Unit Load Device Market Report

Published Date: 22 January 2026 | Report Code: unit-load-device

Unit Load Device Market Size, Share, Industry Trends and Forecast to 2033

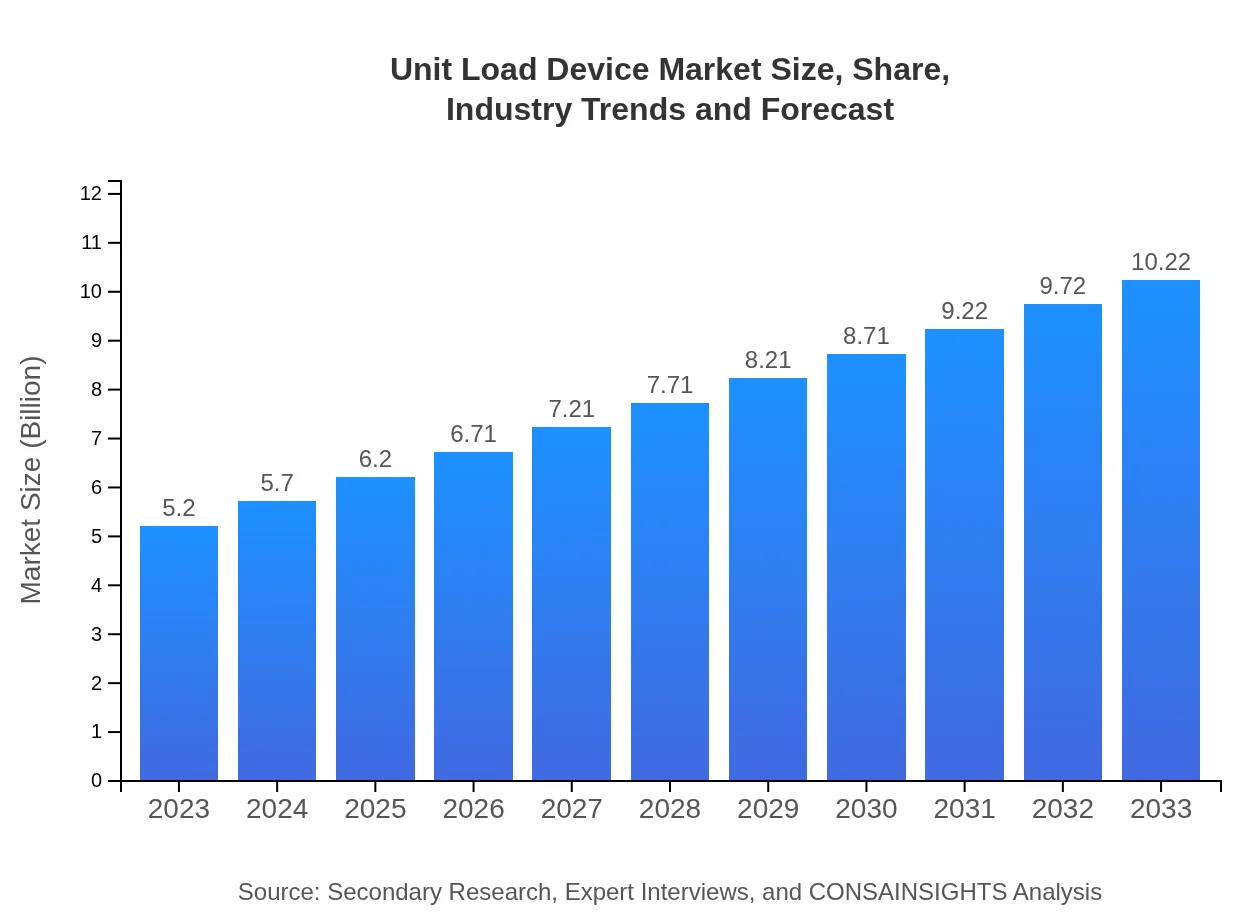

This report presents a comprehensive analysis of the Unit Load Device (ULD) market, covering its growth trajectory, market sizes, regional insights, and competitive landscape. The forecast period is from 2023 to 2033, providing insights into future trends and market dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | Collins Aerospace, AeroSafe Global, Vaayu Aerospace |

| Last Modified Date | 22 January 2026 |

Unit Load Device Market Overview

Customize Unit Load Device Market Report market research report

- ✔ Get in-depth analysis of Unit Load Device market size, growth, and forecasts.

