Ultralight And Light Aircraft Market Report

Published Date: 03 February 2026 | Report Code: ultralight-and-light-aircraft

Ultralight And Light Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the ultralight and light aircraft market, covering key trends, competitive landscape, and forecast until 2033, with insights into market size, segmentation, and growth opportunities across different regions.

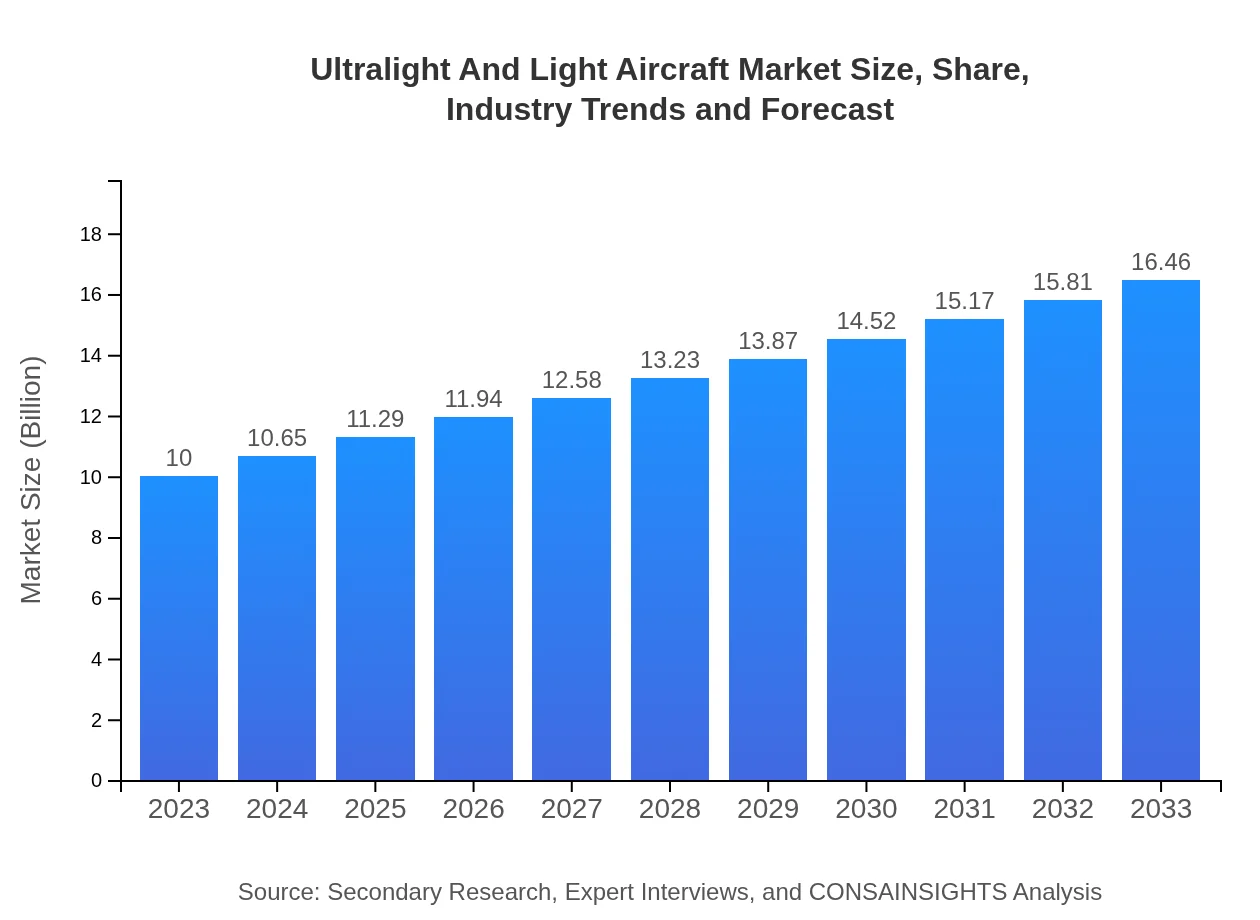

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Flight Design GmbH, Pipistrel, CubCrafters, Eclipse Aviation, Zenith Aircraft Company |

| Last Modified Date | 03 February 2026 |

Ultralight And Light Aircraft Market Overview

Customize Ultralight And Light Aircraft Market Report market research report

- ✔ Get in-depth analysis of Ultralight And Light Aircraft market size, growth, and forecasts.

