Uav Flight Training And Simulation Market Report

Published Date: 03 February 2026 | Report Code: uav-flight-training-and-simulation

Uav Flight Training And Simulation Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the UAV Flight Training and Simulation market, including market size, trends, and forecasts for 2023 to 2033. It encompasses regional insights, industry analysis, and details on the key market players driving growth in this innovative sector.

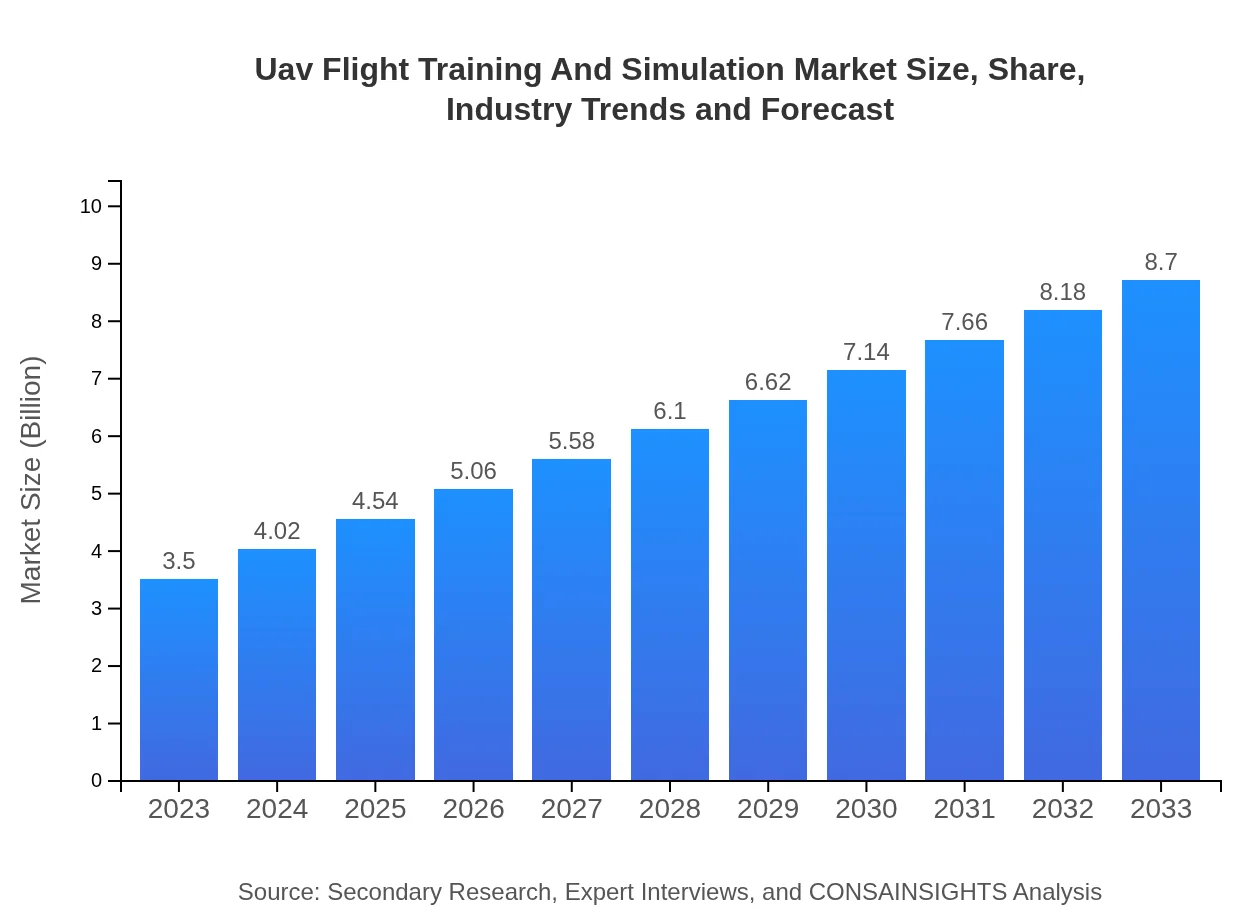

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Lockheed Martin, CAE Inc., Northrop Grumman, Thales Group, Boeing |

| Last Modified Date | 03 February 2026 |

UAV Flight Training and Simulation Market Overview

Customize Uav Flight Training And Simulation Market Report market research report

- ✔ Get in-depth analysis of Uav Flight Training And Simulation market size, growth, and forecasts.

