Trade Management Software Market Report

Published Date: 31 January 2026 | Report Code: trade-management-software

Trade Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Trade Management Software market, detailing trends, market size, growth forecasts, and regional insights for the forecast period from 2023 to 2033.

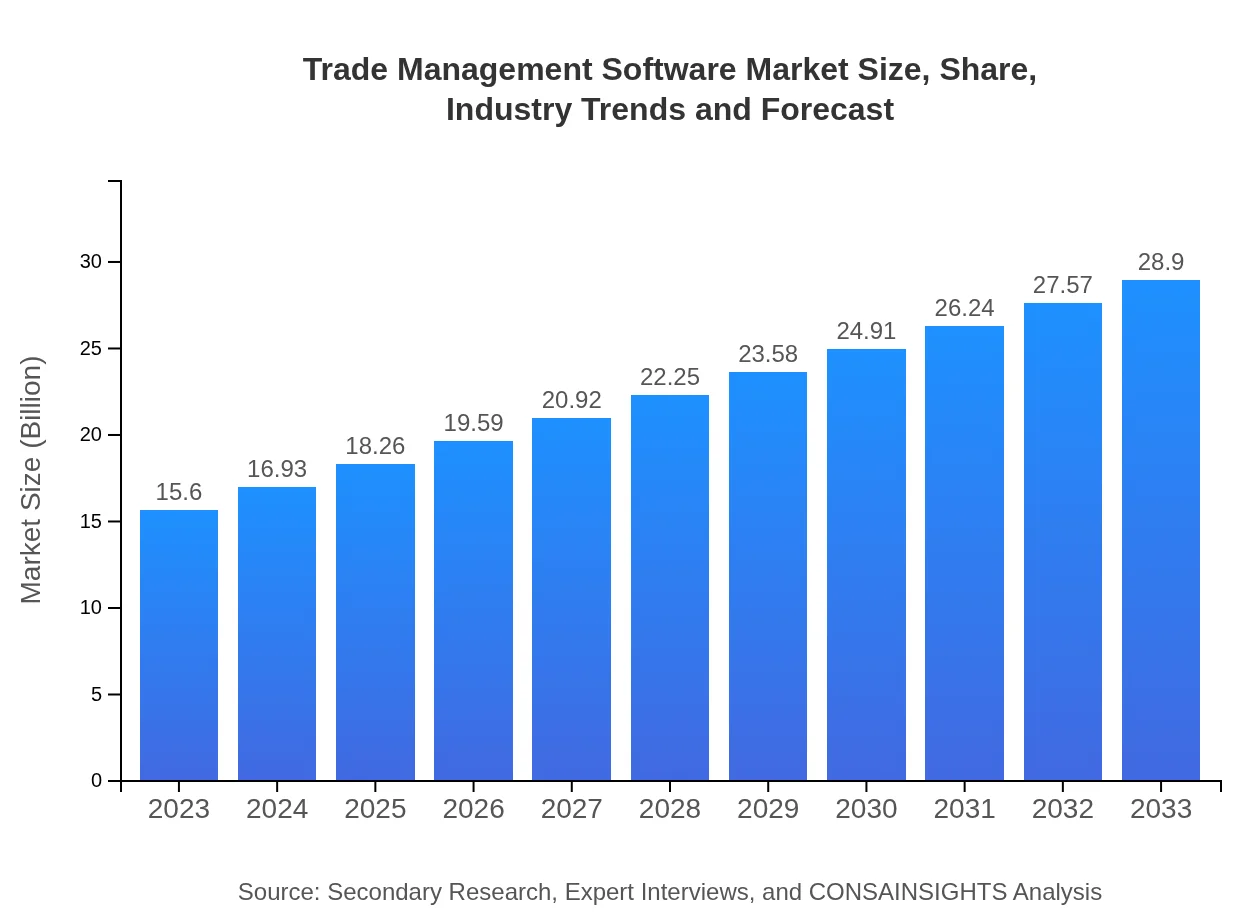

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $28.90 Billion |

| Top Companies | SS&C Technologies Holdings, Inc., FIS Global, Bloomberg LP, FactSet Research Systems Inc. |

| Last Modified Date | 31 January 2026 |

Trade Management Software Market Overview

Customize Trade Management Software Market Report market research report

- ✔ Get in-depth analysis of Trade Management Software market size, growth, and forecasts.

