Uav Payload And Subsystems Market Report

Published Date: 03 February 2026 | Report Code: uav-payload-and-subsystems

Uav Payload And Subsystems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the UAV payload and subsystems market, with insights into market size, growth forecasts for 2023-2033, regional market characteristics, trends, and competitive landscape.

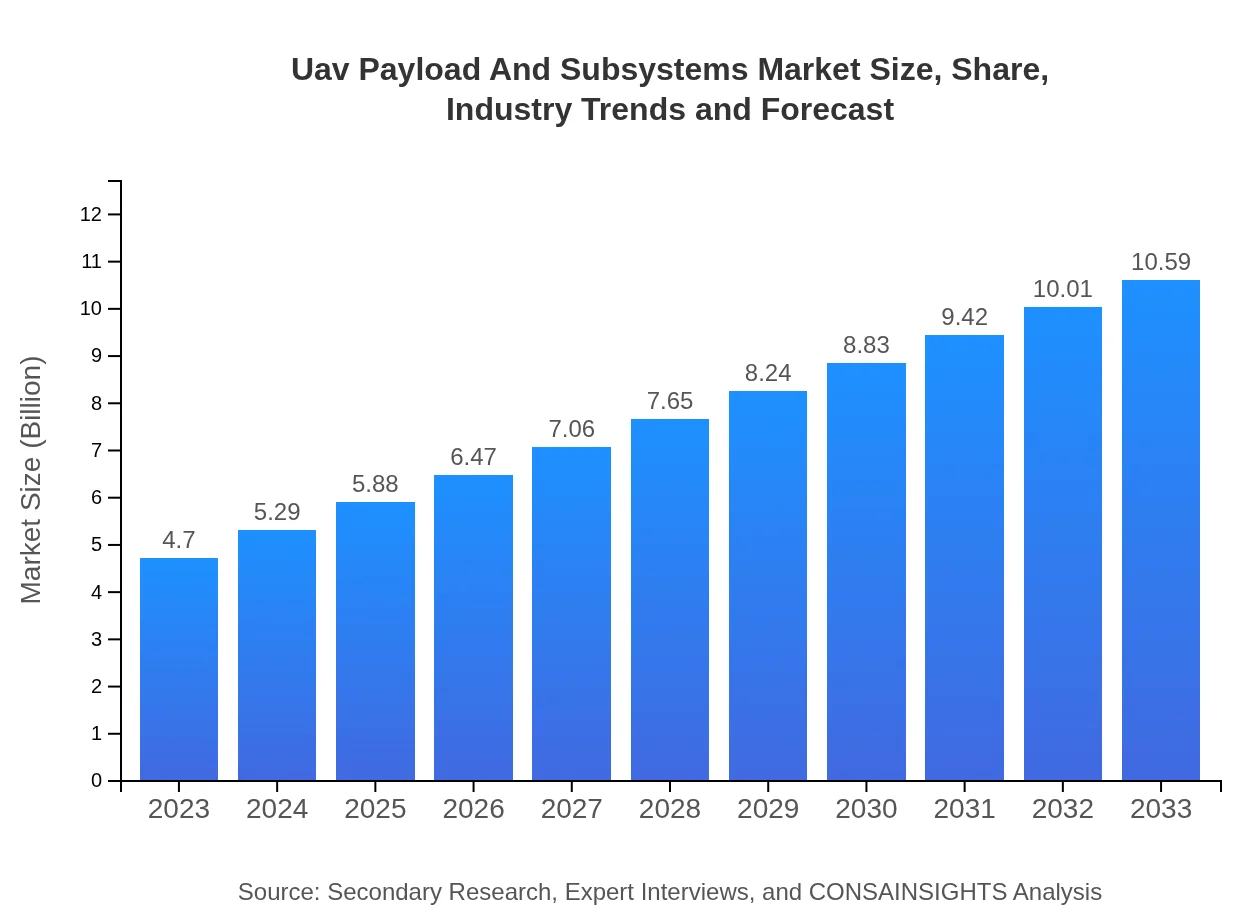

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.70 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $10.59 Billion |

| Top Companies | Northrop Grumman, DJI Technology, Lockheed Martin, Raytheon Technologies, senseFly (Parrot Group) |

| Last Modified Date | 03 February 2026 |

Uav Payload And Subsystems Market Overview

Customize Uav Payload And Subsystems Market Report market research report

- ✔ Get in-depth analysis of Uav Payload And Subsystems market size, growth, and forecasts.

