Tubular Membrane Market Report

Published Date: 02 February 2026 | Report Code: tubular-membrane

Tubular Membrane Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Tubular Membrane market, including market size, growth forecasts, segmentation, and regional insights for the period 2023-2033. It highlights key trends, technological advancements, and competitive landscape to equip stakeholders with critical insights.

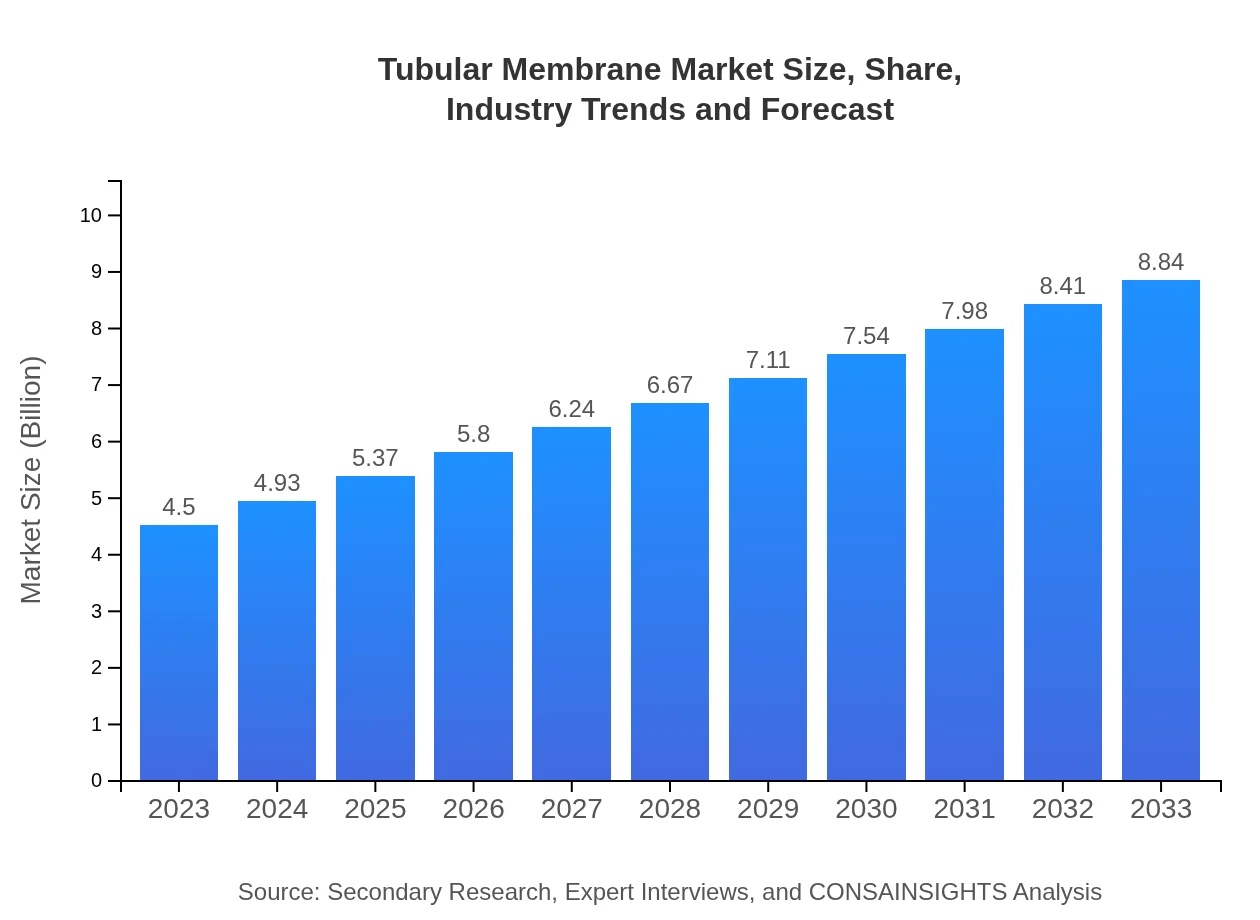

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | Hydranautics, Toray Industries, Dow Water & Process Solutions, Suez Water Technologies |

| Last Modified Date | 02 February 2026 |

Tubular Membrane Market Overview

Customize Tubular Membrane Market Report market research report

- ✔ Get in-depth analysis of Tubular Membrane market size, growth, and forecasts.

