Transaction Monitoring Market Report

Published Date: 24 January 2026 | Report Code: transaction-monitoring

Transaction Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Transaction Monitoring market, encompassing key insights, trends, and forecasts from 2023 to 2033. It highlights market size, growth rates, regional analysis, industry developments, and competitive landscape to aid stakeholders in strategic decision-making.

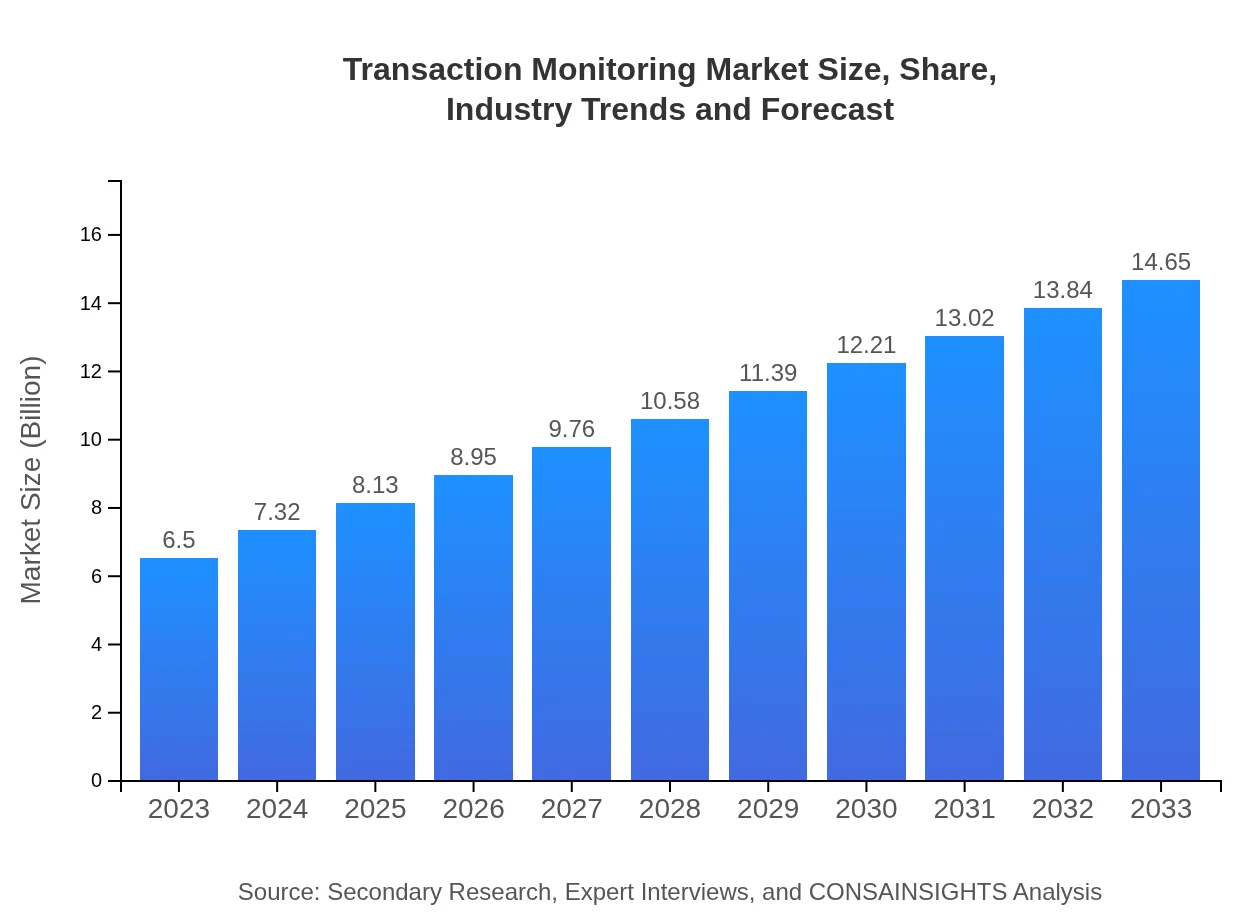

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $14.65 Billion |

| Top Companies | Oracle Corporation, SAS Institute, FICO, Actimize |

| Last Modified Date | 24 January 2026 |

Transaction Monitoring Market Overview

Customize Transaction Monitoring Market Report market research report

- ✔ Get in-depth analysis of Transaction Monitoring market size, growth, and forecasts.

