Travel Retail Market Report

Published Date: 01 February 2026 | Report Code: travel-retail

Travel Retail Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Travel Retail market, covering insights from market size and growth forecasts to regional assessments and competitive landscapes from 2023 to 2033.

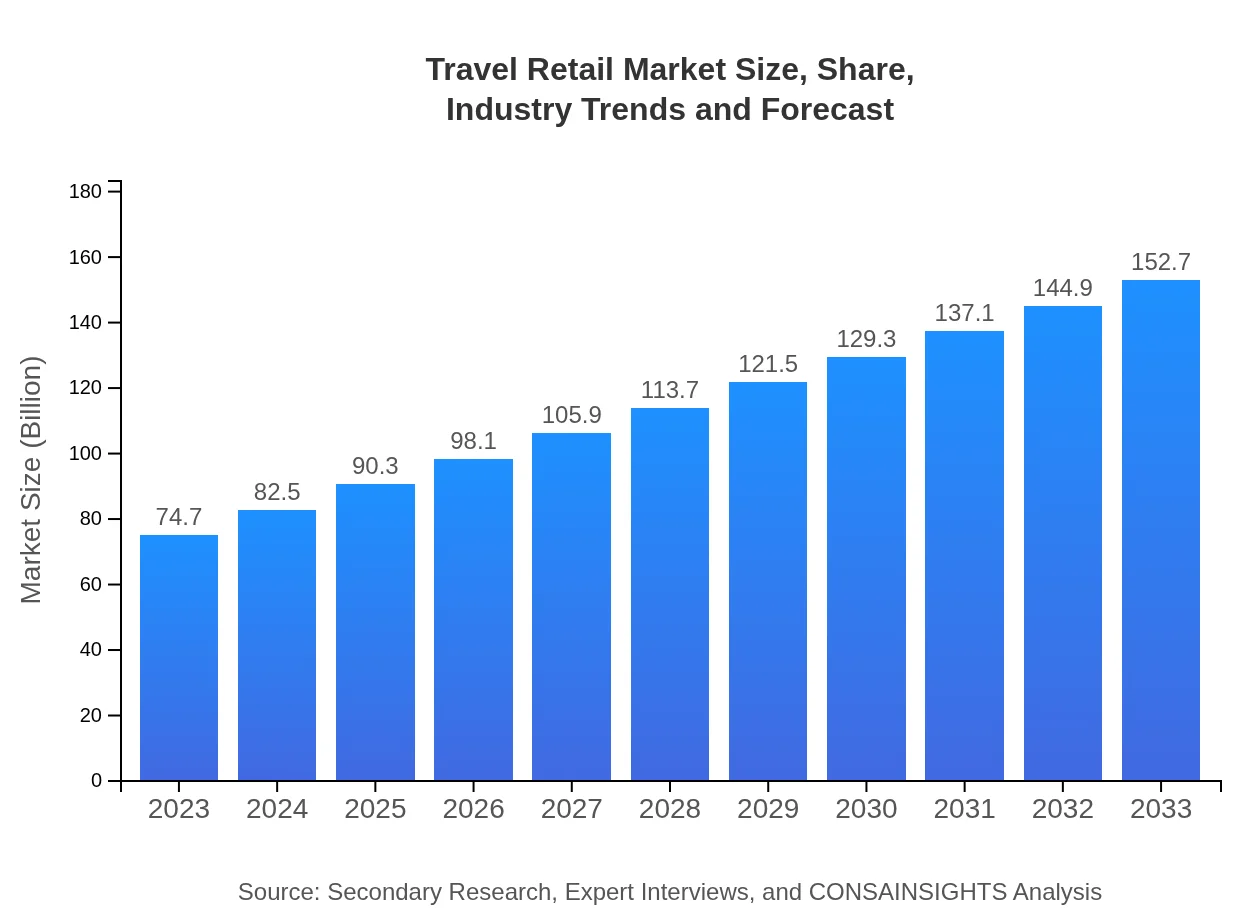

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $74.70 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $152.70 Billion |

| Top Companies | Dufry AG, Lotte Duty Free, Heinemann, King Power International, Aelia Duty Free |

| Last Modified Date | 01 February 2026 |

Travel Retail Market Overview

Customize Travel Retail Market Report market research report

- ✔ Get in-depth analysis of Travel Retail market size, growth, and forecasts.

