Ultrasound Devices Market Report

Published Date: 31 January 2026 | Report Code: ultrasound-devices

Ultrasound Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ultrasound Devices market from 2023 to 2033, covering major trends, industry dynamics, regional insights, and forecasts of market growth and challenges.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

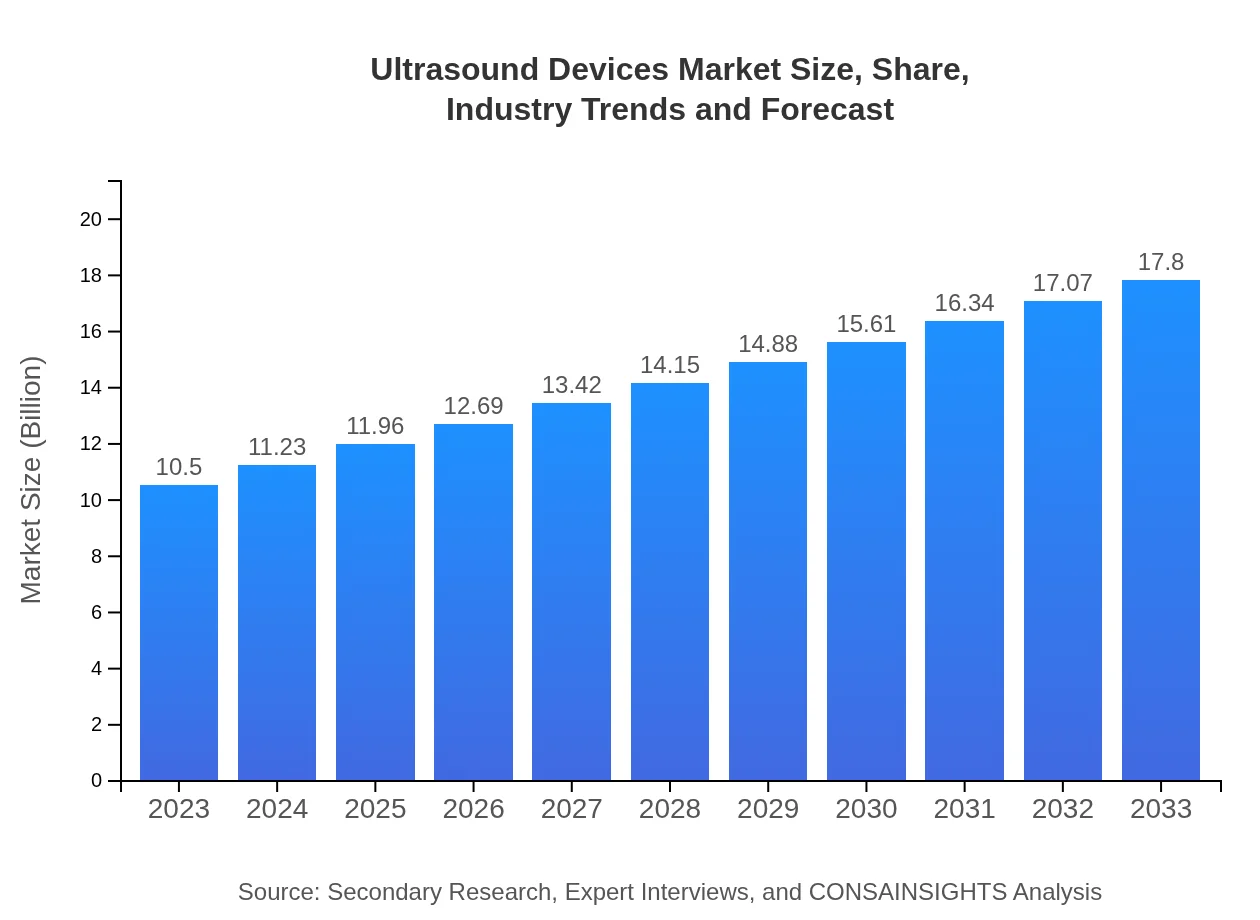

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $17.80 Billion |

| Top Companies | General Electric (GE) Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems |

| Last Modified Date | 31 January 2026 |

Ultrasound Devices Market Overview

Customize Ultrasound Devices Market Report market research report

- ✔ Get in-depth analysis of Ultrasound Devices market size, growth, and forecasts.

