Uav Navigation Systems Market Report

Published Date: 03 February 2026 | Report Code: uav-navigation-systems

Uav Navigation Systems Market Size, Share, Industry Trends and Forecast to 2033

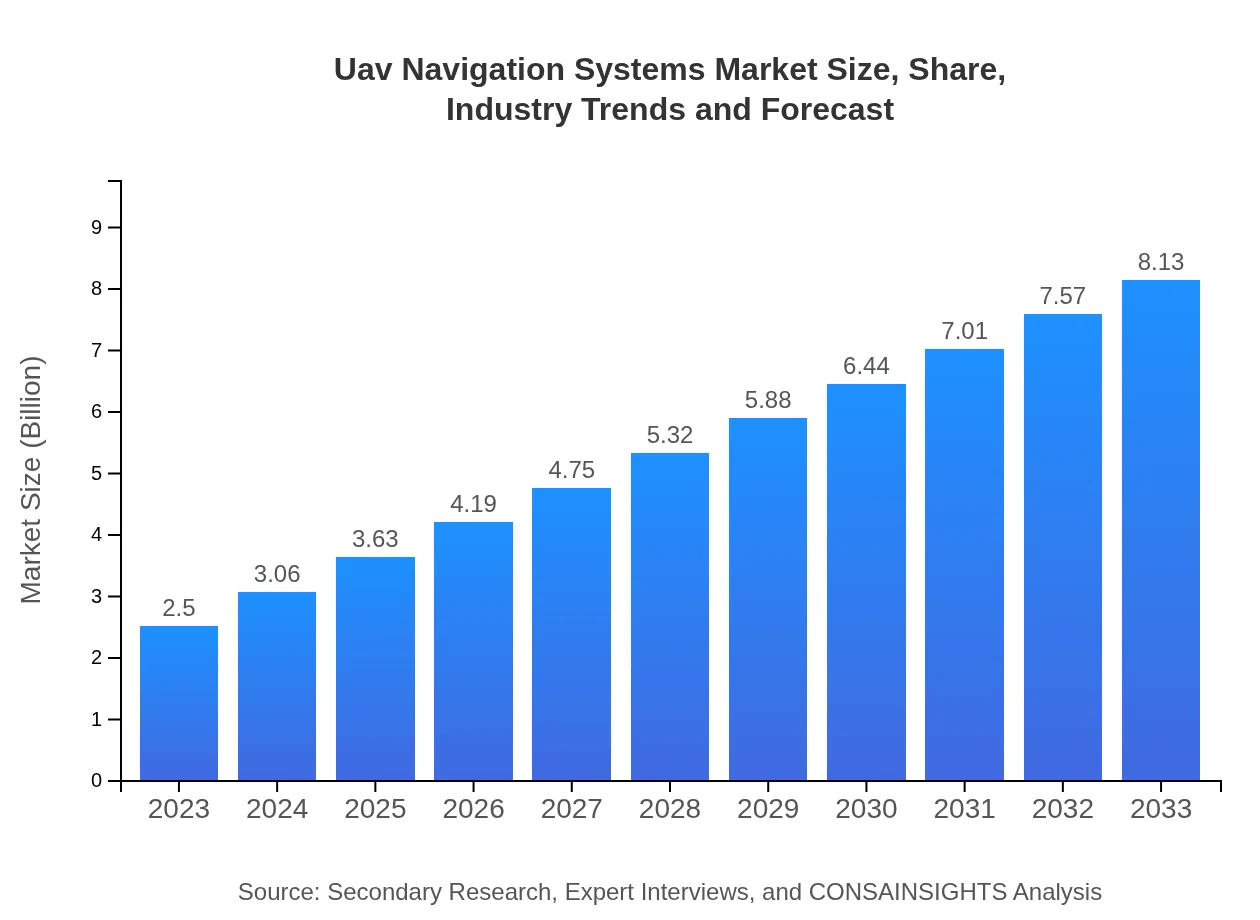

This report provides a comprehensive analysis of the UAV navigation systems market, focusing on market size, segmentation, regional insights, and future trends for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $8.13 Billion |

| Top Companies | DJI, Northrop Grumman, Raytheon Technologies, Furuno, Honeywell |

| Last Modified Date | 03 February 2026 |

Uav Navigation Systems Market Overview

Customize Uav Navigation Systems Market Report market research report

- ✔ Get in-depth analysis of Uav Navigation Systems market size, growth, and forecasts.

