Trade Surveillance Systems Market Report

Published Date: 31 January 2026 | Report Code: trade-surveillance-systems

Trade Surveillance Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Trade Surveillance Systems market, including insights into market trends, growth forecasts for 2023-2033, and detailed segmentation by region and product type.

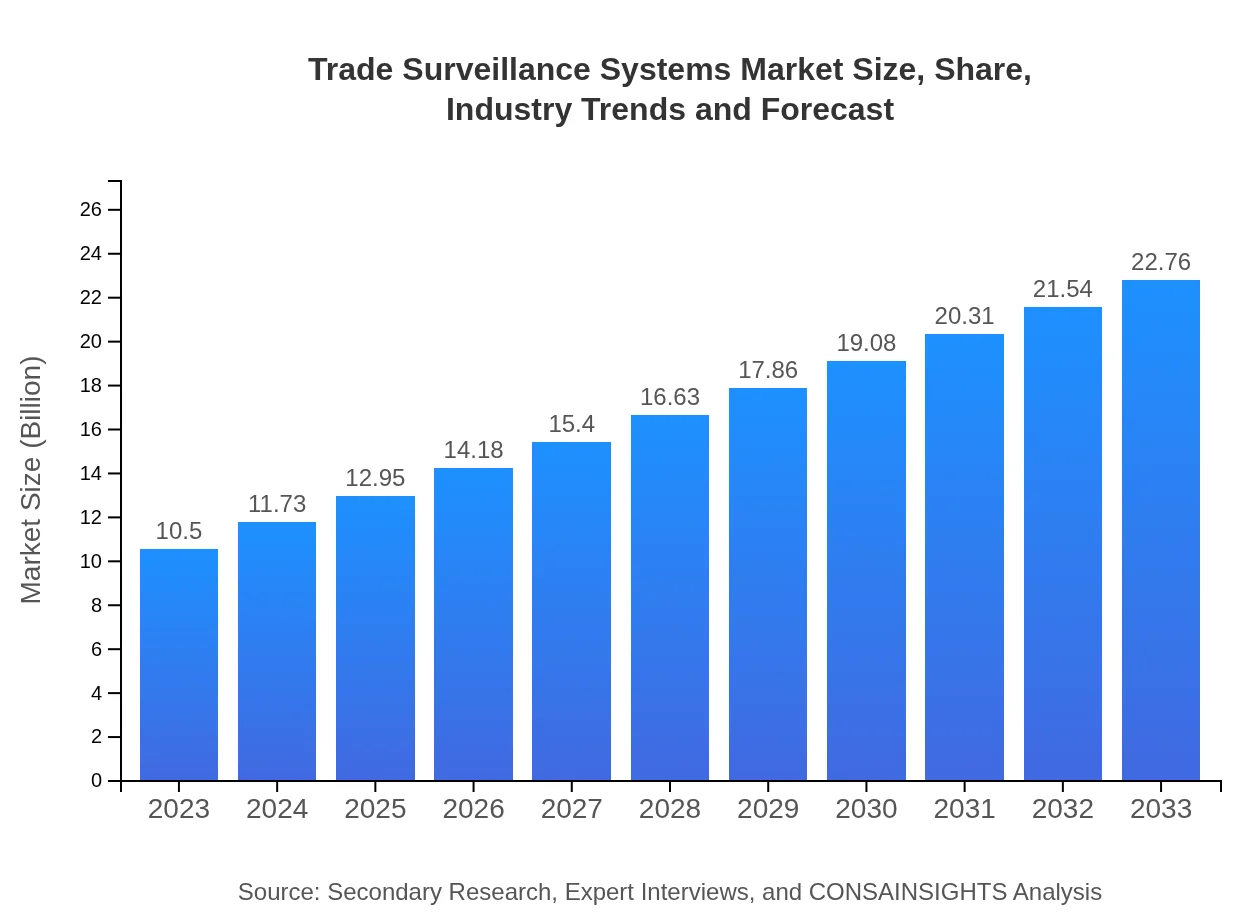

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Nice Actimize, FIS, Bloomberg, Oracle, Thomson Reuters |

| Last Modified Date | 31 January 2026 |

Trade Surveillance Systems Market Overview

Customize Trade Surveillance Systems Market Report market research report

- ✔ Get in-depth analysis of Trade Surveillance Systems market size, growth, and forecasts.

