Trade Finance Market Report

Published Date: 24 January 2026 | Report Code: trade-finance

Trade Finance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Trade Finance market, covering current trends, segmentation, regional insights, and forecasts for the period 2023 to 2033, offering valuable data for stakeholders in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

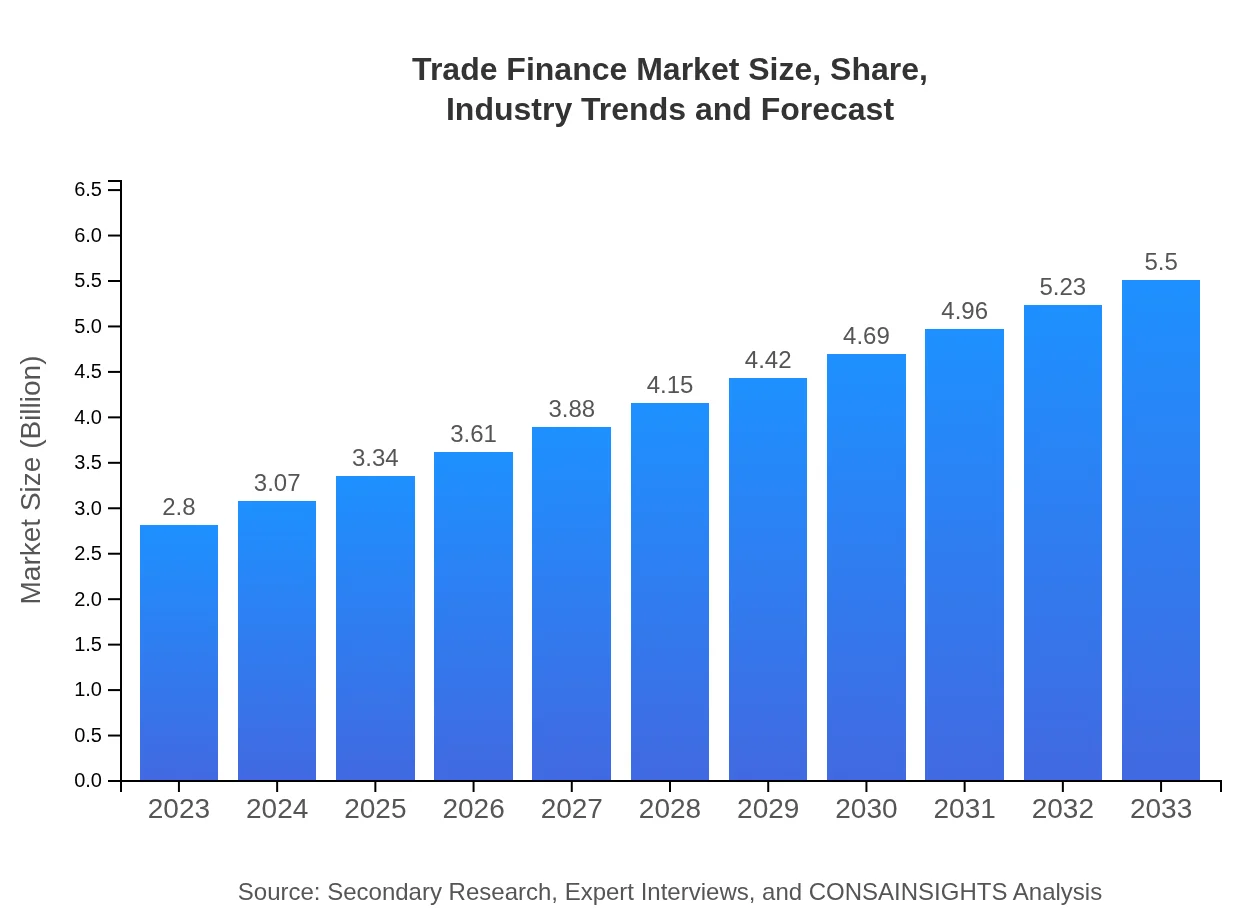

| 2023 Market Size | $2.80 Trillion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $5.50 Trillion |

| Top Companies | HSBC, Citi, JPMorgan Chase, Standard Chartered |

| Last Modified Date | 24 January 2026 |

Trade Finance Market Overview

Customize Trade Finance Market Report market research report

- ✔ Get in-depth analysis of Trade Finance market size, growth, and forecasts.