- ✔ Understand Ultralight And Light Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ultralight And Light Aircraft

What is the Market Size & CAGR of Ultralight And Light Aircraft market in 2023?

Ultralight And Light Aircraft Industry Analysis

Ultralight And Light Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ultralight And Light Aircraft Market Analysis Report by Region

Europe Ultralight And Light Aircraft Market Report:

The European market for ultralight and light aircraft is expected to grow from $2.96 billion in 2023 to $4.87 billion by 2033. Countries such as Germany, France, and the UK are leading this growth, attributed to increasing disposable incomes and a strong culture of recreational flying. Regulatory support for light sport aircraft is also a significant contributor to market expansion.Asia Pacific Ultralight And Light Aircraft Market Report:

The Asia Pacific region is projected to witness substantial growth, with the market expanding from $1.92 billion in 2023 to $3.16 billion by 2033. Increasing recreational flying activities and a booming aviation infrastructure in countries like China and India are key drivers. Furthermore, government initiatives to promote general aviation are expected to bolster market expansion.North America Ultralight And Light Aircraft Market Report:

North America holds a considerable share of the global market, with an estimated size of $3.61 billion in 2023, projected to grow to $5.95 billion by 2033. The U.S. remains a stronghold due to a high number of recreational pilots and strong infrastructure. The integration of new technologies and rising environmental concerns are boosting demand for modern aircraft types.South America Ultralight And Light Aircraft Market Report:

In South America, the ultralight and light aircraft market is estimated to grow from $0.70 billion in 2023 to $1.16 billion in 2033. Countries like Brazil and Argentina are leading the market due to the adoption of general aviation for transportation and agriculture. The region's scenic landscapes are also encouraging recreational flying.Middle East & Africa Ultralight And Light Aircraft Market Report:

In the Middle East and Africa, the market is poised to grow from $0.80 billion in 2023 to $1.32 billion by 2033. The development of aviation networks and increased focus on tourism are encouraging the use of light aircraft throughout the region. Countries like South Africa and UAE are emerging as key players in promoting general aviation.Tell us your focus area and get a customized research report.

