Troffer Market Report

Published Date: 02 February 2026 | Report Code: troffer

Troffer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Troffer market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional dynamics, technology developments, and key players shaping the industry.

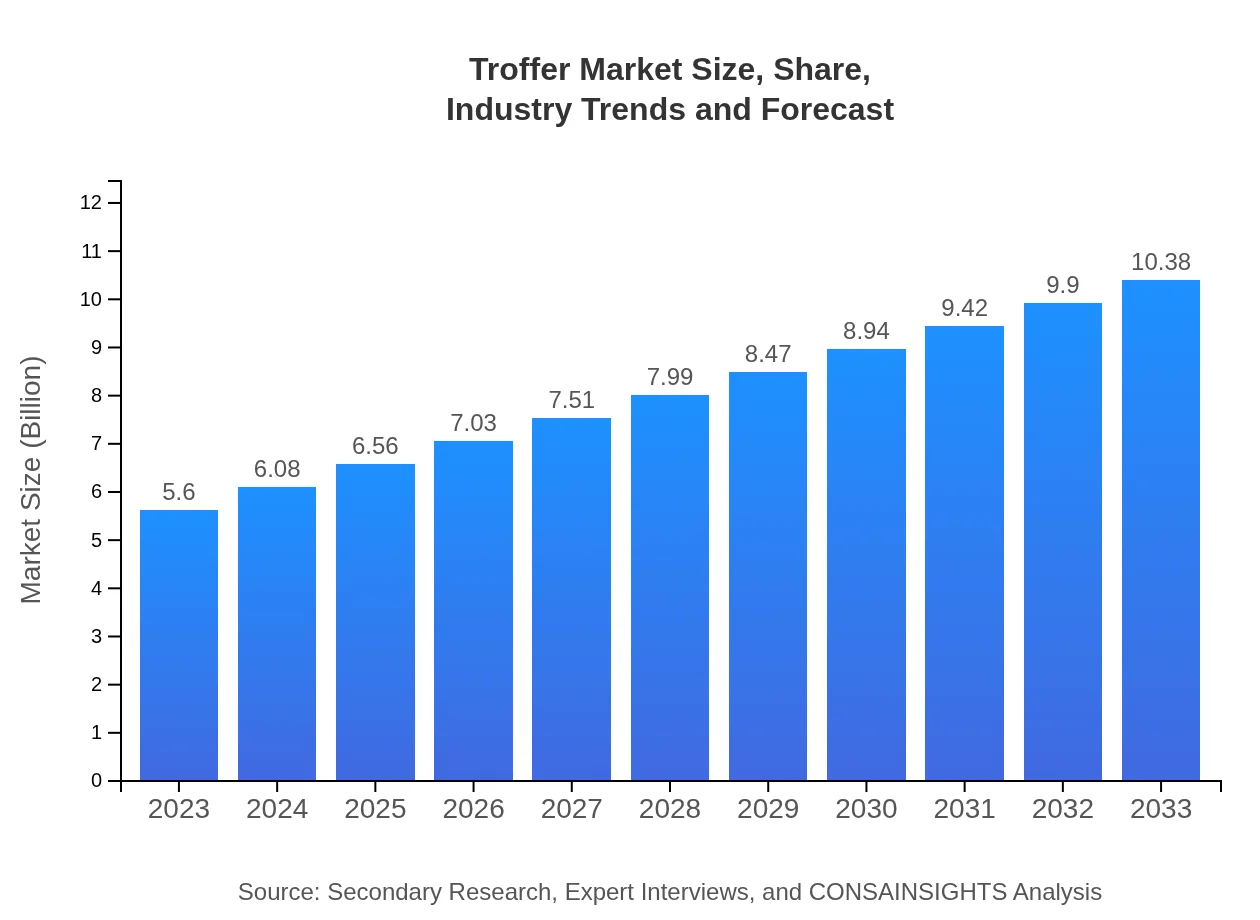

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Philips Lighting, Cree, Inc., Osram Licht AG, General Electric (GE), Zumtobel Group |

| Last Modified Date | 02 February 2026 |

Troffer Market Overview

Customize Troffer Market Report market research report

- ✔ Get in-depth analysis of Troffer market size, growth, and forecasts.

