Transportation Composites Market Report

Published Date: 02 February 2026 | Report Code: transportation-composites

Transportation Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Transportation Composites market, including insights on market size, growth forecasts, trends, and the competitive landscape between 2023 and 2033.

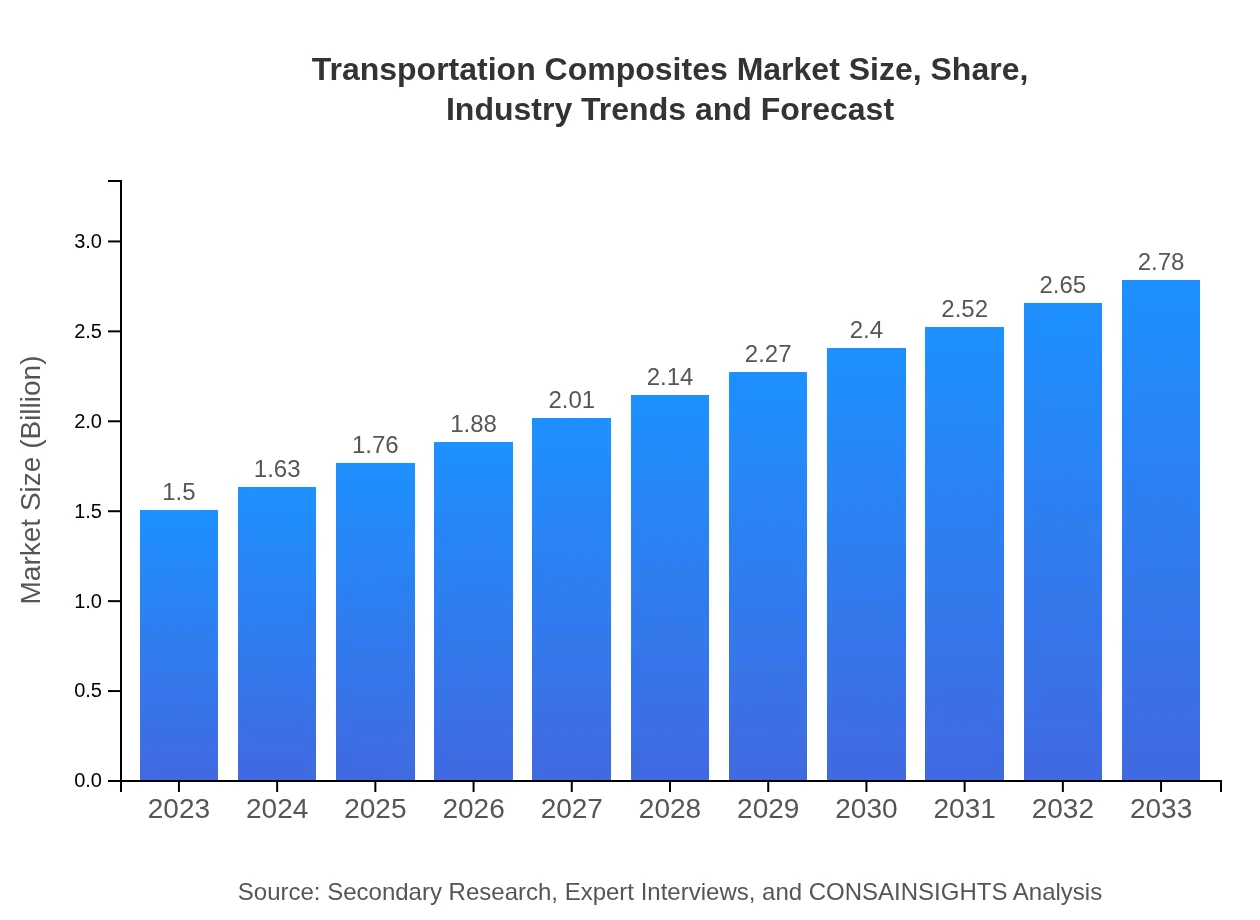

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Hexcel Corporation, Toray Industries, SABIC, BASF |

| Last Modified Date | 02 February 2026 |

Transportation Composites Market Overview

Customize Transportation Composites Market Report market research report

- ✔ Get in-depth analysis of Transportation Composites market size, growth, and forecasts.

