Two Wheeler Lubricants Market Report

Published Date: 02 February 2026 | Report Code: two-wheeler-lubricants

Two Wheeler Lubricants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Two Wheeler Lubricants market, including market size, trends, and forecasts from 2023 to 2033. It highlights industry insights, segmentation, and regional performance, as well as future growth opportunities and challenges.

| Metric | Value |

|---|---|

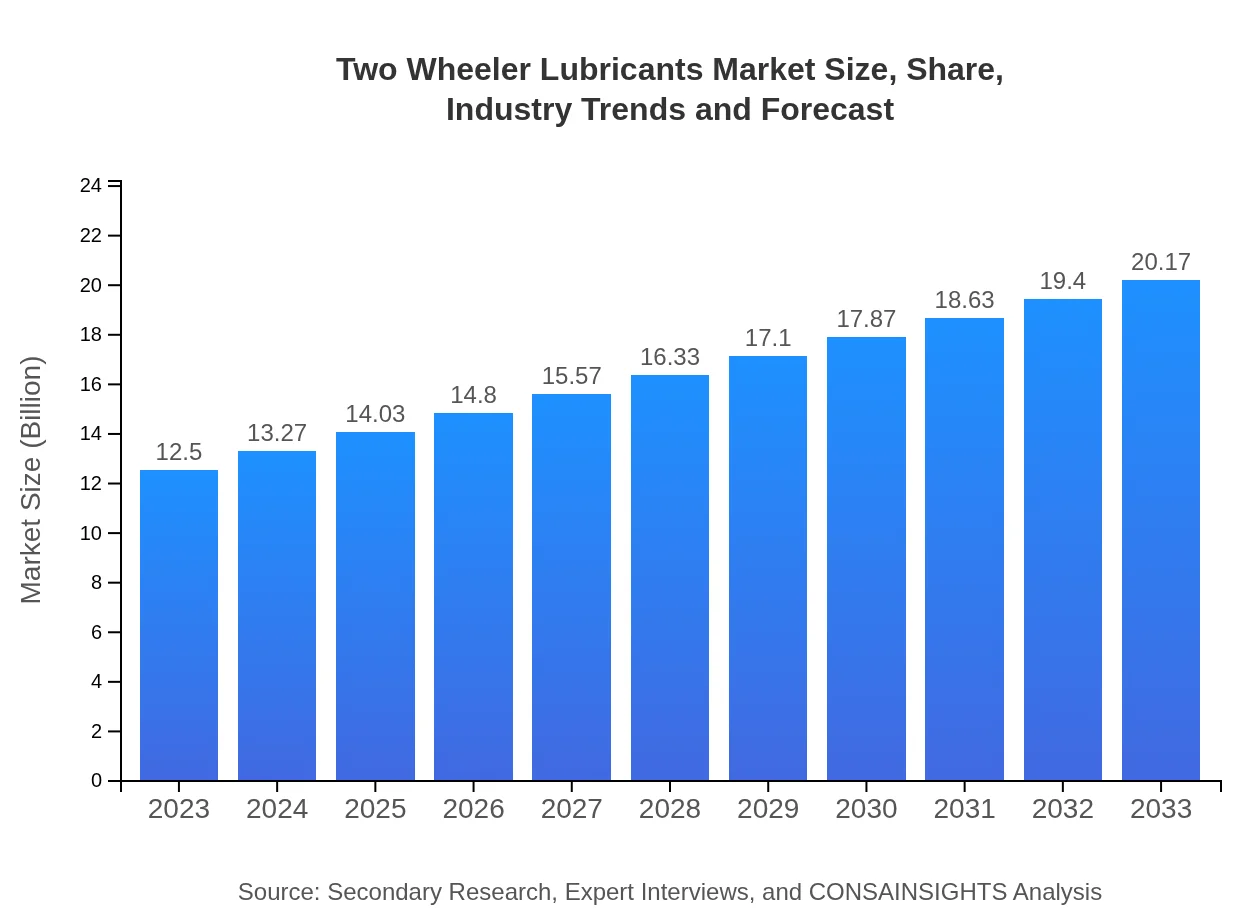

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $20.17 Billion |

| Top Companies | Castrol, Mobil 1, Shell, Valvoline, Liqui Moly |

| Last Modified Date | 02 February 2026 |

Two Wheeler Lubricants Market Overview

Customize Two Wheeler Lubricants Market Report market research report

- ✔ Get in-depth analysis of Two Wheeler Lubricants market size, growth, and forecasts.

