Transparent Ceramics Market Report

Published Date: 31 January 2026 | Report Code: transparent-ceramics

Transparent Ceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Transparent Ceramics market, covering its current state, growth forecasts up to 2033, market segmentation, regional insights, and key trends impacting the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

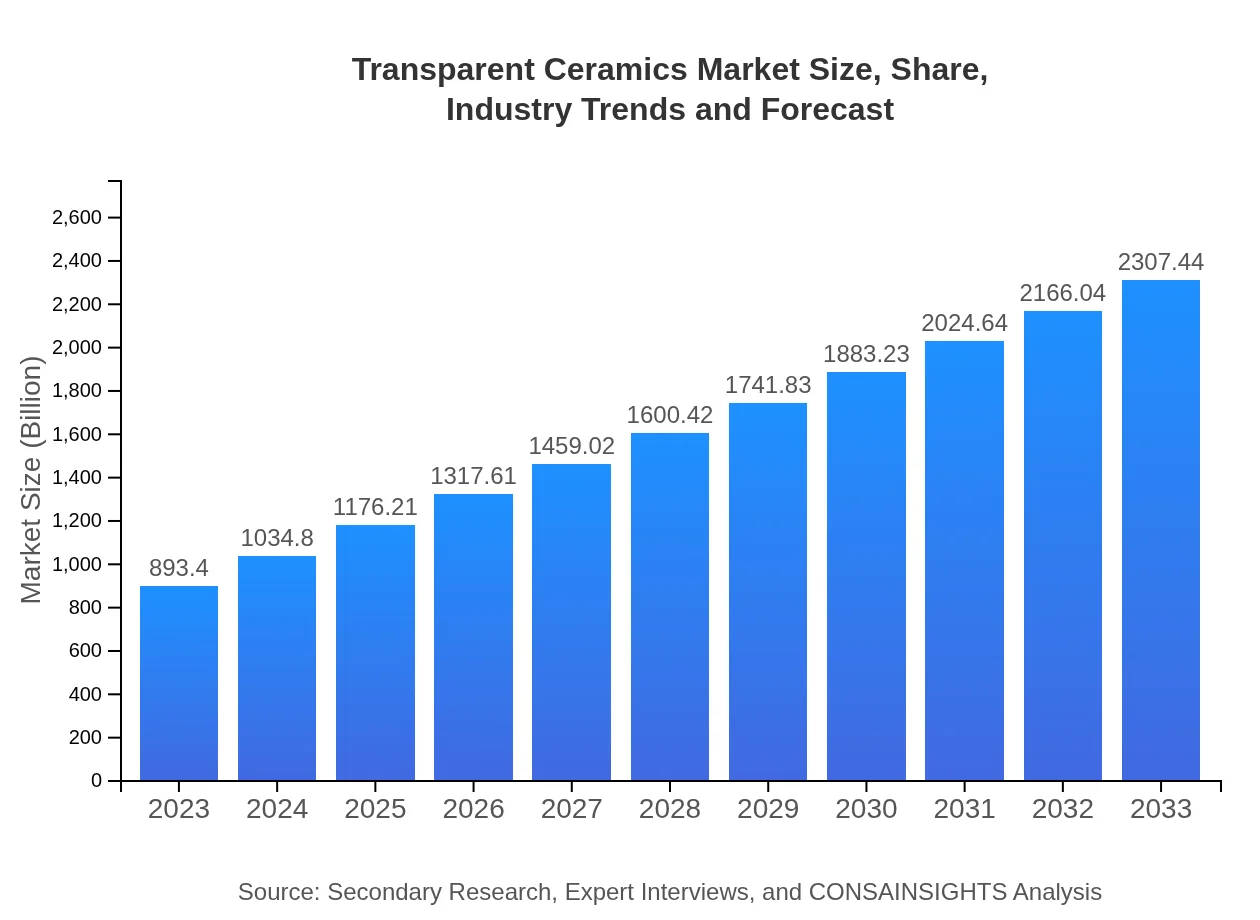

| 2023 Market Size | $893.40 Million |

| CAGR (2023-2033) | 9.6% |

| 2033 Market Size | $2307.44 Million |

| Top Companies | Alcoa Corporation, ROHM Co., Ltd., CeramTec GmbH, Schott AG |

| Last Modified Date | 31 January 2026 |

Transparent Ceramics Market Overview

Customize Transparent Ceramics Market Report market research report

- ✔ Get in-depth analysis of Transparent Ceramics market size, growth, and forecasts.

