Unified Communication As A Service In Banking Market Report

Published Date: 31 January 2026 | Report Code: unified-communication-as-a-service-in-banking

Unified Communication As A Service In Banking Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Unified Communication as a Service (UCaaS) market in the banking sector, covering market trends, growth drivers, challenges, and forecasts from 2023 to 2033.

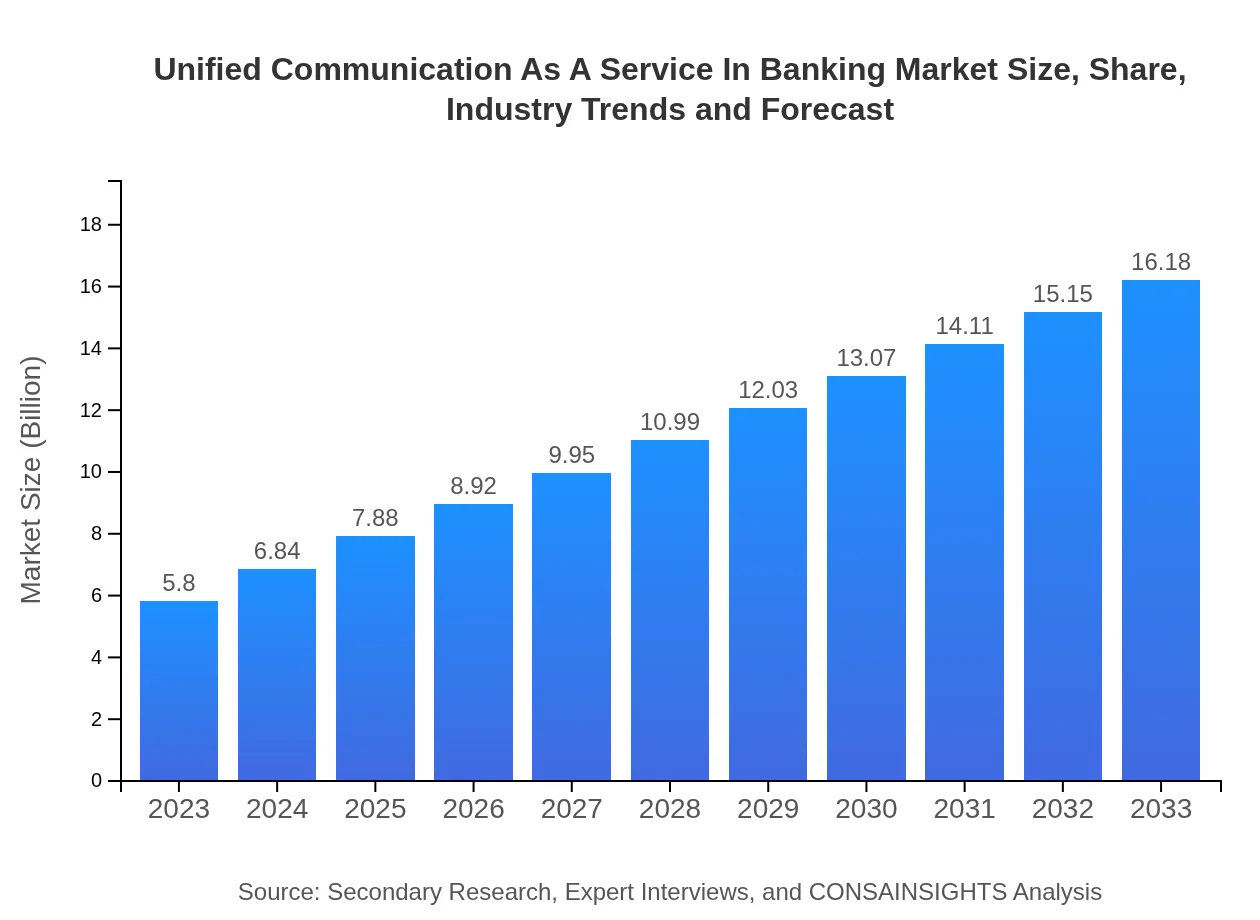

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 10.4% |

| 2033 Market Size | $16.18 Billion |

| Top Companies | Cisco Systems, Inc., Microsoft Corporation, RingCentral, Inc., Zoom Video Communications, Avaya Inc. |

| Last Modified Date | 31 January 2026 |

Unified Communication As A Service In Banking Market Overview

Customize Unified Communication As A Service In Banking Market Report market research report

- ✔ Get in-depth analysis of Unified Communication As A Service In Banking market size, growth, and forecasts.

