Tube Packaging Market Report

Published Date: 02 February 2026 | Report Code: tube-packaging

Tube Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tube Packaging market, covering insights into market size, growth rates, industry trends, key segments, and regional dynamics from 2023 to 2033.

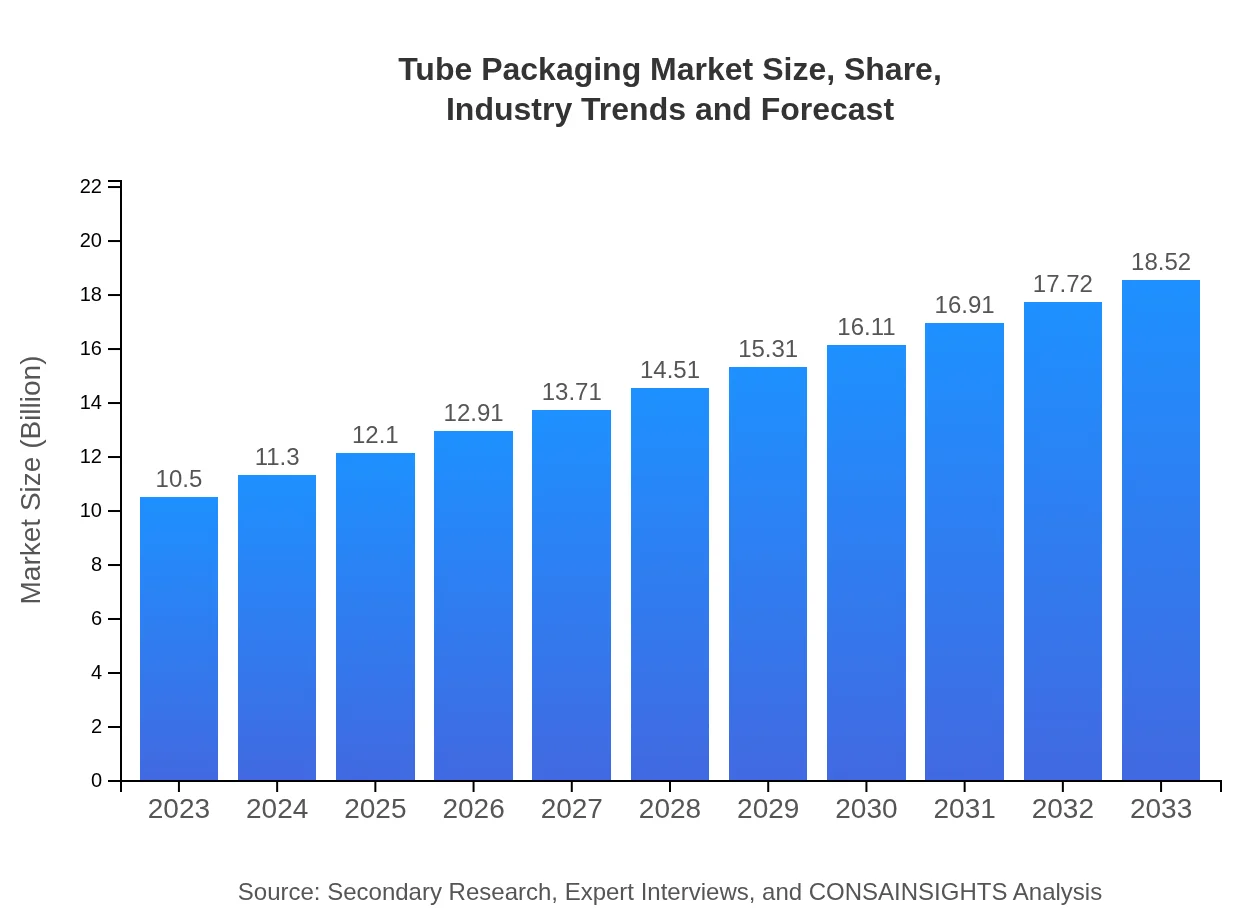

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $18.52 Billion |

| Top Companies | Albea S.A., Essel Propack, Berry Global Inc., Unette Corporation |

| Last Modified Date | 02 February 2026 |

Tube Packaging Market Overview

Customize Tube Packaging Market Report market research report

- ✔ Get in-depth analysis of Tube Packaging market size, growth, and forecasts.

