Tuna And Algae Omega-3 Ingredient Market Report

Published Date: 31 January 2026 | Report Code: tuna-and-algae-omega-3-ingredient

Tuna And Algae Omega-3 Ingredient Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Tuna and Algae Omega-3 Ingredient market, covering key insights, current trends, and future forecasts for the decade spanning 2023 to 2033.

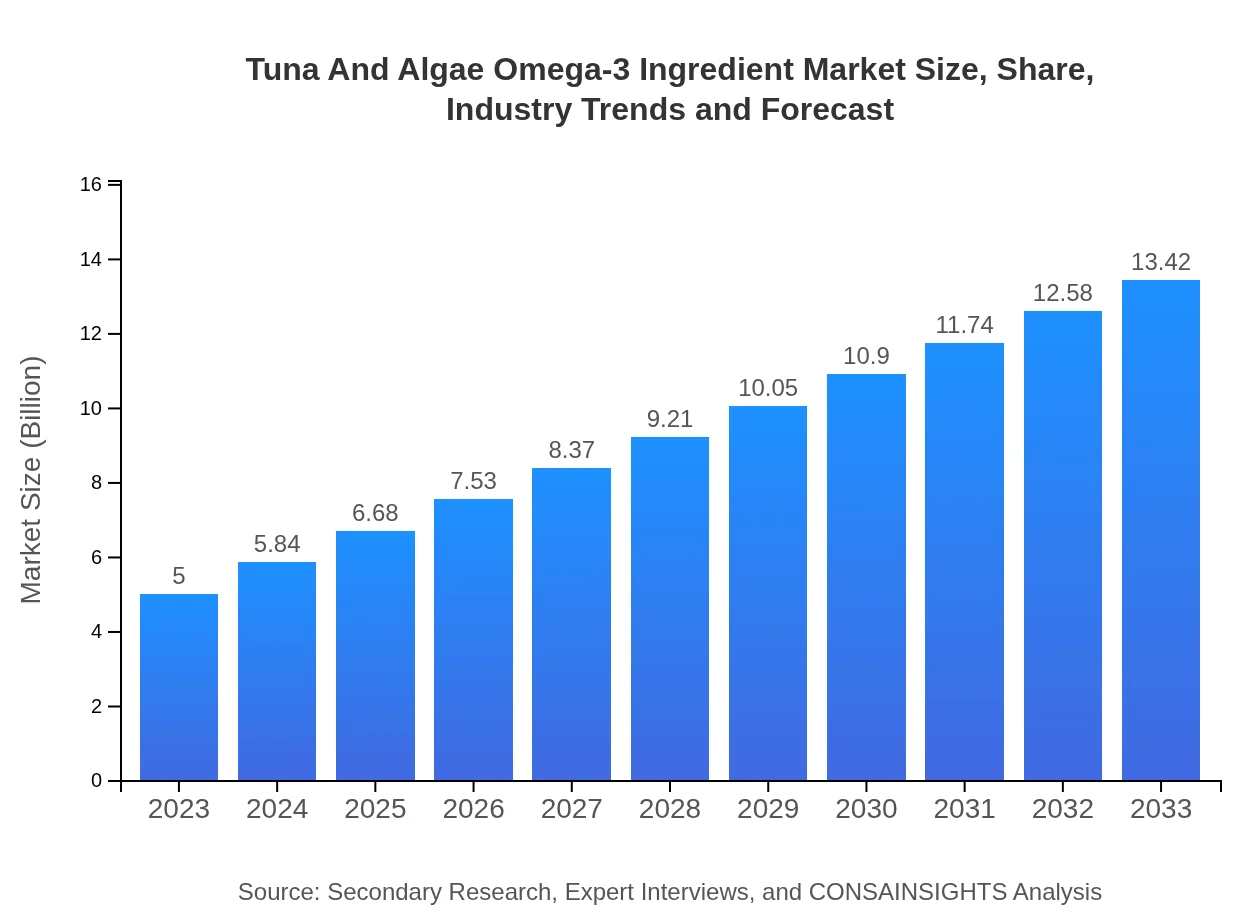

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $13.42 Billion |

| Top Companies | DSM Nutritional Products, BASF SE, KKC Co., Ltd., Cargill Incorporated, Ginkgo BioWorks, Inc. |

| Last Modified Date | 31 January 2026 |

Tuna And Algae Omega-3 Ingredient Market Overview

Customize Tuna And Algae Omega-3 Ingredient Market Report market research report

- ✔ Get in-depth analysis of Tuna And Algae Omega-3 Ingredient market size, growth, and forecasts.