- ✔ Understand Unit Load Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unit Load Device

What is the Market Size & CAGR of Unit Load Device market in 2023?

Unit Load Device Industry Analysis

Unit Load Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unit Load Device Market Analysis Report by Region

Europe Unit Load Device Market Report:

Europe's ULD market size is projected to grow from $1.50 billion in 2023 to $2.95 billion by 2033. The growth can be attributed to stringent regulations promoting the use of standardized devices, coupled with increased air cargo activities across the continent.Asia Pacific Unit Load Device Market Report:

The Asia Pacific region is projected to grow from $0.95 billion in 2023 to $1.86 billion by 2033, driven by burgeoning air freight volumes, increased manufacturing activities, and expanding trade routes. Countries like China and India are leading this growth with their burgeoning logistics sectors.North America Unit Load Device Market Report:

The North American market, valued at $2.01 billion in 2023, is anticipated to reach $3.95 billion by 2033. The region benefits from a well-established logistics network, the presence of major freight carriers, and a strong e-commerce sector driving the demand for efficient air cargo solutions.South America Unit Load Device Market Report:

In South America, the ULD market is expected to see an increase from $0.14 billion in 2023 to $0.28 billion by 2033. The growth is primarily attributed to improving infrastructure and greater investment in logistics capabilities across countries such as Brazil and Argentina.Middle East & Africa Unit Load Device Market Report:

The Middle East and Africa region is set to expand from $0.60 billion in 2023 to $1.18 billion by 2033. The rise of aviation hubs in the Gulf countries and increasing trade activities are significant drivers of market growth in this region.Tell us your focus area and get a customized research report.

