Trocars Market Report

Published Date: 31 January 2026 | Report Code: trocars

Trocars Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Trocars market, analyzing insights on market size, growth projections, segmentation, and regional dynamics over a forecast period from 2023 to 2033. It provides data on industry trends, key players, technological advancements, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

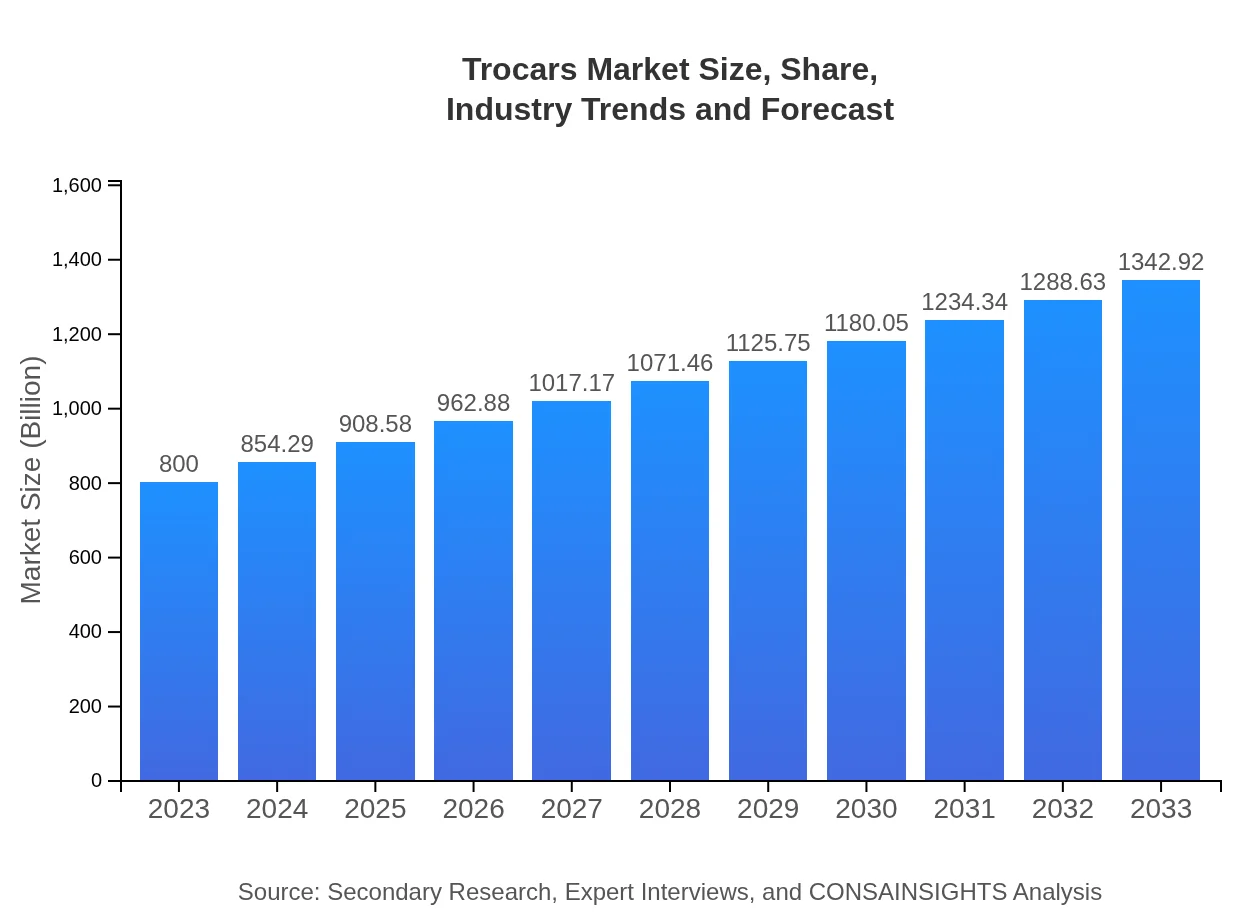

| 2023 Market Size | $800.00 Million |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $1342.92 Million |

| Top Companies | Medtronic , Johnson & Johnson, Olympus Corporation, Stryker Corporation |

| Last Modified Date | 31 January 2026 |

Trocars Market Overview

Customize Trocars Market Report market research report

- ✔ Get in-depth analysis of Trocars market size, growth, and forecasts.