- ✔ Understand Tuna And Algae Omega-3 Ingredient's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tuna And Algae Omega-3 Ingredient

What is the Market Size & CAGR of Tuna And Algae Omega-3 Ingredient market in 2023?

Tuna And Algae Omega-3 Ingredient Industry Analysis

Tuna And Algae Omega-3 Ingredient Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tuna And Algae Omega-3 Ingredient Market Analysis Report by Region

Europe Tuna And Algae Omega-3 Ingredient Market Report:

Europe's market is poised for considerable expansion, scaling from $1.29 billion in 2023 to $3.47 billion by 2033. The driving forces include stringent food safety regulations, consumer demand for transparency in food sources, and the growing prevalence of chronic diseases necessitating dietary interventions.Asia Pacific Tuna And Algae Omega-3 Ingredient Market Report:

In the Asia Pacific region, the Tuna and Algae Omega-3 Ingredient market is projected to grow from $1.05 billion in 2023 to $2.82 billion by 2033. Increased health consciousness and growing disposable income among consumers are driving this growth, coupled with the rising trend of incorporating Omega-3 in daily diets across various food items.North America Tuna And Algae Omega-3 Ingredient Market Report:

North America is expected to witness substantial growth, from $1.87 billion in 2023 to about $5.03 billion by 2033. This growth can be attributed to a well-established consumer base emphasizing dietary supplements and functional foods, alongside supportive regulatory frameworks.South America Tuna And Algae Omega-3 Ingredient Market Report:

The South American market, though smaller, is set to expand from $0.20 billion to $0.53 billion in the same period, thanks to the burgeoning interest in nutritional supplements and increased penetration of health-related products in emerging markets.Middle East & Africa Tuna And Algae Omega-3 Ingredient Market Report:

In the Middle East and Africa, the market is predicted to grow from $0.58 billion to $1.57 billion from 2023 to 2033. Economic growth in these regions, combined with increased health awareness campaigns, is propelling the market forward.Tell us your focus area and get a customized research report.