- ✔ Understand Trade Finance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Trade Finance

What is the Market Size & CAGR of Trade Finance market in 2023?

Trade Finance Industry Analysis

Trade Finance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Trade Finance Market Analysis Report by Region

Europe Trade Finance Market Report:

The European Trade Finance market, estimated at USD 0.90 trillion in 2023, is expected to expand to USD 1.77 trillion by 2033. The region's regulatory framework and diverse economy promote safety and reliability in trade financing.Asia Pacific Trade Finance Market Report:

In 2023, the Trade Finance market in the Asia Pacific region is valued at USD 0.49 trillion and is projected to grow to USD 0.96 trillion by 2033. The region benefits from a robust manufacturing base and increasing regional trade agreements, making it a significant player in global trade.North America Trade Finance Market Report:

North America holds a market value of USD 1.02 trillion in 2023, projected to grow to USD 2.00 trillion by 2033. The presence of major financial institutions and a stable economic environment supports trade operations, enhanced by technological innovations.South America Trade Finance Market Report:

The South American Trade Finance market is valued at USD 0.21 trillion in 2023, expecting to reach USD 0.42 trillion by 2033. Growth is bolstered by the increasing e-commerce activities and demand for secure financing given the region’s evolving trade relationships.Middle East & Africa Trade Finance Market Report:

In the Middle East and Africa, the market size is USD 0.18 trillion in 2023, anticipated to double to USD 0.36 trillion by 2033. Political stability in certain regions and increasing foreign investments drive the growth of Trade Finance.Tell us your focus area and get a customized research report.

