Uht Processing Market Report

Published Date: 31 January 2026 | Report Code: uht-processing

Uht Processing Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the UHT Processing market, providing key insights and detailed analysis. Spanning the forecast years from 2023 to 2033, it covers market trends, growth potential, regional insights, and competitive landscape critical for stakeholders.

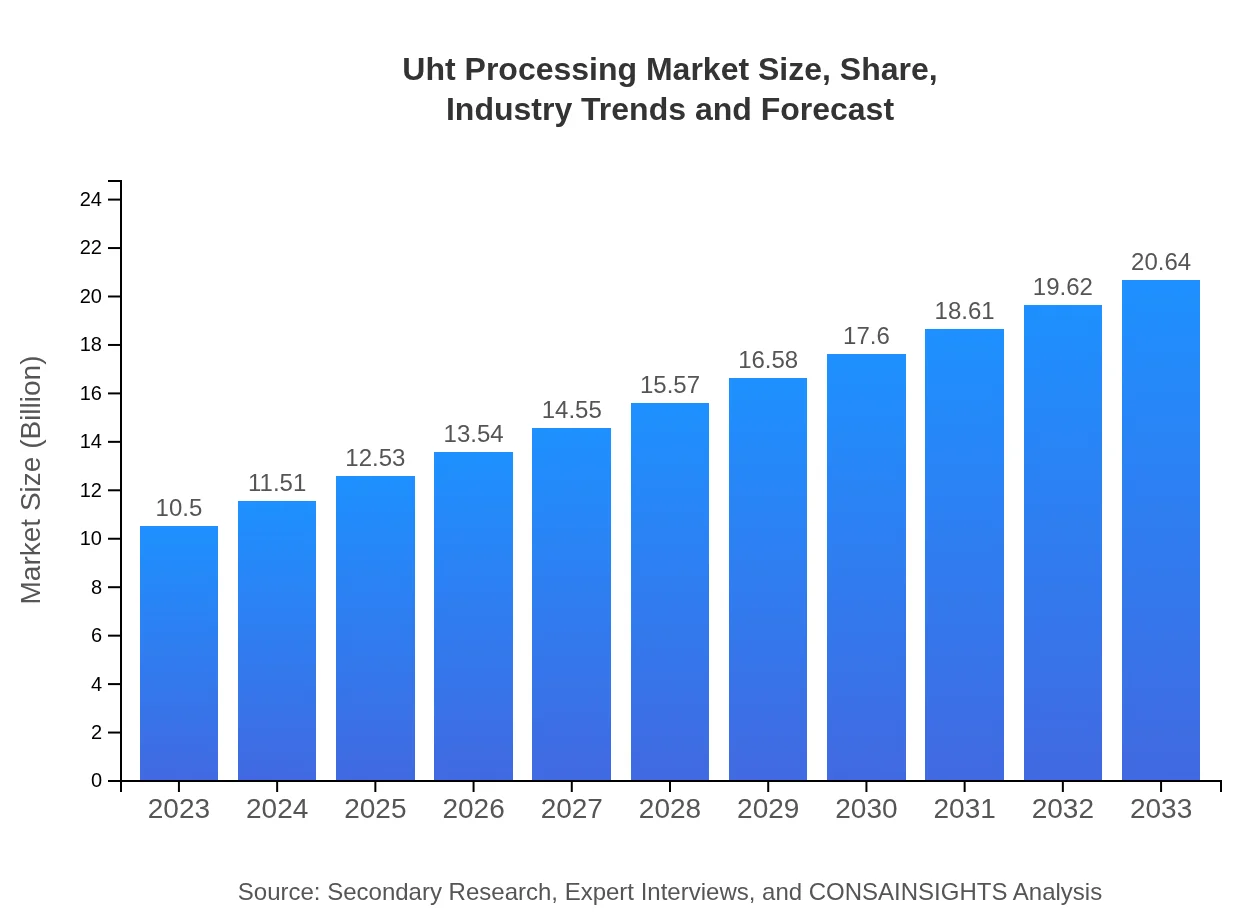

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Tetra Laval, Alfa Laval, GEA Group, SPX FLOW |

| Last Modified Date | 31 January 2026 |

Uht Processing Market Overview

Customize Uht Processing Market Report market research report

- ✔ Get in-depth analysis of Uht Processing market size, growth, and forecasts.