- ✔ Understand Uav Navigation Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Uav Navigation Systems

What is the Market Size & CAGR of Uav Navigation Systems market in 2023?

Uav Navigation Systems Industry Analysis

Uav Navigation Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Uav Navigation Systems Market Analysis Report by Region

Europe Uav Navigation Systems Market Report:

Europe's UAV navigation systems market is expected to grow from $0.69 billion in 2023 to around $2.24 billion by 2033. The region is witnessing increased adoption of UAVs for agriculture, environmental monitoring, and infrastructure inspection, driven by research and development investments and favorable regulatory frameworks.Asia Pacific Uav Navigation Systems Market Report:

In 2023, the UAV navigation systems market in the Asia Pacific region is valued at approximately $0.47 billion, projected to grow to $1.54 billion by 2033. The growth is fueled by increasing drone utilization in agriculture, infrastructure inspections, and logistics, bolstered by supportive government regulations and advancements in drone technology.North America Uav Navigation Systems Market Report:

North America dominates the UAV navigation systems market, valued at $0.97 billion in 2023 and projected to reach $3.15 billion by 2033. This region's dominance can be attributed to the extensive use of drones in military operations, emergency services, and commercial applications, coupled with significant government investment in drone technology.South America Uav Navigation Systems Market Report:

The market in South America is relatively smaller, with a size of about $0.11 billion in 2023, expected to reach $0.35 billion by 2033. This growth is mainly attributed to rising interest in agricultural monitoring and small-scale industrial applications, alongside increasing investments in infrastructure development.Middle East & Africa Uav Navigation Systems Market Report:

The Middle East and Africa UAV navigation systems market is roughly valued at $0.26 billion in 2023, with expectations to grow to $0.86 billion by 2033. The increasing adoption of drones in military and surveillance sectors aligns with government initiatives to enhance aerial capabilities in the region.Tell us your focus area and get a customized research report.