- ✔ Understand Two Wheeler Lubricants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Two Wheeler Lubricants

What is the Market Size & CAGR of Two Wheeler Lubricants market in 2023?

Two Wheeler Lubricants Industry Analysis

Two Wheeler Lubricants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Two Wheeler Lubricants Market Analysis Report by Region

Europe Two Wheeler Lubricants Market Report:

With a market size of $4.08 billion in 2023, Europe is anticipated to grow to $6.59 billion by 2033. A strong emphasis on environmental regulations and high standards for vehicle performance drive demand for advanced lubricant solutions.Asia Pacific Two Wheeler Lubricants Market Report:

In 2023, the Asia Pacific region holds a market size of approximately $2.06 billion, projected to increase to $3.33 billion by 2033. The growth is driven by a significant increase in two-wheelers sales in countries like India and China, fueled by urbanization and rising income levels.North America Two Wheeler Lubricants Market Report:

North America, valued at $4.52 billion in 2023, is projected to reach $7.30 billion by 2033. The popularity of motorcycles and scooters among consumers, coupled with robust aftermarket services, ensures steady market growth in this region.South America Two Wheeler Lubricants Market Report:

The South American market for Two Wheeler Lubricants is estimated at $0.69 billion in 2023, expected to grow to $1.11 billion by 2033. The region benefits from an increasing demand for economical transportation solutions as urban areas expand.Middle East & Africa Two Wheeler Lubricants Market Report:

In the Middle East and Africa, the market was valued at $1.14 billion in 2023, expected to grow to $1.84 billion by 2033. The region's expanding urban population and increasing motorization rates contribute to the growth of the two-wheeler lubricant market.Tell us your focus area and get a customized research report.

