Traffic Sensors Market Report

Published Date: 31 January 2026 | Report Code: traffic-sensors

Traffic Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Traffic Sensors market, exploring market size, trends, and forecasts from 2023 to 2033, along with insights on key players and regional analysis.

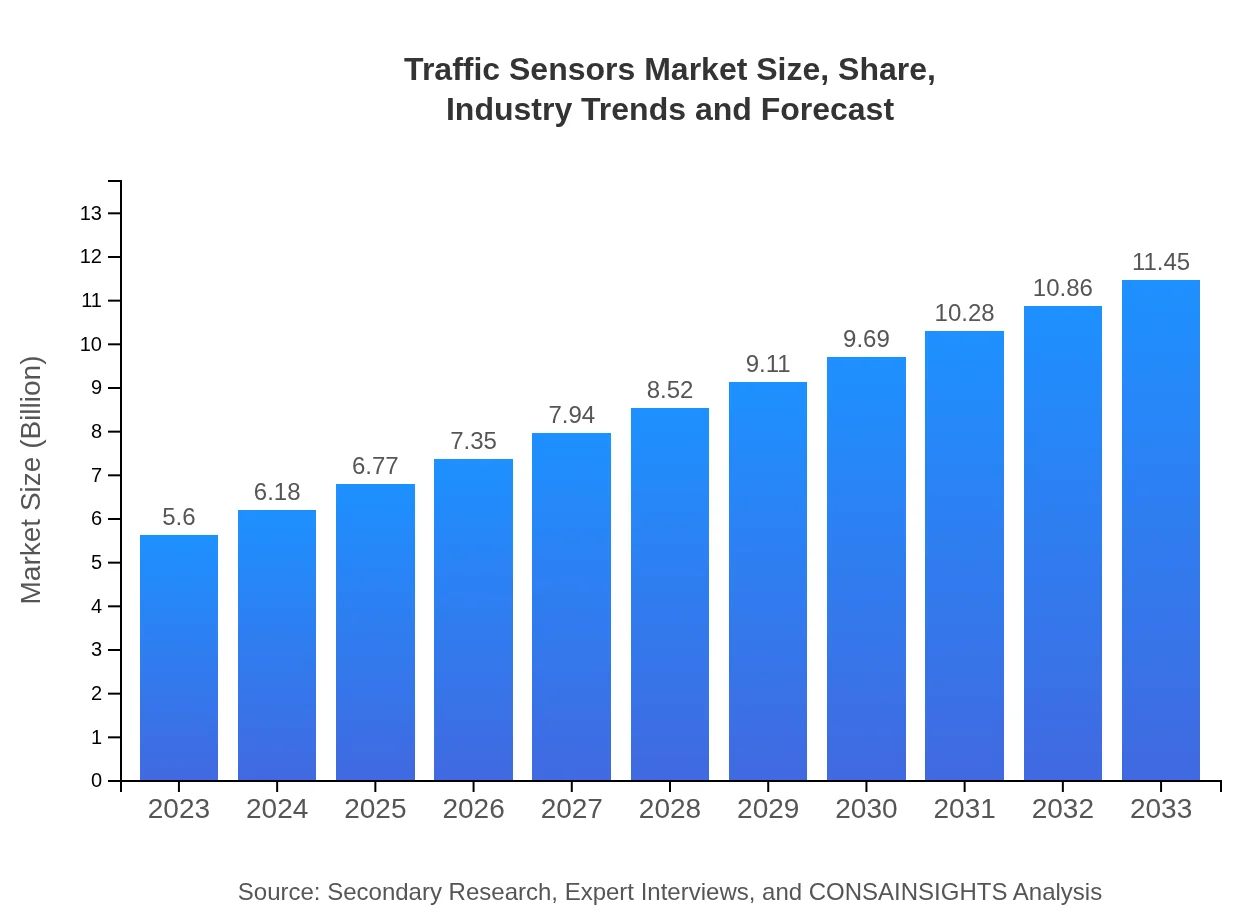

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Siemens AG, Kapsch TrafficCom, Cubic Corporation, Bosch |

| Last Modified Date | 31 January 2026 |

Traffic Sensors Market Overview

Customize Traffic Sensors Market Report market research report

- ✔ Get in-depth analysis of Traffic Sensors market size, growth, and forecasts.

