Transparent Electronics Market Report

Published Date: 31 January 2026 | Report Code: transparent-electronics

Transparent Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Transparent Electronics market, detailing market size, growth trends, and forecasts from 2023 to 2033. It covers industry segments, regional dynamics, technology insights, leading companies, and future outlook, offering essential insights for stakeholders and investors.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

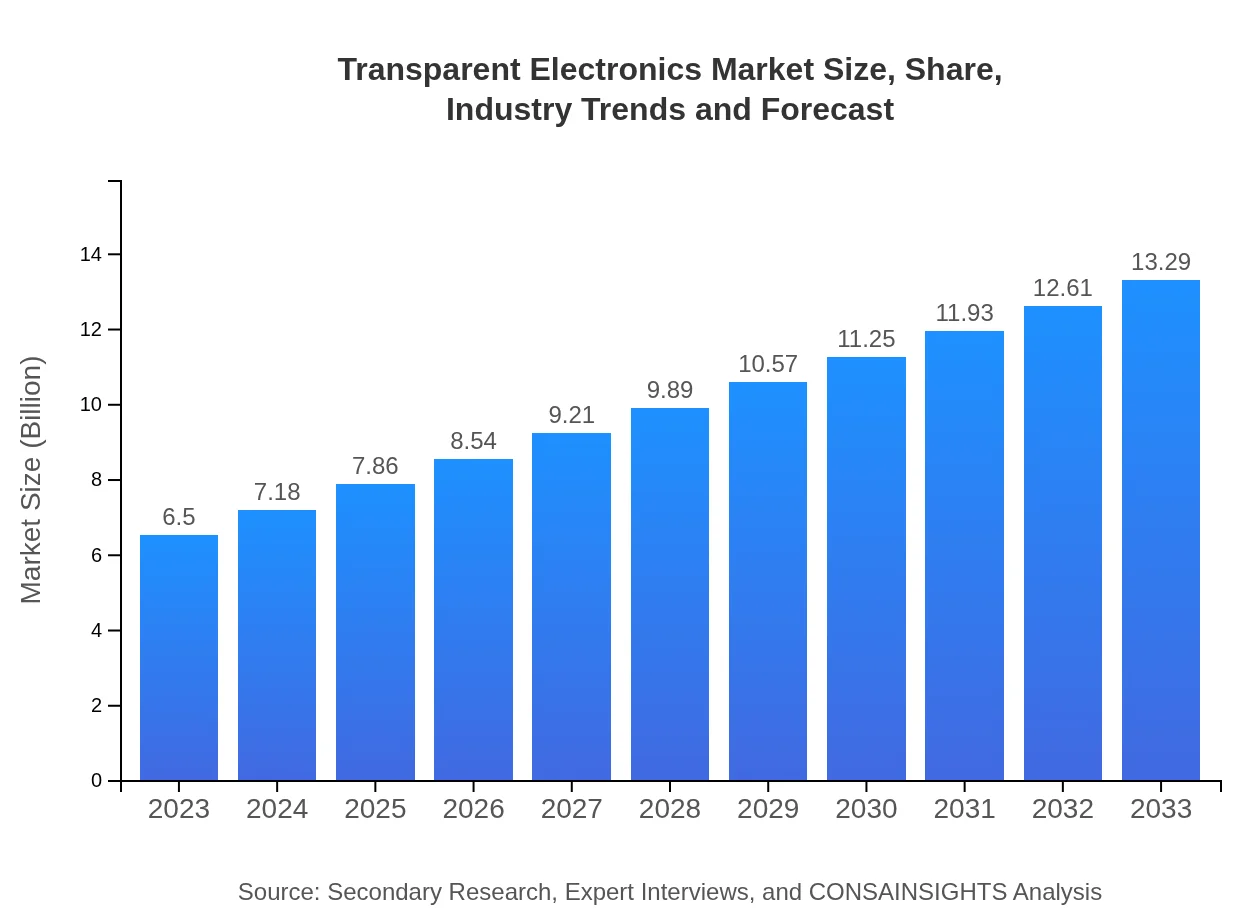

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.29 Billion |

| Top Companies | Samsung Electronics, LG Display, Corning Incorporated |

| Last Modified Date | 31 January 2026 |

Transparent Electronics Market Overview

Customize Transparent Electronics Market Report market research report

- ✔ Get in-depth analysis of Transparent Electronics market size, growth, and forecasts.