- ✔ Understand Uav Flight Training And Simulation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Uav Flight Training And Simulation

What is the Market Size & CAGR of UAV Flight Training and Simulation market in 2023?

UAV Flight Training and Simulation Industry Analysis

UAV Flight Training and Simulation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

UAV Flight Training and Simulation Market Analysis Report by Region

Europe Uav Flight Training And Simulation Market Report:

Europe's UAV Flight Training and Simulation market is projected to increase from USD 1.23 billion in 2023 to USD 3.06 billion by 2033. Key drivers include stringent regulations for UAV operations that mandate structured training and the growing defense budgets in response to geopolitical concerns.Asia Pacific Uav Flight Training And Simulation Market Report:

In 2023, the Asia Pacific UAV Flight Training and Simulation market is valued at USD 0.59 billion, with projections reaching USD 1.47 billion by 2033. The region is witnessing significant growth driven by considerable investments in military modernization and an increasing number of applications for UAVs in agriculture and logistics. Countries like China and India are leading this growth due to their supportive government initiatives and robust manufacturing capabilities.North America Uav Flight Training And Simulation Market Report:

The North American market is expected to grow from USD 1.21 billion in 2023 to USD 3.00 billion by 2033, driven significantly by military contracts and commercial adoption across industries such as infrastructure and public safety. The region's advanced technological landscape supports innovations in UAV training systems.South America Uav Flight Training And Simulation Market Report:

The South American market shows a decline, with an estimated value of USD -0.01 billion in 2023 and projected at -0.03 billion by 2033. The lack of regulatory frameworks and funding for military and technological advancements poses significant challenges in the region, leading to stagnation.Middle East & Africa Uav Flight Training And Simulation Market Report:

This region's market is estimated to grow from USD 0.48 billion in 2023 to USD 1.19 billion by 2033. The rising need for security protocols and efficient border management is expected to increase investment in UAV technologies and the necessary training systems.Tell us your focus area and get a customized research report.

