Turboprop Aircraft Market Report

Published Date: 03 February 2026 | Report Code: turboprop-aircraft

Turboprop Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Turboprop Aircraft market, offering insights into market size, trends, technological advancements, and forecasts from 2023 to 2033. It highlights regional dynamics, industry analysis, and market segmentation to understand future growth potential.

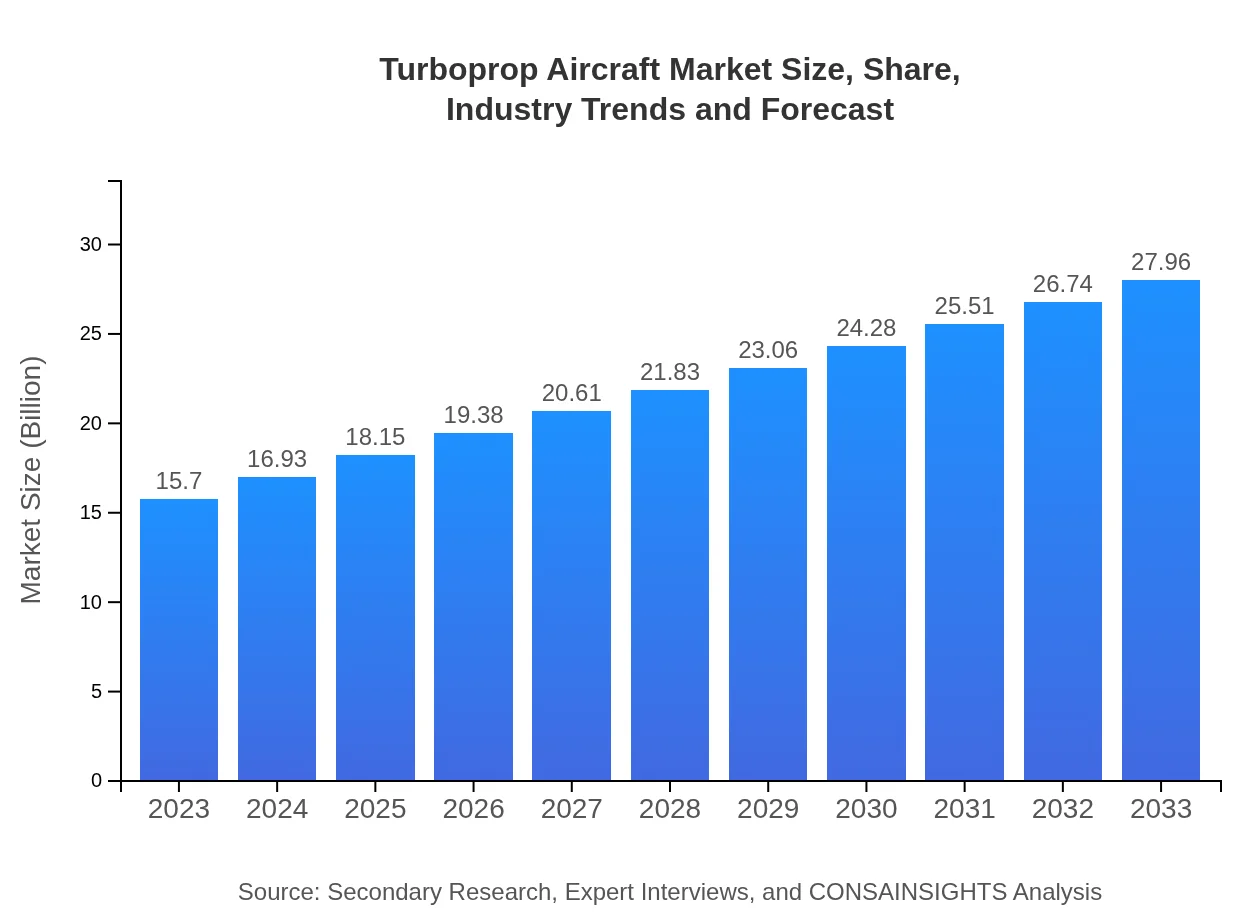

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $27.96 Billion |

| Top Companies | Bombardier Inc., ATR (Avions de transport régional), Embraer, De Havilland Aircraft of Canada Limited |

| Last Modified Date | 03 February 2026 |

Turboprop Aircraft Market Overview

Customize Turboprop Aircraft Market Report market research report

- ✔ Get in-depth analysis of Turboprop Aircraft market size, growth, and forecasts.

