Turboprop Engine Market Report

Published Date: 03 February 2026 | Report Code: turboprop-engine

Turboprop Engine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Turboprop Engine market, offering insights into current conditions, size, growth rates, technological advancements, and projections from 2023 to 2033.

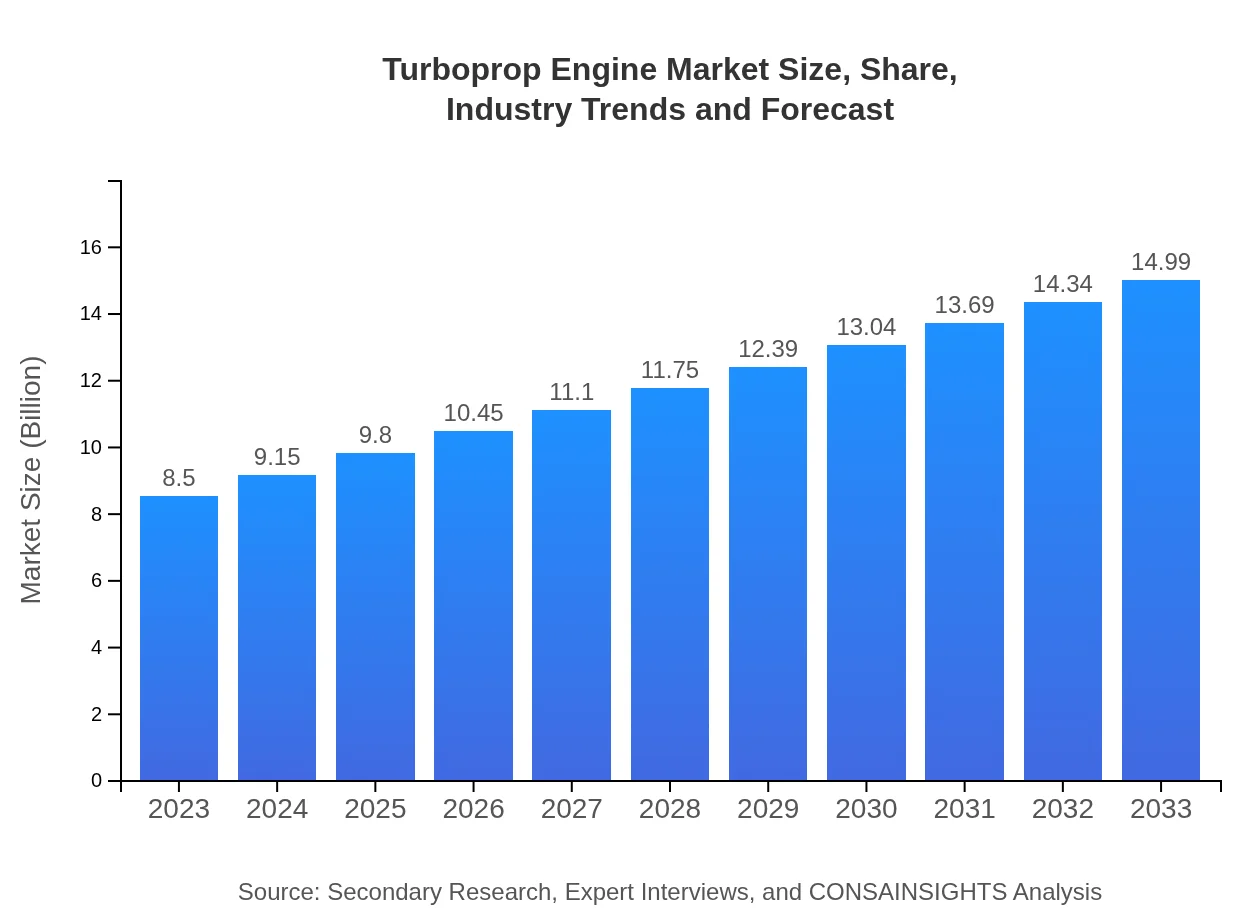

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $14.99 Billion |

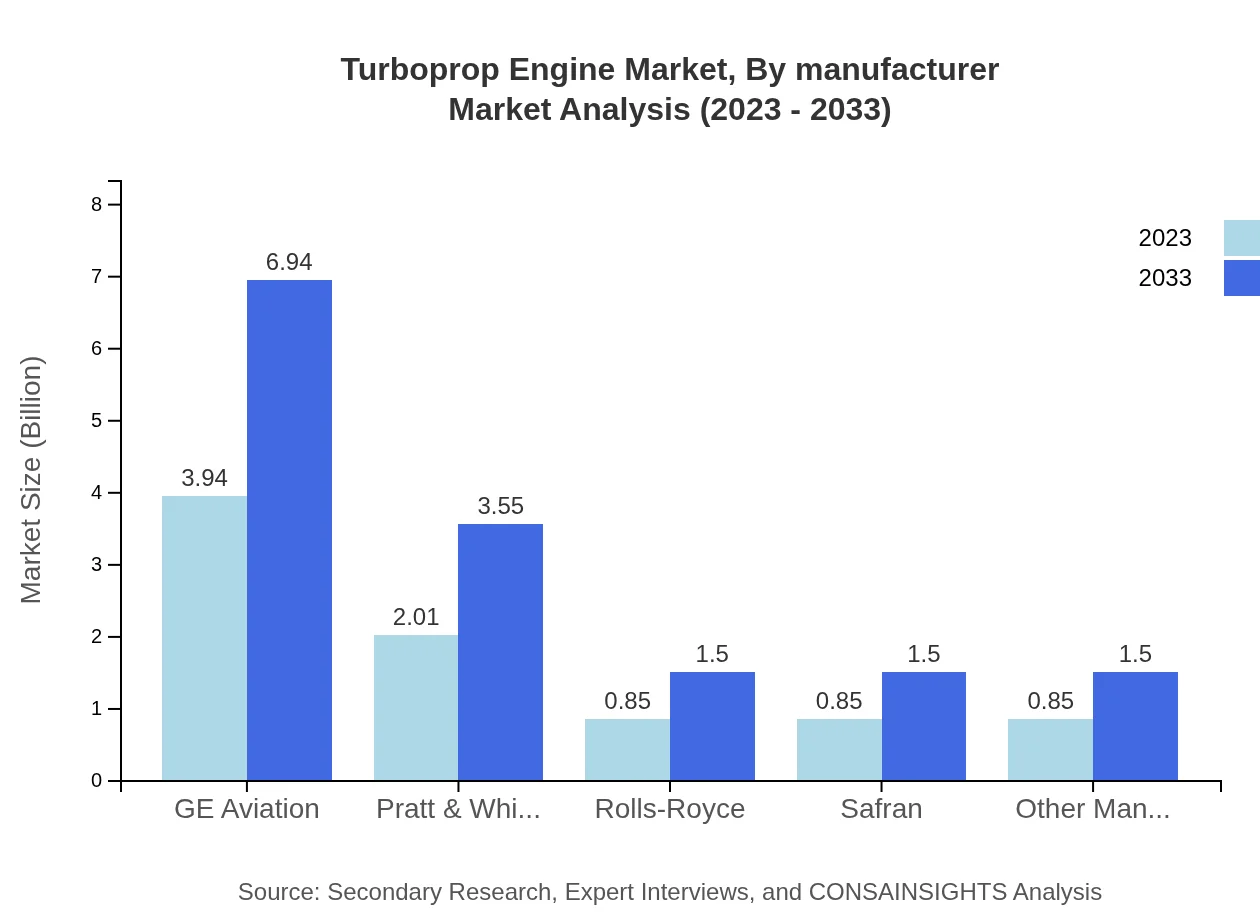

| Top Companies | GE Aviation, Pratt & Whitney, Rolls-Royce, Safran, Other Manufacturers |

| Last Modified Date | 03 February 2026 |

Turboprop Engine Market Overview

Customize Turboprop Engine Market Report market research report

- ✔ Get in-depth analysis of Turboprop Engine market size, growth, and forecasts.

- ✔ Understand Turboprop Engine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Turboprop Engine

What is the Market Size & CAGR of Turboprop Engine market in 2023?