- ✔ Understand Uav Payload And Subsystems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Uav Payload And Subsystems

What is the Market Size & CAGR of Uav Payload And Subsystems market in 2023-2033?

Uav Payload And Subsystems Industry Analysis

Uav Payload And Subsystems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Uav Payload And Subsystems Market Analysis Report by Region

Europe Uav Payload And Subsystems Market Report:

Europe's UAV payload market is expected to grow robustly, from USD 1.16 billion in 2023 to USD 2.62 billion by 2033. Innovators in the region focus on integrating advanced payload solutions for both civilian and military applications, supported by regulatory frameworks encouraging UAV usage.Asia Pacific Uav Payload And Subsystems Market Report:

The Asia Pacific region is witnessing significant growth in the UAV payload market, driven by increasing defense budgets and a growing focus on surveillance and reconnaissance applications. The market size is projected to grow from USD 0.90 billion in 2023 to USD 2.03 billion by 2033, reflecting a high growth potential in countries like China and India.North America Uav Payload And Subsystems Market Report:

The North American market remains the largest, escalating from USD 1.68 billion in 2023 to USD 3.79 billion by 2033, driven by the dominance of the defense sector, government contracts, and high commercialization rates of UAV technologies across various industries.South America Uav Payload And Subsystems Market Report:

In South America, the UAV payload market is expected to grow from USD 0.32 billion in 2023 to USD 0.72 billion by 2033. The growth is fueled by increasing adoption of UAVs in agriculture and environmental monitoring, enhanced by regional investments in technology infrastructure.Middle East & Africa Uav Payload And Subsystems Market Report:

The Middle East and Africa market is also on an upward trajectory, with the size projected to rise from USD 0.63 billion in 2023 to USD 1.43 billion by 2033. Rising investment in defense technologies and drone applications for infrastructure monitoring are driving this growth.Tell us your focus area and get a customized research report.