- ✔ Understand Trocars's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Trocars

What is the Market Size & CAGR of Trocars market in 2023?

Trocars Industry Analysis

Trocars Market Segmentation and Scope

Tell us your focus area and get a customized research report.

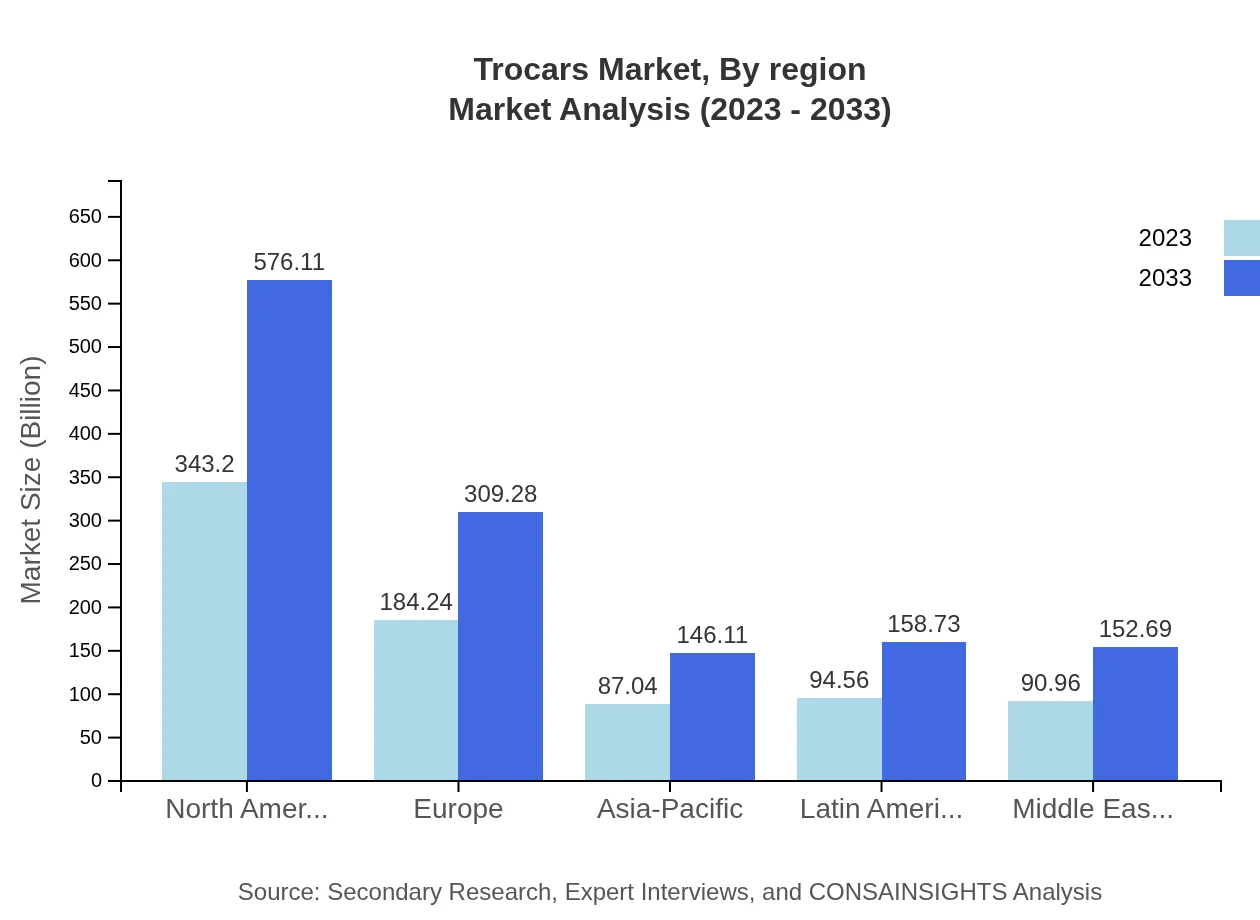

Trocars Market Analysis Report by Region

Europe Trocars Market Report:

The European Trocars market is also witnessing robust growth, with expected figures of $216.72 million in 2023 expanding to $363.80 million by 2033. Factors influencing this growth include the aging population, increasing healthcare expenditure, and technological advancements in surgical instruments, with a CAGR of 5.2%.Asia Pacific Trocars Market Report:

The Asia Pacific Trocars market is expected to grow from $153.68 million in 2023 to $257.98 million by 2033, driven by increasing healthcare investments and the rising occurrence of surgeries. With a CAGR of 5.5%, countries like India and China are significant contributors due to their expanding healthcare infrastructures and a growing patient population seeking surgical options.North America Trocars Market Report:

North America undoubtedly holds a substantial share of the Trocars market, growing from $303.12 million in 2023 to $508.83 million by 2033. The region's dominance is due to advanced healthcare systems, high adoption of minimally invasive surgeries, and increasing investments in surgical technologies. The CAGR for North America is projected at around 5.6%.South America Trocars Market Report:

In South America, the Trocars market is set to expand from $28.08 million in 2023 to $47.14 million by 2033, showcasing a moderate growth rate fueled by enhanced surgical practices and improving healthcare facilities in countries such as Brazil and Argentina.Middle East & Africa Trocars Market Report:

The Middle East and Africa Trocars market is burgeoning, projected to grow from $98.40 million in 2023 to $165.18 million by 2033. This region's growth is attributed to the rising demand for advanced surgical procedures and the expansion of healthcare infrastructures, with a CAGR of around 5.0%.Tell us your focus area and get a customized research report.

