Transplant Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: transplant-diagnostics

Transplant Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Transplant Diagnostics market, including market size, growth forecasts, industry analysis, regional performance, and key trends from 2023 to 2033.

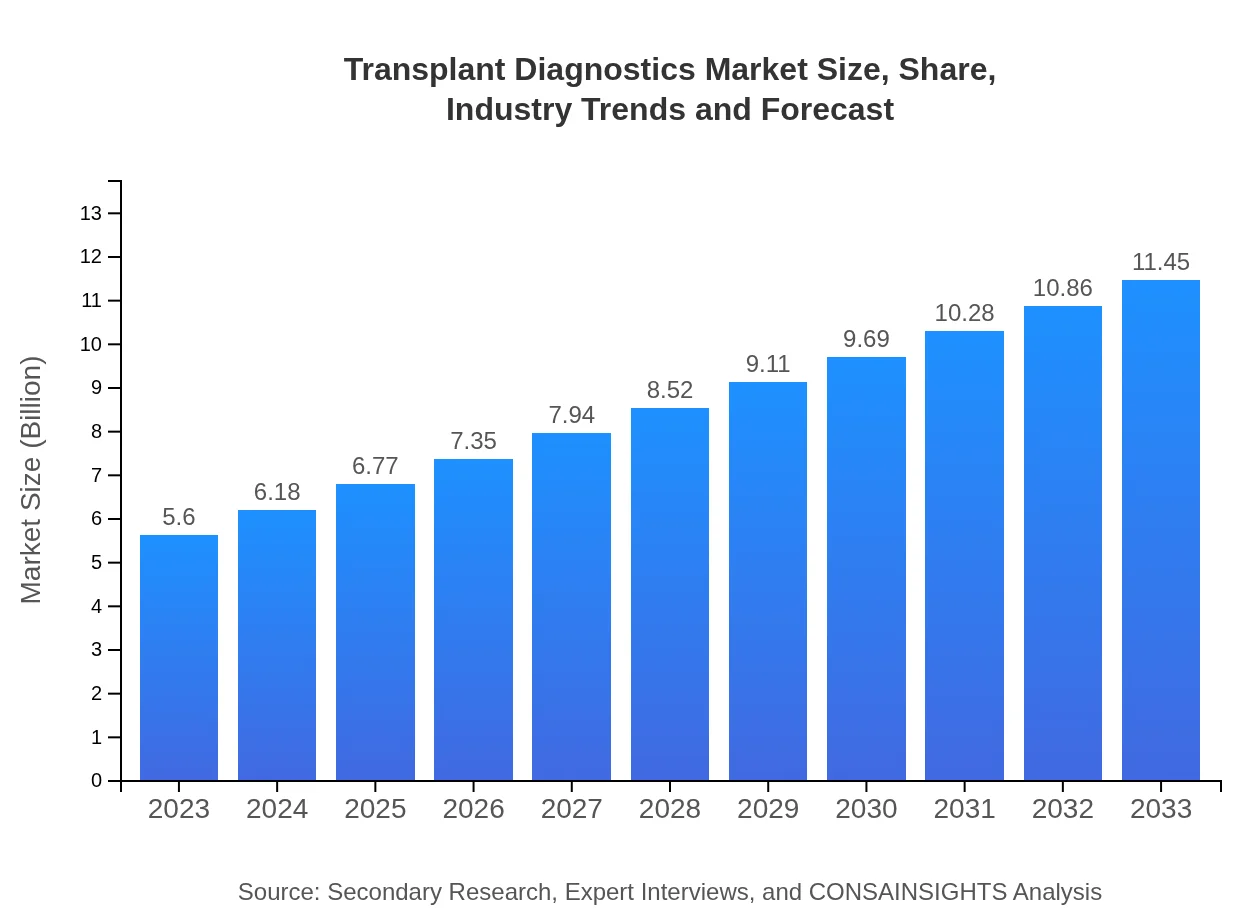

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Thermo Fisher Scientific, Abbott Laboratories, Hoffmann-La Roche AG, F. Hoffmann-La Roche AG, Bio-Rad Laboratories |

| Last Modified Date | 31 January 2026 |

Transplant Diagnostics Market Overview

Customize Transplant Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Transplant Diagnostics market size, growth, and forecasts.

- ✔ Understand Transplant Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transplant Diagnostics

What is the Market Size & CAGR of Transplant Diagnostics market in 2023?