- ✔ Understand Uht Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Uht Processing

What is the Market Size & CAGR of Uht Processing market in 2023?

Uht Processing Industry Analysis

Uht Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Uht Processing Market Analysis Report by Region

Europe Uht Processing Market Report:

Europe's UHT Processing market is expected to rise significantly from $3.91 billion in 2023 to $7.68 billion by 2033. This growth is mainly due to health-conscious consumers and increasing demand for organic and reduced-preservation food products. Western European countries with highly developed retail and food service sectors are driving this market.Asia Pacific Uht Processing Market Report:

The Asia Pacific region is witnessing the fastest growth in the UHT Processing market, with a market value increasing from $1.65 billion in 2023 to $3.24 billion by 2033. Rapid urbanization, an expanding middle class, and changing dietary habits facilitate this growth. Countries like India and China are expected to be significant contributors due to their large populations and rising disposable incomes.North America Uht Processing Market Report:

North America’s UHT Processing market is projected to grow from $3.40 billion in 2023 to $6.69 billion by 2033. The region's growth is propelled by increasing consumer preference for UHT products, coupled with advancements in food processing technology. The USA and Canada are leading this growth due to their well-established food processing infrastructure.South America Uht Processing Market Report:

In South America, the UHT Processing market is anticipated to growth from $0.97 billion in 2023 to $1.91 billion by 2033. The rise in demand for long shelf-life foods, driven by regional food security concerns and economic developments, is enhancing market dynamics. Brazil and Argentina are the key markets in this region.Middle East & Africa Uht Processing Market Report:

The Middle East and Africa region will see growth from $0.57 billion in 2023 to $1.12 billion by 2033, supported by a growing demand for shelf-stable food products. Increased investments in food technology in some Middle Eastern countries contribute to growth, while challenges in infrastructure might hinder further acceleration.Tell us your focus area and get a customized research report.