- ✔ Understand Unified Communication As A Service In Banking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unified Communication As A Service In Banking

What is the Market Size & CAGR of Unified Communication As A Service In Banking market in 2023 and 2033?

Unified Communication As A Service In Banking Industry Analysis

Unified Communication As A Service In Banking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unified Communication As A Service In Banking Market Analysis Report by Region

Europe Unified Communication As A Service In Banking Market Report:

In Europe, the market is expected to expand from $1.74 billion in 2023 to $4.86 billion by 2033. Factors such as regulatory incentives for digital transformation and operational cost reduction strategies are contributing to this growth.Asia Pacific Unified Communication As A Service In Banking Market Report:

In the Asia Pacific region, the UCaaS market size is projected to increase from $1.07 billion in 2023 to $2.97 billion by 2033. The rapid adoption of digital banking and increasing smartphone penetration are key drivers of this growth.North America Unified Communication As A Service In Banking Market Report:

North America holds a significant market share, with a projected size increase from $2.16 billion in 2023 to $6.02 billion in 2033, driven by a strong focus on innovation and the presence of major financial service providers.South America Unified Communication As A Service In Banking Market Report:

Latin America’s market size is expected to grow from $0.12 billion in 2023 to $0.34 billion by 2033. Key trends include the modernization of banking infrastructure and increased investments in technology solutions.Middle East & Africa Unified Communication As A Service In Banking Market Report:

In the Middle East and Africa, the UCaaS market is projected to increase from $0.71 billion in 2023 to $1.99 billion in 2033, attributed to rising smartphone usage and increasing investments in fintech.Tell us your focus area and get a customized research report.