- ✔ Understand Travel Retail's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Travel Retail

What is the Market Size & CAGR of Travel Retail market in 2023?

Travel Retail Industry Analysis

Travel Retail Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Travel Retail Market Analysis Report by Region

Europe Travel Retail Market Report:

Europe's Travel Retail market is projected to grow from $18.41 billion in 2023 to $37.62 billion by 2033. The region is a vibrant hub for international travel, with deeper duty-free regulations fostering growth across multiple product categories.Asia Pacific Travel Retail Market Report:

The Asia Pacific region, valued at $15.67 billion in 2023, is projected to reach $32.04 billion by 2033. With expanding middle-class populations and increased travel on the rise, retailers must focus on local consumer preferences and integrate technology in enhancing shopping experiences.North America Travel Retail Market Report:

North America accounted for the largest market share, valued at $28.55 billion in 2023 and expected to reach $58.36 billion by 2033. The region benefits from high spending per capita among travelers, supported by a significant increase in travel volume post-pandemic.South America Travel Retail Market Report:

In South America, the Travel Retail market was valued at $2.64 billion in 2023, with projections to reach $5.39 billion by 2033. Growth in this region is attributed to rising international travel and investment into airport retail infrastructures. Countries like Brazil and Argentina are seeing a surge in travel-based spending.Middle East & Africa Travel Retail Market Report:

The Middle East and Africa (MEA) market, valued at $9.43 billion in 2023 and forecasted to reach $19.29 billion by 2033, is experiencing rapid growth, spurred by increased travel connectivity and a booming tourism sector. Airports are investing heavily in luxury retail.Tell us your focus area and get a customized research report.