Turboprop Engine Industry Analysis

Turboprop Engine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Turboprop Engine Market Analysis Report by Region

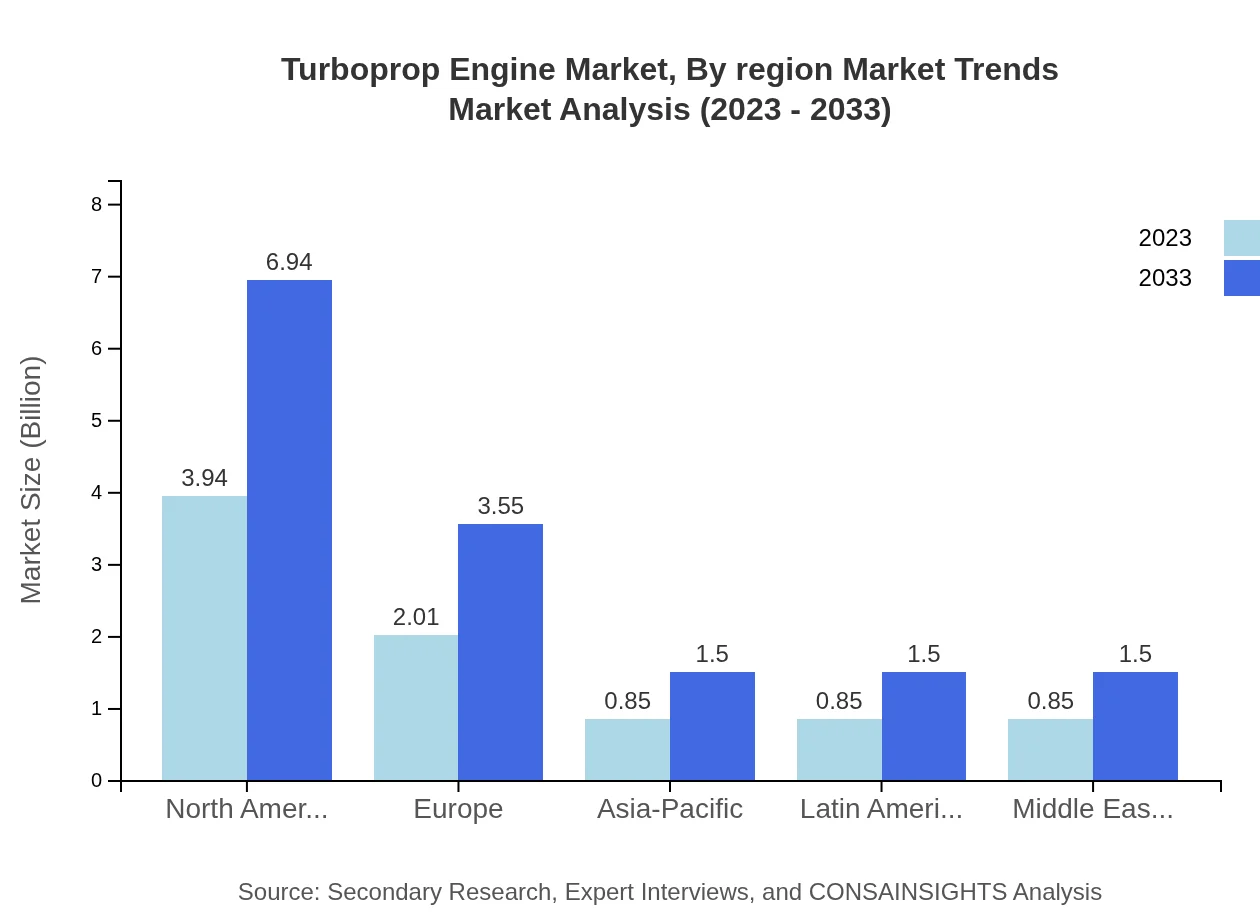

Europe Turboprop Engine Market Report:

Europe's turboprop engine market is projected to grow from $2.81 billion in 2023 to $4.95 billion by 2033. Increased focus on regional connectivity and advancements in engine technology are key factors contributing to this growth.Asia Pacific Turboprop Engine Market Report:

The Asia-Pacific region is expected to witness substantial growth, rising from $1.59 billion in 2023 to $2.80 billion in 2033. Increasing air traffic in emerging economies and infrastructural advancements will drive demand for turboprop engines.North America Turboprop Engine Market Report:

North America is the largest market for turboprop engines, valued at $3.09 billion in 2023 and expected to reach $5.45 billion by 2033. The growth is attributed to the strong presence of key manufacturers and robust demand from the commercial aviation sector.South America Turboprop Engine Market Report:

In South America, the market is projected to grow from $0.05 billion in 2023 to $0.08 billion by 2033. The growth will primarily be fueled by investments in aviation infrastructure and rising tourism.Middle East & Africa Turboprop Engine Market Report:

The Middle East and Africa region is anticipated to grow from $0.97 billion in 2023 to $1.71 billion in 2033, driven mainly by defense contracts and demand for logistics and transport solutions.Tell us your focus area and get a customized research report.

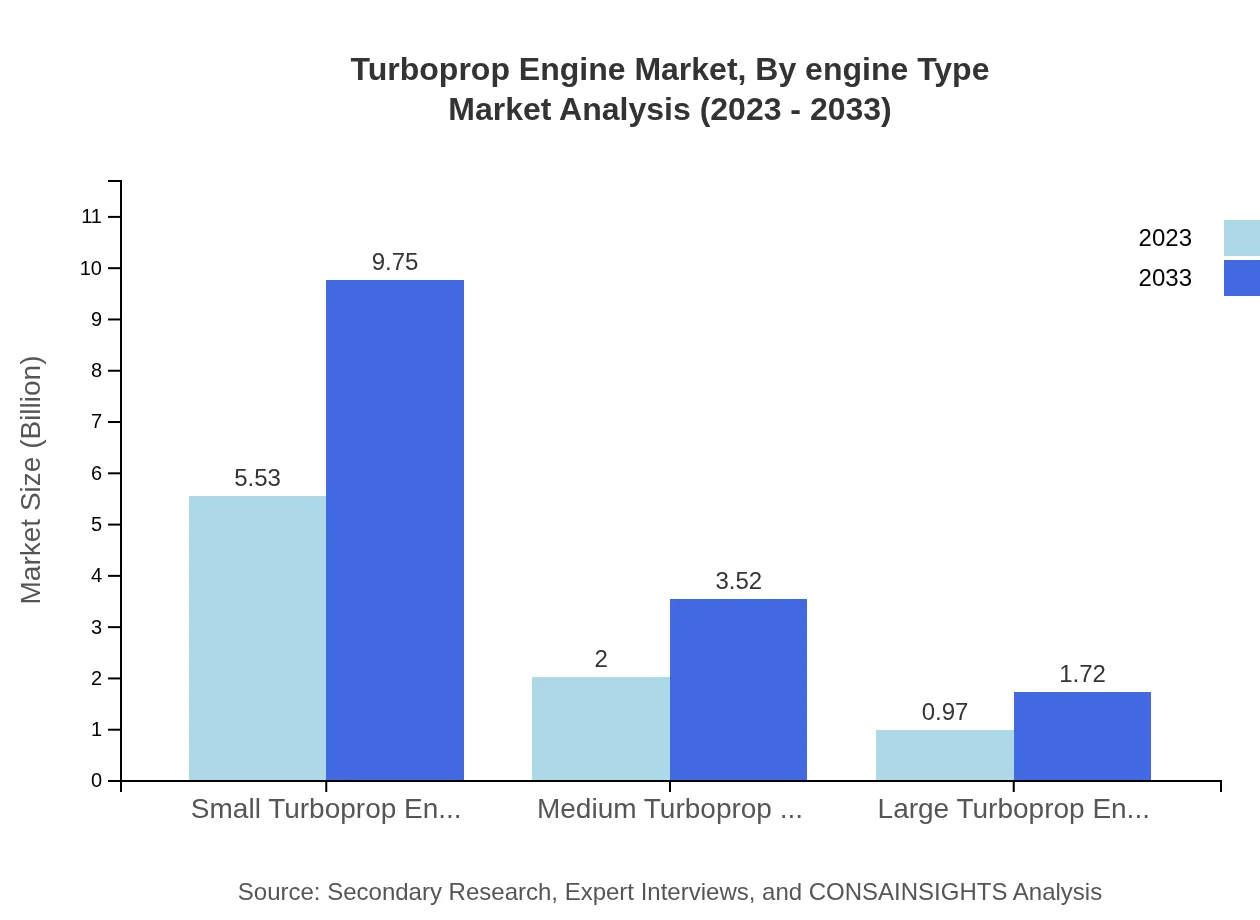

Turboprop Engine Market Analysis By Engine Type

The market for small turboprop engines dominates, valued at $5.53 billion in 2023 and expected to grow to $9.75 billion by 2033. Medium turboprop engines, while smaller, are also witnessing growth, rising from $2.00 billion to $3.52 billion over the same period. Large turboprop engines, though a niche segment, show promise - expanding from $0.97 billion to $1.72 billion.