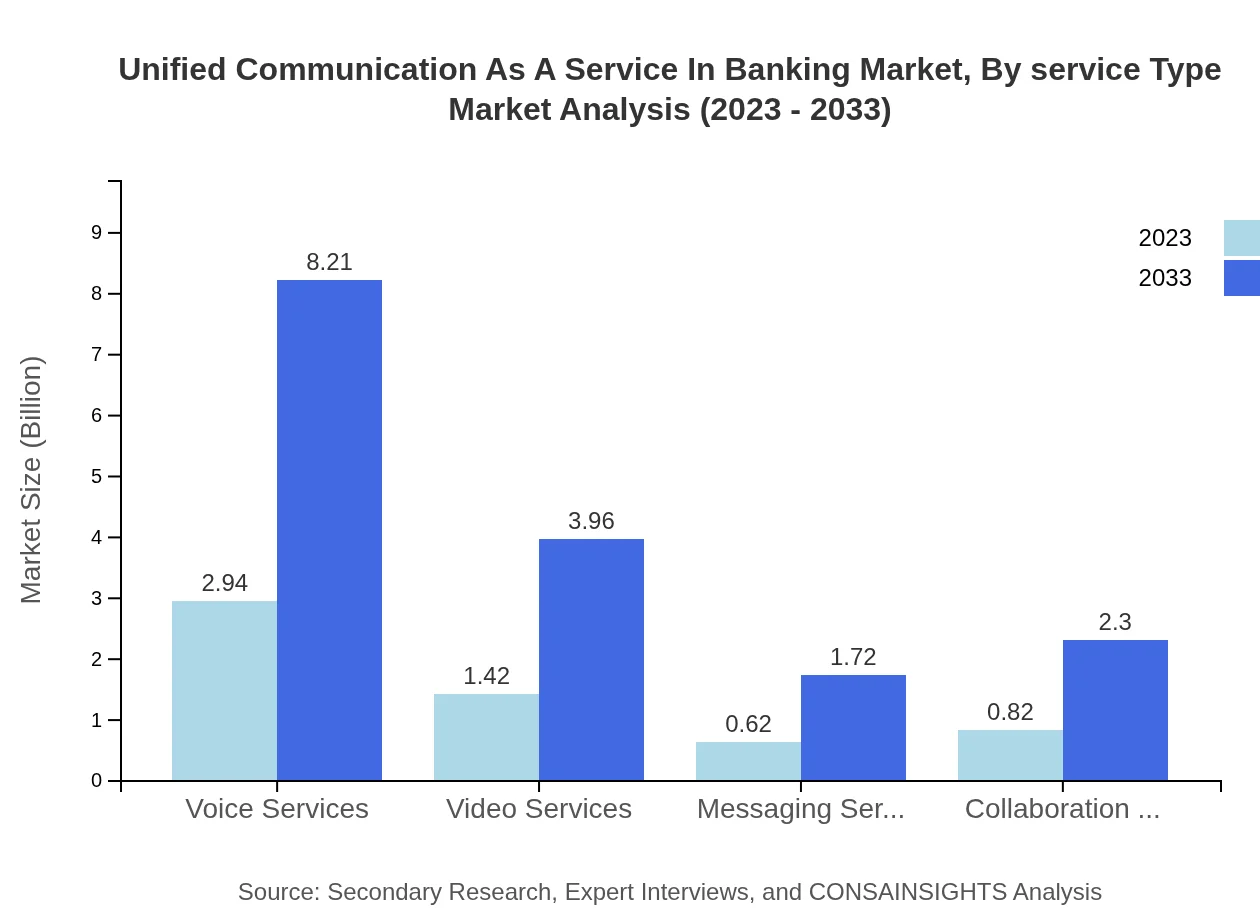

Unified Communication As A Service In Banking Market Analysis By Service Type

In 2023, the voice services segment dominates the market with a value of $2.94 billion. This segment is expected to grow to $8.21 billion by 2033, representing 50.71% market share. Video services follow at $1.42 billion in 2023, projected to reach $3.96 billion by 2033, with a 24.46% share. Messaging services, collaboration tools, and data security frameworks also show considerable growth potential.