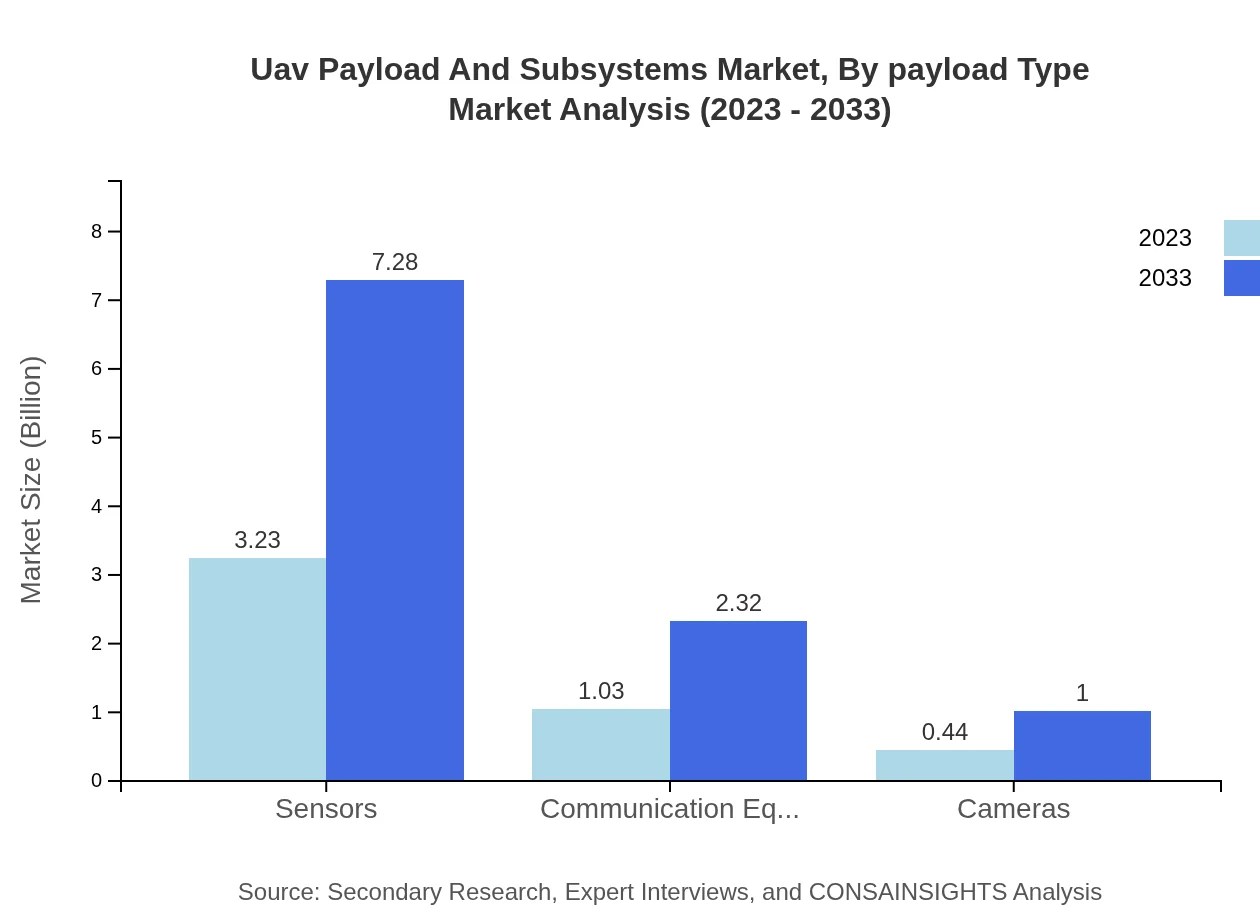

Uav Payload And Subsystems Market Analysis By Payload Type

The payload type segment dominates the UAV market, driven primarily by the high demand for advanced sensors, which accounted for USD 3.23 billion in 2023 and is projected to reach USD 7.28 billion by 2033. Communication equipment and cameras, crucial for data acquisition and operational support, are also significant contributors in terms of size and growth.