- ✔ Understand Tube Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tube Packaging

What is the Market Size & CAGR of Tube Packaging market in 2023?

Tube Packaging Industry Analysis

Tube Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tube Packaging Market Analysis Report by Region

Europe Tube Packaging Market Report:

Europe remains one of the largest markets for Tube Packaging, with an anticipated increase from $3.65 billion in 2023 to $6.44 billion in 2033. The region's focus on reducing plastic waste and stringent regulations on packaging sustainability are shaping market dynamics, leading to innovations in biodegradable and recyclable materials.Asia Pacific Tube Packaging Market Report:

In the Asia Pacific region, the Tube Packaging market is projected to expand significantly, growing from $1.84 billion in 2023 to $3.24 billion by 2033. This growth is fueled by increasing urbanization, rising disposable incomes, and a booming cosmetics industry, particularly in countries like China and India.North America Tube Packaging Market Report:

The North American Tube Packaging market, projected to grow from $3.70 billion in 2023 to $6.52 billion by 2033, is driven by robust demand in the healthcare and personal care sectors, alongside advancements in sustainable packaging technologies that cater to environmentally-conscious consumers.South America Tube Packaging Market Report:

South America is expected to see moderate growth in the Tube Packaging market, with projections increasing from $0.86 billion in 2023 to $1.51 billion by 2033. Factors such as improving economic conditions and a growing preference for packaged goods are driving this growth, particularly in Brazil and Argentina.Middle East & Africa Tube Packaging Market Report:

The Tube Packaging market in the Middle East and Africa is expected to grow moderately from $0.46 billion in 2023 to $0.81 billion by 2033, driven by increasing urbanization, fluctuating oil revenues, and a rising demand for personal care and cosmetic products.Tell us your focus area and get a customized research report.