- ✔ Understand Transaction Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transaction Monitoring

What is the Market Size & CAGR of Transaction Monitoring market in 2023?

Transaction Monitoring Industry Analysis

Transaction Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transaction Monitoring Market Analysis Report by Region

Europe Transaction Monitoring Market Report:

Europe’s Transaction Monitoring market stands at $1.96 billion in 2023, forecasted to grow to $4.41 billion by 2033. The region is characterized by rigorous regulatory frameworks, including GDPR and AML directives, promoting the development of sophisticated monitoring tools. The rise in cross-border transactions in financial services significantly drives demand for effective monitoring systems across Europe.Asia Pacific Transaction Monitoring Market Report:

In 2023, the Asia Pacific Transaction Monitoring market is valued at $1.18 billion, projected to rise to $2.67 billion by 2033. Factors such as increased investments in financial technology, awareness of compliance, and a growing middle-class population drive the market in this region. Countries like India and China are at the forefront, introducing advanced transaction monitoring systems to curb rising fraud cases.North America Transaction Monitoring Market Report:

North America dominates the Transaction Monitoring market with a 2023 valuation of $2.44 billion expected to escalate to $5.50 billion by 2033. The region's advanced technological infrastructure and stringent regulatory requirements compel financial institutions to adopt comprehensive monitoring solutions. The presence of major financial institutions further accelerates growth in this market.South America Transaction Monitoring Market Report:

The South American market for Transaction Monitoring reported a value of $0.48 billion in 2023 with expectations to reach $1.09 billion by 2033. Focus on regulatory compliance and the digital transformation of banking services are key factors influencing this growth. Moreover, increasing cases of money laundering and financial crimes necessitate enhanced monitoring solutions in this region.Middle East & Africa Transaction Monitoring Market Report:

In 2023, the Transaction Monitoring market in the Middle East and Africa is valued at $0.44 billion, projected to grow to $0.98 billion by 2033. Economic diversification and an uptick in financial transactions have prompted financial institutions in this region to adopt transaction monitoring solutions to mitigate risks associated with fraud and enhance compliance.Tell us your focus area and get a customized research report.