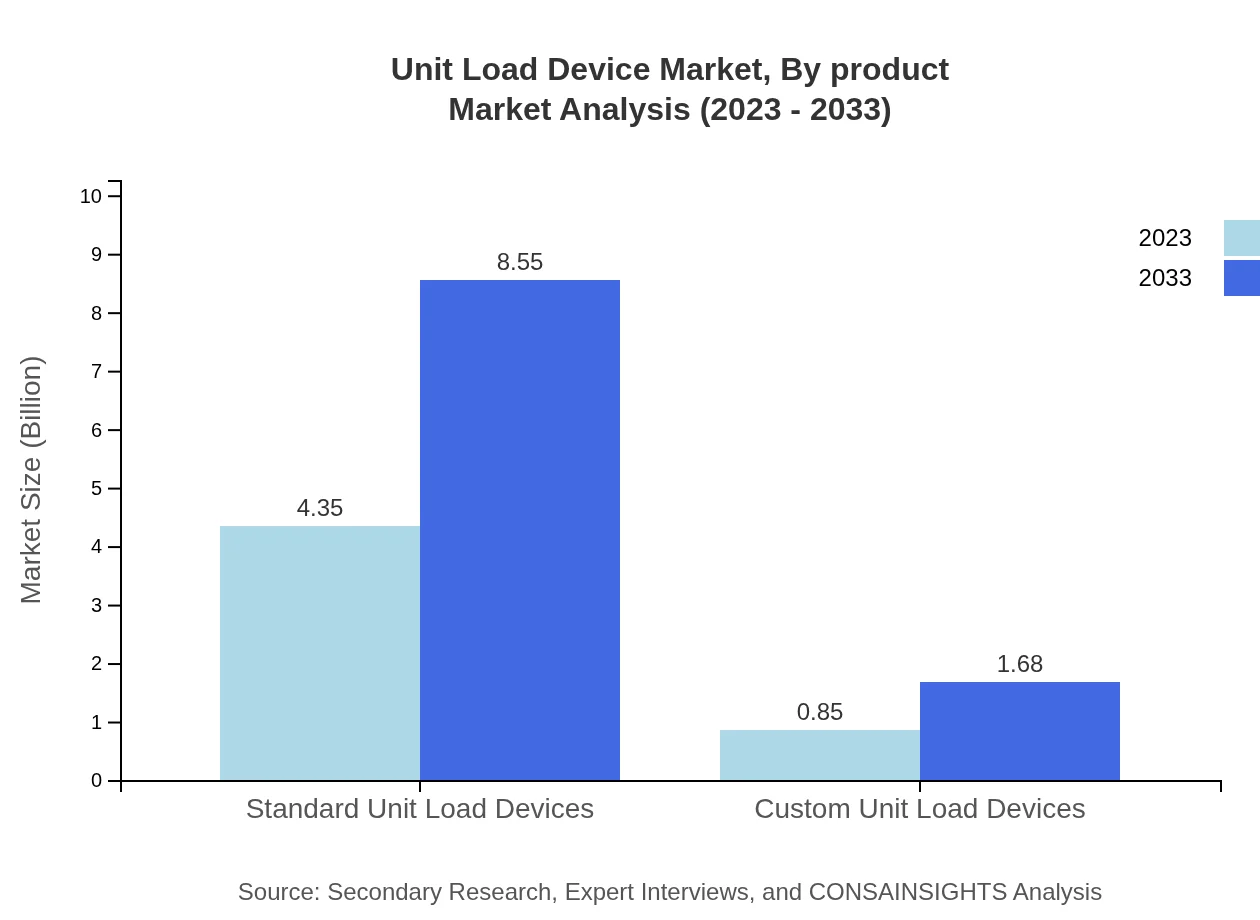

Unit Load Device Market Analysis By Product

In the product segment, the standard ULDs dominate the market with a projected market size of $4.35 billion in 2023, increasing to $8.55 billion by 2033. In contrast, custom ULDs, while smaller, are expected to see a substantial increase from $0.85 billion to $1.68 billion over the same period.