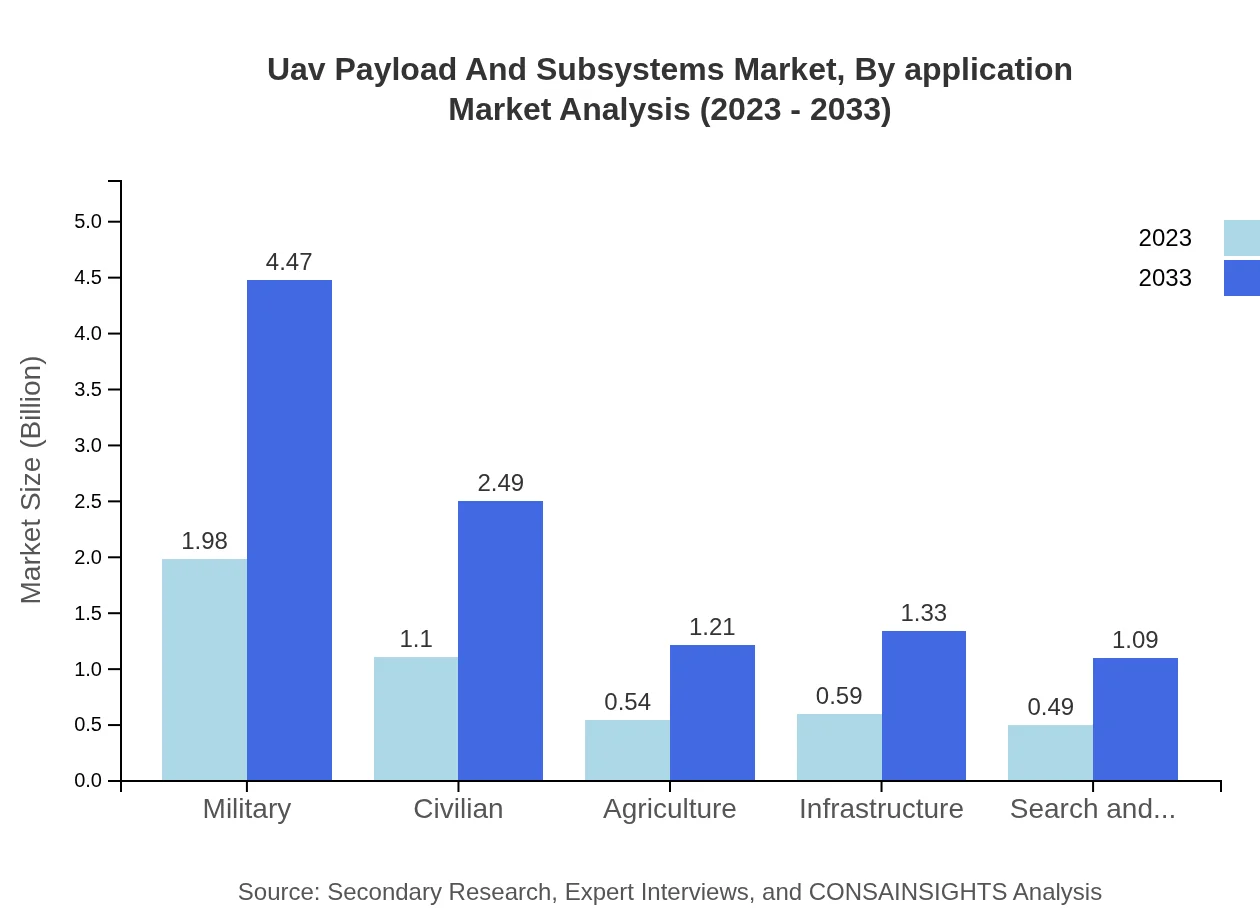

Uav Payload And Subsystems Market Analysis By Application

The application segment reveals strong growth in defense, contributing significantly to the market, with a size of USD 3.23 billion in 2023 and forecasted growth to USD 7.28 billion by 2033. Commercial usage is also on the rise, indicating a shift towards civilian applications including logistics, agriculture, and emergency response.