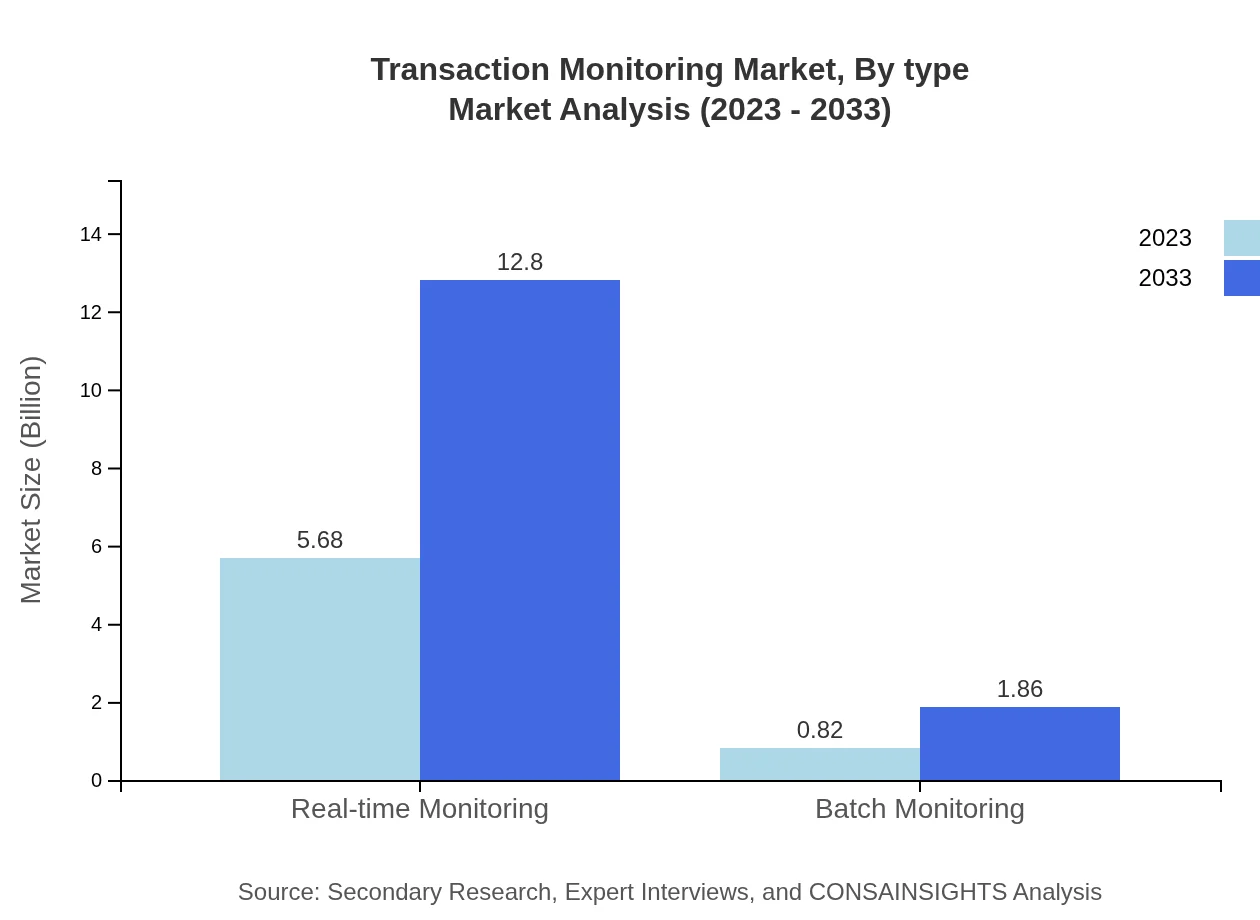

Transaction Monitoring Market Analysis By Type

In the Transaction Monitoring market categorized by type, real-time monitoring leads with an estimated value of $5.68 billion in 2023, growing to $12.80 billion by 2033, maintaining a share of 87.33%. On the other hand, batch monitoring accounts for $0.82 billion in 2023 and is expected to reach $1.86 billion by 2033, capturing a share of 12.67%. Real-time monitoring solutions are favored for their immediacy and effectiveness in detecting suspicious activities as they happen.