- ✔ Understand Turboprop Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Turboprop Aircraft

What is the Market Size & CAGR of Turboprop Aircraft market in 2023?

Turboprop Aircraft Industry Analysis

Turboprop Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Turboprop Aircraft Market Analysis Report by Region

Europe Turboprop Aircraft Market Report:

The Turboprop Aircraft market in Europe was valued at USD 5.54 billion in 2023 and is anticipated to reach USD 9.87 billion by 2033. Growing environmental regulations and a rising focus on reducing carbon footprints drive the demand for innovative turboprop designs that enhance fuel efficiency.Asia Pacific Turboprop Aircraft Market Report:

In the Asia Pacific region, the Turboprop Aircraft market was valued at USD 2.96 billion in 2023, projected to grow to USD 5.28 billion by 2033. The growth is fueled by increasing air travel and government initiatives to improve regional connectivity. Countries like India and China are ramping up their investment in regional aircraft.North America Turboprop Aircraft Market Report:

North America represents a significant market with an estimated value of USD 5.07 billion in 2023, expecting to reach USD 9.03 billion by 2033. The strong presence of key manufacturers and increasing demand for regional aircraft play a crucial role in this region's growth. Moreover, concern for sustainable aviation fuels is influencing new product offerings.South America Turboprop Aircraft Market Report:

The South American market for Turboprop Aircraft is estimated at USD 1.51 billion in 2023, with a projected value of USD 2.69 billion by 2033. Demand is primarily driven by the expansion of regional airlines seeking to serve underserved routes and enhance connectivity between smaller airports.Middle East & Africa Turboprop Aircraft Market Report:

The market in the Middle East and Africa is relatively smaller, starting at USD 0.61 billion in 2023 and projected to grow to USD 1.09 billion by 2033. The growth is attributed to increasing investments in infrastructure and a rise in tourism, providing opportunities for regional air transport.Tell us your focus area and get a customized research report.