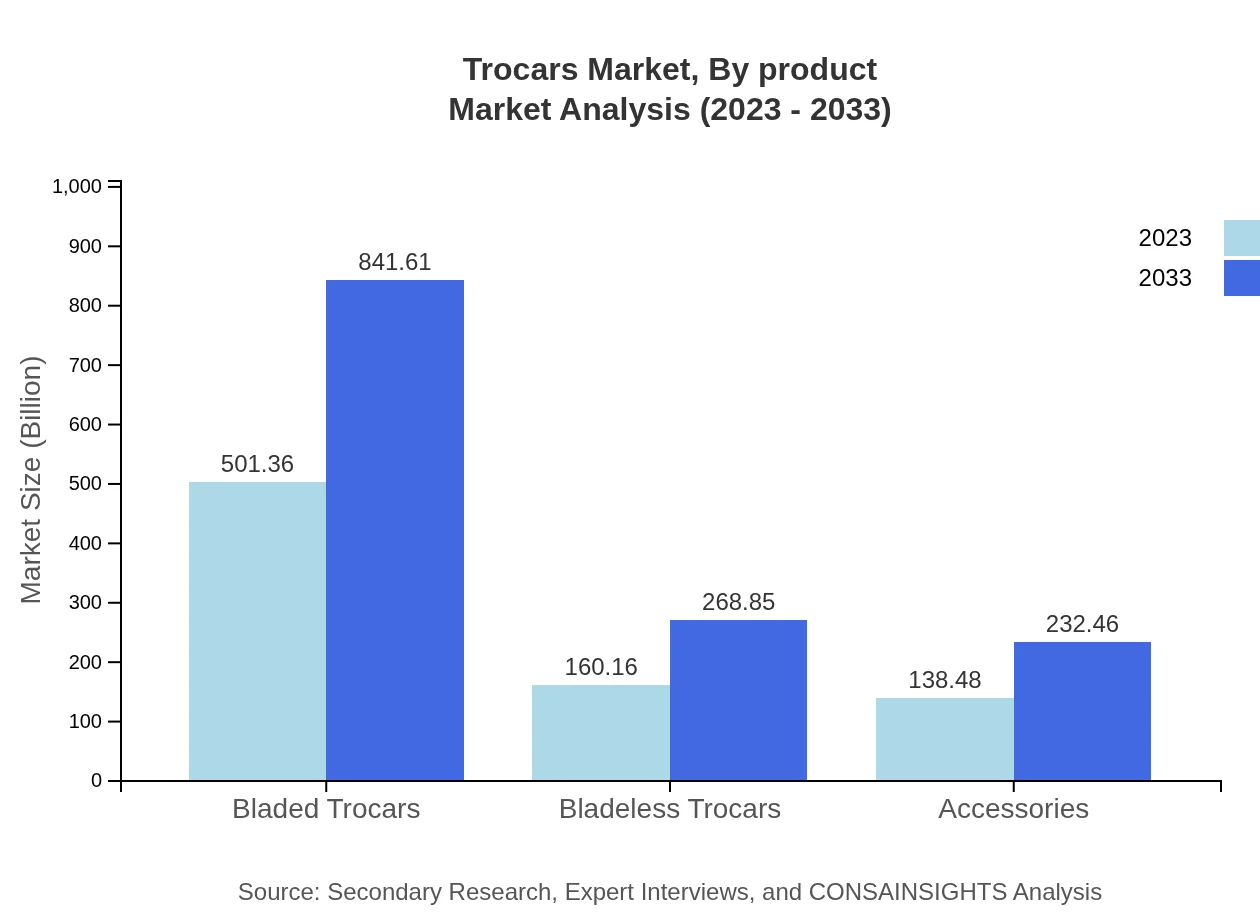

Trocars Market Analysis By Product

The market is segmented into bladed and bladeless Trocars, with bladed Trocars leading in market size. In 2023, the market for bladed Trocars was $501.36 million and is expected to reach $841.61 million by 2033. Bladeless Trocars, while smaller, are gaining traction due to their reduced risk of tissue damage, expected to grow from $160.16 million to $268.85 million during the same period.