- ✔ Understand Trade Surveillance Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Trade Surveillance Systems

What is the Market Size & CAGR of Trade Surveillance Systems market in 2023?

Trade Surveillance Systems Industry Analysis

Trade Surveillance Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Trade Surveillance Systems Market Analysis Report by Region

Europe Trade Surveillance Systems Market Report:

Europe's market is valued at $3.54 billion in 2023, expected to grow to $7.68 billion by 2033. The regulatory landscape, particularly with MiFID II, compels financial institutions to adopt robust surveillance systems.Asia Pacific Trade Surveillance Systems Market Report:

In 2023, the Asia Pacific Trade Surveillance Systems market is valued at approximately $1.85 billion, expanding to $4.01 billion by 2033. This growth is driven by increased investments in financial technology and regulatory compliance by banking and financial institutions in the region.North America Trade Surveillance Systems Market Report:

North America's Trade Surveillance Systems market stands at $3.66 billion in 2023 and is projected to reach $7.94 billion by 2033. The region leads in market maturity, driven by stringent regulations and a strong presence of financial institutions investing in advanced surveillance technologies.South America Trade Surveillance Systems Market Report:

The South American market for Trade Surveillance Systems is estimated at $0.53 billion in 2023 and is expected to grow to $1.14 billion by 2033. This growth can be attributed to the increasing recognition of the need for compliance and fraud detection systems in evolving markets.Middle East & Africa Trade Surveillance Systems Market Report:

The Middle East and Africa Trade Surveillance Systems market is valued at $0.92 billion in 2023, with projections of growth to $2.00 billion by 2033. Growing regulatory requirements and the burgeoning financial sector in emerging economies are key growth drivers.Tell us your focus area and get a customized research report.