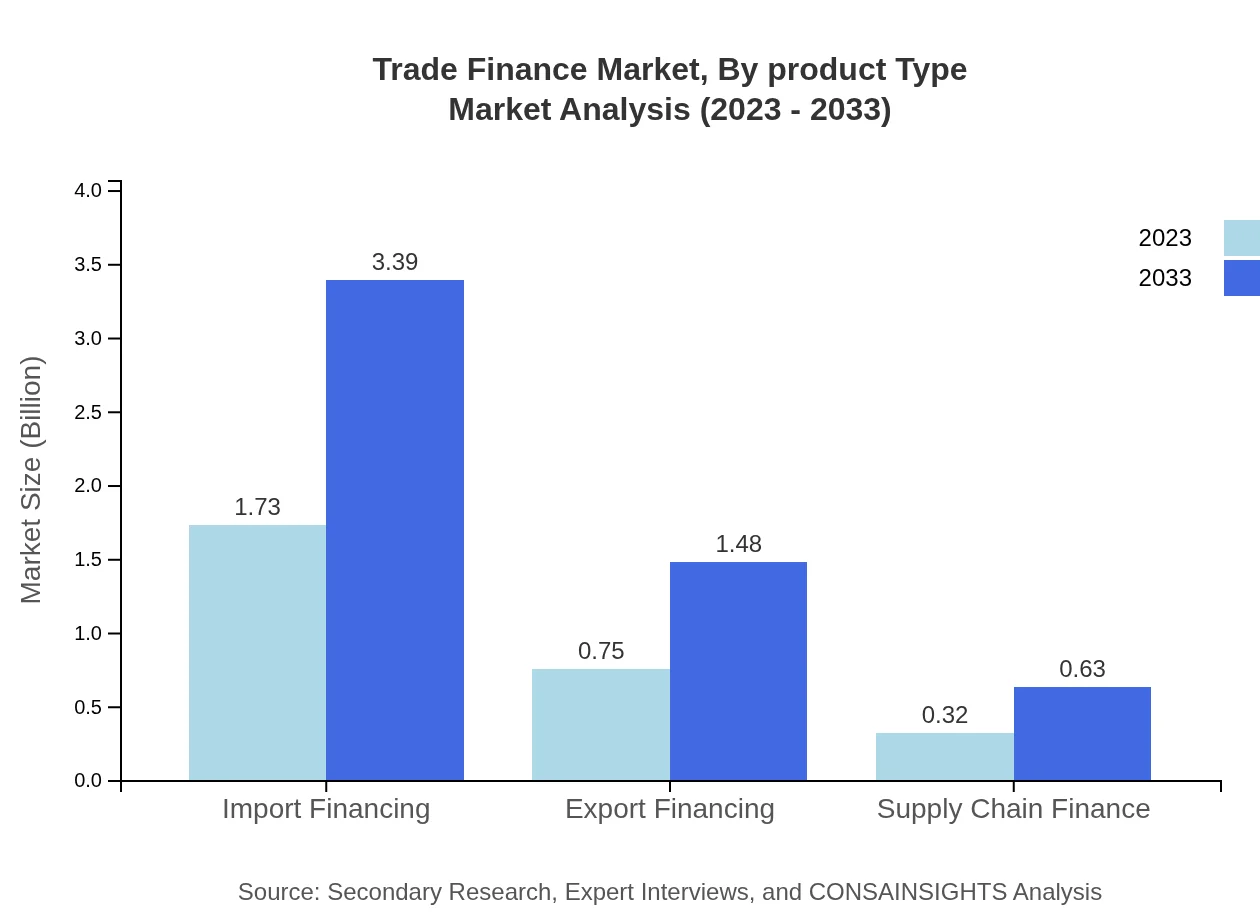

Trade Finance Market Analysis By Product Type

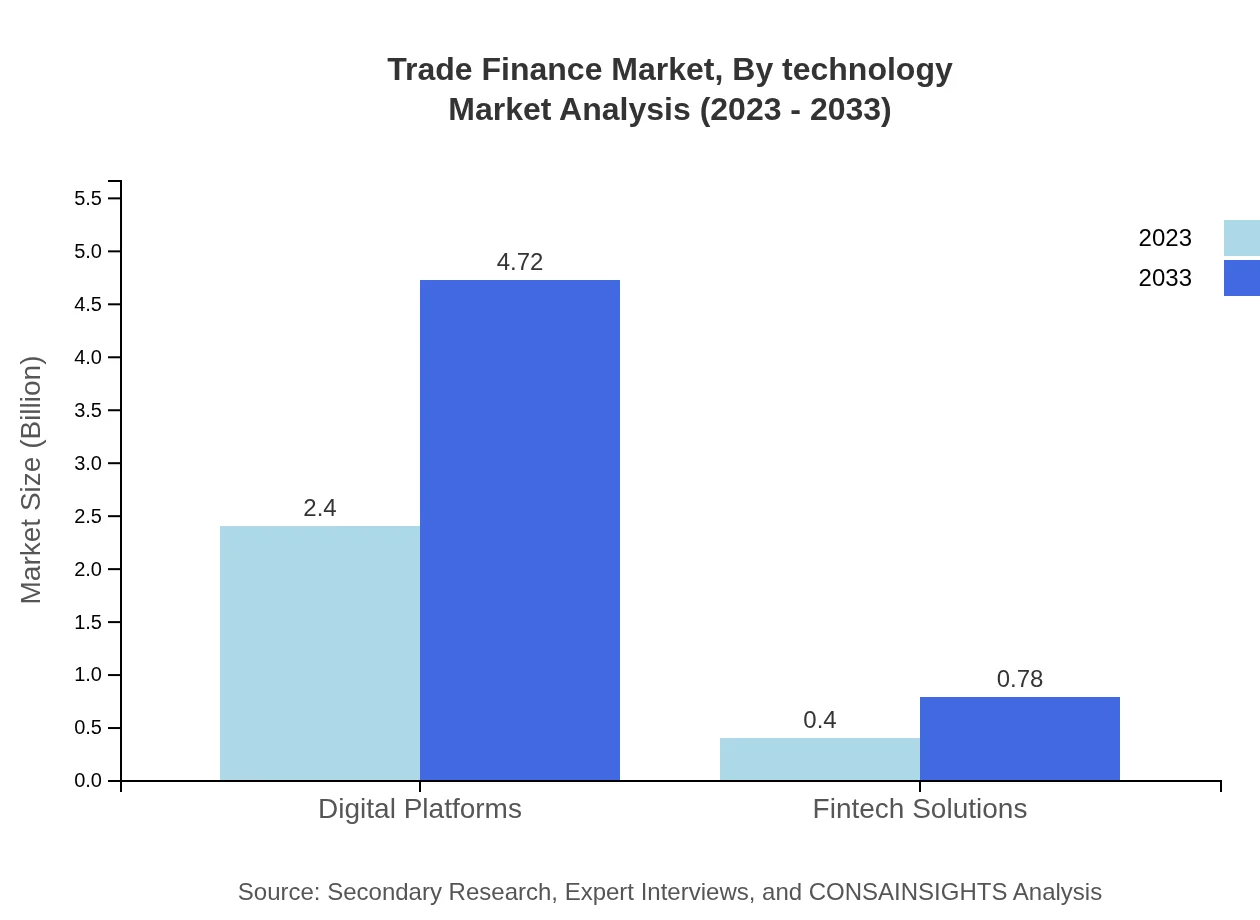

The Trade Finance market is significantly driven by various product types such as Digital Platforms, Fintech Solutions, and traditional banking services. Digital Platforms alone are expected to grow from USD 2.40 trillion in 2023 to USD 4.72 trillion by 2033, holding an 85.74% market share. Conversely, Fintech Solutions are estimated to grow from USD 0.40 trillion to USD 0.78 trillion, capturing 14.26% of the market share. International Trade, primarily consisting of Import and Export Financing, plays a pivotal role, expected to achieve sizes of USD 1.73 trillion and USD 3.39 trillion by 2033. E-commerce, Project Financing, Supply Chain Finance, and roles of Banks and Financial Institutions are also crucial contributors.

Trade Finance Market Analysis By Technology

Technological advancements have significantly altered the Trade Finance landscape. The adoption of blockchain technology is enhancing security, tracking, and transaction efficiency. The rise of Artificial Intelligence (AI) is facilitating better risk assessment and fraud detection measures. Consequently, investments in Fintech solutions are rapidly increasing, with a noteworthy market contribution expected to rise from USD 0.40 trillion to USD 0.78 trillion across the forecast period. Digital transformation practices, including digital platforms for trade finance, are elevating operational efficiency and customer experience.