- ✔ Understand Transparent Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transparent Electronics

What is the Market Size & CAGR of Transparent Electronics market in 2023?

Transparent Electronics Industry Analysis

Transparent Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transparent Electronics Market Analysis Report by Region

Europe Transparent Electronics Market Report:

Europe's market is valued at $1.65 billion in 2023 and is expected to escalate to $3.37 billion by 2033, driven by strong regulatory support for environmentally friendly practices and an increasing number of manufacturers innovating in transparency-based technologies.Asia Pacific Transparent Electronics Market Report:

The Asia Pacific region is expected to witness robust growth in the Transparent Electronics market, with an estimated market size of $1.30 billion in 2023, projected to reach $2.66 billion by 2033. This growth is driven by increasing electronic consumption in emerging economies like China and India, alongside strong investments in research and development.North America Transparent Electronics Market Report:

North America leads with a market size of $2.52 billion in 2023, expected to more than double to $5.15 billion by 2033. This growth is fueled by advanced technology development, high consumer demand for smart devices, and significant contributions from the automotive and IT sectors.South America Transparent Electronics Market Report:

In South America, the Transparent Electronics market is anticipated to grow from $0.41 billion in 2023 to $0.83 billion by 2033. The rising interest in innovative electronic solutions and growing consumer electronics sectors in Brazil and Argentina contribute positively to market expansion.Middle East & Africa Transparent Electronics Market Report:

The Middle East and Africa market is projected to rise from $0.62 billion in 2023 to $1.27 billion by 2033. Growing investments and improvements in electronic infrastructure, especially in the Gulf Cooperation Council (GCC) countries, stimulate market growth in this region.Tell us your focus area and get a customized research report.

