Unified Communication As A Service In The Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: unified-communication-as-a-service-in-the-manufacturing

Unified Communication As A Service In The Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides insights into the market for Unified Communication as a Service (UCaaS) in the manufacturing sector, covering market trends, size projections, and regional analysis from 2023 to 2033.

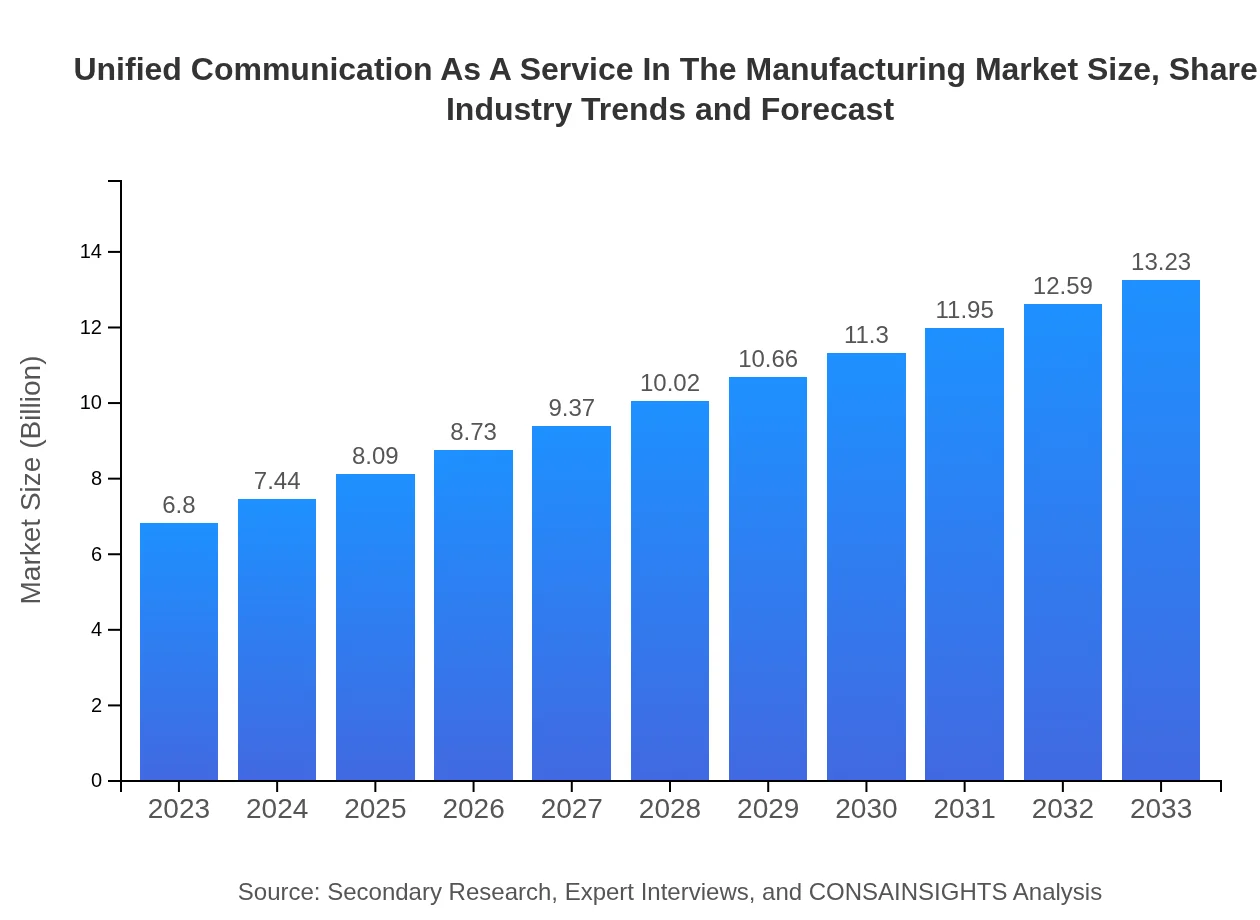

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $13.23 Billion |

| Top Companies | Cisco Systems, Inc., RingCentral, Microsoft, Zoom Video Communications, Inc., Mitel |

| Last Modified Date | 31 January 2026 |

Unified Communication As A Service In The Manufacturing Market Overview

Customize Unified Communication As A Service In The Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Unified Communication As A Service In The Manufacturing market size, growth, and forecasts.