- ✔ Understand Tubular Membrane's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tubular Membrane

What is the Market Size & CAGR of Tubular Membrane market in 2023?

Tubular Membrane Industry Analysis

Tubular Membrane Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tubular Membrane Market Analysis Report by Region

Europe Tubular Membrane Market Report:

Europe's Tubular Membrane market is also forecasted to grow significantly, from $1.54 billion in 2023 to $3.03 billion by 2033. The region benefits from advanced R&D activities and innovation in membrane technology, alongside strict regulations promoting sustainable practices in wastewater treatment.Asia Pacific Tubular Membrane Market Report:

In the Asia Pacific region, the Tubular Membrane market is poised to experience substantial growth, increasing from $0.85 billion in 2023 to $1.68 billion by 2033. This growth is driven by rising investments in water treatment infrastructure, particularly in emerging economies. Moreover, government initiatives focused on pollution control and water conservation are likely to enhance market prospects.North America Tubular Membrane Market Report:

In North America, the market is expected to grow robustly, increasing from $1.59 billion in 2023 to $3.12 billion by 2033. This growth is attributed to stringent environmental regulations, growing industrial activities, and heightened awareness regarding sustainable water management practices.South America Tubular Membrane Market Report:

The South American Tubular Membrane market is facing challenges, with a projected decline from -$0.04 billion in 2023 to -$0.07 billion by 2033. Factors contributing to this negative growth include economic instability and fluctuating investments in water treatment technologies. Nevertheless, niche markets may present opportunities amidst overall decline.Middle East & Africa Tubular Membrane Market Report:

The Middle East and Africa region showcases potential for growth as well, with the market expanding from $0.55 billion in 2023 to $1.08 billion by 2033. This growth is fueled by urbanization, industrial expansion, and increasing demand for clean water. Strategic investments in infrastructure development will further reinforce the market expansion.Tell us your focus area and get a customized research report.

