Unified Communication As A Service In Retail Market Report

Published Date: 31 January 2026 | Report Code: unified-communication-as-a-service-in-retail

Unified Communication As A Service In Retail Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Unified Communication as a Service (UCaaS) market in retail, offering comprehensive analyses from 2023 to 2033. Key insights include market trends, size forecasts, regional analyses, and technological advancements impacting this sector.

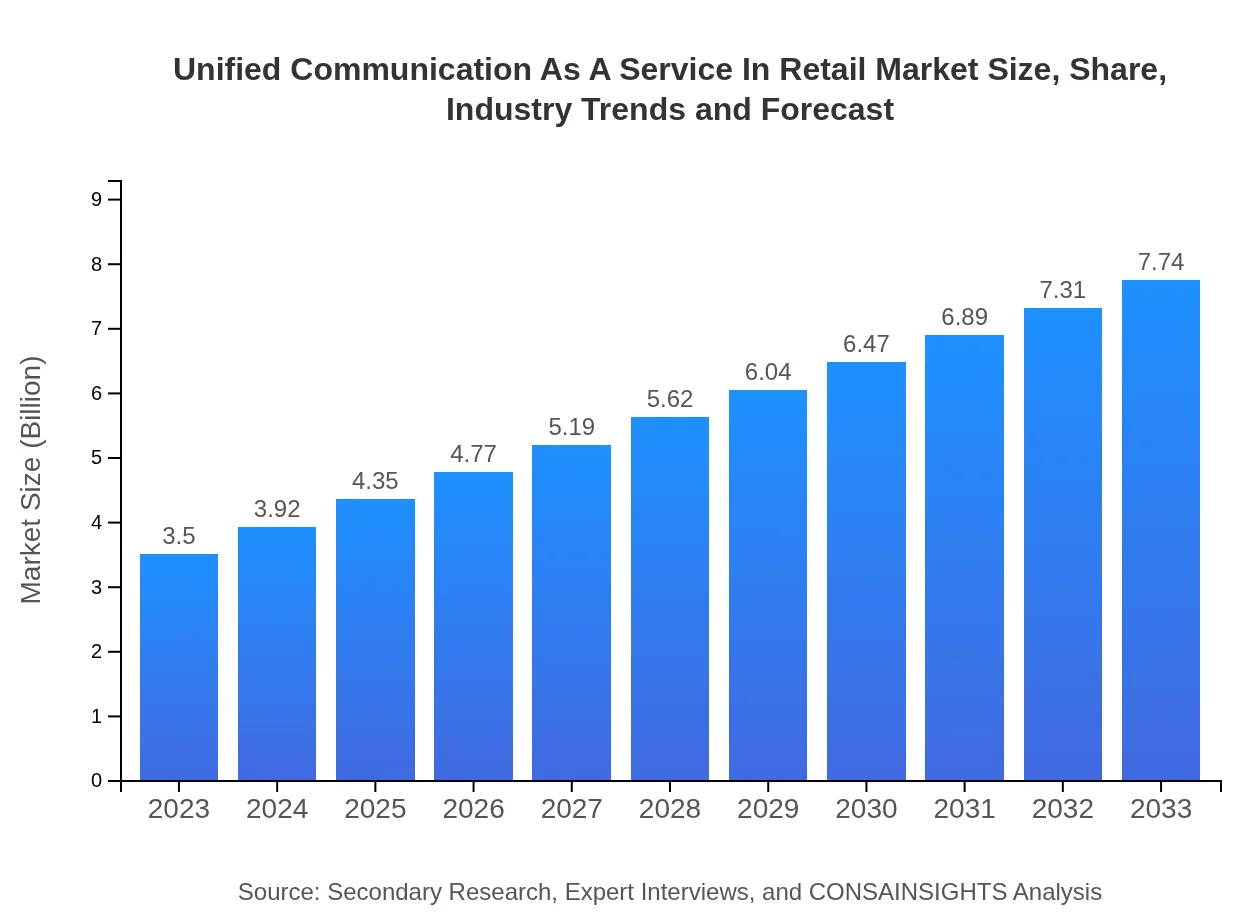

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 8.0% |

| 2033 Market Size | $7.74 Billion |

| Top Companies | Cisco Systems, Inc., RingCentral, Inc., Microsoft Corporation, Zoom Video Communications, Inc. |

| Last Modified Date | 31 January 2026 |

Unified Communication As A Service In Retail Market Overview

Customize Unified Communication As A Service In Retail Market Report market research report

- ✔ Get in-depth analysis of Unified Communication As A Service In Retail market size, growth, and forecasts.