- ✔ Understand Transparent Ceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transparent Ceramics

What is the Market Size & CAGR of Transparent Ceramics market in 2023?

Transparent Ceramics Industry Analysis

Transparent Ceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transparent Ceramics Market Analysis Report by Region

Europe Transparent Ceramics Market Report:

Europe is set to evolve considerably, anticipated to grow from $279.81 million in 2023 to $722.69 million by 2033, driven by innovations in automotive and electronics applications, along with stringent regulations favoring advanced materials.Asia Pacific Transparent Ceramics Market Report:

The Asia Pacific region shows significant growth potential, with the market projected to reach $406.11 million by 2033, up from $157.24 million in 2023. Key drivers include rising industrialization, increased spending on defense and technology, and a growing electronics market.North America Transparent Ceramics Market Report:

The North American market, valued at $327.79 million in 2023, is projected to expand to $846.60 million by 2033. Major factors driving growth include substantial investments in defense technology and high demand for durable materials in manufacturing.South America Transparent Ceramics Market Report:

In South America, the Transparent Ceramics market is expected to grow from $23.76 million in 2023 to $61.38 million by 2033. This growth is primarily fueled by advancements in the medical sector and growing demand for innovative materials in electronics.Middle East & Africa Transparent Ceramics Market Report:

The Middle East and Africa market is forecasted to see growth from $104.80 million in 2023 to $270.66 million by 2033. The expanding aerospace and defense sectors will play a vital role, alongside increasing industrialisation efforts in several nations.Tell us your focus area and get a customized research report.