- ✔ Understand Trade Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Trade Management Software

What is the Market Size & CAGR of Trade Management Software market in 2023?

Trade Management Software Industry Analysis

Trade Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Trade Management Software Market Analysis Report by Region

Europe Trade Management Software Market Report:

In Europe, the market value is projected at USD 4.62 billion in 2023, increasing to USD 8.56 billion by 2033. Strong regulatory frameworks and advanced technology adoption drive growth, making it a robust market for trade management software.Asia Pacific Trade Management Software Market Report:

In 2023, the Asia Pacific region holds a market size of USD 3.01 billion with projections reaching USD 5.58 billion by 2033. The growth is driven by increased trading activity in emerging economies and the adoption of advanced technological solutions in trade management.North America Trade Management Software Market Report:

North America leads the market with a size of USD 5.58 billion in 2023 and expected to reach USD 10.33 billion by 2033. The presence of major financial institutions and a strong focus on compliance contribute significantly to its growth.South America Trade Management Software Market Report:

The South American market, valued at USD 0.62 billion in 2023, is forecasted to expand to USD 1.14 billion by 2033. This growth is fueled by the rising awareness of technology-driven trading solutions and the development of local financial markets.Middle East & Africa Trade Management Software Market Report:

The Middle East and Africa market is estimated at USD 1.77 billion in 2023, which is projected to reach USD 3.28 billion by 2033, with growth being driven by increasing investments in financial technology and evolving trading platforms.Tell us your focus area and get a customized research report.