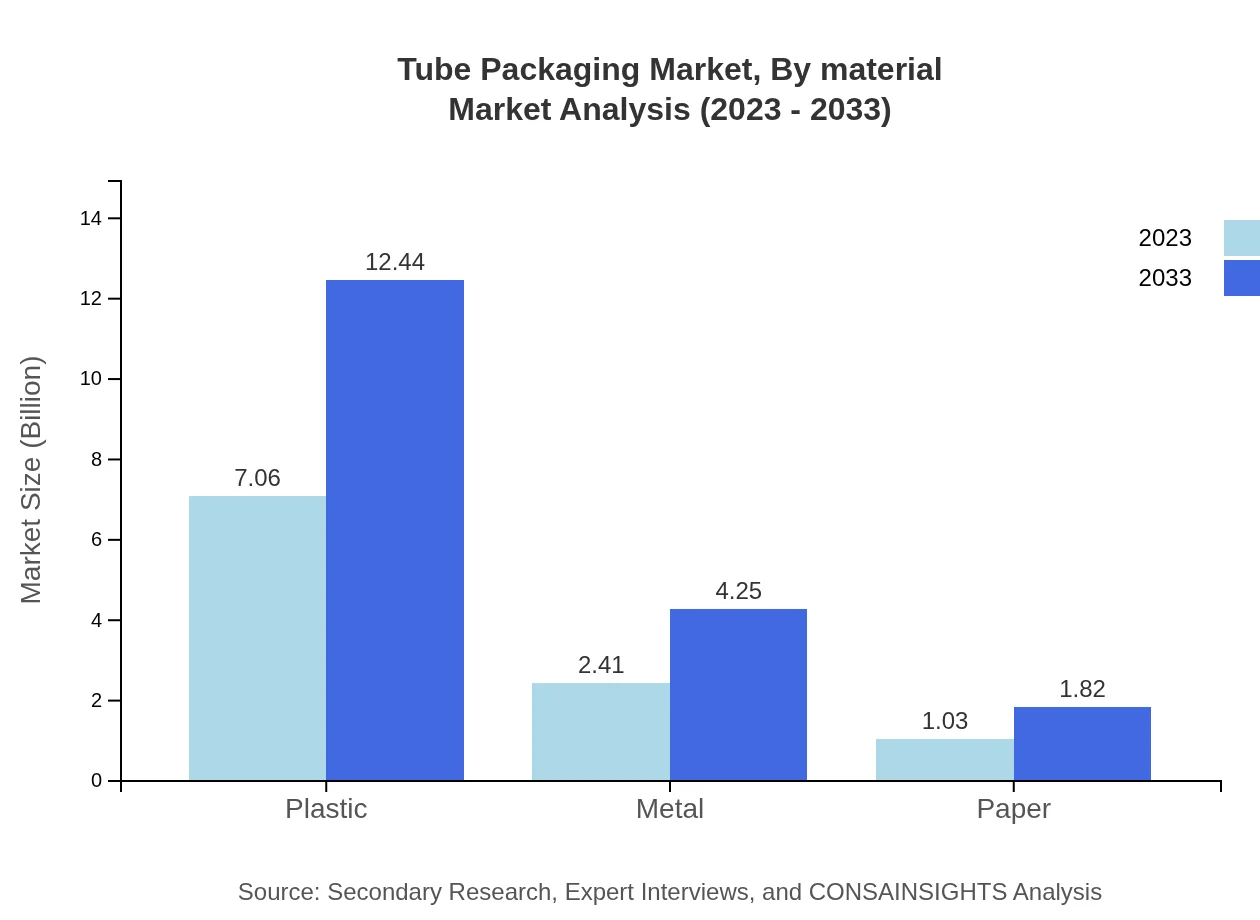

Tube Packaging Market Analysis By Material

The Tube Packaging market is dominated by materials such as plastic, metal, and paper. Plastic tubes hold a major share of the market due to their lightweight nature and flexibility, accounting for approximately 67.2% in 2023. Metal tubes are also gaining traction, especially in food applications, while paper-based tubes are witnessing growth due to increasing sustainability efforts.