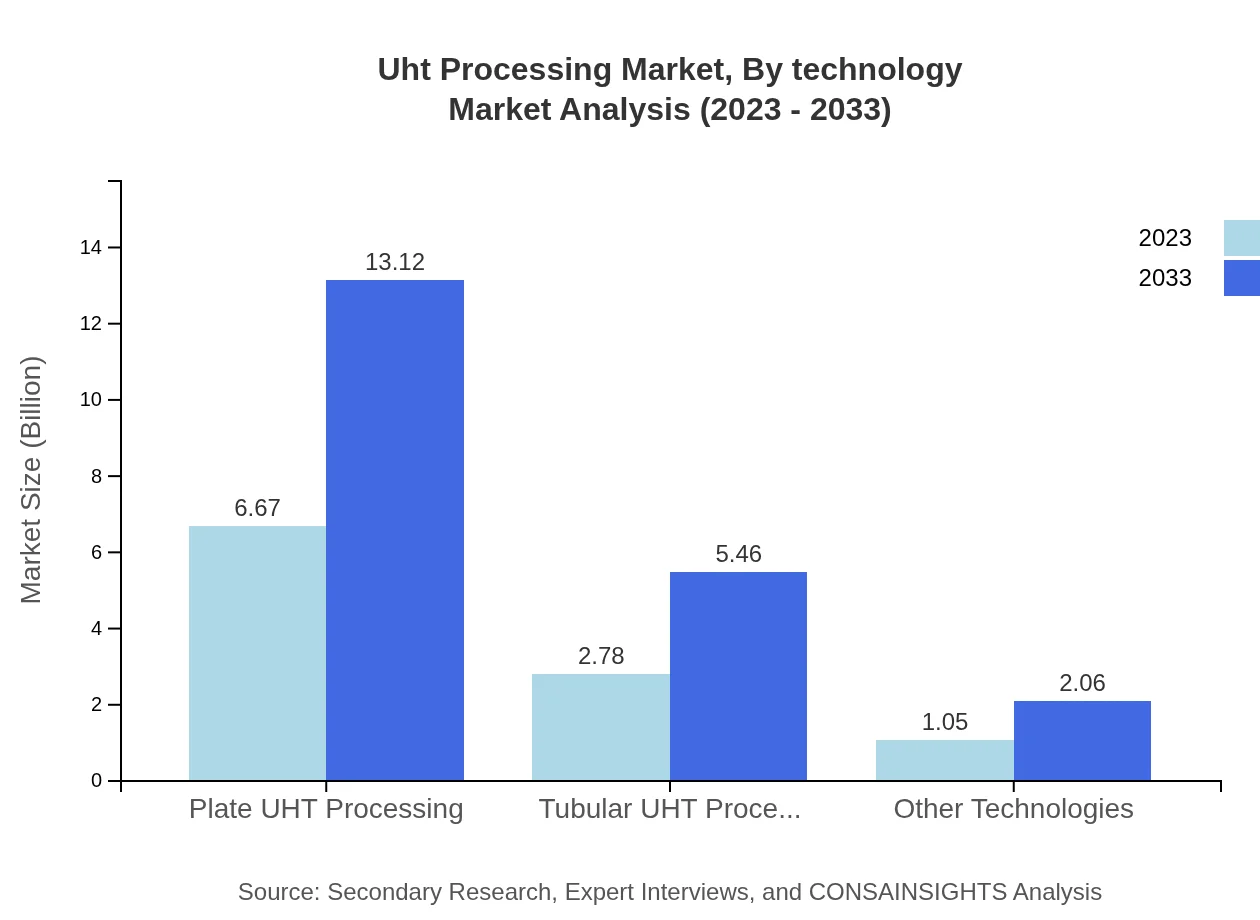

Uht Processing Market Analysis By Technology

The UHT Processing market's technology segmentation includes Plate UHT Processing and Tubular UHT Processing. Plate systems dominate the market due to their efficiency and lower operational costs, accounting for approximately 63.56% of the technology market share in 2023, with expectations to maintain this lead through 2033. Tubular systems are gaining traction in the food service industry due to their capacity and efficiency, while other technologies continue to play a smaller role.