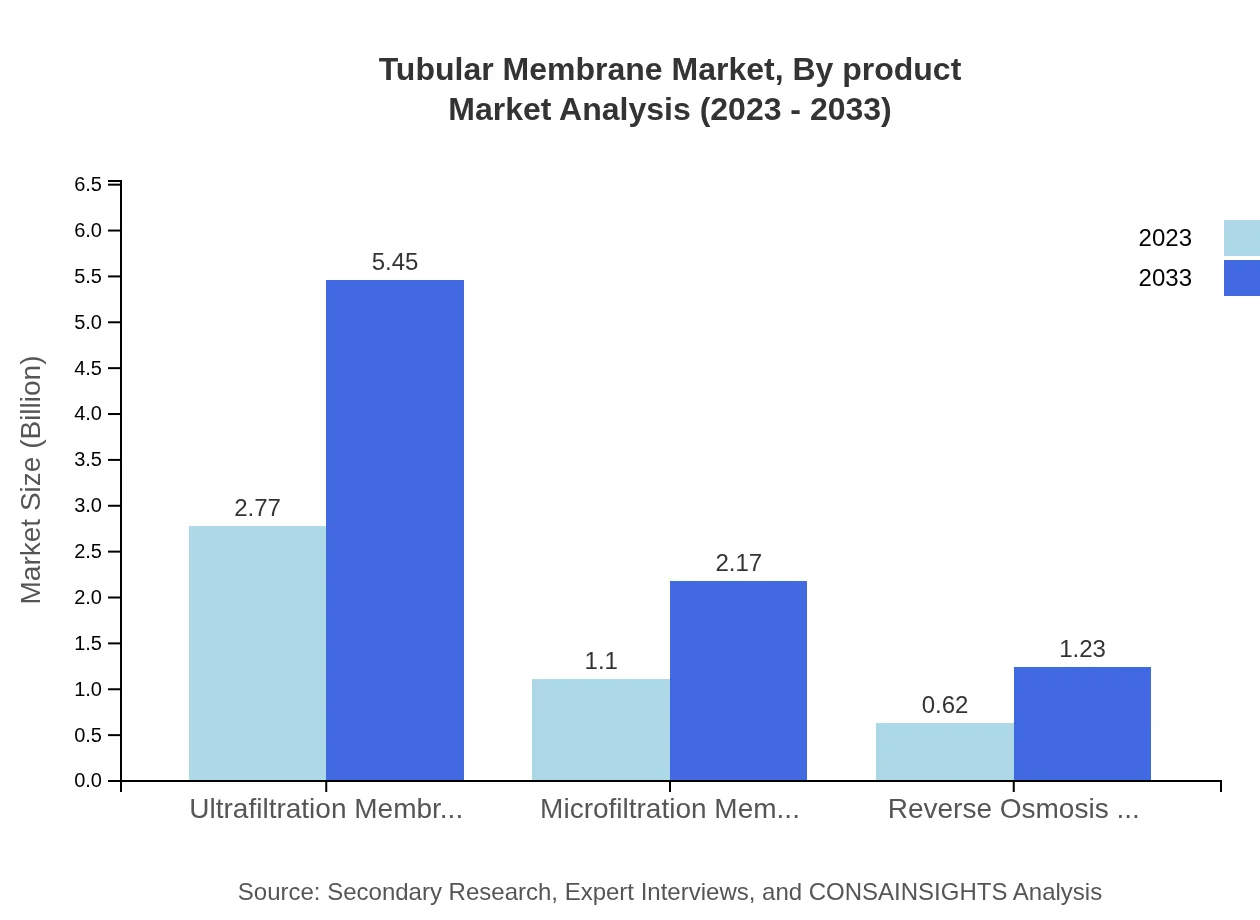

Tubular Membrane Market Analysis By Product

The Tubular Membrane market is primarily driven by ultrafiltration membranes, which represent a dominant portion of the market share. Ultrafiltration membranes are projected to grow from $2.77 billion in 2023 to $5.45 billion in 2033, maintaining a consistent market share of 61.64%. Microfiltration and reverse osmosis membranes also contribute significantly, with respective sizes of $1.1 billion in 2023 and $0.62 billion in 2023, expected to reach $2.17 billion and $1.23 billion by 2033.