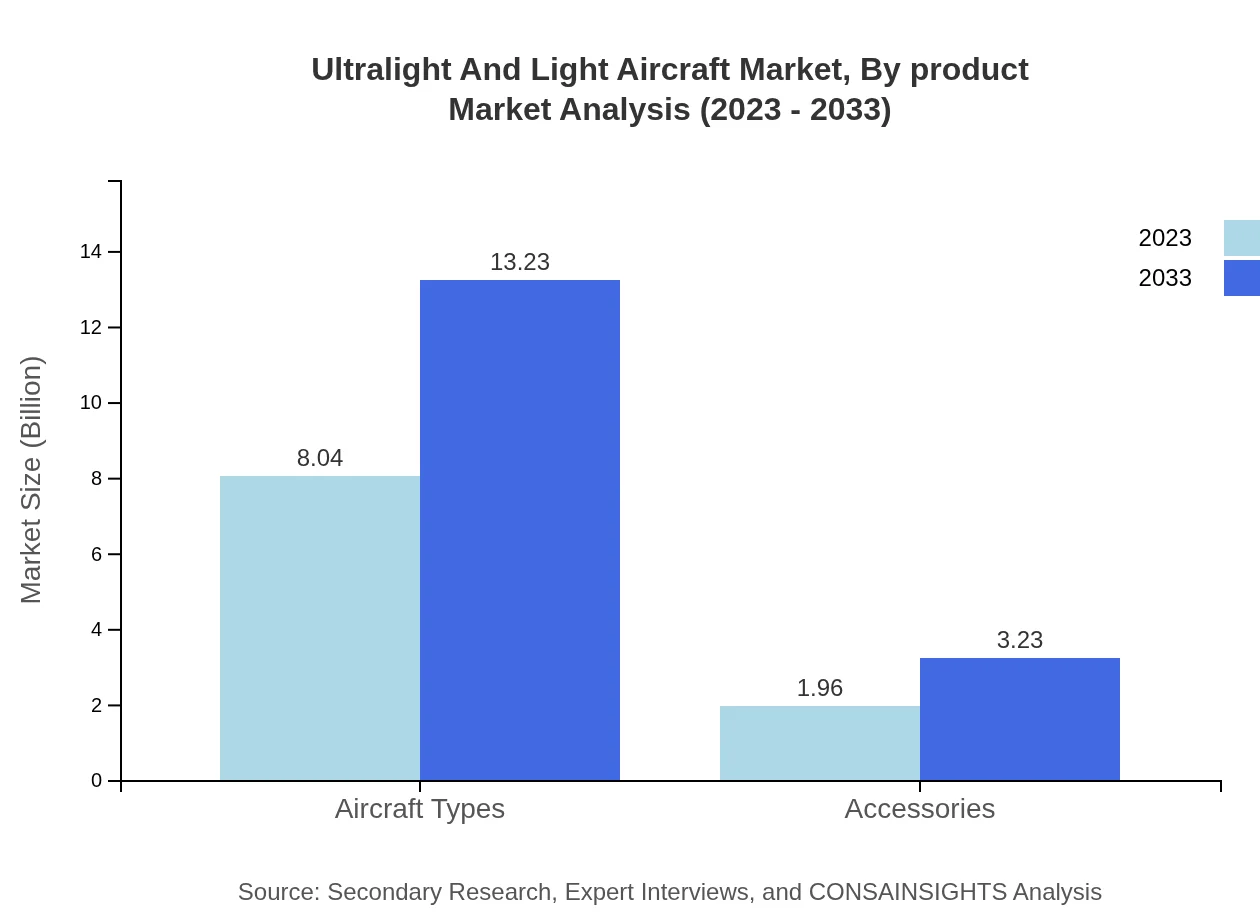

Ultralight And Light Aircraft Market Analysis By Product

The product segment is dominated by aircraft types that serve various functionalities. The total market size for aircraft types stands at approximately $8.04 billion in 2023, expected to reach $13.23 billion by 2033. This segment constitutes around 80.38% of the total market, highlighting its significance.

