Turbocompressor Market Report

Published Date: 22 January 2026 | Report Code: turbocompressor

Turbocompressor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Turbocompressor market from 2023 to 2033. It includes market size, growth rate, regional analysis, trends, technology insights, and profiles of key players in the industry.

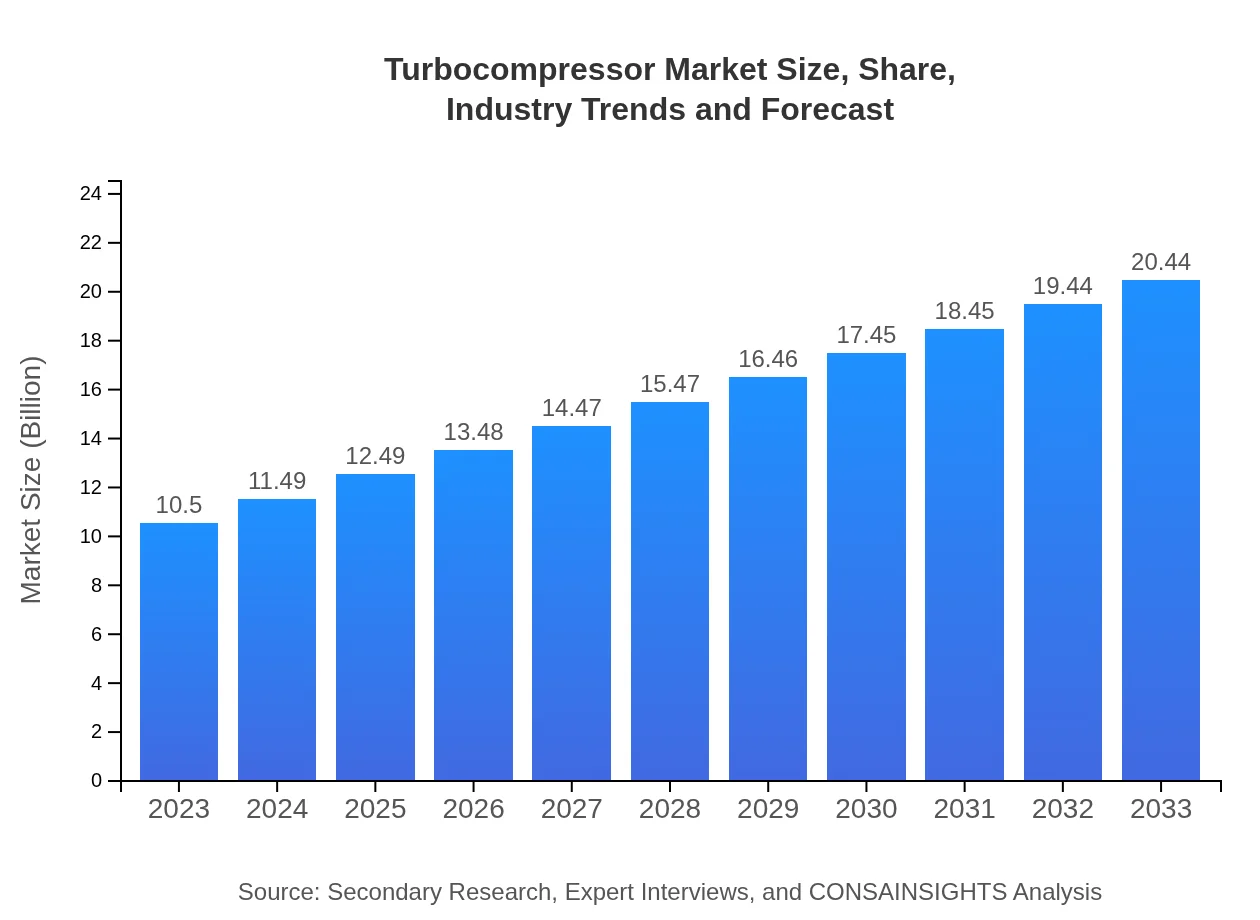

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $20.44 Billion |

| Top Companies | Siemens AG, GE Aviation, Atlas Copco, Ingersoll Rand, MAN Energy Solutions |

| Last Modified Date | 22 January 2026 |

Turbocompressor Market Overview

Customize Turbocompressor Market Report market research report

- ✔ Get in-depth analysis of Turbocompressor market size, growth, and forecasts.