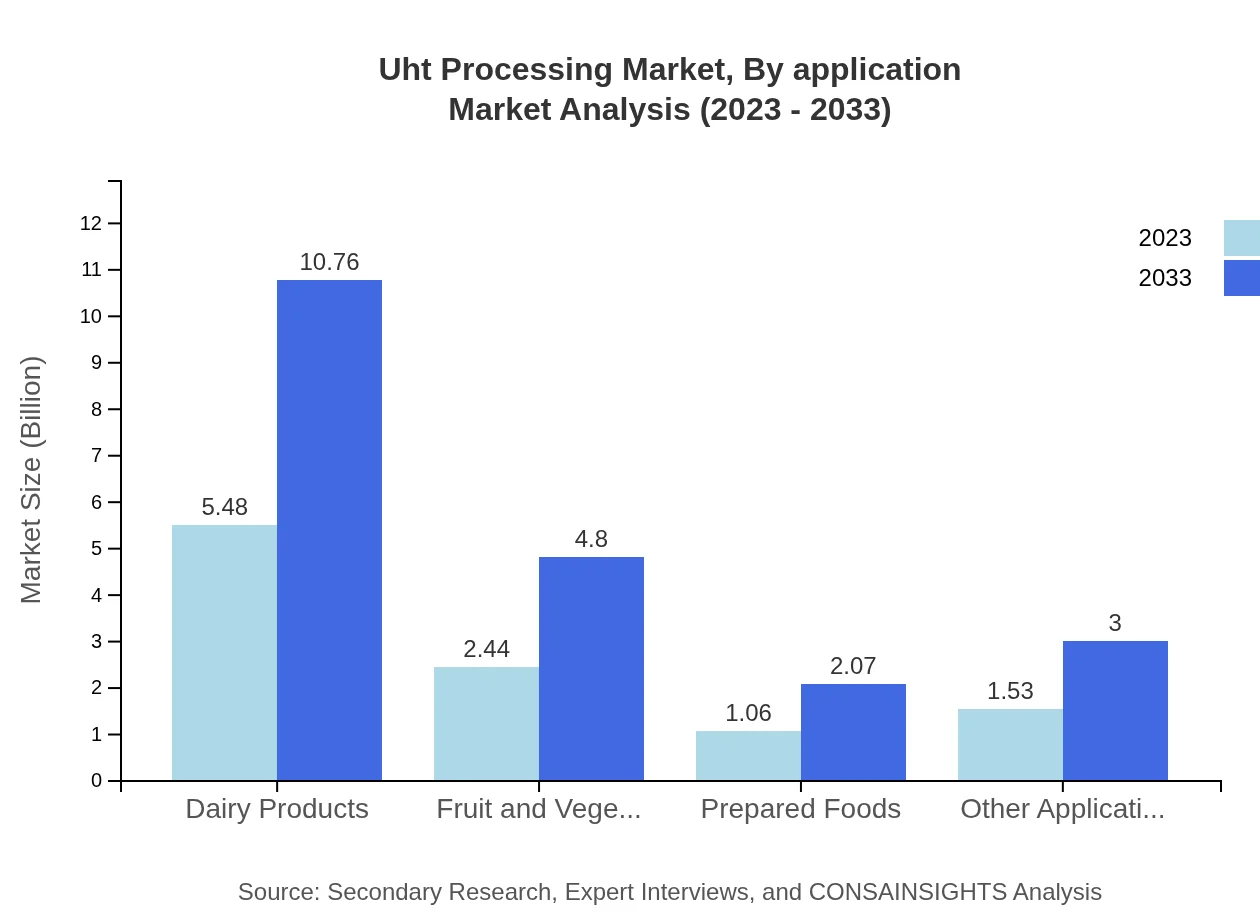

Uht Processing Market Analysis By Application

In terms of application, Dairy Products lead the market, holding a significant share of around 52.15% in 2023. This segment is expected to witness substantial growth due to demands for milk, yogurt, and cream, with projections estimating an increase to 10.76 billion by 2033. Other applications, such as Fruit and Vegetable Juices and Prepared Foods, also show promise, driven by consumer preferences for healthy convenience foods.