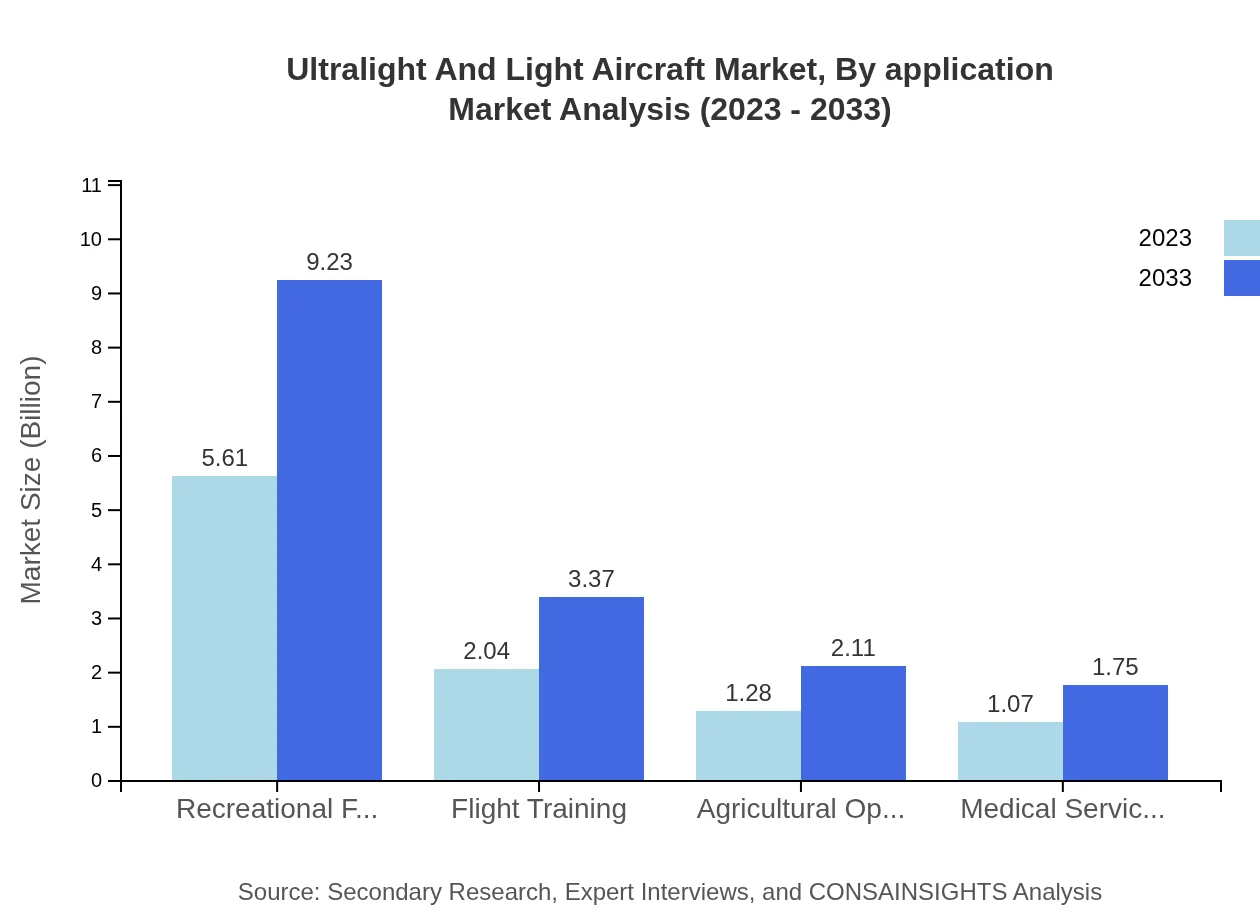

Ultralight And Light Aircraft Market Analysis By Application

Applications of ultralight and light aircraft are diverse, including recreational flying, flight training, and agricultural operations. The market share for recreational flying accounts for approximately 56.09% in 2023, translating into a size of $5.61 billion. By 2033, it is projected to grow to $9.23 billion. Flight training also plays a crucial role, with a notable share of 20.45%.