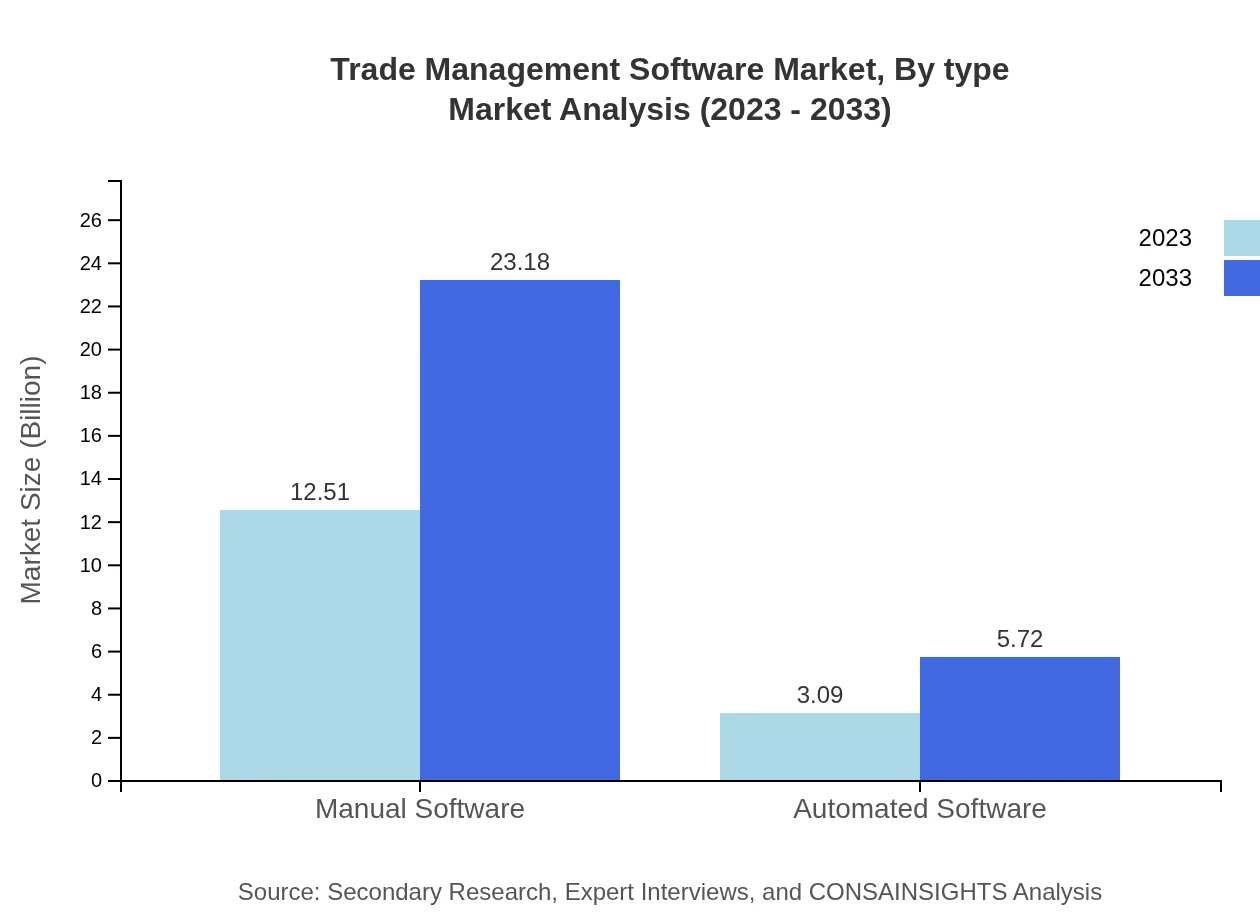

Trade Management Software Market Analysis By Type

Manual Software constitutes a dominant share of the trade management software market, standing at a size of USD 12.51 billion in 2023 and expected to reach USD 23.18 billion by 2033, maintaining an 80.21% market share. Automated Software is gaining traction with a market size of USD 3.09 billion in 2023, projected to grow to USD 5.72 billion by 2033, capturing a 19.79% share. This growth indicates a steady shift from manual processes to automation, enhancing efficiency and accuracy.