- ✔ Understand Turbocompressor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Turbocompressor

What is the Market Size & CAGR of Turbocompressor market in 2023 and 2033?

Turbocompressor Industry Analysis

Turbocompressor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Turbocompressor Market Analysis Report by Region

Europe Turbocompressor Market Report:

Europe’s turbocompressor market is expected to rise from $3.05 billion in 2023 to $5.94 billion by 2033. The focus on sustainable energy sources and stringent environmental regulations are major drivers for the market in this region.Asia Pacific Turbocompressor Market Report:

The Asia Pacific region, valued at $2.08 billion in 2023, is expected to grow to $4.04 billion by 2033. This increase is driven by rapid industrialization and expanding manufacturing sectors in countries like China and India, contributing significantly to the turbocompressor demand.North America Turbocompressor Market Report:

With a current market size of $3.79 billion in 2023, North America is anticipated to grow to $7.37 billion by 2033. The region is characterized by advanced technology adoption in industrial processes, which encourages market growth.South America Turbocompressor Market Report:

In South America, the market is projected to grow from $0.28 billion in 2023 to $0.54 billion in 2033. Increasing investments in infrastructure and energy projects are expected to boost the turbocompressor market in this region.Middle East & Africa Turbocompressor Market Report:

In the Middle East and Africa, the market is expected to expand from $1.31 billion in 2023 to $2.54 billion by 2033. The ongoing investments in oil and gas exploration and production activities are substantial contributors to market growth.Tell us your focus area and get a customized research report.