- ✔ Understand Unified Communication As A Service In The Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unified Communication As A Service In The Manufacturing

What is the Market Size & CAGR of Unified Communication As A Service In The Manufacturing market in 2023?

Unified Communication As A Service In The Manufacturing Industry Analysis

Unified Communication As A Service In The Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unified Communication As A Service In The Manufacturing Market Analysis Report by Region

Europe Unified Communication As A Service In The Manufacturing Market Report:

In Europe, the UCaaS market in manufacturing is anticipated to expand from $1.86 billion in 2023 to $3.61 billion by 2033. The region's strong manufacturing base and increasing implementation of Industry 4.0 practices are creating demand for integrated communication systems that enhance connectivity and streamline business processes.Asia Pacific Unified Communication As A Service In The Manufacturing Market Report:

The Unified Communication as a Service market in the Asia Pacific region is anticipated to grow from $1.49 billion in 2023 to $2.90 billion by 2033. This growth is attributed to increased manufacturing activities in countries like China and India, which are investing heavily in digital transformation and smart manufacturing technologies. High demand for real-time communication and collaboration tools among manufacturers further drives adoption.North America Unified Communication As A Service In The Manufacturing Market Report:

The North American market is projected to grow from $2.43 billion in 2023 to $4.72 billion by 2033. The United States, as a leading manufacturing hub, is witnessing significant investments in UCaaS technologies. The emphasis on cloud migration and digital collaboration in manufacturing firms is driving demand for such solutions.South America Unified Communication As A Service In The Manufacturing Market Report:

In South America, the market for UCaaS in manufacturing is expected to rise from $0.36 billion in 2023 to $0.70 billion by 2033. Economic recovery post-pandemic and rising investments in technology infrastructure are propelling this growth. Manufacturers are increasingly recognizing the value of improved communication solutions to enhance operational efficiency.Middle East & Africa Unified Communication As A Service In The Manufacturing Market Report:

The Middle East and Africa are expected to see growth from $0.67 billion in 2023 to $1.30 billion by 2033. The ongoing industrialization efforts and growing focus on automation in manufacturing are significant factors fueling the demand for UCaaS solutions. Companies are increasingly looking to enhance communication and collaboration capabilities to remain competitive.Tell us your focus area and get a customized research report.