- ✔ Understand Unified Communication As A Service In Retail's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unified Communication As A Service In Retail

What is the Market Size & CAGR of Unified Communication As A Service In Retail market in 2023?

Unified Communication As A Service In Retail Industry Analysis

Unified Communication As A Service In Retail Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unified Communication As A Service In Retail Market Analysis Report by Region

Europe Unified Communication As A Service In Retail Market Report:

Europe's UCaaS market is also experiencing upward momentum with a forecast growth from $0.89 billion in 2023 to $1.97 billion by 2033, supported by a strong focus on enhancing customer experience and operational efficiencies.Asia Pacific Unified Communication As A Service In Retail Market Report:

In the Asia Pacific region, the UCaaS market is projected to grow from $0.70 billion in 2023 to $1.55 billion by 2033, driven by increasing adoption of cloud-based services and rapid digitalization among retailers.North America Unified Communication As A Service In Retail Market Report:

The North America UCaaS market is poised for significant growth, expanding from $1.29 billion in 2023 to $2.85 billion by 2033. The presence of major retailers and advanced digital infrastructure propels this market segment.South America Unified Communication As A Service In Retail Market Report:

South America is expected to witness moderate growth, increasing from $0.19 billion in 2023 to $0.41 billion by 2033. The retail sector's ongoing transformation and investment in communication technology are key growth factors.Middle East & Africa Unified Communication As A Service In Retail Market Report:

The Middle East and Africa region is projected to grow from $0.43 billion in 2023 to $0.96 billion by 2033, as interest in digital transformation and unified solutions increases among retailers in this area.Tell us your focus area and get a customized research report.