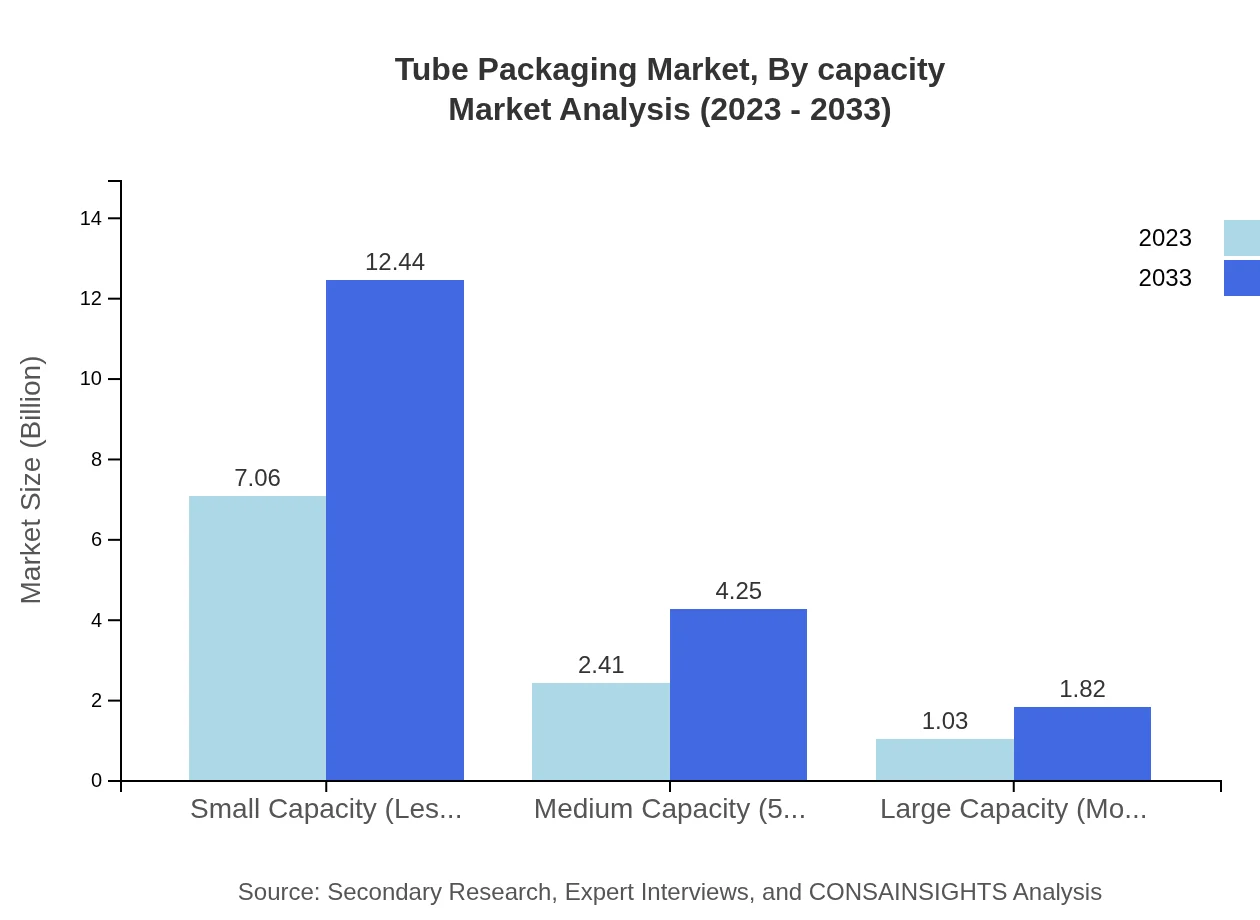

Tube Packaging Market Analysis By Capacity

The market can also be segmented by capacity. Small capacity tubes (less than 50ml) lead the market with anticipated growth from $7.06 billion in 2023 to $12.44 billion by 2033, primarily driven by personal care products. Medium capacity tubes (50ml to 200ml) and large capacity tubes (more than 200ml) also hold substantial shares, catering to diverse applications from healthcare to food and beverage.