Transplant Diagnostics Industry Analysis

Transplant Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transplant Diagnostics Market Analysis Report by Region

Europe Transplant Diagnostics Market Report:

Europe's market is projected to increase from USD 1.48 billion in 2023 to USD 3.02 billion by 2033. Factors such as government initiatives for organ donor programs and strong regulatory frameworks for diagnostic products enhance the market's growth prospects.Asia Pacific Transplant Diagnostics Market Report:

The Asia Pacific region shows a promising market, projected to grow from USD 1.09 billion in 2023 to USD 2.24 billion by 2033. This growth is fueled by rising healthcare spending, increasing awareness of organ donation, and more advanced diagnostic technologies being adopted in countries like India and China.North America Transplant Diagnostics Market Report:

North America leads the market with an anticipated growth from USD 2.18 billion in 2023 to USD 4.45 billion by 2033. The growth is driven by the region’s sophisticated healthcare system, high organ transplant rates, and continuous innovation in transplant diagnostic technologies.South America Transplant Diagnostics Market Report:

In South America, the Transplant Diagnostics market is set to expand from USD 0.44 billion in 2023 to USD 0.90 billion by 2033. Factors such as improving healthcare infrastructure and growing prevalence of chronic diseases are contributing to increased demand for transplant diagnostics.Middle East & Africa Transplant Diagnostics Market Report:

The Middle East and Africa market is expected to see growth from USD 0.41 billion in 2023 to USD 0.83 billion by 2033. Increasing healthcare investments and rising demand for advanced diagnostic solutions to improve transplantation outcomes are key contributors to market growth in this region.Tell us your focus area and get a customized research report.