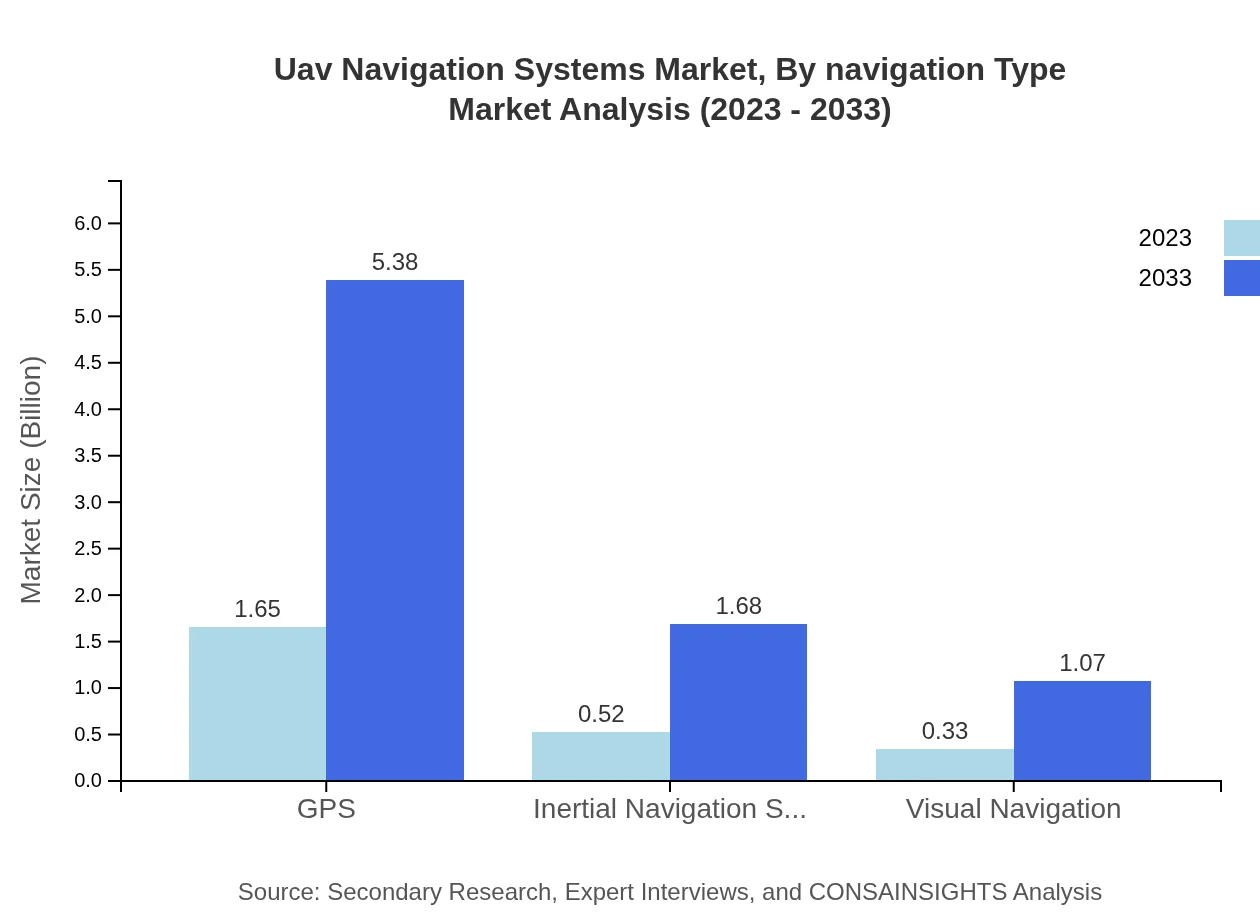

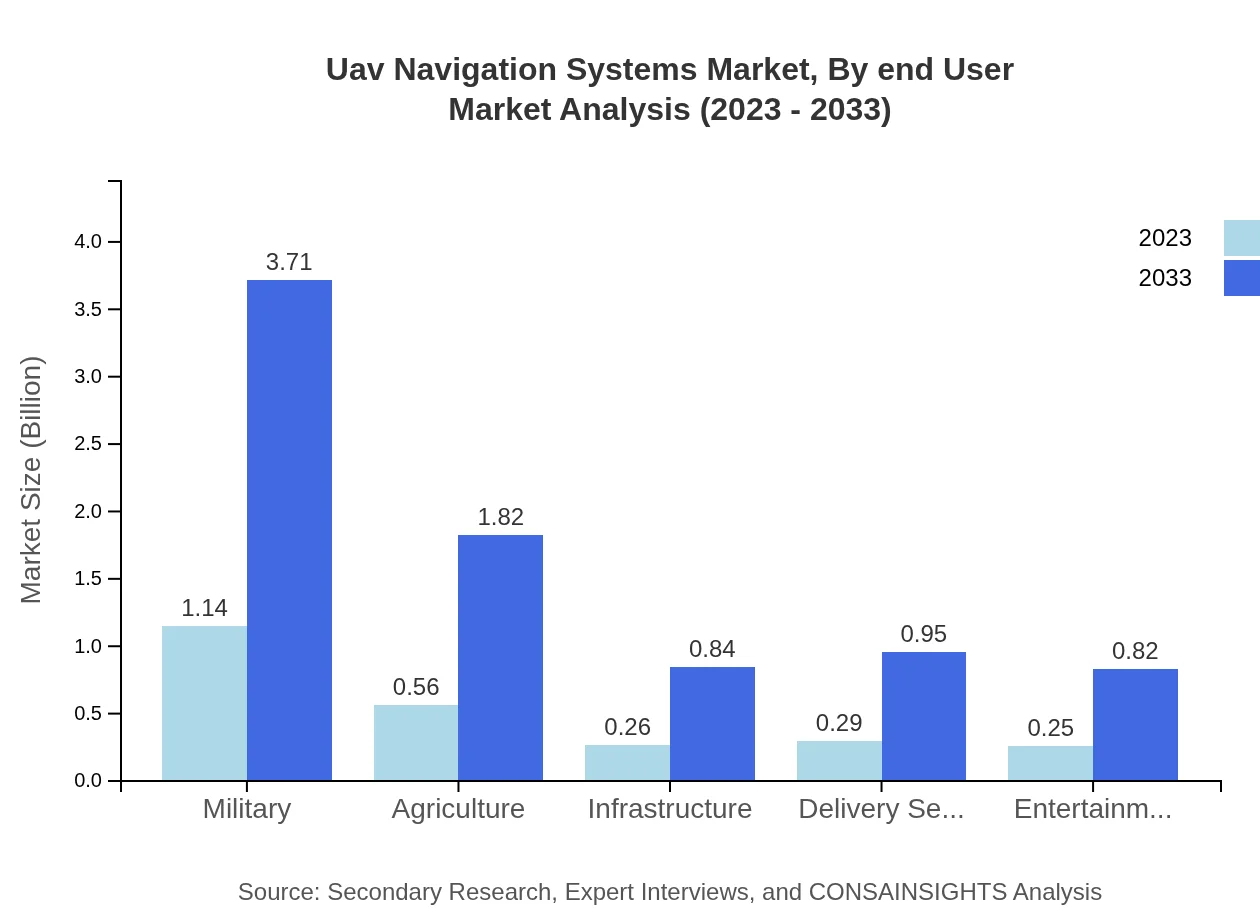

Uav Navigation Systems Market Analysis By End User

The end-user segment includes military, agriculture, infrastructure, delivery services, entertainment, and monitoring applications. Military applications dominate with an estimated market size of $1.14 billion in 2023, increasing to $3.71 billion by 2033, representing a 45.57% market share. Agriculture and monitoring applications are also crucial segments, indicating steady growth driven by the need for efficiency and precision.