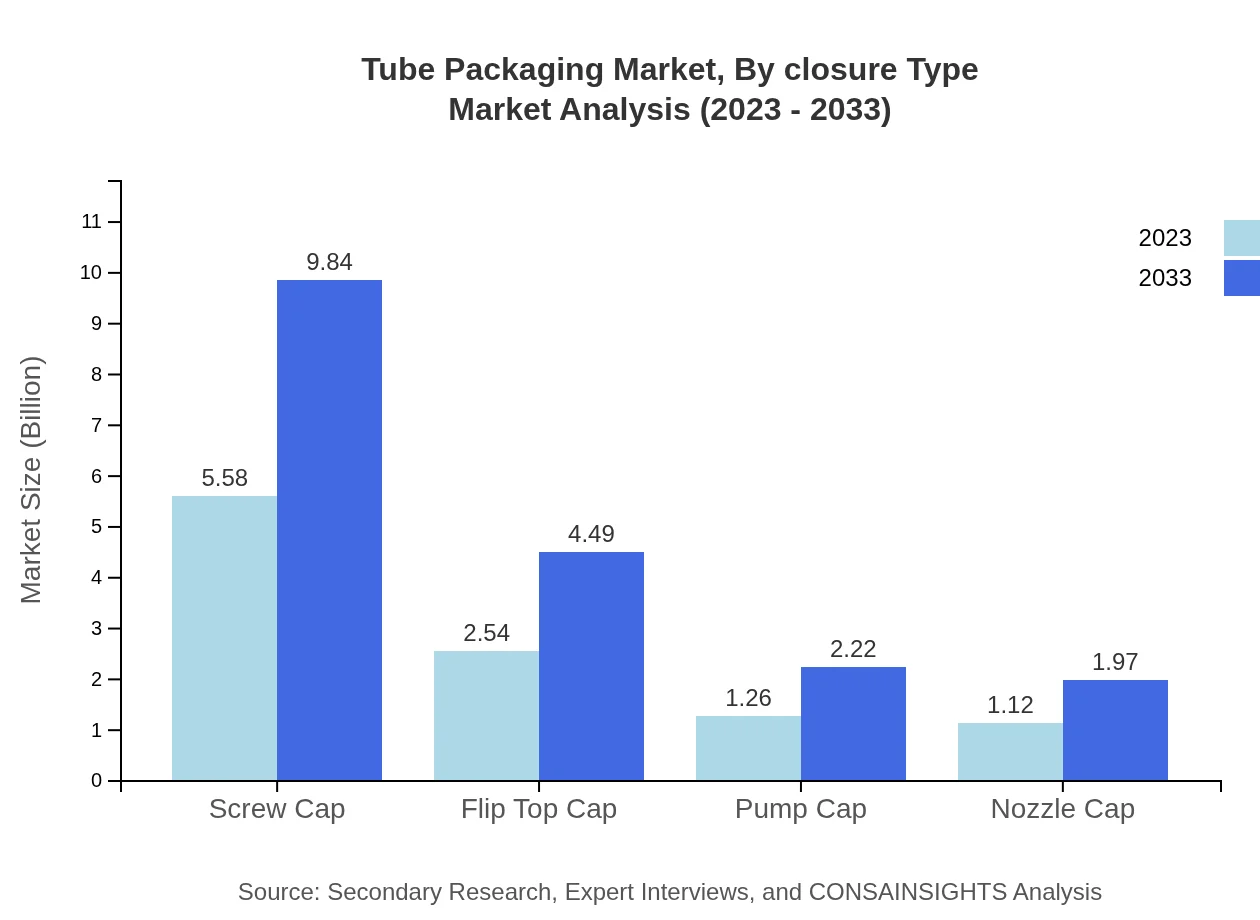

Tube Packaging Market Analysis By Closure Type

Different closure types such as screw caps, flip-top caps, and pump caps significantly influence consumer preferences. Screw caps remain the most popular option, making up 53.11% of the market in 2023, followed by flip-top caps which are favored for convenience, holding a share of approximately 24.23%.