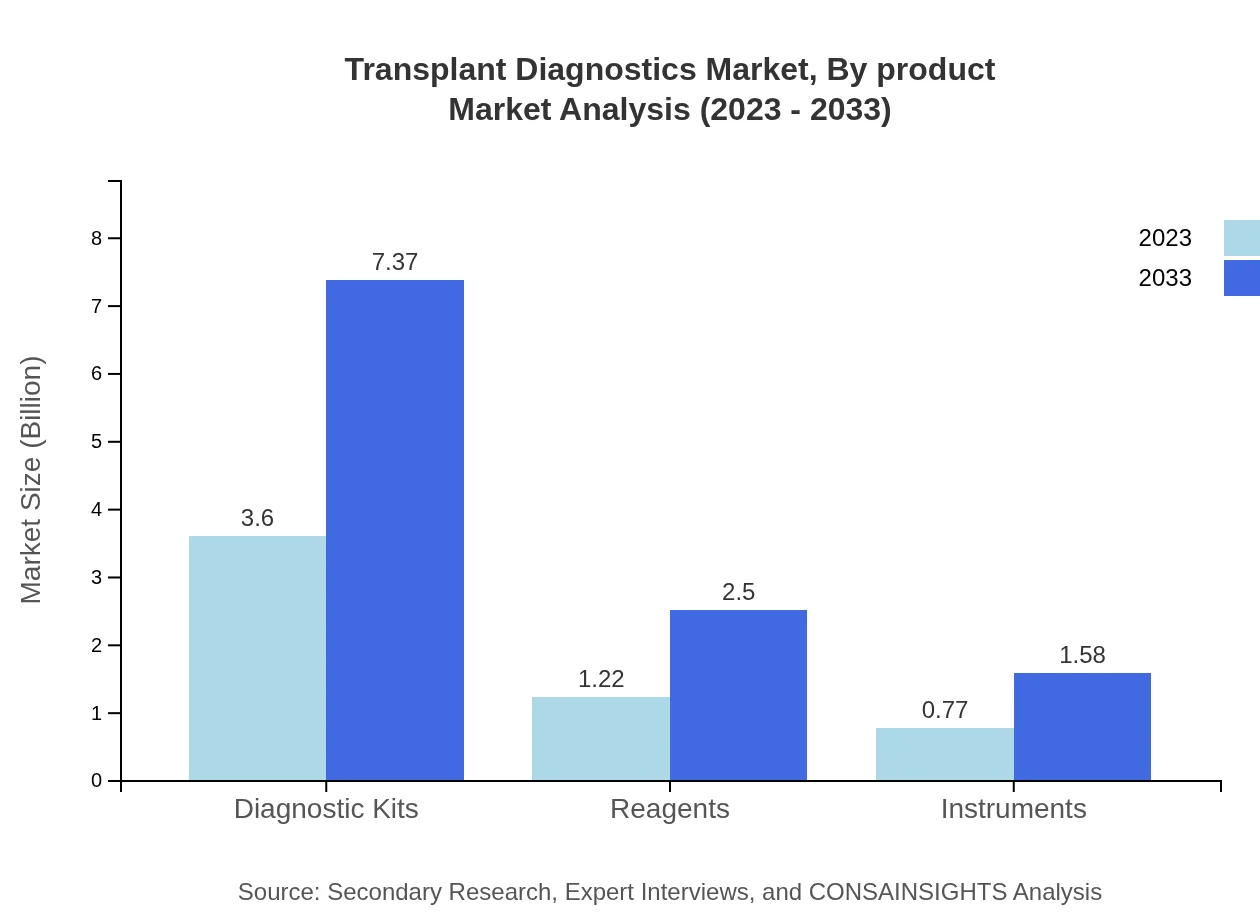

Transplant Diagnostics Market Analysis By Product

The diagnostic kits segment dominates the Transplant Diagnostics market, projected to grow from USD 3.60 billion in 2023 to USD 7.37 billion by 2033, holding a market share of 64.34% throughout the forecast period. This is followed by reagents, expected to rise from USD 1.22 billion to USD 2.50 billion with a share of 21.87%, and instruments with a projected increase from USD 0.77 billion to USD 1.58 billion representing 13.79% of the market.