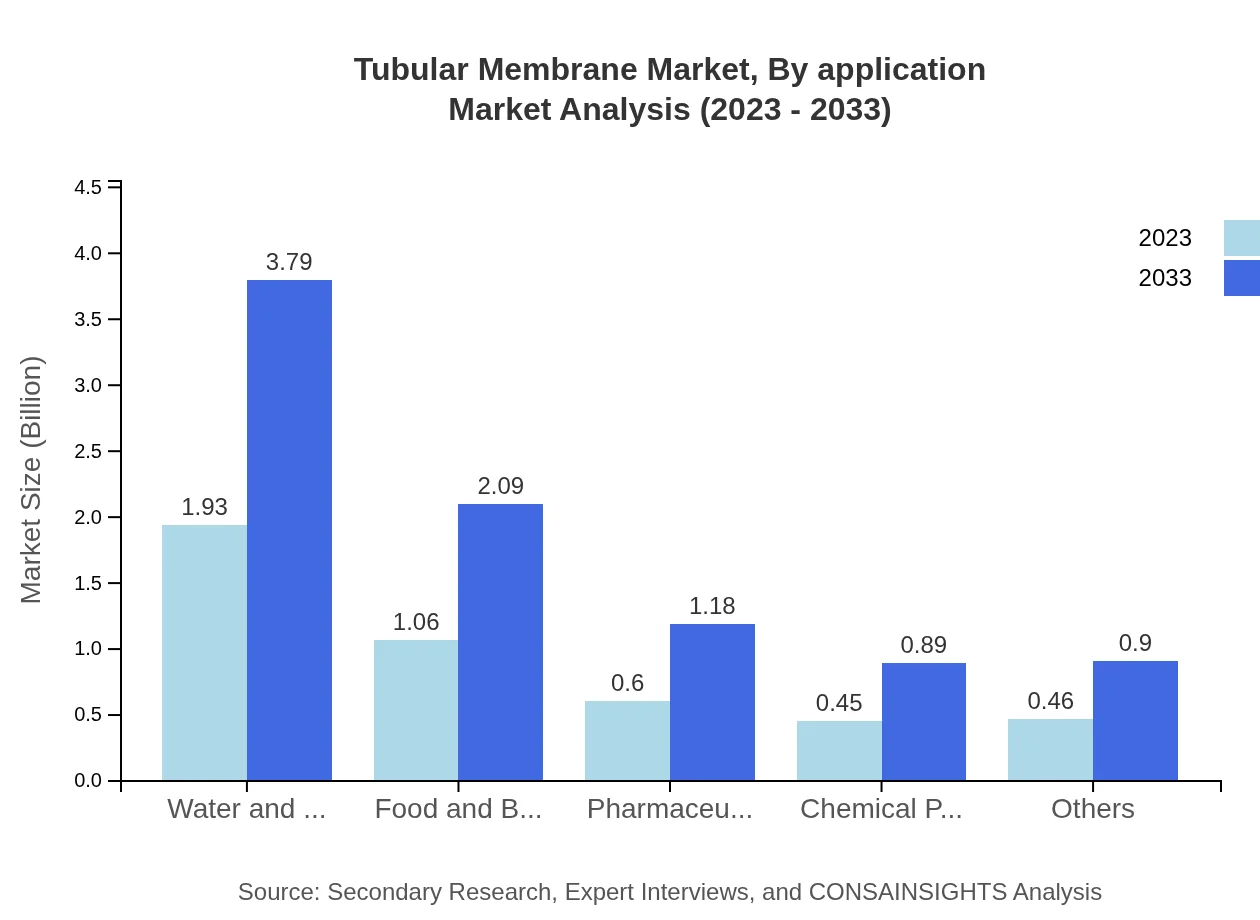

Tubular Membrane Market Analysis By Application

The applications of Tubular Membranes span several industries, with water and wastewater treatment holding the largest share. This segment is projected to grow from $1.93 billion in 2023 to $3.79 billion in 2033, representing a substantial 42.85% market share. Food and beverage processing, as well as pharmaceutical applications, are also vital segments, anticipated to grow steadily over the forecast period.