Trocars Market Analysis By Application

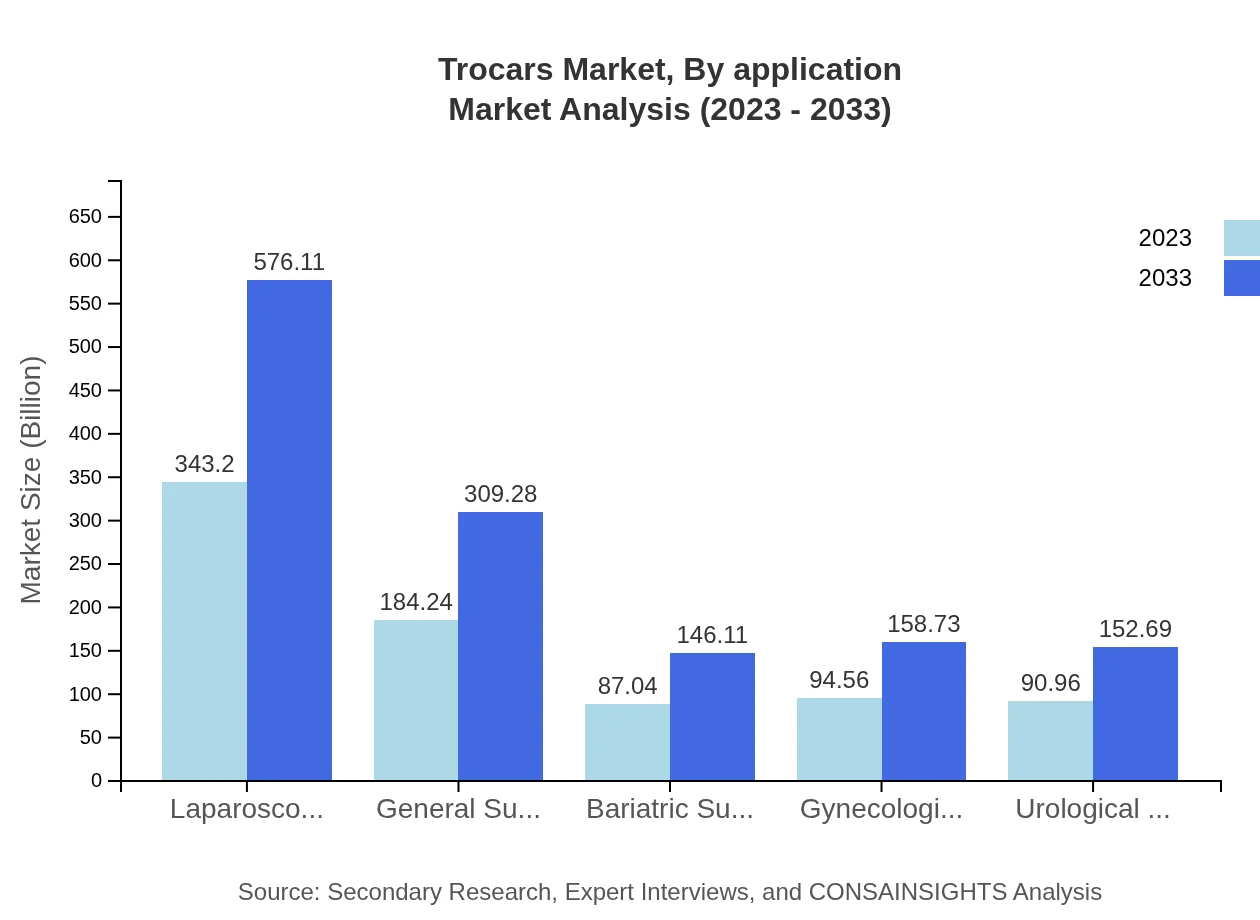

By application, laparoscopic surgery represents the largest segment, with a market size of $343.20 million in 2023, foreseen to grow to $576.11 million by 2033. General surgery and gynecological surgery follow, with significant contributions to the market as awareness of minimally invasive approaches is heightened.