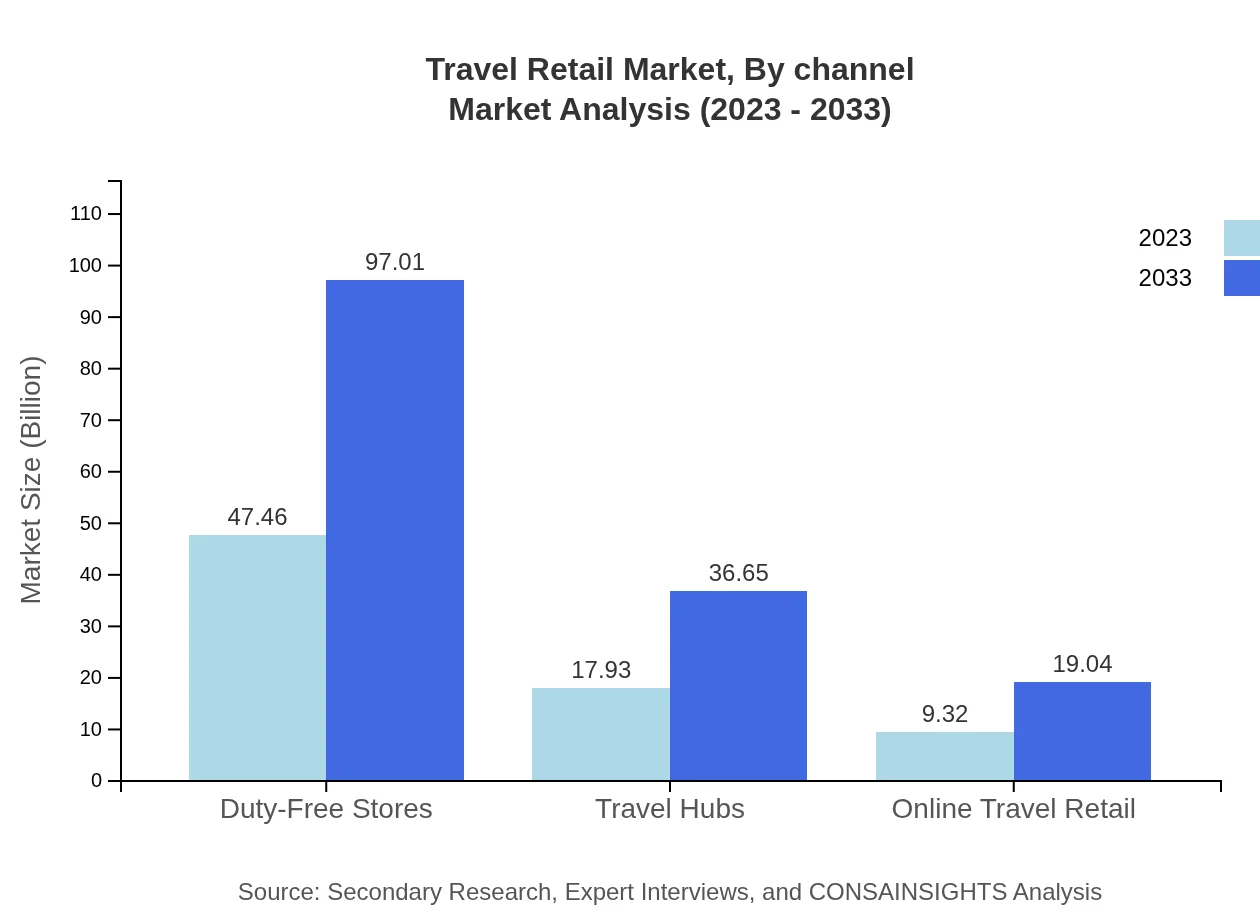

Travel Retail Market Analysis By Channel

The channel breakdown reveals that duty-free stores dominate the market with a market size of $47.46 billion in 2023 and a projected $97.01 billion by 2033, representing over 63% of the market share. In contrast, online travel retail is projected to grow significantly from $9.32 billion in 2023 to $19.04 billion by 2033, reflecting a notable trend towards digital shopping innovations.