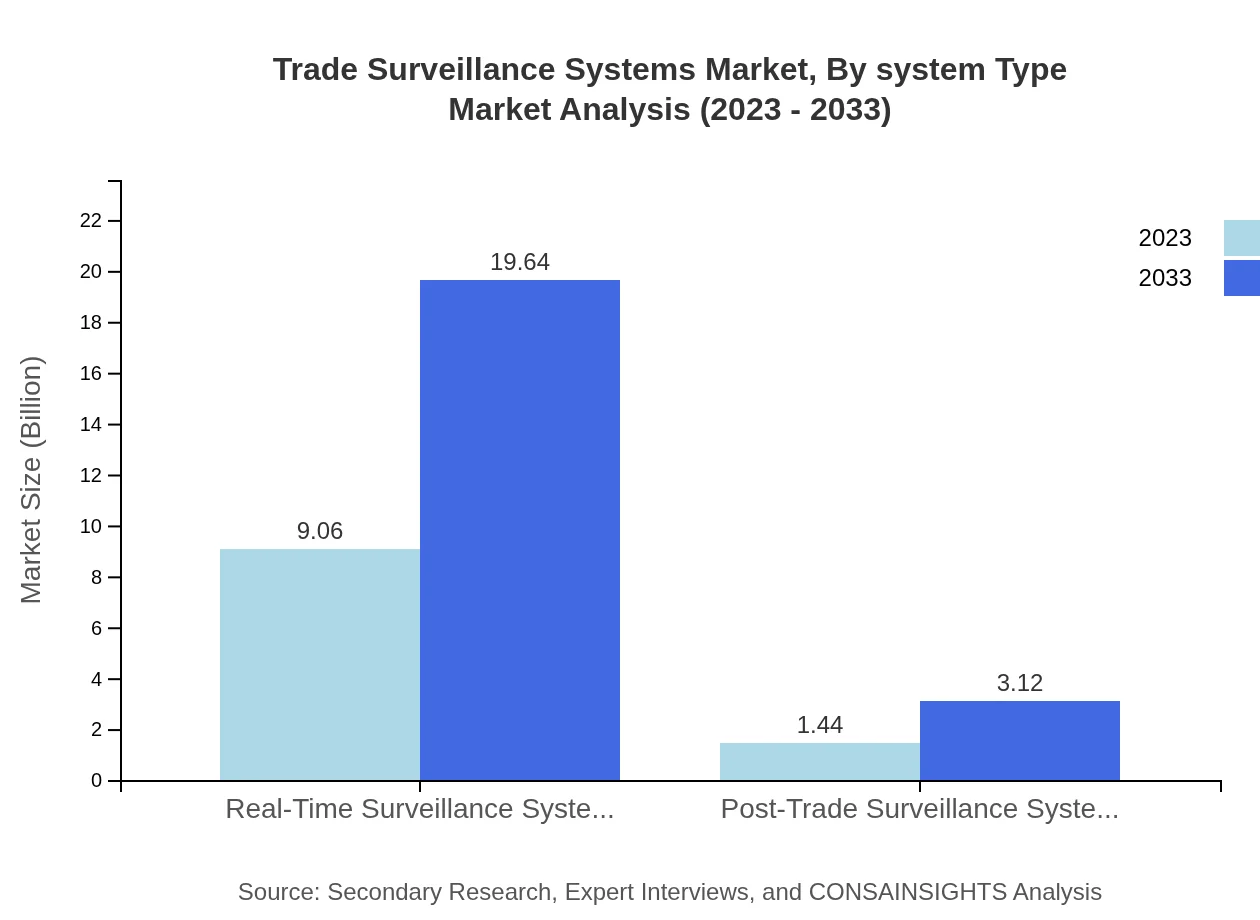

Trade Surveillance Systems Market Analysis By System Type

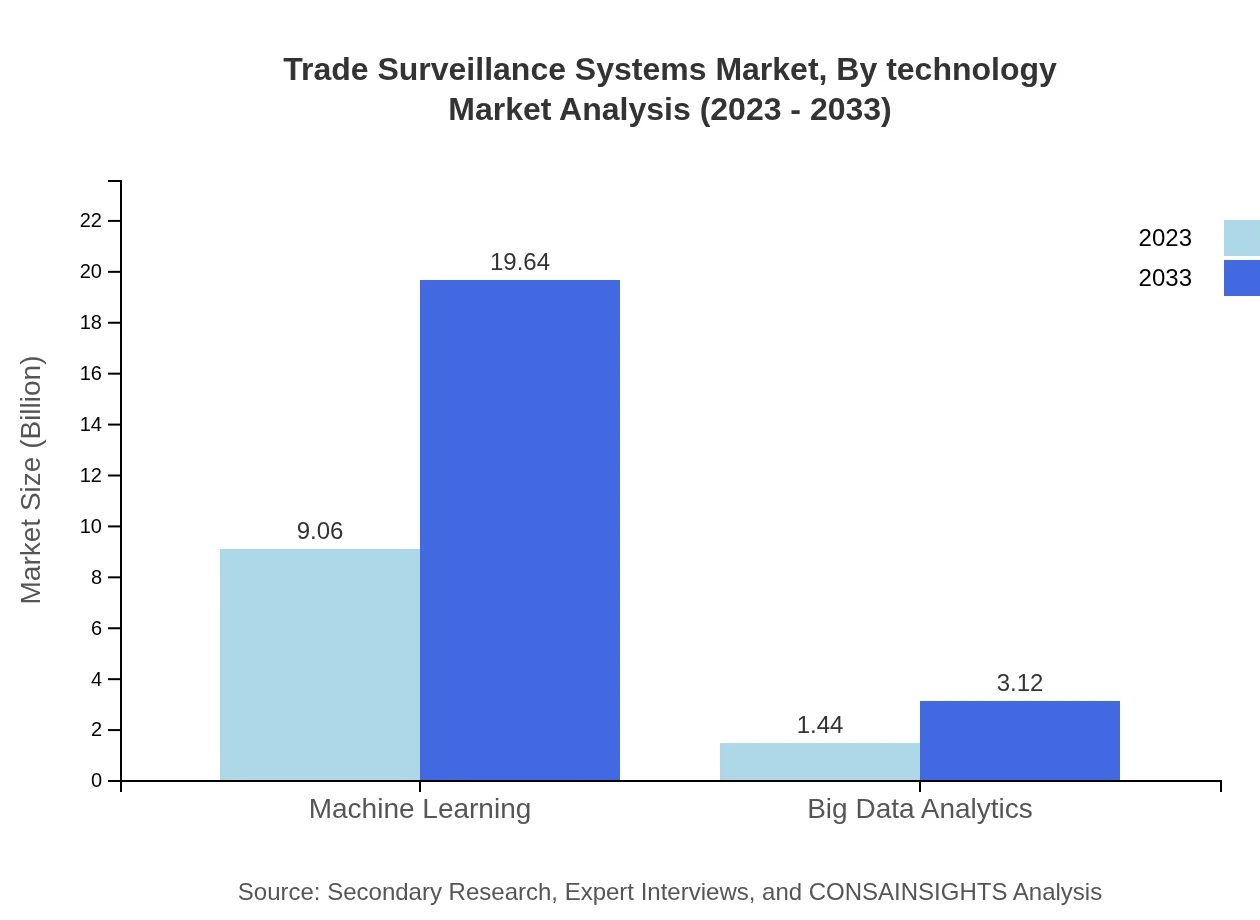

The system types include Machine Learning, Big Data Analytics, Real-Time Surveillance Systems, and Post-Trade Surveillance Systems. Machine Learning dominates the market, expected to reach $19.64 billion by 2033, with a market share of 86.3%. Big Data Analytics follows, projected to reach $3.12 billion, holding a 13.7% market share.