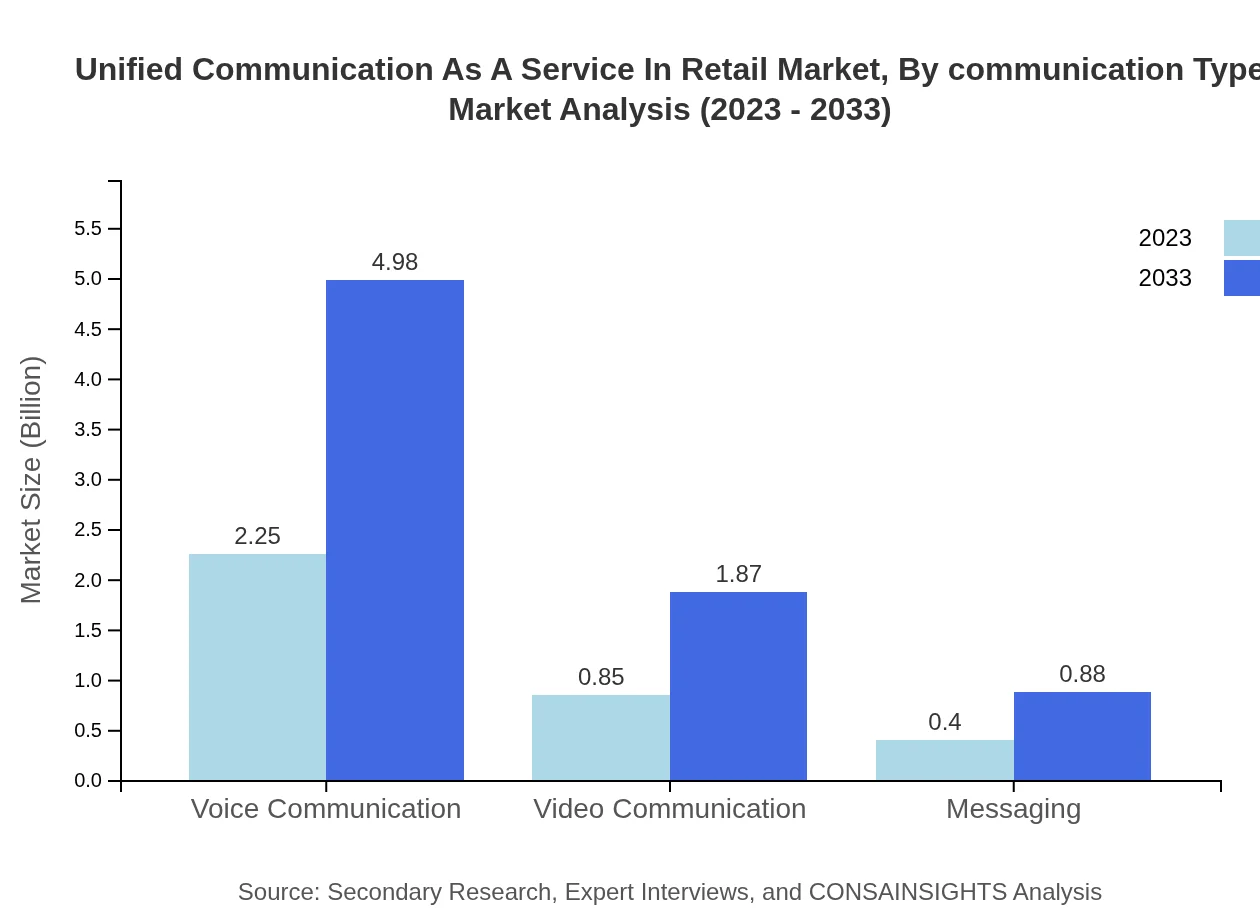

Unified Communication As A Service In Retail Market Analysis By Communication Type

In 2023, voice communication dominates the market with a size of $2.25 billion, expected to reach $4.98 billion by 2033. Video communication follows, growing from $0.85 billion to $1.87 billion, while messaging holds a steady position growing from $0.40 billion to $0.88 billion over the same period.