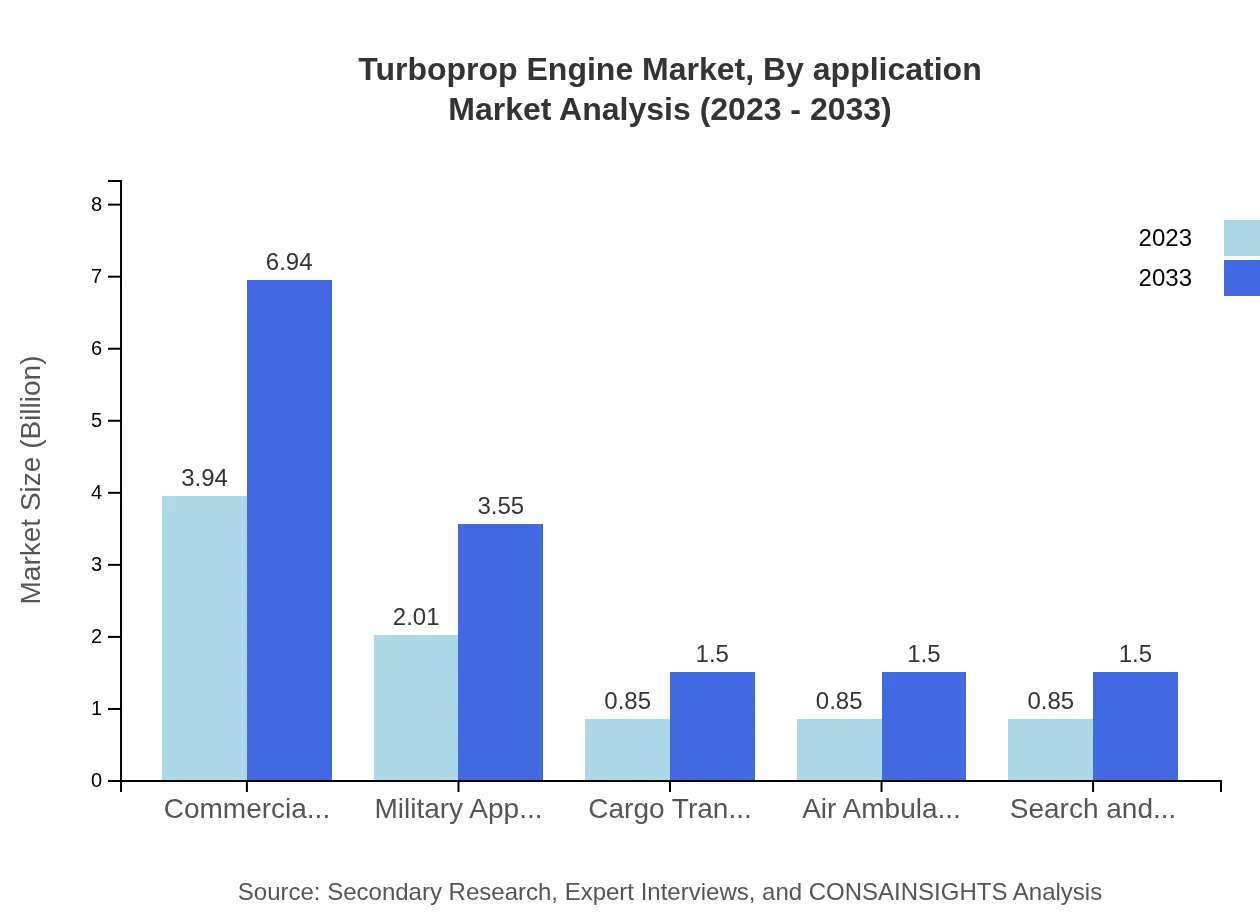

Turboprop Engine Market Analysis By Application

Commercial aviation represents the largest share of the market, maintaining a steady share of 46.32%, slated to grow from $3.94 billion in 2023 to $6.94 billion by 2033. Military applications also hold a significant portion, representing 23.68%, growing from $2.01 billion to $3.55 billion.