- ✔ Understand Transportation Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transportation Composites

What is the Market Size & CAGR of Transportation Composites market in 2023?

Transportation Composites Industry Analysis

Transportation Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transportation Composites Market Analysis Report by Region

Europe Transportation Composites Market Report:

In Europe, the Transportation Composites market is worth $0.46 billion in 2023 and is anticipated to reach $0.85 billion by 2033. The European market benefits from robust regulations promoting sustainable practices and innovation in transport materials.Asia Pacific Transportation Composites Market Report:

In 2023, the Transportation Composites market in the Asia Pacific region is valued at approximately $0.26 billion, projected to grow to $0.49 billion by 2033. Key growth factors include the booming automotive sector in countries like China and India, alongside increasing aerospace activities due to rising air travel.North America Transportation Composites Market Report:

North America leads the global market, with a size of $0.56 billion in 2023, escalating to $1.05 billion by 2033. The automotive sector’s focus on lightweight materials and stringent emissions regulations are major contributors to this growth.South America Transportation Composites Market Report:

The market in South America is relatively smaller, with a size of $0.04 billion in 2023, expected to rise to $0.07 billion by 2033. Factors influencing this market include infrastructural developments and growing demand for eco-friendly transport solutions.Middle East & Africa Transportation Composites Market Report:

The Middle East and Africa market, evaluated at $0.18 billion in 2023, is estimated to increase to $0.33 billion by 2033. Growth is driven by rising investments in infrastructure and advances in the transportation sector.Tell us your focus area and get a customized research report.