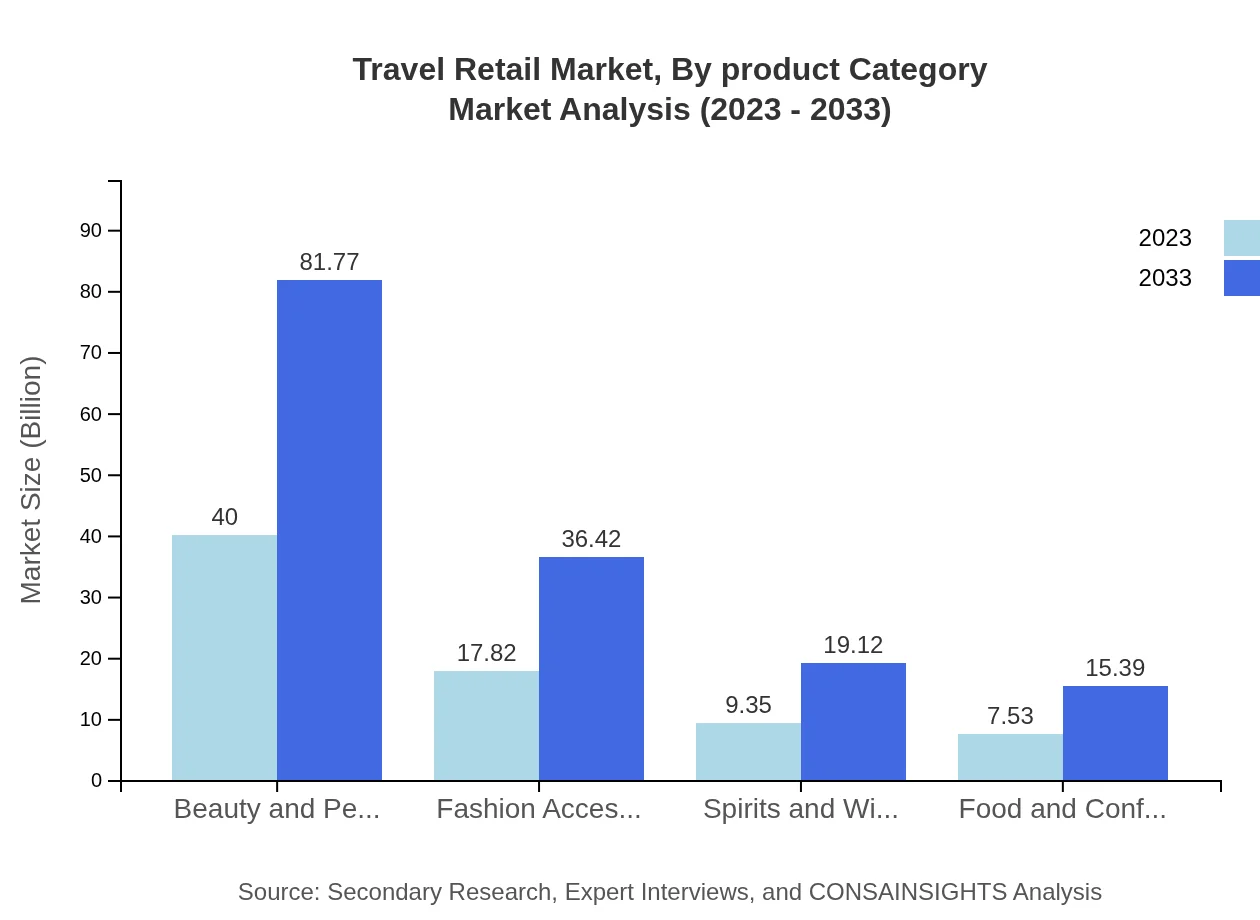

Travel Retail Market Analysis By Product Category

The product category analysis shows that Beauty and Personal Care items account for a significant share, valued at $40 billion in 2023 and expected to reach $81.77 billion by 2033. Additionally, Fashion Accessories contribute notably as well, starting at $17.82 billion in 2023 and projected to double in market size by 2033.