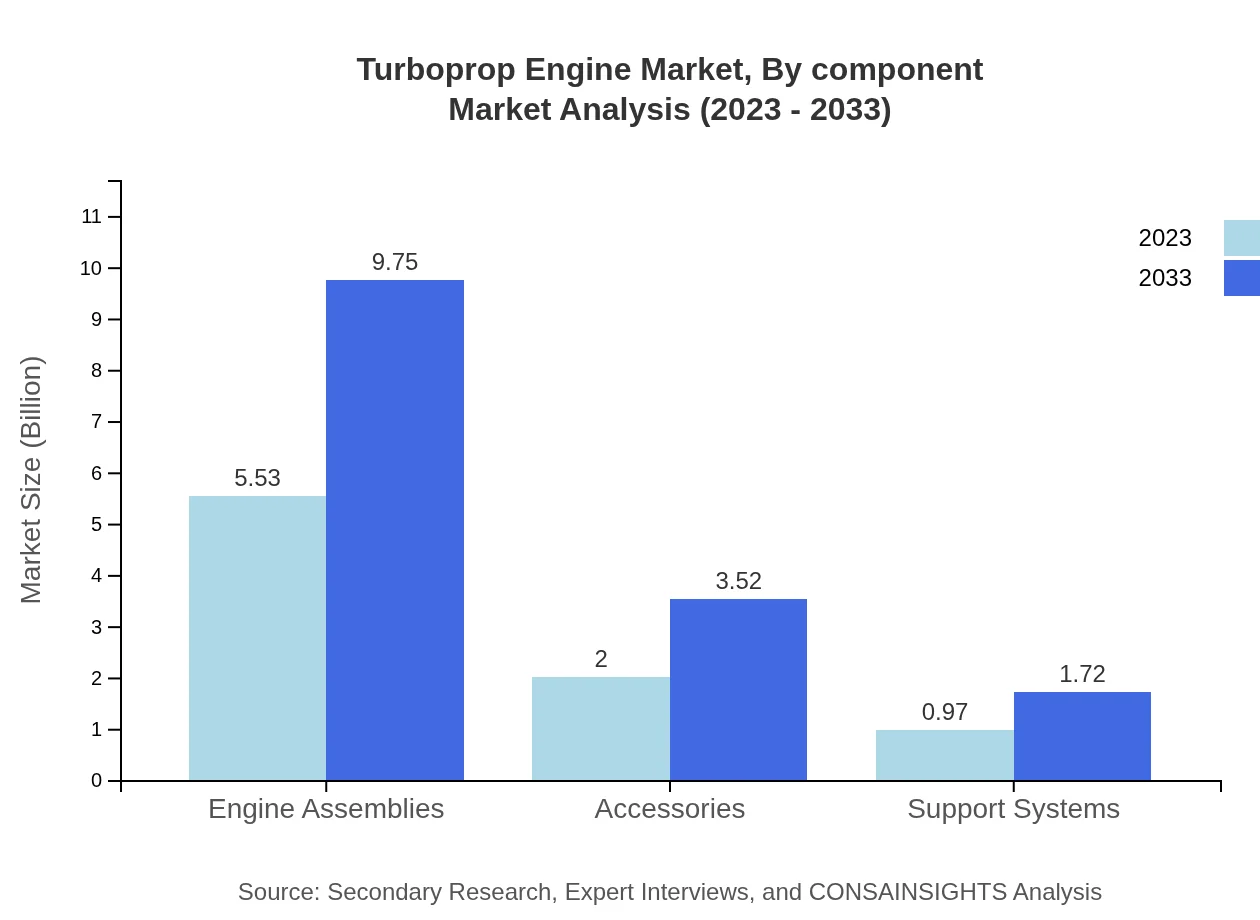

Turboprop Engine Market Analysis By Component

Engine assemblies, leading the market with a share of 65.06%, are valued at $5.53 billion in 2023, projected to grow to $9.75 billion. Accessories and support systems comprise 23.49% and 11.45%, respectively, showing growth from $2.00 billion to $3.52 billion and from $0.97 billion to $1.72 billion.

Turboprop Engine Market Analysis By Manufacturer

Market leaders like GE Aviation capture approximately 46.32% of the market value, projected to reach $6.94 billion by 2033. Pratt & Whitney follows with 23.68% market share, growing from $2.01 billion to $3.55 billion, while other manufacturers contribute significantly to sector diversity.

Turboprop Engine Market Analysis By Region Market Trends

Regional trends reveal North America as a stable leader in the turboprop segment, while Asia-Pacific is emerging aggressively due to rapid urbanization and increased air travel. The European market is characterized by regulatory support geared towards cleaner technologies, while Latin America stands to benefit from new market entrants.

Turboprop Engine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Turboprop Engine Industry

GE Aviation:

A leading global provider of jet engines and other aerospace components, GE Aviation is at the forefront of turboprop technology, focusing on innovation and sustainability.Pratt & Whitney:

A division of Raytheon Technologies, Pratt & Whitney is known for its advanced turboprop engines used in diverse aircraft applications, emphasizing performance and efficiency.Rolls-Royce:

Rolls-Royce specializes in high-speed engines for commercial and military aviation, contributing significantly to the turboprop segment with their focus on power and sustainability.Safran:

Safran is a French multinational company focusing on aircraft propulsion and equipment, and has a strong portfolio in turboprop engines supporting various commercial and military applications.Other Manufacturers:

Several smaller and regional manufacturers contribute to a vibrant market landscape, enabling competition and fostering innovation across the turboprop efficiency spectrum.We're grateful to work with incredible clients.