- ✔ Understand Ultrasound Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ultrasound Devices

What is the Market Size & CAGR of Ultrasound Devices market in 2023?

Ultrasound Devices Industry Analysis

Ultrasound Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ultrasound Devices Market Analysis Report by Region

Europe Ultrasound Devices Market Report:

The European market is estimated to grow from $3.14 billion in 2023 to $5.32 billion by 2033. Increased focus on maternal and fetal health and the development of minimally invasive procedures are key growth factors.Asia Pacific Ultrasound Devices Market Report:

In the Asia Pacific region, the market is expected to grow from $2.01 billion in 2023 to $3.41 billion by 2033, fueled by expanding healthcare infrastructure and increased demand for diagnostic imaging.North America Ultrasound Devices Market Report:

North America represents one of the largest markets, projected to grow from $3.78 billion in 2023 to $6.40 billion by 2033. The growth is driven by high demand for advanced medical imaging technologies and strong healthcare spending.South America Ultrasound Devices Market Report:

The South American market is forecasted to grow from $0.49 billion in 2023 to $0.83 billion by 2033. This growth is attributed to rising healthcare expenditures and improvements in medical facilities.Middle East & Africa Ultrasound Devices Market Report:

The Middle East and Africa market CAGR is promising, with growth expected from $1.09 billion in 2023 to $1.85 billion by 2033. This is driven by improvements in healthcare access and increasing government investments in healthcare.Tell us your focus area and get a customized research report.

