Underground Mining Diamond Drilling Market Report

Published Date: 22 January 2026 | Report Code: underground-mining-diamond-drilling

Underground Mining Diamond Drilling Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report covers the Underground Mining Diamond Drilling sector, providing insights into market trends, size estimates, technological advancements, and regional analyses. It forecasts market growth from 2023 to 2033, highlighting key drivers and challenges within the industry.

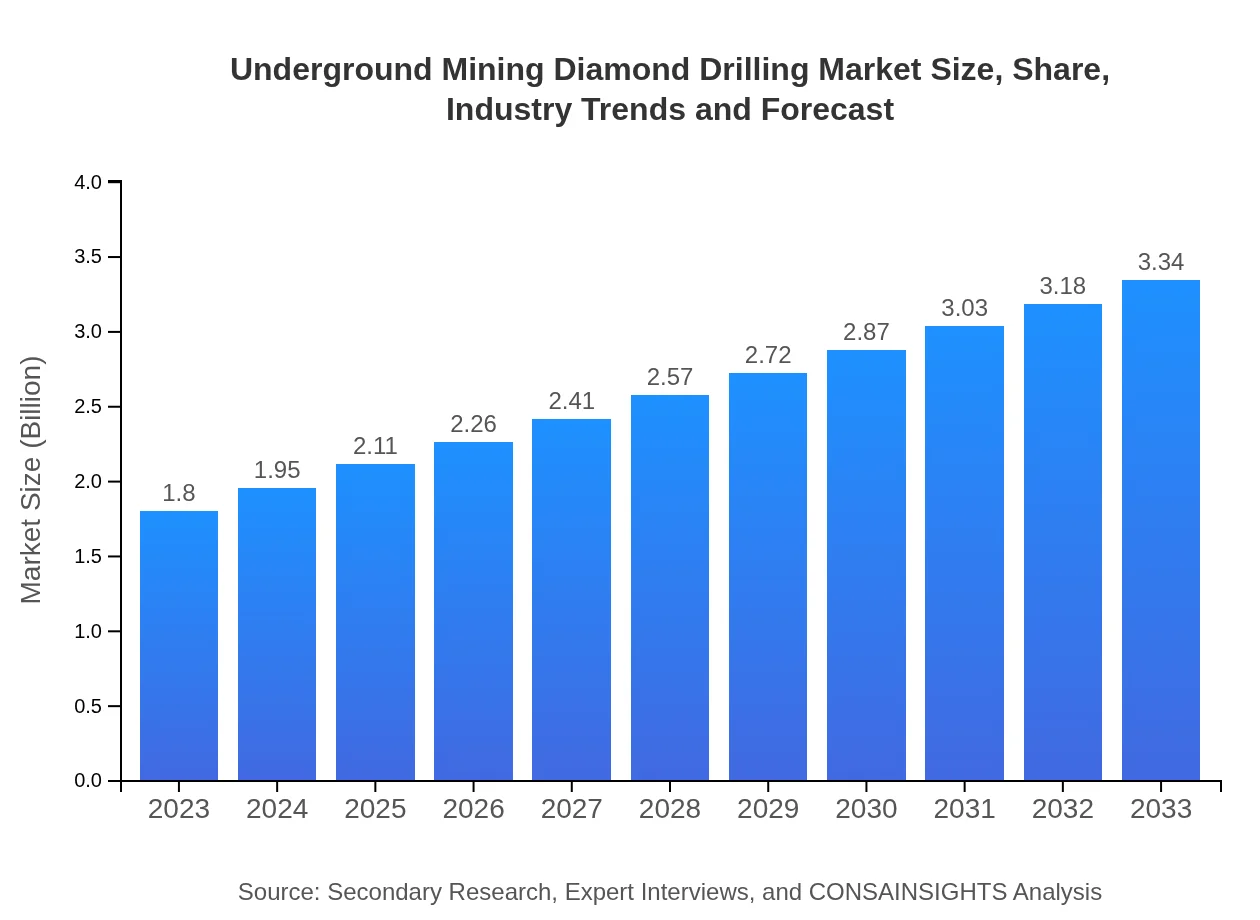

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Boart Longyear, Schlumberger, Epiroc, Atlas Copco |

| Last Modified Date | 22 January 2026 |

Underground Mining Diamond Drilling Market Overview

Customize Underground Mining Diamond Drilling Market Report market research report

- ✔ Get in-depth analysis of Underground Mining Diamond Drilling market size, growth, and forecasts.