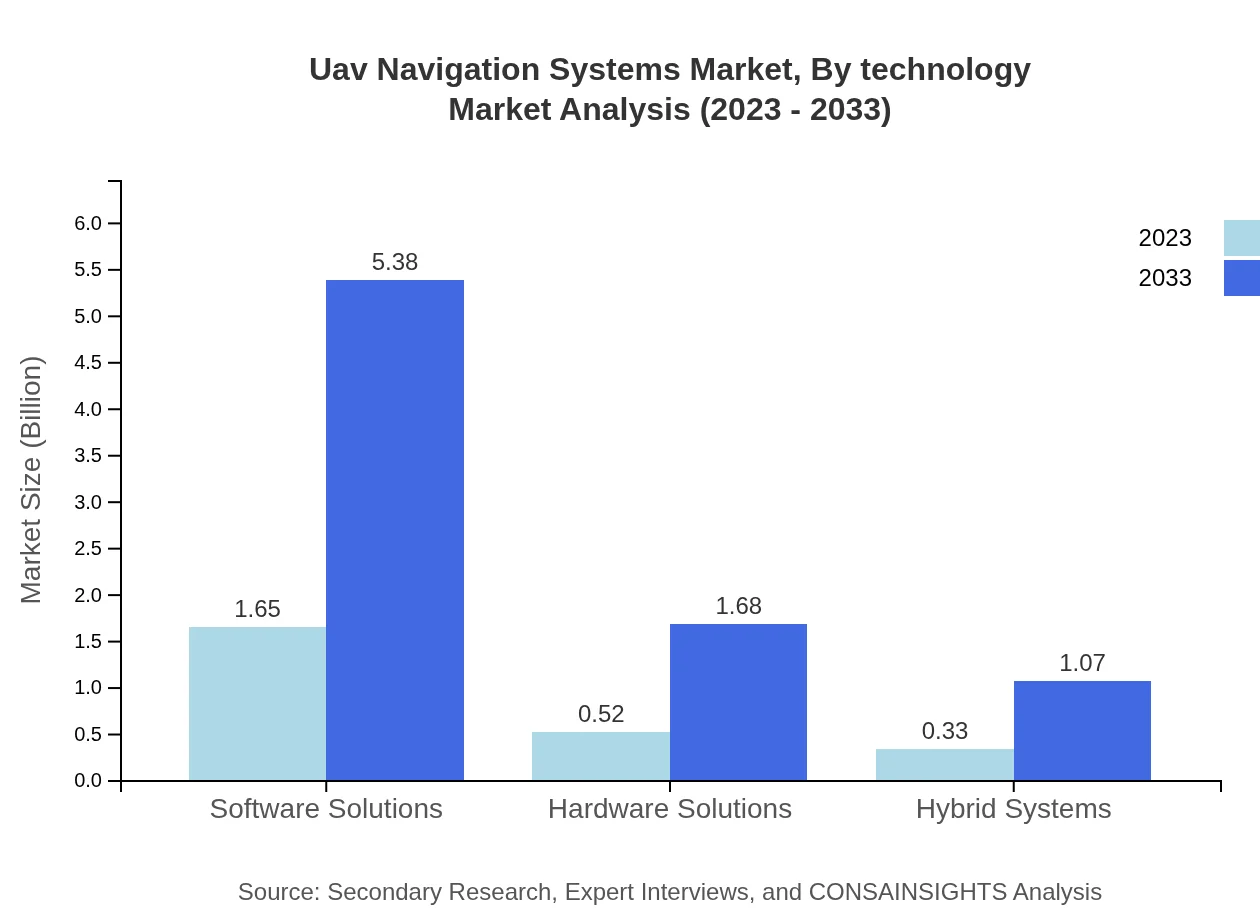

Uav Navigation Systems Market Analysis By Technology

Technological advancements play a pivotal role in the UAV navigation systems market. With innovations in software and hardware solutions, the software market segment is leading with a valuation of around $1.65 billion in 2023, poised to reach $5.38 billion by 2033, accounting for a 66.18% share. Hardware solutions contribute significantly, highlighting the importance of integrated systems for optimal performance.