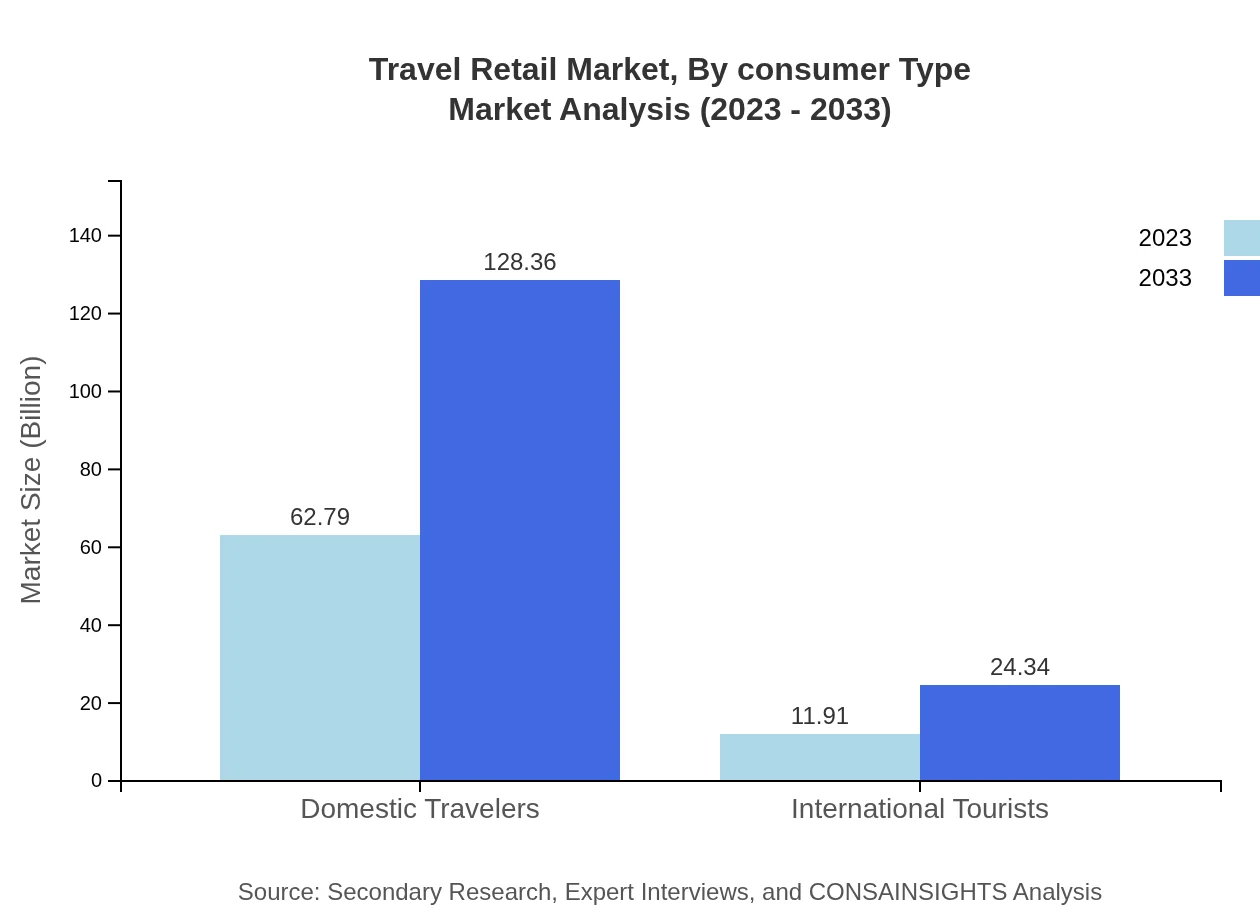

Travel Retail Market Analysis By Consumer Type

The consumer type segmentation highlights that Domestic Travelers account for a major share, estimated at $62.79 billion in 2023 and expected to see tremendous growth, reaching $128.36 billion by 2033. In comparison, International Tourists brought in $11.91 billion in 2023, and while their growth is notable, it remains lower than domestic segments.