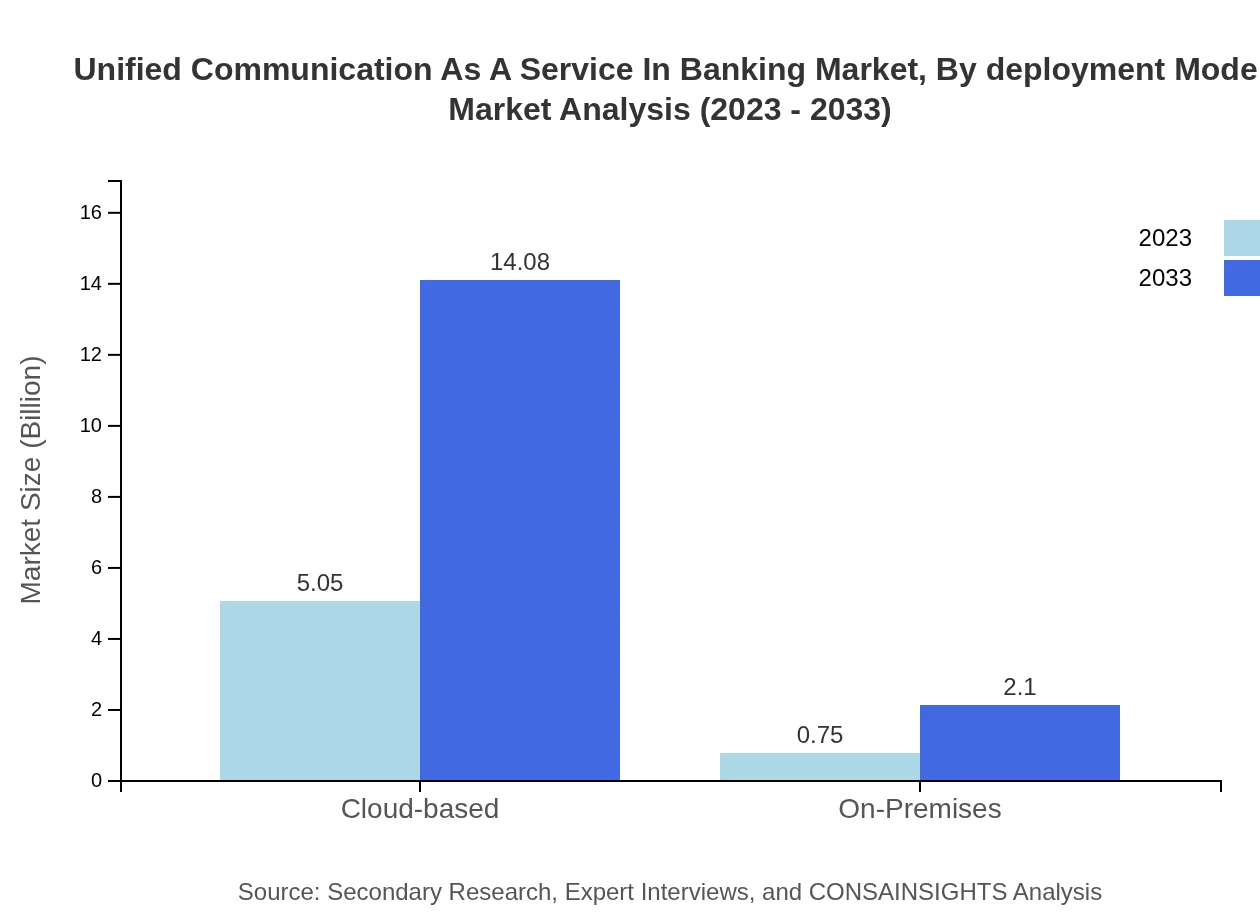

Unified Communication As A Service In Banking Market Analysis By Deployment Model

Cloud-based solutions represent the largest deployment model in the UCaaS market for banking, accounting for $5.05 billion in 2023, with growth anticipated to $14.08 billion by 2033, maintaining an 87% share. On-premises solutions, while smaller, are projected to grow from $0.75 billion to $2.10 billion, capturing 13% of the market.