Trocars Market Analysis By End User

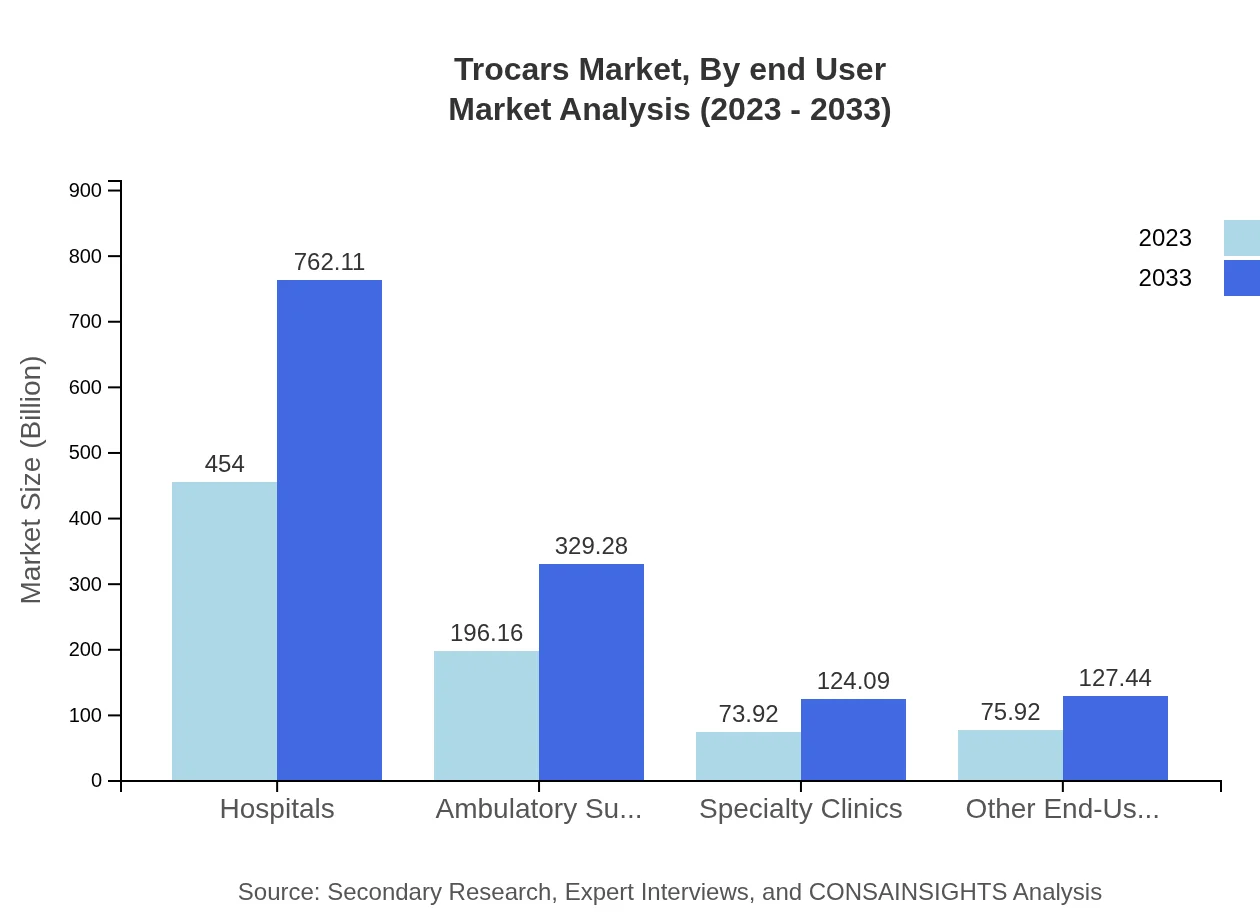

Hospitals are the primary end-users, accounting for a significant share of the Trocars market with a size of $454.00 million in 2023, expanding to $762.11 million in 2033. Ambulatory surgical centers are also prominent, expected to see growth from $196.16 million to $329.28 million.

Trocars Market Analysis By Region

Regional analysis indicates North America dominating the market, followed by Europe and Asia Pacific. Increasing surgical procedures and advancements in surgical technologies are driving market growth across all regions.

Trocars Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Trocars Industry

Medtronic :

A global leader in medical technology, Medtronic offers a wide range of Trocars that enhance surgical procedures through innovation and reliability.Johnson & Johnson:

With a strong presence in the surgical instruments market, Johnson & Johnson develops advanced trocars known for their quality and efficacy in various surgical applications.Olympus Corporation:

Olympus is renowned for its endoscopic equipment and contributes significantly to the Trocars market through its innovative technologies in laparoscopic surgeries.Stryker Corporation:

Stryker is a key player providing a range of Trocars specifically designed to improve surgical outcomes and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Trocars?

The global trocars market is currently valued at approximately $800 million and is projected to grow at a CAGR of 5.2%. This growth signifies substantial opportunities within the surgical instrument sector over the next decade.

What are the key market players or companies in the Trocars industry?

Key players in the trocars market include major medical device companies that provide innovative surgical instruments. These companies consistently invest in research and development to enhance product offerings and meet advancing healthcare needs.

What are the primary factors driving the growth in the Trocars industry?

Factors driving growth in the trocars industry include the rising prevalence of minimally invasive surgeries, increasing surgical procedures, and advancements in technology. Additionally, a growing geriatric population boosts the demand for effective surgical tools like trocars.

Which region is the fastest Growing in the Trocars market?

The fastest-growing region in the trocars market is Asia Pacific, with a market size projected to increase from $153.68 million in 2023 to $257.98 million by 2033, reflecting a significant growth rate due to expanding healthcare investments.

Does ConsaInsights provide customized market report data for the Trocars industry?

Yes, ConsaInsights offers customized market reports tailored to specific client requirements within the trocars industry, ensuring relevant insights and data that meet unique strategic needs and facilitate informed decision-making.

What deliverables can I expect from this Trocars market research project?

From this trocars market research project, clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape insights, and tailored recommendations that aid in strategic planning and investment decisions.

What are the market trends of Trocars?

Current trends in the trocars market include the emergence of advanced, bladed, and bladeless trocar technologies, enhanced designs for user safety, and the increasing use of minimally invasive surgical procedures across various healthcare settings.