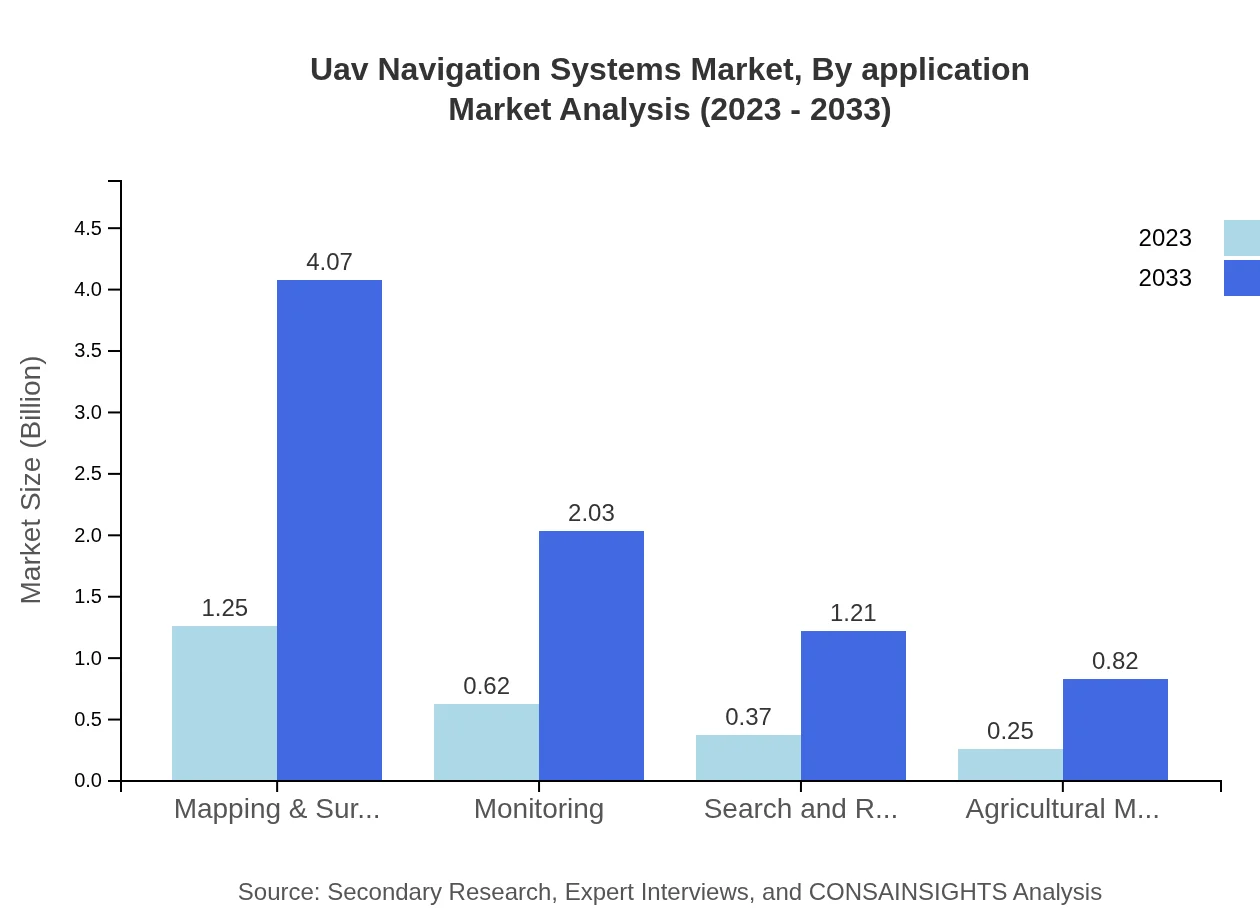

Uav Navigation Systems Market Analysis By Application

Applications of UAV navigation systems range from military operations to surveillance, monitoring, and surveying. The largest share of applications is found in mapping and surveying, which holds approximately 50.03% share in the market, while delivery services, agriculture, and monitoring also display robust growth potential with diversifying use cases.