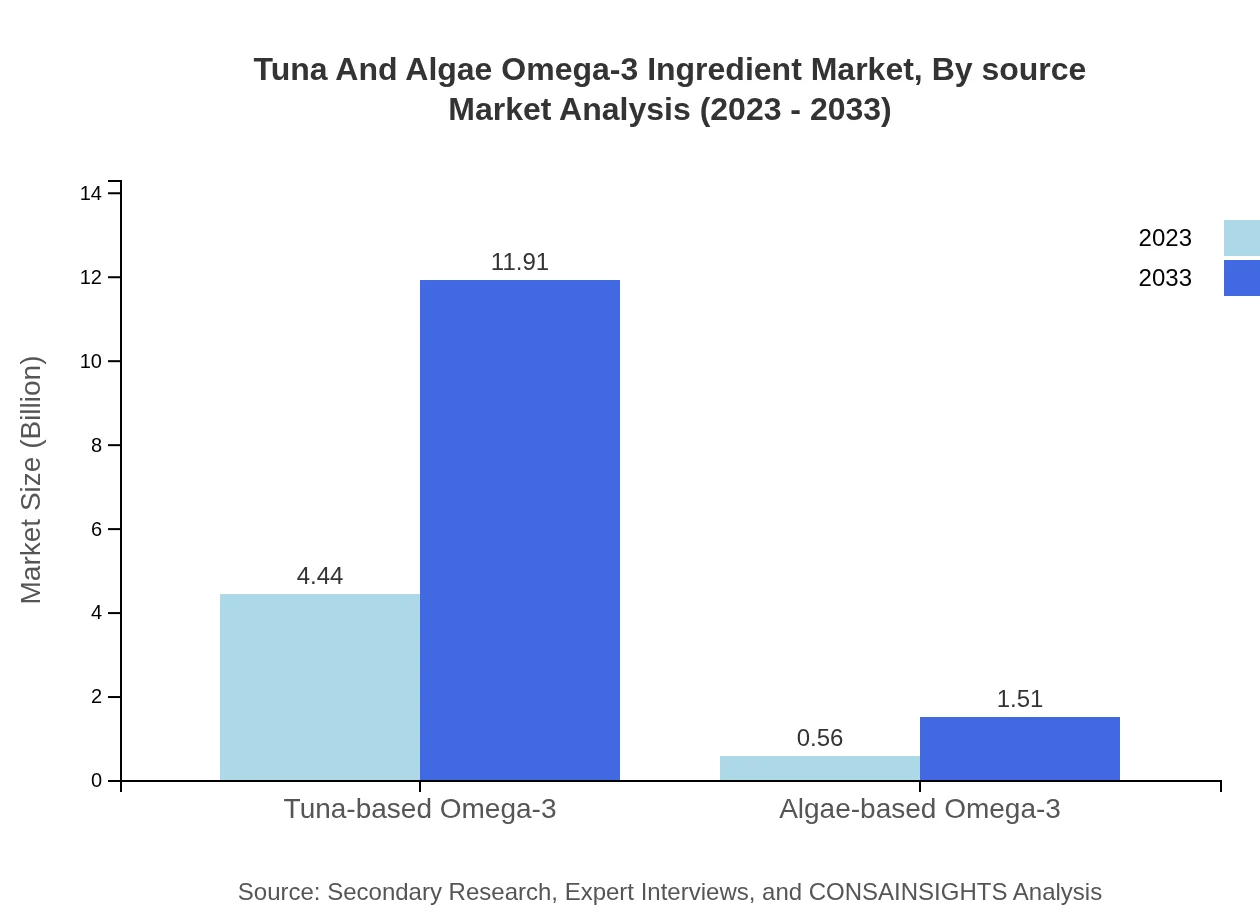

Tuna And Algae Omega-3 Ingredient Market Analysis By Source

The market segment by source reveals a notable dominance of Tuna-based Omega-3 ingredients, which accounted for approximately 88.73 percent of the market in 2023 and is projected to maintain this share through 2033. Algae-based Omega-3 ingredients, although currently at 11.27 percent, are anticipated to grow significantly due to their appeal in vegan and health-conscious consumer segments.