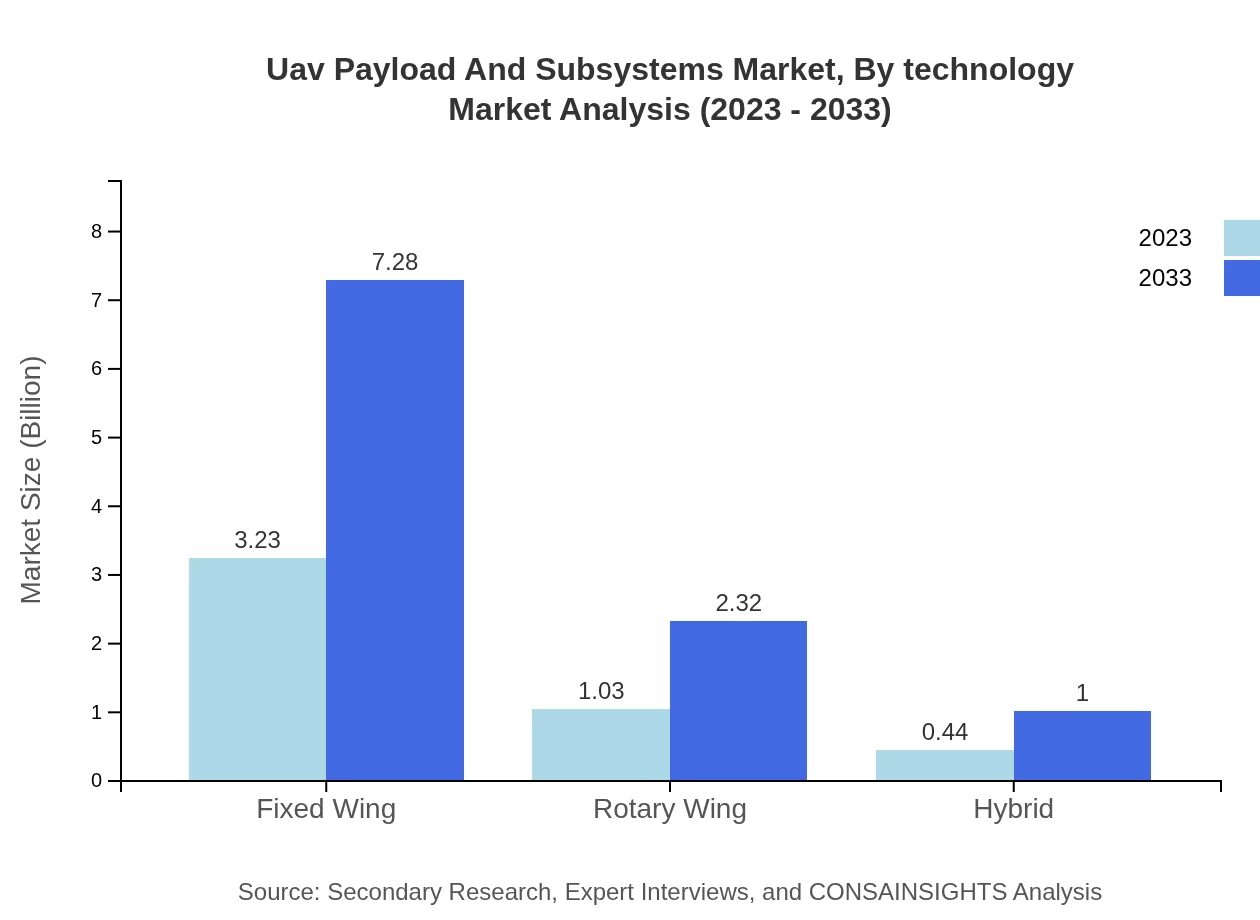

Uav Payload And Subsystems Market Analysis By Technology

The technology segment is prominently featured in fixed-wing UAVs, which held a market size of USD 3.23 billion in 2023, with steady growth expected. Rotary wing and hybrid technologies are gaining traction, influenced by advancements in drone efficiency and utility.

