Unified Communication As A Service In Energy Market Report

Published Date: 31 January 2026 | Report Code: unified-communication-as-a-service-in-energy

Unified Communication As A Service In Energy Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Unified Communication as a Service (UCaaS) market within the energy sector, offering insights into market dynamics, size, growth, and future trends from 2023 to 2033.

| Metric | Value |

|---|---|

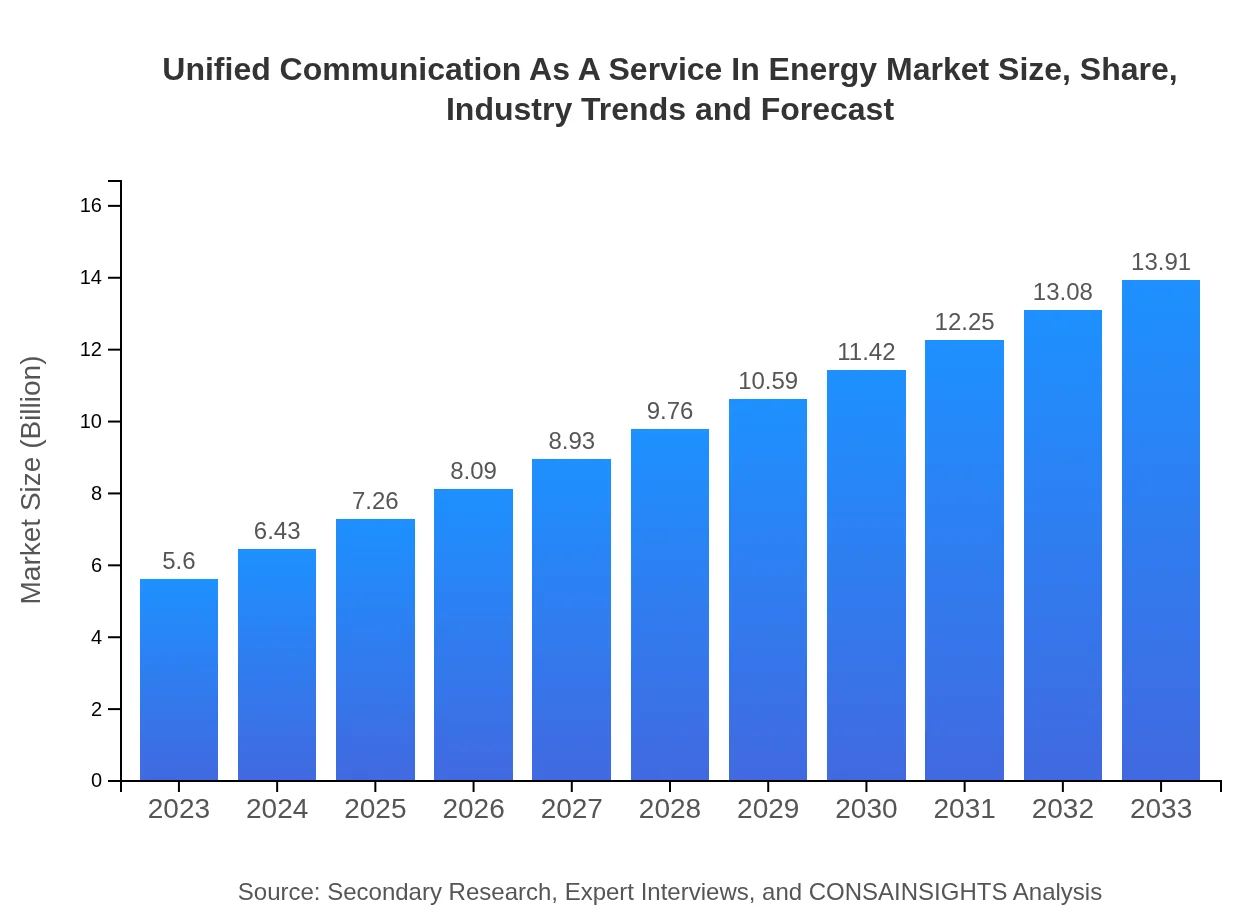

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | Microsoft, Cisco Systems, RingCentral, Zoom Video Communications, Avaya |

| Last Modified Date | 31 January 2026 |

Unified Communication As A Service In Energy Market Overview

Customize Unified Communication As A Service In Energy Market Report market research report

- ✔ Get in-depth analysis of Unified Communication As A Service In Energy market size, growth, and forecasts.

- ✔ Understand Unified Communication As A Service In Energy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unified Communication As A Service In Energy

What is the Market Size & CAGR of Unified Communication As A Service In Energy market in 2023?