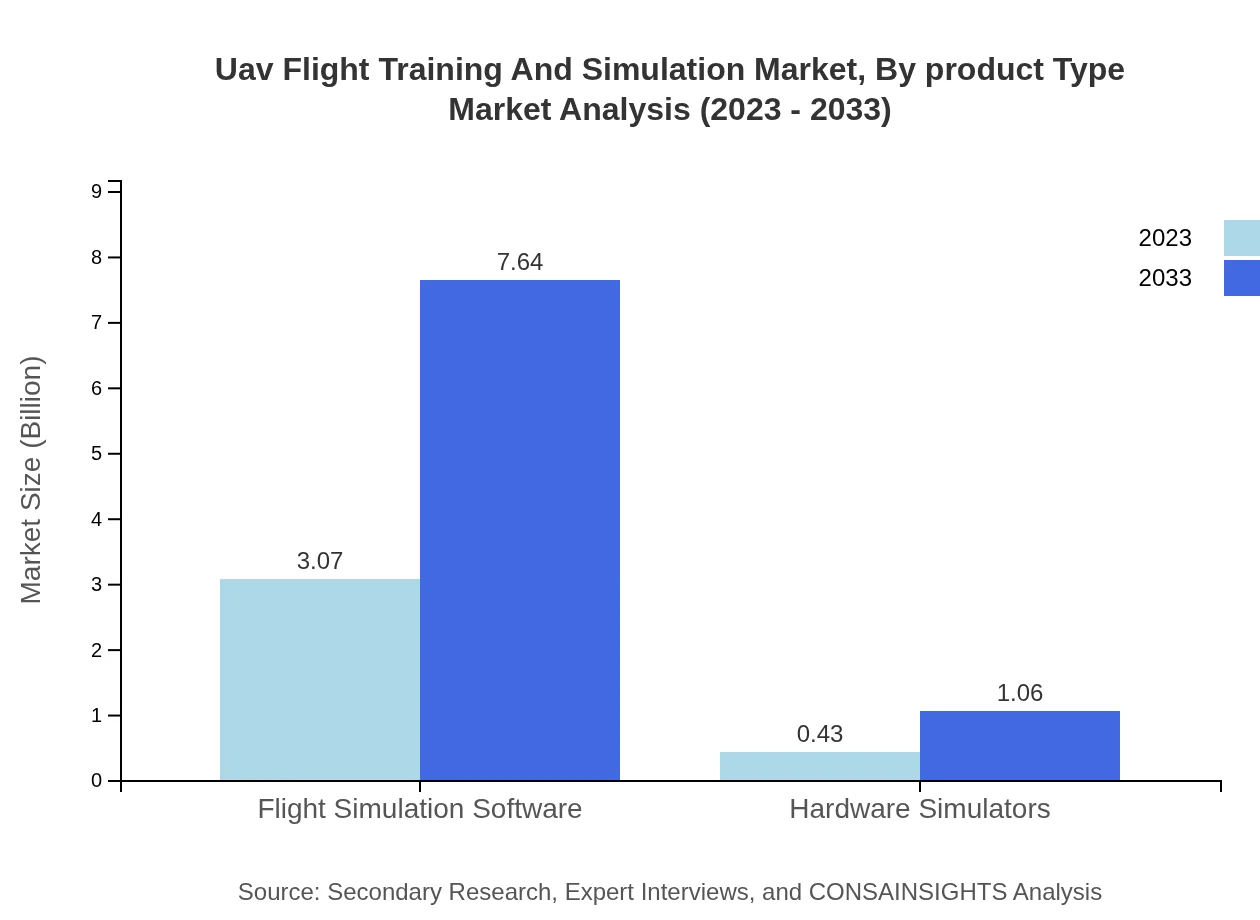

Uav Flight Training And Simulation Market Analysis By Product Type

The UAV Flight Training and Simulation market is significantly influenced by different product types, which include simulation software and hardware simulators. The software market comprises advanced flight simulation systems, while hardware simulators support immersive training experiences. Both segments are crucial for maintaining operational efficiency and ensuring pilots are equipped with the necessary skills to operate UAVs safely.