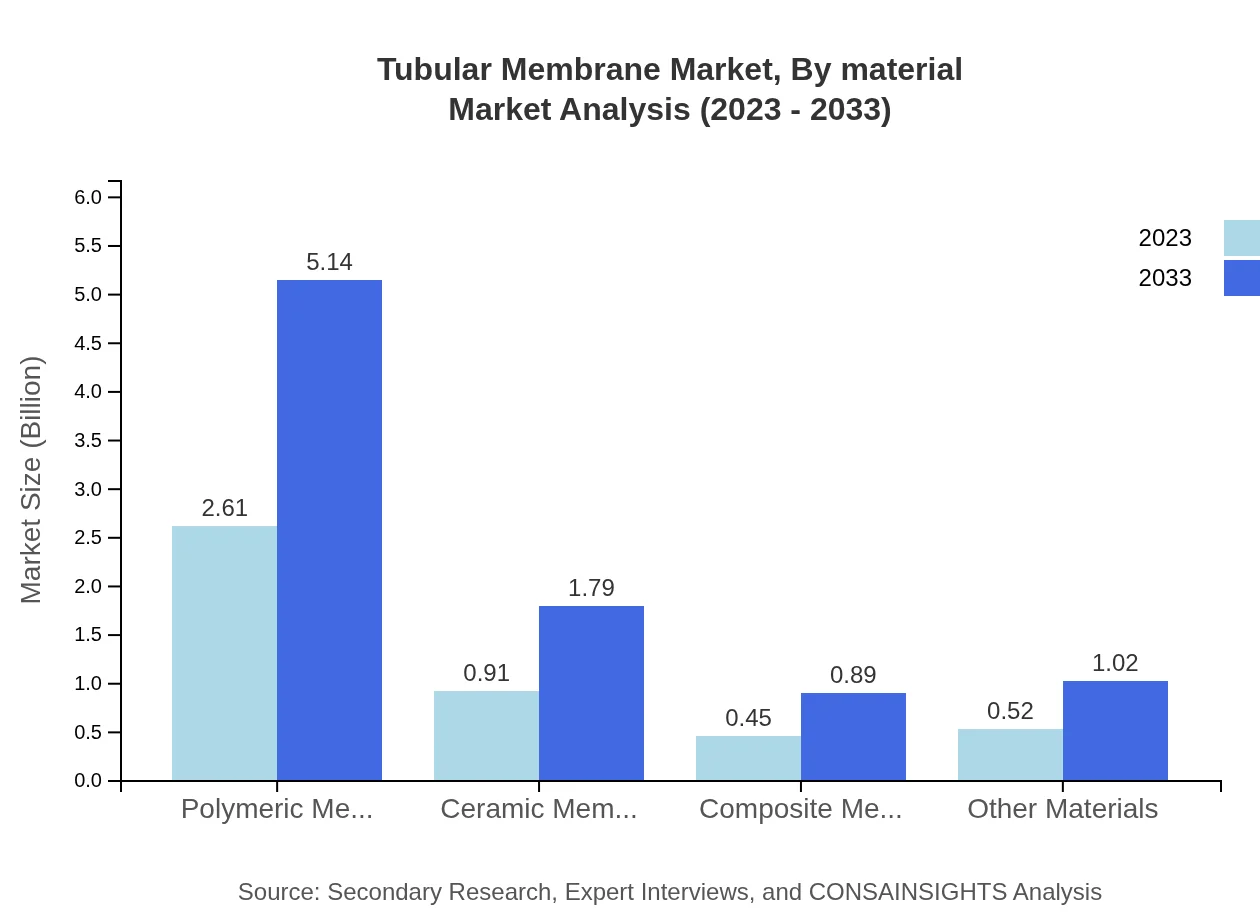

Tubular Membrane Market Analysis By Material

Polymeric membranes dominate the market, holding a significant share of 58.1% in 2023 and expected to maintain this share in 2033 with a market growth from $2.61 billion to $5.14 billion. Ceramic membranes, with a market size of $0.91 billion in 2023, are also anticipated to witness growth due to their durability and effectiveness, expanding to $1.79 billion by 2033.