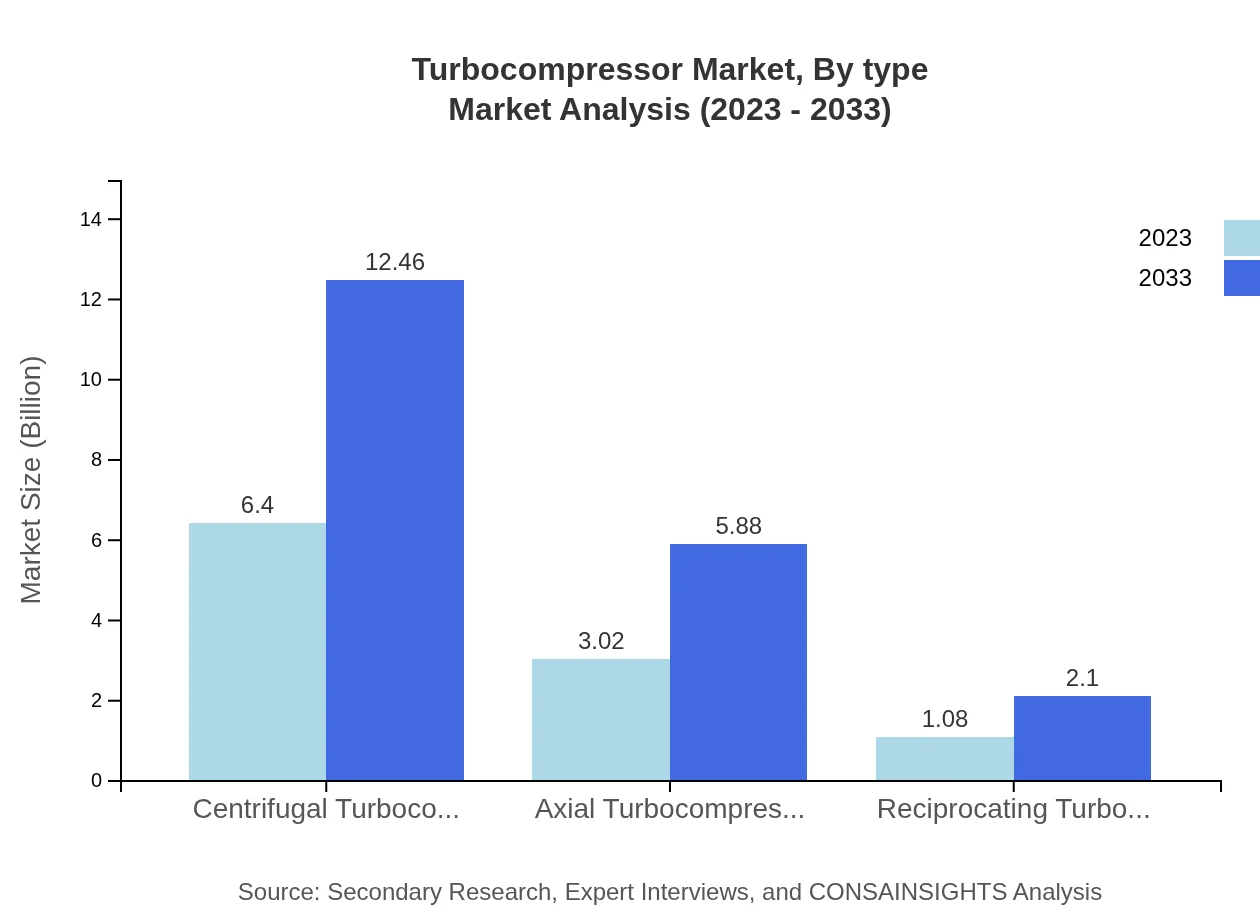

Turbocompressor Market Analysis By Type

Centrifugal turbocompressors dominate the market with sizes projected to grow from $6.40 billion in 2023 to $12.46 billion in 2033, holding a market share of approximately 60.97% in both 2023 and 2033. Axial turbocompressors also show significant growth, with size projections moving from $3.02 billion in 2023 to $5.88 billion by 2033, maintaining a 28.76% share. Reciprocating turbocompressors, while smaller, are expected to grow from $1.08 billion to $2.10 billion, reflecting a 10.27% market share.