- ✔ Understand Troffer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Troffer

What is the Market Size & CAGR of Troffer market in 2023?

Troffer Industry Analysis

Troffer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Troffer Market Analysis Report by Region

Europe Troffer Market Report:

Europe is set to expand from $2.00 billion in 2023 to $3.71 billion by 2033, driven by stringent regulations concerning energy efficiency and sustainability. The region's commitment to carbon neutrality and innovative smart technologies is fostering a dynamic market for Troffer solutions.Asia Pacific Troffer Market Report:

The Asia Pacific region is expected to witness robust growth, reaching a market size of $1.88 billion by 2033, compared to $1.02 billion in 2023. The increasing investments in infrastructure, coupled with the growing adoption of energy-efficient lighting solutions, are key growth drivers. Countries like China and India are at the forefront of this expansion due to urbanization and rising demand for modern lighting.North America Troffer Market Report:

The North American market is expected to grow significantly, with a forecasted increase from $1.87 billion in 2023 to $3.47 billion by 2033. The region's emphasis on energy conservation and smart buildings, alongside a strong regulatory framework supporting LED adoption, positions it as a leading market for Troffer products.South America Troffer Market Report:

In South America, the market is projected to grow modestly from $0.01 billion in 2023 to $0.02 billion by 2033. The slow growth can be attributed to the region's economic conditions and limited infrastructure. However, rising urbanization and government initiatives aimed at promoting energy-efficient technologies present opportunities for growth.Middle East & Africa Troffer Market Report:

The Middle East and Africa are projected to grow from $0.69 billion in 2023 to $1.28 billion by 2033. Though emerging markets, there is an increasing focus on infrastructure improvement and energy conservation, which is expected to drive the Troffer market growth in these regions.Tell us your focus area and get a customized research report.