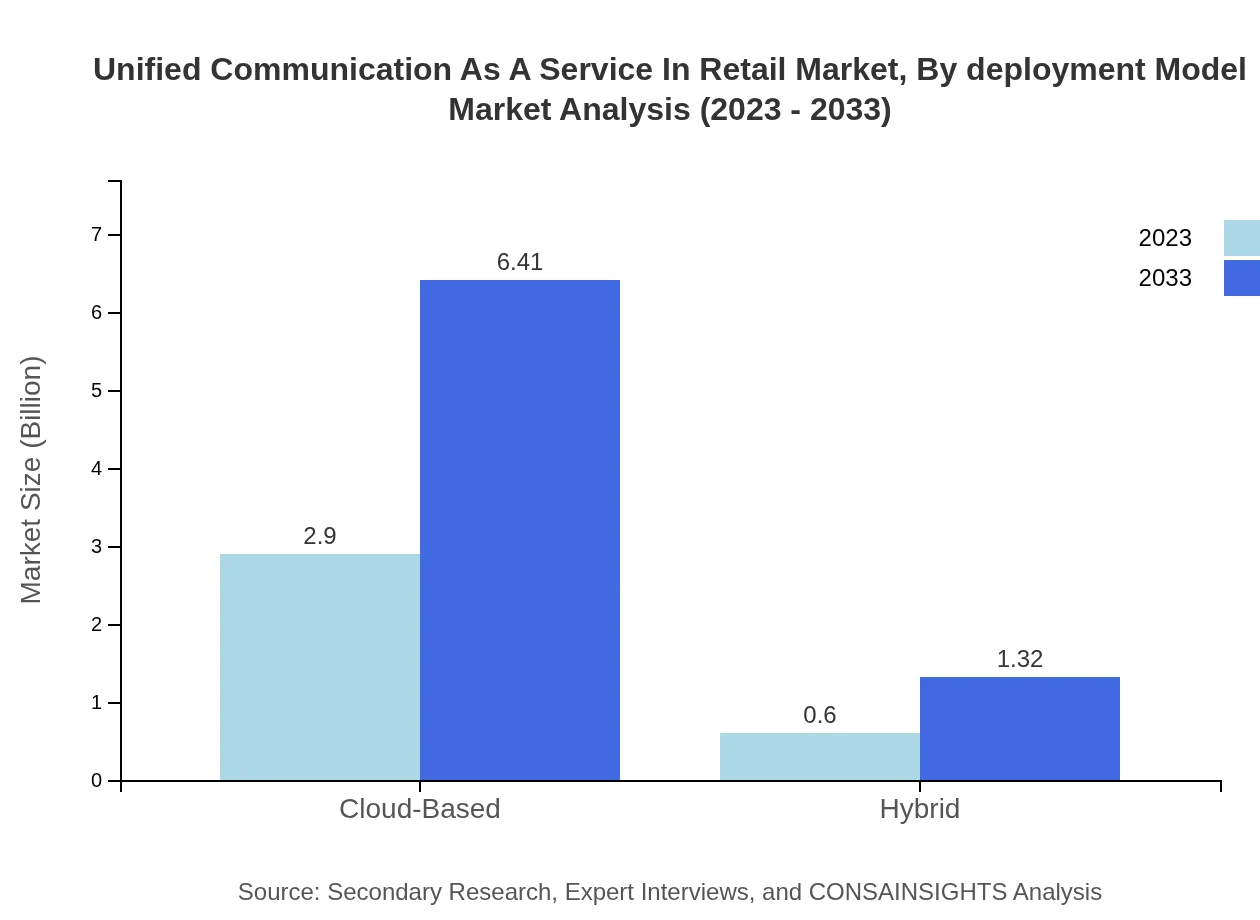

Unified Communication As A Service In Retail Market Analysis By Deployment Model

The cloud-based deployment model continues to lead the market, with an anticipated increase from $2.90 billion in 2023 to $6.41 billion by 2033, capturing 82.91% of the market share, while hybrid models remain significant at 17.09%.