- ✔ Understand Underground Mining Diamond Drilling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Underground Mining Diamond Drilling

What is the Market Size & CAGR of Underground Mining Diamond Drilling market in 2023?

Underground Mining Diamond Drilling Industry Analysis

Underground Mining Diamond Drilling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Underground Mining Diamond Drilling Market Analysis Report by Region

Europe Underground Mining Diamond Drilling Market Report:

Europe presents a growing market for underground mining diamond drilling, valued at $0.49 billion in 2023 and forecasted to reach $0.92 billion by 2033. The demand is bolstered by increased mining investments and stricter regulations enhancing sustainable mining practices.Asia Pacific Underground Mining Diamond Drilling Market Report:

The Asia Pacific region, with a market size of $0.39 billion in 2023, is projected to reach $0.72 billion by 2033, driven by increasing mining activities in countries like Australia, China, and India. The regional focus on mineral exploration and technological advancements in drilling practices is enhancing overall productivity.North America Underground Mining Diamond Drilling Market Report:

North America is anticipated to show robust growth, with the market size projected to surge from $0.62 billion in 2023 to approximately $1.15 billion by 2033. The United States and Canada are major contributors, driven by high-value mineral resources and the continuous evolution of drilling technologies.South America Underground Mining Diamond Drilling Market Report:

In South America, the market starts at $0.14 billion in 2023 and is expected to grow to $0.26 billion by 2033. The mining industry in this region is pivotal due to its rich mineral deposits, particularly in Brazil and Chile, prompting a sustained demand for diamond drilling.Middle East & Africa Underground Mining Diamond Drilling Market Report:

This region has marked growth in underground diamond drilling, anticipated to rise from $0.16 billion in 2023 to $0.29 billion by 2033. The mining potential in Africa, especially, is gaining international attention, resulting in increased investments and exploration activities.Tell us your focus area and get a customized research report.