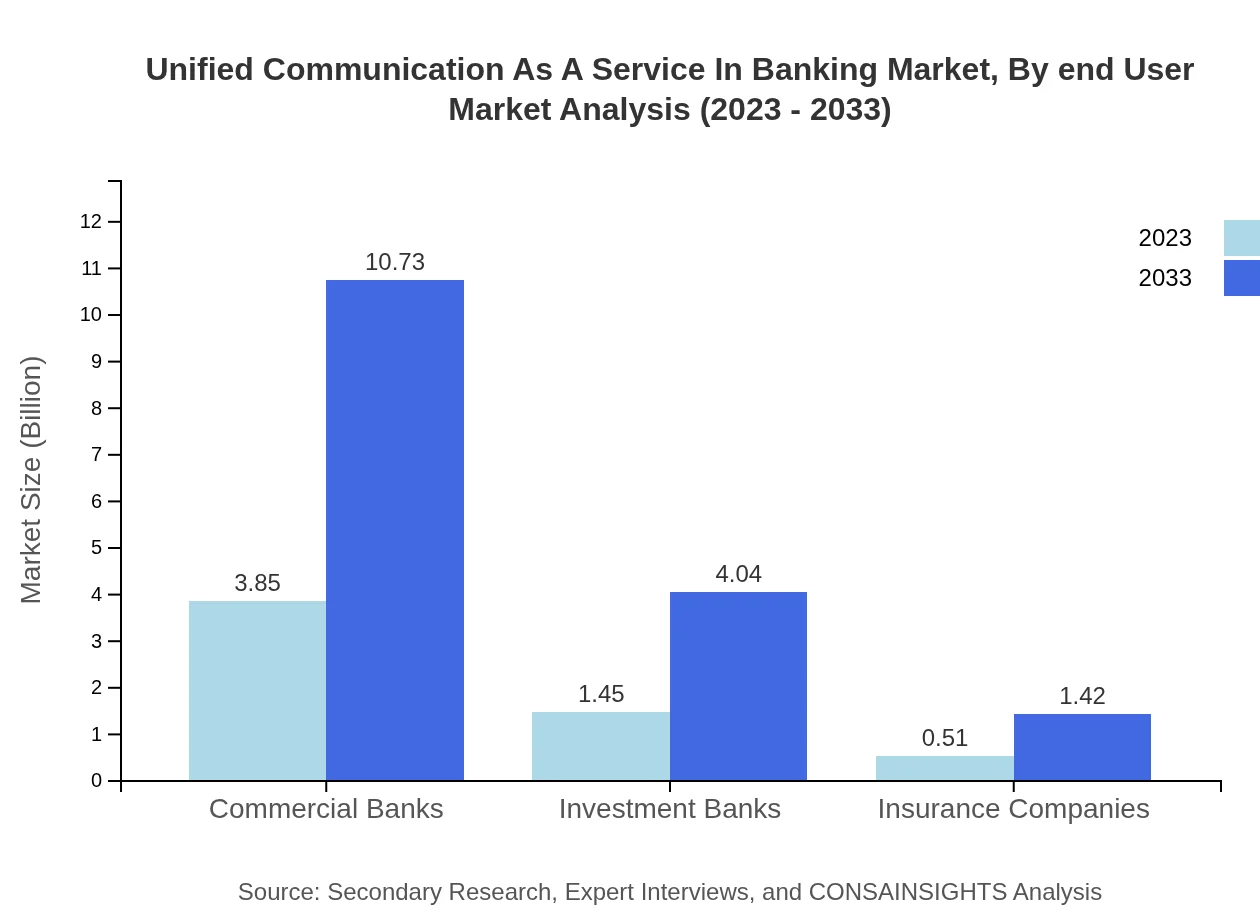

Unified Communication As A Service In Banking Market Analysis By End User

Commercial banks lead the market with a size of $3.85 billion in 2023, set to reach $10.73 billion by 2033, holding a steady 66.3% market share. Investment banks and insurance companies are also significant users, with sizes of $1.45 billion and $0.51 billion in 2023, respectively, projected to grow to $4.04 billion and $1.42 billion by 2033.