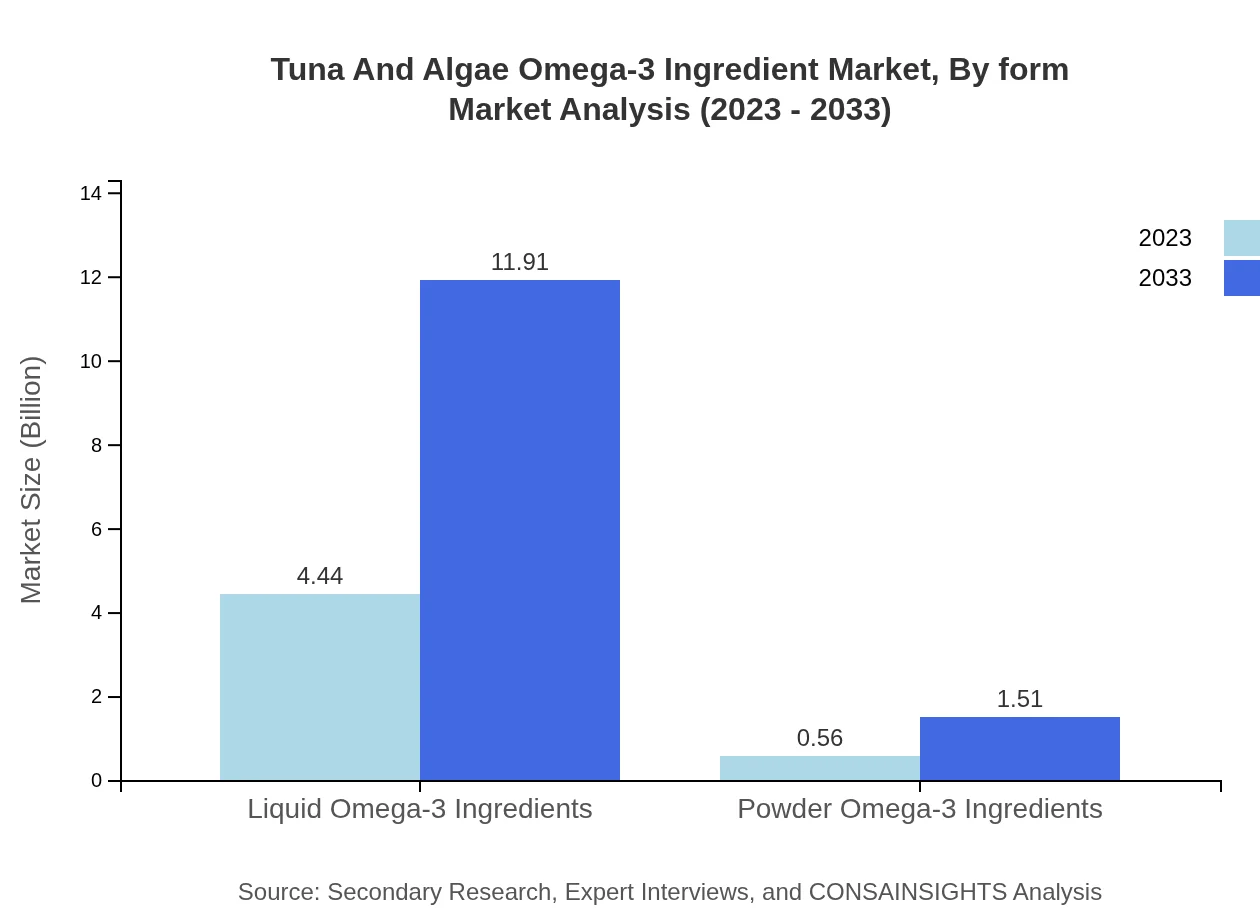

Tuna And Algae Omega-3 Ingredient Market Analysis By Form

In terms of product form, Liquid Omega-3 Ingredients lead the market with a share of around 88.73 percent in 2023, valued at $4.44 billion. Powder Omega-3 Ingredients, though currently accounting for a smaller portion at 11.27 percent, are projected to grow due to their convenience and application in various products.