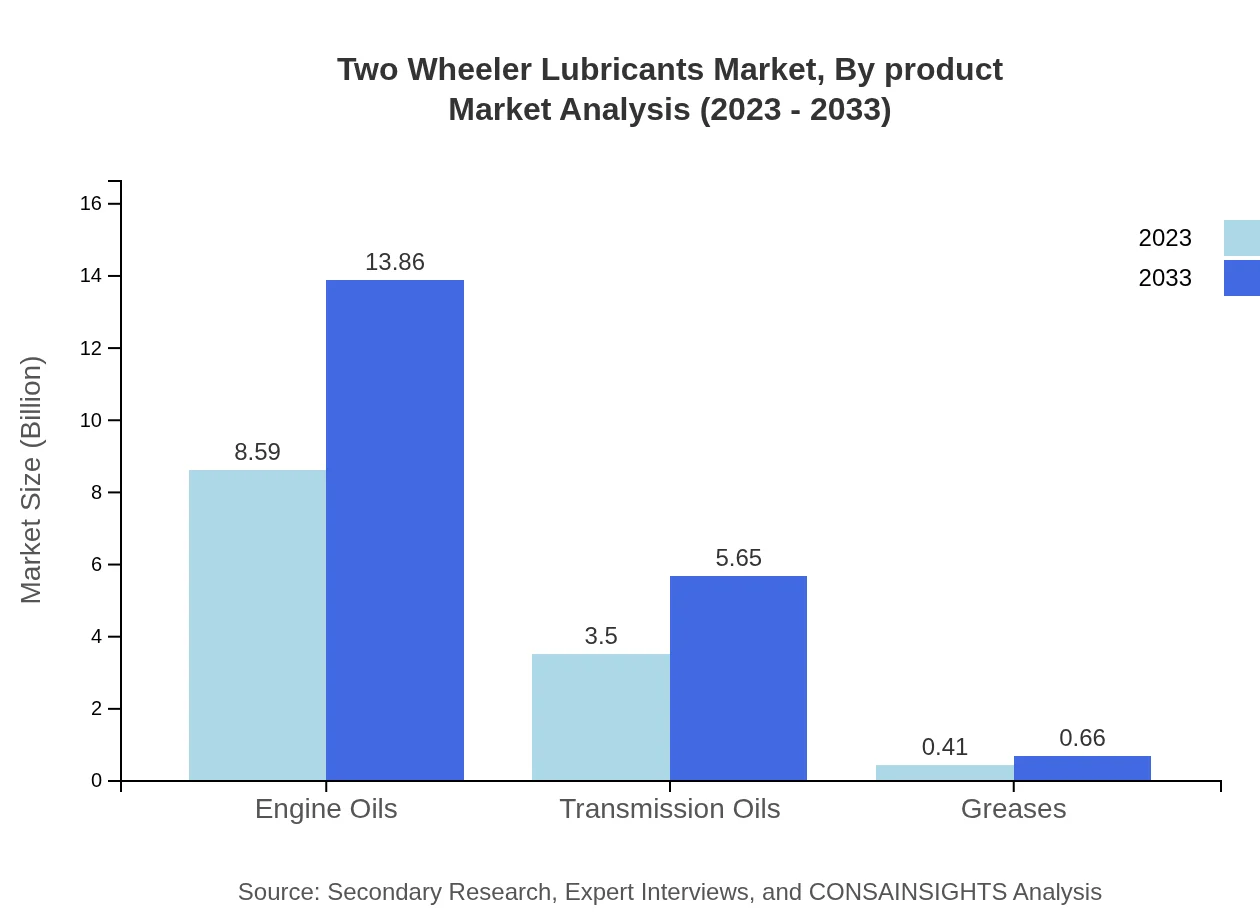

Two Wheeler Lubricants Market Analysis By Product

The market is categorized into Engine Oils, Transmission Oils, and Greases, with engine oils making up a substantial share. In 2023, Engine Oils accounted for $8.59 billion, projected to reach $13.86 billion by 2033. Transmission Oils and Greases are also vital, but with significant lower size, indicating a focused consumer preference.