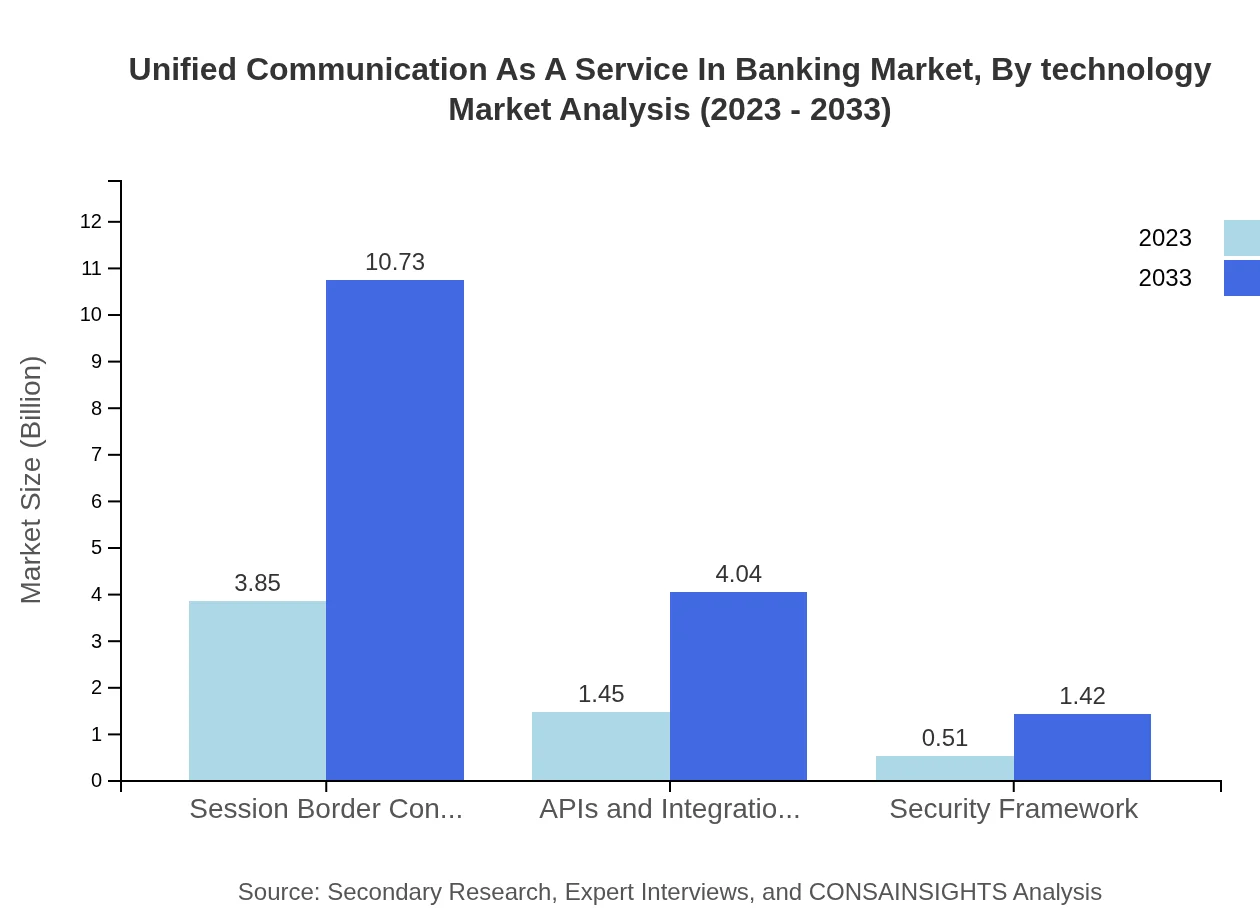

Unified Communication As A Service In Banking Market Analysis By Technology

The technology segment includes advanced features like session border controllers and integration tools. The session border controller (SBC) segment is valued at $3.85 billion in 2023, growing to $10.73 billion by 2033, maintaining a 66.3% share. APIs and integration tools show growth from $1.45 billion to $4.04 billion during the same period.