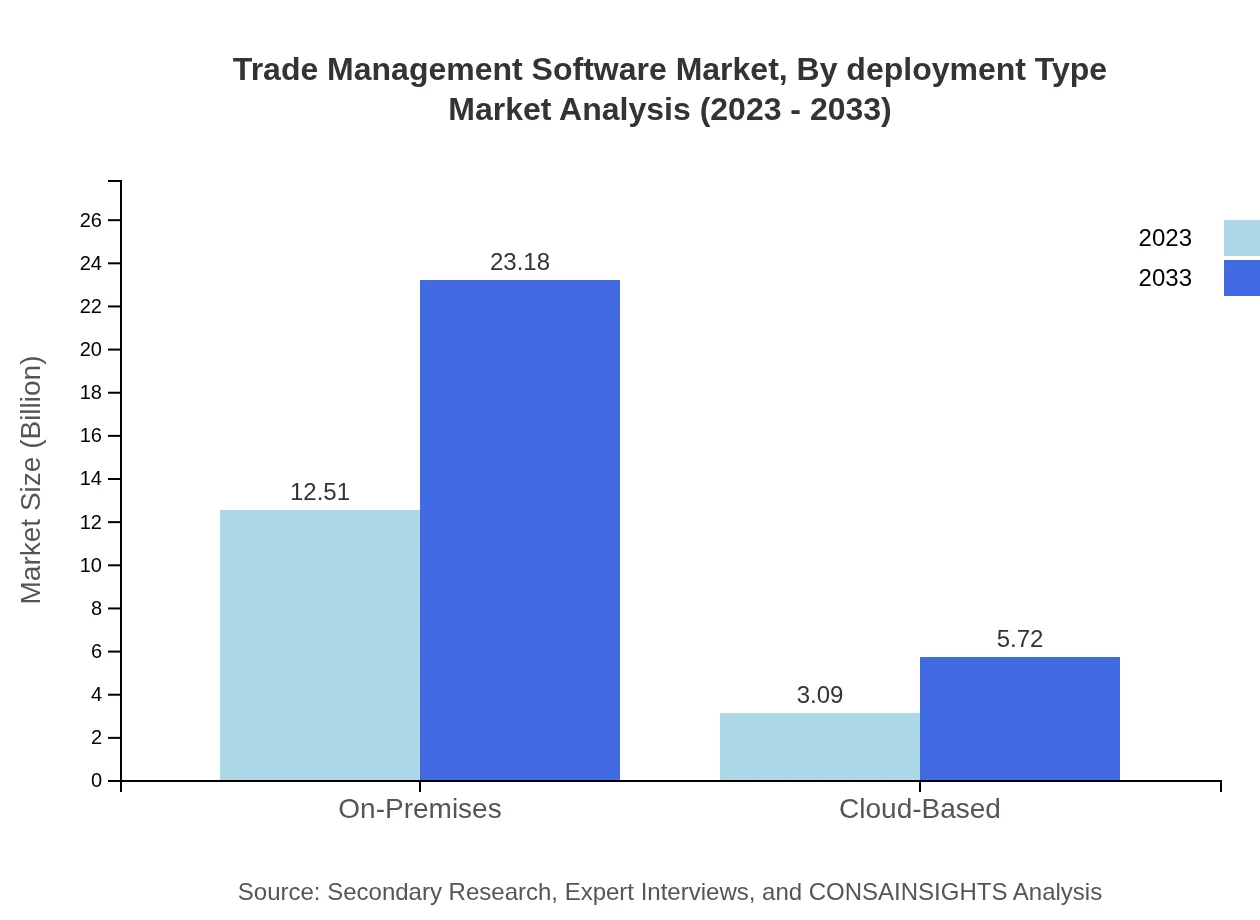

Trade Management Software Market Analysis By Deployment Type

The market is surveyed by deployment type wherein On-Premises solutions dominate with a projected size of USD 12.51 billion in 2023 to USD 23.18 billion by 2033, representing an 80.21% share. Cloud-based solutions, although smaller, are increasingly popular, with a size of USD 3.09 billion in 2023 and anticipated to increase to USD 5.72 billion by 2033, holding a 19.79% share. The preference for on-premises solutions is attributed to security and control factors.