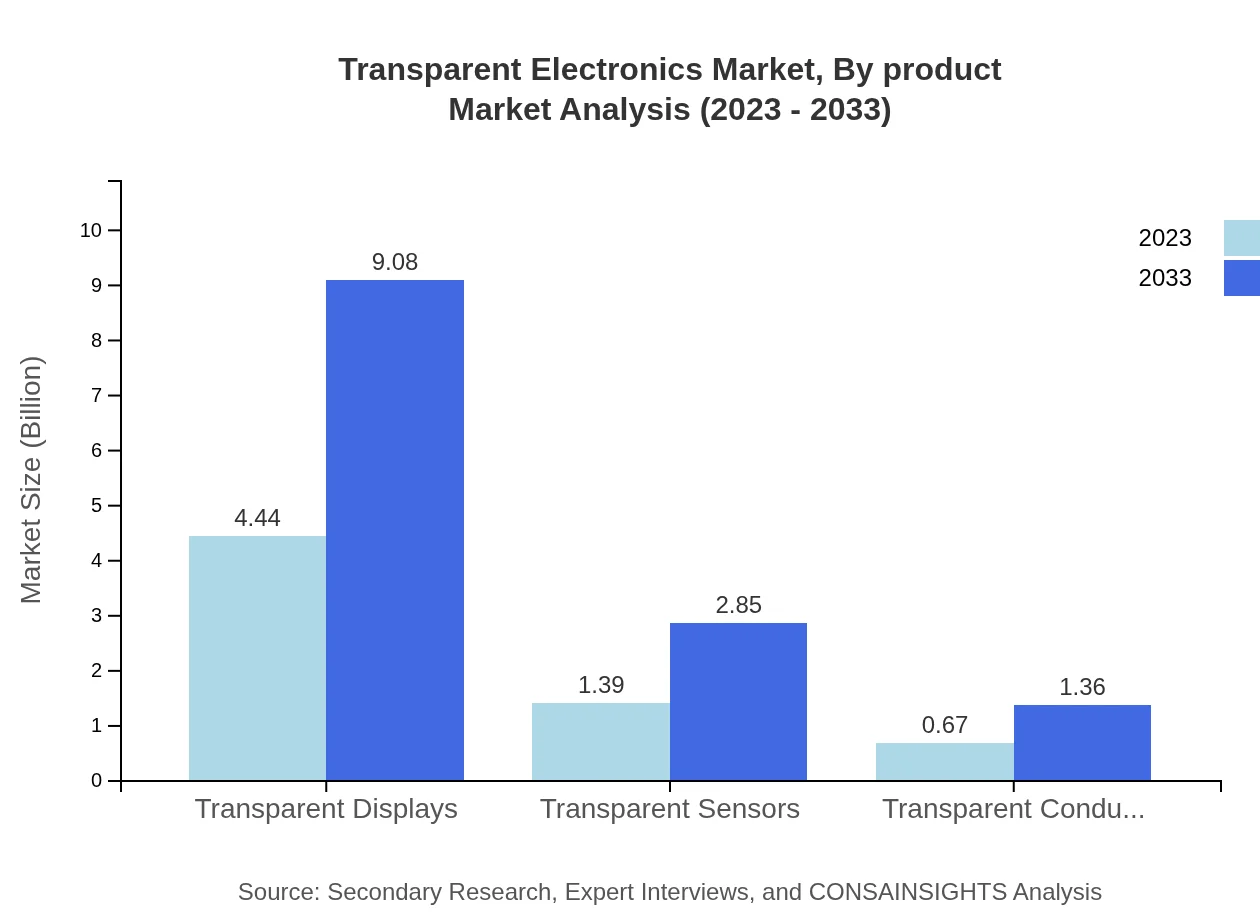

Transparent Electronics Market Analysis By Product

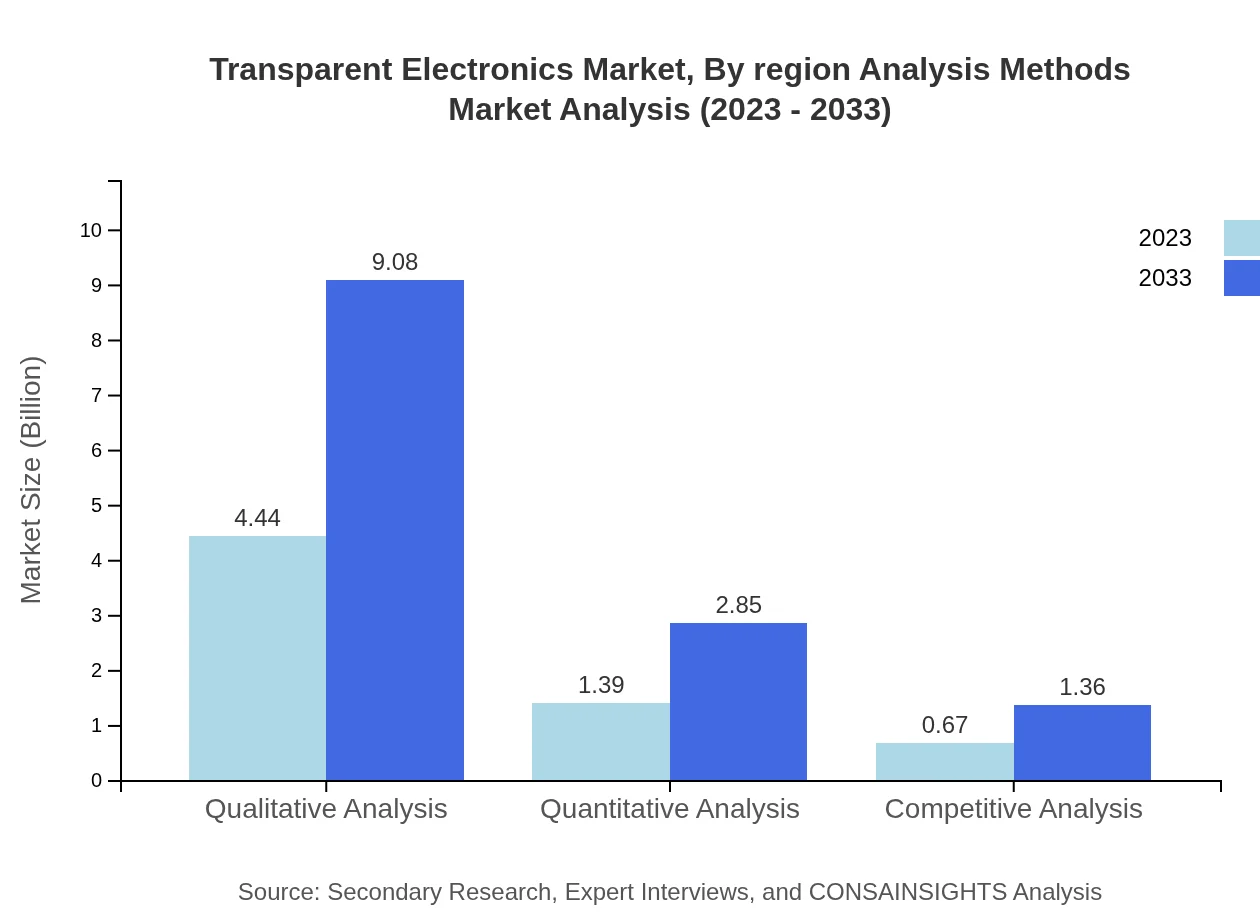

Under the product segment, the Transparent Displays market is the largest, expected to grow from $4.44 billion in 2023 to $9.08 billion by 2033, accounting for a significant share. Transparent Sensors and Conductors are also key segments, with market sizes of $1.39 billion and $0.67 billion respectively in 2023, projected to grow substantially. Other products include IT and Telecom solutions which comprise a major portion of the industry's revenue.