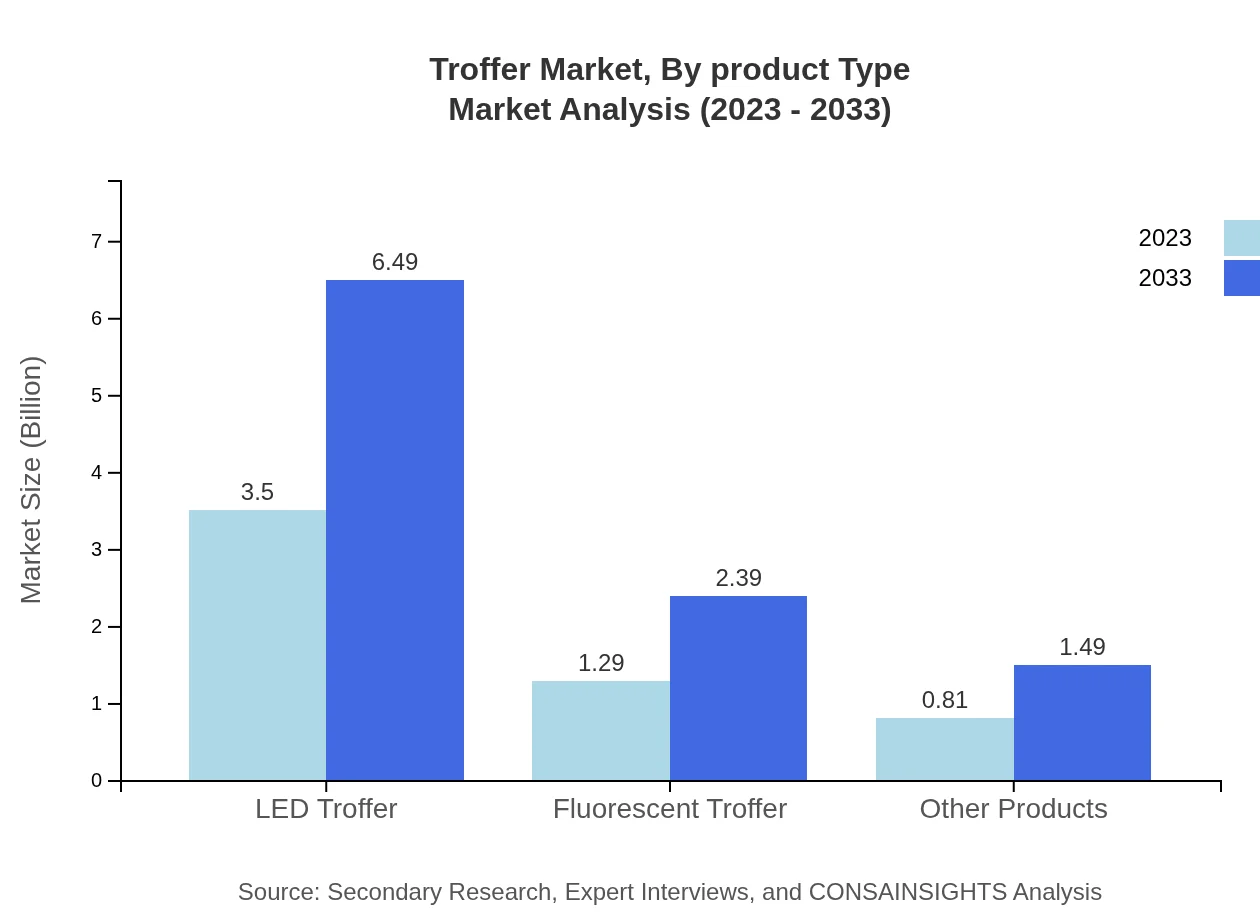

Troffer Market Analysis By Product Type

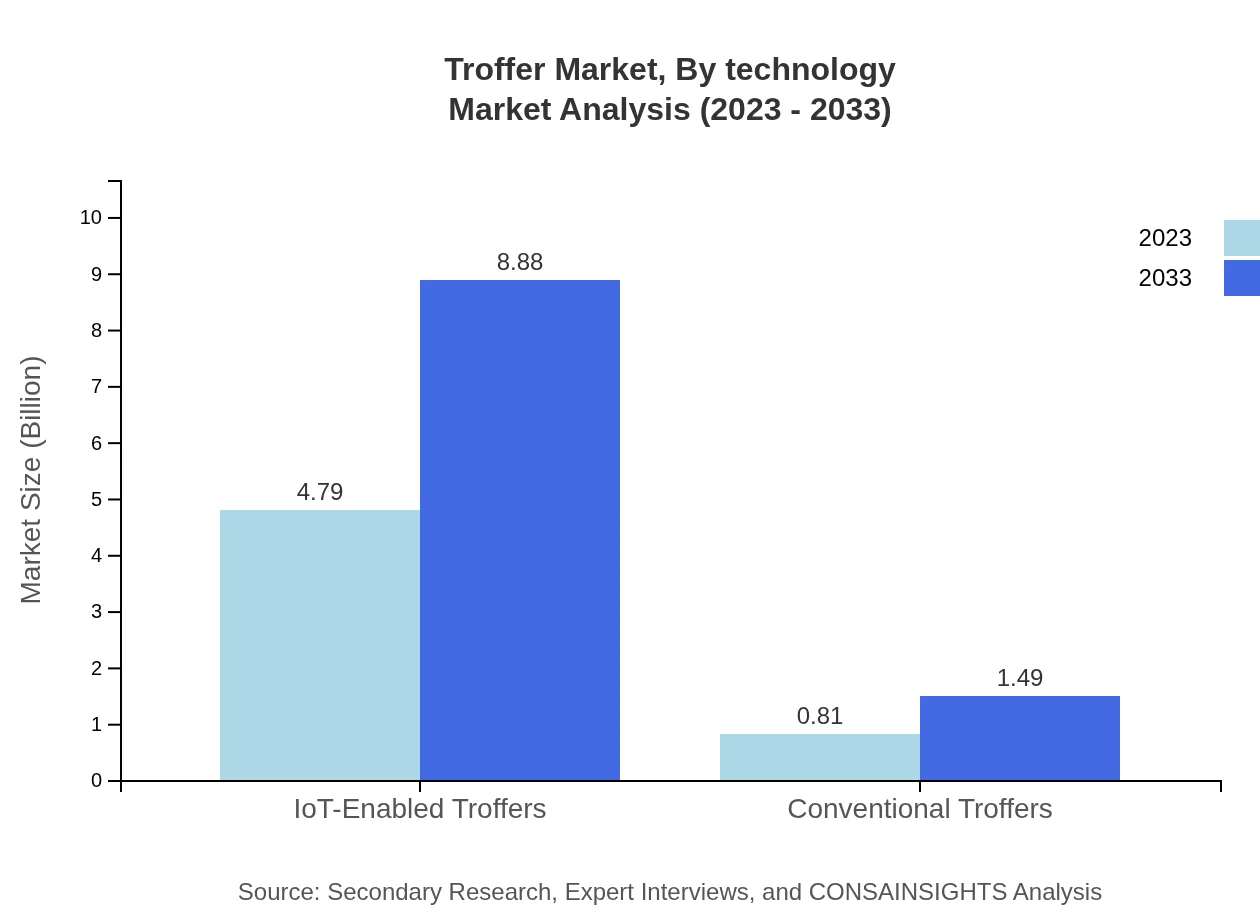

In terms of product type, IoT-enabled Troffers lead the market significantly, valued at $4.79 billion in 2023 and expected to grow to $8.88 billion by 2033, capturing an impressive market share of 85.6%. LED Troffers hold a substantial position with a market size of $3.50 billion in 2023 and projected to rise to $6.49 billion by 2033. Conventional Troffers, albeit smaller, are anticipated to have a market value of $0.81 billion in 2023, increasing to $1.49 billion by 2033, representing 14.4% market share.

Troffer Market Analysis By Technology

The market is driven predominantly by LED technology, which is favored for its energy efficiency and long lifespan. The rapid advancements in smart lighting technologies, integrating IoT capabilities, are transforming traditional Troffer systems into connected devices, thus expanding their utility and market appeal. These changes are paving the way for extensive growth in IoT-enabled Troffers and enhancing traditional choices through retrofitting options.