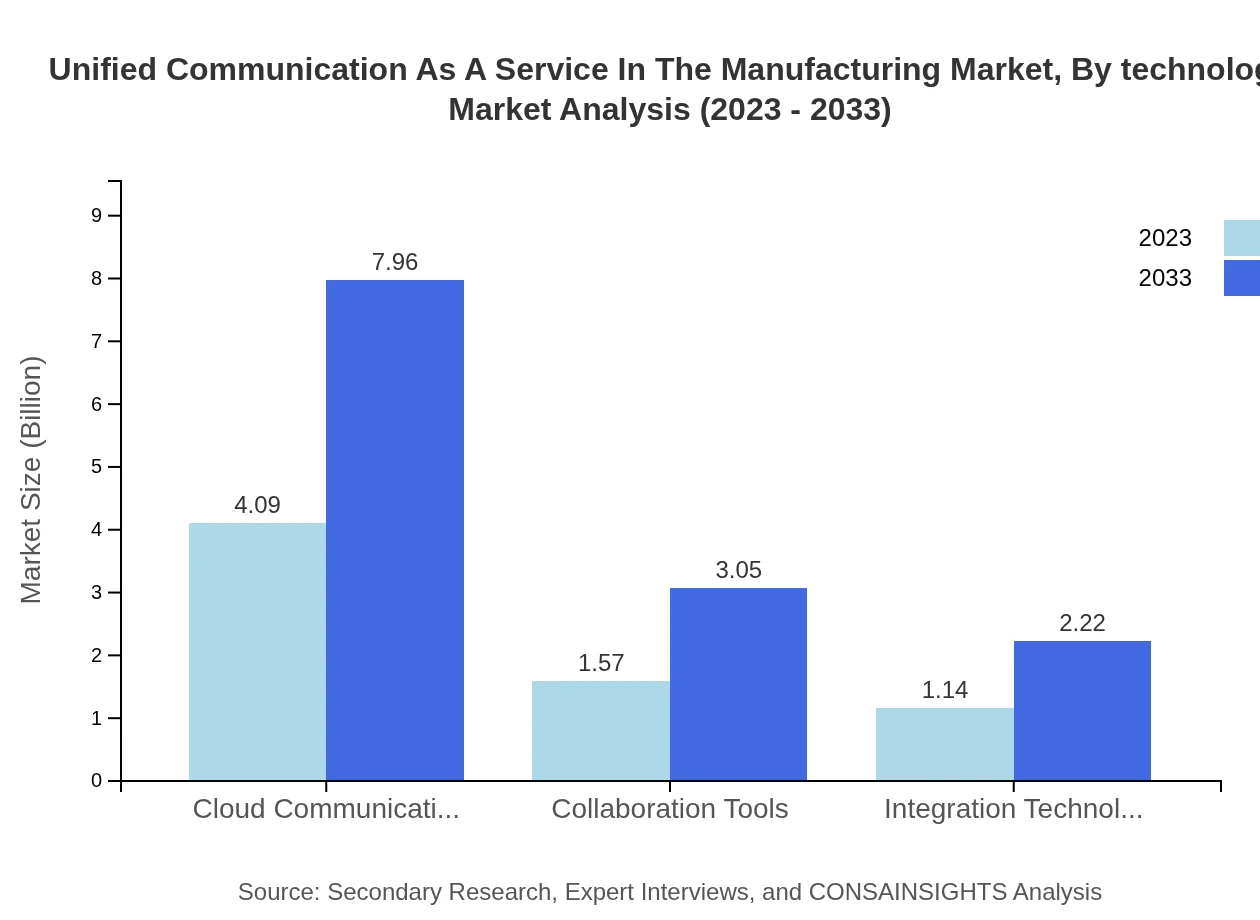

Unified Communication As A Service In The Manufacturing Market Analysis By Technology

The technology segment of the UCaaS market in manufacturing comprises various innovative solutions such as Cloud Communication, Collaboration Tools, Integration Technology, and more. Each technology plays a crucial role in modernizing communication frameworks within manufacturing environments.