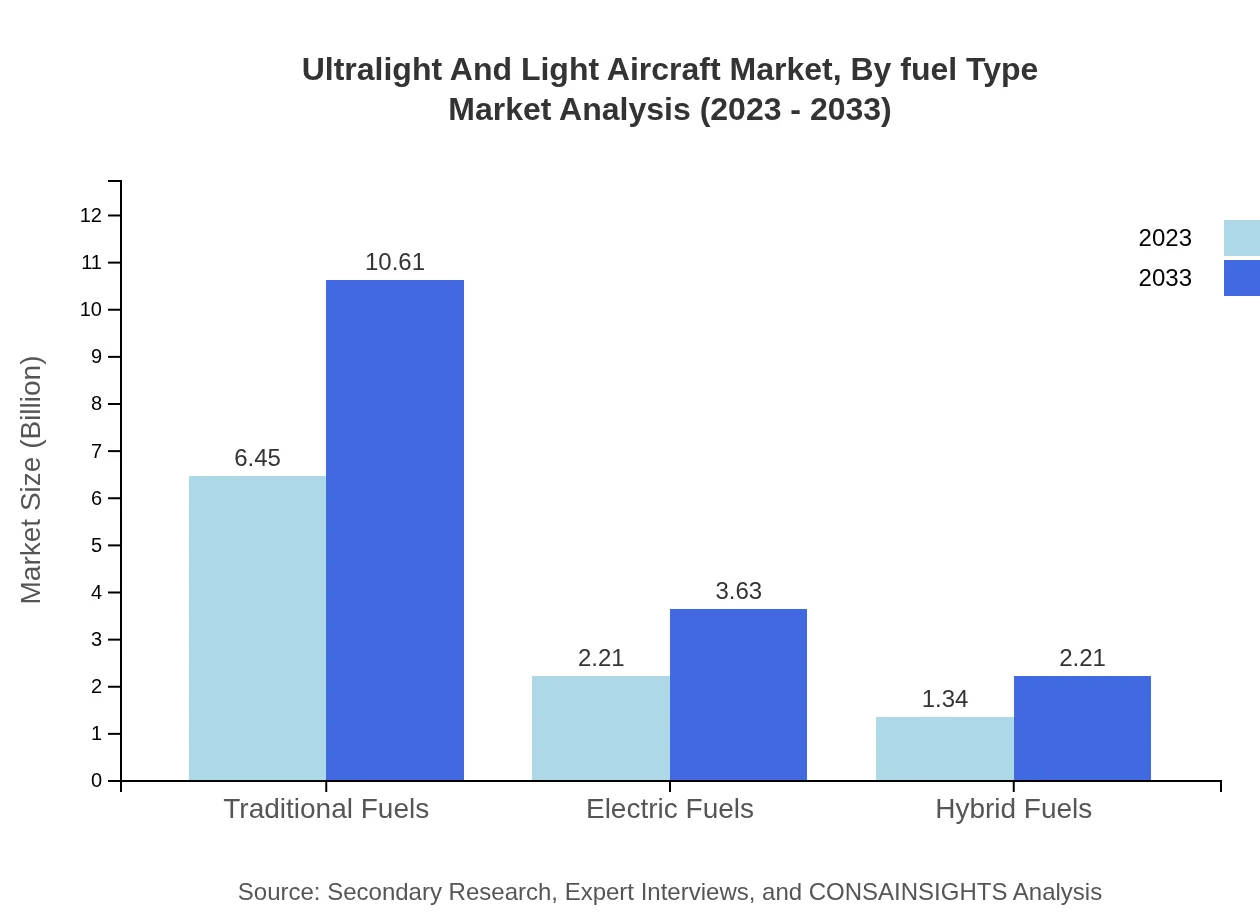

Ultralight And Light Aircraft Market Analysis By Fuel Type

The fuel type breakdown shows that traditional fuels dominate the market, comprising 64.49% of the total, valued at $6.45 billion in 2023, growing to $10.61 billion by 2033. Electric fuels, although smaller, are gaining traction, making up 22.07% of the market with significant growth potential as technology evolves.