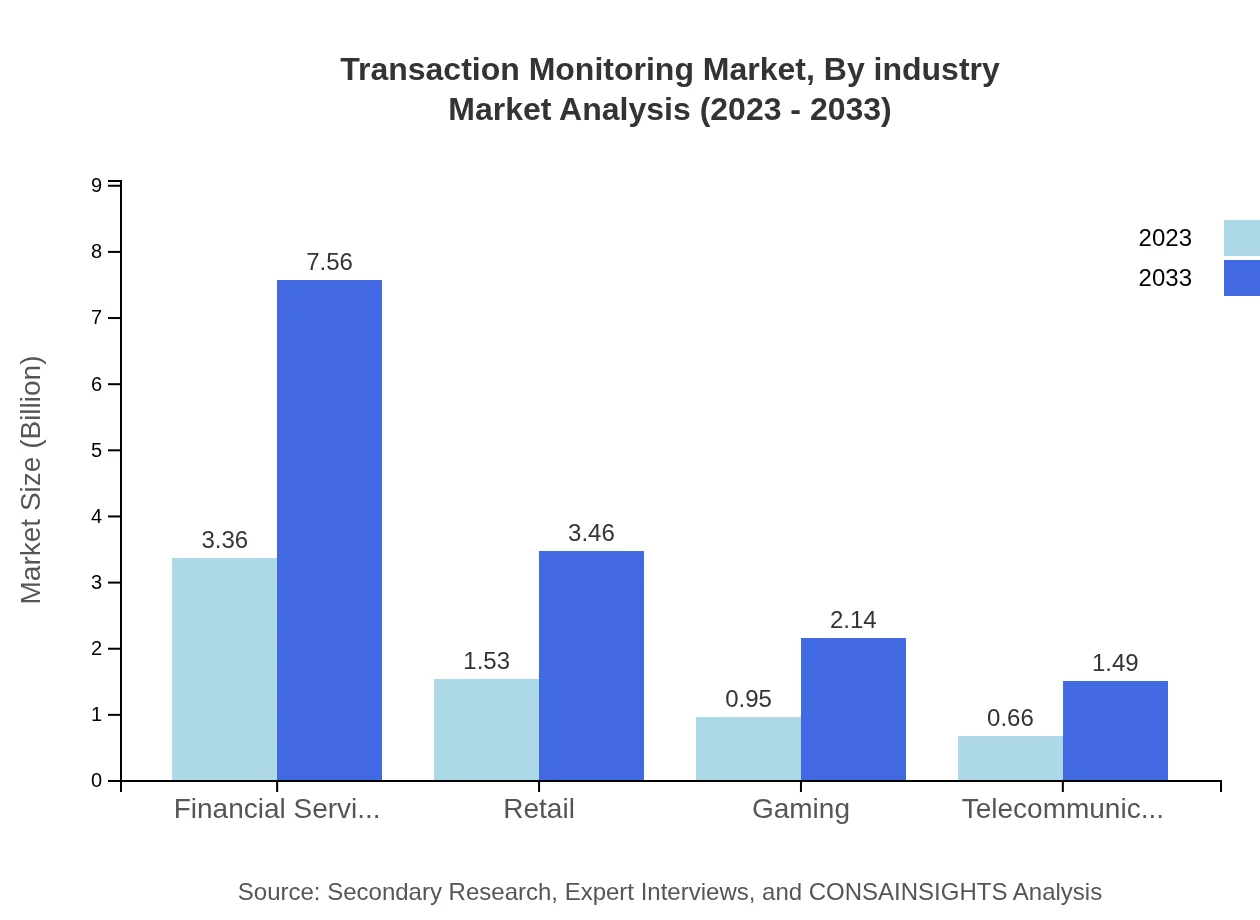

Transaction Monitoring Market Analysis By Industry

When analyzing the market by industry, financial services dominate with a size of $3.36 billion in 2023, projected to grow to $7.56 billion by 2033. This segment comprises the largest share at 51.63%. Retail follows with $1.53 billion, anticipated to grow to $3.46 billion, holding a 23.59% share. Gaming and telecommunications also represent significant sectors, indicating a broadening scope of transaction monitoring applications.