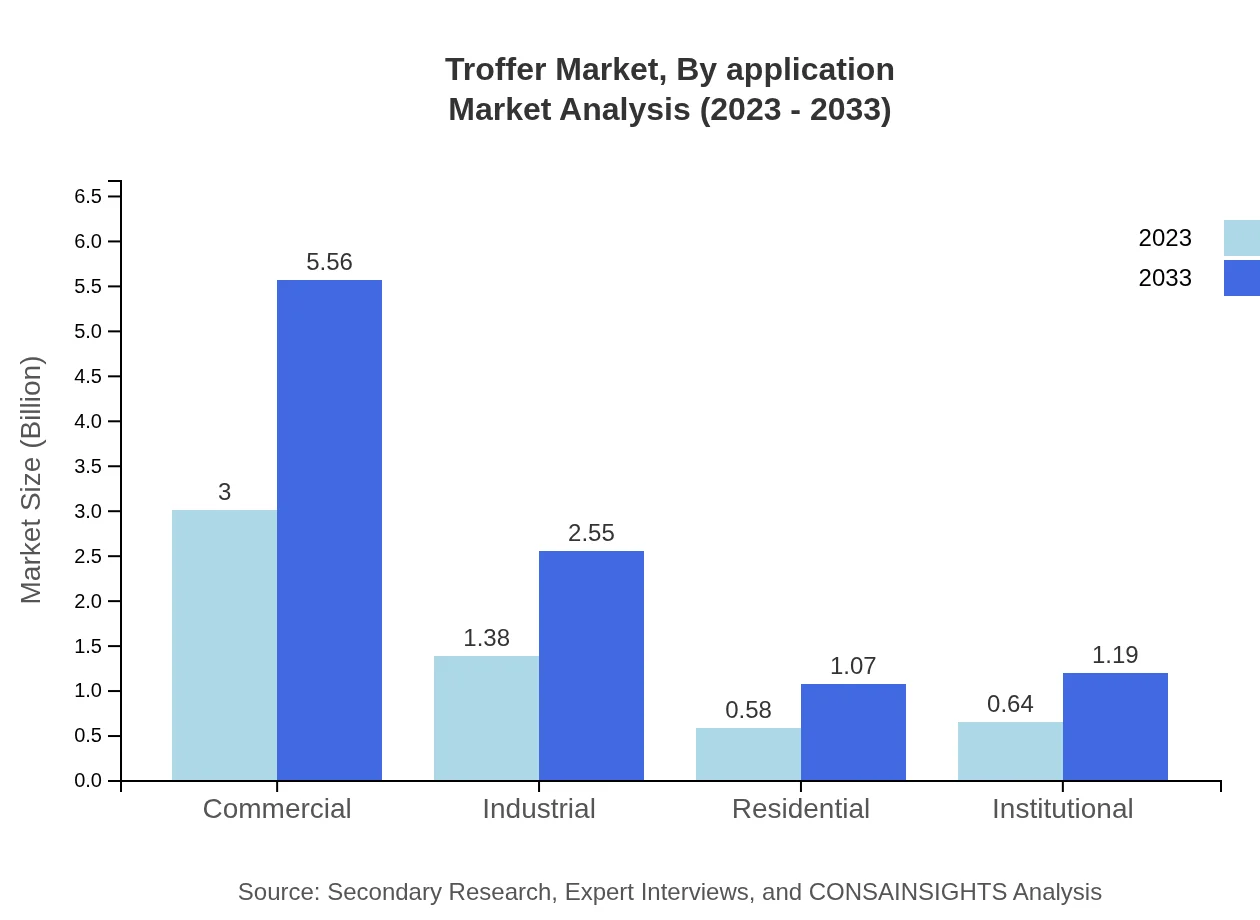

Troffer Market Analysis By Application

Commercial applications dominate the Troffer market with a size of $3.00 billion in 2023, growing to $5.56 billion by 2033. The industrial sector also comprises a substantial share, valued at $1.38 billion in 2023, anticipated to reach $2.55 billion by 2033. Residential and institutional applications are smaller but poised for growth, supported by evolving consumer preferences and increased energy-saving measures adopted in homes and institutions alike.