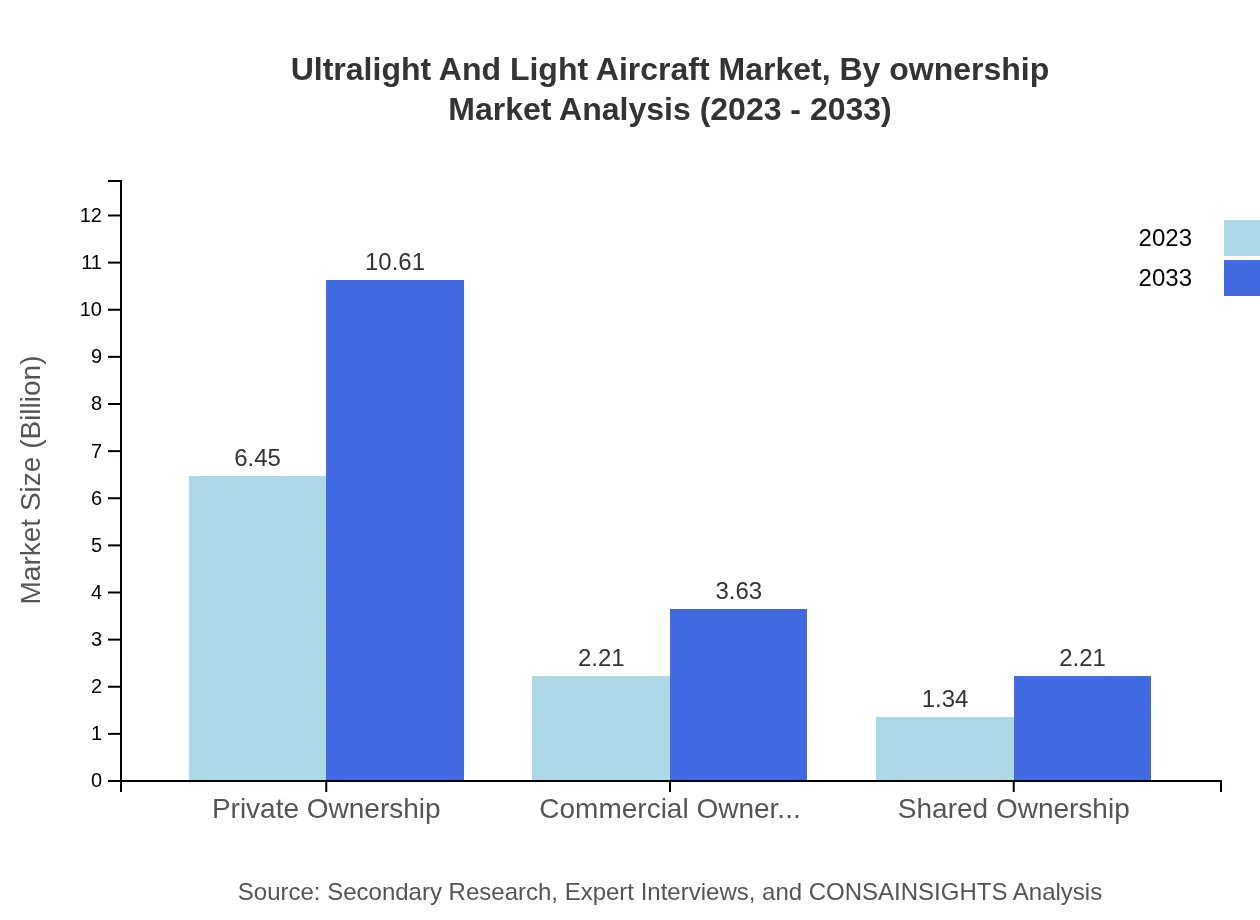

Ultralight And Light Aircraft Market Analysis By Ownership

Market segmentation by ownership shows that private ownership represents a strong segment, comprising 64.49% of the market in 2023, with a size of $6.45 billion. This segment is anticipated to grow to $10.61 billion by 2033, reflecting the preferences of individual consumers for owning personal aircraft.