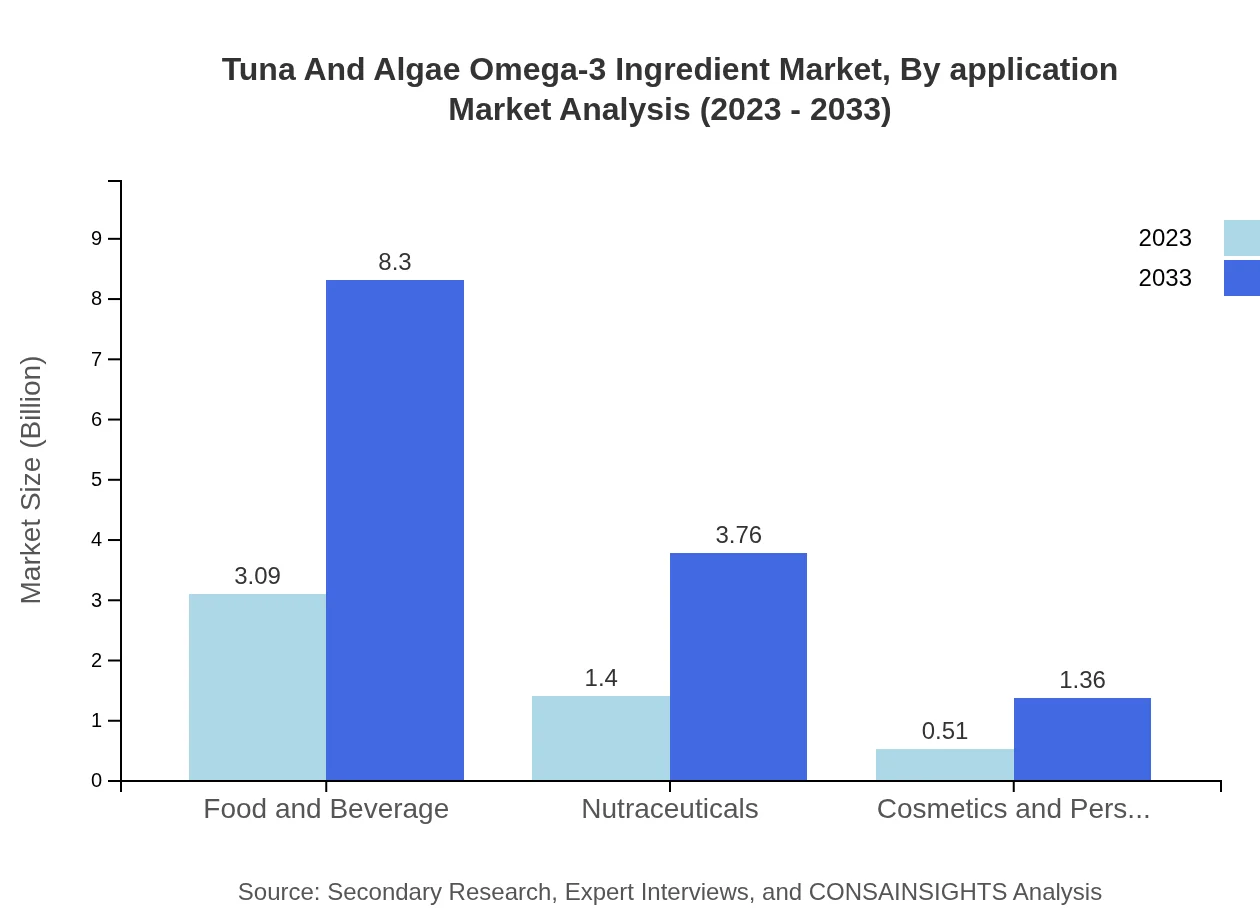

Tuna And Algae Omega-3 Ingredient Market Analysis By Application

Food and Beverage applications dominate the market, securing a 61.85 percent share in 2023, while Healthcare and Nutraceutical companies account for 28.04 percent. Cosmetics and Personal Care sectors are emerging rapidly, driven by the health benefits attributed to Omega-3 fatty acids.