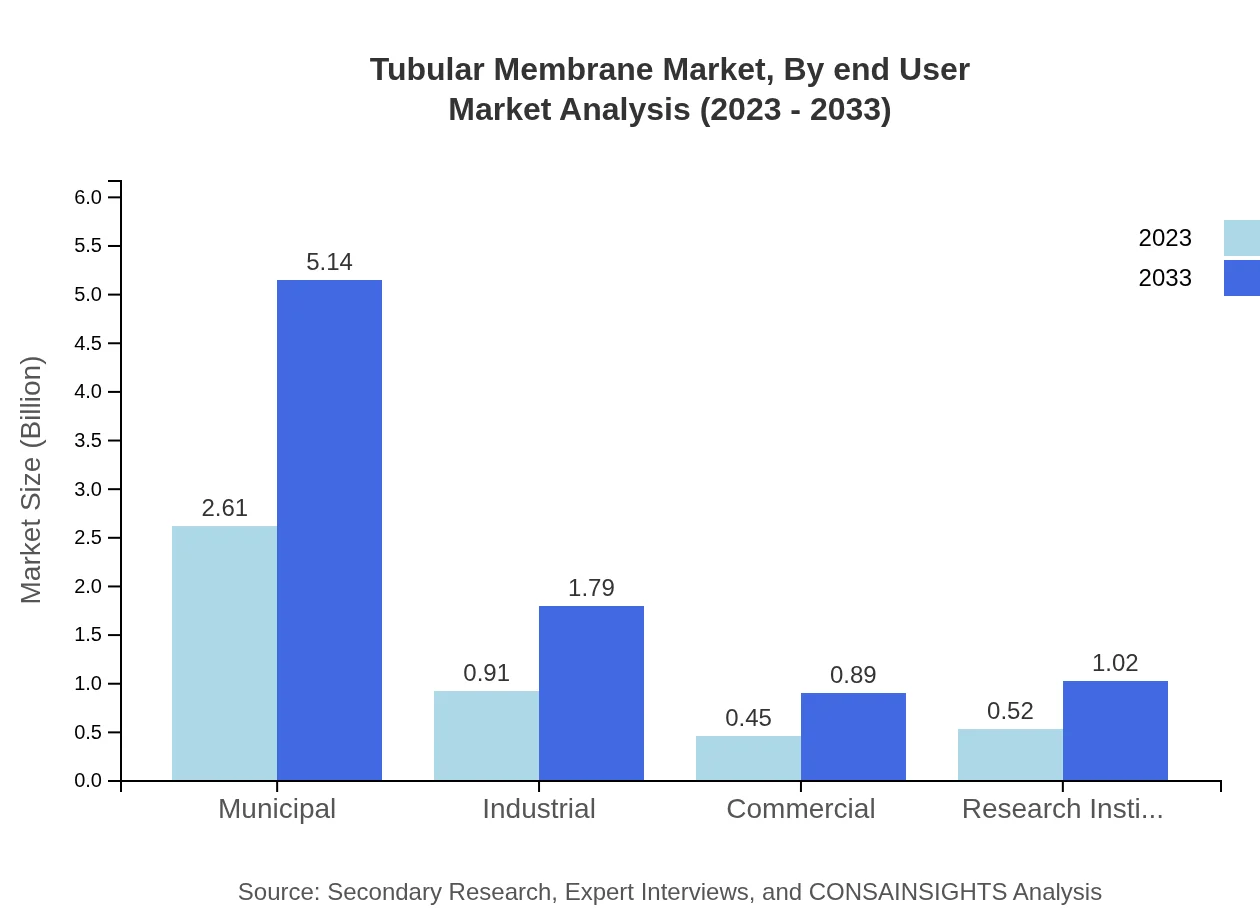

Tubular Membrane Market Analysis By End User

The end-user analysis reveals that municipal applications remain the largest segment, projected to grow from $2.61 billion in 2023 to $5.14 billion in 2033, holding a market share of 58.1%. Industrial applications also express potential, increasing from $0.91 billion to $1.79 billion during the same period, while commercial and research institutions contribute significantly to overall demand.