- ✔ Understand Traffic Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Traffic Sensors

What is the Market Size & CAGR of Traffic Sensors market in 2023?

Traffic Sensors Industry Analysis

Traffic Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Traffic Sensors Market Analysis Report by Region

Europe Traffic Sensors Market Report:

Europe's market is expected to rise from $1.60 billion in 2023 to $3.28 billion in 2033, driven by stringent regulations for transport management and a strong push for smart transportation solutions across the continent.Asia Pacific Traffic Sensors Market Report:

The Asia Pacific region is forecasted to reach $2.19 billion by 2033, growing from $1.07 billion in 2023. Rapid urbanization and government investments in smart city projects significantly drive market growth in countries such as China and India, highlighting the demand for advanced traffic monitoring systems.North America Traffic Sensors Market Report:

North America is expected to record substantial growth, growing from $2.08 billion in 2023 to $4.25 billion by 2033. The region benefits from well-established infrastructure and growing adoption of advanced technologies in traffic management systems, particularly in the U.S. and Canada.South America Traffic Sensors Market Report:

The South American market is smaller, with a forecasted growth from $0.16 billion in 2023 to $0.33 billion in 2033. Factors such as urban congestion and increasing road safety concerns are spurring investments in traffic sensor technology.Middle East & Africa Traffic Sensors Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.68 billion in 2023 to $1.40 billion by 2033. Growing urban populations and investments in infrastructure projects contribute to expanding demand for traffic sensors.Tell us your focus area and get a customized research report.