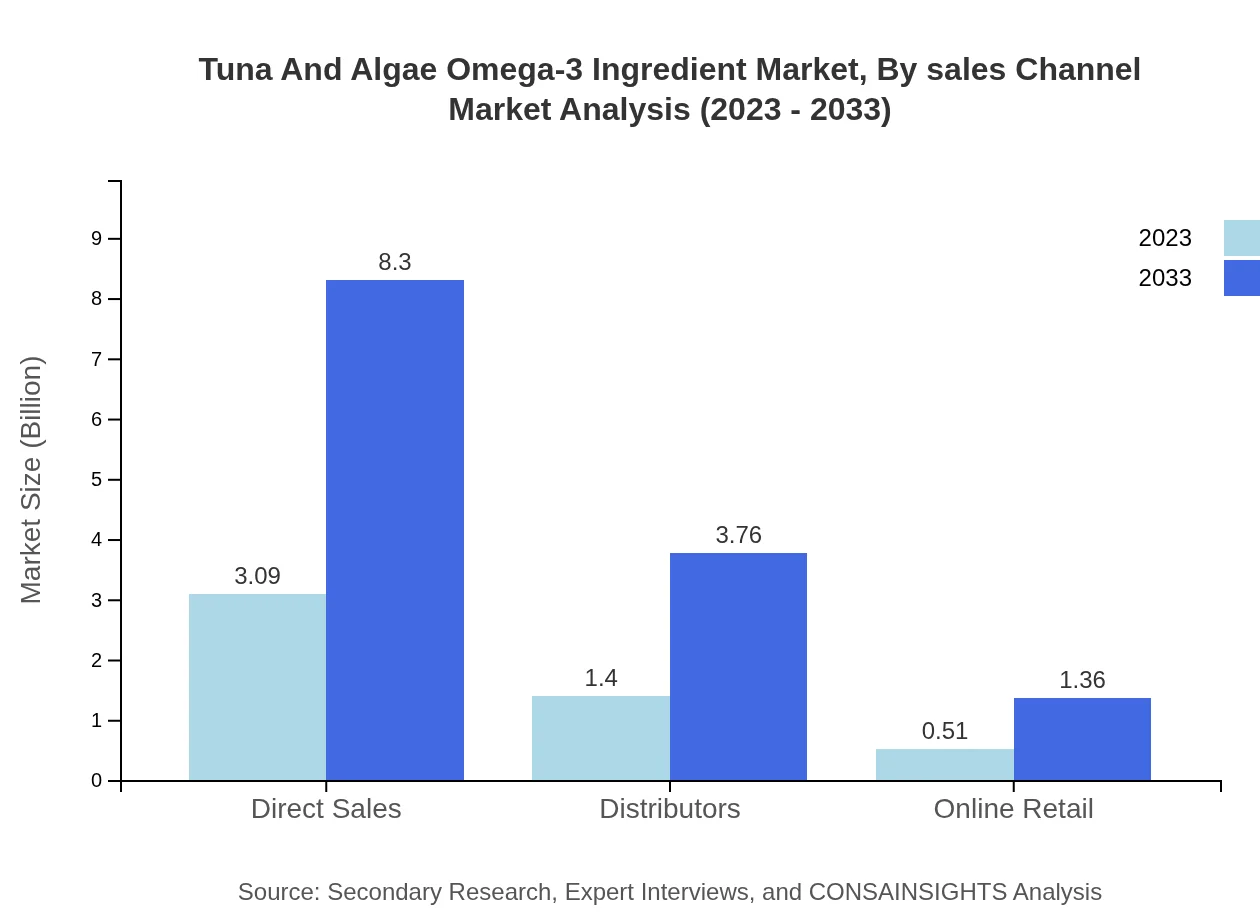

Tuna And Algae Omega-3 Ingredient Market Analysis By Sales Channel

Direct sales channels exhibit significant performance, contributing to 61.85 percent of market revenue in 2023, with substantial online retail growth expected as consumer purchasing habits shift more towards e-commerce platforms.

