Transradial Access Market Report

Published Date: 31 January 2026 | Report Code: transradial-access

Transradial Access Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Transradial Access market, covering market size, trends, and forecasts from 2023 to 2033. Insights into regional performance, segmentation, and key players will guide stakeholders in understanding this evolving industry.

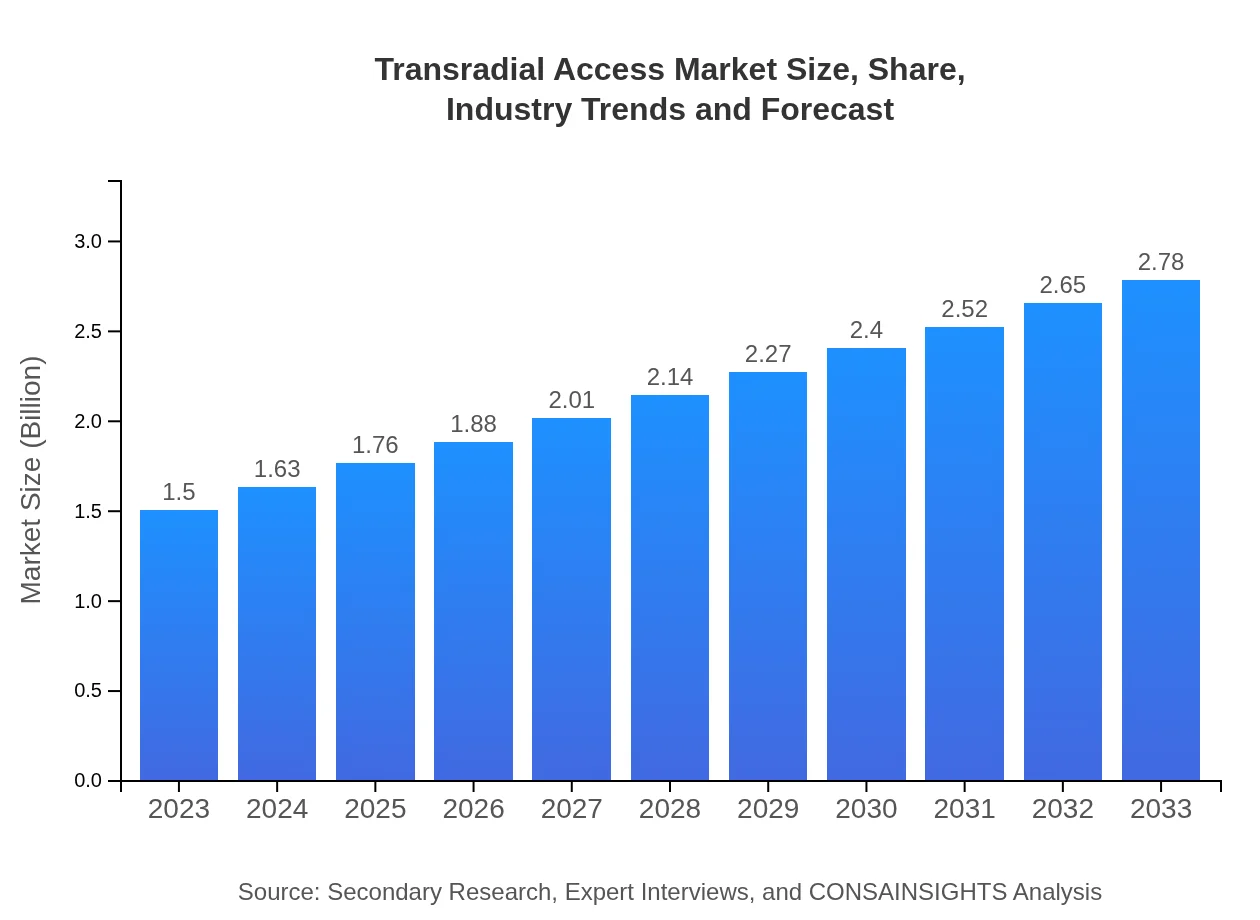

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Boston Scientific, Terumo Corporation |

| Last Modified Date | 31 January 2026 |

Transradial Access Market Overview

Customize Transradial Access Market Report market research report

- ✔ Get in-depth analysis of Transradial Access market size, growth, and forecasts.