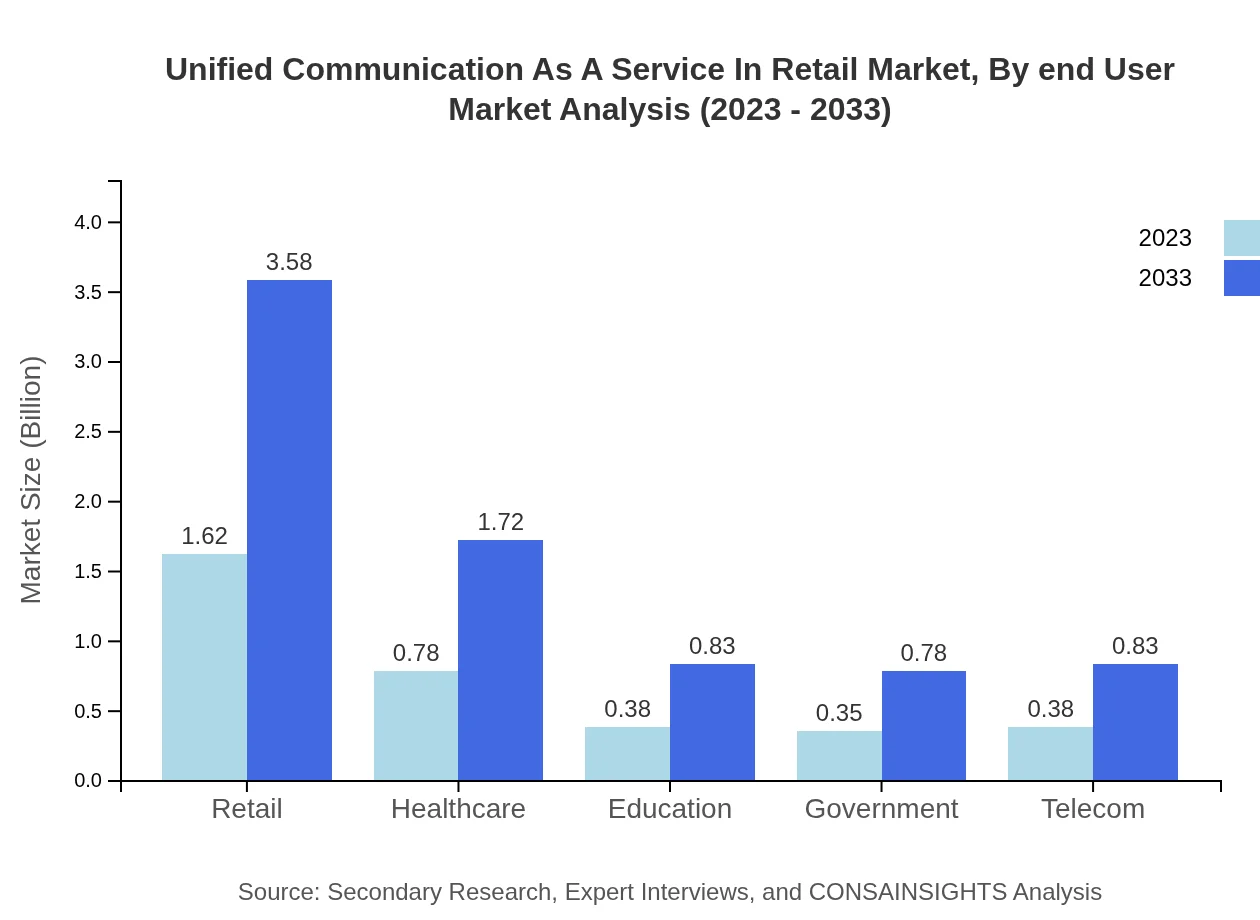

Unified Communication As A Service In Retail Market Analysis By End User

The retail sector captures a noticeable 46.26% market share, reflecting its critical role in the overall UCaaS landscape. Healthcare follows at 22.17%, while education and government provide additional substantial shares.