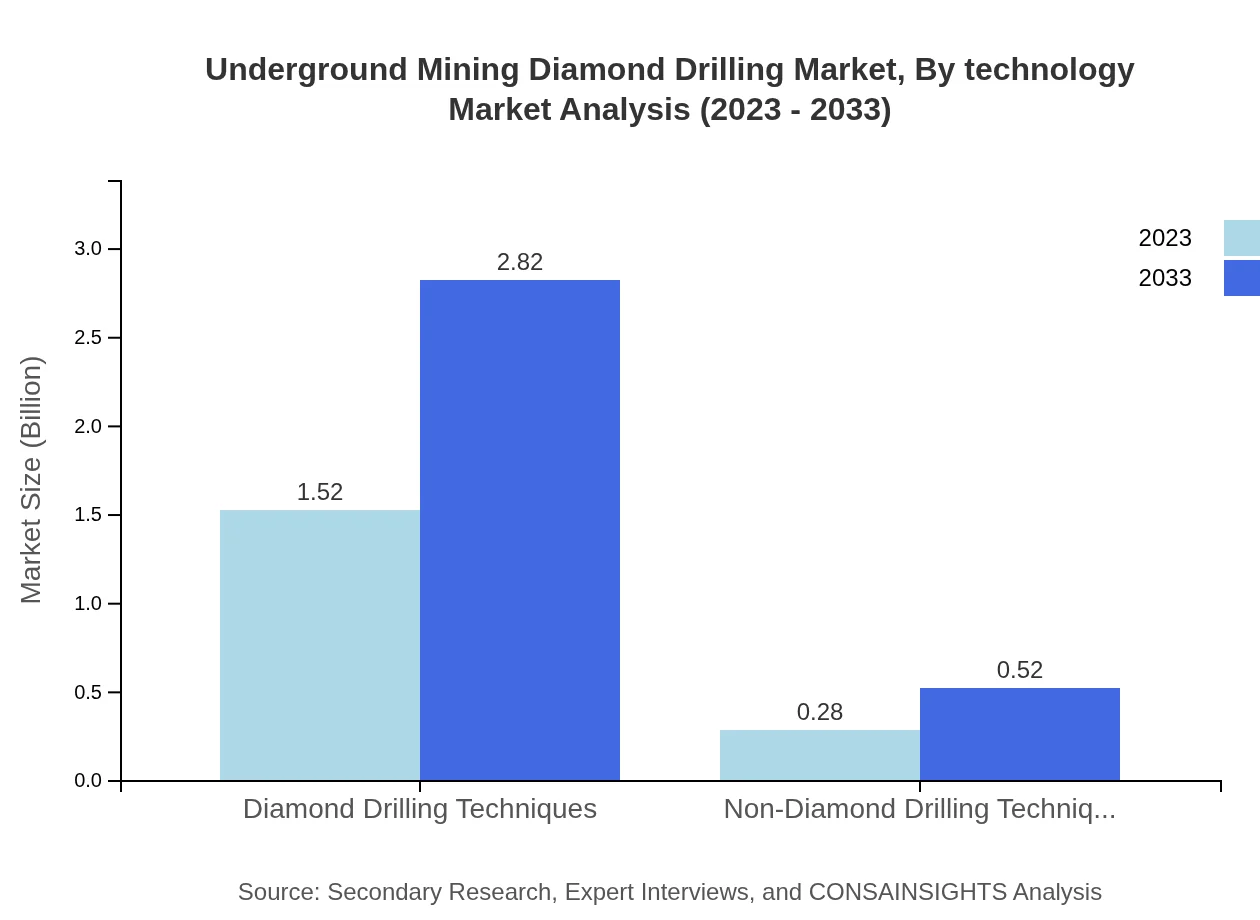

Underground Mining Diamond Drilling Market Analysis By Technology

In analyzing the technology segment, diamond drilling techniques dominate the market, holding a share of 84.45% as of 2023 and expected to remain substantial by 2033. This method is celebrated for its efficiency in penetrating hard rock formations, making it the preferred choice for mining companies. Non-diamond techniques also play a role, capturing 15.55% of the market. Their use is primarily aligned with cost restrictions in specific operations where diamond drilling may not be feasible.