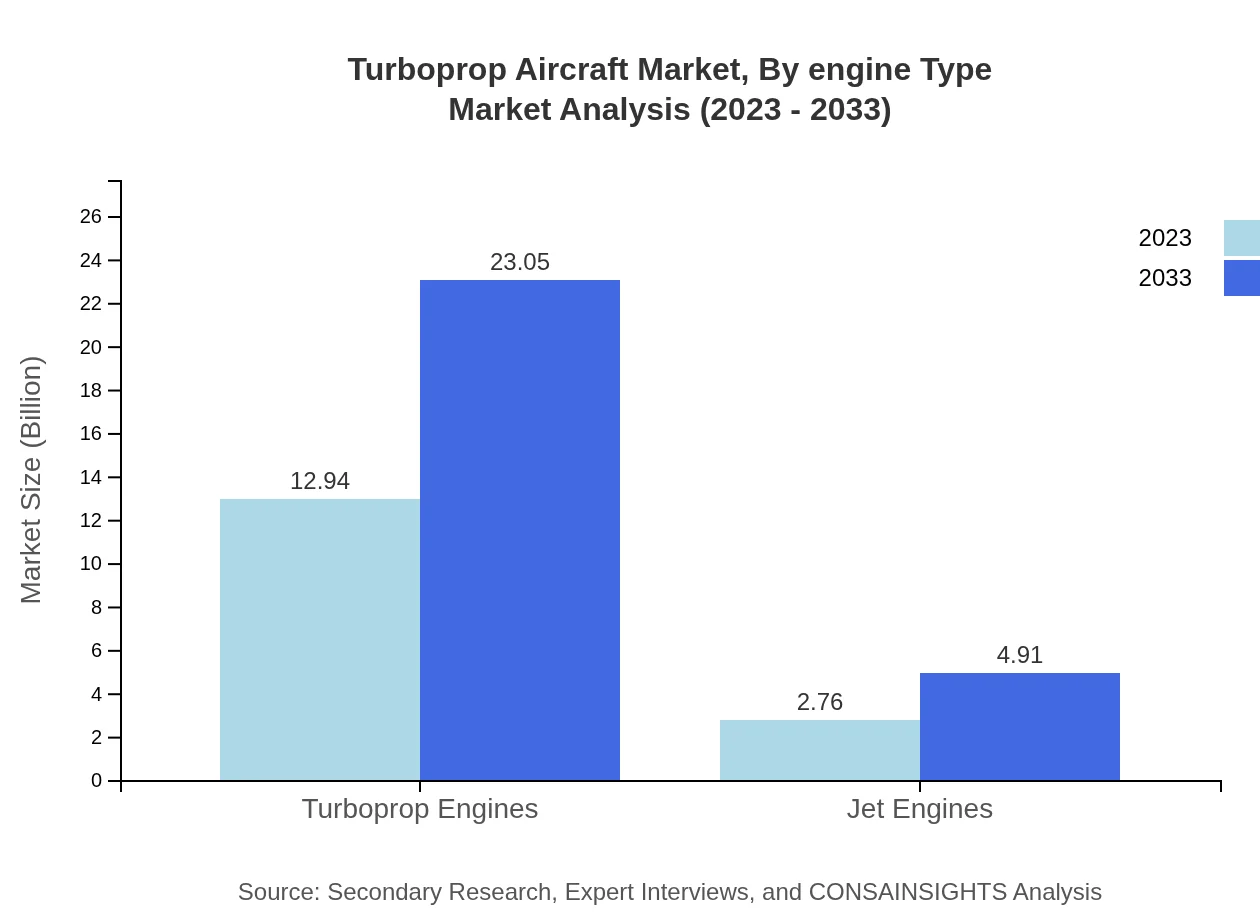

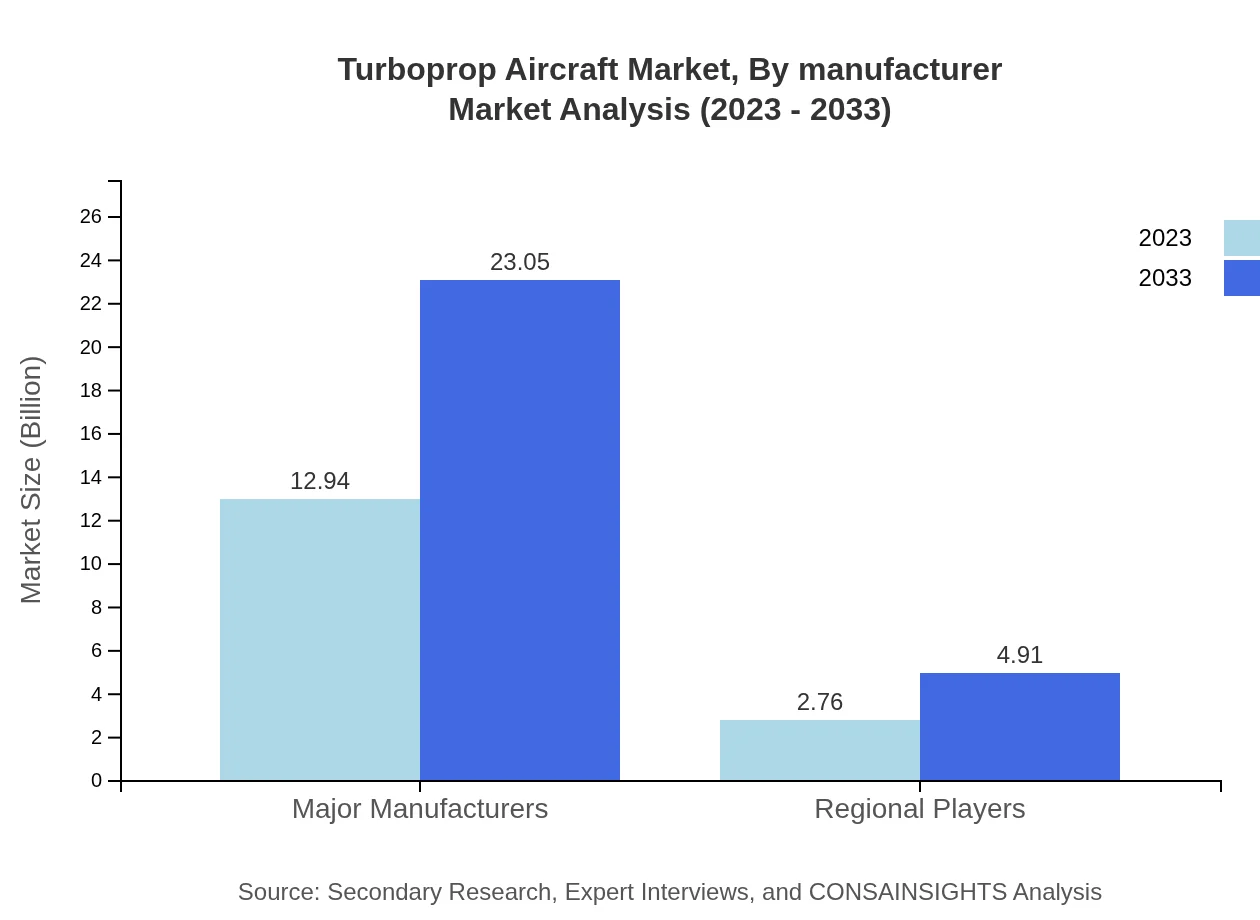

Turboprop Aircraft Market Analysis By Engine Type

The segment based on engine type distinguishes between turboprop engines and jet engines. Turboprop engines dominate this segment, accounting for USD 12.94 billion in 2023 and expected to reach USD 23.05 billion by 2033, particularly in regional passenger transport applications, highlighting their efficiency and cost-effectiveness. Jet engines, in contrast, maintain a smaller share valued at USD 2.76 billion in 2023, projected to grow to USD 4.91 billion.