- ✔ Understand Transradial Access's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Transradial Access

What is the Market Size & CAGR of Transradial Access market in 2023?

Transradial Access Industry Analysis

Transradial Access Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Transradial Access Market Analysis Report by Region

Europe Transradial Access Market Report:

Europe's Transradial Access market is projected to increase from $0.48 billion in 2023 to $0.89 billion by 2033. Factors contributing to this growth include favorable regulations for medical equipment, high levels of healthcare expenditure, and increasing awareness regarding the advantages of transradial access. Moreover, ongoing clinical trials further enhance market potential.Asia Pacific Transradial Access Market Report:

The Asia Pacific region is witnessing robust growth in the Transradial Access market, expected to reach $0.54 billion by 2033 from $0.29 billion in 2023. Major factors include an increase in healthcare infrastructure investments and a rise in chronic diseases. The growing number of skilled cardiologists and procedural awareness among patients also support market expansion.North America Transradial Access Market Report:

The North American market, particularly in the United States, maintains a significant share, expected to grow from $0.48 billion in 2023 to $0.90 billion by 2033. High prevalence of cardiovascular diseases, advanced healthcare facilities, and strong reimbursement policies drive growth in this region, alongside a growing preference for transradial procedures among healthcare providers.South America Transradial Access Market Report:

In South America, the market for Transradial Access is projected to grow from $0.04 billion in 2023 to $0.08 billion by 2033. Factors influencing growth include the rising adoption of advanced medical technologies and an increasing focus on improving healthcare standards. However, regional disparities in healthcare access pose challenges.Middle East & Africa Transradial Access Market Report:

In the Middle East and Africa, the market is set to increase from $0.20 billion in 2023 to $0.37 billion by 2033. Growth is primarily driven by increasing healthcare investments, improving infrastructure, and rising incidences of heart conditions. Despite challenges such as economic instability, the focus on expanding access to advanced healthcare technologies is expected to bolster the market.Tell us your focus area and get a customized research report.