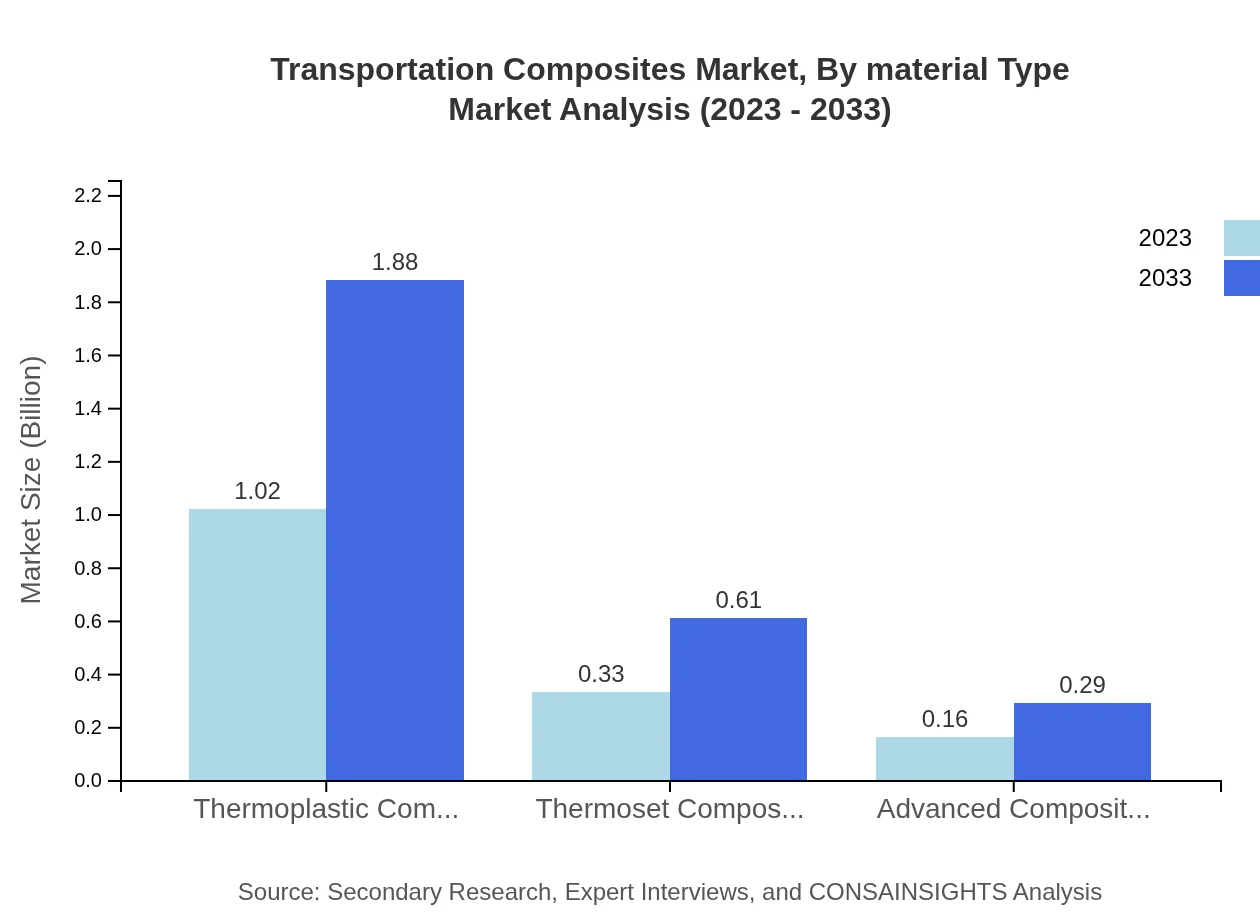

Transportation Composites Market Analysis By Material Type

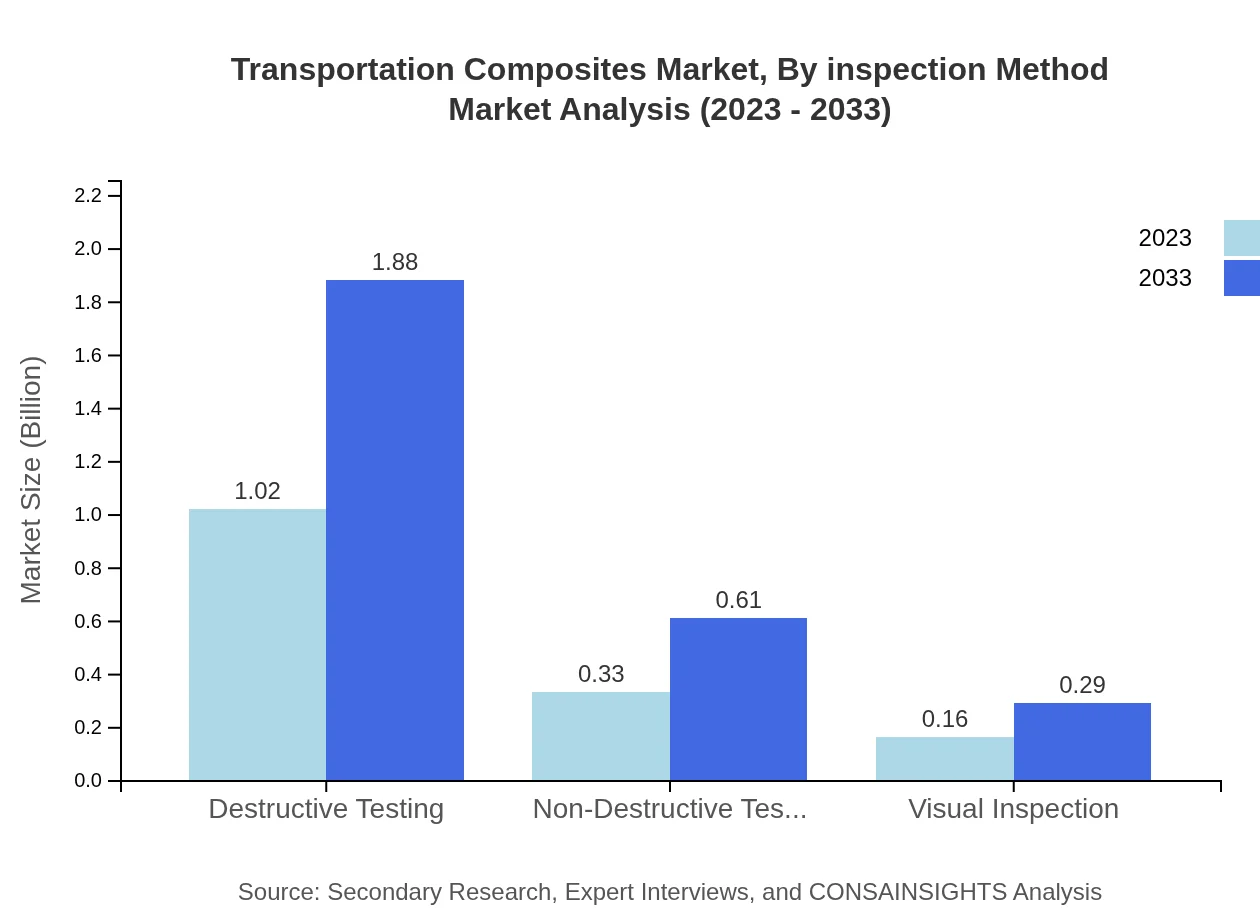

Thermoplastic composites dominate the market, growing from $1.02 billion in 2023 to $1.88 billion by 2033, holding 67.7% market share. Thermoset composites, while smaller, exhibit steady growth from $0.33 billion to $0.61 billion, capturing 21.87% share. Advanced composites contribute minor but significant growth, appealing to niche applications.