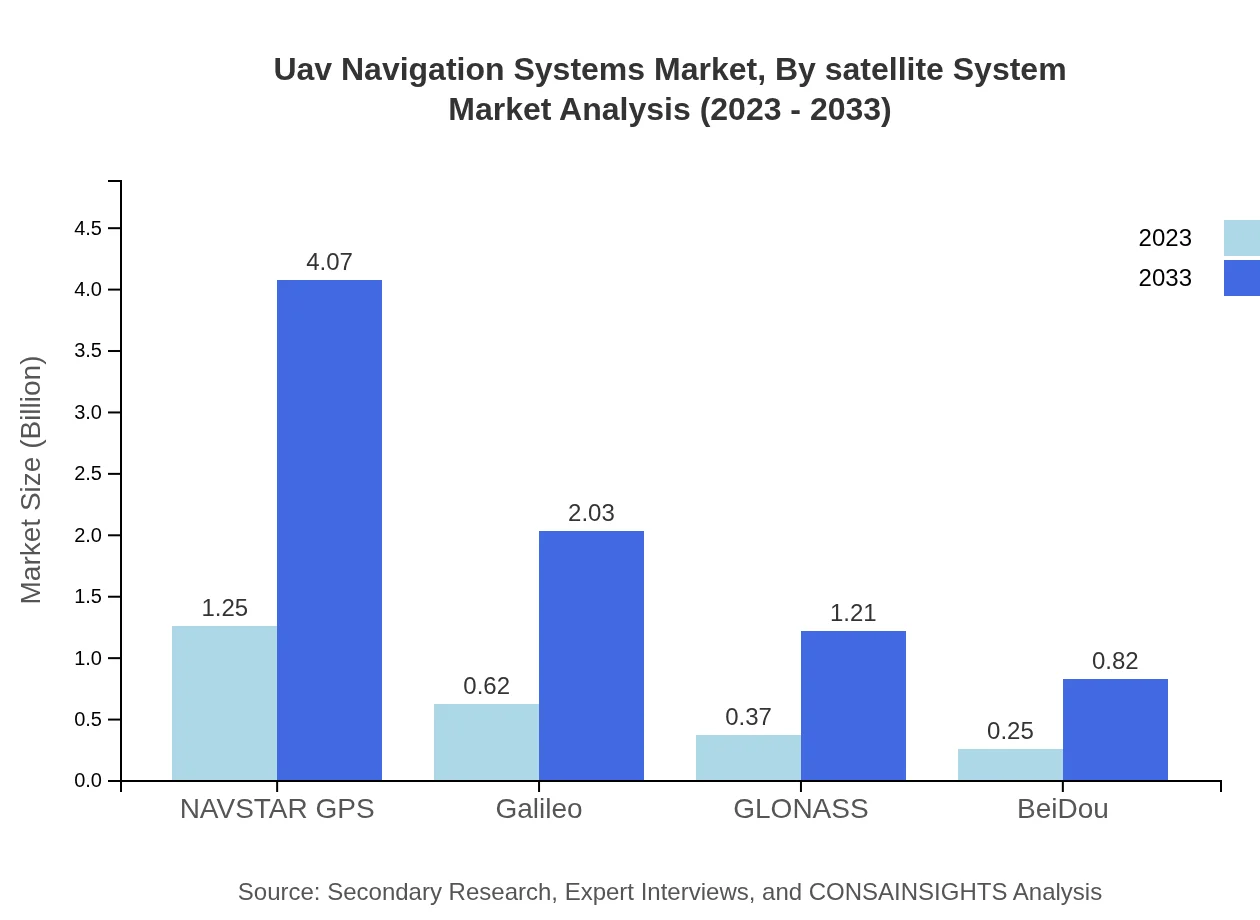

Uav Navigation Systems Market Analysis By Satellite System

The satellite system segment includes key players like NAVSTAR GPS, Galileo, GLONASS, and BeiDou. NAVSTAR GPS dominates with a market size of $1.25 billion in 2023, expected to reach $4.07 billion by 2033. Each system showcases unique capabilities, influencing their adoption based on regional and application-specific preferences.

Uav Navigation Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Uav Navigation Systems Industry

DJI:

A leading manufacturer of commercial drones, DJI specializes in advanced UAV technologies and navigation systems, contributing significantly to the global UAV navigation systems market.Northrop Grumman:

Known for its role in military UAVs, Northrop Grumman excels in developing sophisticated drone navigation and guidance systems, reinforcing its leading position in the UAV sector.Raytheon Technologies:

Raytheon offers advanced navigation technologies for UAV applications, focusing on defense and aerospace sectors, thereby enhancing operational capabilities.Furuno:

Furuno specializes in marine and UAV navigation systems, providing reliable solutions that meet various industry needs and challenges.Honeywell :

Honeywell is a prominent player providing navigation solutions for both commercial and military UAVs, improving safety and operational efficiency in aerial navigation.We're grateful to work with incredible clients.

FAQs

What is the market size of UAV navigation systems?

The UAV navigation systems market is valued at approximately $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 12% leading to substantial growth by 2033.

What are the key market players or companies in the UAV navigation systems industry?

Key players include industry leaders in drone technology and navigation solutions. Companies such as DJI, Northrop Grumman, and Qualcomm are pivotal in shaping the UAV navigation landscape with innovative offerings.

What are the primary factors driving the growth in the UAV navigation systems industry?

Growth drivers include increased demand for unmanned aerial vehicles in sectors such as agriculture, military, and delivery services, alongside advancements in navigation technologies and regulatory support for drone operations.

Which region is the fastest Growing in the UAV navigation systems market?

North America is the fastest-growing region, projected to expand from $0.97 billion in 2023 to $3.15 billion by 2033, driven by technological advancements and widespread adoption in various sectors.

Does Consainsights provide customized market report data for the UAV navigation systems industry?

Yes, Consainsights offers tailored market reports for the UAV navigation systems industry, allowing clients to gain insights specific to their requirements and market segments.

What deliverables can I expect from this UAV navigation systems market research project?

Deliverables include comprehensive market analysis reports, regional insights, competitive landscape assessments, and forecasts, ensuring you receive actionable intelligence for informed decision-making.

What are the market trends of UAV navigation systems?

Trends indicate a shift towards software-centric solutions, increased integration of AI in navigation, and a rising focus on safety and compliance, enhancing operational efficiencies across various applications.