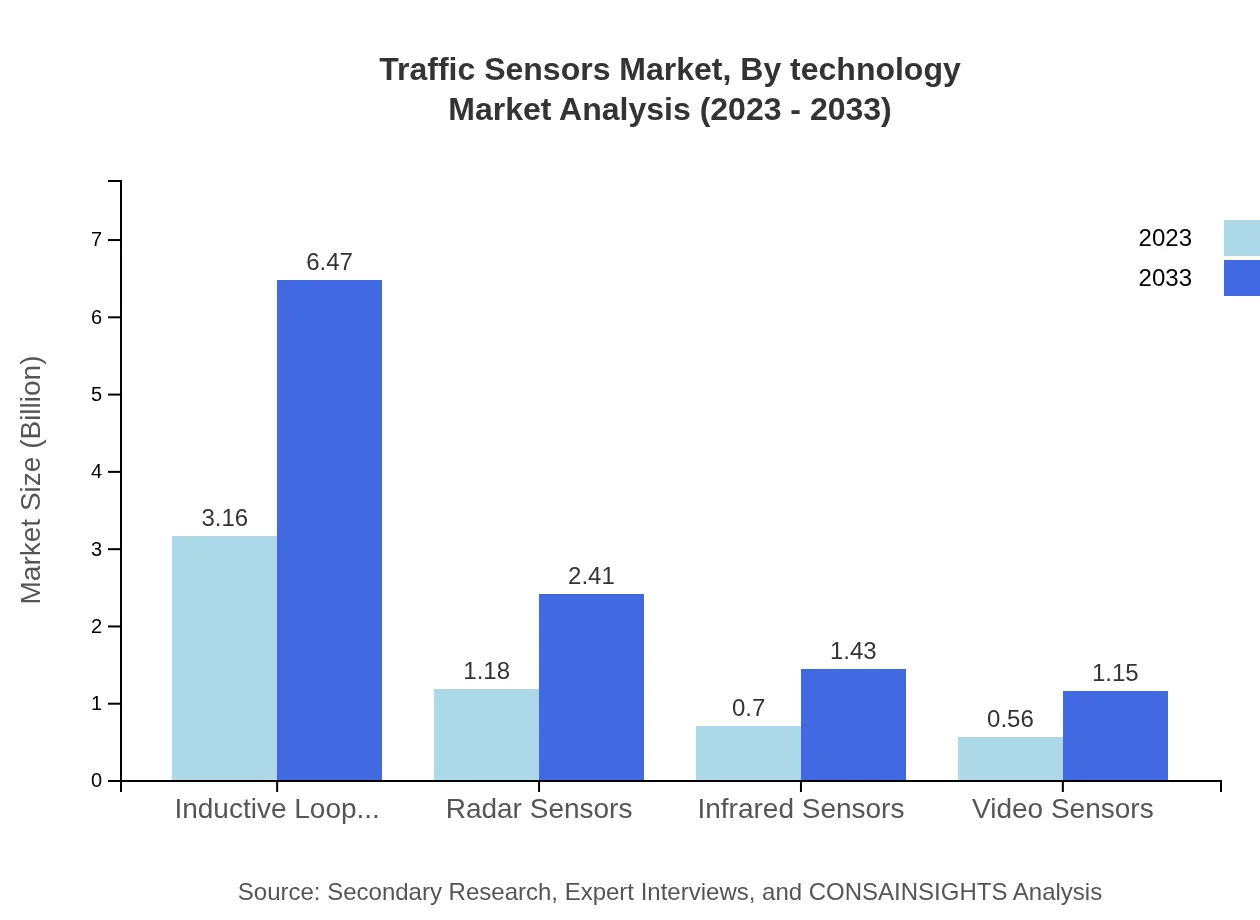

Traffic Sensors Market Analysis By Technology

The key technologies in the Traffic Sensors market include inductive loop sensors, radar sensors, infrared sensors, video sensors, and wearable sensors. Inductive loop sensors dominate by representing a market size of $3.16 billion in 2023, expected to grow to $6.47 billion by 2033, capturing significant market share due to their reliability and effectiveness in vehicle detection. Radar sensors follow with notable growth forecasts, driven by their ability to operate under diverse conditions.