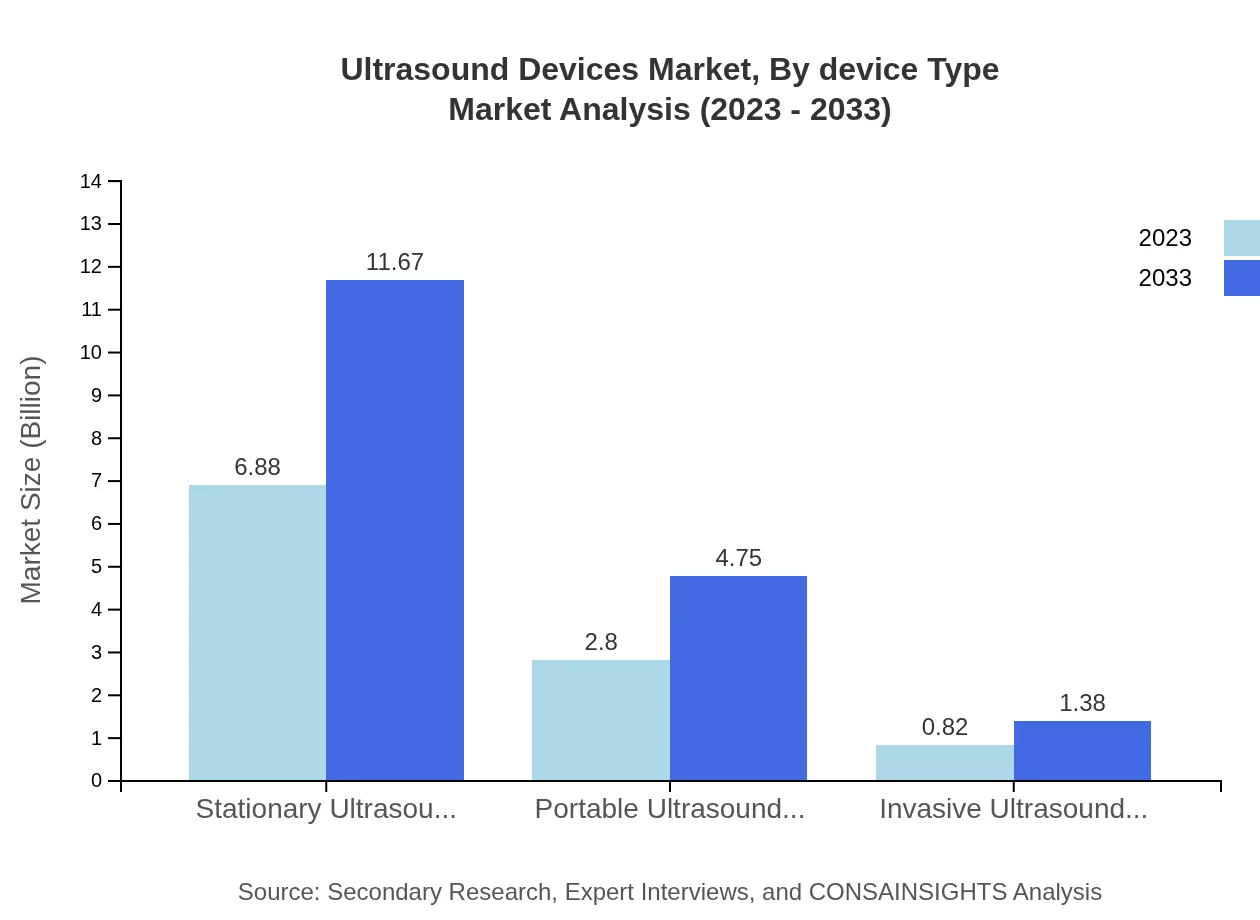

Ultrasound Devices Market Analysis By Device Type

In 2023, Stationary Ultrasound Devices lead the market at $6.88 billion, projected to grow to $11.67 billion by 2033. Portable devices, currently at $2.80 billion, are expected to reach $4.75 billion, reflecting increased demand for versatility in patient care.