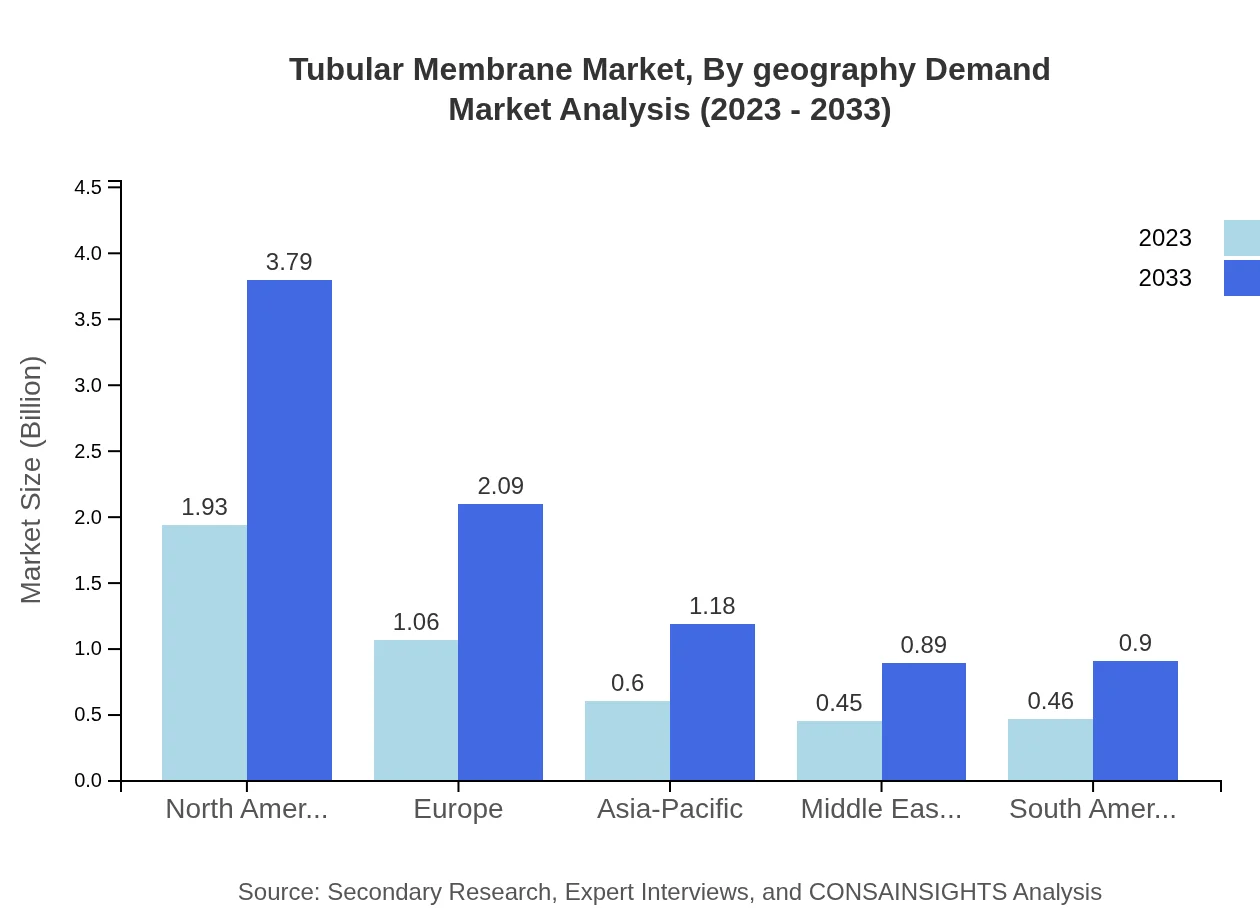

Tubular Membrane Market Analysis By Geography Demand

Geographical trends indicate North America and Europe as major markets for Tubular Membranes, with respective sizes of $1.93 billion and $1.54 billion in 2023, projected to reach $3.79 billion and $3.03 billion by 2033. The Asia-Pacific region is also emerging as a significant player, primarily driven by the need for advanced water treatment solutions.

Tubular Membrane Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tubular Membrane Industry

Hydranautics:

A part of Nitto Group, Hydranautics specializes in membrane technology for water treatment and industrial processes, recognized for its advanced reverse osmosis products.Toray Industries:

Toray is a leading global manufacturer of advanced membrane technologies with applications in desalination and water purification, leveraging strong R&D capabilities.Dow Water & Process Solutions:

This division of Dow Chemical focuses on innovative water treatment solutions, providing a wide range of membrane products for various applications.Suez Water Technologies:

Suez is a prominent figure in water management, offering state-of-the-art membrane technologies aimed at enhancing water treatment processes across different industries.We're grateful to work with incredible clients.

FAQs

What is the market size of tubular Membrane?

The tubular membrane market is projected to reach $4.5 billion by 2033, growing at a CAGR of 6.8%. This growth indicates strong demand and increasing applications across various sectors globally.

What are the key market players or companies in the tubular Membrane industry?

Key players in the tubular membrane market include major companies specializing in membrane technologies, water treatment solutions, and industrial filtration systems. These companies are leading in innovation and production capacity.

What are the primary factors driving the growth in the tubular Membrane industry?

Growth in the tubular membrane industry is driven by increasing demand for efficient water treatment processes, advancements in membrane technology, and the rising need for clean water worldwide, particularly in developing regions.

Which region is the fastest Growing in the tubular Membrane?

The fastest-growing region in the tubular membrane market is Europe, expected to grow from $1.54 billion in 2023 to $3.03 billion by 2033. This growth is fueled by stringent environmental regulations and increased industrial applications.

Does ConsaInsights provide customized market report data for the tubular Membrane industry?

Yes, ConsaInsights offers customized market report data tailored to the tubular membrane industry, enabling clients to gain insights specific to their needs, competitive landscape, and regional opportunities.

What deliverables can I expect from this tubular Membrane market research project?

Expect comprehensive analysis reports, market forecasts, competitive landscape assessments, supplier profiles, and customized insights specific to the tubular membrane market, along with strategic recommendations.

What are the market trends of tubular Membrane?

Key market trends include increasing adoption of ultra-filtration membranes, advancements in ceramic membrane technologies, and rising applications in water treatment and food processing sectors, influencing market dynamics.