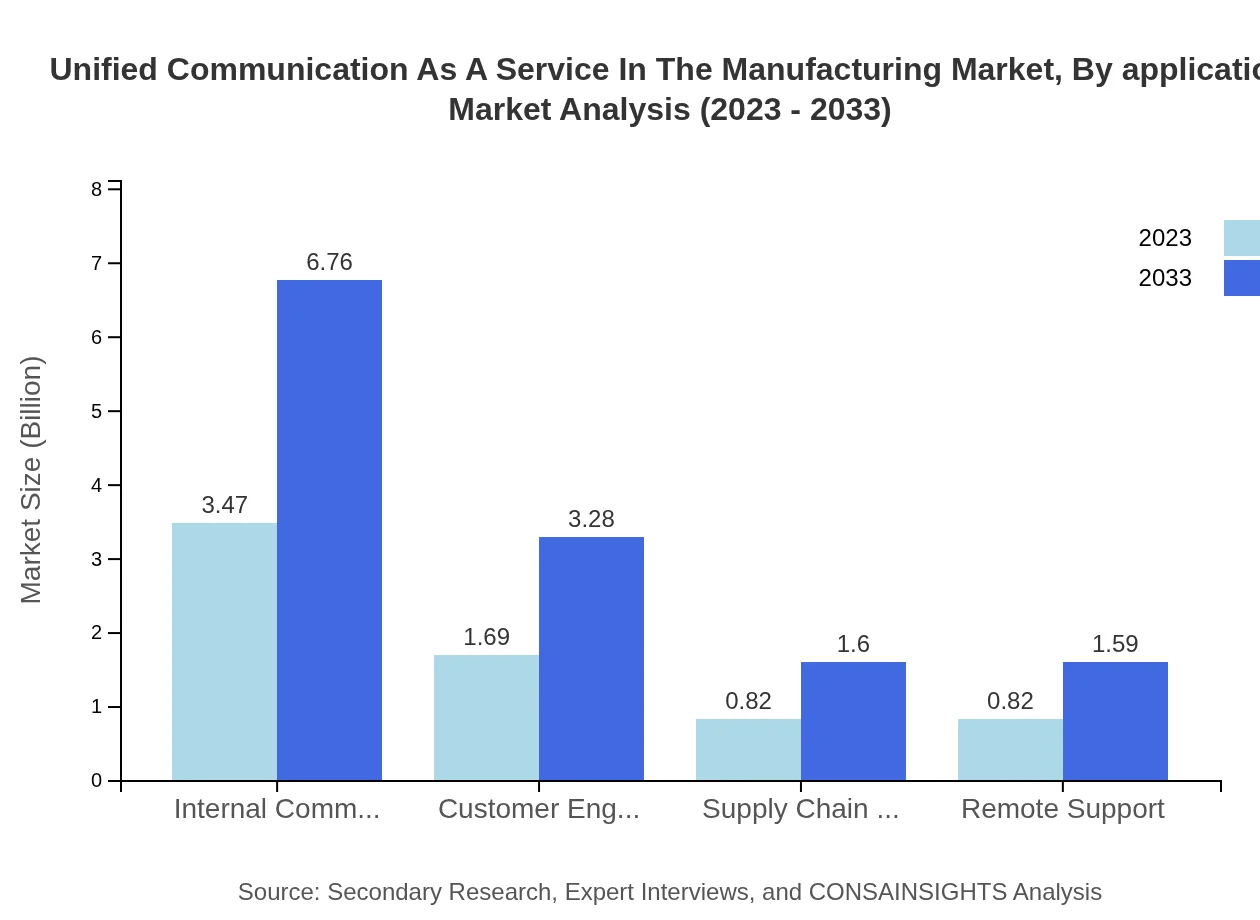

Unified Communication As A Service In The Manufacturing Market Analysis By Application

Applications of UCaaS in manufacturing focus on facilitating Internal Communication, Customer Engagement, Supply Chain Management, and Remote Support. These applications enhance organizational effectiveness by enabling seamless communication across different manufacturing functions.