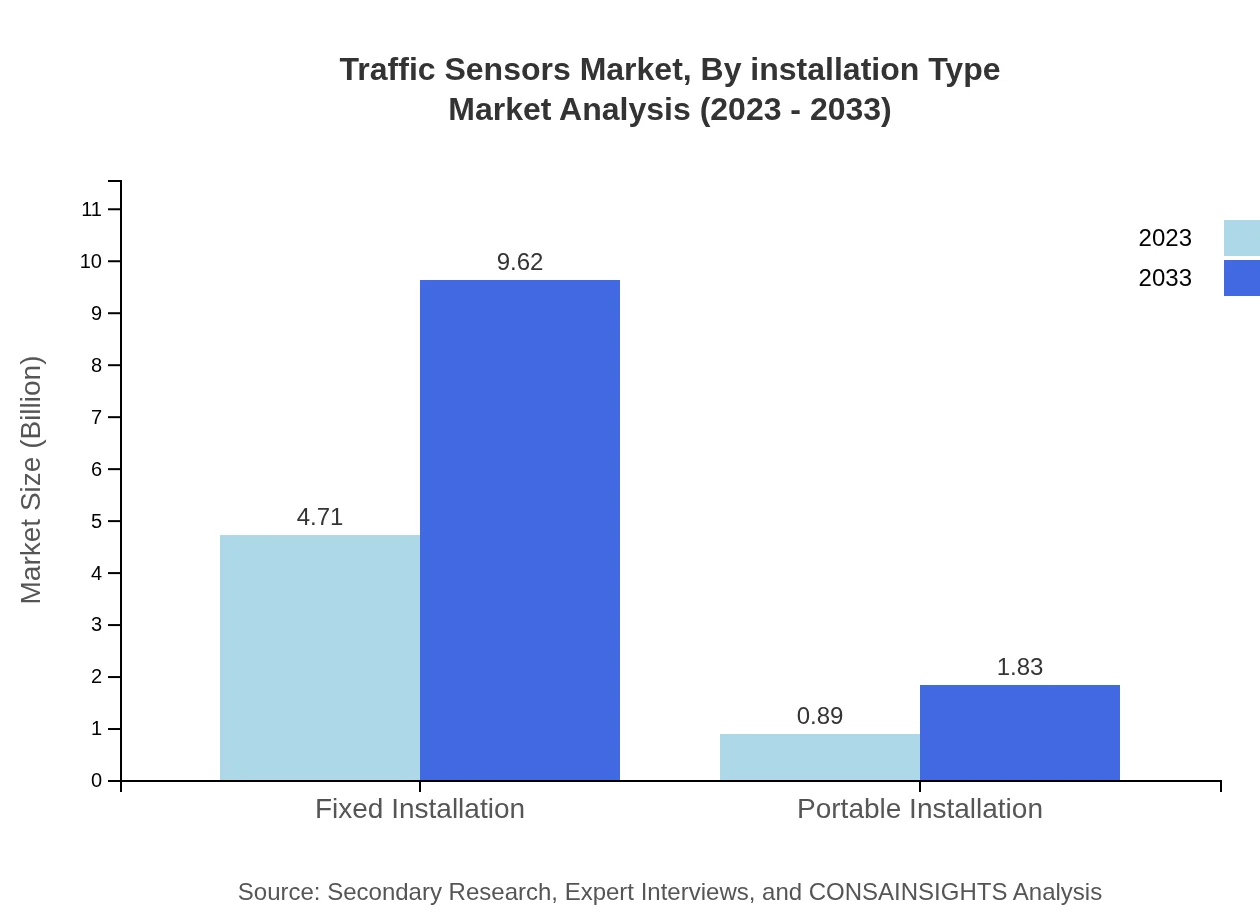

Traffic Sensors Market Analysis By Installation Type

Waste management of installation methods splits into fixed sensors and mobile sensors. Fixed installation is forecasted to grow significantly from $4.71 billion in 2023 to $9.62 billion by 2033, as it is crucial for permanent traffic monitoring setups. In contrast, portable installations are also expected to see growth, capturing a niche market needs in temporary applications.

