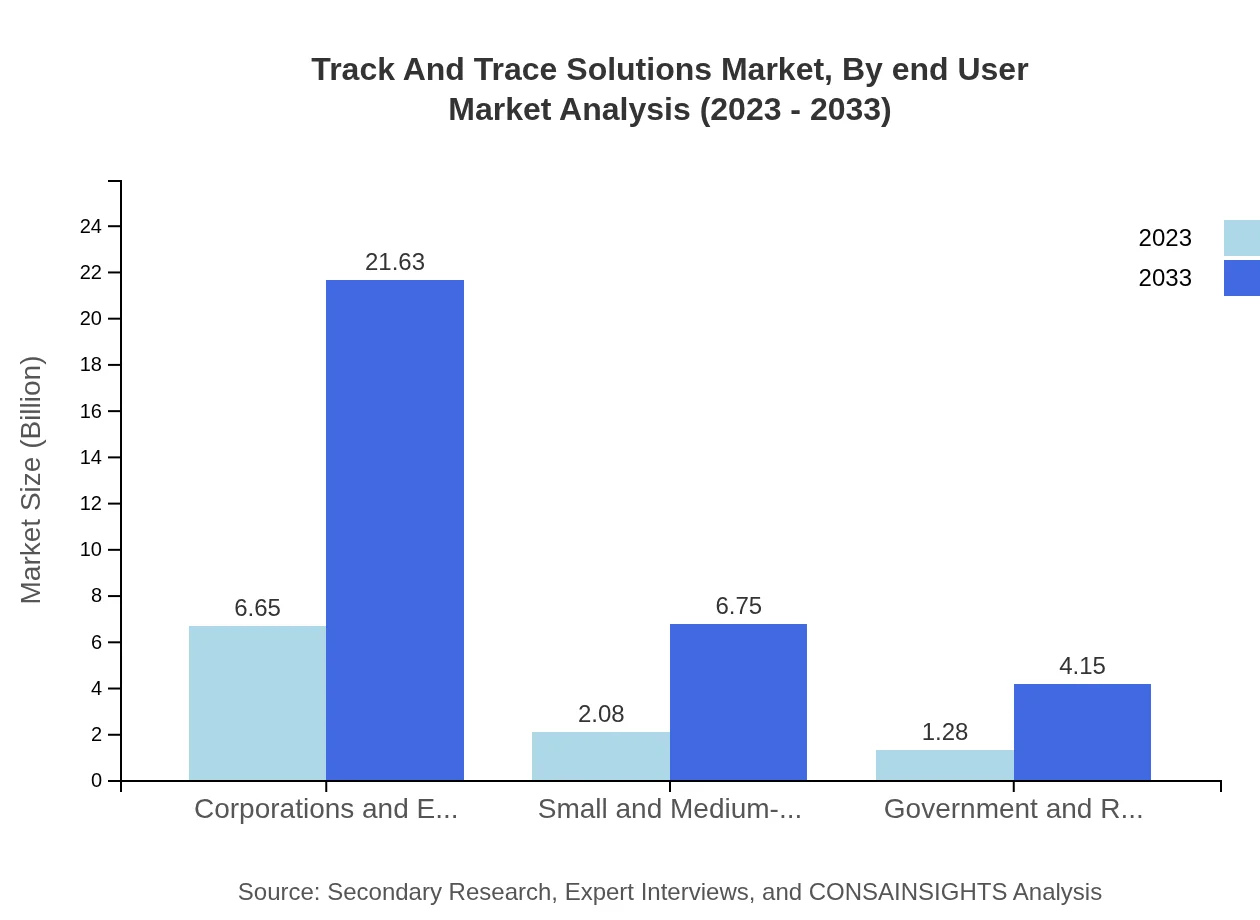

Track And Trace Solutions Market Analysis By Technology

The By Technology segment includes RFID technology, which dominates with a market size of $6.65 billion in 2023, expected to grow to $21.63 billion by 2033, holding a mandatory share of 66.48%. Barcode technology follows, projected from $2.08 billion to $6.75 billion during the same period, and GPS technology, which is expected to increase from $1.28 billion to $4.15 billion. The strong adoption of these technologies is largely driven by their efficiency and the demand for regulatory compliance.