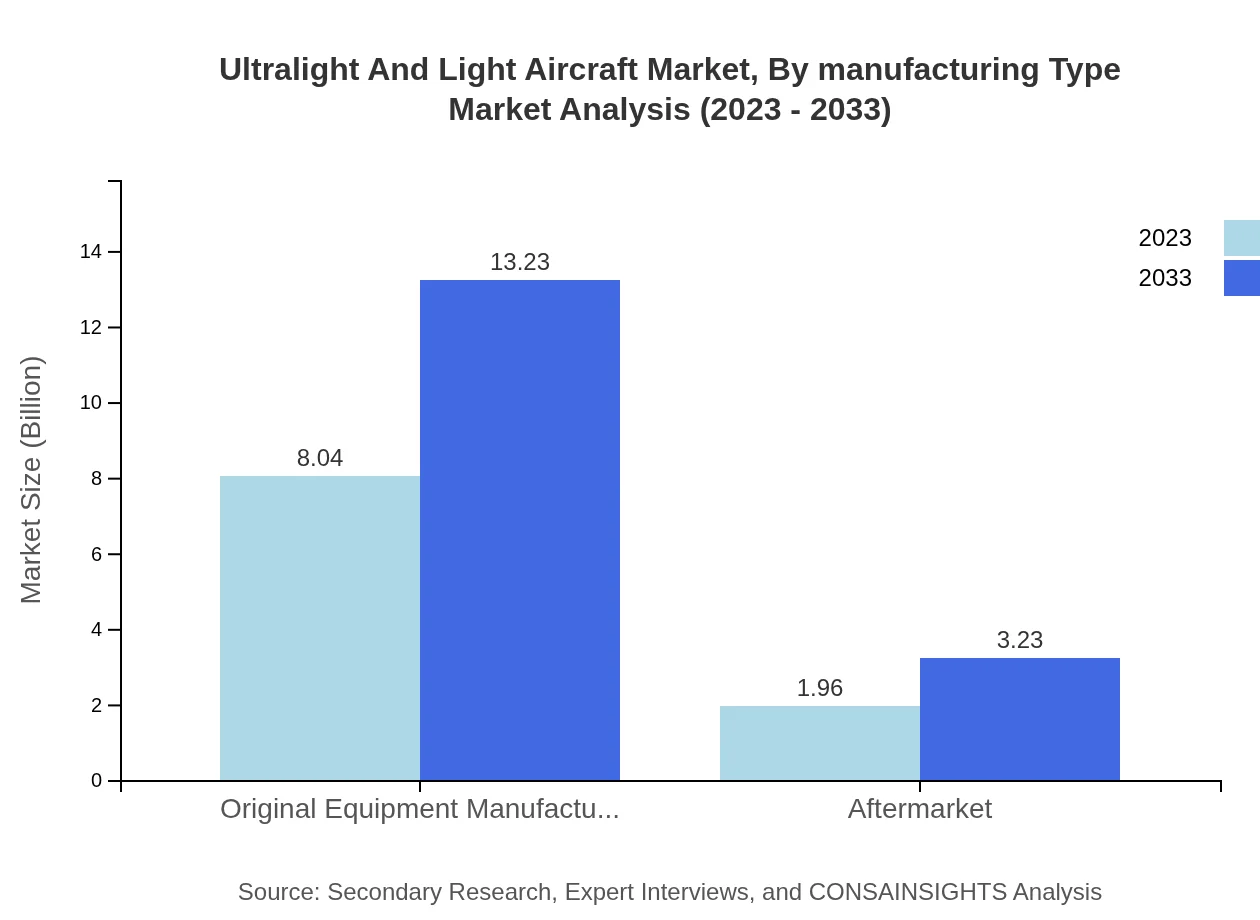

Ultralight And Light Aircraft Market Analysis By Manufacturing Type

Original Equipment Manufacturers (OEMs) lead the manufacturing segment, capturing around 80.38% of the market, reflected in a size of $8.04 billion in 2023. The aftermarket segment, while smaller, at 19.62%, valued at $1.96 billion in 2023, shows growth opportunities related to service and parts for existing aircraft.

Ultralight And Light Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ultralight And Light Aircraft Industry

Flight Design GmbH:

A leading manufacturer of lightweight aviation aircraft, known for innovation in light sport aircraft and ultralight solutions, promoting safety and performance.Pipistrel:

A pioneer in the design of energy-efficient ultralight and light sport aircraft, focusing on electric propulsion and green technology.CubCrafters:

Specializes in manufacturing light aircraft for recreational flying and has a strong market presence due to high performance and adaptability.Eclipse Aviation:

Known for innovative design in Executive jets and light aircraft contributing toward expanding general aviation.Zenith Aircraft Company:

Recognized for providing quality kits for homebuilt aircraft, catering to the growing community of amateur aviators and enthusiasts.We're grateful to work with incredible clients.

FAQs

What is the market size of ultralight And Light Aircraft?

The global market size for ultralight and light aircraft is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5%. In 2023, it stands at around $10 billion.

What are the key market players or companies in this ultralight And Light Aircraft industry?

Key players in the ultralight and light aircraft market include renowned manufacturers and OEMs specializing in light aviation. Their focus on innovation and quality positions them as leaders in this growing sector.

What are the primary factors driving the growth in the ultralight And Light Aircraft industry?

Major factors driving growth in the ultralight and light aircraft market include increasing demand for recreational flying, advances in technology, cost-effective flight training solutions, and the rise of sustainability-focused aviation solutions.

Which region is the fastest Growing in the ultralight And Light Aircraft?

In the ultralight and light aircraft market, Europe is expected to grow from $2.96 billion in 2023 to $4.87 billion by 2033, making it the fastest-growing region due to regulatory support and increased recreational flying activities.

Does ConsaInsights provide customized market report data for the ultralight And Light Aircraft industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the ultralight and light aircraft industry, ensuring comprehensive insights for strategic decision-making.

What deliverables can I expect from this ultralight And Light Aircraft market research project?

Deliverables for this ultralight and light aircraft market research project include detailed market analysis, segment insights, regional forecasts, competitive landscape assessments, and comprehensive trend reports.

What are the market trends of ultralight And Light Aircraft?

Market trends in ultralight and light aircraft include a shift towards electric and hybrid fuels, increased demand for private ownership, and a growing focus on sustainable aviation practices.