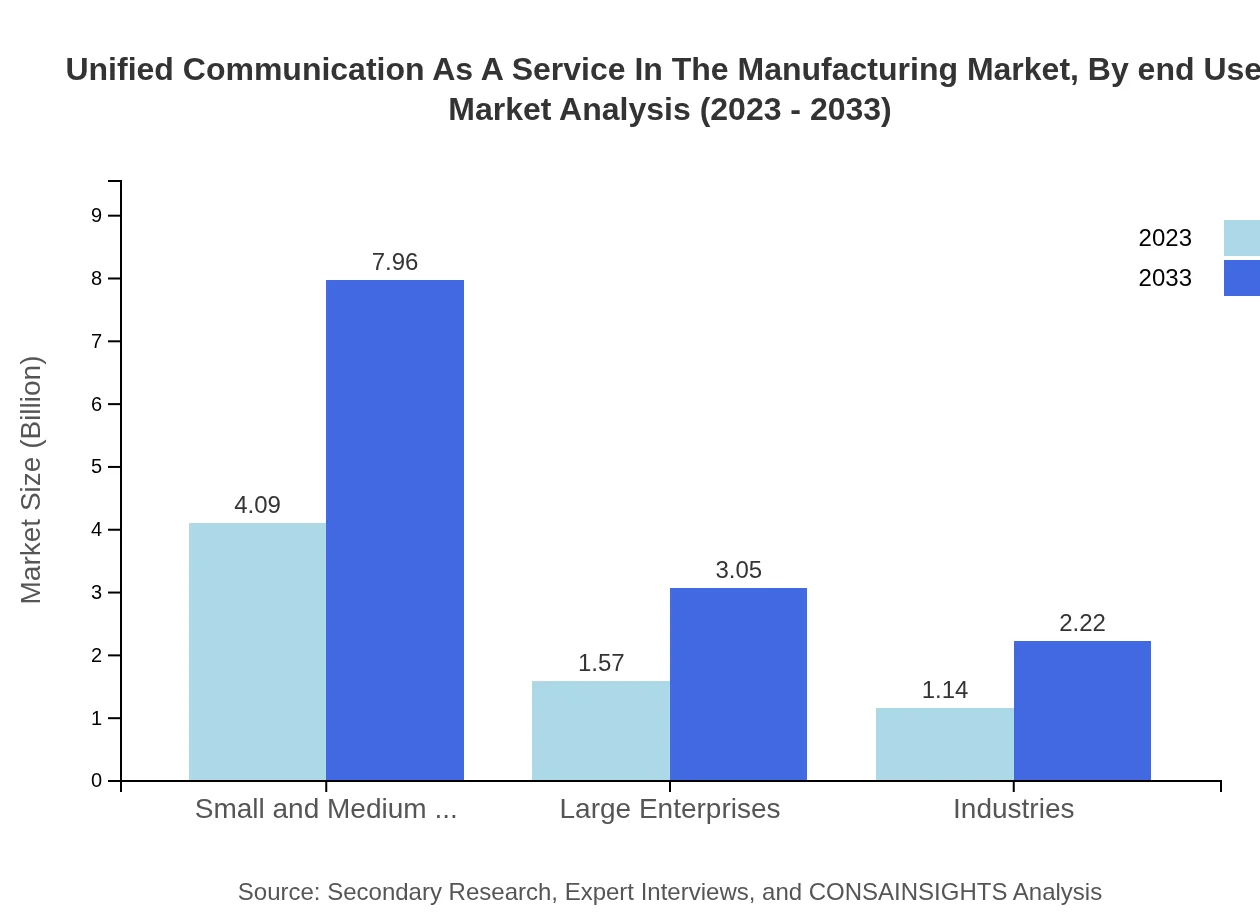

Unified Communication As A Service In The Manufacturing Market Analysis By End User

End-users of UCaaS in manufacturing include Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs particularly benefit from flexible and cost-effective communication solutions that UCaaS offers to streamline operations and improve collaboration.