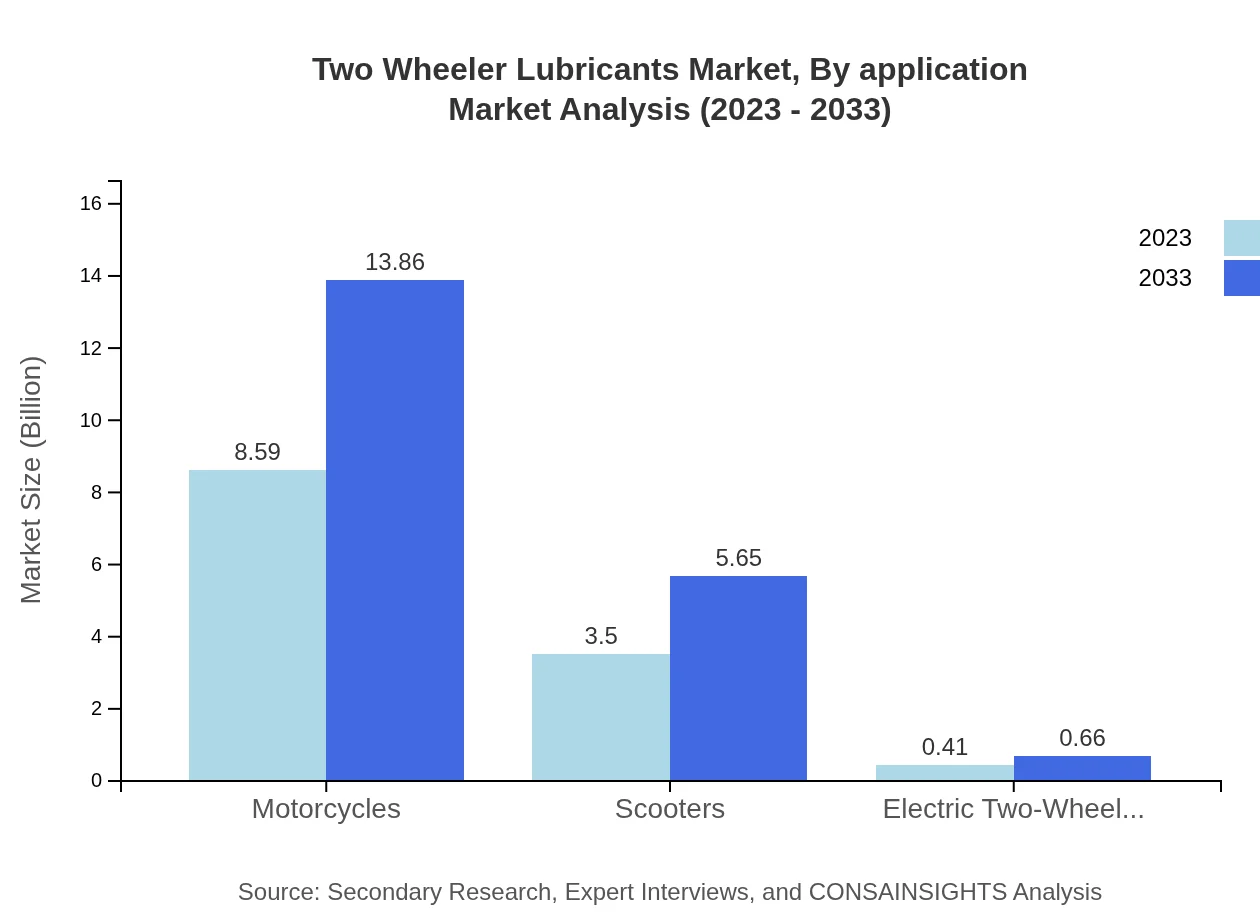

Two Wheeler Lubricants Market Analysis By Application

The major applications include motorcycles and scooters. Motorcycles hold a dominant share, valued at $8.59 billion and expected to grow to $13.86 billion by 2033. The scooter segment mirrors this trend, capturing a growing market as preferences shift toward more fuel-efficient two-wheelers.