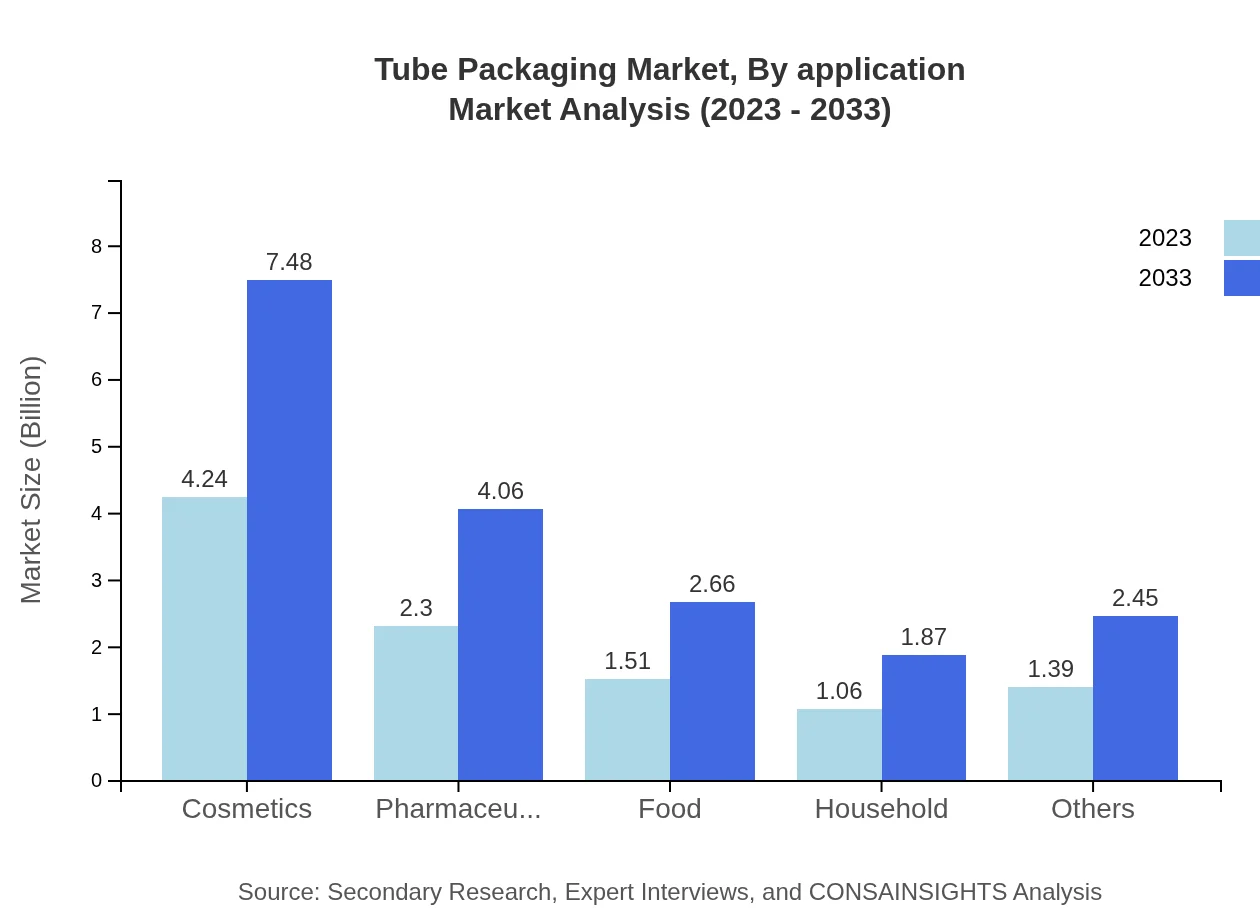

Tube Packaging Market Analysis By Application

The Tube Packaging market is diverse in terms of applications. Personal Care is the leading sector, with a market share of 53.11% in 2023, followed by healthcare products. The rise of e-commerce has spurred demand for eye-catching and functional packaging across various applications, including cosmetics and pharmaceuticals.