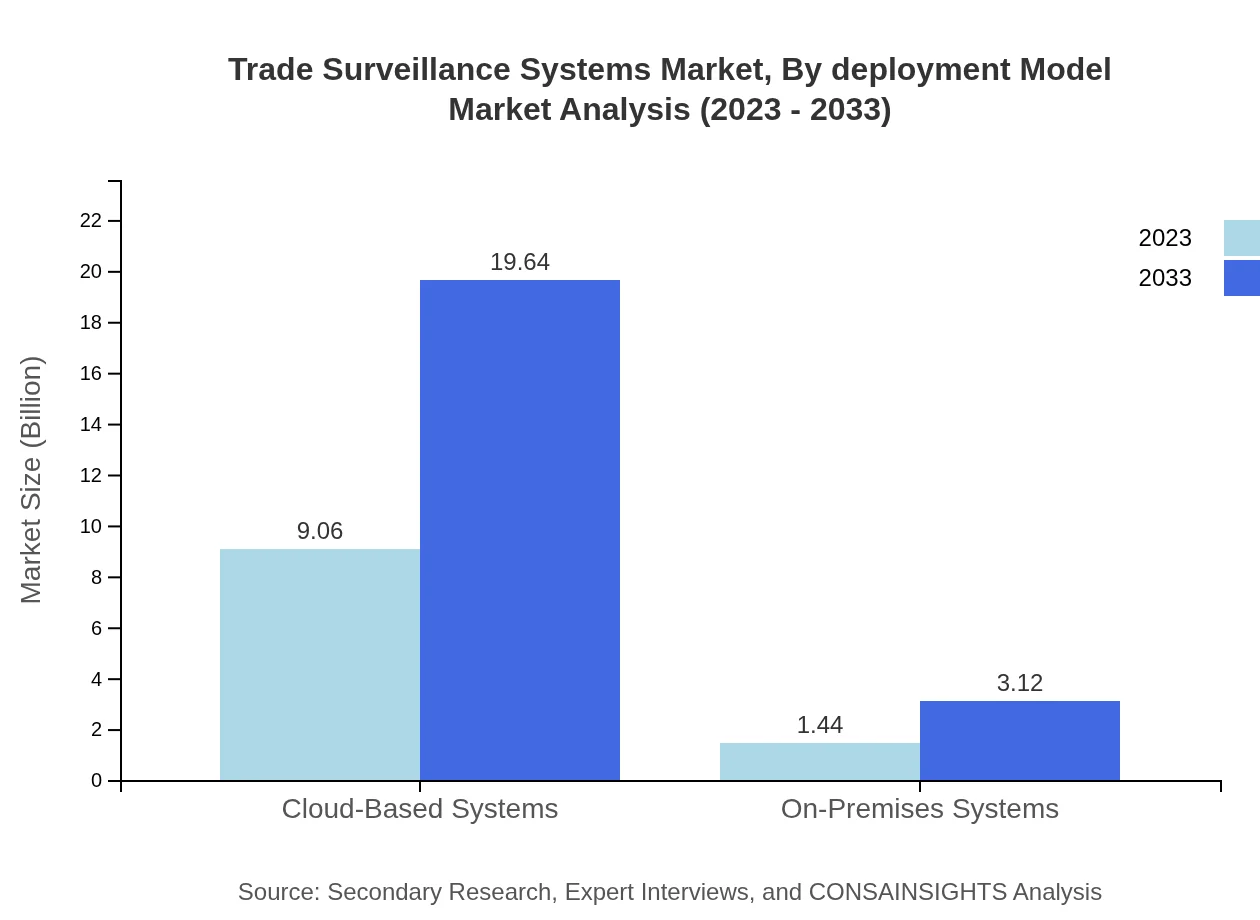

Trade Surveillance Systems Market Analysis By Deployment Model

The market is segmented into Cloud-Based and On-Premises Systems. Cloud-Based Systems lead the way, projected to reach $19.64 billion by 2033, with a market share of 86.3%. On-Premises Systems are expected to achieve $3.12 billion by the same year, accounting for 13.7%.