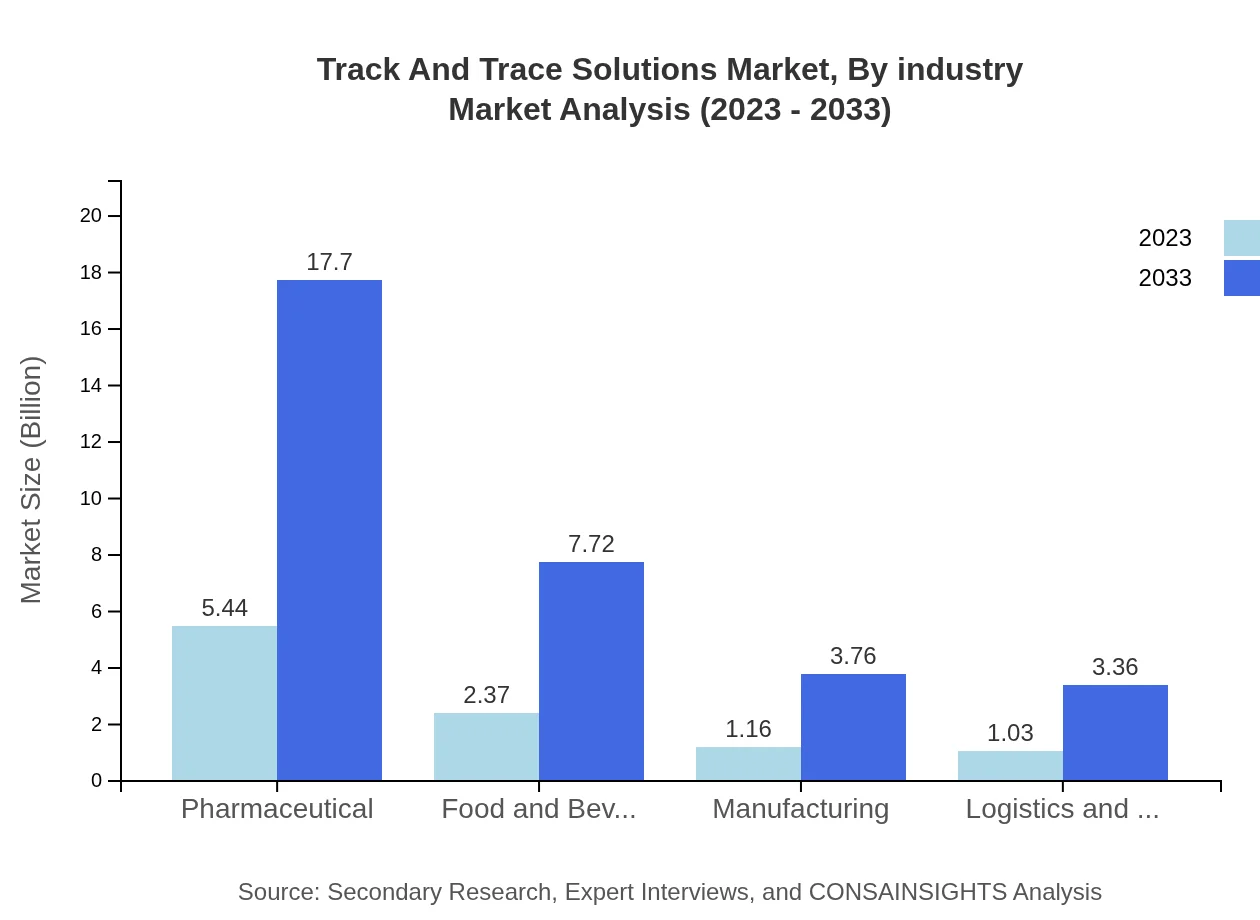

Track And Trace Solutions Market Analysis By Industry

Pharmaceuticals remain the leading industry with a market size of $5.44 billion in 2023, set to reach $17.70 billion by 2033. This is closely followed by the Food and Beverage sector, growing from $2.37 billion to $7.72 billion, leveraging traceability to enhance safety and quality. The Government and Regulatory Bodies segment supports compliance efforts, growing from $1.28 billion to $4.15 billion, further showcasing the critical role of Track and Trace Solutions in various sectors.