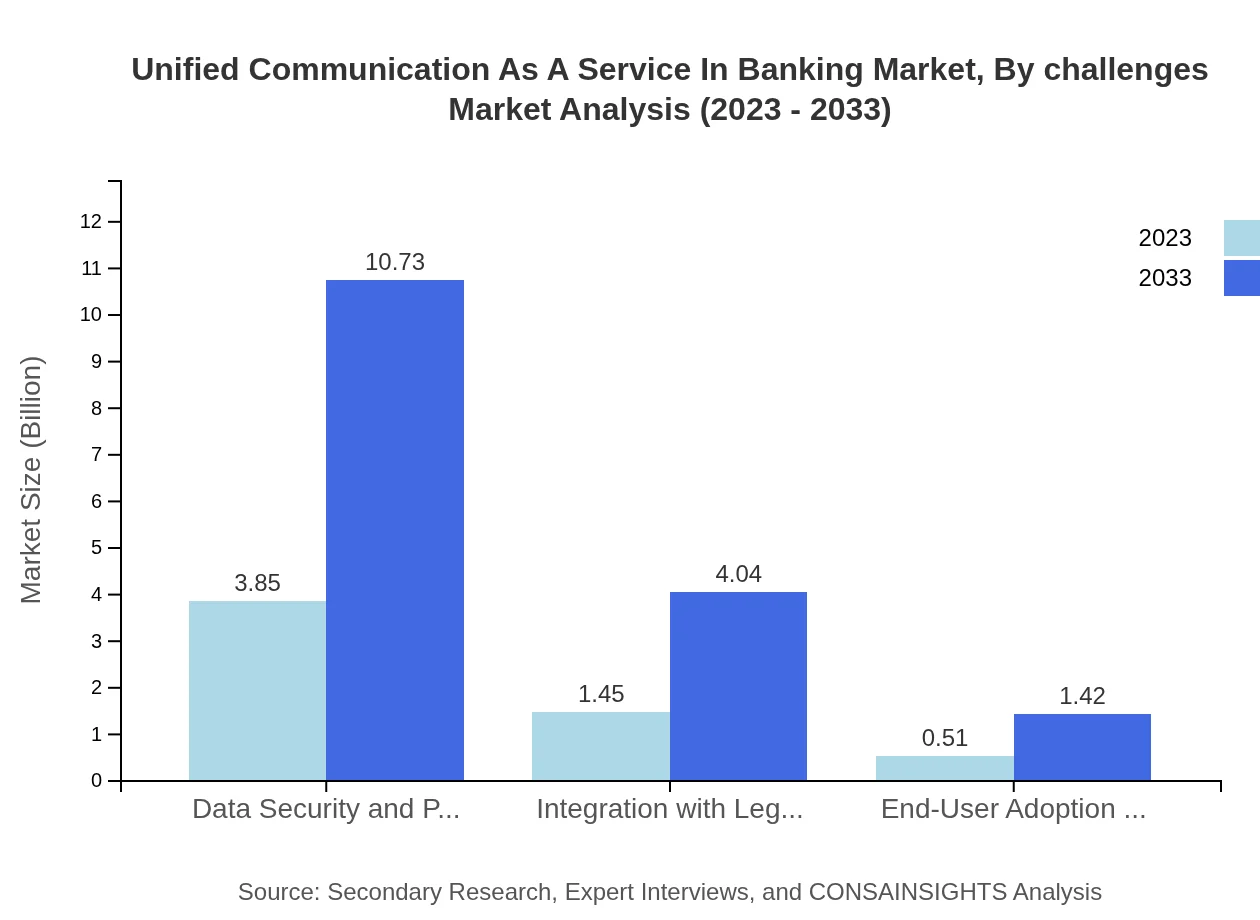

Unified Communication As A Service In Banking Market Analysis By Challenges

The UCaaS market faces several challenges, including data security issues, compliance with regulations, and integration with legacy systems. Ensuring robust cybersecurity measures and educating end users are crucial for the continued adoption and growth of UCaaS in the banking sector.

Unified Communication As A Service In Banking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unified Communication As A Service In Banking Industry

Cisco Systems, Inc.:

Cisco provides a comprehensive suite of UCaaS solutions, including Webex, which enables seamless communication and collaboration in the banking industry.Microsoft Corporation:

Microsoft's Teams platform has become integral for banks seeking efficient communication tools, offering secure cloud-based solutions tailored for financial services.RingCentral, Inc.:

RingCentral is a leading provider of UCaaS solutions, delivering an all-in-one communication platform focused on enhancing customer interactions in banking.Zoom Video Communications:

Known for its video conferencing capabilities, Zoom is increasingly being integrated into banking operations for enhanced customer engagement and internal collaboration.Avaya Inc.:

Avaya specializes in business communication solutions, offering UCaaS services that improve both customer service experiences and operational efficiencies in banks.We're grateful to work with incredible clients.

FAQs

What is the market size of Unified Communication as a Service in Banking?

The Unified Communication as a Service (UCaaS) market in banking is projected to grow from $5.8 billion in 2023 to an estimated $17.1 billion by 2033, reflecting a robust CAGR of 10.4% over the decade.

What are the key market players or companies in the UCaaS industry?

The UCaaS in banking market features key players such as Microsoft, Cisco, RingCentral, 8x8, and Zoom. These companies are innovating and enhancing communication solutions tailored to meet banking industry demands, ensuring compliance and security.

What are the primary factors driving the growth in the UCaaS industry?

Growth in the UCaaS market for banking is driven by increasing digital transformation initiatives, demand for secure and efficient communication solutions, regulatory compliance needs, and innovations in AI and machine learning enhancing customer service capabilities.

Which region is the fastest Growing in the UCaaS market?

North America is the fastest-growing region in the UCaaS banking market, expected to expand from $2.16 billion in 2023 to $6.02 billion by 2033. Europe follows, growing from $1.74 billion to $4.86 billion over the same period.

Does ConsaInsights provide customized market report data for the UCaaS industry?

Yes, ConsaInsights offers customized market report data tailored for the UCaaS industry. Clients can receive insights specific to their needs, including market segmentation, competitive landscape, and future trends.

What deliverables can I expect from this UCaaS market research project?

Deliverables from this UCaaS market research project include comprehensive market reports, executive summaries, trend analysis, competitive landscape assessments, and forecasts segmented by region and market segment.

What are the market trends of UCaaS?

Key market trends in UCaaS for banking include increasing adoption of cloud services, emphasis on data security, integration with AI technologies, and the shift towards remote collaboration tools, which enhance overall operational efficiency.