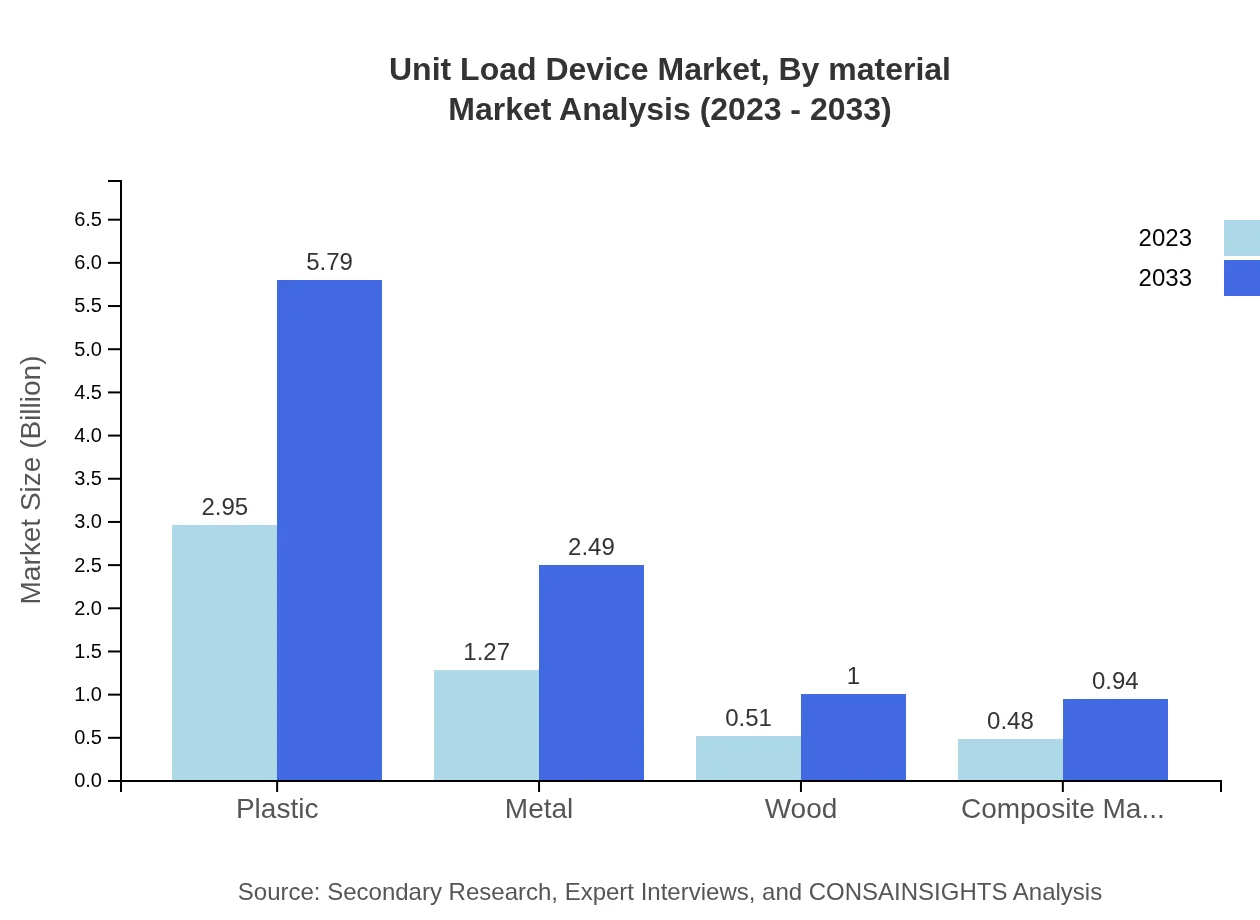

Unit Load Device Market Analysis By Material

Plastic ULDs, holding a market share of 56.68% in 2023, are projected to grow significantly to $5.79 billion by 2033, while metal ULDs will maintain a stable share from $1.27 billion to $2.49 billion, highlighting the ongoing shift towards lightweight materials in logistics.