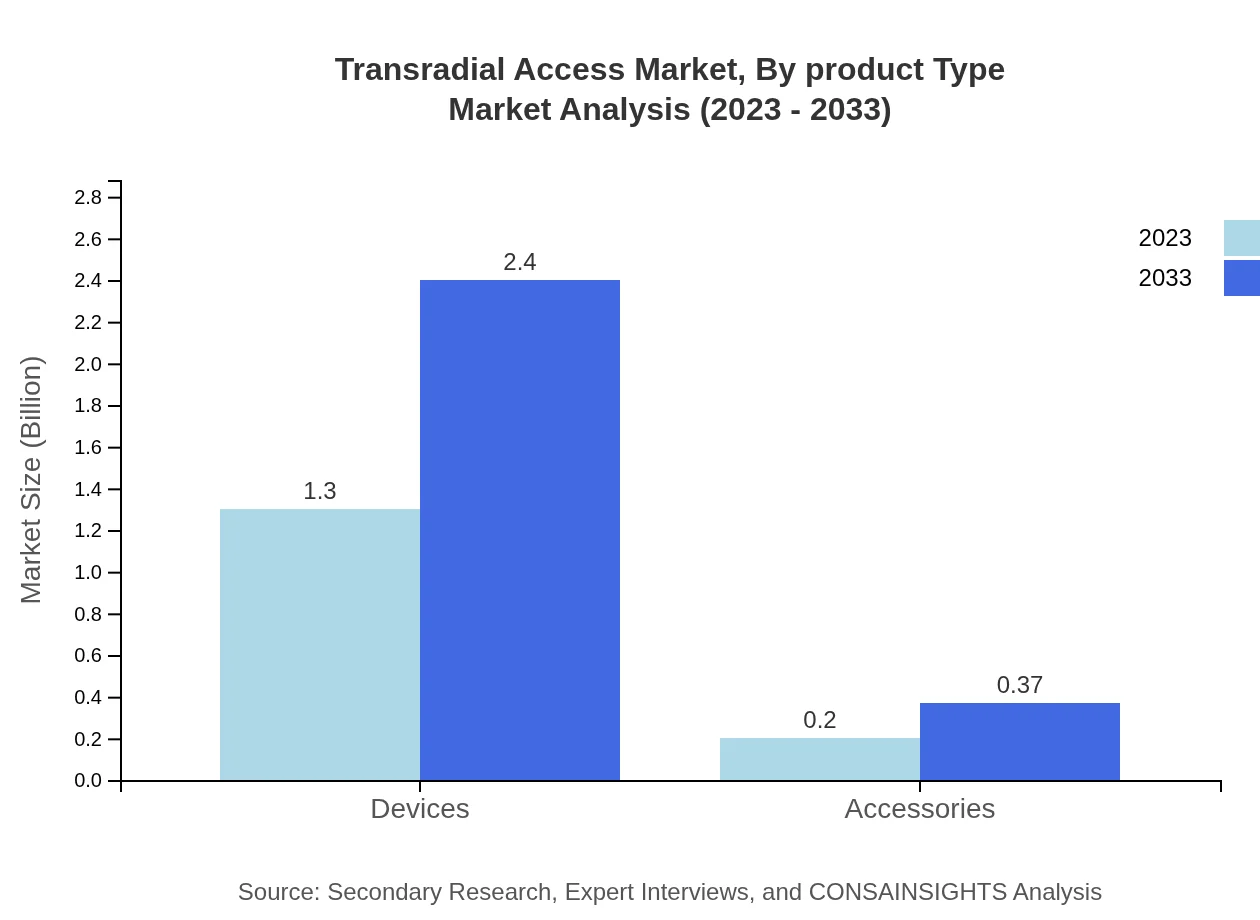

Transradial Access Market Analysis By Product Type

The product type segment of the Transradial Access market includes devices and accessories, accounting for a substantial share. By 2033, the devices segment is projected to achieve significant growth due to rising demand for innovative and safer access techniques, from $1.30 billion to $2.40 billion. Accessories also exhibit a promising growth trajectory, specifically in supporting the main devices and procedures.