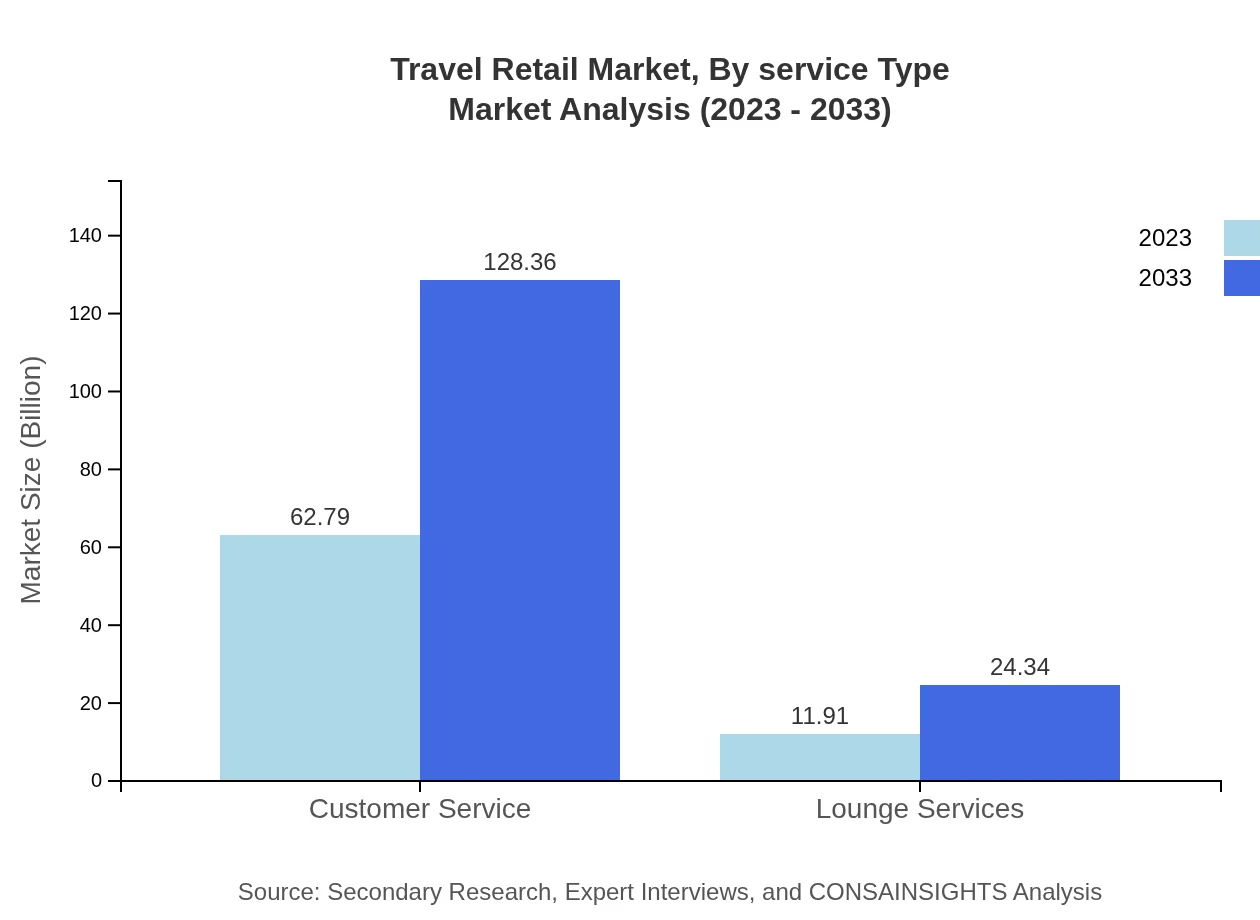

Travel Retail Market Analysis By Service Type

Under service types, Customer Service generates significant revenue, at $62.79 billion in 2023, projected to surge to $128.36 billion by 2033, showcasing the importance of customer experience in travel settings. Lounge Services also show potential, growing from $11.91 billion in 2023 to $24.34 billion by 2033.

Travel Retail Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Travel Retail Industry

Dufry AG:

Dufry AG is a leading global travel retailer, operating duty-free and duty-paid shops in airports, cruise lines, and other locations worldwide. Dufry is well-known for its strong market presence and extensive product range.Lotte Duty Free:

Lotte Duty Free is a prominent player in the travel retail sector, particularly in Asia. It offers a wide variety of luxury goods and emphasizes customer service and technological integration to enhance shopping experiences.Heinemann:

Heinemann is a significant global player in travel retail, focusing on duty-free shops across major airports. The company is positioned as a leader in providing high-end brands and personalized shopping services.King Power International:

King Power International is a major player in Thailand's duty-free retail operations, known for providing exclusive products and exceptional customer experiences in their travel retail outlets.Aelia Duty Free:

Aelia Duty Free operates an extensive network of duty-free shops in airports, offering a premium selection of international brands. The company focuses on combining duty-free pricing with a luxury shopping experience.We're grateful to work with incredible clients.

FAQs

What is the market size of Travel Retail?

The global Travel Retail market is valued at approximately $74.7 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching significant growth by 2033.

What are the key market players or companies in the Travel Retail industry?

Key companies in the Travel Retail industry include major retailers and brands like Dufry Group, Lotte Duty Free, Lagardère Travel Retail, and Heinemann, which dominate the market with extensive networks and diverse product offerings.

What are the primary factors driving the growth in the Travel Retail industry?

Growth in the Travel Retail industry is propelled by increasing global travel, expanding international airports, rising disposable income, and a growing preference for branded products among travelers.

Which region is the fastest Growing in the Travel Retail?

The Asia Pacific region is the fastest-growing in the Travel Retail sector, with projected market growth from $15.67 billion in 2023 to $32.04 billion by 2033, reflecting a vibrant travel culture and increased tourism.

Does ConsaInsights provide customized market report data for the Travel Retail industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the Travel Retail industry, providing granular insights and analysis designed to meet unique business requirements.

What deliverables can I expect from this Travel Retail market research project?

Deliverables from the Travel Retail market research project include detailed reports, market forecasts, competitive analyses, and insights into consumer behavior and trends within the industry.

What are the market trends of Travel Retail?

Trends in the Travel Retail market include a rise in online travel retail, increased focus on premium products, sustainability in offerings, and an emphasis on customer experience transformation in retail spaces.