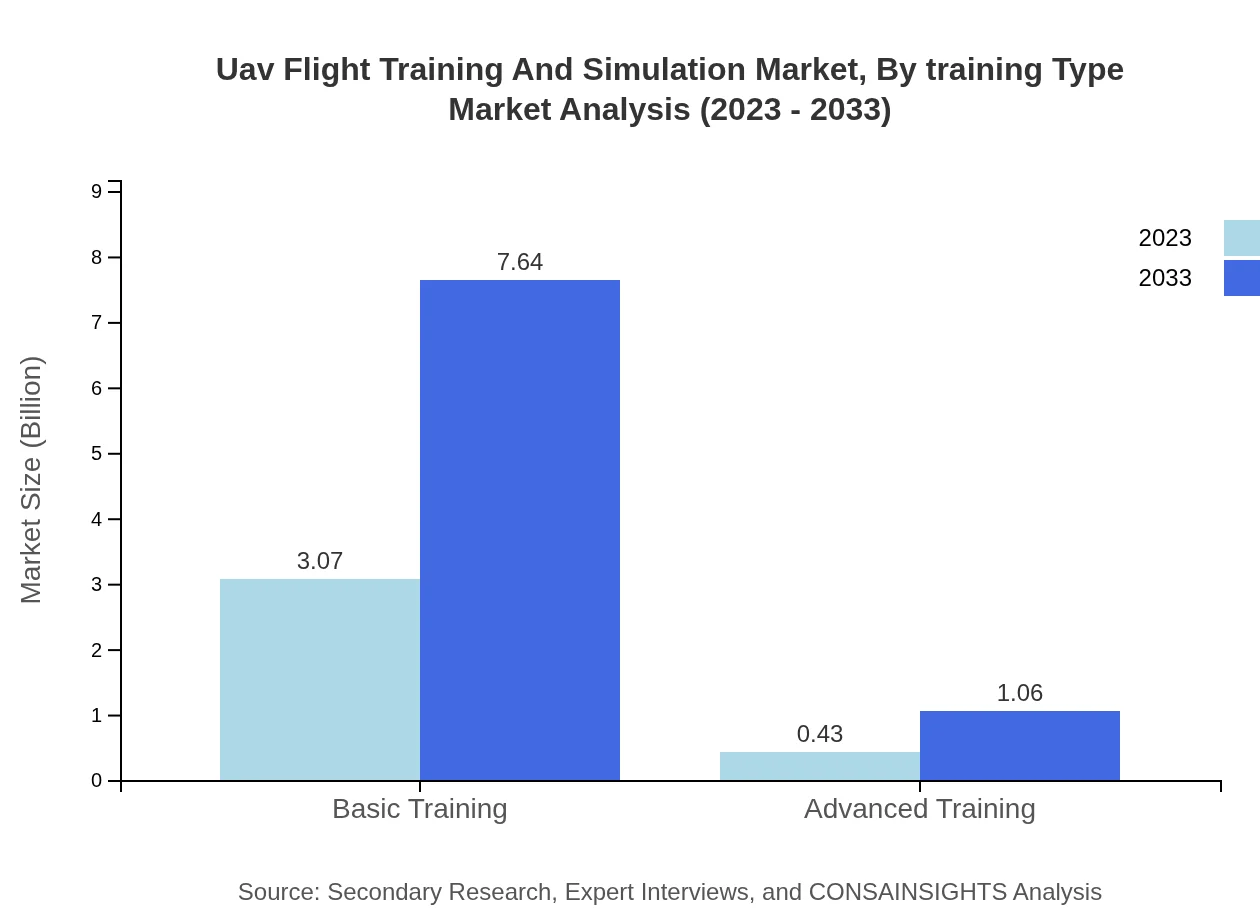

Uav Flight Training And Simulation Market Analysis By Training Type

Training types are categorized into basic and advanced training segments. Basic training accounts for the majority of the market size due to the foundational skills required for new operators. Advanced training, while a smaller segment, is gaining traction as experienced pilots seek specialization in complex UAV operations and applications.