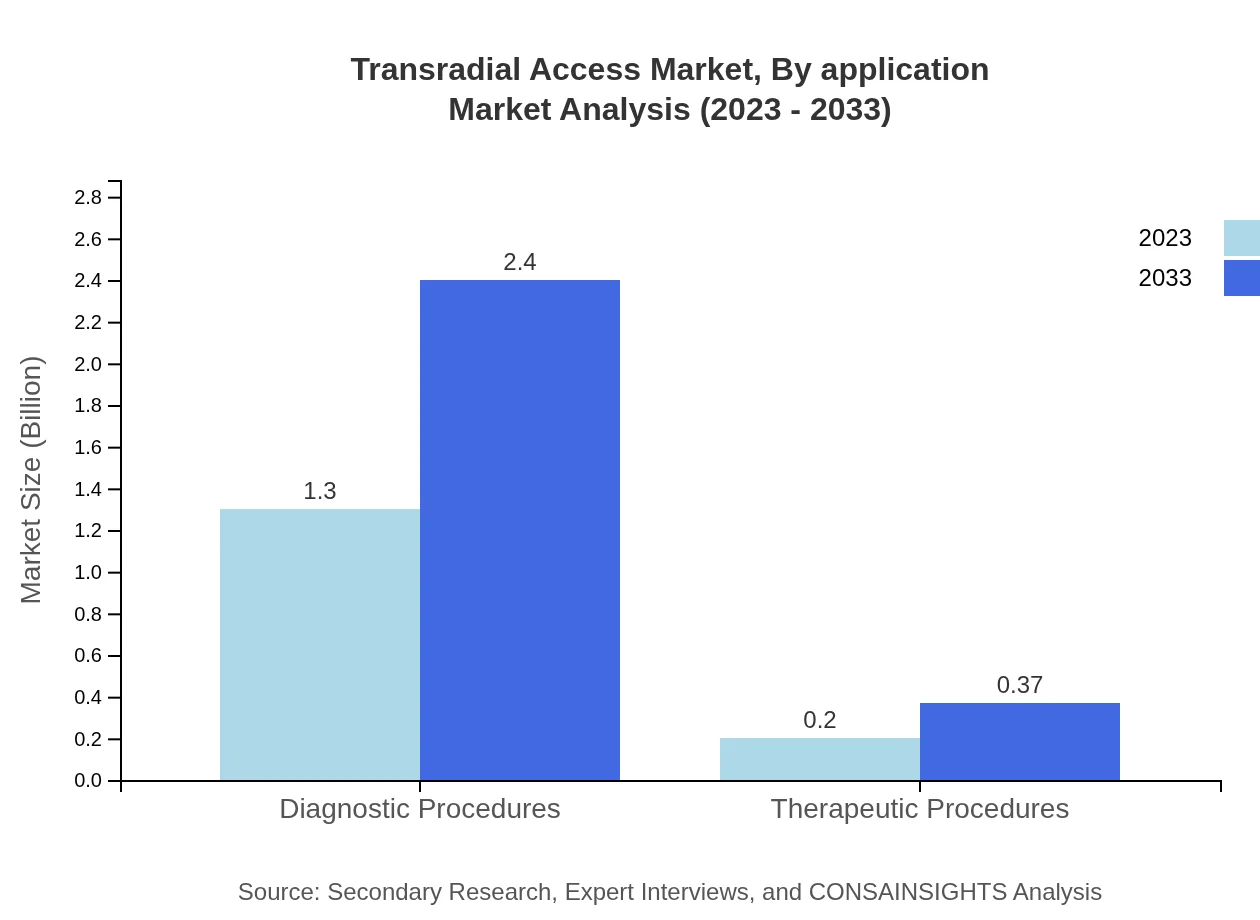

Transradial Access Market Analysis By Application

The application segment encompasses diagnostic and therapeutic procedures. Diagnostic procedures dominate the market, with a share of 86.52% in both 2023 and 2033. The rising number of cardiac diagnostic procedures significantly drives this segment, while therapeutic procedures are gradually gaining traction as hospitals and cardiologists adopt transradial methods.