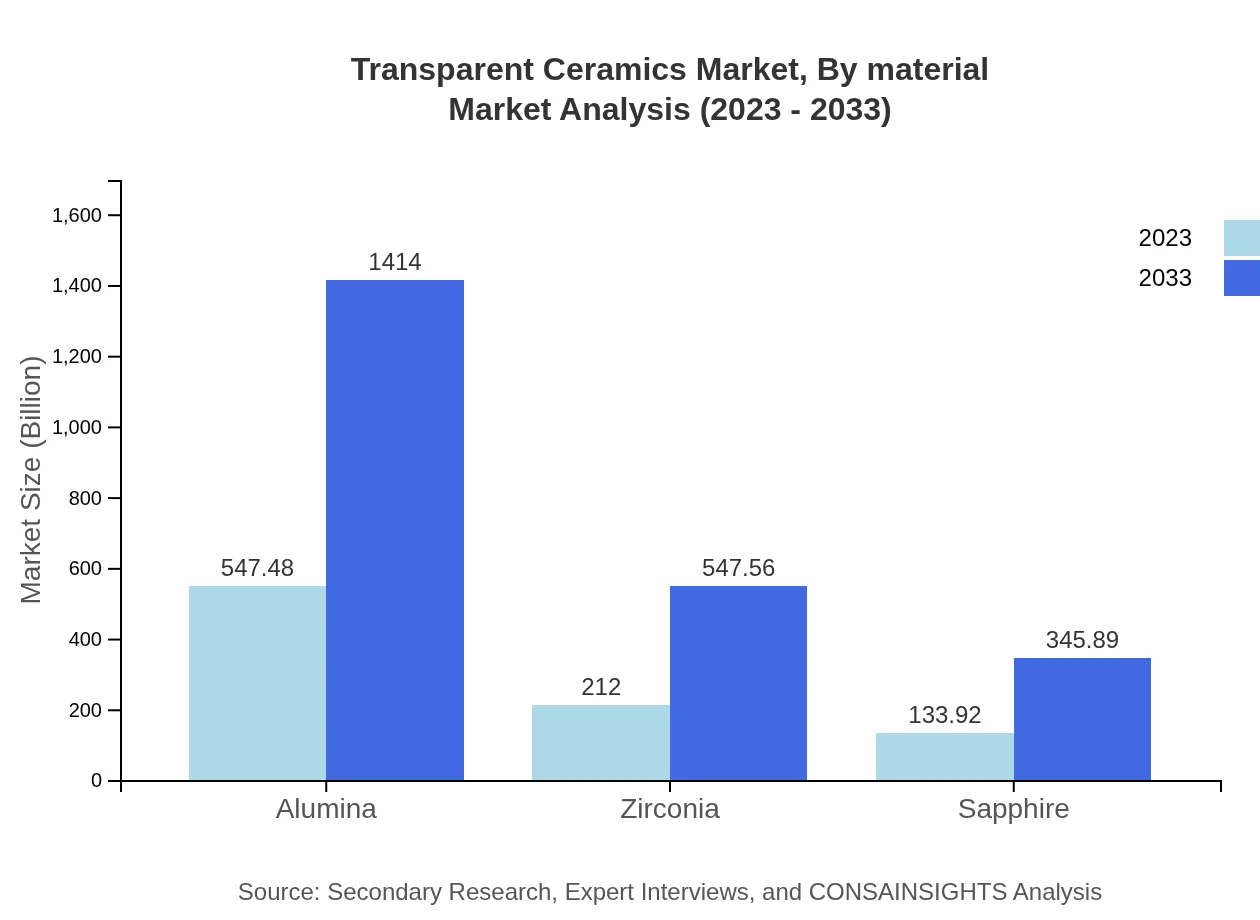

Transparent Ceramics Market Analysis By Material

In terms of material usage, alumina dominates with a market valuation of $547.48 million in 2023, expected to reach $1,414 million by 2033. Zirconia follows, indicating substantial applications in optical and biomedical fields. Other materials like sapphire and specialized composites are also growing in preference due to their unique properties.