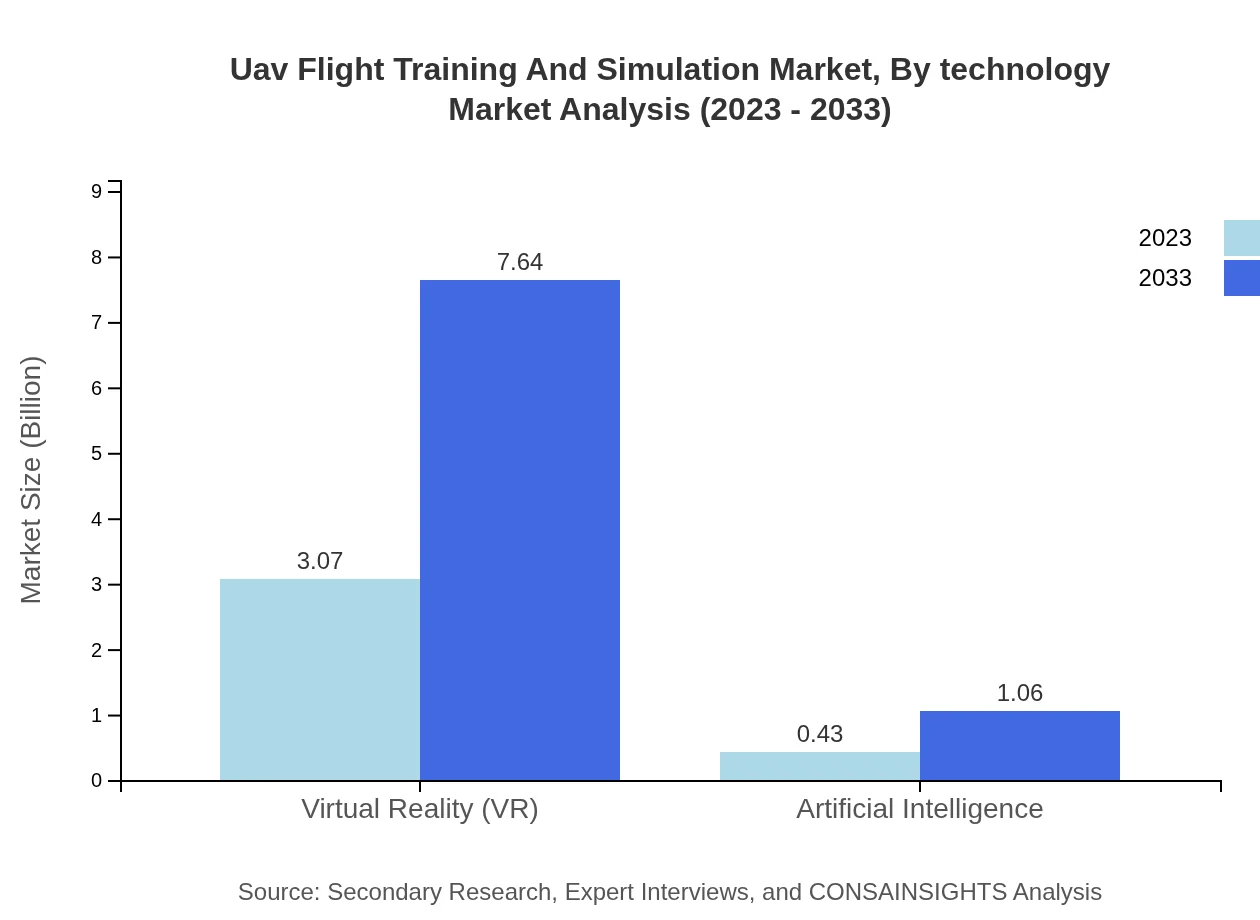

Uav Flight Training And Simulation Market Analysis By Technology

In terms of technology, the integration of virtual reality (VR) and artificial intelligence (AI) plays a far-reaching impact on the UAV training landscape. VR provides a more immersive training experience, allowing pilots to encounter realistic scenarios without the risks associated with actual flight. AI facilitates personalized learning paths based on ongoing performance evaluations.