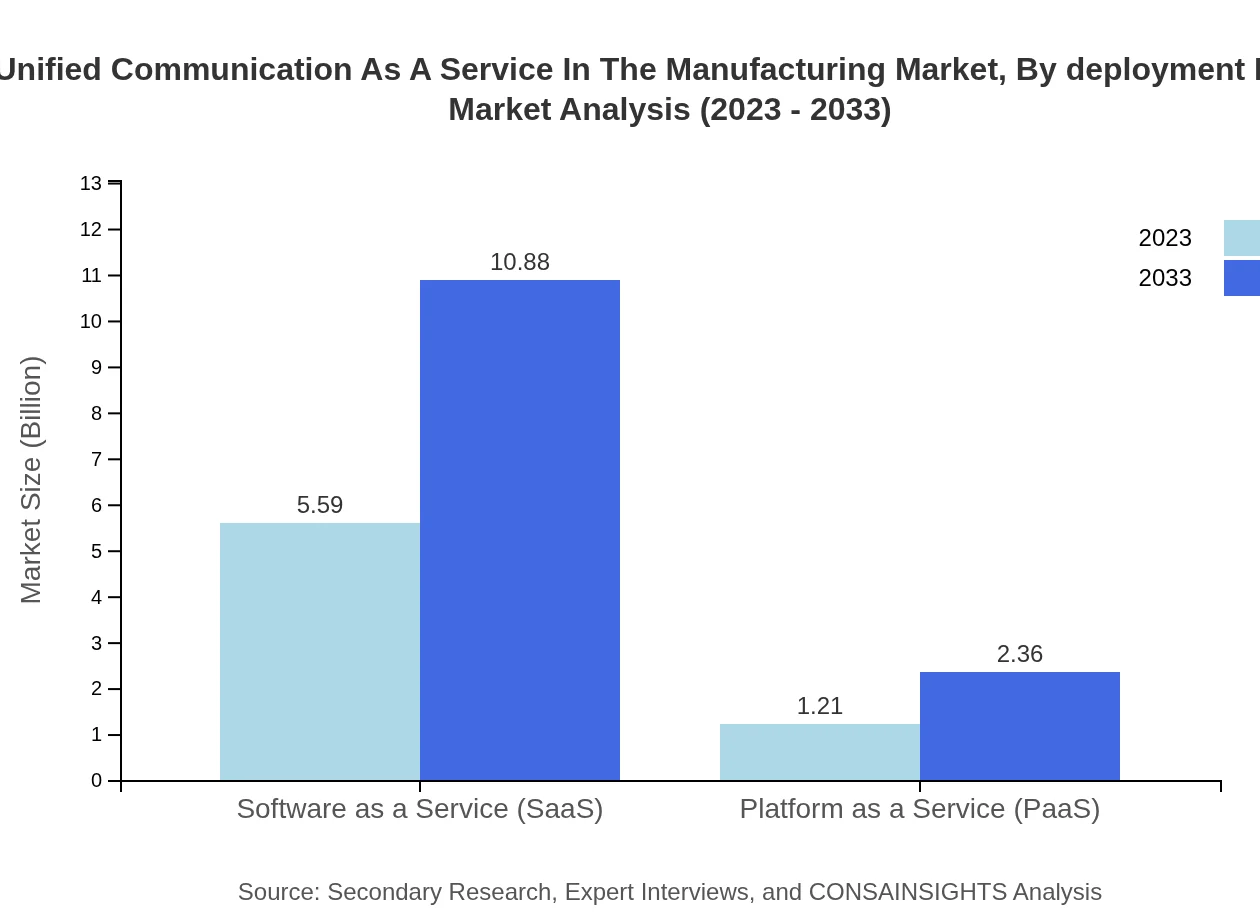

Unified Communication As A Service In The Manufacturing Market Analysis By Deployment Model

The deployment model segment includes Software as a Service (SaaS) and Platform as a Service (PaaS). SaaS holds a significant market share, offering manufacturers scalable and easy-to-implement communication solutions that cater to their operational needs.

Unified Communication As A Service In The Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unified Communication As A Service In The Manufacturing Industry

Cisco Systems, Inc.:

Cisco is a leading provider of UCaaS solutions, offering a comprehensive suite of communication and collaboration tools specifically designed for manufacturing firms to improve operational efficiency.RingCentral:

RingCentral provides cloud-based communication solutions with advanced collaboration features tailored for the manufacturing sector, enabling seamless integration and real-time communication.Microsoft:

Microsoft offers integrated UCaaS solutions through Microsoft 365, facilitating enhanced collaboration and productivity for manufacturing enterprises.Zoom Video Communications, Inc.:

Zoom is recognized for its video conferencing solutions, which are vital for remote collaboration in manufacturing, especially in the era of hybrid work environments.Mitel:

Mitel delivers robust UCaaS applications tailored for manufacturing businesses, focusing on enhancing workforce productivity and maintaining communication channels.We're grateful to work with incredible clients.

FAQs

What is the market size of Unified Communication as a Service in the manufacturing?

The Unified Communication as a Service (UCaaS) in manufacturing market is expected to reach $6.8 billion by 2033, with a compound annual growth rate (CAGR) of 6.7% from 2023 to 2033.

What are the key market players or companies in the Unified Communication as a Service industry?

Key players in the UCaaS industry for manufacturing include tech giants such as Microsoft, Cisco, RingCentral, and Zoom. These companies are driving innovation and forming strategic partnerships to enhance their service offerings.

What are the primary factors driving the growth in the Unified Communication as a Service industry?

Factors driving UCaaS growth include the increasing need for collaboration tools, rising adoption of cloud technologies, and the demand for cost-efficient communication solutions in manufacturing processes, all contributing to a more unified business operation.

Which region is the fastest Growing in Unified Communication as a Service?

Asia Pacific is the fastest-growing region for UCaaS in manufacturing, predicted to grow from $1.49 billion in 2023 to $2.90 billion by 2033, fueled by its expanding industrial base and digital transformation initiatives.

Does ConsaInsights provide customized market report data for the Unified Communication as a Service industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the UCaaS industry. Clients can expect detailed insights and data analysis to empower informed business decisions.

What deliverables can I expect from this Unified Communication as a Service market research project?

Deliverables from the UCaaS market research project include comprehensive market size reports, growth forecasts, segmentation analysis, competitive landscape evaluations, and actionable insights relevant to stakeholders in the manufacturing sector.

What are the market trends of Unified Communication as a Service?

Current trends in UCaaS include an increase in hybrid work models, heightened focus on cybersecurity, and the integration of AI-driven analytics tools to enhance communication systems in manufacturing, leading to improved efficiency and productivity.