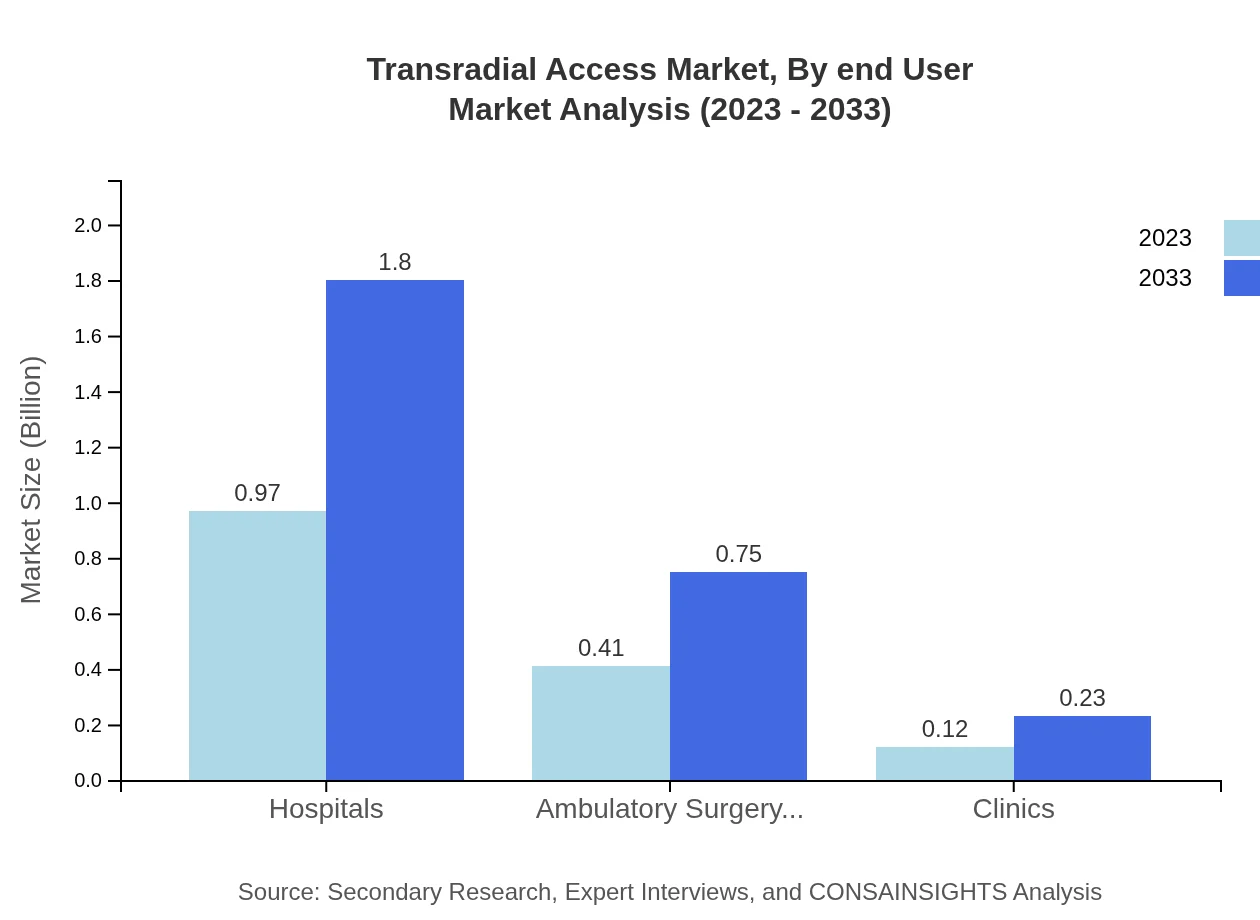

Transradial Access Market Analysis By End User

In the end-user segment, hospitals hold a leading position, with a share of 64.71% in 2023, maintaining the same share by 2033. Ambulatory surgery centers follow with a share of 27.13%, while clinics account for a smaller portion of the market at 8.16%. The trend towards outpatient care and minimally invasive surgery has increased the relevance of ambulatory centers.