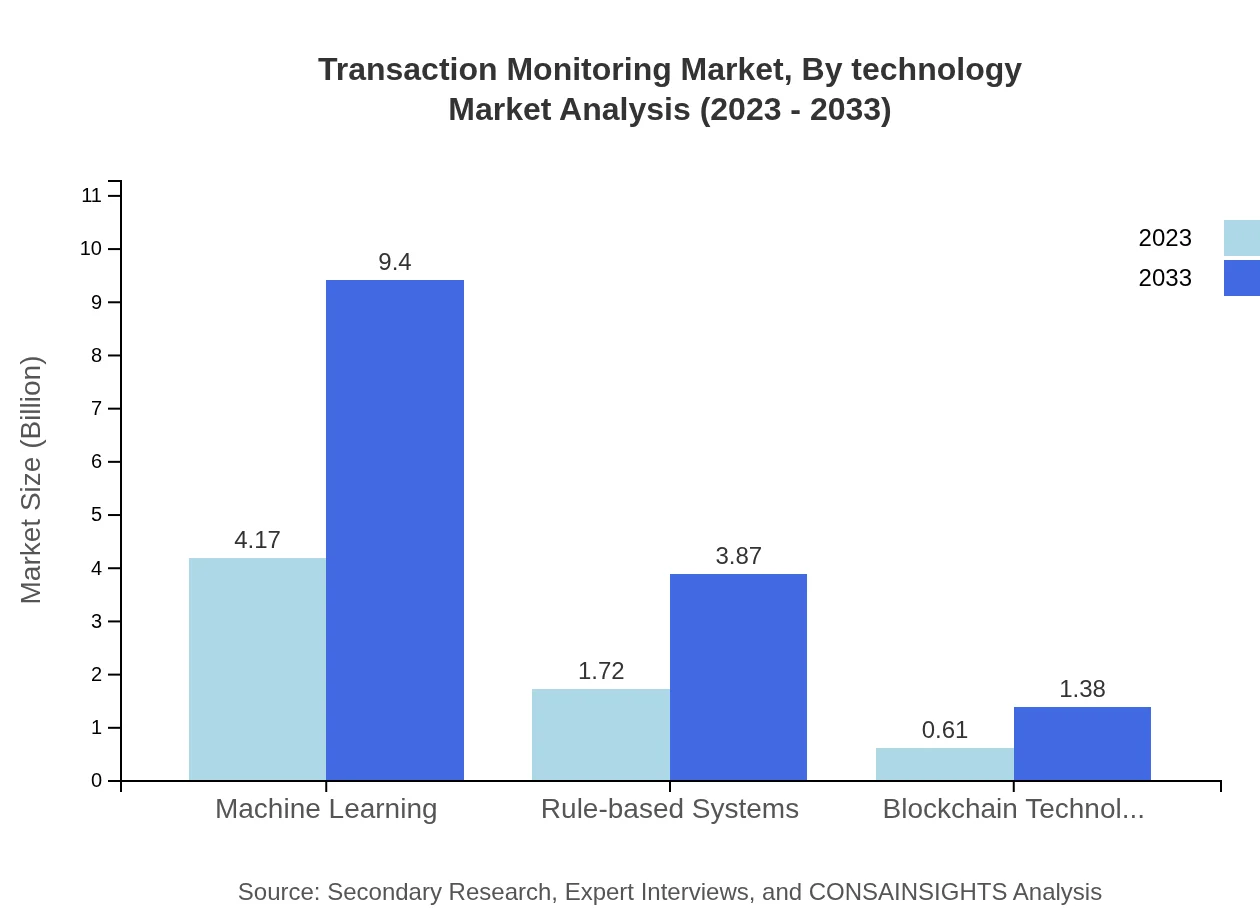

Transaction Monitoring Market Analysis By Technology

The market segmented by technology highlights machine learning as a cornerstone, valued at $4.17 billion in 2023 with expectations of $9.40 billion by 2033, capturing a large share at 64.16%. Rule-based systems follow with $1.72 billion, anticipated to grow to $3.87 billion, holding a 26.44% share. Advancements in blockchain technology, estimated at $0.61 billion in 2023 and expected to reach $1.38 billion by 2033, also showcase innovative adaptations complementing traditional systems.