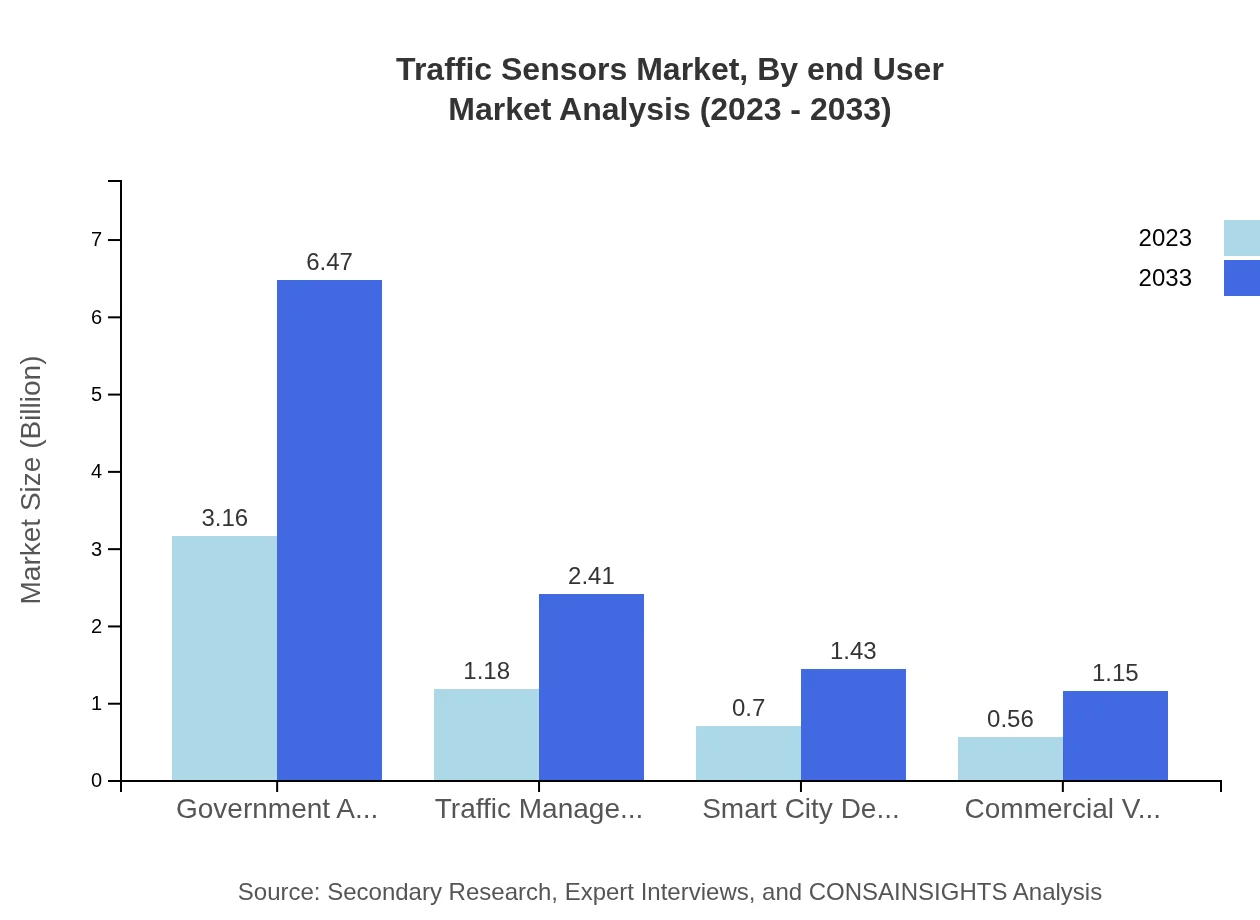

Traffic Sensors Market Analysis By End User

Government agencies remain the largest segment in the Traffic Sensors market, expected to capture a market size of $3.16 billion in 2023 and grow to $6.47 billion by 2033. Traffic management companies and smart city developers are also crucial players, highlighting the multiple applications of traffic sensors for urban and rural traffic management.