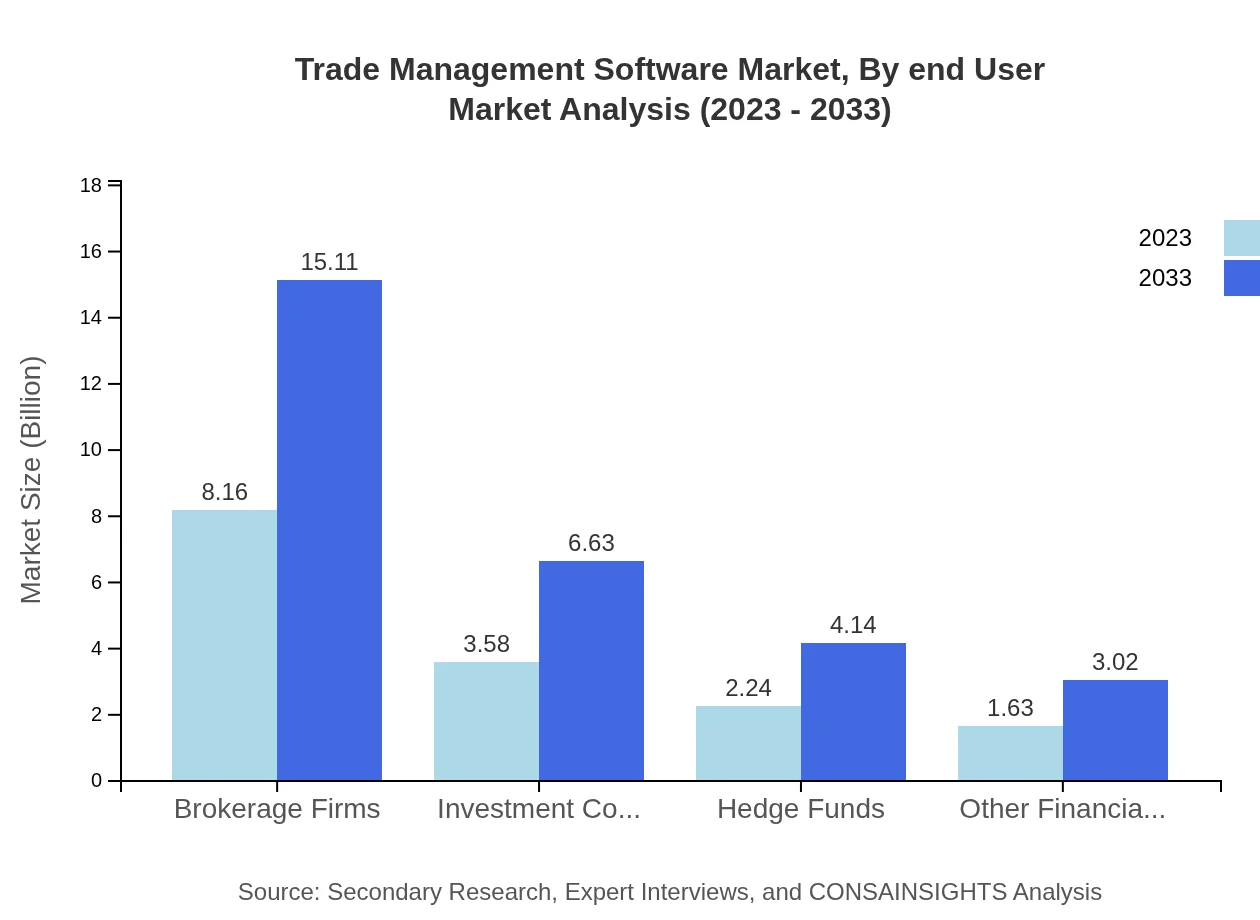

Trade Management Software Market Analysis By End User

Brokerage Firms are the largest end-user segment with a market size of USD 8.16 billion in 2023, expected to increase to USD 15.11 billion by 2033. They represent a significant portion, commanding 52.29% market share. Investment Companies follow closely with a size of USD 3.58 billion in 2023, projected to grow to USD 6.63 billion by 2033, capturing 22.93% market share. Hedge Funds and Other Financial Institutions, while smaller in size, are steadily growing with increasing adoption of tailored trade management solutions.