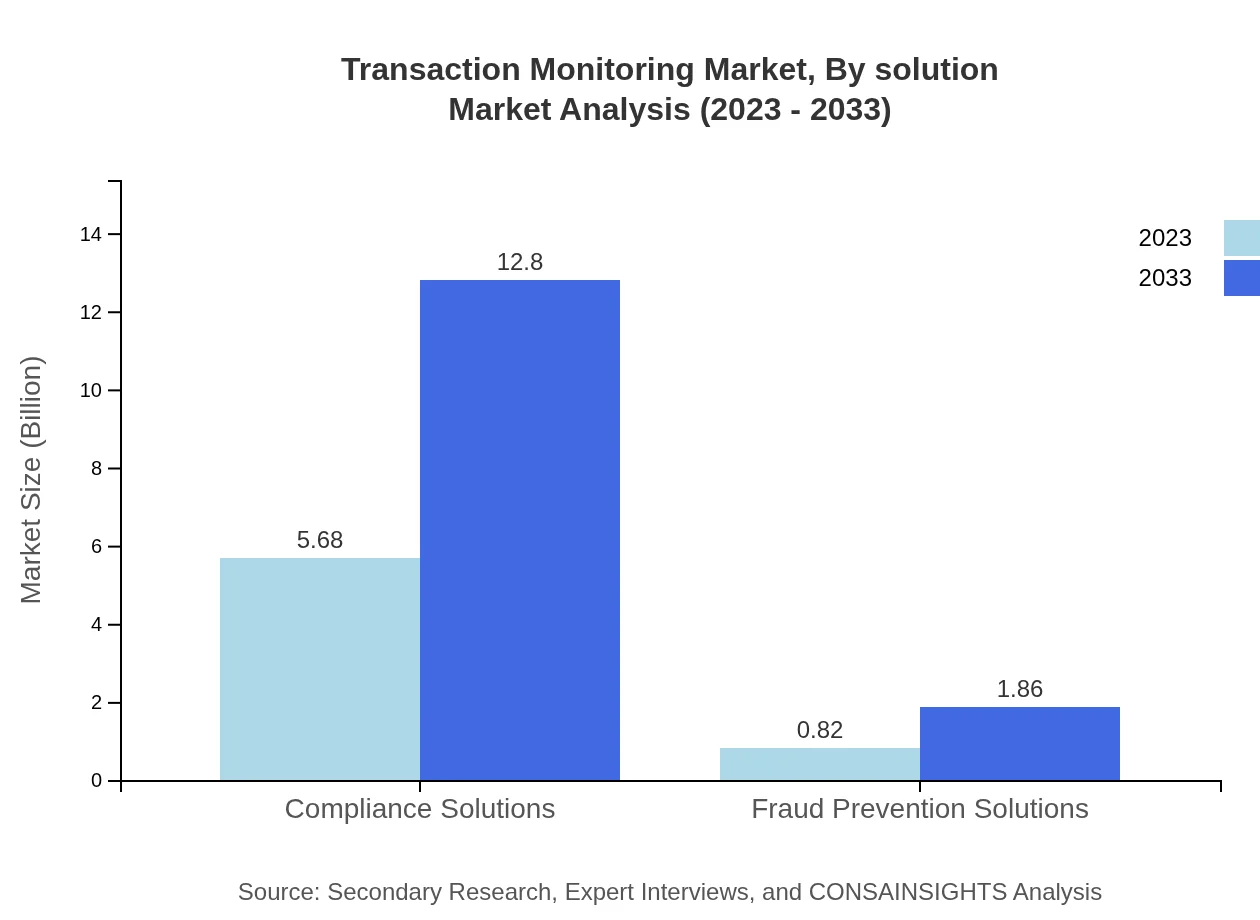

Transaction Monitoring Market Analysis By Solution

Compliance solutions represent the largest segment in the Transaction Monitoring space, estimated at $5.68 billion in 2023 and expected to rise to $12.80 billion by 2033, maintaining an 87.33% share. Fraud prevention solutions are smaller but significant, starting at $0.82 billion in 2023 and reaching $1.86 billion by 2033. The focus on compliance is largely driven by strict regulatory environments across industries emphasizing the need for robust monitoring solutions.

Transaction Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transaction Monitoring Industry

Oracle Corporation:

A leader in cloud applications and platform services, Oracle provides comprehensive solutions for transaction monitoring, integrating AI and machine learning to enhance fraud detection capabilities.SAS Institute:

Specializing in advanced analytics and business intelligence, SAS offers robust monitoring solutions designed to tackle financial crimes while ensuring regulatory compliance.FICO:

Known for its innovative solutions, FICO supplies analytic and decision management technologies, empowering organizations to combat fraud effectively through sophisticated monitoring tools.Actimize:

A subsidiary of NICE Systems, Actimize focuses on providing risk management solutions that help financial institutions meet regulatory obligations through effective transaction monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of transaction Monitoring?

The transaction monitoring market reached approximately $6.5 billion in 2023, with a robust CAGR of 8.2%. It is projected to grow significantly over the next decade, with gradual revenue increases leading to a more expansive market by 2033.

What are the key market players or companies in this transaction Monitoring industry?

The transaction monitoring industry comprises key players such as FICO, NICE Actimize, Oracle, SAS Institute, and ACI Worldwide. These companies lead with innovative solutions to enhance compliance and fraud prevention efforts across various sectors.

What are the primary factors driving the growth in the transaction Monitoring industry?

Key growth drivers include stringent regulatory requirements for financial transactions, increasing digital payments, rising fraudulent activities, and advancements in technology such as AI and machine learning, enhancing efficiency and detection capabilities in monitoring.

Which region is the fastest Growing in the transaction Monitoring?

Europe leads as the fastest-growing region with a market size estimated at $4.41 billion by 2033, up from $1.96 billion in 2023. Other regions showing promising growth include Asia Pacific and North America, emphasizing emerging markets.

Does ConsaInsights provide customized market report data for the transaction Monitoring industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the transaction monitoring sector. Clients can request reports focusing on niche areas like geographical regions, segments, or emerging technologies.

What deliverables can I expect from this transaction Monitoring market research project?

Deliverables typically include comprehensive reports, detailed market analysis, growth predictions, insights into competitive landscapes, and strategic recommendations tailored for stakeholders in the transaction monitoring industry.

What are the market trends of transaction Monitoring?

Current trends include an increasing reliance on advanced analytics, the rise of real-time monitoring solutions, and the integration of blockchain technology. Companies are also focusing on enhancing user experience while ensuring compliance with regulatory standards.