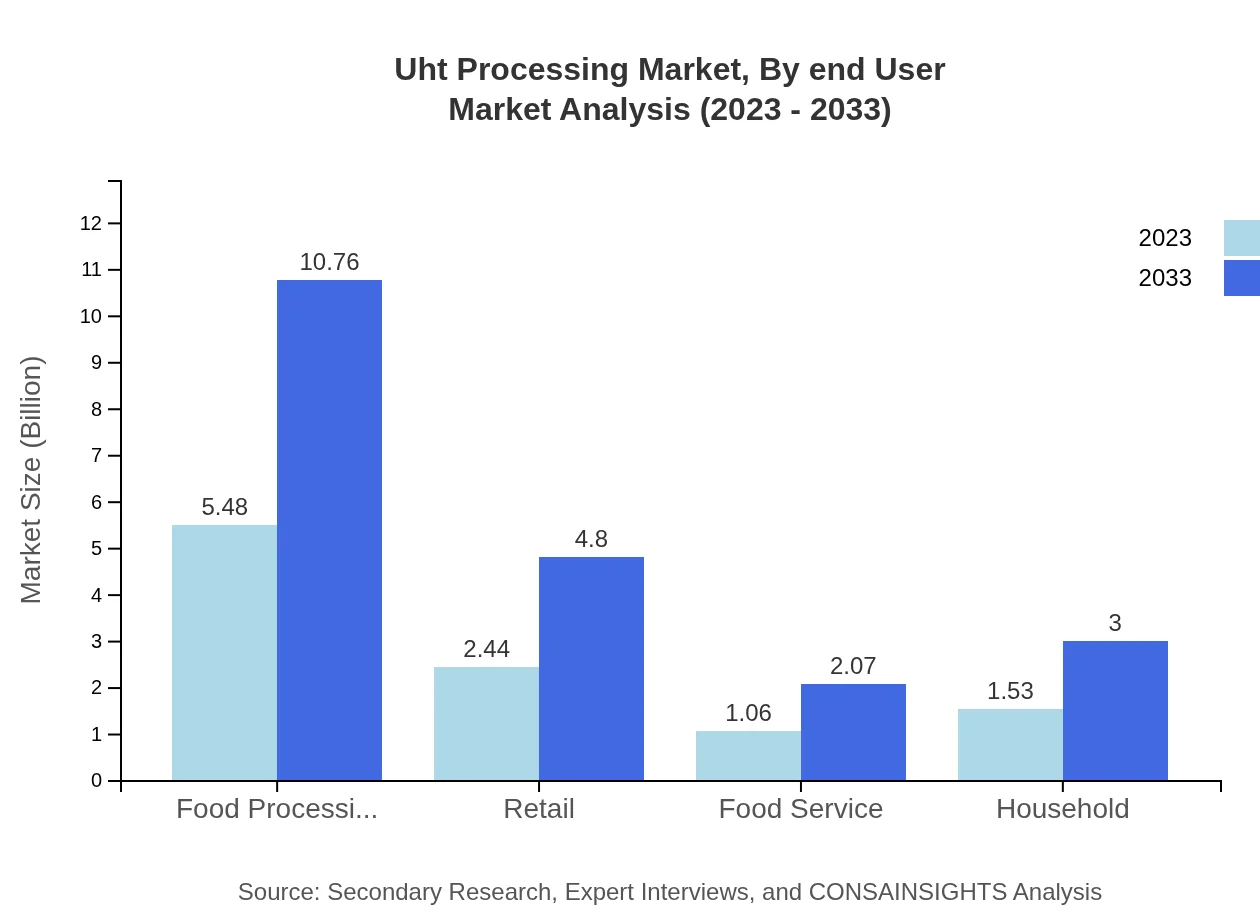

Uht Processing Market Analysis By End User

The end-user segments reveal that Food Processing holds a dominant market share of around 52.15% in 2023, expected to remain stable through 2033. The Retail segment follows closely, with a share of 23.27%, as more retailers stock UHT products to meet consumer demand. The Food Service and Household segments, while smaller, show potential for growth driven by changing consumer behaviors and increasing demand for ready-to-eat options.