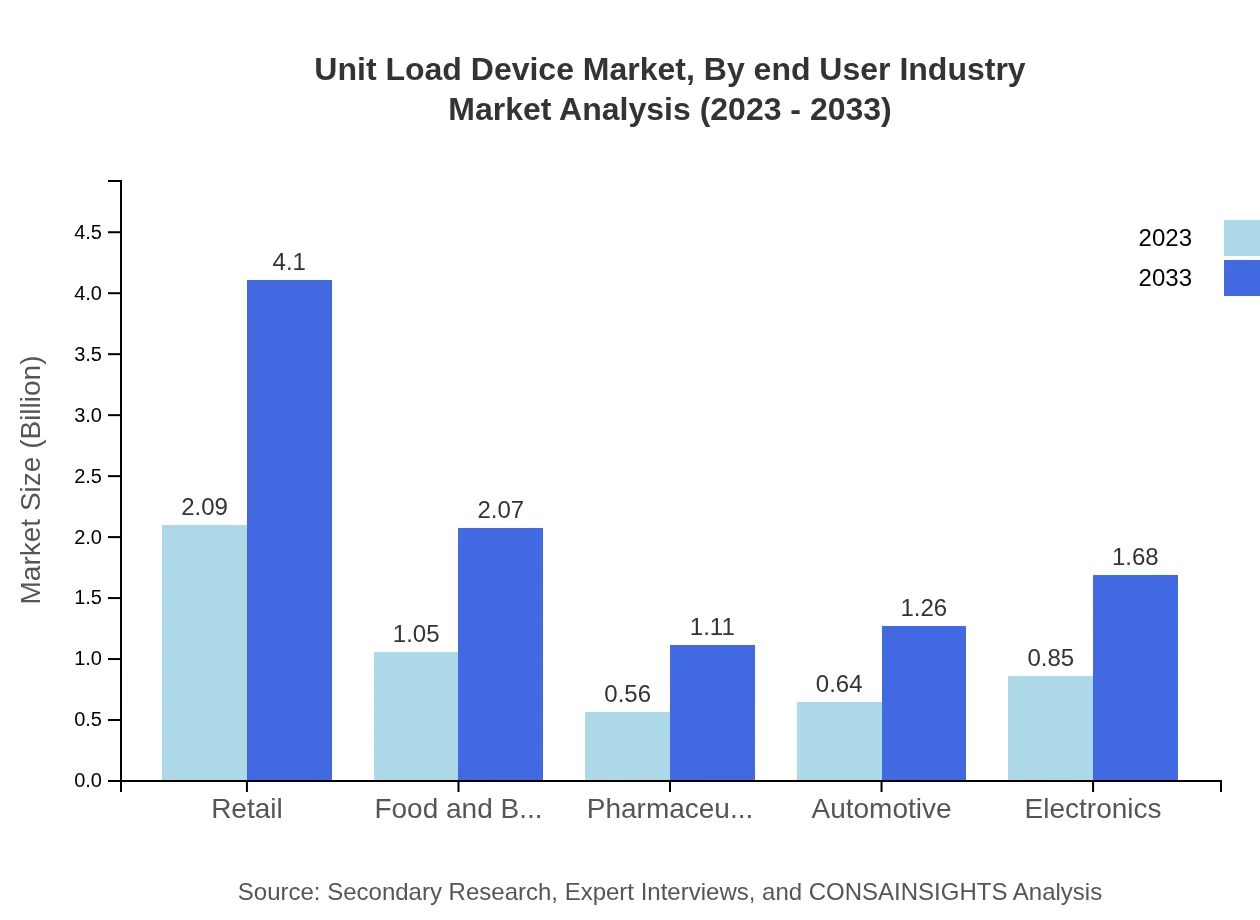

Unit Load Device Market Analysis By End User Industry

The retail sector represents a significant portion of the ULD market, expected to grow from $2.09 billion in 2023 to $4.10 billion by 2033. Other industries like pharmaceuticals and food & beverage are also witnessing notable growth, with respective market sizes projected to increase significantly in the coming decade.