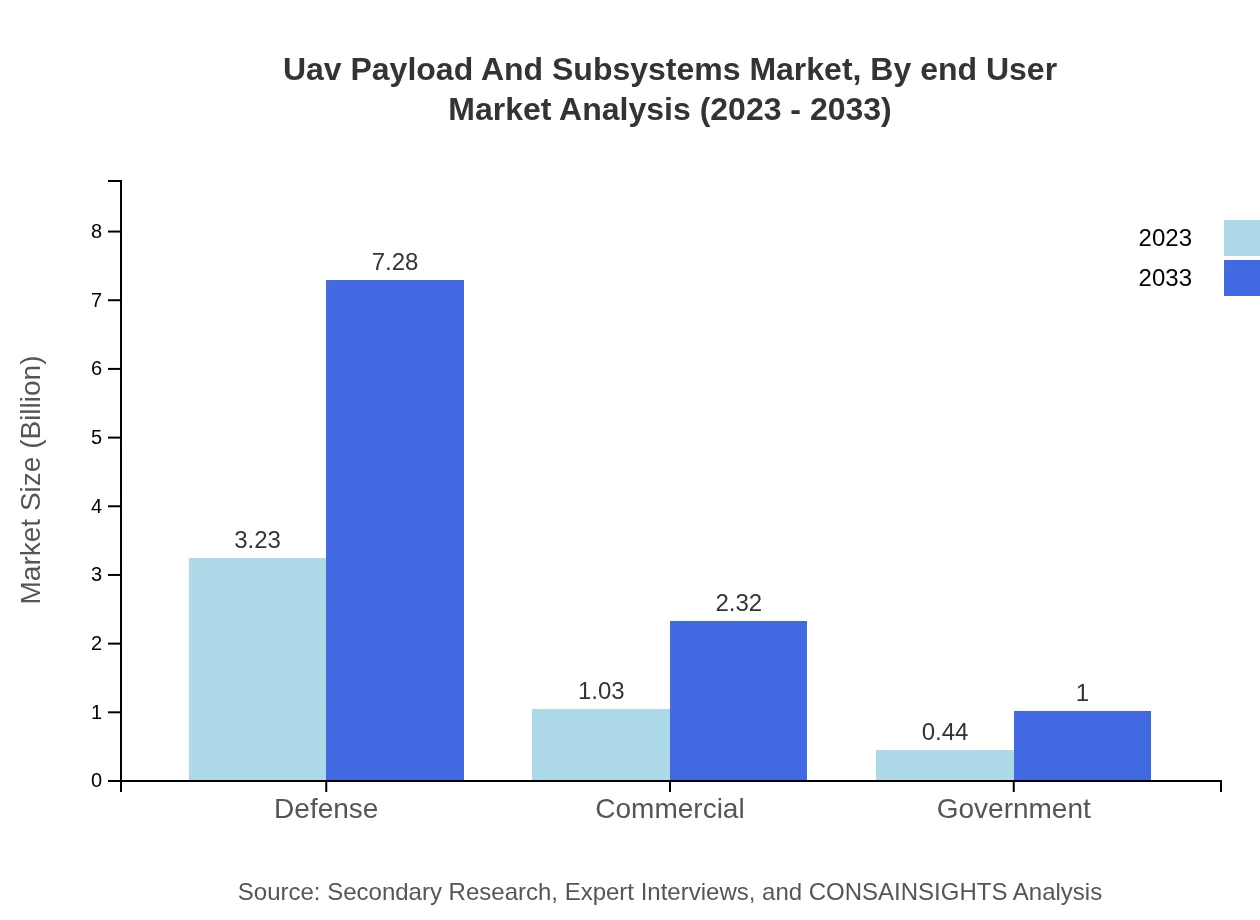

Uav Payload And Subsystems Market Analysis By End User

The end-user segment shows military applications leading with a size of USD 1.98 billion in 2023, due to defense-related procurement and technological advancements. Civilian applications are also flourishing, addressing sectors such as agriculture and search and rescue, enhancing service capabilities.