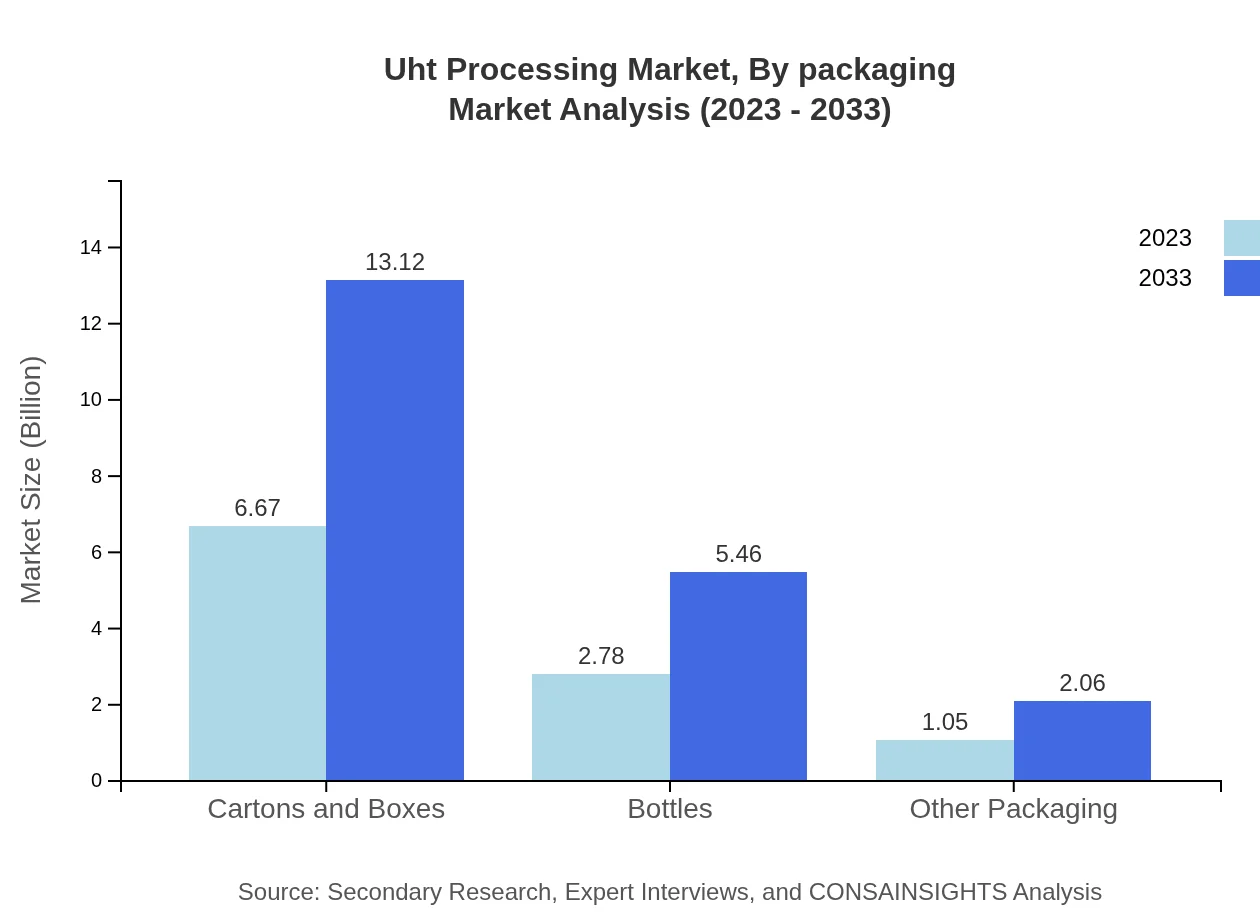

Uht Processing Market Analysis By Packaging

Packaging plays a crucial role in the UHT Processing market. Cartons and Boxes dominate the packaging segment with a share of approximately 63.56% in 2023. Bottles account for around 26.47%, while Other Packaging types contribute with a smaller share of 9.97%. The trend towards sustainable and innovative packaging is likely to impact these market dynamics significantly.

Uht Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Uht Processing Industry

Tetra Laval:

A global leader in food processing and packaging, Tetra Laval specializes in UHT technology, providing innovative solutions that contribute significantly to the industry's development.Alfa Laval:

Known for its systems and equipment for dairy and food processing, Alfa Laval improves efficiency in UHT processing, enhancing the quality and shelf life of products.GEA Group:

GEA Group is a prominent supplier of equipment and process technology for the food industry, including UHT systems that optimize production and energy efficiency.SPX FLOW:

SPX FLOW offers state-of-the-art solutions for UHT processing, emphasizing quality and sustainability in their technology offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of UHT Processing?

The global UHT processing market is currently valued at approximately $10.5 billion, with a projected CAGR of 6.8% from 2023 to 2033. This growth reflects increasing demand for shelf-stable food and beverage products.

What are the key market players or companies in the UHT Processing industry?

Key players in the UHT processing industry include Tetra Pak, SPX Flow, and Alfa Laval. These companies dominate the market by providing advanced technology, enhancing product quality, and ensuring operational efficiency for food processing.

What are the primary factors driving the growth in the UHT Processing industry?

The growth in the UHT processing industry is driven by rising consumer demand for convenience foods, advancements in technology, and increased focus on food safety and preservation. Moreover, expansion in developing regions also plays a crucial role.

Which region is the fastest Growing in the UHT Processing market?

The Asia Pacific region is identified as the fastest-growing market for UHT processing, with market size projected to increase from $1.65 billion in 2023 to $3.24 billion by 2033, driven by rapid urbanization and changing consumer preferences.

Does ConsaInsights provide customized market report data for the UHT Processing industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the UHT processing industry. This ensures comprehensive insights relevant to unique market conditions and business strategies.

What deliverables can I expect from this UHT Processing market research project?

Deliverables from the UHT processing market research project include detailed market analysis, forecasts, competitive landscape, and strategic recommendations. Expect comprehensive reports that cover market size, trends, and growth opportunities.

What are the market trends of UHT Processing?

Current trends in the UHT processing market include the increasing demand for eco-friendly packaging, technological innovations in processing equipment, and a surge in plant-based product offerings. Sustainability and health consciousness significantly influence market dynamics.