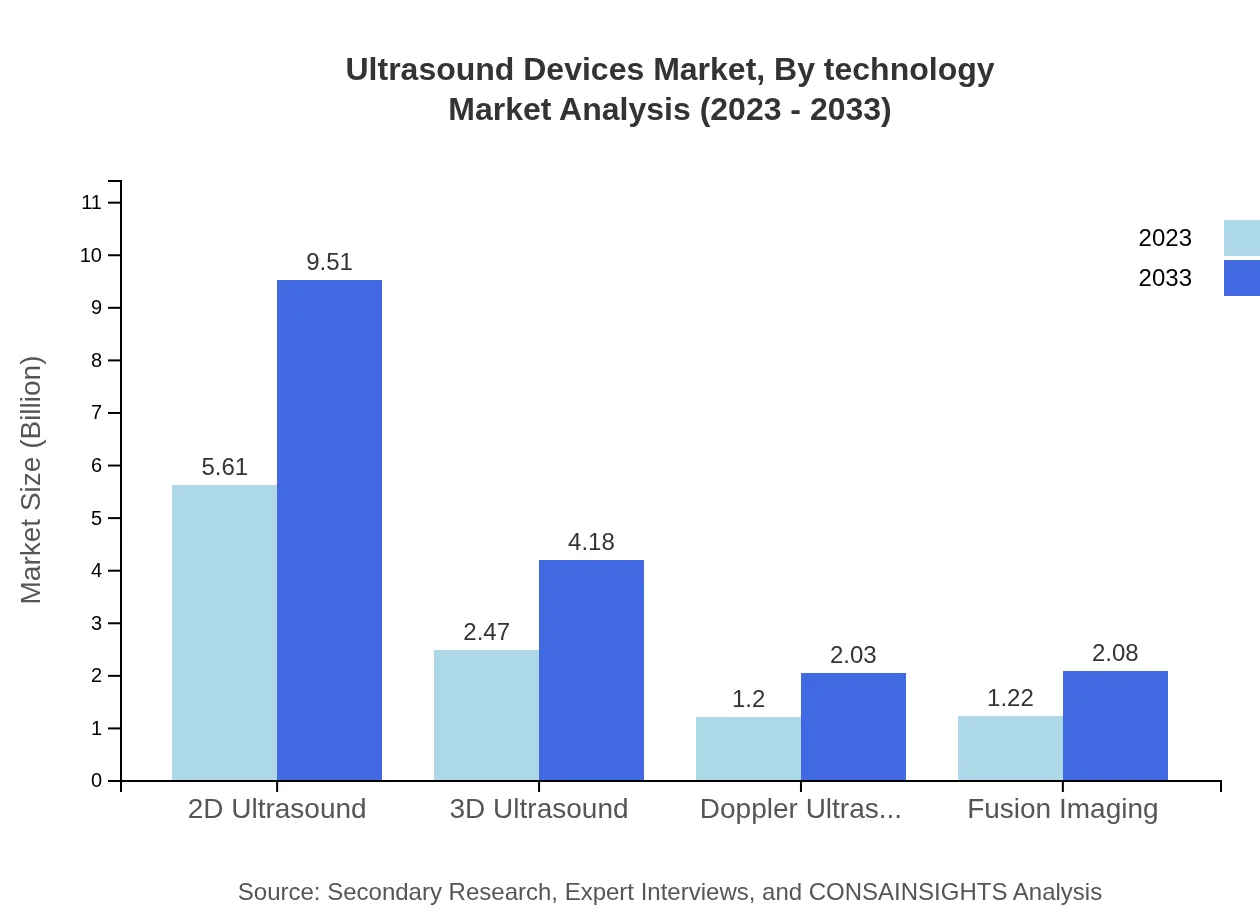

Ultrasound Devices Market Analysis By Technology

The 2D Ultrasound segment, valued at $5.61 billion in 2023, will maintain its dominance, projected to grow to $9.51 billion by 2033. Emerging technologies such as 3D and Doppler imaging are also gaining traction in clinical settings.