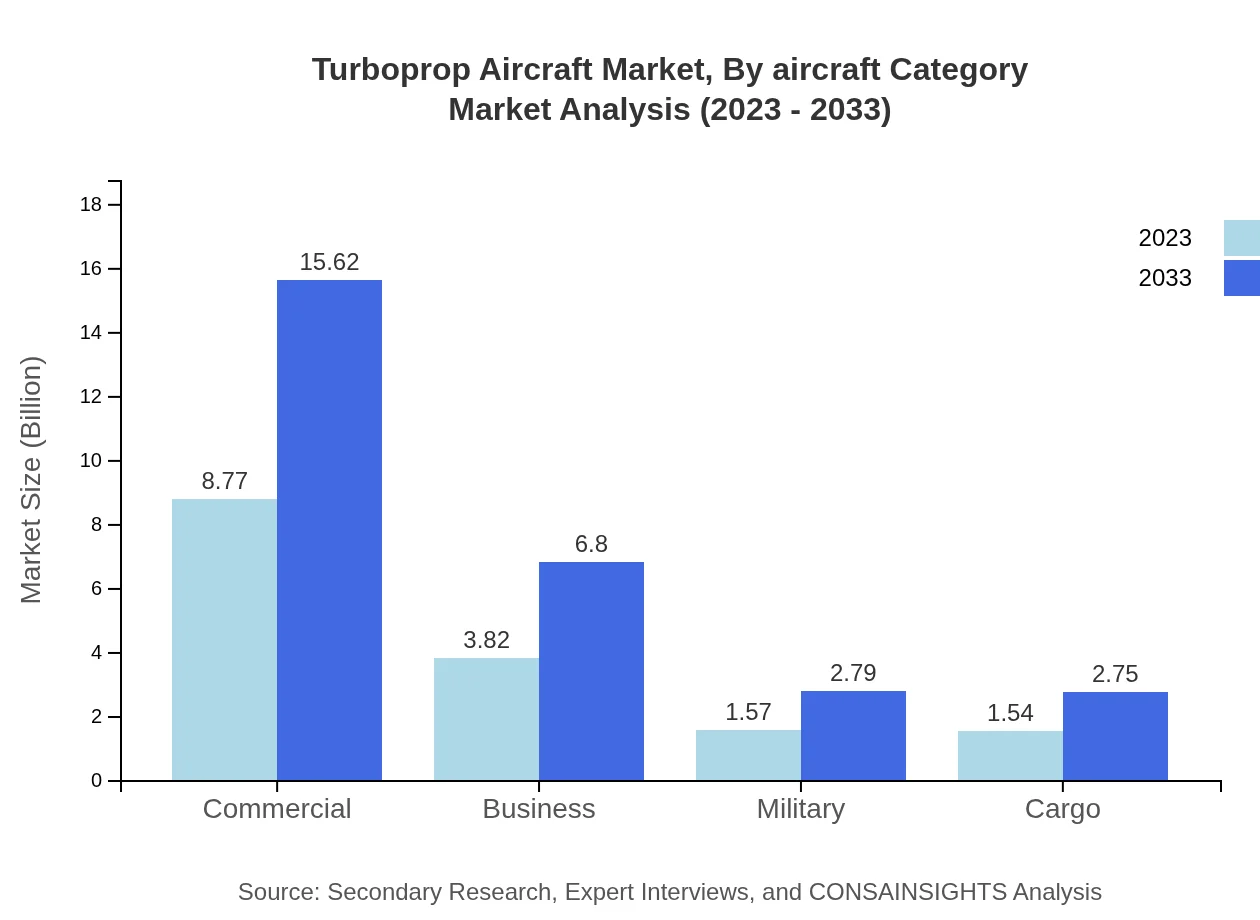

Turboprop Aircraft Market Analysis By Aircraft Category

The market can be segmented based on aircraft categories such as commercial, business, military, and cargo. Commercial turboprop aircraft, valued at USD 8.77 billion in 2023 and estimated to grow to USD 15.62 billion, represent a significant portion of the market. Business aircraft also exhibit growth, recovering from pandemic impacts with significant demand in the small and mid-sized aircraft categories.