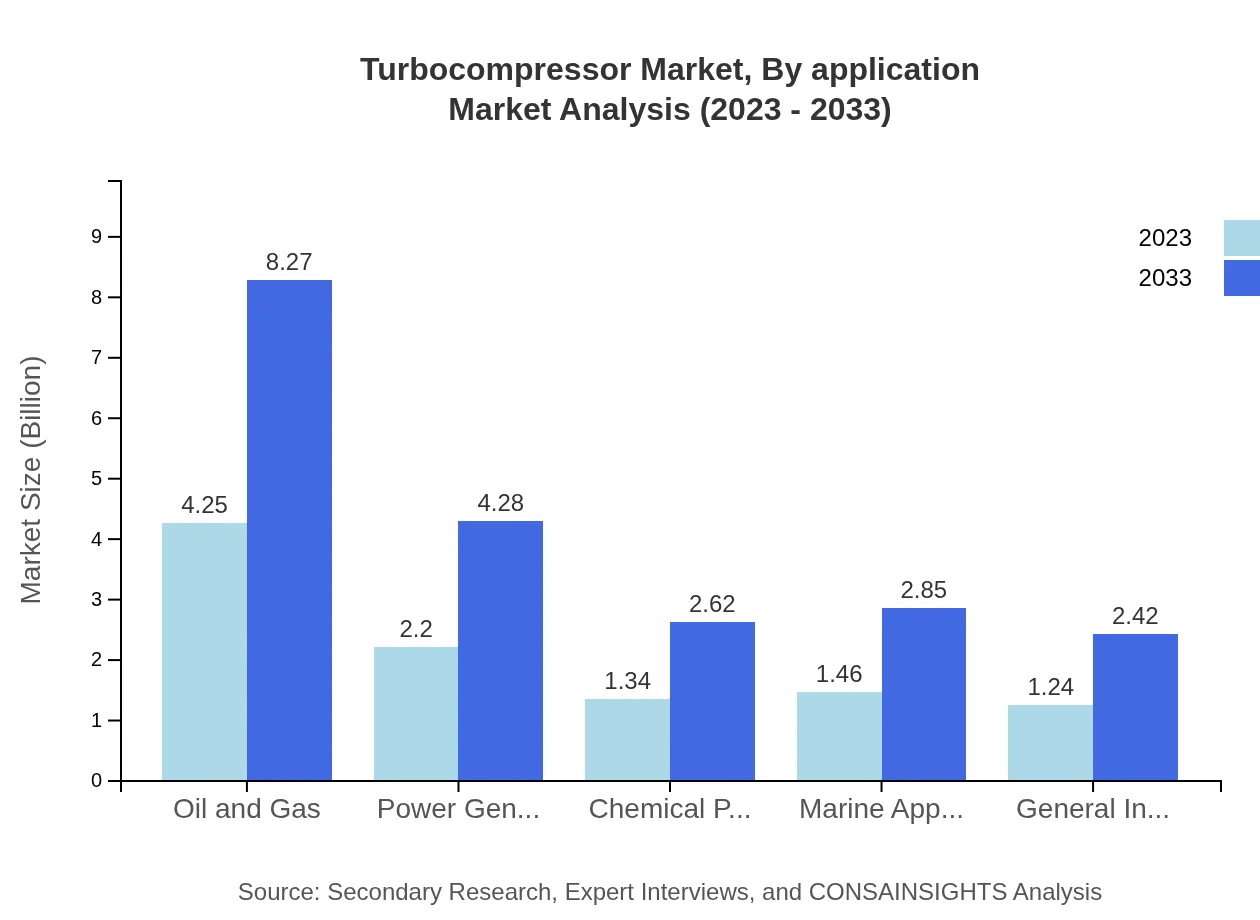

Turbocompressor Market Analysis By Application

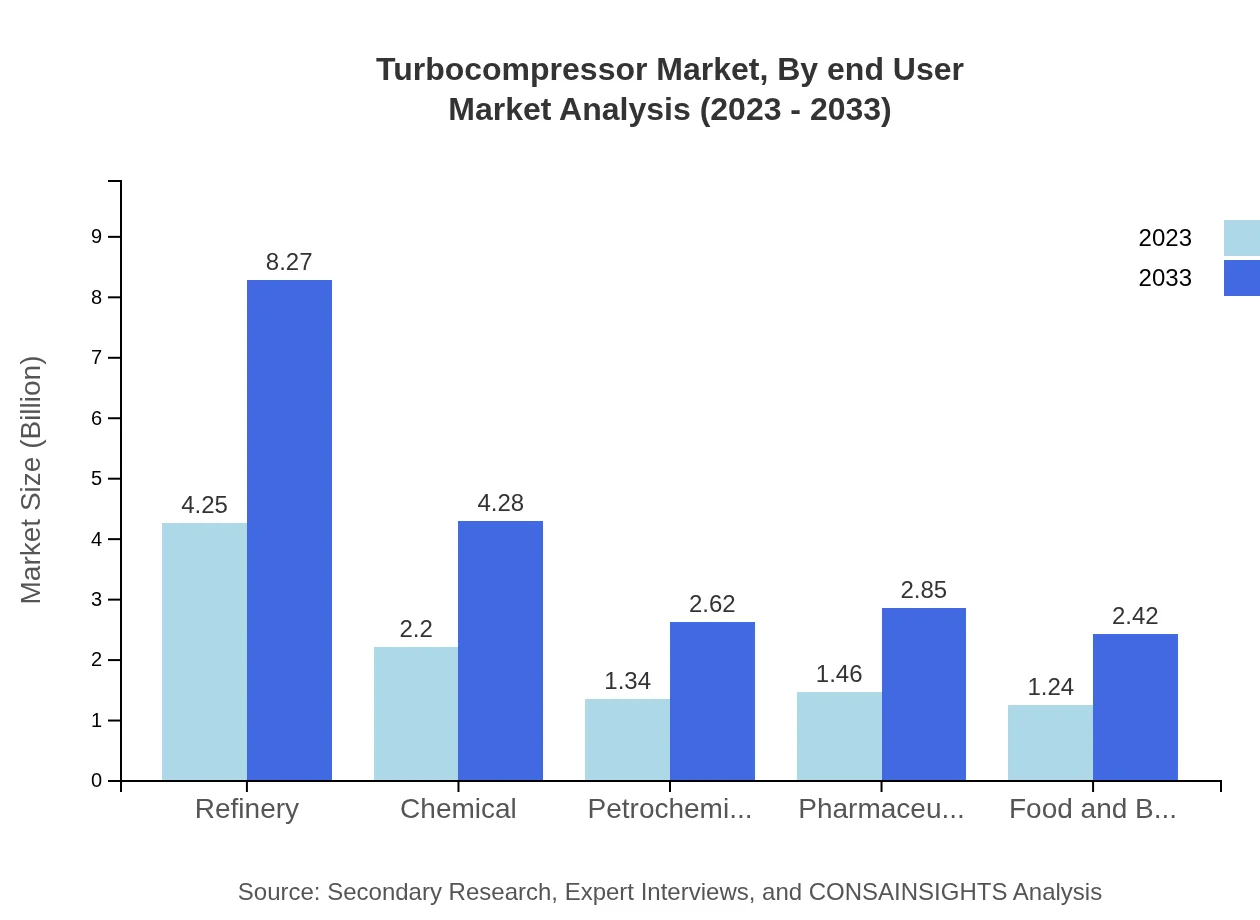

In the refinery sector, the market size is projected to increase from $4.25 billion in 2023 to $8.27 billion by 2033. The chemical processing sector, too, is expected to grow from $2.20 billion to $4.28 billion, reflecting robust demand. The oil and gas sectors remain crucial, with projections from $4.25 billion to $8.27 billion driven by ongoing exploration efforts.