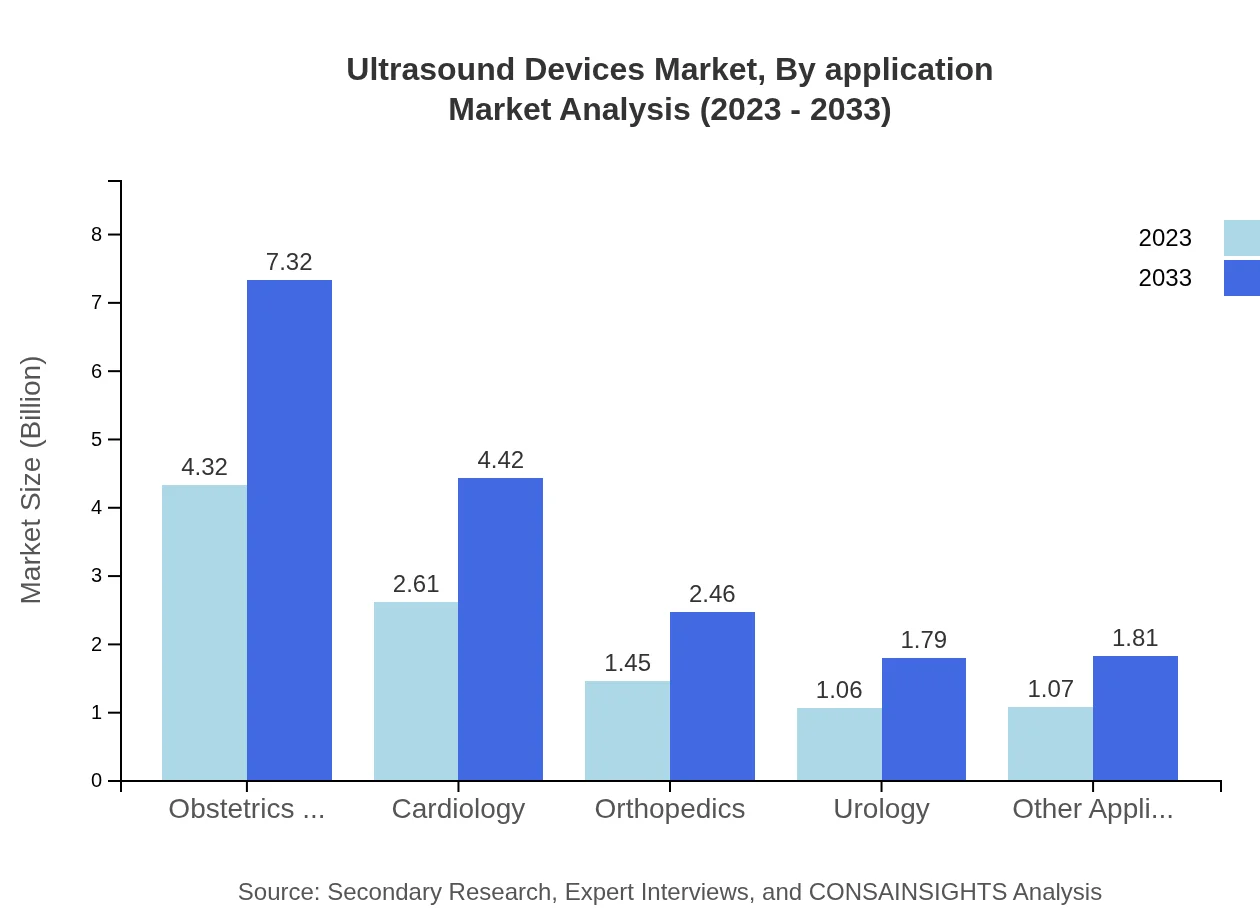

Ultrasound Devices Market Analysis By Application

Obstetrics & Gynecology holds a significant share, growing from $4.32 billion in 2023 to $7.32 billion by 2033. Applications in cardiology are also expected to see substantial growth as awareness increases.