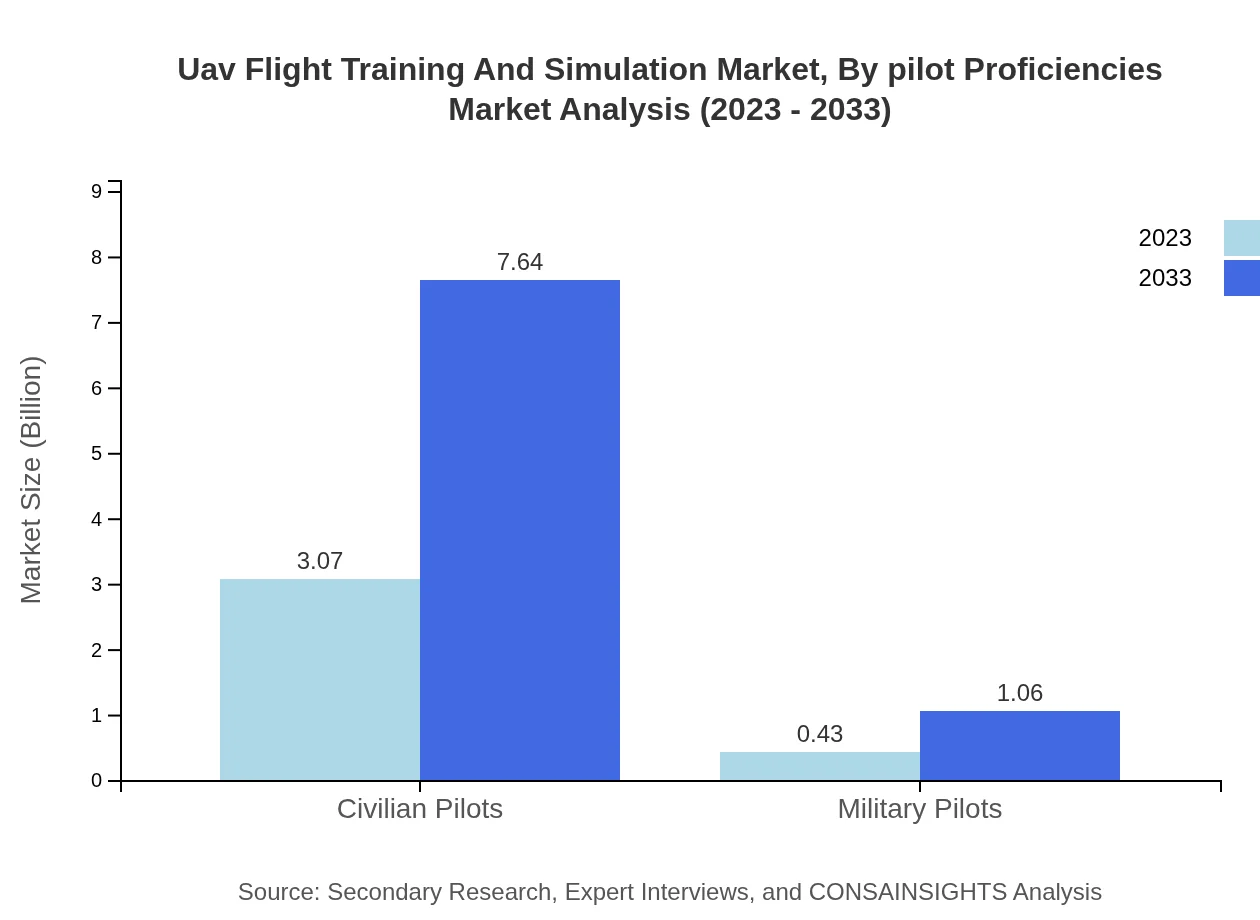

Uav Flight Training And Simulation Market Analysis By Pilot Proficiencies

Pilot proficiencies are mostly divided between military and civilian applications. Military pilots require rigorous training protocols due to operational complexities, while civilian operators focus on regulatory compliance and safety protocols. Understanding the varying proficiency levels enhances the design of training programs aimed at improving safety and flight performance.