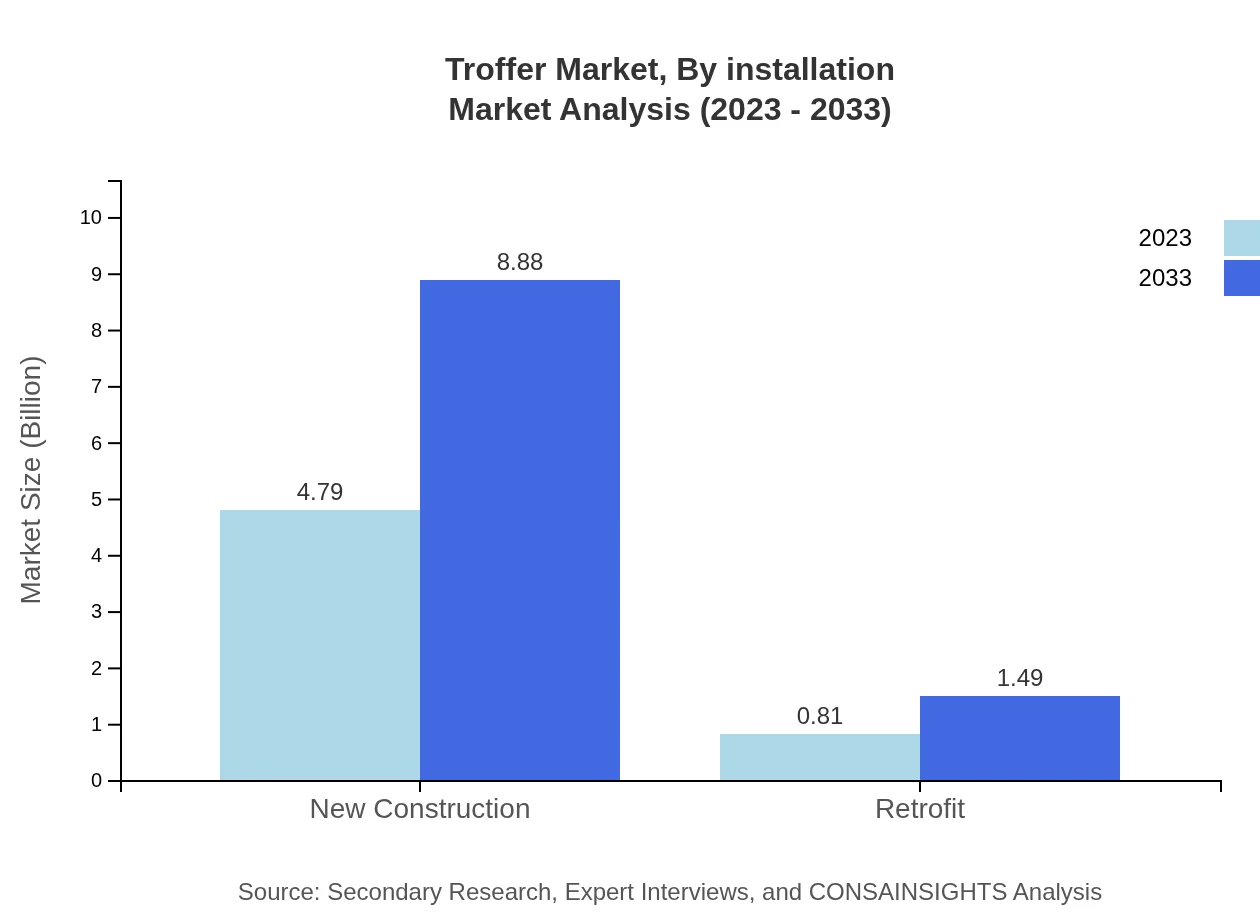

Troffer Market Analysis By Installation

New construction installations significantly lead the Troffer market, anticipated to have a market size of $4.79 billion in 2023, growing to $8.88 billion by 2033. Retrofit options also hold importance with a projected growth from $0.81 billion to $1.49 billion in the same time frame, appealing to existing building stock efficiency upgrades.