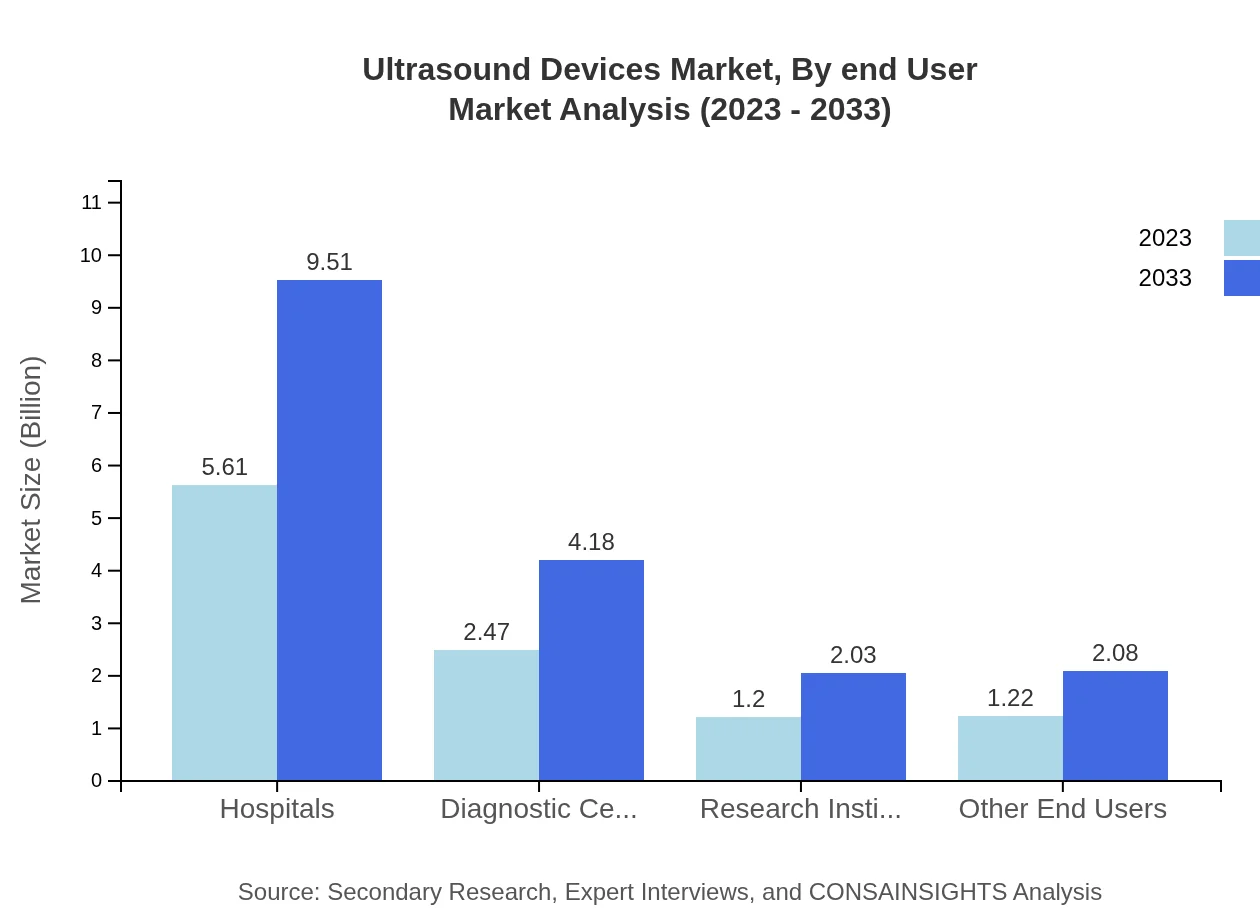

Ultrasound Devices Market Analysis By End User

Hospitals dominate the market, currently at $5.61 billion with a projected growth to $9.51 billion by 2033. Diagnostic centers and research institutes are also significant contributors to market expansion.