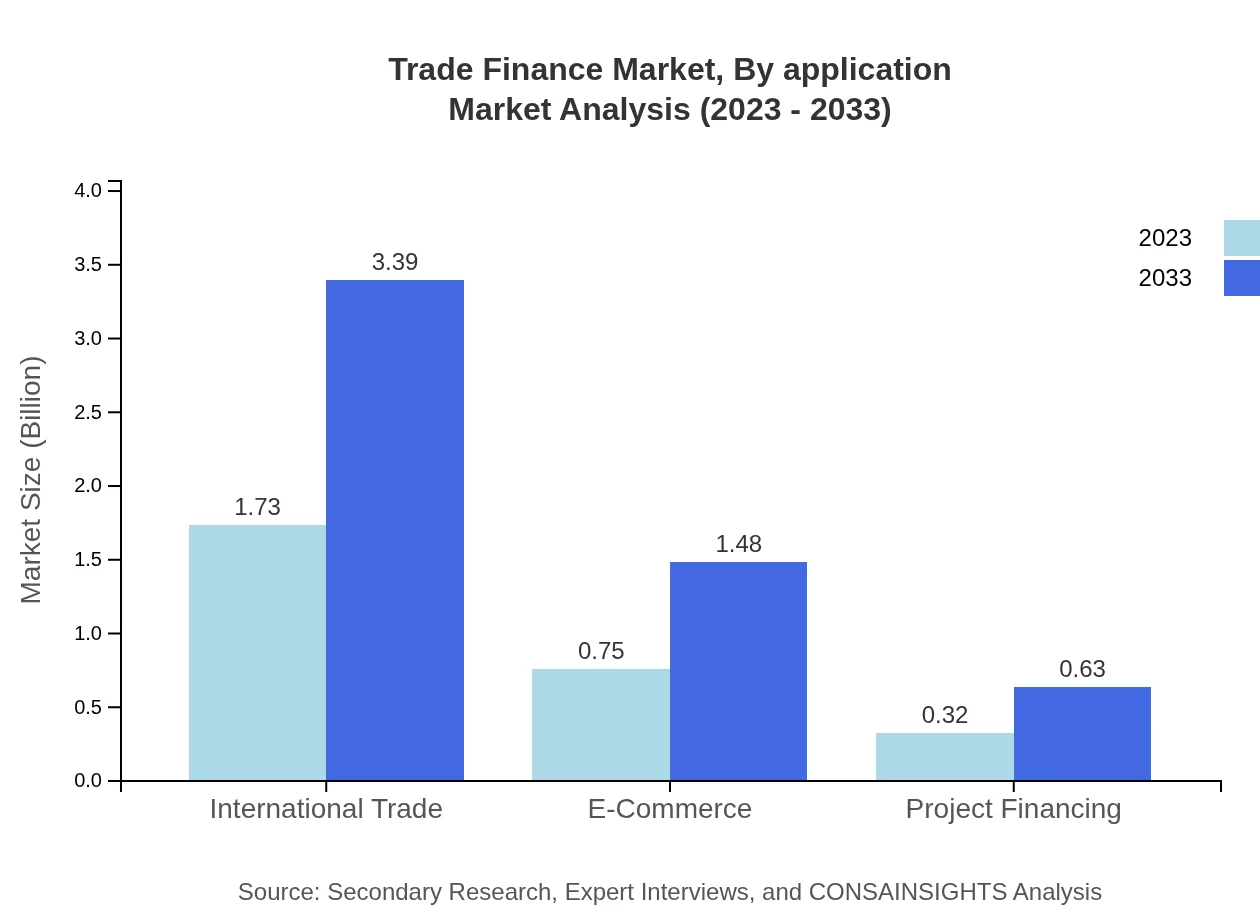

Trade Finance Market Analysis By Application

The Trade Finance market spans several applications, majorly targeting both large corporations and SMEs. The share of assistance for SMEs is gaining attention, emphasizing the need for accessible financing solutions. As international trade expands, the demand for structured financing products tailored to different business sizes is anticipated to grow. The increasing complexities of supply chains in global trade are fostering the expansion of tailored services within Trade Finance, enhancing its application in diverse sectors including manufacturing, retail, and services.