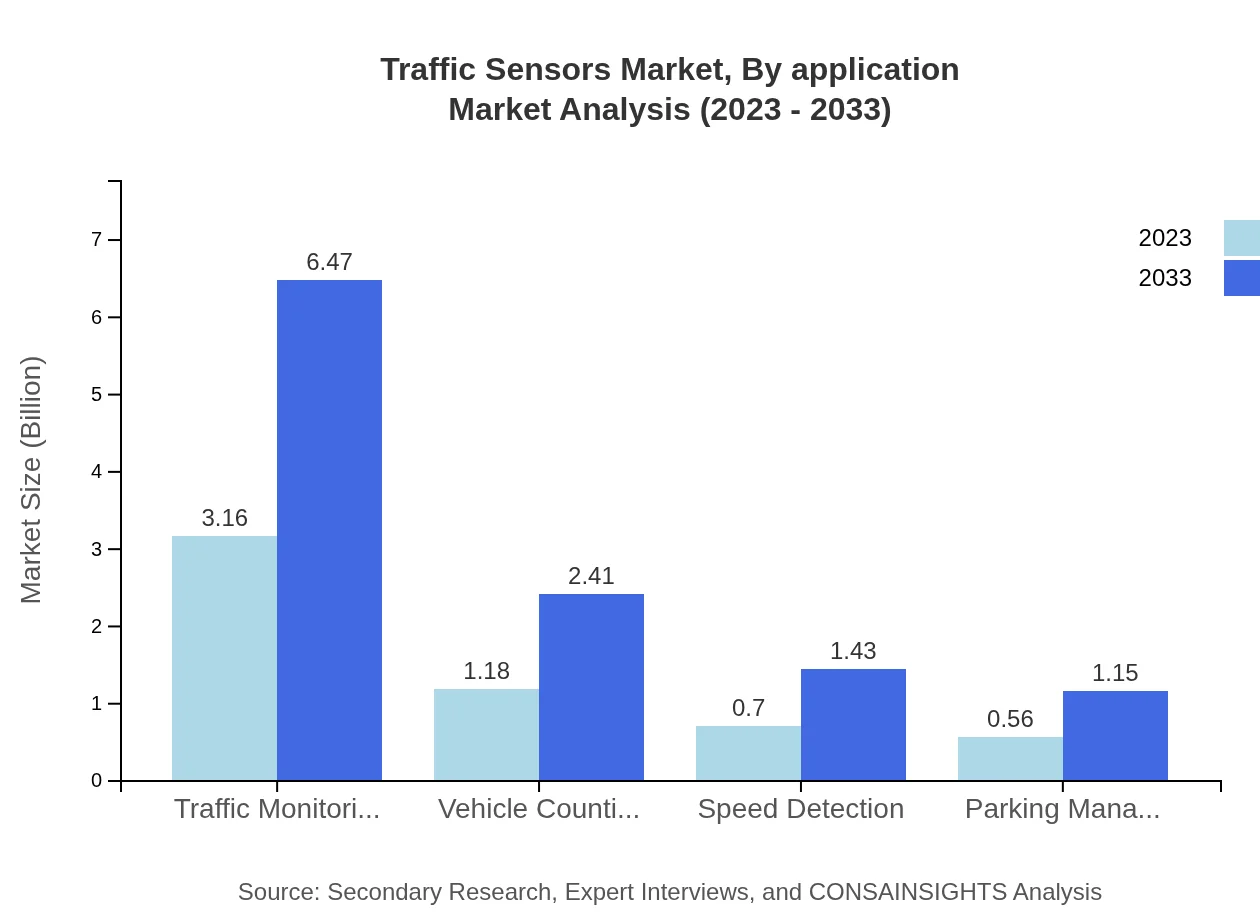

Traffic Sensors Market Analysis By Application

The application landscape is categorized into Traffic Monitoring, Vehicle Counting, Speed Detection, and Parking Management. Traffic monitoring leads the market with $3.16 billion in 2023, which will grow to $6.47 billion by 2033, demonstrating the critical need for real-time traffic data analysis.