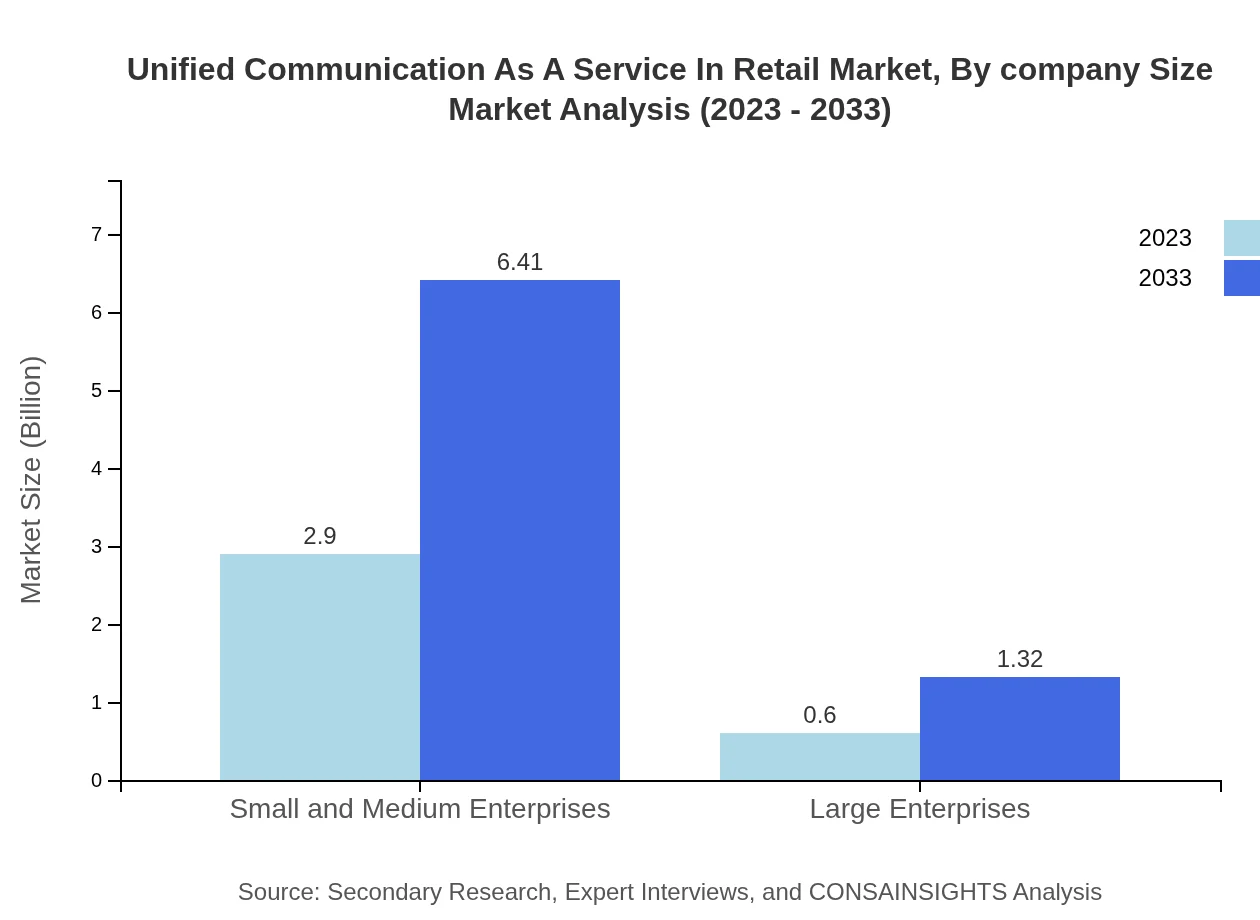

Unified Communication As A Service In Retail Market Analysis By Company Size

Small and medium enterprises are the largest segment, accounting for 82.91% of the market share in 2023, continuing to expand from $2.90 billion to $6.41 billion by 2033. Meanwhile, large enterprises reflect a growing trend from $0.60 billion to $1.32 billion.