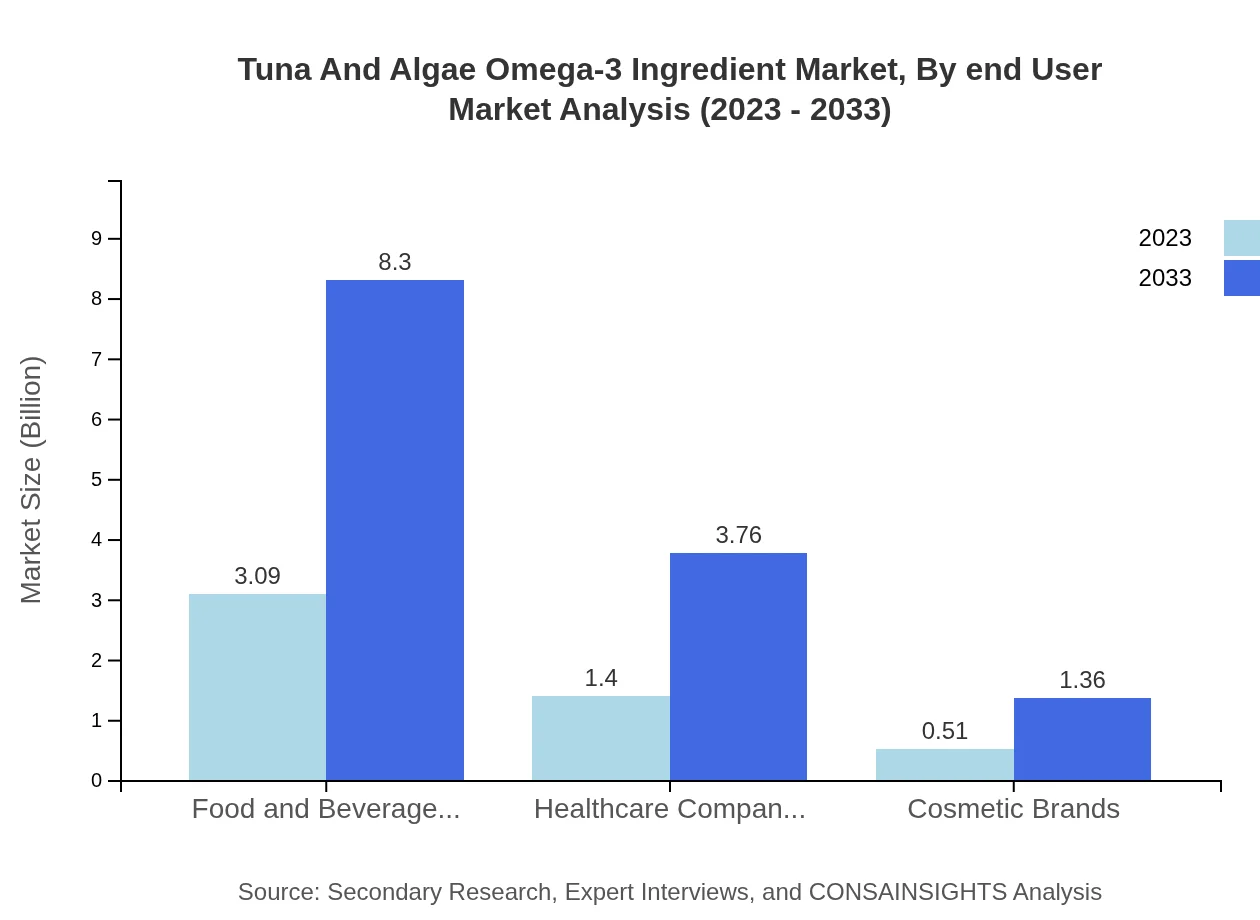

Tuna And Algae Omega-3 Ingredient Market Analysis By End User

The end user segment is primarily made up of Food and Beverage Manufacturers, representing 61.85 percent of the market, followed by Healthcare Companies at 28.04 percent. The Cosmetics sector is starting to establish a stronger foothold, driven by heightened consumer awareness of natural ingredients.

Tuna And Algae Omega-3 Ingredient Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tuna And Algae Omega-3 Ingredient Industry

DSM Nutritional Products:

DSM is a leading player in the nutritional ingredient market, providing Omega-3 products from algae and fish, with a focus on sustainability and innovation.BASF SE:

BASF is a global leader in chemical solutions that includes a robust portfolio in nutrition and health ingredients, emphasizing sustainable sourcing of Omega-3 fatty acids.KKC Co., Ltd.:

KKC specializes in algae-based Omega-3 solutions, focusing on clean-label products that target health-conscious consumers.Cargill Incorporated:

Cargill is known for its diverse capabilities in food and agricultural products, including high-quality fish oil and Omega-3 products.Ginkgo BioWorks, Inc.:

Ginkgo provides fermentation-based alternatives to Omega-3 fatty acids, enhancing sustainability and reducing reliance on marine sources.We're grateful to work with incredible clients.

FAQs

What is the market size of tuna And Algae Omega-3 Ingredient?

The global market size for tuna and algae omega-3 ingredients is projected to reach $5 billion by 2033, growing at a CAGR of 10% from 2023. This substantial growth highlights the rising demand for omega-3 products across various sectors.

What are the key market players or companies in this tuna And Algae Omega-3 Ingredient industry?

Key market players include major food and beverage manufacturers, healthcare companies, and cosmetic brands, leading the way in the utilization of omega-3 ingredients. Their innovations and investments significantly shape industry dynamics.

What are the primary factors driving the growth in the tuna And Algae Omega-3 Ingredient industry?

Growth in the tuna and algae omega-3 ingredient industry is driven by increasing health awareness, the rise in demand for sustainable sources of omega-3, and greater incorporation of these ingredients in food, nutraceuticals, and cosmetics.

Which region is the fastest Growing in the tuna And Algae Omega-3 Ingredient?

North America is the fastest-growing region for tuna and algae omega-3 ingredients, projected to grow from $1.87 billion in 2023 to $5.03 billion by 2033. This surge is attributed to increased health consciousness and product innovation.

Does ConsaInsights provide customized market report data for the tuna And Algae Omega-3 Ingredient industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the tuna and algae omega-3 ingredient industry, ensuring relevant insights and actionable strategies for market players.

What deliverables can I expect from this tuna And Algae Omega-3 Ingredient market research project?

Deliverables from this research project include comprehensive market analysis, future growth forecasts, segmentation data, competitive landscape reviews, and strategic recommendations tailored to the tuna and algae omega-3 ingredient market.

What are the market trends of tuna And Algae Omega-3 Ingredient?

Current market trends indicate a rising preference for plant-based omega-3 sources, innovations in extraction technology, and an increasing focus on sustainability, which are shaping the tuna and algae omega-3 ingredient market.