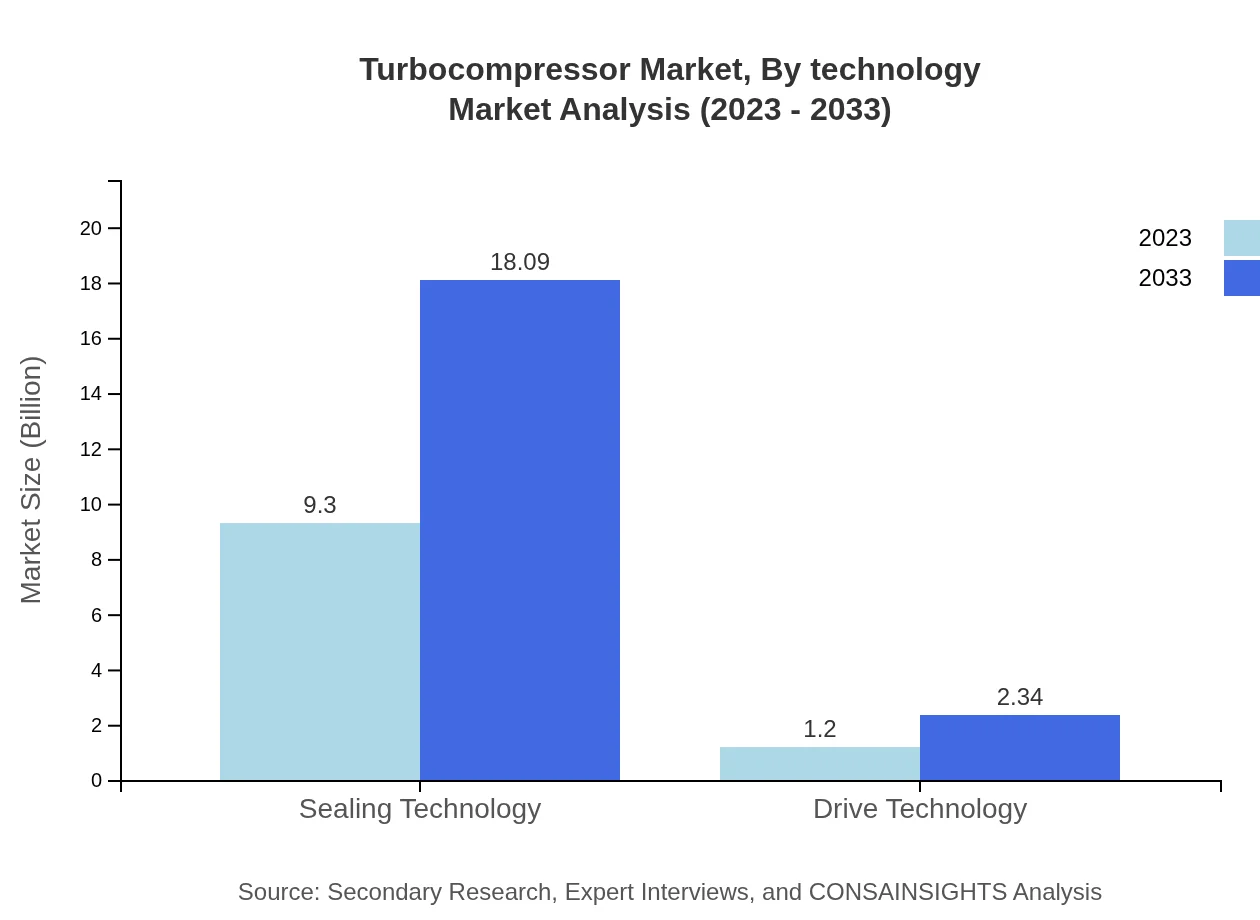

Turbocompressor Market Analysis By Technology

Sealing technology rules the market with sizes expected to increase from $9.30 billion in 2023 to $18.09 billion by 2033, capturing a whopping 88.54% of the market share. Drive technology is also noteworthy, projected to grow from $1.20 billion to $2.34 billion, maintaining an 11.46% market share.

Turbocompressor Market Analysis By End User

The demand across various sectors highlights a diverse end-user base. In pharmaceuticals, the market size is expected to grow from $1.46 billion to $2.85 billion, while food and beverage applications foresee growth from $1.24 billion to $2.42 billion. This indicates a significant adaptation across various sectors aiming for improved efficiency.

Turbocompressor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Turbocompressor Industry

Siemens AG:

A global leader in electrification, automation, and digitalization, Siemens provides innovative turbocompressor solutions with a focus on energy efficiency.GE Aviation:

Known for its leadership in jet engines and power systems, GE Aviation also offers advanced turbocompressor technologies for various industrial applications.Atlas Copco:

A key player in the compressed air and gas industry, Atlas Copco offers a range of turbocompressors that emphasize sustainability and efficiency.Ingersoll Rand:

Ingersoll Rand is recognized for its innovative solutions in industrial equipment, including high-performance turbocompressors.MAN Energy Solutions:

This company specializes in turbocompressor technologies for marine, power, and oil & gas sectors, highlighting efficiency and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of turbocompressor?

The global turbocompressor market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 6.7%, indicating robust growth potential as demand increases across various industries.

What are the key market players or companies in the turbocompressor industry?

Key players in the turbocompressor market include Siemens AG, General Electric, Atlas Copco, and Mitsubishi Heavy Industries. These companies lead the industry with innovative technologies and extensive portfolios, enhancing competitive dynamics.

What are the primary factors driving the growth in the turbocompressor industry?

Growth drivers include rising demand for efficient energy solutions, increasing investments in the oil and gas sector, and the need for advanced technologies to reduce emissions in industrial applications, all fueling market expansion.

Which region is the fastest Growing in the turbocompressor market?

Asia Pacific is projected to be the fastest-growing region in the turbocompressor market, expected to grow from $2.08 billion in 2023 to $4.04 billion by 2033, driven by industrialization and energy sector investments.

Does ConsaInsights provide customized market report data for the turbocompressor industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients, allowing for deeper insights into the turbocompressor industry tailored to particular market segments or geographies.

What deliverables can I expect from this turbocompressor market research project?

Deliverables include comprehensive market analysis reports, up-to-date market size estimates, growth forecasts, competitive landscape assessments, and tailored statistical data to support strategic decision-making.

What are the market trends of turbocompressor?

Key market trends include advancements in turbocompressor technologies, increasing automation in industrial applications, and a shift towards sustainable energy solutions, matching evolving customer demands and regulatory environments.