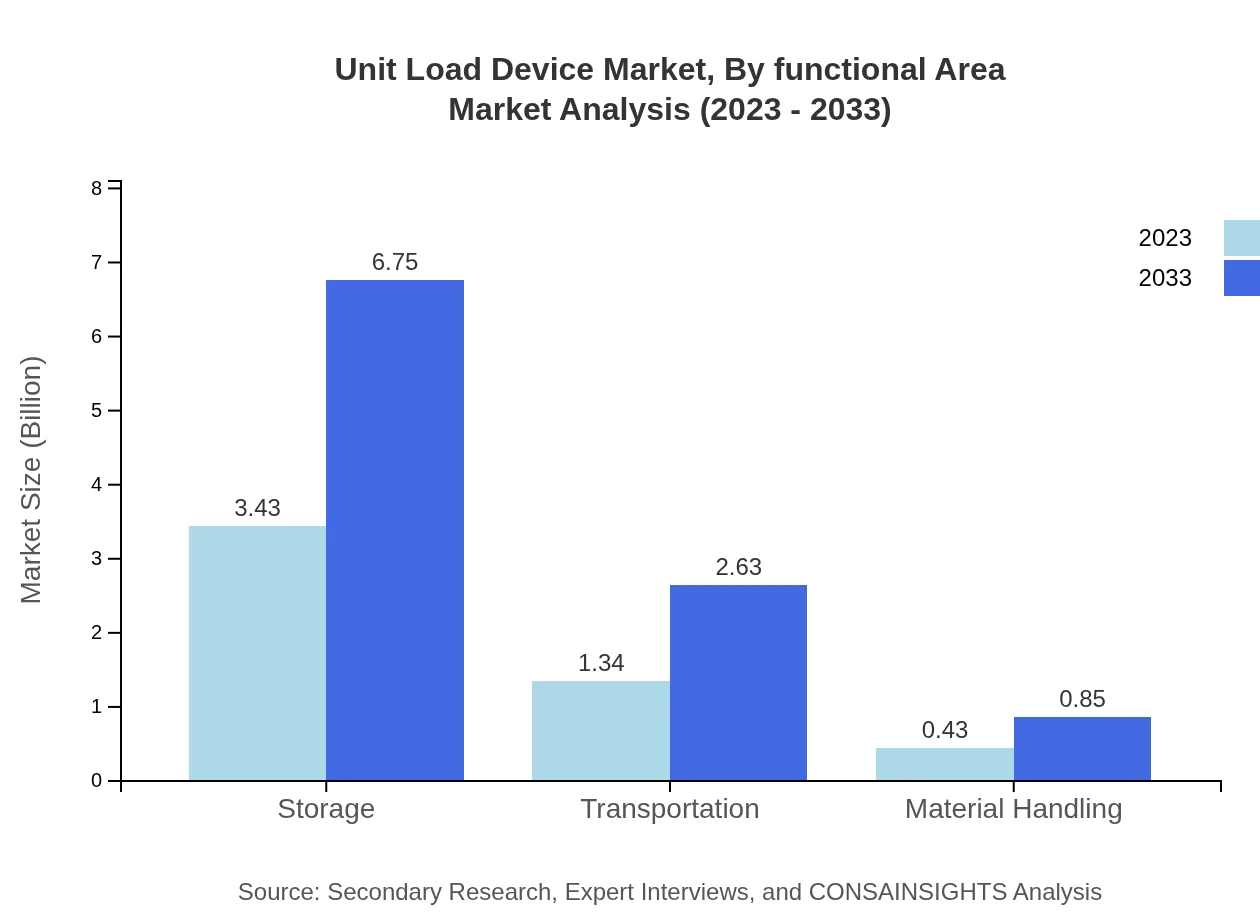

Unit Load Device Market Analysis By Functional Area

The storage segment dominates the functional area market, with a projected size of $3.43 billion in 2023, growing to $6.75 billion by 2033. Transportation and material handling also play critical roles, reflecting their importance in logistics operations.

Unit Load Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unit Load Device Industry

Collins Aerospace:

A leading player in aerospace and defense, Collins Aerospace specializes in innovative ULD solutions, enhancing cargo management and efficiency in the air transport sector.AeroSafe Global:

Known for its temperature-controlled ULDs, AeroSafe Global focuses on specialized needs in the pharmaceutical and food sectors, contributing to safe and reliable logistics.Vaayu Aerospace:

Vaayu Aerospace provides advanced ULD designs employing sustainable materials, positioned strongly in the growing demand for environmentally-friendly transport solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of unit Load Device?

The global Unit Load Device market size is projected to reach approximately $5.2 billion by 2033, growing at a CAGR of 6.8% from 2023. This reflects a robust demand driven by the increasing need for standardized and efficient cargo management.

What are the key market players or companies in this unit Load Device industry?

Key players in the Unit Load Device market include major manufacturers like Zodiac Aerospace, HAECO, and Nordisk Aviation Products. These companies are instrumental in developing innovative solutions aimed at enhancing logistics and cargo efficiency.

What are the primary factors driving the growth in the unit Load Device industry?

Growth in the Unit Load Device industry is driven by rising air cargo traffic, the demand for lightweight and durable materials, and increased automation in logistics processes, facilitating faster shipping and handling services.

Which region is the fastest Growing in the unit Load Device market?

The fastest-growing region in the Unit Load Device market is North America, with market growth projected from $2.01 billion in 2023 to $3.95 billion by 2033, showcasing a strong demand for efficient air cargo transport solutions.

Does ConsaInsights provide customized market report data for the unit Load Device industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the unit-load-device industry, providing insights that cater to unique requirements and market focus.

What deliverables can I expect from this unit Load Device market research project?

Deliverables from this Unit Load Device market research project typically include detailed market analysis reports, growth forecasts, competitive landscape assessments, and insights on key trends and consumer behaviors.

What are the market trends of unit Load Device?

Current trends in the Unit Load Device market include a shift towards sustainability with the use of eco-friendly materials, advancements in cargo technology for better tracking, and increased collaborations between logistics firms and manufacturers.