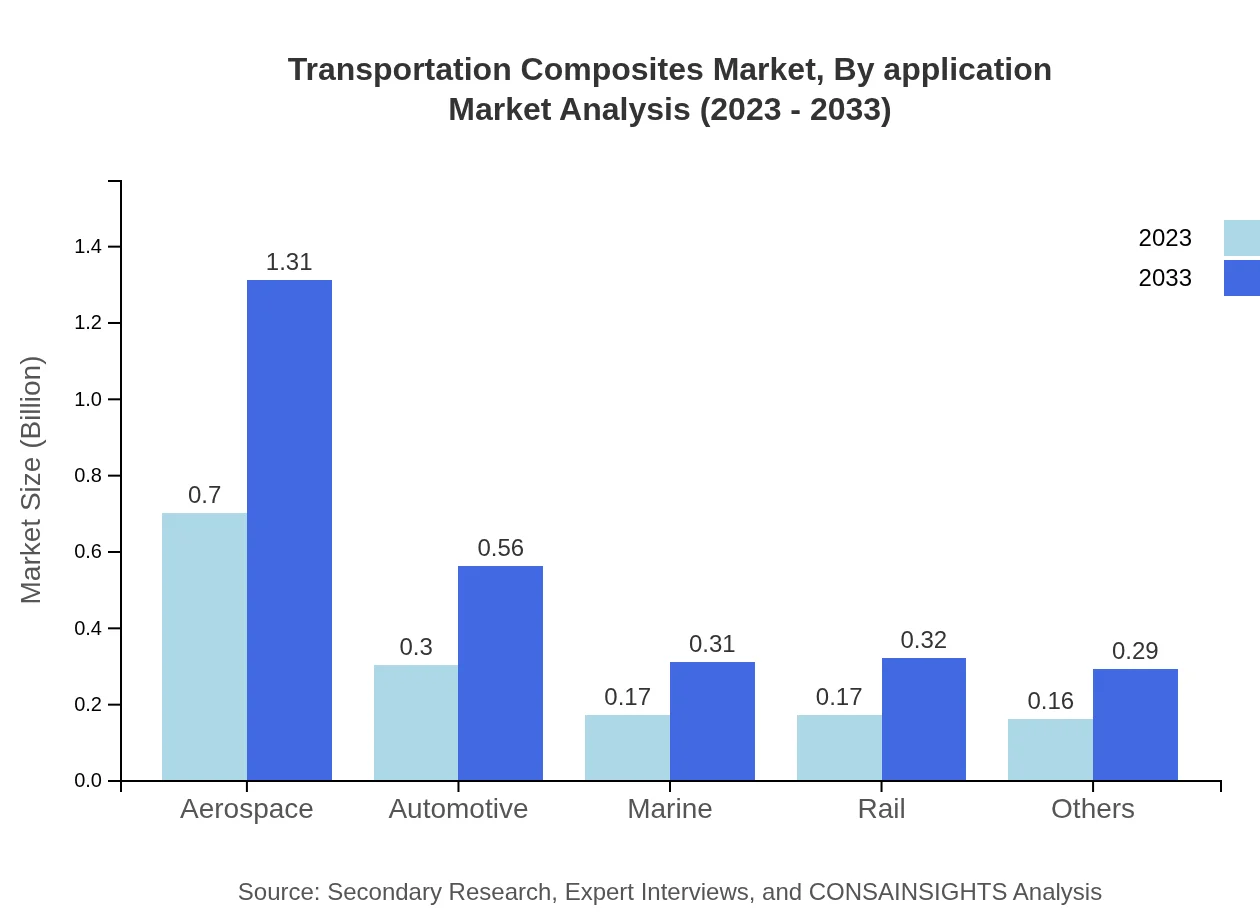

Transportation Composites Market Analysis By Application

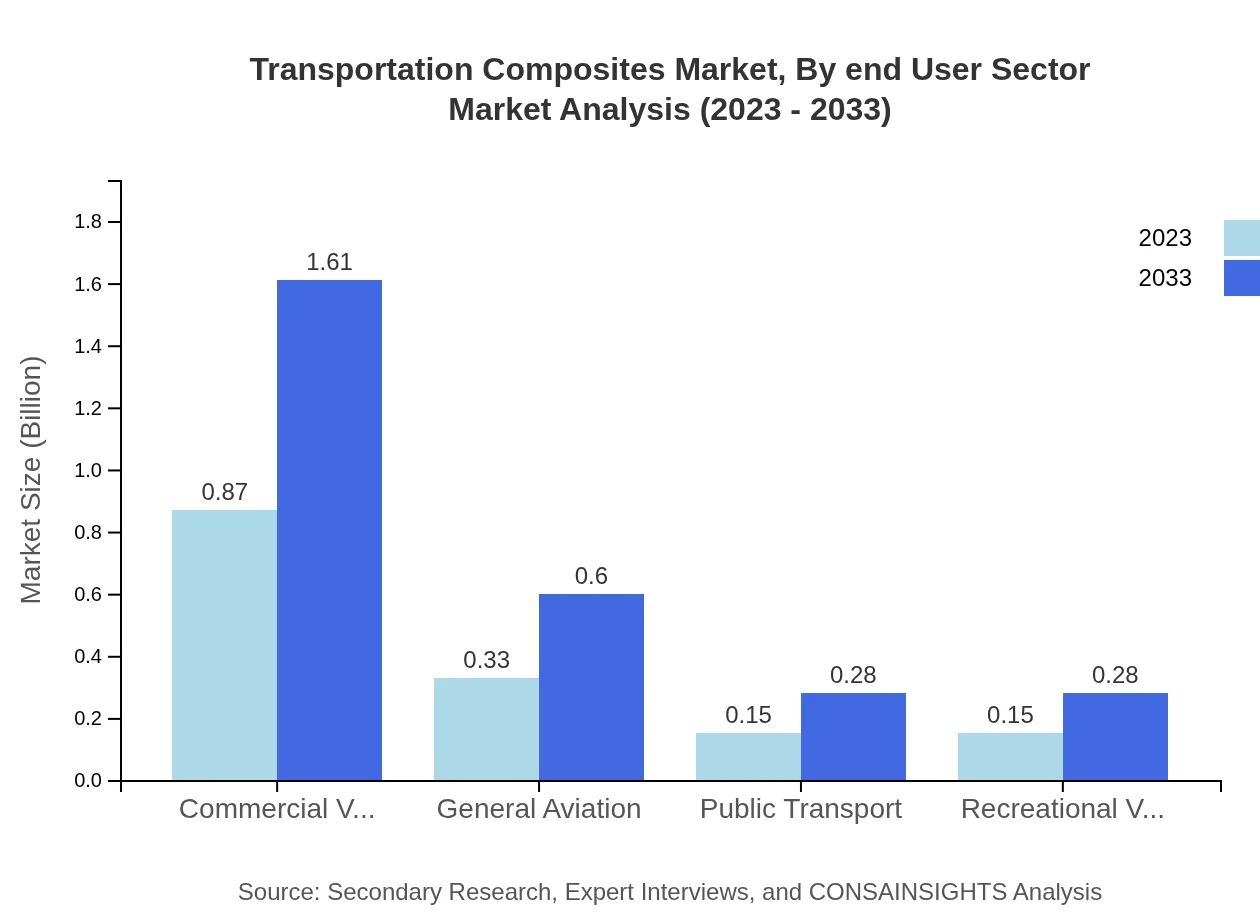

Key applications include Aerospace (growing from $0.70 billion to $1.31 billion) and Automotive (increasing from $0.30 billion to $0.56 billion). The Commercial Vehicles segment remains substantial, expanding from $0.87 billion to $1.61 billion, driven by demand for lighter, durable materials.