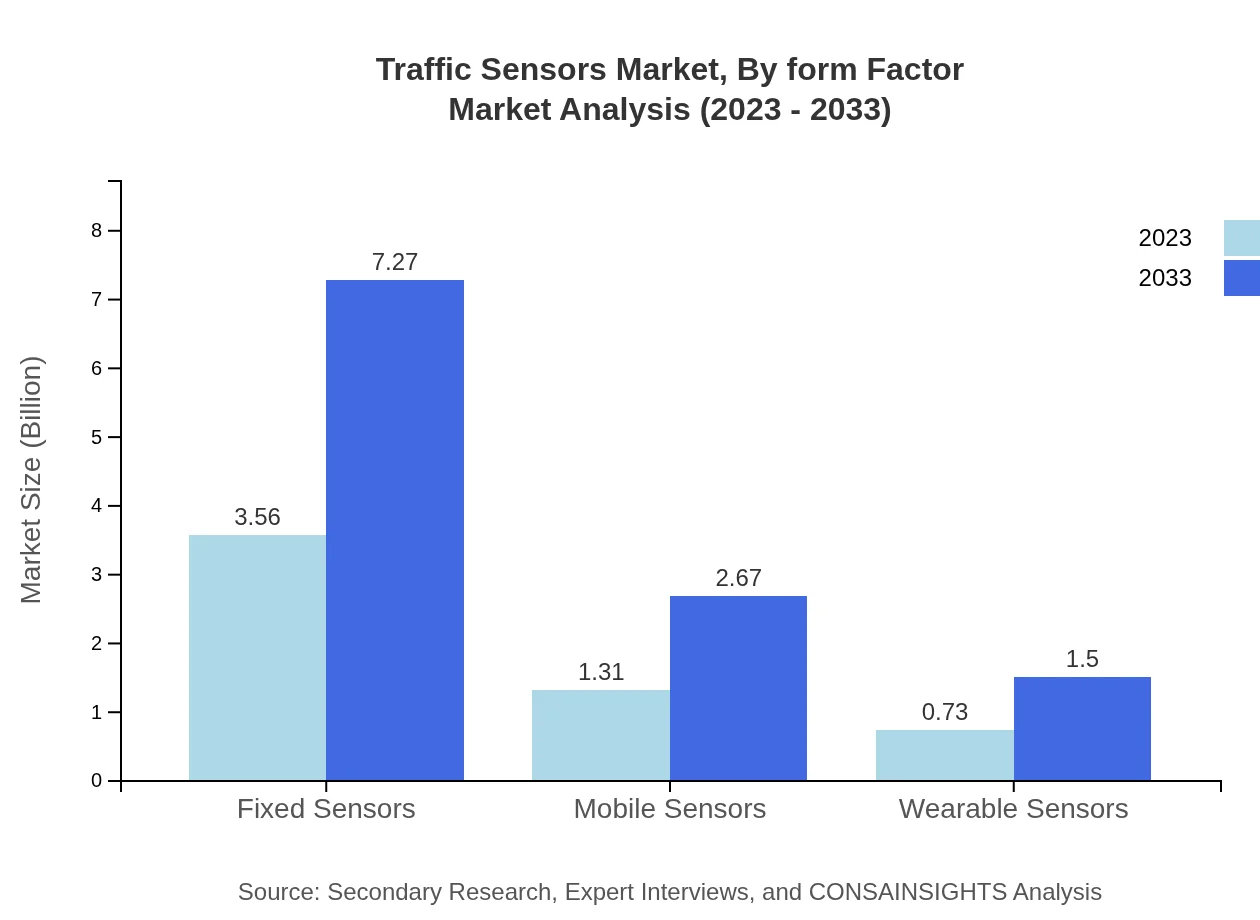

Traffic Sensors Market Analysis By Form Factor

The market consists of various form factors including fixed and mobile sensors, contributing significantly to performance effectiveness. Fixed sensors hold a dominant market presence, showcasing robust growth potential, as their infrastructure is already in place in many urban environments.

Traffic Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Traffic Sensors Industry

Siemens AG:

Siemens AG is a global leader in traffic management solutions, offering various traffic sensors and intelligent infrastructure systems, contributing to smarter urban transport.Kapsch TrafficCom:

Kapsch TrafficCom specializes in providing traffic management solutions with innovative sensor technology designed for optimized vehicle flow and safety.Cubic Corporation:

Cubic Corporation focuses on intelligent transportation systems, helping to develop advanced traffic sensor technologies for dynamic traffic environments.Bosch:

Bosch provides various sensor technologies for traffic management systems, enhancing urban mobility and safety through smart solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of traffic sensors?

The global traffic sensors market is projected to reach $5.6 billion by 2033, growing at a CAGR of 7.2%. The market is trending upward due to increasing urbanization and the need for smarter traffic management solutions.

What are the key market players or companies in the traffic sensors industry?

Key players in the traffic sensors market include companies like Siemens AG, Kapsch TrafficCom AG, and FLIR Systems, Inc. These companies lead with innovative solutions in traffic management and smart city technologies.

What are the primary factors driving the growth in the traffic sensors industry?

Factors driving growth include urbanization, rising vehicle numbers, demand for intelligent transportation systems, and governmental investments in infrastructure. These trends highlight the crucial role of traffic sensors in enhancing road safety and efficiency.

Which region is the fastest Growing in the traffic sensors market?

North America is the fastest-growing region, with market size projected to grow from $2.08 billion in 2023 to $4.25 billion in 2033. This growth is fueled by advanced infrastructure and smart city initiatives.

Does ConsaInsights provide customized market report data for the traffic sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the traffic sensors industry. This includes in-depth analysis, segment data, and regional insights for better decision-making.

What deliverables can I expect from this traffic sensors market research project?

Expected deliverables include comprehensive market analysis reports, segment-level insights, regional growth forecasts, competitive landscape assessments, and tailored recommendations for strategy development in the traffic sensors sector.

What are the market trends of traffic sensors?

Current trends include the increasing use of AI and IoT, growth in vehicle-to-everything (V2X) communication, and a shift toward sustainable traffic management solutions, evidenced by the development of smart city technologies.