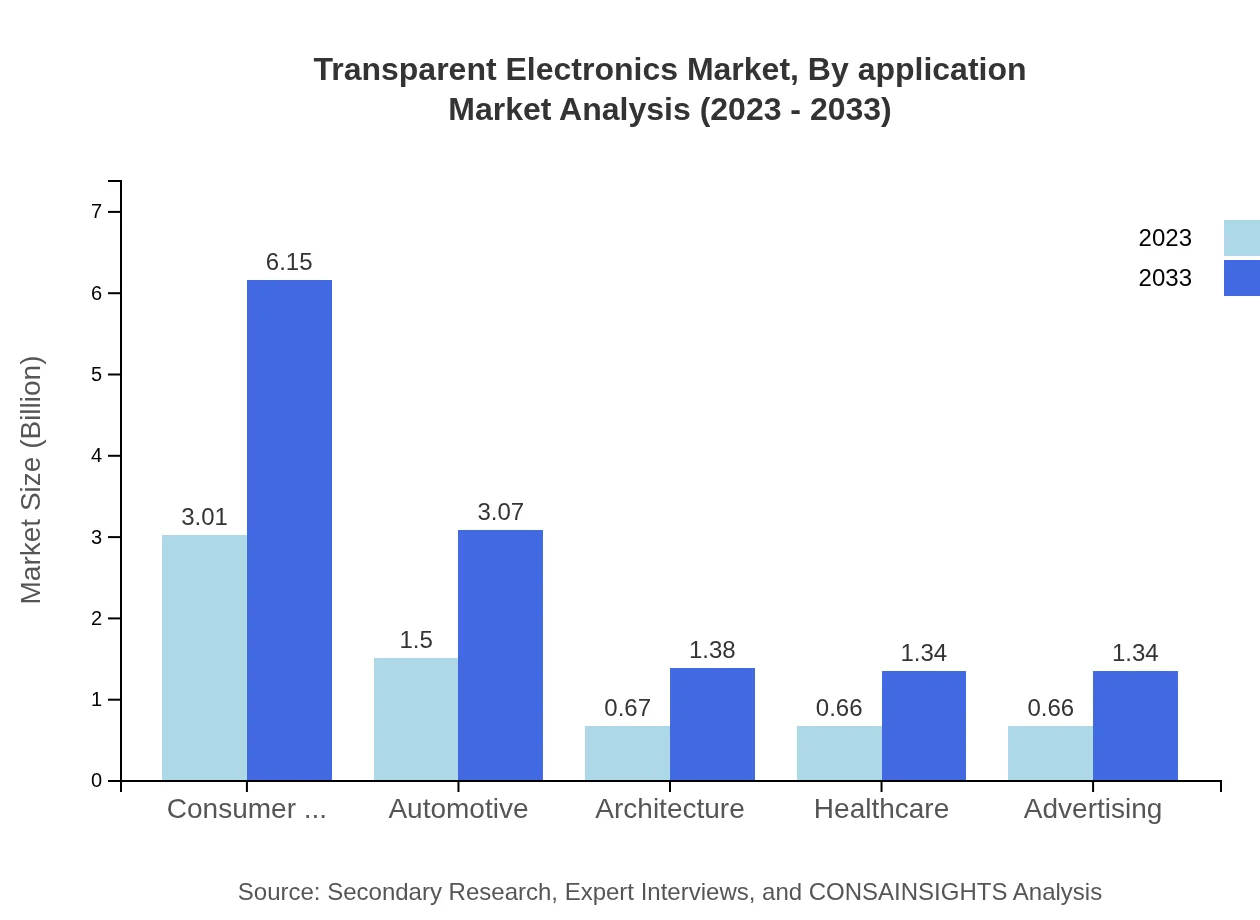

Transparent Electronics Market Analysis By Application

Applications in Consumer Electronics and IT will dominate, together holding up to 46.32% of market share in 2023. Energy and Utilities follow with a significant share due to the increasing focus on smart and efficient technologies. Additional sectors contributing to market growth include automotive and construction, where transparency enhances functionality and aesthetics.