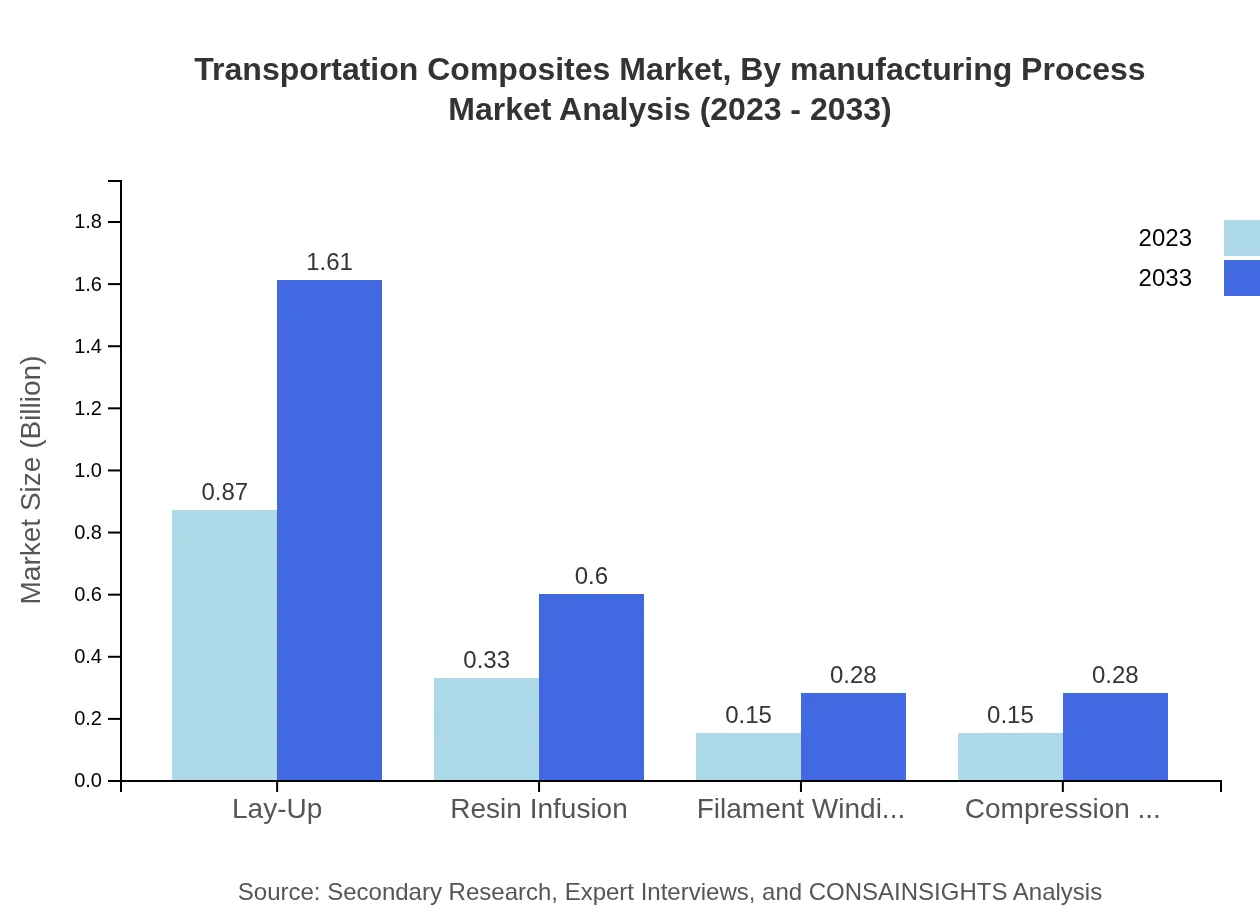

Transportation Composites Market Analysis By Manufacturing Process

Lay-up and resin infusion processes dominate this segment, with lay-up projected to grow from $0.87 billion to $1.61 billion. Destructive testing and non-destructive testing also contribute significant value, underscoring the emphasis on quality and material assessment.

Transportation Composites Market Analysis By End User Sector

The aerospace and automotive sectors remain the largest consumers of composites, due to their demand for lightweight and high-strength materials. Public transport and recreational vehicles sectors are also emerging as vital due to environmental concerns and the shift towards greener solutions.

Transportation Composites Market Analysis By Inspection Method

Destructive testing continues to lead with a market size of $1.02 billion in 2023, expected to reach $1.88 billion by 2033, focusing on ensuring material integrity. Non-destructive testing is also essential, growing from $0.33 billion to $0.61 billion, reflecting industry focus on manifest reliability.

Transportation Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transportation Composites Industry

Hexcel Corporation:

A leading manufacturer of advanced composite materials, Hexcel specializes in high-performance composites for aerospace and industrial applications, playing a pivotal role in the sector's innovation.Toray Industries:

Toray is a major player in the polymer and carbon fiber sectors, providing lightweight composite materials primarily for the aerospace and automotive industries, focusing on high-quality production.SABIC:

Known for its innovative approach to thermoplastics, SABIC offers a range of composite materials that cater to various transportation applications, advocating for sustainability.BASF:

A leader in chemistry, BASF produces advanced composites that are integrated into several transport applications, contributing significantly to performance improvements.We're grateful to work with incredible clients.

FAQs

What is the market size of transportation Composites?

The transportation composites market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.2% through 2033. This growth indicates increasing demand across numerous sectors within transportation.

What are the key market players or companies in this transportation Composites industry?

Key players in the transportation composites market include major manufacturers involved in aerospace, automotive, and marine sectors, focusing on innovative composite materials and sustainable production methods to meet growing environmental standards.

What are the primary factors driving the growth in the transportation Composites industry?

The growth is primarily driven by advancements in material technologies, increasing demand for lightweight materials to enhance fuel efficiency, and a growing shift towards sustainable and eco-friendly transportation solutions across the globe.

Which region is the fastest Growing in the transportation Composites?

The North American region is experiencing the fastest growth in the transportation composites market, with its market size projected to rise from $0.56 billion in 2023 to $1.05 billion by 2033, reflecting a significant expansion in automotive and aerospace applications.

Does ConsaInsights provide customized market report data for the transportation Composites industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the transportation composites industry, allowing stakeholders to gain insights relevant to their unique market segments and goals.

What deliverables can I expect from this transportation Composites market research project?

From this market research project, you can expect comprehensive reports detailing market trends, growth forecasts, competitive landscape analysis, and specific recommendations for business strategies in the transportation composites sector.

What are the market trends of transportation Composites?

Current trends in transportation composites include increasing use of thermoplastic composites for their recyclability and strength, alongside advancements in manufacturing processes like 3D printing, driving innovation and sustainability in the sector.