Unified Communication As A Service In Energy Industry Analysis

Unified Communication As A Service In Energy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unified Communication As A Service In Energy Market Analysis Report by Region

Europe Unified Communication As A Service In Energy Market Report:

Europe’s UCaaS market is projected to expand from $1.80 billion in 2023 to $4.46 billion by 2033, driven by stringent regulations on emissions and the transition to cleaner energy sources, prompting energy firms to adopt better communication tools.Asia Pacific Unified Communication As A Service In Energy Market Report:

The Asia Pacific UCaaS market in energy is growing, projected to increase from $1.07 billion in 2023 to $2.67 billion by 2033. Economic growth, increased energy consumption, and the adoption of smart grid technologies are driving this growth.North America Unified Communication As A Service In Energy Market Report:

North America is a prominent market, with values rising from $1.87 billion in 2023 to $4.66 billion by 2033. The region's advanced infrastructure, adoption of cloud solutions, and a high concentration of energy companies fuel this growth.South America Unified Communication As A Service In Energy Market Report:

In South America, the market is projected to grow from $0.20 billion in 2023 to $0.49 billion in 2033. The rise in renewable energy projects and government initiatives to modernize communication infrastructure contribute to this growth.Middle East & Africa Unified Communication As A Service In Energy Market Report:

The Middle East and Africa region is expected to see growth from $0.66 billion in 2023 to $1.63 billion in 2033, spurred by investments in energy efficiency programs and the integration of smart technologies.Tell us your focus area and get a customized research report.

Unified Communication As A Service In Energy Market Analysis Collaboration_software

Global Unified Communication as a Service (UCaaS) in Energy Market, By Product Market Analysis (2023 - 2033)

The collaboration software segment dominates the UCaaS in energy market, valued at $3.76 billion in 2023, projected to reach $9.34 billion by 2033. It accounts for a significant share of 67.15% in 2023, primarily due to the demand for real-time communication and collaboration tools that enhance productivity.

Unified Communication As A Service In Energy Market Analysis Communication_hardware

Global Unified Communication as a Service (UCaaS) in Energy Market, By Application Market Analysis (2023 - 2033)

In the communication hardware segment, the market size is expected to grow from $1.42 billion in 2023 to $3.53 billion by 2033, representing a share of 25.34%. This reflects the ongoing need for effective hardware components that facilitate better communication systems.

Unified Communication As A Service In Energy Market Analysis Integrated_services

Global Unified Communication as a Service (UCaaS) in Energy Market, By Deployment Mode Market Analysis (2023 - 2033)

Integrated services segment reflects a market size of $0.42 billion in 2023, anticipated to grow to $1.04 billion by 2033. This 7.51% share indicates increasing reliance on comprehensive communication solutions integrating voice, data, and conferencing.

Unified Communication As A Service In Energy Market Analysis Renewable_energy

Global Unified Communication as a Service (UCaaS) in Energy Market, By End-User Industry Market Analysis (2023 - 2033)

The renewable energy segment is significant, with a size of $3.11 billion in 2023, projected to reach $7.73 billion by 2033. Holding a significant share of 55.57%, this segment highlights the emphasis on transitioning to clean energy and sustainable practices within the UCaaS framework.

Unified Communication As A Service In Energy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unified Communication As A Service In Energy Industry

Microsoft:

Microsoft offers UCaaS solutions through its Microsoft Teams platform, facilitating collaboration and communication in the energy sector, known for its robust feature set and integration capabilities.Cisco Systems:

Cisco is a leader in communication hardware and software, providing comprehensive UCaaS solutions designed to enhance connectivity and efficiency in various energy applications.RingCentral:

RingCentral provides cloud communications and collaboration solutions tailored for the energy sector, recognized for its scalable and user-friendly platform.Zoom Video Communications:

Zoom offers video conferencing and UCaaS capabilities, increasingly adopted in the energy sector for remote collaboration and meetings.Avaya:

Avaya delivers integrated communication solutions that enhance operational efficiency and improve communication within energy companies.We're grateful to work with incredible clients.

FAQs

What is the market size of Unified Communication as a Service in Energy?

The Unified Communication as a Service (UCaaS) in the Energy market is projected to grow from $5.6 billion in 2023 to significant figures by 2033, with a compound annual growth rate (CAGR) of 9.2%.

What are the key market players or companies in the Unified Communication as a Service in Energy industry?

Key players in the UCaaS energy sector include prominent global tech companies focusing on digital communication solutions, telecommunications giants, and specialized technology firms that cater specifically to energy clients and enterprises.

What are the primary factors driving the growth in the Unified Communication as a Service in Energy industry?

Growth in the UCaaS in energy sector is driven by rising demand for enhanced communication solutions, the shift towards remote operations, and increasing investments in smart energy solutions, along with regulatory support for digital transformation.

Which region is the fastest Growing in the Unified Communication as a Service in Energy?

Europe is the fastest-growing region in the UCaaS in energy market, with projected growth from $1.80 billion in 2023 to $4.46 billion by 2033, indicating strong adoption of digital communication technologies.

Does ConsaInsights provide customized market report data for the Unified Communication as a Service in Energy industry?

Yes, ConsaInsights offers customized market report data for the UCaaS in the energy industry, allowing clients to access tailored insights that align with their specific areas of interest and operational needs.

What deliverables can I expect from this Unified Communication as a Service in Energy market research project?

Deliverables from the UCaaS market research project include comprehensive market analysis reports, growth forecasts, segment breakdowns, competitive landscape assessments, and strategic recommendations to enhance market positioning.

What are the market trends of Unified Communication as a Service in Energy?

Current trends in the UCaaS in energy market highlight the increasing integration of AI technologies, expansion of cloud-based solutions, emphasis on collaboration software, and a focus on sustainability and renewable energy integration.