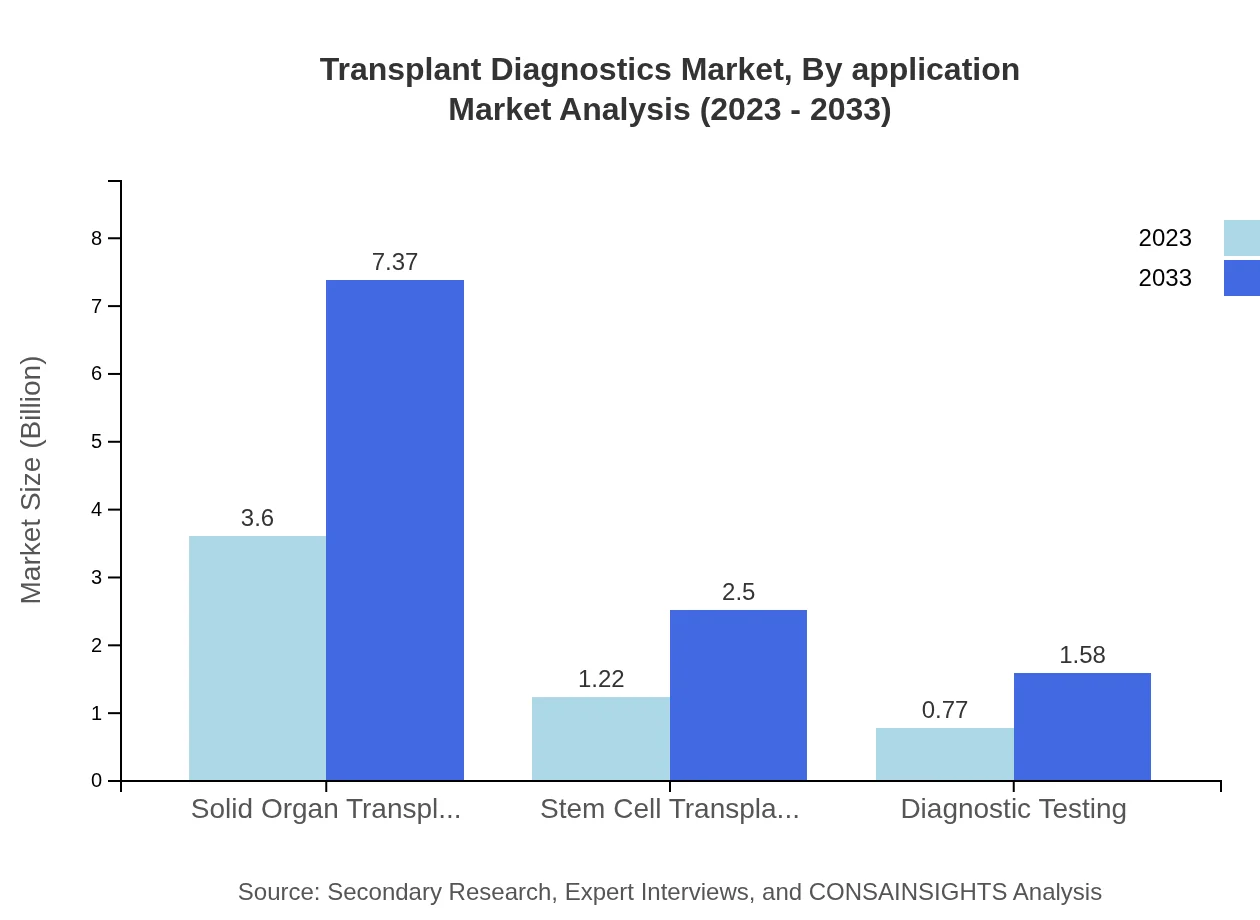

Transplant Diagnostics Market Analysis By Application

The major application in the transplant diagnostics market is solid organ transplantation, projected to grow from USD 3.60 billion in 2023 to USD 7.37 billion by 2033, maintaining a consistent share of 64.34%. Stem cell transplantation follows, with an increase from USD 1.22 billion to USD 2.50 billion and a 21.87% market share. Diagnostic testing also holds significance, growing from USD 0.77 billion to USD 1.58 billion, accounting for 13.79% of the segment.