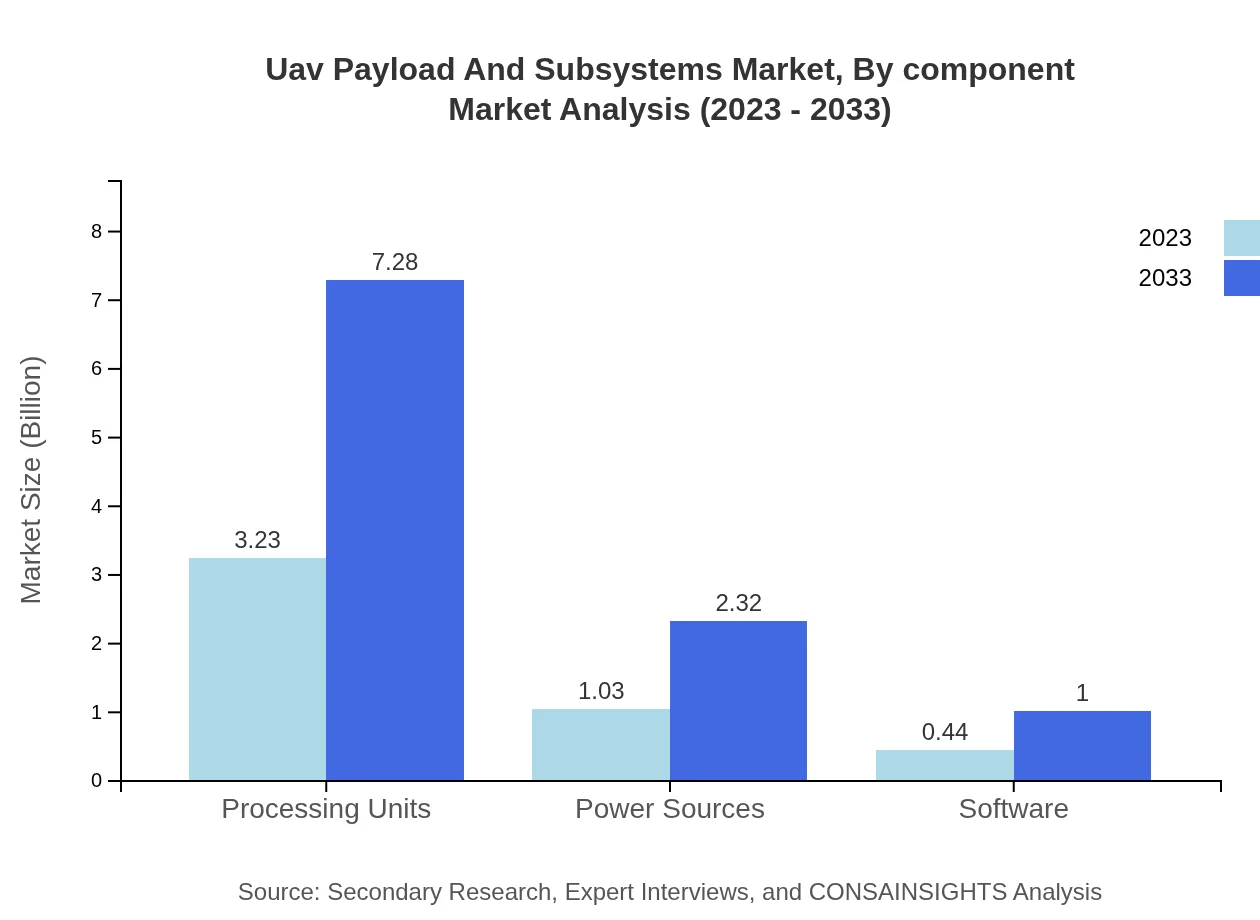

Uav Payload And Subsystems Market Analysis By Component

By component, processing units lead the market with USD 3.23 billion in 2023, driving overall performance and operational capacity. Other critical components include power sources and software, essential for data handling and operational efficiency.

Uav Payload And Subsystems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Uav Payload And Subsystems Industry

Northrop Grumman:

A leader in aerospace and defense, Northrop Grumman provides advanced UAV systems and payloads used in intelligence, surveillance, and reconnaissance missions globally.DJI Technology:

As a pioneer in drone technology, DJI dominates the commercial UAV market with advanced payload systems for photography, agriculture, and industrial applications.Lockheed Martin:

A significant player in the defense sector, Lockheed Martin develops various UAVs integrated with innovative payload technologies for military operations.Raytheon Technologies:

Raytheon is well-known for its sophisticated defense electronics and UAV payload systems, enhancing reconnaissance and military capabilities for operations worldwide.senseFly (Parrot Group):

Specializing in mapping and surveying applications, senseFly provides drone solutions equipped with advanced sensors for civil use in agriculture and environmental monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of uav Payload And Subsystems?

The UAV payload and subsystems market is valued at approximately $4.7 billion in 2023 and is projected to expand at a CAGR of 8.2%, indicating robust growth potential through 2033.

What are the key market players or companies in this uav Payload And Subsystems industry?

Key players in the UAV payload and subsystems market include major defense contractors and aerospace firms, technology developers, and manufacturers specializing in drone components, though specific names require direct market research.

What are the primary factors driving the growth in the uav Payload And Subsystems industry?

Growth in the UAV payload and subsystems industry is driven by advancements in drone technology, increased defense spending, commercial applications in agriculture, and rising demand for surveillance and reconnaissance capabilities.

Which region is the fastest Growing in the uav Payload And Subsystems?

The Asia Pacific region is the fastest-growing market for UAV payload and subsystems, expected to grow from $0.9 billion in 2023 to $2.03 billion by 2033, reflecting increasing investments in drone technology.

Does ConsaInsights provide customized market report data for the uav Payload And Subsystems industry?

Yes, ConsaInsights offers customized market report data for the UAV payload and subsystems sector, ensuring tailored research to meet the specific needs of clients and their unique market strategies.

What deliverables can I expect from this uav Payload And Subsystems market research project?

From this UAV payload and subsystems market research project, clients can expect comprehensive reports including market size, segment analysis, forecasts, competitive landscape assessments, and strategic recommendations.

What are the market trends of uav Payload And Subsystems?

Key trends in the UAV payload and subsystems market include the integration of AI in unmanned systems, increased adoption of modular subsystems, and growth in partnerships between technology firms and defense contractors.