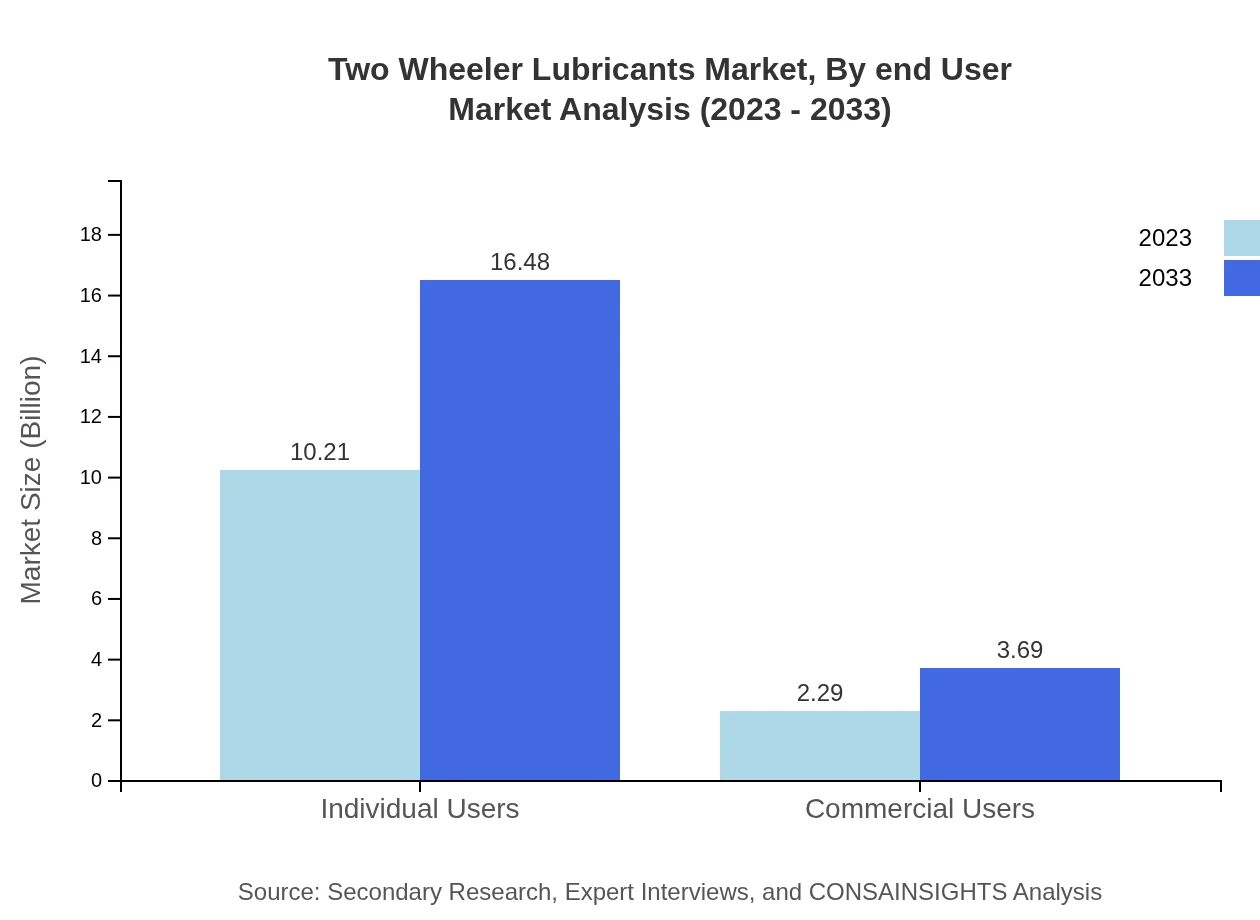

Two Wheeler Lubricants Market Analysis By End User

End users are segmented into Individual Users and Commercial Users. Individual Users contribute significantly with a market size of $10.21 billion, projected to reach $16.48 billion by 2033. Commercial Users, while smaller at $2.29 billion, are also expected to see growth as businesses expand their vehicle fleets.

Two Wheeler Lubricants Market Analysis By Distribution_channel

Global Two-Wheeler Lubricants Market, By Distribution Channel Market Analysis (2023 - 2033)

Market segmentation by distribution channels shows a strong preference for online sales, estimated at $10.21 billion in 2023, indicating a rapid shift in purchasing behaviors. Offline channels still represent a notable market segment, projected at $2.29 billion, but are seeing slower growth.