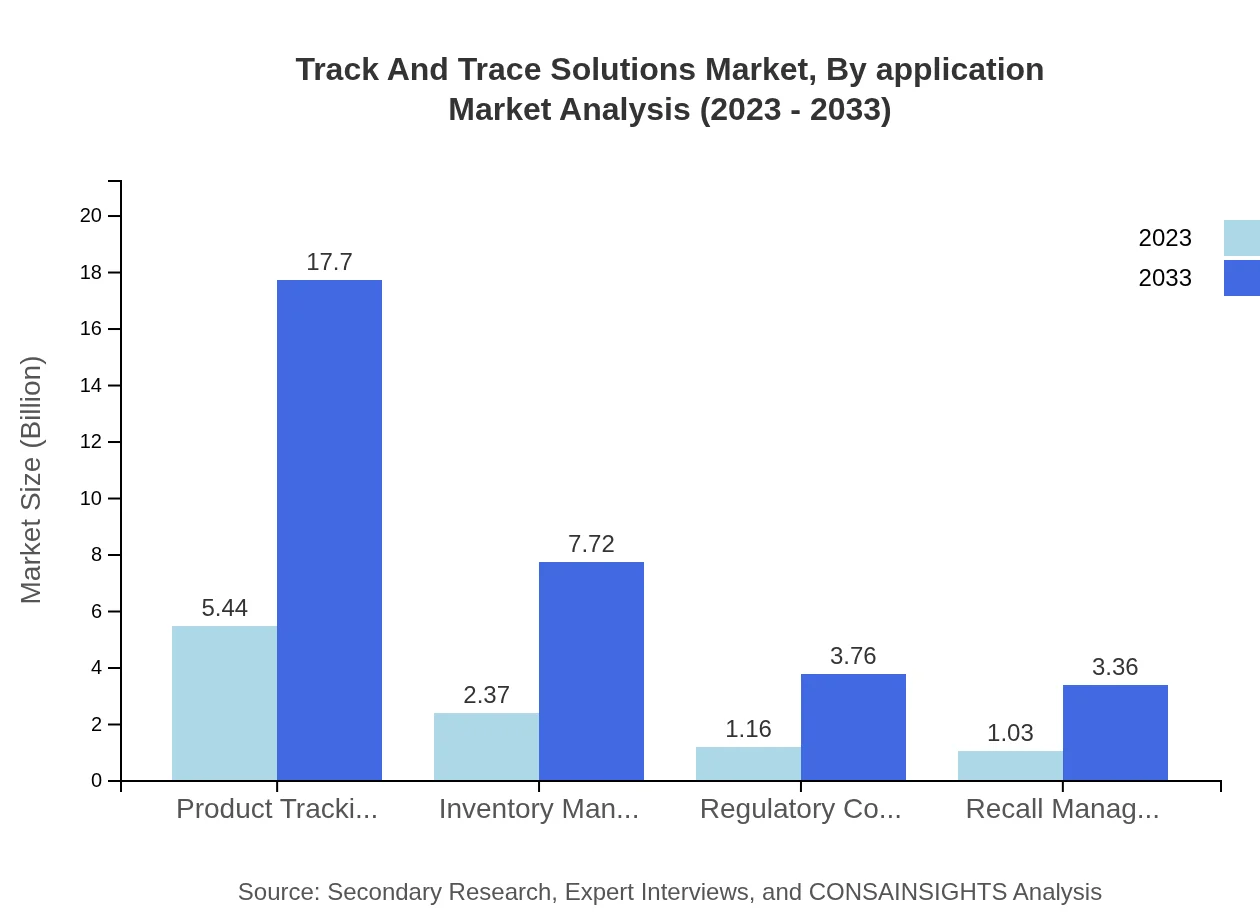

Track And Trace Solutions Market Analysis By Application

The application of Track and Trace Solutions encompasses several critical functions including product tracking, regulatory compliance, inventory management, and recall management. Product tracking leads with a market size of $5.44 billion in 2023, expected to grow to $17.70 billion by 2033, highlighting essential demand in logistics and supply chain operations. Regulatory compliance also plays a key role, with significant investments anticipated to ensure adherence to industry standards.