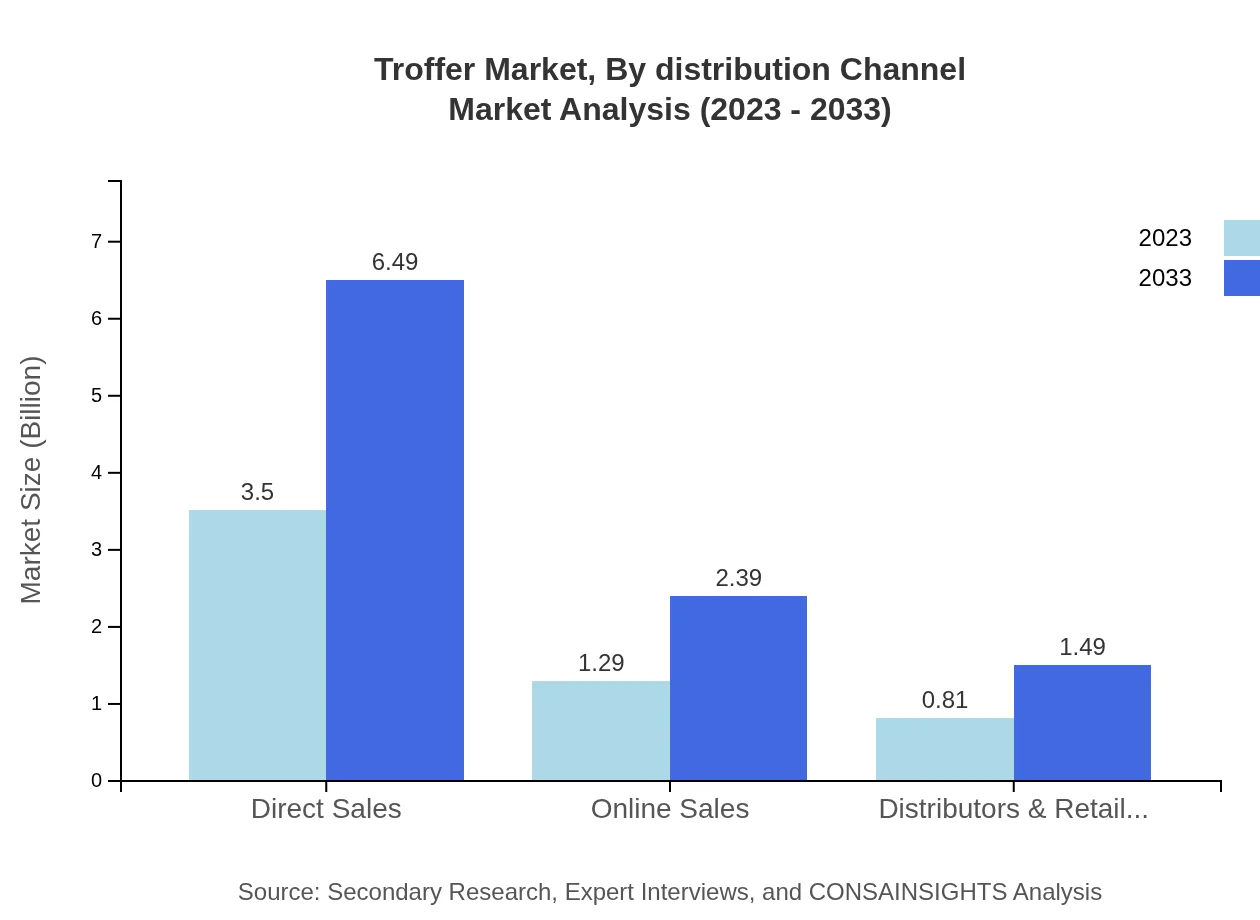

Troffer Market Analysis By Distribution Channel

Direct sales form the dominant channel in distributing Troffer products with a current market size of $3.50 billion in 2023, growing over the next decade. Online sales channels also show significant promise, increasing from $1.29 billion to $2.39 billion. Distributors and retailers serve a smaller share but are essential for market penetration in varied regions.

Troffer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Troffer Industry

Philips Lighting:

Philips Lighting is a leader in the global lighting solutions market, driving innovation in LED technology and smart lighting, significantly impacting the Troffer lighting segment.Cree, Inc.:

Cree is known for its cutting-edge LED technology, providing energy-efficient Troffer solutions that cater to both commercial and residential sectors.Osram Licht AG:

Osram offers a wide range of lighting solutions, including Troffers, and is committed to sustainability and energy efficiency through advanced technologies.General Electric (GE):

GE is a prominent player in the lighting market, integrating innovative technologies into Troffer designs to enhance performance and user experience.Zumtobel Group:

The Zumtobel Group focuses on professional lighting solutions, including Troffers, emphasizing superior design and energy-saving technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Troffer?

The Troffer market is currently valued at approximately $5.6 billion. It is projected to grow at a compound annual growth rate (CAGR) of 6.2% during the next decade, reflecting increasing demand for energy-efficient lighting solutions.

What are the key market players or companies in this Troffer industry?

Key players in the Troffer industry include prominent companies such as Acuity Brands, Signify, Eaton, and Cree. These companies are actively engaged in innovation, driving market dynamics through new product launches and strategic partnerships.

What are the primary factors driving the growth in the Troffer industry?

Growth in the Troffer industry is primarily driven by increasing demand for energy-efficient lighting, advancements in smart lighting technologies, and a rising focus on green building initiatives. Additionally, the shift towards IoT-enabled products is enhancing market prospects.

Which region is the fastest Growing in the Troffer market?

The fastest-growing region in the Troffer market is Europe, projected to increase from $2.00 billion in 2023 to $3.71 billion by 2033. Rapid urbanization and stringent energy regulations characterize this dynamic growth in the region.

Does ConsaInsights provide customized market report data for the Troffer industry?

Yes, Consainsights offers tailored market report data for the Troffer industry, allowing clients to gain insights specific to their needs. This can include custom segments, geographical breakdowns, and market forecasts tailored to unique business strategies.

What deliverables can I expect from this Troffer market research project?

Deliverables from the Troffer market research project typically include comprehensive market analysis reports, detailed segmentation data, growth forecasts, and strategic recommendations tailored to enhance market positioning and decision-making.

What are the market trends of Troffer?

Current trends in the Troffer market include the shift towards LED and IoT-enabled Troffers, increasing adoption in the commercial sector, and a focus on sustainable building practices. The market is evolving with innovative designs and energy-efficient solutions.