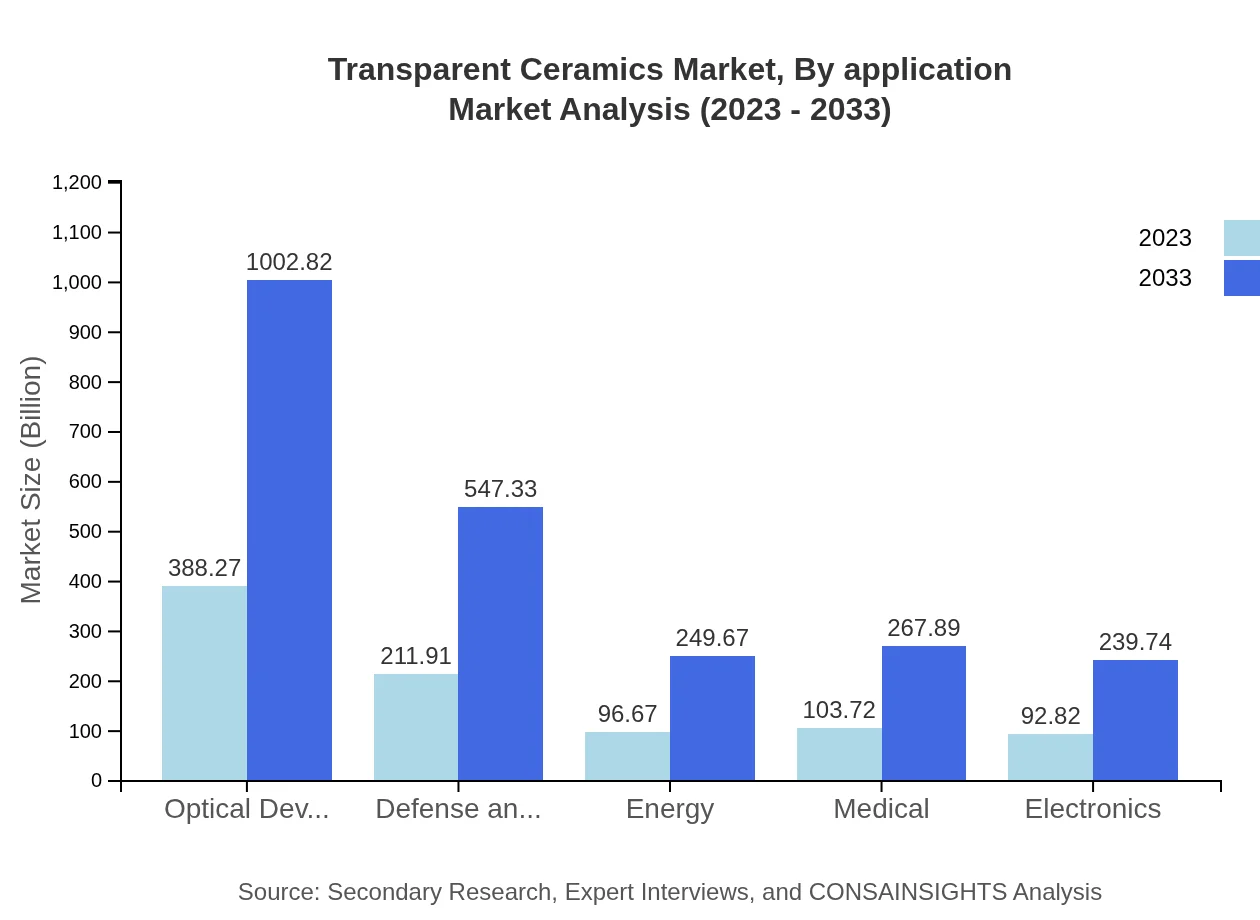

Transparent Ceramics Market Analysis By Application

The electronics application segment leads with a market size of $388.27 million in 2023, projected to exceed $1 billion by 2033. The defense sector is significant, expected to grow from $211.91 million to $547.33 million in a decade, emphasizing the demand for robust and transparent materials.