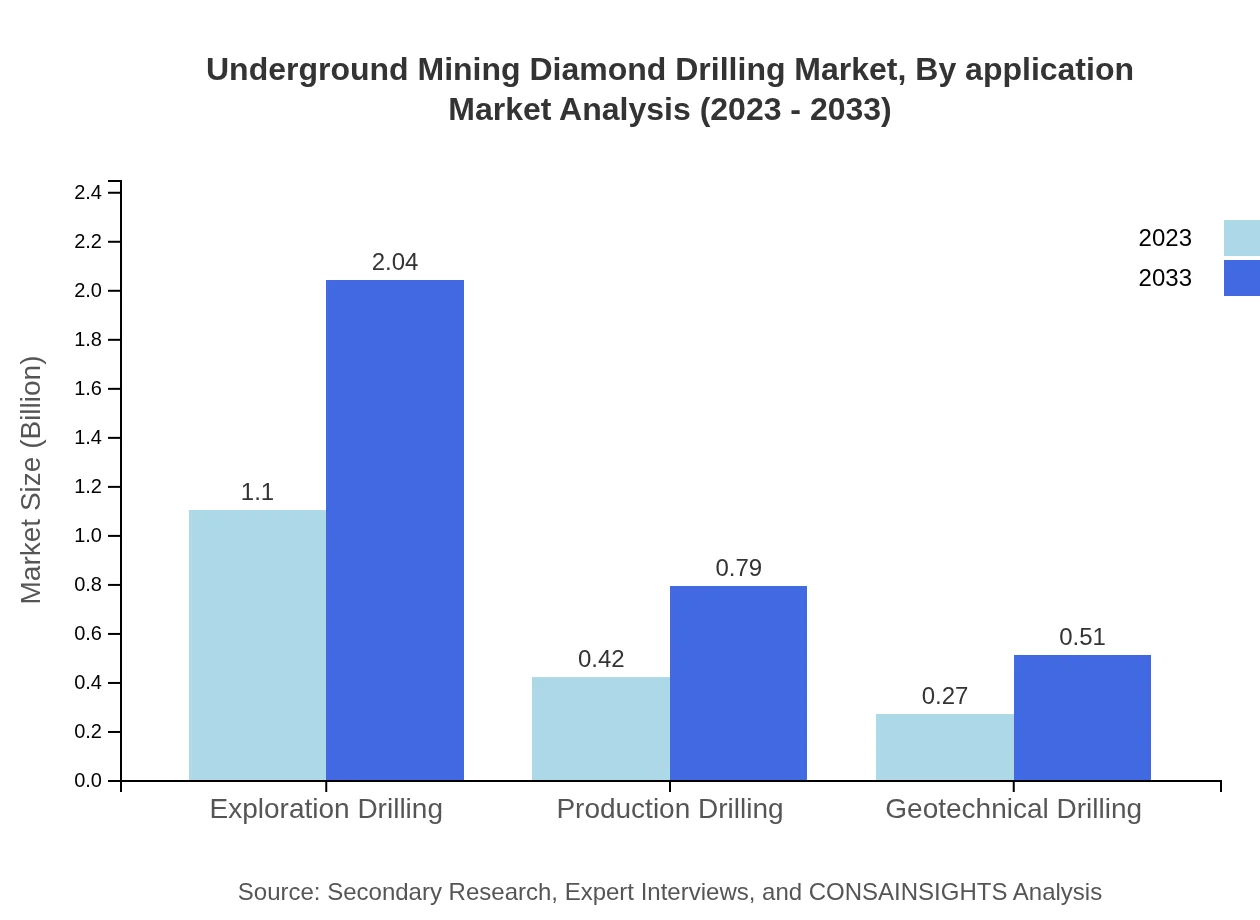

Underground Mining Diamond Drilling Market Analysis By Application

Exploration drilling represents a significant share of the market with 61.19% in 2023, forecasted to sustain that share through 2033 as companies prioritize identifying valuable mineral deposits. Production drilling follows with 23.57%, increasingly gaining attention due to operational efficiencies sought in ongoing extraction projects. Geotechnical drilling serves a critical niche but maintains a smaller share of 15.24%, focused on assessing site conditions and stability for future mining operations.