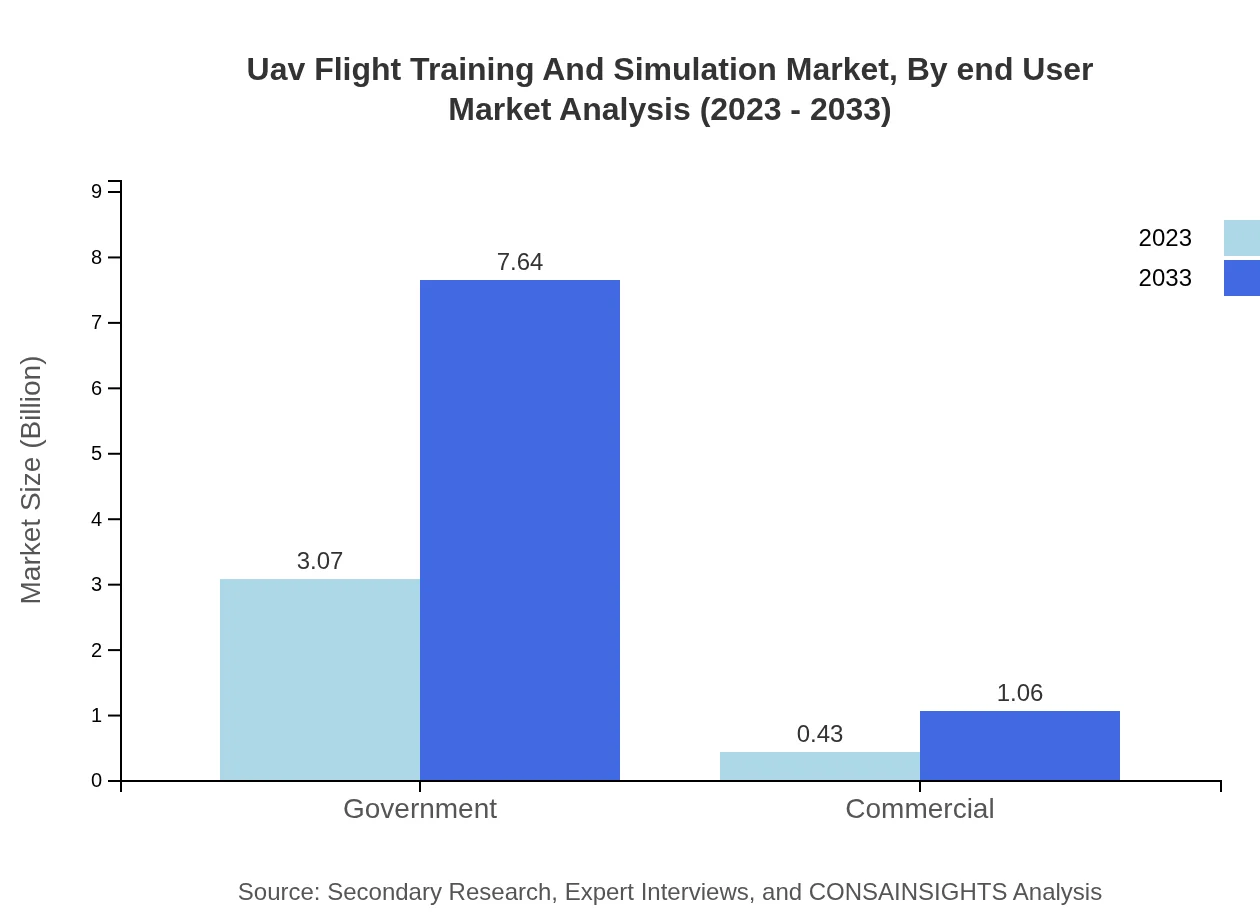

Uav Flight Training And Simulation Market Analysis By End User

The end-user analysis splits the market into government and commercial sectors. The government segment dominates, driven by defense and security applications, while the commercial segment is growing as businesses increasingly recognize the value of UAVs in sectors such as agriculture, logistics, and emergency services.

UAV Flight Training and Simulation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in UAV Flight Training And Simulation Industry

Lockheed Martin:

A leading global security and aerospace company, Lockheed Martin provides innovative training solutions for military and defense applications, focusing on advanced UAV technologies.CAE Inc.:

A global leader in modeling, simulation, and training solutions, CAE specializes in integrated training systems for aerospace and defense, including UAV flight training simulators.Northrop Grumman:

Northrop Grumman is a prominent provider of defense technologies, offering comprehensive training programs that integrate UAV simulation into military training curricula.Thales Group:

Thales Group delivers advanced training and simulation systems that enhance pilots' operational functionality, focusing on both military and civilian UAV applications.Boeing :

Working across the aerospace domain, Boeing develops innovative training solutions for UAV operators, prioritizing safety, efficiency, and cutting-edge technology.We're grateful to work with incredible clients.

FAQs

What is the market size of UAV Flight Training and Simulation?

The UAV Flight Training and Simulation market was valued at approximately $3.5 billion in 2023 and is expected to grow with a CAGR of 9.2% through 2033, driven by increasing UAV adoption across various sectors.

What are the key market players or companies in the UAV Flight Training and Simulation industry?

Key players include major aerospace and defense companies specializing in UAV technologies, flight simulation software developers, and training service providers that cater to military and civilian sectors, contributing significantly to the market.

What are the primary factors driving the growth in the UAV Flight Training and Simulation industry?

The growth is primarily driven by the rising demand for UAV operations in commercial applications, advancements in simulation technologies, regulatory frameworks promoting drone usage, and increased investments in training programs.

Which region is the fastest Growing in the UAV Flight Training and Simulation market?

The fastest-growing region is Europe, where the market is projected to grow from $1.23 billion in 2023 to $3.06 billion by 2033, outpacing others with robust industry investment and expanding UAV applications.

Does ConsaInsights provide customized market report data for the UAV Flight Training and Simulation industry?

Yes, ConsaInsights offers tailored market reports that can be customized to fit specific requirements, including detailed analysis, regional insights, and competitor benchmarking within the UAV Flight Training and Simulation industry.

What deliverables can I expect from this UAV Flight Training and Simulation market research project?

Deliverables typically include comprehensive market analysis reports, forecasts, segmentation data, competitive landscape assessments, and actionable insights that help guide strategic business decisions.

What are the market trends of UAV Flight Training and Simulation?

Market trends include increased incorporation of AI and VR technologies, a shift towards advanced training methodologies, growing military interest for tactical applications, and an emphasis on cost-effective training solutions.