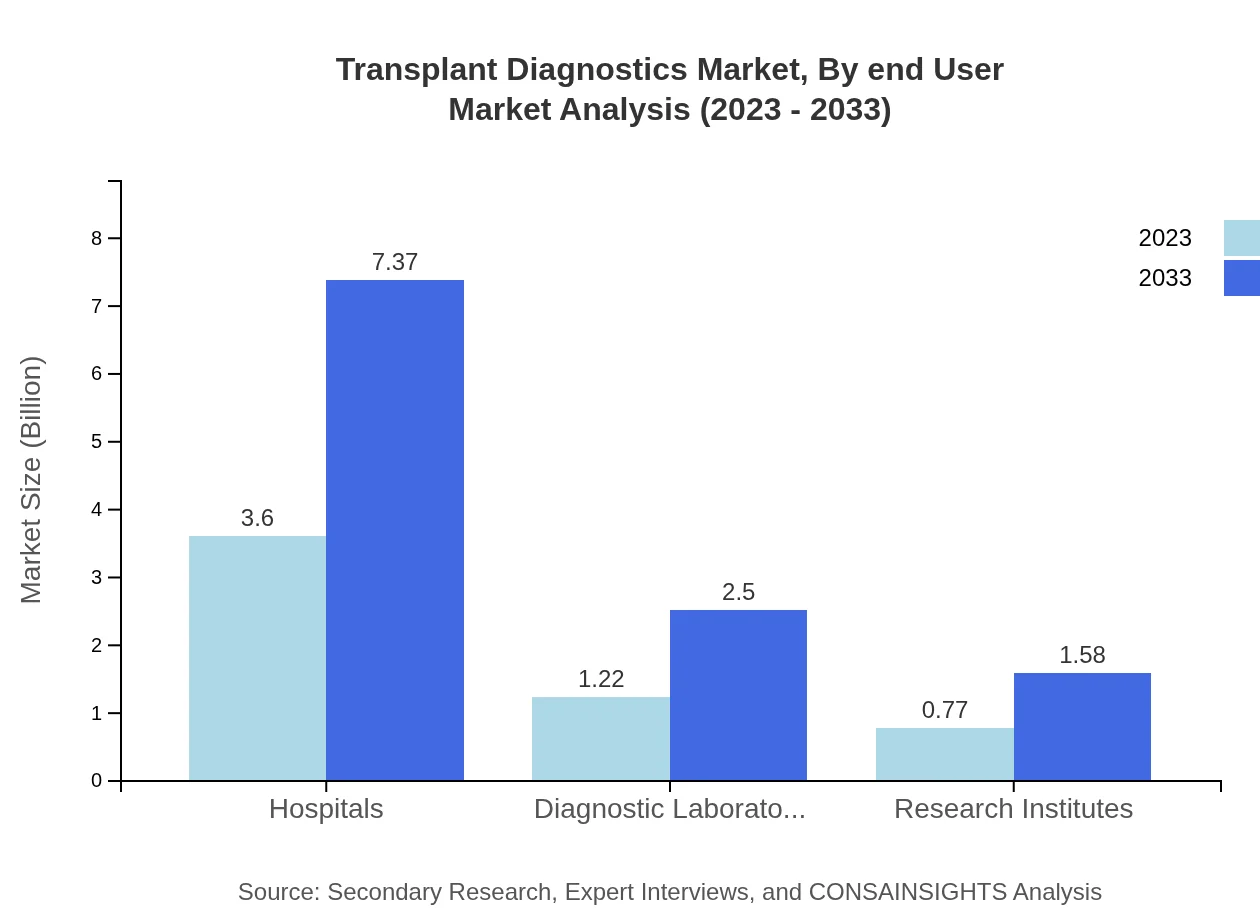

Transplant Diagnostics Market Analysis By End User

Hospitals are expected to remain the leading end-users in the Transplant Diagnostics market, growing from USD 3.60 billion in 2023 to USD 7.37 billion by 2033, constituting a 64.34% market share. Diagnostic laboratories will experience growth from USD 1.22 billion to USD 2.50 billion, holding a 21.87% share, while research institutes are projected to grow from USD 0.77 billion to USD 1.58 billion, holding 13.79% of the market.