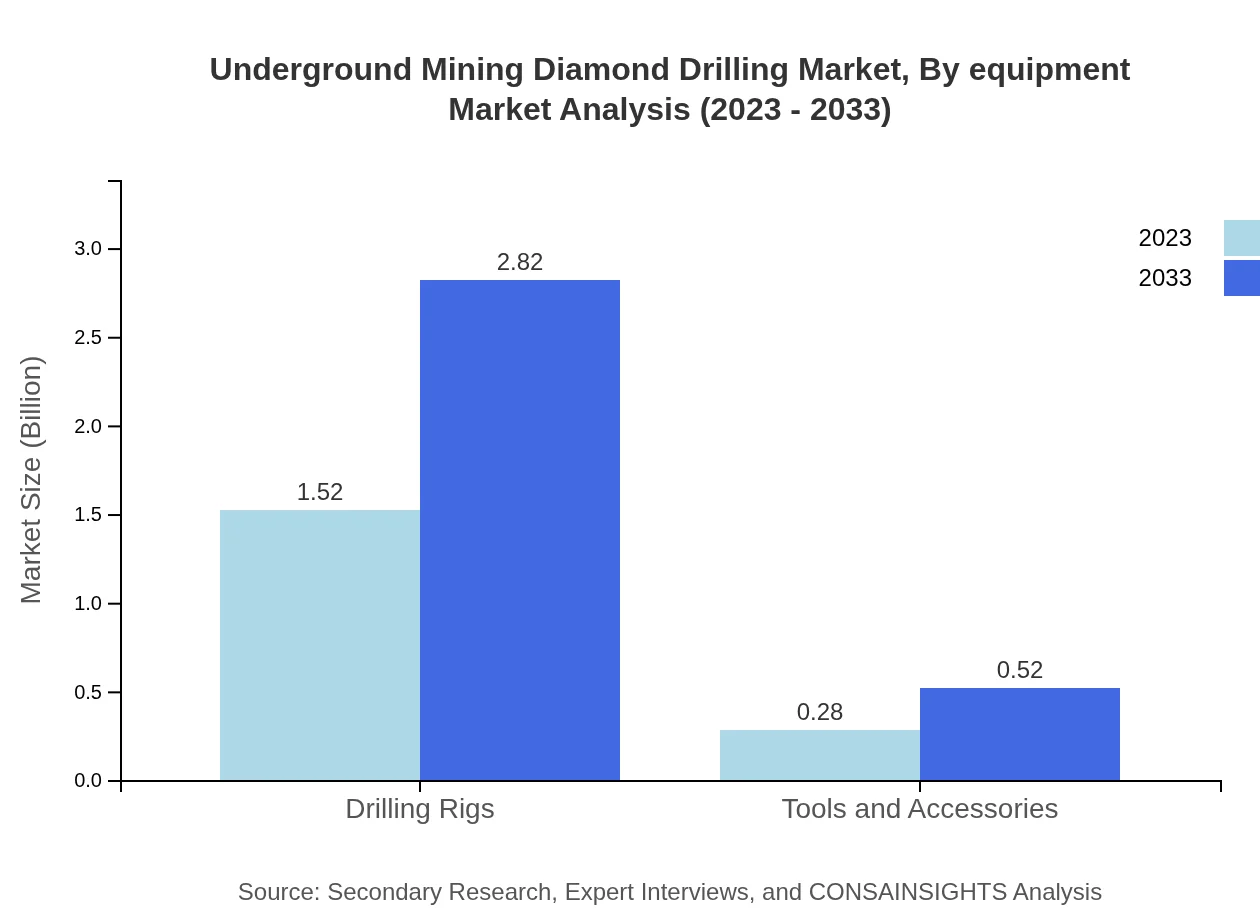

Underground Mining Diamond Drilling Market Analysis By Equipment

The equipment segment is primarily led by drilling rigs, which account for an impressive share of 84.45% in 2023, projected to rise to 84.45% by 2033. This category is crucial as drilling rigs are essential for executing the diamond drilling process effectively in various geological conditions. Tools and accessories, essential for supporting the primary drilling operations, command a 15.55% share, indicating their significance in enhancing drilling accuracy and efficiency.