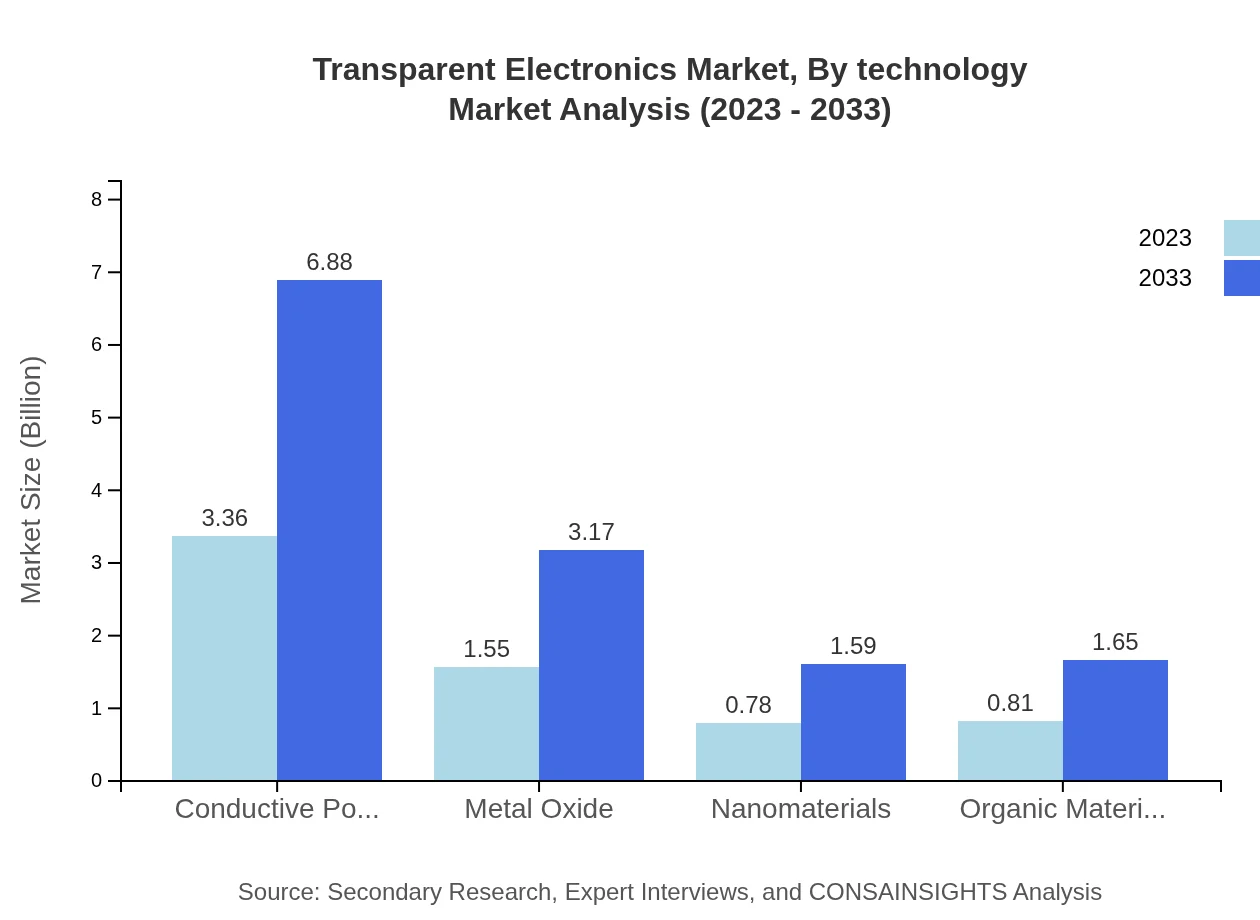

Transparent Electronics Market Analysis By Technology

Technology analysis reveals a strong demand for Conductive Polymers, which will constitute approximately 51.76% of the market share in 2023. Metal Oxide technologies will also play a significant role, especially in display technologies where transparency is key. Nanomaterials are gaining traction due to their unique properties and potential applications.