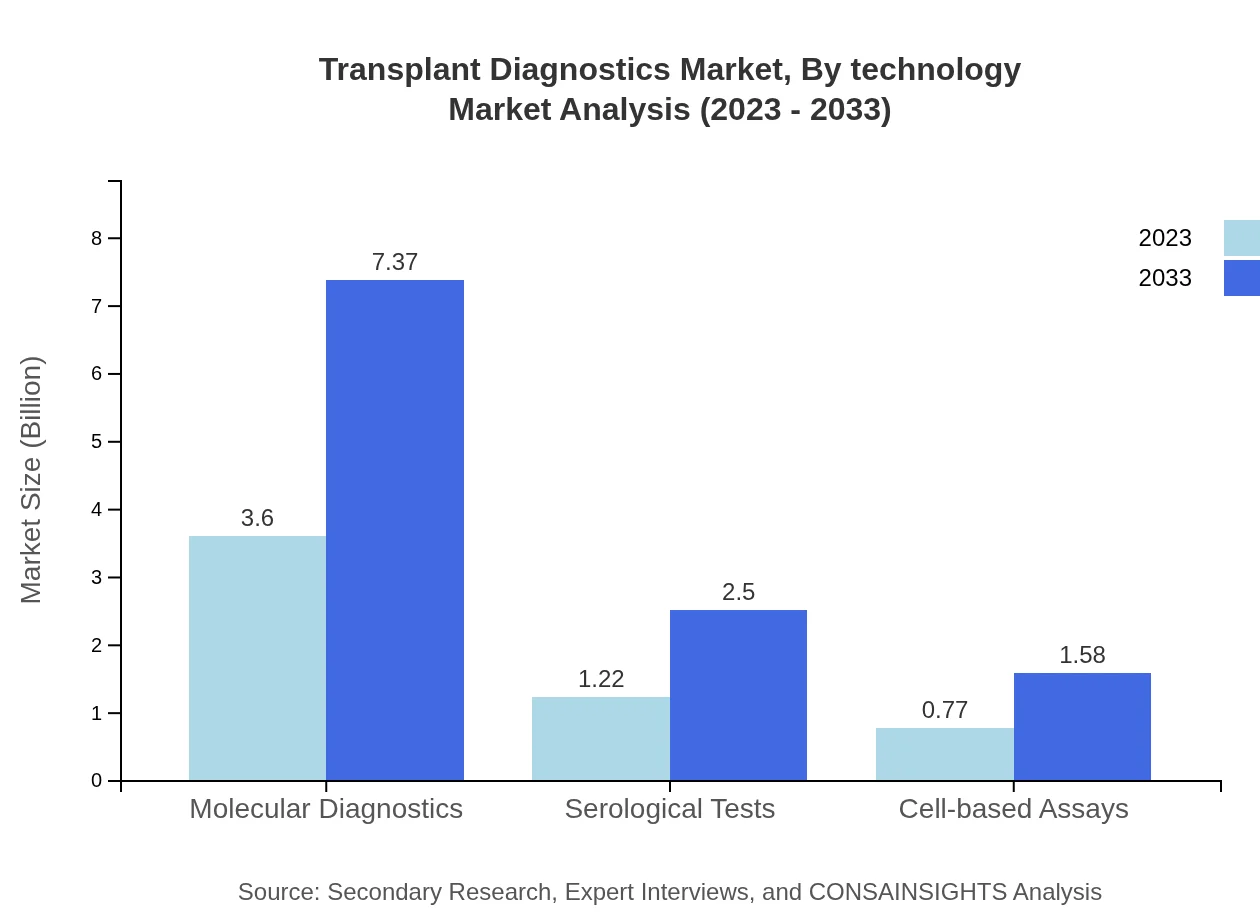

Transplant Diagnostics Market Analysis By Technology

Molecular diagnostics continues to dominate, with market size growing from USD 3.60 billion in 2023 to USD 7.37 billion by 2033, maintaining a share of 64.34%. Serological tests also grow significantly, expected to reach USD 1.22 billion by 2033, contributing a 21.87% market share. Cell-based assays, meanwhile, are expected to increase from USD 0.77 billion to USD 1.58 billion, accounting for 13.79% of the market.

Transplant Diagnostics Market Analysis By Region

Global Transplant Diagnostics Market, By Region Market Analysis (2023 - 2033)

Regional segmentation reveals differentiated growth trajectories, with North America leading in market size followed by Europe, Asia Pacific, and emerging markets in South America and the Middle East. Each region presents unique drivers such as healthcare infrastructure development, awareness campaigns, and governmental policies aimed at enhancing transplant procedures and outcomes.

Transplant Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transplant Diagnostics Industry

Thermo Fisher Scientific:

A leader in the biosciences sector, Thermo Fisher offers extensive product portfolios, including advanced diagnostic solutions for transplant diagnostics, contributing significantly to the field's development.Abbott Laboratories:

Abbott specializes in diagnostic products and has invested heavily in transplant diagnostics, providing innovative testing solutions and technological advancements.Hoffmann-La Roche AG:

Roche is a powerful player in diagnostics, providing a vast range of tests and reagents for organ transplant monitoring and improvement of patient care.F. Hoffmann-La Roche AG:

With an extensive portfolio of diagnostic tools and technologies, Roche addresses major challenges in post-transplant care and organ matching.Bio-Rad Laboratories:

Bio-Rad is known for its cutting-edge diagnostic products, including assay kits vital for transplant diagnostics, enhancing patient outcomes and research.We're grateful to work with incredible clients.

FAQs

What is the market size of transplant diagnostics?

The global market size of transplant diagnostics is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.2% from its current valuation. This growth reflects the increasing demand for effective transplant procedures and the rising incidence of transplant surgeries.

What are the key market players or companies in this transplant diagnostics industry?

Key players in the transplant diagnostics industry include prominent companies that specialize in diagnostic kits, reagents, and laboratory instruments, which cater to hospitals and diagnostic laboratories. Their innovation and R&D efforts drive the competitive landscape and patient care advancements.

What are the primary factors driving the growth in the transplant diagnostics industry?

Factors driving growth in transplant diagnostics include technological advancements in molecular diagnostics, rising prevalence of chronic diseases, increased organ transplantation rates, and the growing awareness of transplant compatibility testing among healthcare providers and patients.

Which region is the fastest Growing in the transplant diagnostics market?

The fastest-growing region in the transplant diagnostics market is North America, where the market size is expected to grow from $2.18 billion in 2023 to $4.45 billion by 2033. This growth is attributed to advanced healthcare infrastructure and a high rate of organ transplants.

Does ConsaInsights provide customized market report data for the transplant diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the transplant diagnostics industry, allowing stakeholders to gain insights relevant to their strategic interests and operational requirements.

What deliverables can I expect from this transplant diagnostics market research project?

Deliverables from the transplant diagnostics market research project typically include detailed reports on market size, trends, segment analysis, regional insights, competitive landscapes, and forecasts, providing comprehensive data to inform business strategies.

What are the market trends of transplant diagnostics?

Market trends in transplant diagnostics highlight a shift towards personalized medicine, increased use of molecular diagnostic techniques, and the growing emphasis on non-invasive testing methods, which enhance patient outcomes and streamline transplant processes.