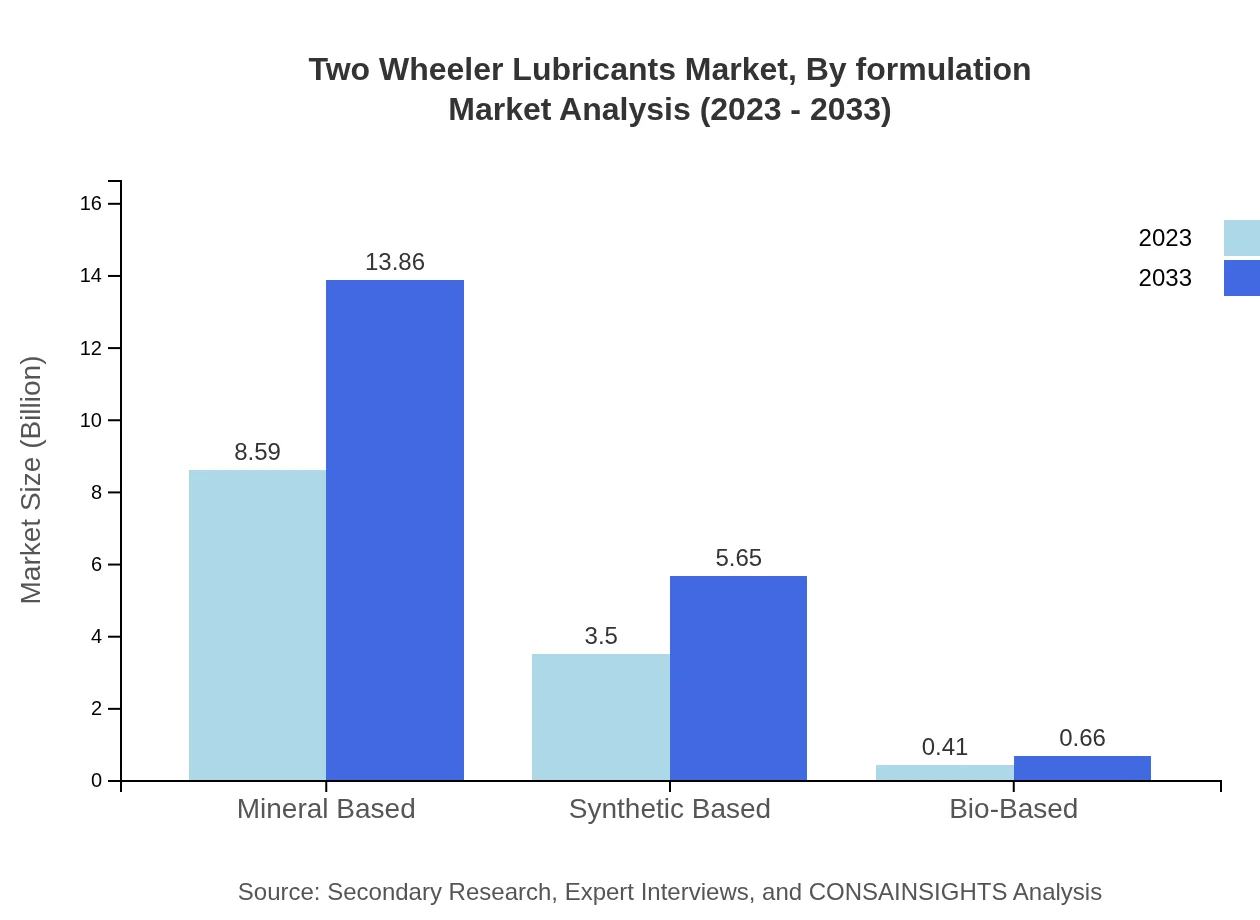

Two Wheeler Lubricants Market Analysis By Formulation

The market is distinguished by formulation types, namely Mineral Based, Synthetic Based, and Bio-Based lubricants. Mineral Based lubricants lead the market at $8.59 billion, while Synthetic and Bio-Based lubricants are gradually gaining traction due to technological advancements and increased environmental awareness.

Two Wheeler Lubricants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Two Wheeler Lubricants Industry

Castrol:

Castrol, a leading lubricant company, offers a variety of products tailored for two-wheelers, focusing on high-performance formulations that enhance engine life and efficiency.Mobil 1:

Mobil 1 is known for its innovative synthetic lubricants and is a major player in the two-wheeler segment, catering to both regular and high-performance motorcycles.Shell:

Shell has a comprehensive range of automotive lubricants including specialized products for two-wheelers, emphasizing sustainability and performance.Valvoline:

Valvoline provides high-quality lubricants, particularly focusing on motorcycle oils that ensure smoother rides and longer maintenance intervals.Liqui Moly:

Liqui Moly is renowned for its premium lubricants and additives, focusing on high-quality, eco-friendly two-wheeler oils.We're grateful to work with incredible clients.

FAQs

What is the market size of two Wheeler lubricants?

The two-wheeler lubricants market is projected to reach $12.5 billion by 2033, with a CAGR of 4.8%. This growth reflects increasing demand driven by rising two-wheeler ownership and maintenance needs globally.

What are the key market players or companies in the two Wheeler lubricants industry?

Key players in the two-wheeler lubricants market include major companies like ExxonMobil, Royal Dutch Shell, Valvoline, and Castrol. These companies leverage innovation and branding to capture market share and enhance customer loyalty.

What are the primary factors driving the growth in the two Wheeler lubricants industry?

Growth drivers in the two-wheeler lubricants industry include increasing two-wheeler sales, urbanization, rising disposable incomes, and awareness of the benefits of high-quality lubricants in vehicle performance and longevity.

Which region is the fastest Growing in the two Wheeler lubricants?

The fastest-growing region in the two-wheeler lubricants market is North America, anticipated to expand from $4.52 billion in 2023 to $7.30 billion in 2033. This growth is fueled by heightened awareness of vehicle maintenance and advanced lubricant technologies.

Does ConsaInsights provide customized market report data for the two Wheeler lubricants industry?

Yes, ConsaInsights offers tailored market reports for the two-wheeler lubricants industry, providing clients with specific data and insights based on their unique requirements for informed decision-making.

What deliverables can I expect from this two Wheeler lubricants market research project?

Deliverables from the two-wheeler lubricants market research will include comprehensive reports, data analysis, market forecasts, competitive landscape assessments, and segmented insights tailored to specific customer needs.

What are the market trends of two Wheeler lubricants?

Current trends in the two-wheeler lubricants market include a shift towards synthetic lubricants, growth in online sales channels, and innovations in bio-based lubricants, driven by environmental concerns and changing consumer preferences.