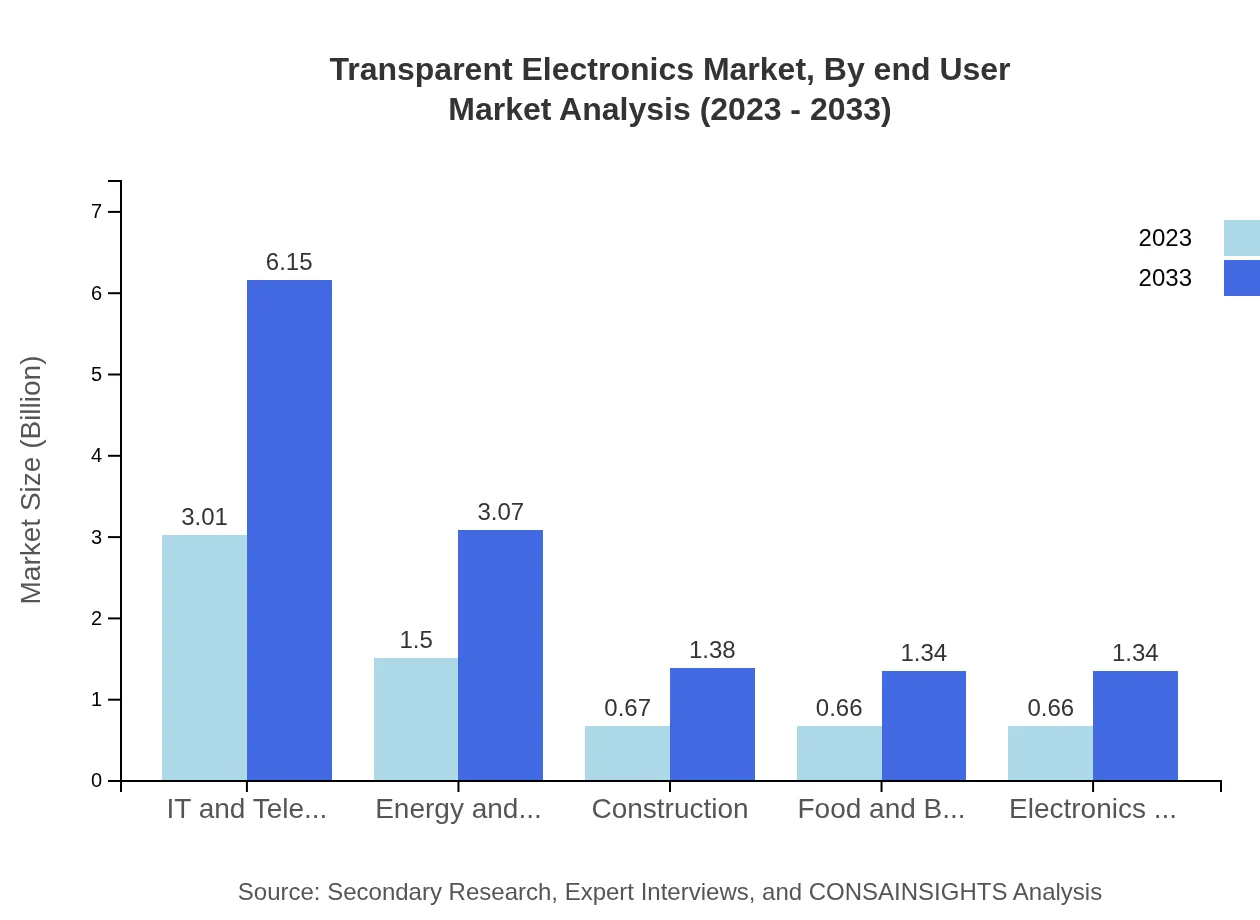

Transparent Electronics Market Analysis By End User

The key end-user segments include Consumer Electronics, Automotive, and Healthcare. The Consumer Electronics industry alone is projected to hold 46.32% of the total market share in 2023. Growth within the automotive sector is driven by the increasing demand for advanced display technologies and smart dashboards.

Transparent Electronics Market Analysis By Region Analysis Methods

Market analysis methods employed include qualitative and quantitative frameworks to assess trends and opportunities. Qualitative analysis focuses on consumer behavior, while quantitative analysis utilizes statistical parameters for more precise forecasting. Competitive analysis is also vital in identifying market leaders and understanding their strategies.

Transparent Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transparent Electronics Industry

Samsung Electronics:

A leader in the global electronics market, Samsung is at the forefront of transparent display technology and has made significant investments in developing innovative applications across various sectors.LG Display:

Known for its cutting-edge display technologies, LG Display is pioneering initiatives in transparent OLED panels, enhancing capabilities in various consumer and industrial applications.Corning Incorporated:

Specializing in glass and ceramics, Corning has developed transparent materials suitable for electronic applications, which has significantly contributed to the growth of the Transparent Electronics sector.We're grateful to work with incredible clients.

FAQs

What is the market size of transparent Electronics?

The transparent electronics market is projected to reach $6.5 billion by 2033, growing at a CAGR of 7.2%. This growth is fueled by rising demand for transparent displays and sensors across various industries.

What are the key market players or companies in this transparent electronics industry?

Leading companies in the transparent electronics market include major tech firms known for innovative display technologies, sensor manufacturers, and firms specializing in conductive materials. Their research and development efforts significantly drive market growth.

What are the primary factors driving the growth in the transparent electronics industry?

Key drivers include technological advancements in display technology, increasing adoption of smart devices, and the demand for lightweight, energy-efficient materials across applications such as automotive and consumer electronics.

Which region is the fastest Growing in the transparent electronics market?

The fastest-growing region is North America, projected to grow from $2.52 billion in 2023 to $5.15 billion by 2033. This growth is driven by technological advancements and significant investments in R&D.

Does ConsaInsights provide customized market report data for the transparent electronics industry?

Yes, ConsaInsights offers tailored market reports to meet specific business needs through customized analysis, delivering unique insights to help clients make informed strategic decisions within the transparent electronics industry.

What deliverables can I expect from this transparent electronics market research project?

Expected deliverables include comprehensive market analysis, segment insights, competitive landscape, trends, and forecasts with detailed data on market size, growth rates, and key player strategies.

What are the market trends of transparent electronics?

Emerging trends include the adoption of flexible and durable transparent materials, integration of augmented reality features in displays, and increasing focus on sustainability in manufacturing processes.