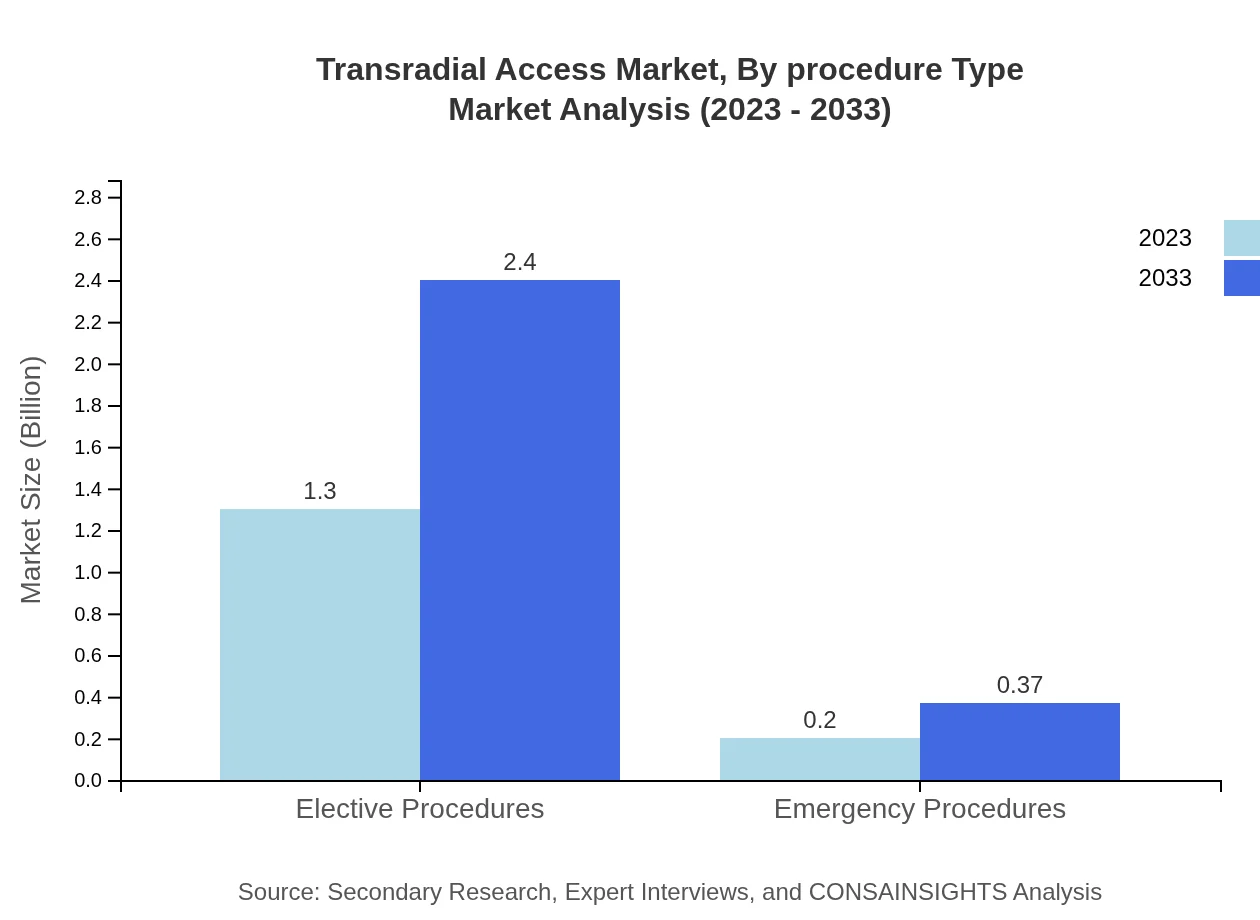

Transradial Access Market Analysis By Procedure Type

The procedure type segment includes elective and emergency procedures. Elective procedures represent the majority share at 86.52% in both 2023 and 2033, as they comprise scheduled interventions prevalent in Transradial Access. Emergency procedures, while smaller in share at 13.48%, are crucial for expanding the overall access and acceptance of the technique.