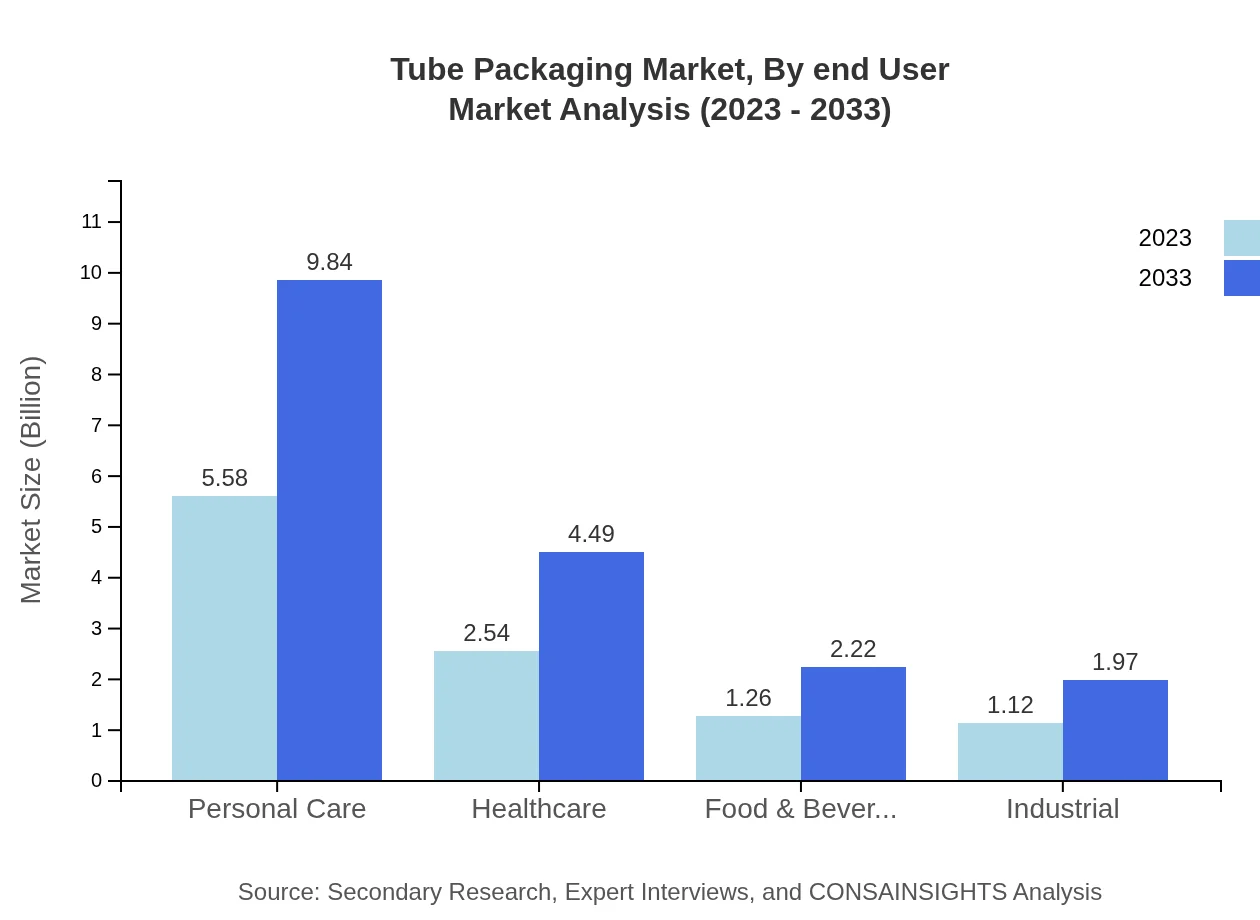

Tube Packaging Market Analysis By End User

Key end-users of tube packaging include the personal care, healthcare, food and beverage, and cosmetics industries. Personal care products dominate this sector, emphasizing the need for aesthetically pleasing and functional packaging. Healthcare products are also on the rise, with increasing demand for sterile and safe packaging solutions.

Tube Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tube Packaging Industry

Albea S.A.:

A leading manufacturer specializing in innovative tube solutions for various industries, known for its commitment to sustainability.Essel Propack:

One of the largest manufacturers of laminated tubes, focusing on R&D to develop eco-friendly packaging solutions.Berry Global Inc.:

A major player in the plastic packaging sector, offering a diverse range of tube packaging solutions for personal care and food industries.Unette Corporation:

Specializes in producing high-quality tube packaging specifically for cosmetics and pharmaceuticals, with a focus on child-resistant designs.We're grateful to work with incredible clients.

FAQs

What is the market size of tube Packaging?

The global tube packaging market is estimated to be valued at approximately $10.5 billion in 2023, with a projected CAGR of 5.7% through 2033. This reflects increasing demands across various industries.

What are the key market players or companies in the tube Packaging industry?

Key players in the tube packaging industry include leading packaging companies and manufacturers globally, focusing on innovation and sustainability to meet diverse market needs. Their competitive strategies significantly influence market dynamics.

What are the primary factors driving the growth in the tube packaging industry?

Growth drivers include rising demand for convenient and sustainable packaging solutions, expanding sectors such as cosmetics, pharmaceuticals, and food & beverage industries, coupled with increasing consumer preferences for eco-friendly materials.

Which region is the fastest Growing in the tube packaging market?

Asia Pacific is the fastest-growing region in the tube packaging market, with projections indicating growth from $1.84 billion in 2023 to $3.24 billion by 2033, driven by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the tube packaging industry?

Yes, ConsaInsights offers customized market report data for the tube packaging industry, tailoring insights to fit specific client requirements based on market needs and emerging trends.

What deliverables can I expect from this tube packaging market research project?

Deliverables include comprehensive market analysis reports, segmented data, growth projections, competitive landscape evaluations, and actionable insights tailored to assist strategic decision-making in the tube packaging sector.

What are the market trends of tube packaging?

Market trends indicate a shift towards sustainable materials, increased usage of biodegradable options, and advancements in design and manufacturing technologies. These trends align with growing consumer awareness and regulatory pressures.