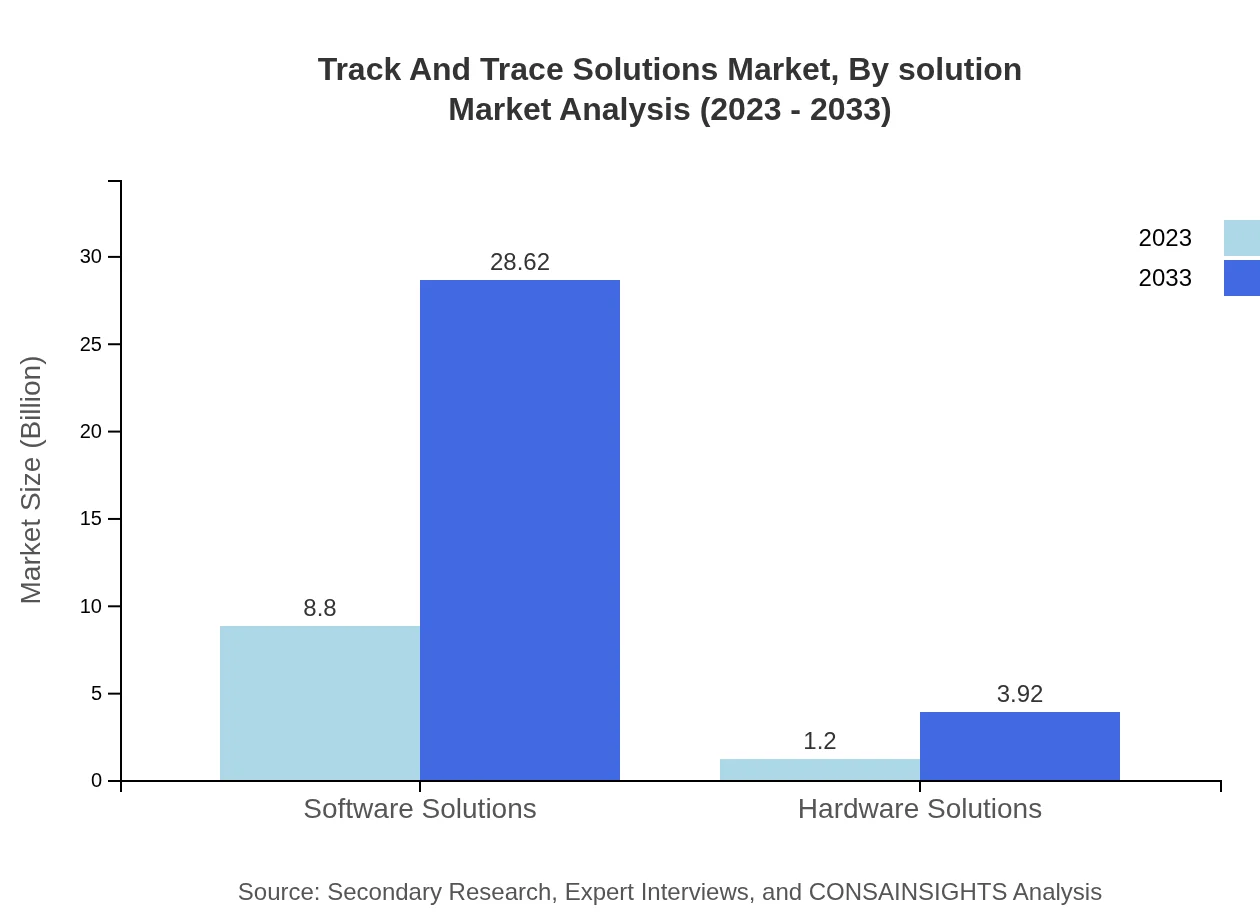

Track And Trace Solutions Market Analysis By Solution

Software solutions dominate the market, starting at $8.80 billion in 2023 and projected to grow to $28.62 billion by 2033, representing an 87.96% market share. Hardware solutions follow, with sizes of $1.20 billion in 2023 to $3.92 billion in 2033. The demand for integrated software solutions is rapidly increasing across industries looking to improve visibility and control within their supply chains.

Track And Trace Solutions Market Analysis By End User

Corporations and Enterprises are the largest end-users, with a market value of $6.65 billion in 2023, expected to reach $21.63 billion by 2033, making up 66.48% of the total market. Small and Medium-Sized Enterprises also contribute significantly, with anticipated growth from $2.08 billion to $6.75 billion, making traceability accessible for a broader range of businesses.

Track And Trace Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Track And Trace Solutions Industry

Zebra Technologies:

Zebra Technologies is a leading provider of Track and Trace Solutions, offering innovative hardware and software that enhances supply chain and inventory management. Their products are widely used in logistics, manufacturing, and healthcare sectors.Savi Technology:

Savi Technology specializes in real-time visibility solutions for military, logistics, and supply chain management. Their focus on RFID technology has positioned them as a key player in the Track and Trace market.Mysupplychain:

Mysupplychain delivers comprehensive software solutions for supply chain visibility and compliance, catering to a diverse range of industries, helping organizations implement effective tracking systems.Siemens :

Siemens offers a wide range of automation and digitalization solutions that integrate track and trace functionalities, providing significant value across industries such as manufacturing, healthcare, and energy.We're grateful to work with incredible clients.