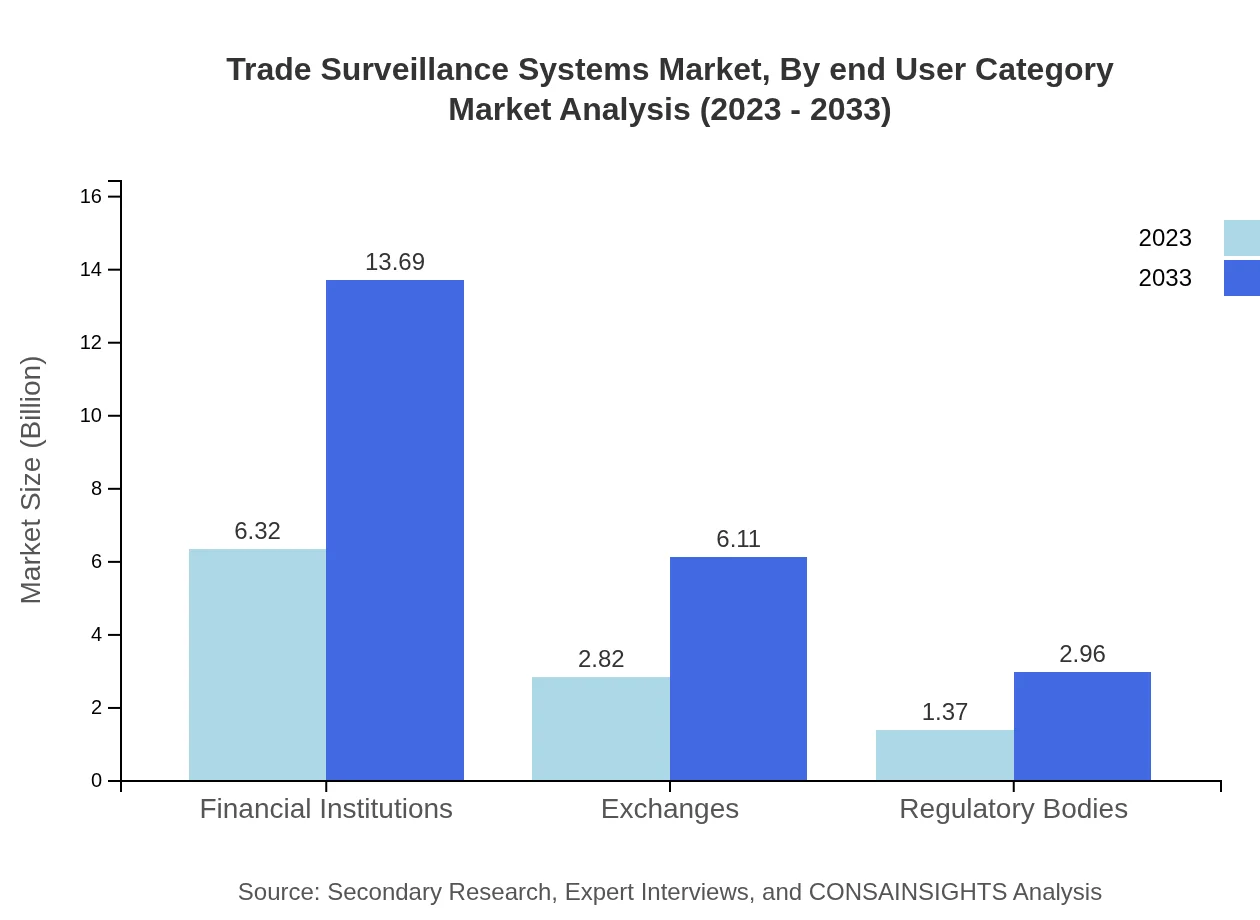

Trade Surveillance Systems Market Analysis By End User Category

Key end users include Financial Institutions, Exchanges, and Regulatory Bodies. Financial Institutions currently dominate the market with $6.32 billion and a projected growth to $13.69 billion by 2033, maintaining a market share of 60.15%.

Trade Surveillance Systems Market Analysis By Technology

Technological advancements, particularly in Machine Learning and AI, enhance the efficiency of Trade Surveillance Systems. The segment is expected to see a significant uptick as organizations increasingly rely on data-driven insights for compliance and risk management.