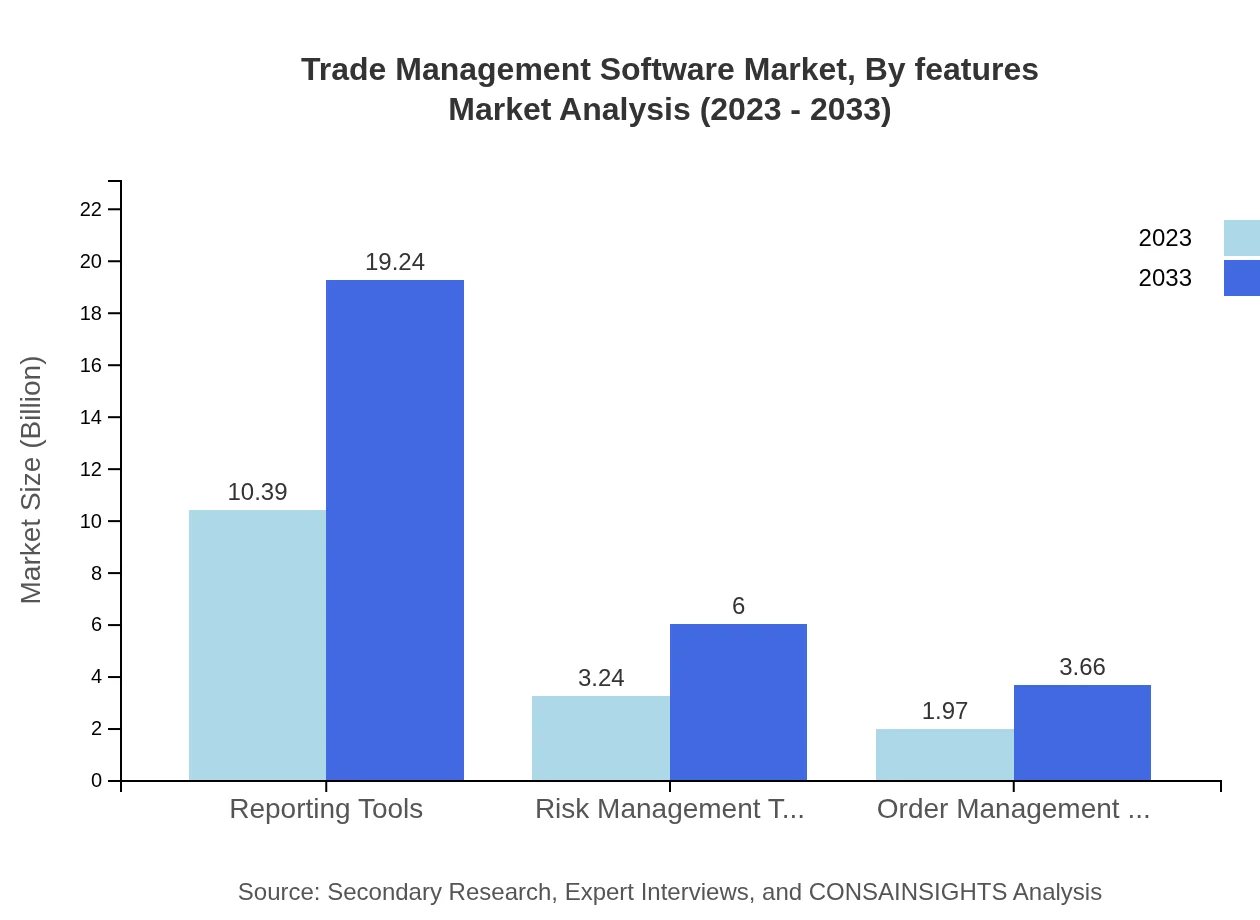

Trade Management Software Market Analysis By Features

Key features such as Reporting Tools lead the market with a size of USD 10.39 billion in 2023, expected to grow to USD 19.24 billion by 2033, maintaining a robust 66.58% share. Risk Management Tools come next, with projected growth from USD 3.24 billion to USD 6.00 billion by 2033, holding a 20.77% share. Other features like Order Management Tools and API Integration are also significant, showcasing a trend toward multi-functionality in trade management software.