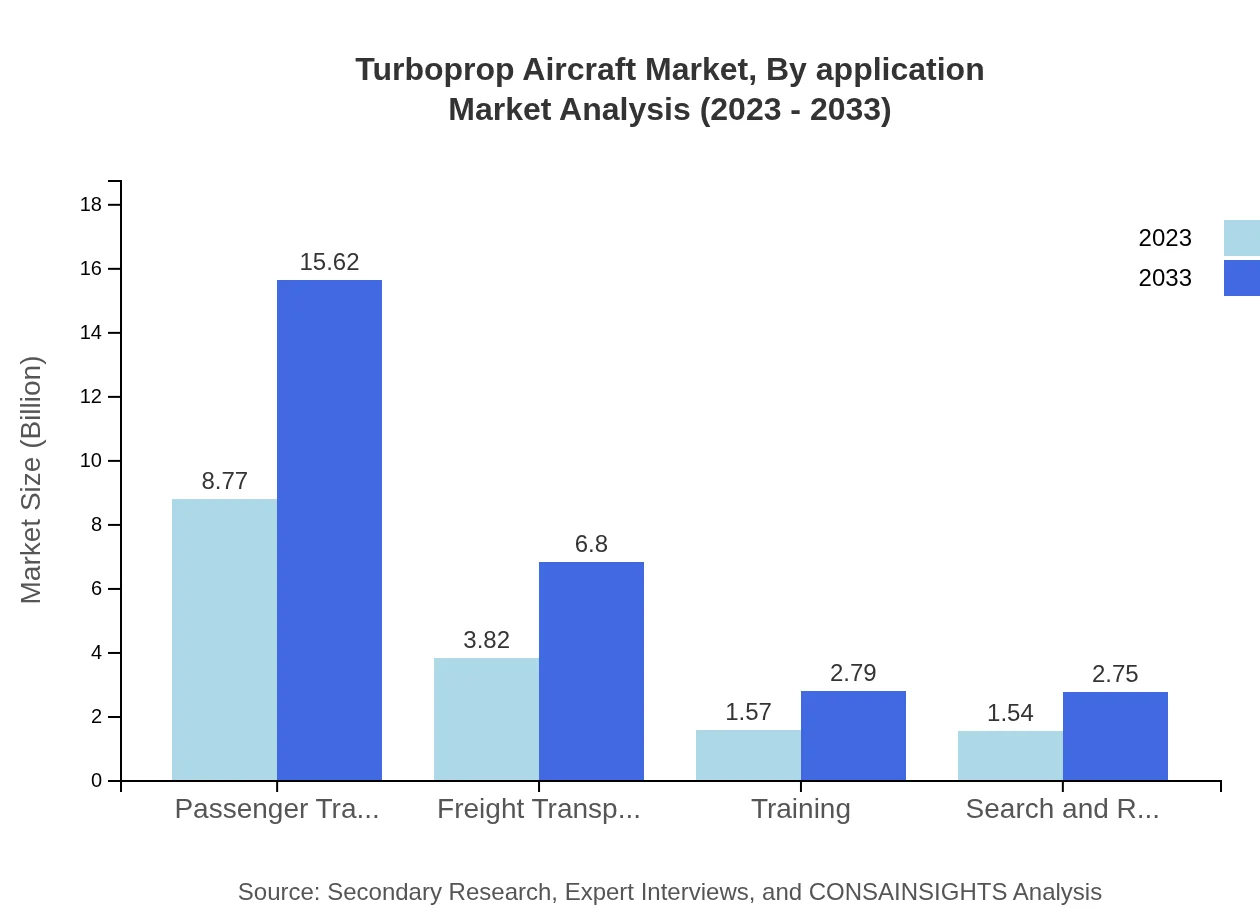

Turboprop Aircraft Market Analysis By Application

Applications for turboprop aircraft include passenger transport, freight transport, training, search and rescue, etc. Passenger transport leads this segment, expected to grow from USD 8.77 billion in 2023 to USD 15.62 billion by 2033. Freight transport anticipates growth from USD 3.82 billion to USD 6.80 billion, influenced by e-commerce growth necessitating efficient cargo services.