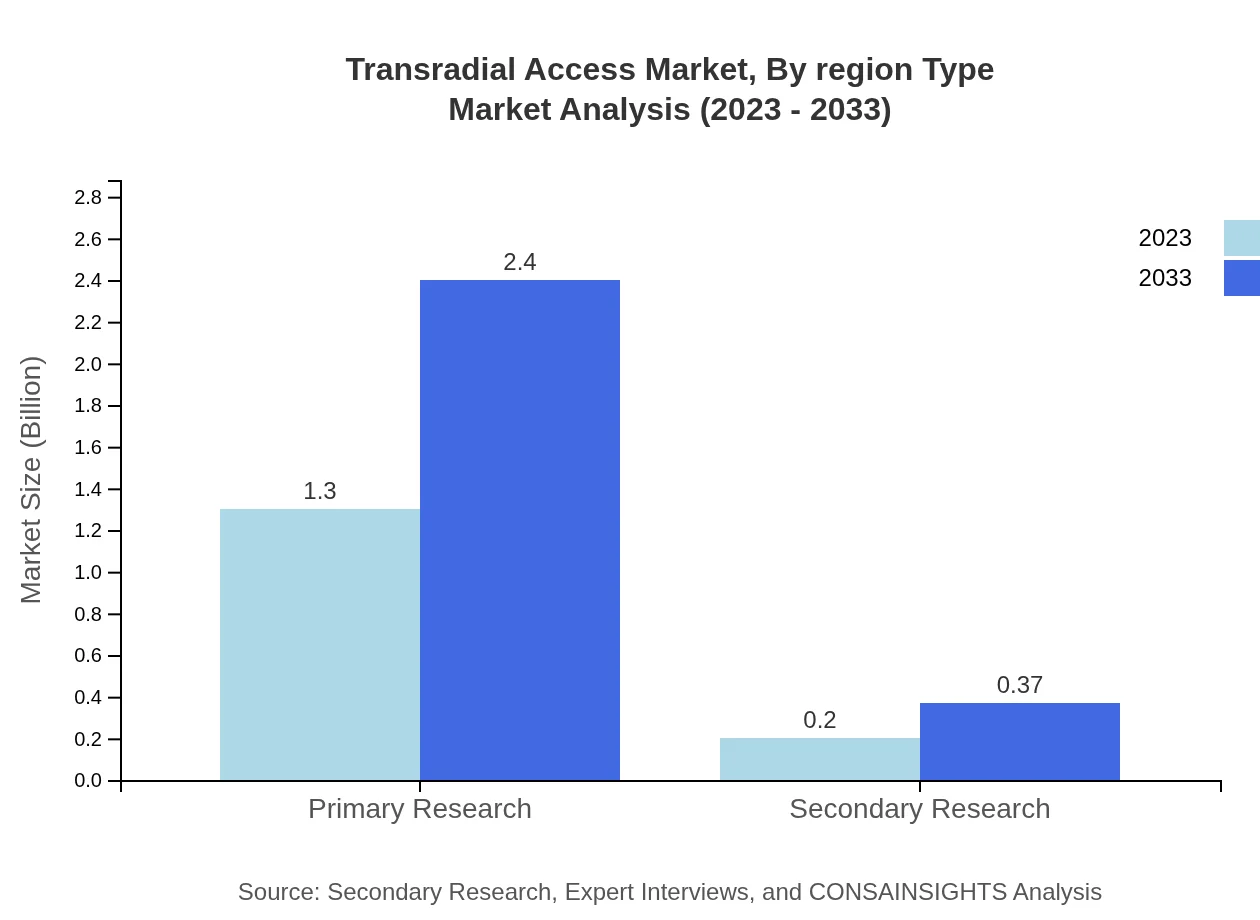

Transradial Access Market Analysis By Region Type

Research methodology for the Transradial Access market includes primary and secondary research. Primary research indicates growing engagement with healthcare professionals to evaluate device effectiveness. Secondary research illustrates market trends and provides data for understanding competitive dynamics. Both methodologies complement each other in offering a comprehensive market perspective.

Transradial Access Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Transradial Access Industry

Medtronic :

Medtronic is a leading global healthcare technology company, recognized for its innovations in transradial access devices, significantly enhancing safety and efficacy in cardiovascular procedures.Abbott Laboratories:

Abbott Laboratories specializes in medical devices and diagnostics, known for its commitment to advancing transradial access technology and improving patient outcomes.Boston Scientific:

Boston Scientific is renowned for its portfolio of minimally invasive medical devices, particularly in cardiology, with significant contributions to advancing transradial access techniques.Terumo Corporation:

Terumo Corporation excels in developing innovative medical devices and technologies, including transradial access solutions that cater to the evolving needs of healthcare providers.We're grateful to work with incredible clients.

FAQs

What is the market size of transradial Access?

The transradial access market is projected to reach approximately $1.5 billion by 2033, growing at a CAGR of 6.2%. This growth reflects the rising preference for less invasive cardiac procedures and advancements in medical technology.

What are the key market players or companies in the transradial Access industry?

Key players in the transradial access market include major medical device companies and healthcare providers that specialize in cardiac interventions, though specific names are proprietary to the report content. They are instrumental in driving innovation and standards.

What are the primary factors driving the growth in the transradial Access industry?

Growth in the transradial access market is primarily driven by increasing prevalence of cardiovascular diseases, technological advancements in catheter devices, and a growing trend towards minimally invasive procedures that enhance patient recovery times.

Which region is the fastest Growing in the transradial Access market?

The Asia Pacific region is witnessing significant growth in the transradial access market, projected to increase from $0.29 billion in 2023 to $0.54 billion by 2033, highlighting its emergence as a critical market for cardiovascular technologies.

Does Consainsights provide customized market report data for the transradial Access industry?

Yes, Consainsights offers customized market reports tailored to specific client needs, including in-depth analyses of trends, forecasts, and competitor landscapes within the transradial-access industry, ensuring relevant and actionable insights.

What deliverables can I expect from this transradial Access market research project?

Project deliverables include comprehensive market reports with data on market size, segments, growth forecasts, regional analysis, competitive landscape, and strategic insights, aiding stakeholders in making informed business decisions.

What are the market trends of transradial Access?

Key trends in the transradial access market include increasing adoption of innovative catheter technologies, a shift towards outpatient procedures, and ongoing investments in healthcare infrastructure, all contributing to the market's robust growth trajectory.