FAQs

What is the market size of track And Trace solutions?

The global track-and-trace solutions market size is projected to reach $10 billion by 2033, growing from $10 billion in 2023, with a remarkable CAGR of 12% over the forecast period.

What are the key market players or companies in this track And Trace solutions industry?

Key players in the track-and-trace solutions industry include major technology providers and solutions integrators such as Zebra Technologies, Systech International, and Antares Vision, which lead the market with innovative offerings.

What are the primary factors driving the growth in the track And Trace solutions industry?

Growth is driven by increasing demand for supply chain transparency, enhanced regulatory compliance requirements, and technological advancements in tracking technologies like RFID and GPS, ensuring product authenticity and safety.

Which region is the fastest Growing in the track And Trace solutions market?

The fastest-growing region is North America, expected to rise from $3.67 billion in 2023 to $11.94 billion by 2033, showcasing a significant expansion driven by stringent regulatory frameworks and advanced technologies.

Does ConsaInsights provide customized market report data for the track And Trace solutions industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, enabling clients to gain insights into niche sectors of the track-and-trace solutions industry.

What deliverables can I expect from this track And Trace solutions market research project?

Expected deliverables include comprehensive market analysis reports, trend assessments, competitive landscape, and segmented data insights, along with tailored recommendations for strategic planning.

What are the market trends of track And Trace solutions?

Market trends indicate a shift towards integration of IoT with track-and-trace solutions, increased usage of blockchain for data security, and a growing emphasis on sustainability and automated tracking processes.