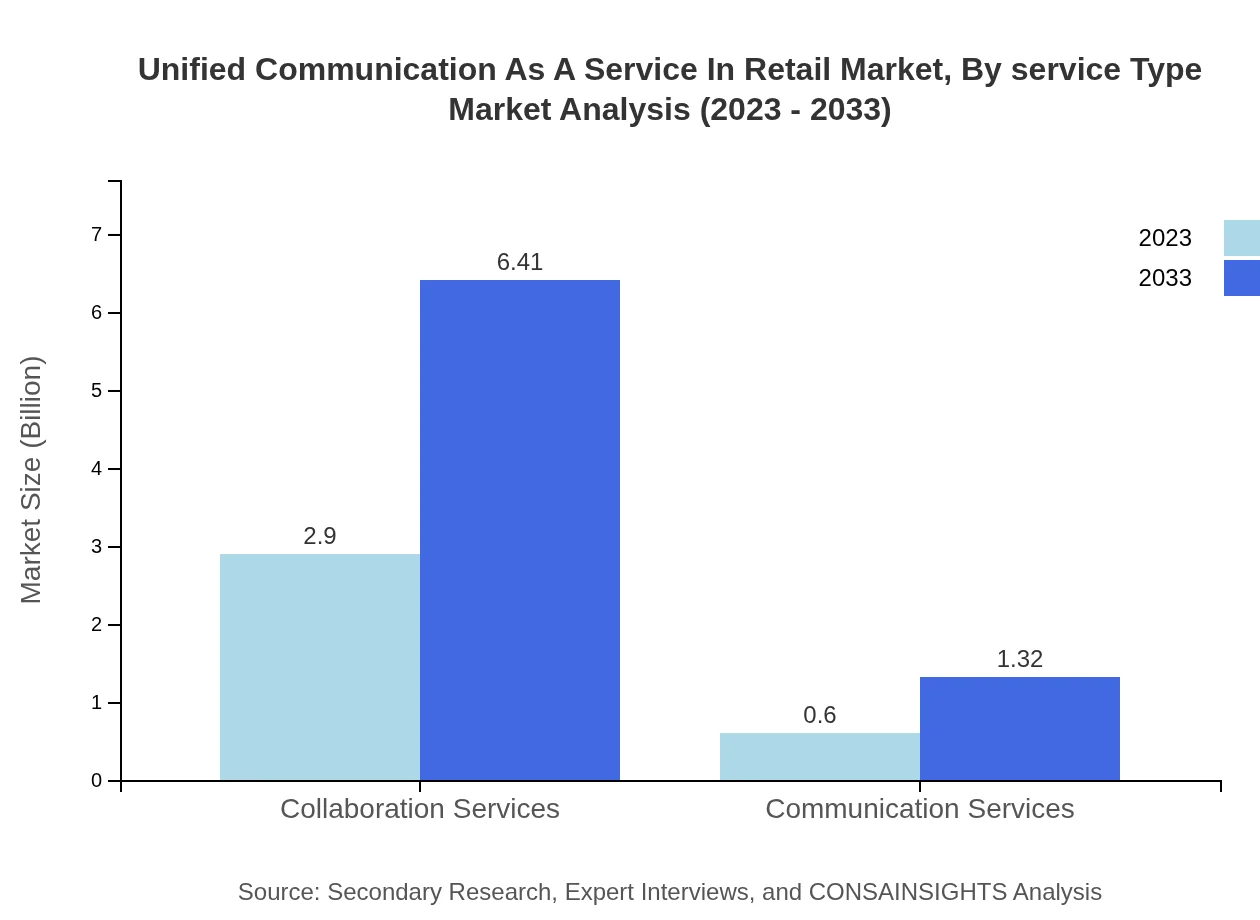

Unified Communication As A Service In Retail Market Analysis By Service Type

Collaboration services dominate at 82.91% in 2023 with a market size of $2.90 billion, projected to rise to $6.41 billion by 2033, while communication services represent 17.09% of the market.

Unified Communication As A Service In Retail Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unified Communication As A Service In Retail Industry

Cisco Systems, Inc.:

Cisco is a leading player in the UCaaS market, providing cloud-based communication solutions that enhance collaboration among retailers worldwide.RingCentral, Inc.:

RingCentral offers a comprehensive cloud communications platform that supports integrated voice, video, and messaging functionalities for retail businesses.Microsoft Corporation:

With its Teams platform, Microsoft has captured a significant share of the UCaaS market by providing seamless collaboration tools to retail enterprises.Zoom Video Communications, Inc.:

Zoom is renowned for its video communication solutions, which have become integral in the retail sector for customer and employee interaction.We're grateful to work with incredible clients.

FAQs

What is the market size of Unified Communication as a Service in Retail?

The Unified Communication as a Service (UCaaS) in Retail market is projected to reach approximately $3.5 billion by 2033, with a CAGR of 8.0%. This growth highlights the increasing adoption of unified communication solutions among retailers.

What are the key market players or companies in this UCaaS industry?

Key players in the UCaaS industry include RingCentral, Microsoft, Zoom Video Communications, and Cisco. These companies are leading the way with innovative solutions tailored for the retail sector.

What are the primary factors driving the growth in the UCaaS industry?

Growth in the UCaaS market is driven by increased demand for collaborative tools, the need for enhanced customer experiences, and the growing trend of remote work. Retailers are leveraging these solutions to improve communication efficiency.

Which region is the fastest Growing in the UCaaS market?

The Asia Pacific region is the fastest-growing market for UCaaS in retail, expected to grow from $0.70 billion in 2023 to $1.55 billion by 2033, driven by rapid digital transformation in retail operations.

Does ConsaInsights provide customized market report data for the UCaaS industry?

Yes, ConsaInsights offers customized market report data tailored to the UCaaS industry, providing insights specific to various sectors and regions to meet diverse client needs.

What deliverables can I expect from this UCaaS market research project?

From the UCaaS market research project, clients can expect comprehensive reports including market analysis, regional trends, competitive landscape, and future forecasts, helping to inform strategic decisions.

What are the market trends of UCaaS?

Current trends in the UCaaS market include heightened adoption of cloud-based solutions, a shift towards hybrid communication models, and the integration of AI-driven analytics for improved customer engagement.