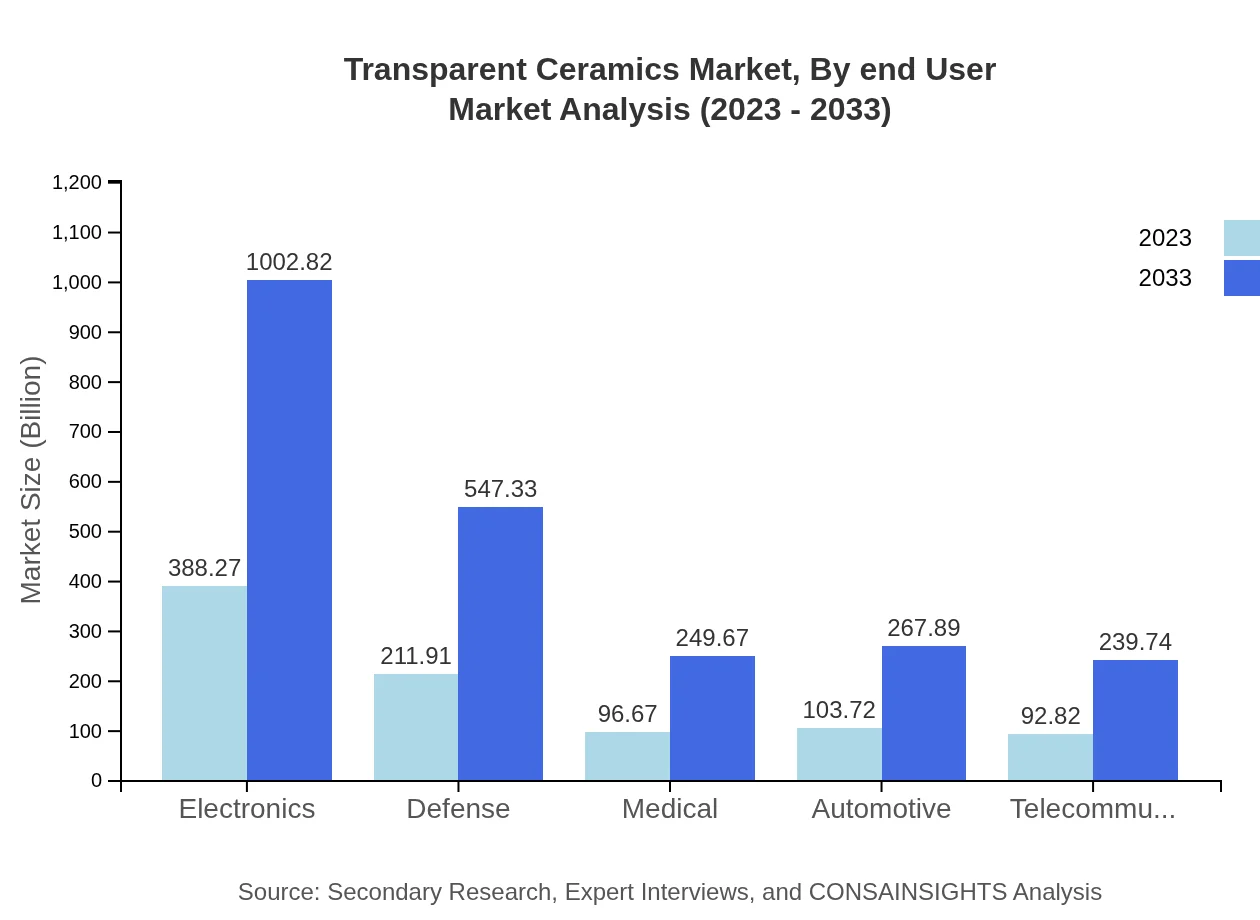

Transparent Ceramics Market Analysis By End User

End-users include major sectors such as healthcare, where the market is estimated at $96.67 million in 2023, anticipated to grow to $249.67 million by 2033. The automotive and telecommunications sectors are witnessing increased adoption of transparent ceramics owing to lightweight and durable materials.