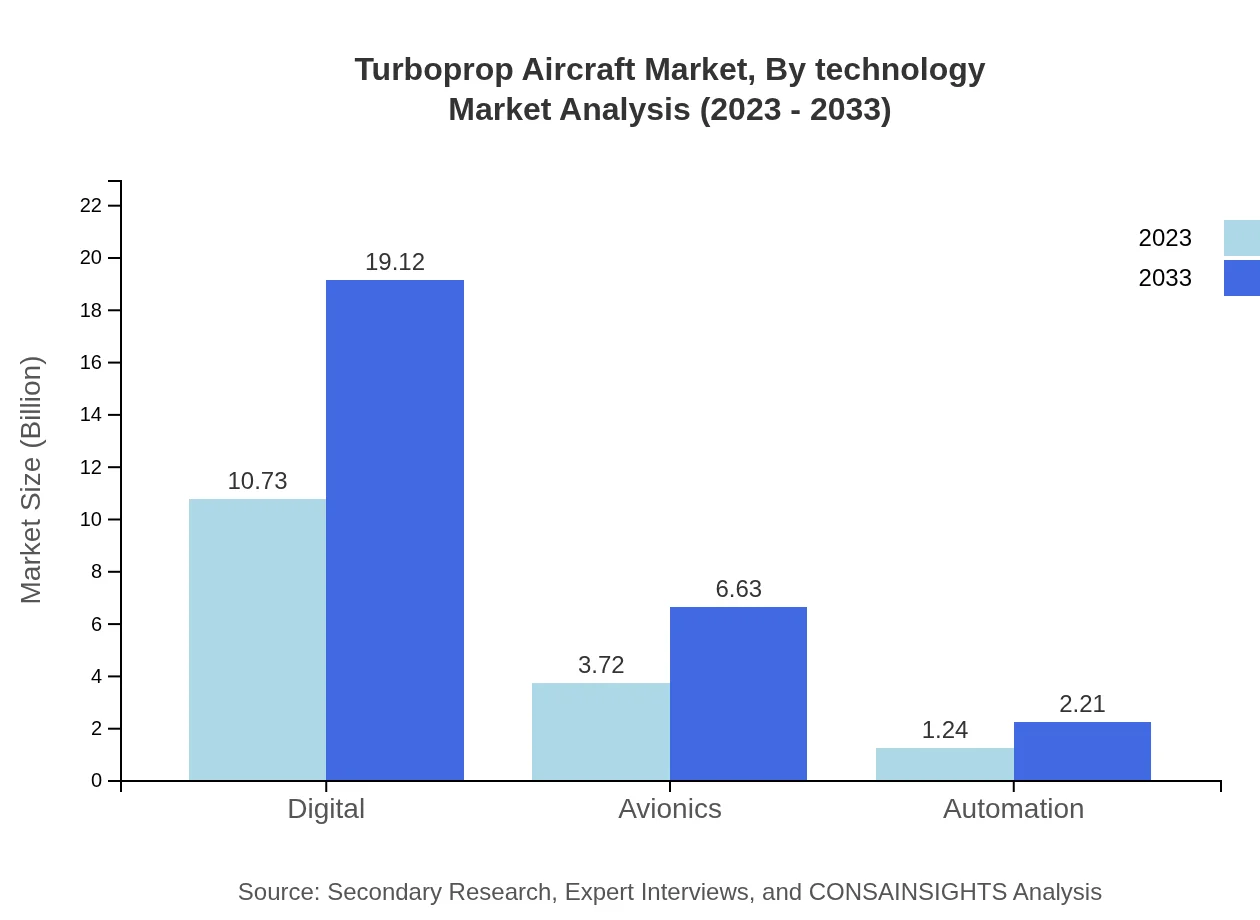

Turboprop Aircraft Market Analysis By Technology

The technology segment focuses on digital advancements, avionics, and automation impacting the turboprop market. Digital technology, leveraging improved navigational systems, is expected to expand from USD 10.73 billion to USD 19.12 billion by 2033, while avionics systems will see growth from USD 3.72 billion to USD 6.63 billion.

Turboprop Aircraft Market Analysis By Manufacturer

Different manufacturers categorize into Major Manufacturers and Regional Players. Major Manufacturers, highlighting top players in this space, represent a significant market size from USD 12.94 billion to USD 23.05 billion, demonstrating robust market positioning. Regional Players, on the other hand, have smaller market shares growing from USD 2.76 billion to USD 4.91 billion, focusing more on niche markets and customized solutions.

Turboprop Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Turboprop Aircraft Industry

Bombardier Inc.:

A leading manufacturer of regional and business aircraft, Bombardier plays a significant role in the turboprop sector with its Q-Series aircraft, known for their fuel efficiency and performance.ATR (Avions de transport régional):

ATR specializes in the production of turboprop aircraft, offering the ATR 42 and ATR 72 models that are popular for regional transportation, known for their efficiency and cost-effectiveness.Embraer:

A prominent player in the aviation market, Embraer manufactures the EMB 120 Brasilia and the Cessna 208, contributing to the growing demand for regional air transport.De Havilland Aircraft of Canada Limited:

Manufacturer of the Dash 8 family, this company is a key player in the turboprop market, known for its reliability and suitability for regional transportation.We're grateful to work with incredible clients.

FAQs

What is the market size of turboprop Aircraft?

The turboprop aircraft market is valued at approximately $15.7 billion in 2023, with a projected CAGR of 5.8% leading to significant growth by 2033. The market encompasses various segments contributing to its overall expansion.

What are the key market players or companies in this turboprop Aircraft industry?

Key players in the turboprop aircraft industry include leading manufacturers like Bombardier, ATR, and Pratt & Whitney, which focus on technological advancements and innovation to maintain competitiveness and cater to increasing demand in the market.

What are the primary factors driving the growth in the turboprop Aircraft industry?

Growth in the turboprop aircraft industry is driven by rising demand for regional air travel, cost-effective operating solutions, advancements in aircraft technology, and increased focus on fuel efficiency, thereby catering to diverse market needs.

Which region is the fastest Growing in the turboprop Aircraft?

Europe is the fastest-growing region for turboprop aircraft, projected to expand from $5.54 billion in 2023 to $9.87 billion by 2033. Asia Pacific, North America, Latin America, and the Middle East & Africa are also experiencing growth.

Does ConsaInsights provide customized market report data for the turboprop Aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the turboprop aircraft industry. Our reports provide insights and analytics specific to client requirements, enhancing decision-making capabilities.

What deliverables can I expect from this turboprop Aircraft market research project?

From the turboprop aircraft market research project, expect comprehensive reports detailing market analysis, segment insights, growth forecasts, competitive landscape, and strategic recommendations to aide in fostering informed business decisions.

What are the market trends of turboprop Aircraft?

Key market trends in the turboprop aircraft segment include a shift towards digitalization, increased automation in operations, and innovations in avionics technology. These trends reflect a growing adaptation to modern aviation demands and efficiency needs.