FAQs

What is the market size of turboprop Engine?

The global turboprop engine market is valued at approximately $8.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 5.7% through to 2033. This growth reflects increasing demand for efficient regional transport solutions.

What are the key market players or companies in this turboprop Engine industry?

Key players in the turboprop engine market include industry leaders such as GE Aviation, Pratt & Whitney, Rolls-Royce, and Safran. Each company plays a significant role in innovation and product offerings leading the market.

What are the primary factors driving the growth in the turboprop Engine industry?

Factors driving growth in the turboprop engine market include the rising demand for regional air travel, advancements in fuel efficiency, and increasing military applications. These drivers contribute significantly to the industry's expansion and future prospects.

Which region is the fastest Growing in the turboprop Engine market?

North America currently leads the turboprop engine market with a size of $3.09 billion in 2023, projected to reach $5.45 billion by 2033. Europe follows as another rapidly growing region, attributed to increasing regional air transport needs.

Does ConsaInsights provide customized market report data for the turboprop Engine industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the turboprop engine industry. Clients can receive insights that align with their strategic needs and market focus.

What deliverables can I expect from this turboprop Engine market research project?

Clients can expect detailed market analysis reports including market size, growth forecasts, competitive landscape evaluation, and segment data analysis. Additional deliverables could include regional insights and company profiles.

What are the market trends of turboprop Engine?

Market trends in the turboprop engine sector indicate a shift towards advanced propulsion technologies, increased utilization of regional aircraft, and a focus on sustainability in manufacturing. These trends illustrate the industry's response to evolving aviation demands.