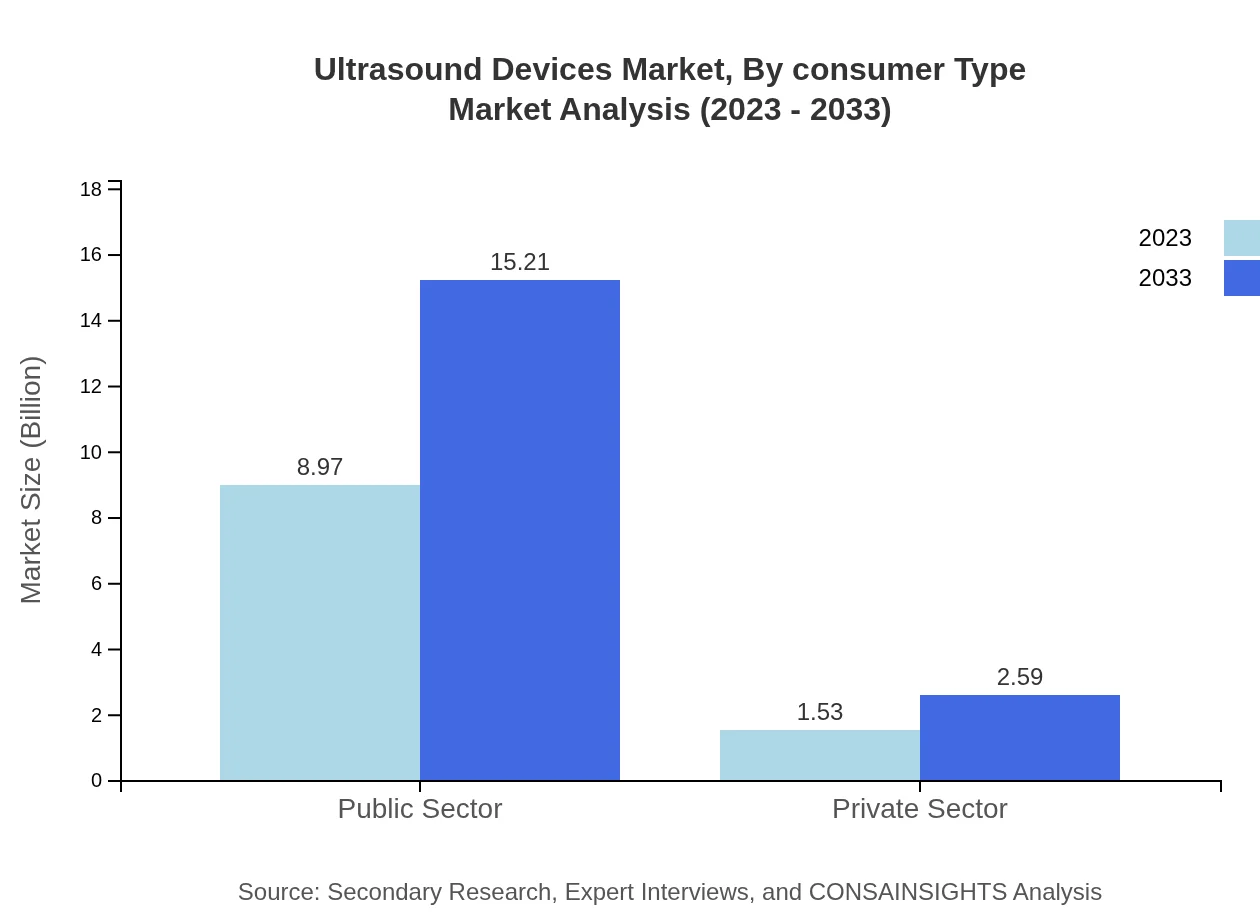

Ultrasound Devices Market Analysis By Consumer Type

The public sector accounts for a larger market share at $8.97 billion in 2023, anticipated to grow to $15.21 billion by 2033, reflecting the sustained governmental focus on healthcare improvements.

Ultrasound Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ultrasound Devices Industry

General Electric (GE) Healthcare:

A leader in medical imaging equipment, GE Healthcare develops advanced ultrasound technology with a focus on enhancing patient care and clinical outcomes.Philips Healthcare:

Philips is known for innovative ultrasound solutions that prioritize patient comfort and offer feature-rich systems for various clinical applications.Siemens Healthineers:

Siemens Healthineers provides cutting-edge ultrasound solutions and is recognized for its contributions to prenatal care and cardiology.Canon Medical Systems:

Canon specializes in imaging equipment with a robust ultrasound portfolio, focusing on high-resolution imaging and ease of use.We're grateful to work with incredible clients.

FAQs

What is the market size of ultrasound devices?

The ultrasound devices market is projected to reach $10.5 billion by 2033, growing at a CAGR of 5.3% from its current value. This growth reflects increasing healthcare demands and technological advancements in diagnostic equipment.

What are the key market players or companies in the ultrasound devices industry?

Major companies in the ultrasound devices market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, and Fujifilm. These companies lead the market with innovative technologies and comprehensive product ranges in medical imaging.

What are the primary factors driving the growth in the ultrasound devices industry?

Key factors fueling growth include advancements in ultrasound technology, increasing prevalence of chronic diseases, rising awareness of early diagnosis, and expanding applications in various medical fields such as obstetrics, cardiology, and urology.

Which region is the fastest Growing in the ultrasound devices market?

North America is anticipated to be the fastest-growing region, with market growth from $3.78 billion in 2023 to $6.40 billion by 2033. This growth is driven by technological advancements and high healthcare expenditure.

Does ConsaInsights provide customized market report data for the ultrasound devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the ultrasound devices industry. Clients can request specialized insights and data reflecting unique market segments or regional focuses.

What deliverables can I expect from this ultrasound devices market research project?

Deliverables typically include detailed market analysis, growth forecasts, competitive landscape assessments, and segmented data by regions and applications. Clients will receive comprehensive reports with actionable insights for decision-making.

What are the market trends of ultrasound devices?

Current trends in the ultrasound devices market include the rise of portable ultrasound devices, integration of AI-enhanced imaging, and increasing use in telemedicine. These trends reflect the industry's shift towards greater accessibility and improved diagnostic capabilities.