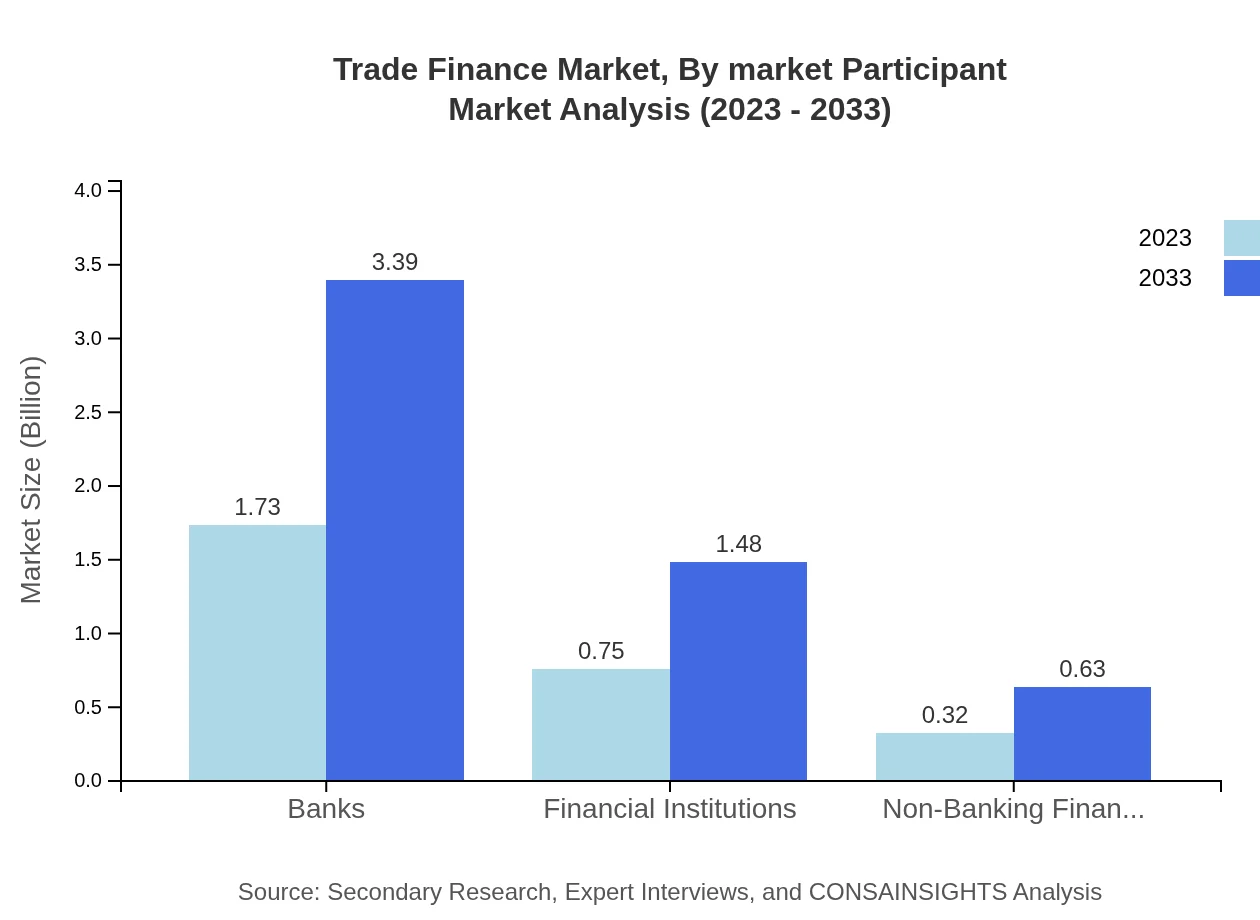

Trade Finance Market Analysis By Market Participant

The Trade Finance market consists of diverse participants. Banks dominate with a market share of 61.66% in 2023, valued at USD 1.73 trillion and projected to grow. Financial Institutions contribute significantly as well, with an unwavering share of 26.89%. Non-Banking Financial Companies (NBFCs), despite accounting for 11.45%, are increasingly gaining traction due to the flexibility they offer. Collaboration among these players is pivotal for improving service delivery and addressing the evolving needs of trade finance customers.

Trade Finance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Trade Finance Industry

HSBC:

HSBC is a global banking and financial services organization that provides comprehensive Trade Finance solutions leveraging technology and innovation to enhance customer service.Citi:

Citi offers a wide range of Trade Finance services, focusing on risk mitigation and financing solutions tailored to both small and large corporations across the globe.JPMorgan Chase:

As one of the largest financial services firms in the world, JPMorgan Chase provides robust Trade Finance services utilizing its strong global presence to facilitate cross-border trade.Standard Chartered:

Standard Chartered focuses on connecting its clients with the global trade ecosystem, offering tailored financing and risk management solutions to enhance trade operations.We're grateful to work with incredible clients.

FAQs

What is the market size of trade Finance?

The global trade-finance market is valued at $2.8 trillion, with a projected CAGR of 6.8% from 2023 to 2033. This growth indicates increasing reliance on structured financial solutions for international trade.

What are the key market players or companies in this trade Finance industry?

Key players in trade-finance include major banks such as JPMorgan Chase, HSBC, and Citibank, alongside fintech companies like PayPal and TradeShift. These organizations serve as influential forces shaping the sector's landscape.

What are the primary factors driving the growth in the trade Finance industry?

Growth in trade-finance is fueled by globalization, advancements in digital financial technology, increased cross-border trade, and rising demand for innovative financing solutions that cater to international businesses.

Which region is the fastest Growing in the trade Finance?

The North America region is projected to be the fastest-growing in trade-finance, expanding from $1.02 trillion in 2023 to $2.00 trillion by 2033, reflecting a strong demand for financing solutions in trade.

Does ConsaInsights provide customized market report data for the trade Finance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the trade-finance industry, enabling clients to receive insights that best fit their strategic planning.

What deliverables can I expect from this trade Finance market research project?

Deliverables include a comprehensive market analysis report, detailed insights on market trends, competitive landscape assessments, and segmented data covering various aspects such as regional and player-specific information.

What are the market trends of trade Finance?

Current trends in trade-finance include increased adoption of digital platforms, the rise of fintech solutions, a growing emphasis on e-commerce financing, and expanded partnerships between banks and technology providers.