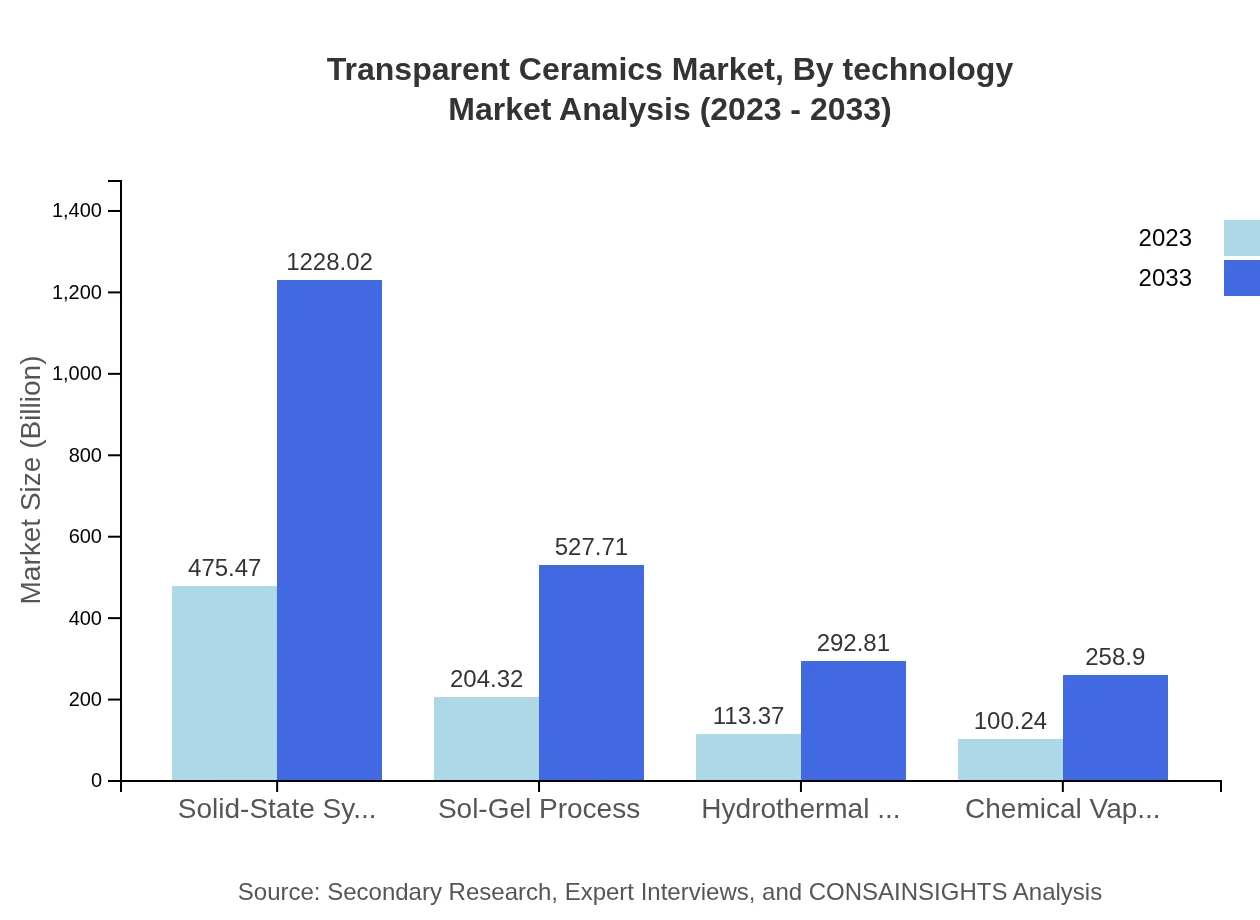

Transparent Ceramics Market Analysis By Technology

Key technologies in manufacturing transparent ceramics include solid-state synthesis, chemical vapor deposition, and sol-gel processes. Solid-state synthesis, valued at $475.47 million in 2023, is expected to continue dominant due to its efficiency and effectiveness in producing high-quality ceramics.

Transparent Ceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transparent Ceramics Industry

Alcoa Corporation:

Alcoa is a key player in advanced materials and transparent ceramics, focusing on innovations for aerospace and defense industries.ROHM Co., Ltd.:

ROHM excels in semiconductor and integrated circuit production, leveraging transparent ceramics in various electronic applications.CeramTec GmbH:

CeramTec specializes in manufacturing advanced ceramic components, providing transparent solutions for medical and telecommunications applications.Schott AG:

Schott is widely recognized for its optical glasses and transparent ceramics, leading innovations in various high-tech sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of transparent ceramics?

The transparent ceramics market is projected to reach approximately $893.4 million by 2033, growing at a CAGR of 9.6% from 2023. This growth indicates substantial advancements in applications spanning various industries including electronics and defense.

What are the key market players or companies in the transparent ceramics industry?

Key players in the transparent ceramics market include established companies specializing in advanced materials. Their innovations and product offerings significantly shape market growth and competitive landscape, influencing technological advancements and customer adoption.

What are the primary factors driving the growth in the transparent ceramics industry?

Growth drivers include increasing demand from the electronics and defense sectors, technological advancements in materials, and expanding applications in medical devices and telecommunication. Economic growth in developing regions also contributes to elevated demand for durable and lightweight materials.

Which region is the fastest Growing in the transparent ceramics market?

North America currently holds a leading position, expected to reach $846.60 million by 2033, with a rapid growth trend. Other growing regions include Europe and Asia Pacific, benefiting from enhanced manufacturing capabilities and rising technology adoption.

Does ConsaInsights provide customized market report data for the transparent ceramics industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs. Detailed analytics and insights are available, facilitating informed decision-making for companies looking to enhance their market strategies in the transparent ceramics field.

What deliverables can I expect from this transparent ceramics market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape insights, consumer trend reports, and forecasts to 2033. These findings will help stakeholders align their strategies and optimize investment opportunities in the transparent ceramics market.

What are the market trends of transparent ceramics?

Key trends encompass advancements in material science that enhance performance, growing use in optical devices, and increased investment in defense and aerospace applications. Sustainability and eco-friendly manufacturing processes are also driving market innovations.