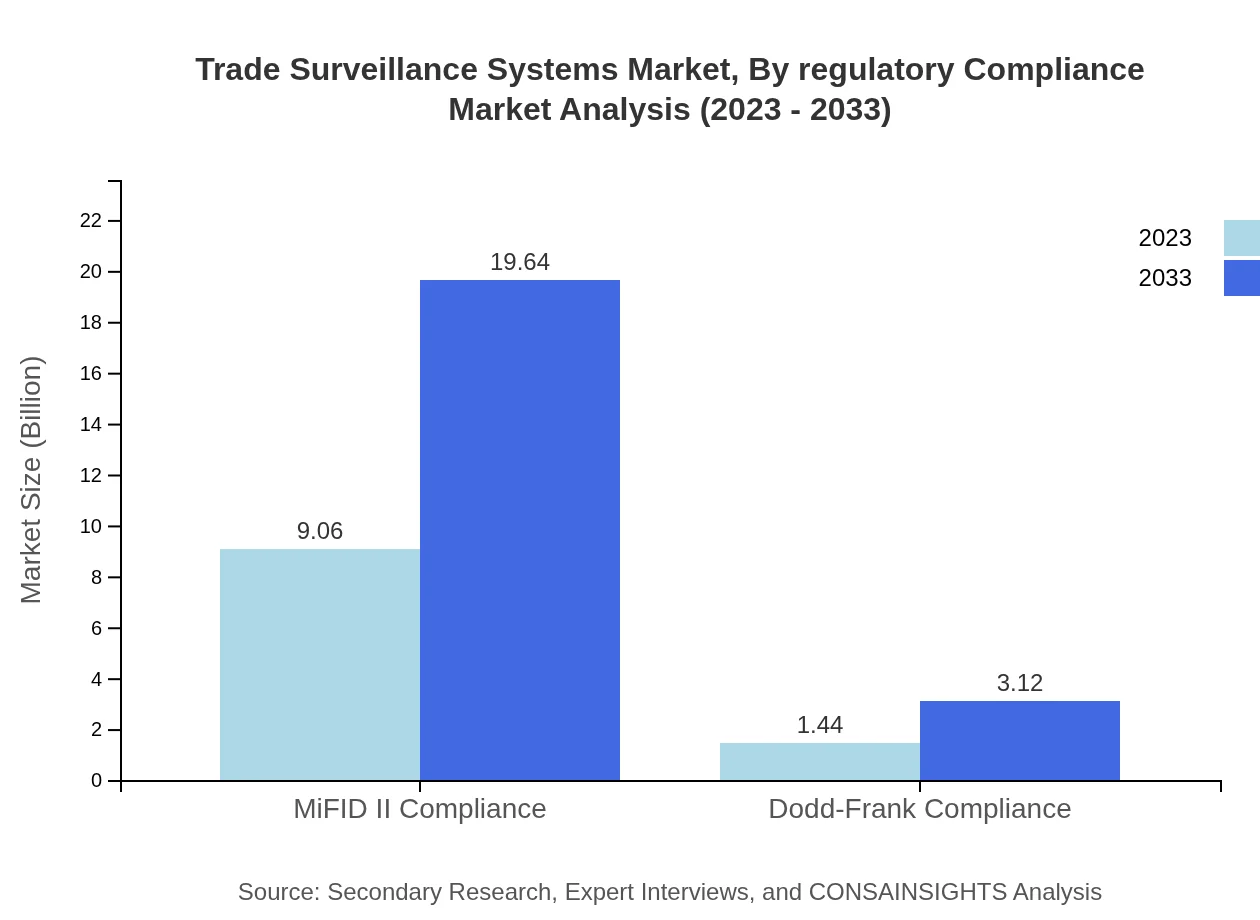

Trade Surveillance Systems Market Analysis By Regulatory Compliance

Regulatory Compliance types include MiFID II and Dodd-Frank compliance solutions. MiFID II Compliance leads the market with a size of $9.06 billion by 2033, possessing a significant market share of 86.3%, while Dodd-Frank Compliance reaches $3.12 billion, accounting for 13.7%.

Trade Surveillance Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Trade Surveillance Systems Industry

Nice Actimize:

Nice Actimize is a leader in financial crime, risk, and compliance solutions, delivering innovative trade surveillance technologies that help firms mitigate risk and enhance operational efficiency.FIS:

FIS provides integrated financial solutions, including effective trade surveillance systems that support compliance regulation across the financial services industry.Bloomberg:

Bloomberg offers comprehensive systems that allow users to monitor trades, analyze data trends and comply with significant market regulations.Oracle:

Oracle provides powerful trade surveillance solutions, utilizing cloud technology to enhance compliance and detection capabilities in trading activities.Thomson Reuters:

Thomson Reuters furnishes trading firms with advanced surveillance technology, enabling efficient compliance with global regulations while minimizing fraud risk.We're grateful to work with incredible clients.

FAQs

What is the market size of trade Surveillance Systems?

The trade surveillance systems market is projected to reach $10.5 billion by 2033, growing at a CAGR of 7.8%. In 2023, the market is valued at $10.5 billion, with robust demand across various sectors driving this expansion.

What are the key market players or companies in this trade Surveillance Systems industry?

Key players in the trade surveillance systems industry include prominent firms that specialize in compliance technology and solutions for financial services. They develop tools to mitigate risks and ensure regulatory compliance across trading platforms.

What are the primary factors driving the growth in the trade surveillance Systems industry?

The growth in trade surveillance systems is driven by increasing regulatory requirements, the need for enhanced risk management, and technological advancements like AI and machine learning that improve surveillance capabilities.

Which region is the fastest Growing in the trade Surveillance Systems?

Asia Pacific is the fastest-growing region, projected to increase from $1.85 billion in 2023 to $4.01 billion by 2033. Europe and North America also show substantial growth, reflecting the global demand for surveillance systems.

Does ConsaInsights provide customized market report data for the trade Surveillance Systems industry?

Yes, ConsaInsights offers customized market reports for the trade surveillance systems industry, tailoring insights and data to meet specific client needs, ensuring relevant information for strategic decision-making.

What deliverables can I expect from this trade Surveillance Systems market research project?

Deliverables include comprehensive market analysis reports, detailed segment data, growth forecasts, competitive landscape assessments, and customized insights tailored to client objectives in trade surveillance.

What are the market trends of trade Surveillance Systems?

Current trends include the adoption of AI technologies, a shift towards cloud-based systems, and a growing focus on compliance with regulations like MiFID II. These factors are reshaping investment in trade surveillance technologies.