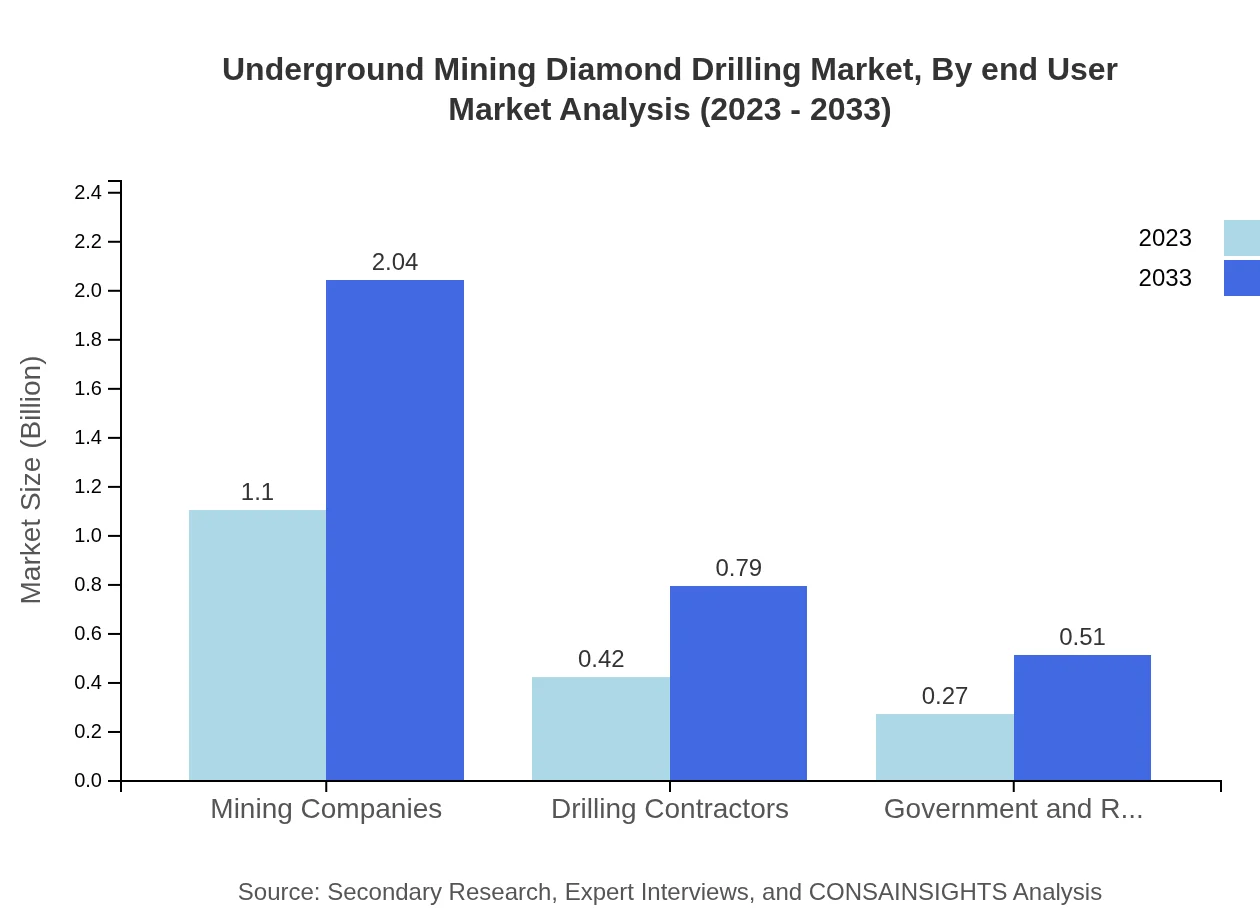

Underground Mining Diamond Drilling Market Analysis By End User

The end-user analysis highlights mining companies as the predominant segment, holding a market share of 61.19% as of 2023. Drilling contractors play an essential role as well, sharing 23.57% of the market, while the involvement of government and research organizations contributes with 15.24%, focusing on mining regulation and environmental protections.

Underground Mining Diamond Drilling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Underground Mining Diamond Drilling Industry

Boart Longyear:

A leading provider of drilling services and equipment with a strong focus on innovative technologies, Boart Longyear offers comprehensive solutions to the mining sector, emphasizing safety and efficiency.Schlumberger:

Recognized globally for its advanced technology and drilling services, Schlumberger provides effective drilling solutions across multiple sectors, including energy and mining, thereby ensuring optimal mineral extraction.Epiroc:

As a major player in the mining equipment market, Epiroc provides a wide range of products and services that enhance productivity and safety in underground diamond drilling operations.Atlas Copco:

Atlas Copco is renowned for its innovative drilling technologies and commitment to sustainability, offering equipment and services tailored for the demands of modern mining operations.We're grateful to work with incredible clients.

FAQs

What is the market size of underground Mining Diamond Drilling?

The underground mining diamond drilling market is valued at approximately $1.8 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033, indicating robust growth potential and increased industry investment.

What are the key market players or companies in this underground Mining Diamond Drilling industry?

Key players in the underground mining diamond drilling industry include major mining companies and specialized drilling contractors. Their advancements in drilling technology and project execution are vital for maintaining market competitiveness and driving innovation.

What are the primary factors driving the growth in the underground Mining Diamond Drilling industry?

Growth in the underground mining diamond drilling industry is primarily driven by increasing demand for mineral resources, advancements in drilling technology, and the need for efficient resource exploration and recovery across diverse geographic regions.

Which region is the fastest Growing in the underground Mining Diamond Drilling?

North America is witnessing the fastest growth in the underground mining diamond drilling market, with a market size increasing from $0.62 billion in 2023 to $1.15 billion in 2033, highlighting a significant regional demand for mining activities.

Does ConsaInsights provide customized market report data for the underground Mining Diamond Drilling industry?

Yes, ConsaInsights offers customized market report data tailored to the underground mining diamond drilling industry, ensuring clients receive specific insights that align with their strategic needs for decision-making and forecasting.

What deliverables can I expect from this underground Mining Diamond Drilling market research project?

Deliverables from the underground mining diamond drilling market research project typically include comprehensive market analysis reports, regional forecasts, segmentation data, competitive landscape insights, and actionable recommendations to support business strategies.

What are the market trends of underground Mining Diamond Drilling?

Current market trends in underground mining diamond drilling include the adoption of advanced drilling technologies, increasing focus on sustainable practices, and rising integration of automation, enhancing efficiency and productivity in mining operations.