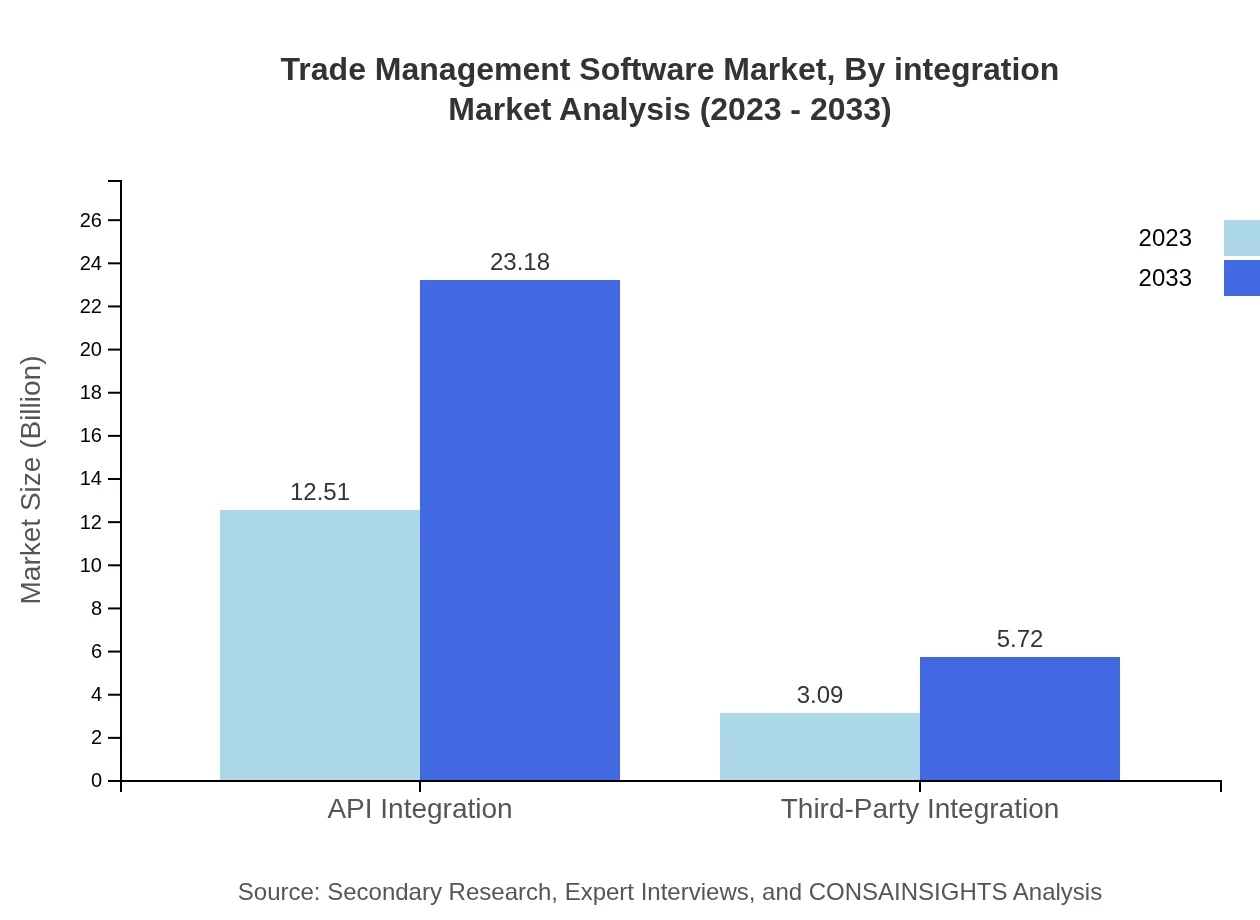

Trade Management Software Market Analysis By Integration

Integrations play a crucial role in trade management software effectiveness. API Integration leads with a market size of USD 12.51 billion in 2023, with projections of reaching USD 23.18 billion by 2033, maintaining an 80.21% share. Third-Party Integration grows steadily, with market values expected to increase from USD 3.09 billion to USD 5.72 billion by 2033, representing a 19.79% share, as firms look for seamless interoperability and enhanced trading functionalities.

Trade Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Trade Management Software Industry

SS&C Technologies Holdings, Inc.:

A leading global provider of investment and financial software-focused services, SS&C offers comprehensive solutions for trade management, with an emphasis on risk management and regulatory compliance.FIS Global:

FIS is a major player in the financial services space, providing technology solutions across banking and trading sectors. Their trade management software enhances automation and operational efficiency for financial institutions.Bloomberg LP:

Bloomberg is renowned for its financial data services and trading platforms, offering state-of-the-art trade management systems that leverage vast data for informed decision-making.FactSet Research Systems Inc.:

FactSet provides integrated financial information and analytics software, including tools for trade management that enhance accuracy and speed in executing trades.We're grateful to work with incredible clients.

FAQs

What is the market size of trade Management Software?

The global trade management software market is valued at approximately $15.6 billion in 2023, with a projected CAGR of 6.2%, indicating robust growth potential through 2033.

What are the key market players or companies in the trade Management Software industry?

Key players in the trade management software industry include major companies specializing in financial technology solutions, which dominate regional markets through innovative products catering to diverse financial institutions.

What are the primary factors driving the growth in the trade Management Software industry?

Key growth drivers include digital transformation trends, increased regulatory compliance requirements, and the rising need for efficient trade and risk management solutions across financial sectors.

Which region is the fastest Growing in the trade Management Software?

North America leads the market with projected growth from $5.58 billion in 2023 to $10.33 billion by 2033, followed closely by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the trade Management Software industry?

Yes, ConsaInsights offers tailored market report data for the trade-management-software industry, allowing clients to focus on specific segments and trends relevant to their strategic needs.

What deliverables can I expect from this trade Management Software market research project?

Deliverables include detailed market analysis, regional breakdowns, competitive landscape assessments, and insights on emerging trends, ensuring a comprehensive overview of the trade management software market.

What are the market trends of trade Management Software?

Current trends include increased adoption of automated solutions, cloud-based platforms, and integration capabilities, driving efficiency and effectiveness in trade management processes.