Universal Flash Storage Market Report

Published Date: 31 January 2026 | Report Code: universal-flash-storage

Universal Flash Storage Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Universal Flash Storage market from 2023 to 2033, including market size, growth forecasts, regional insights, and technology trends. It aims to inform stakeholders about potential opportunities and challenges in this rapidly evolving sector.

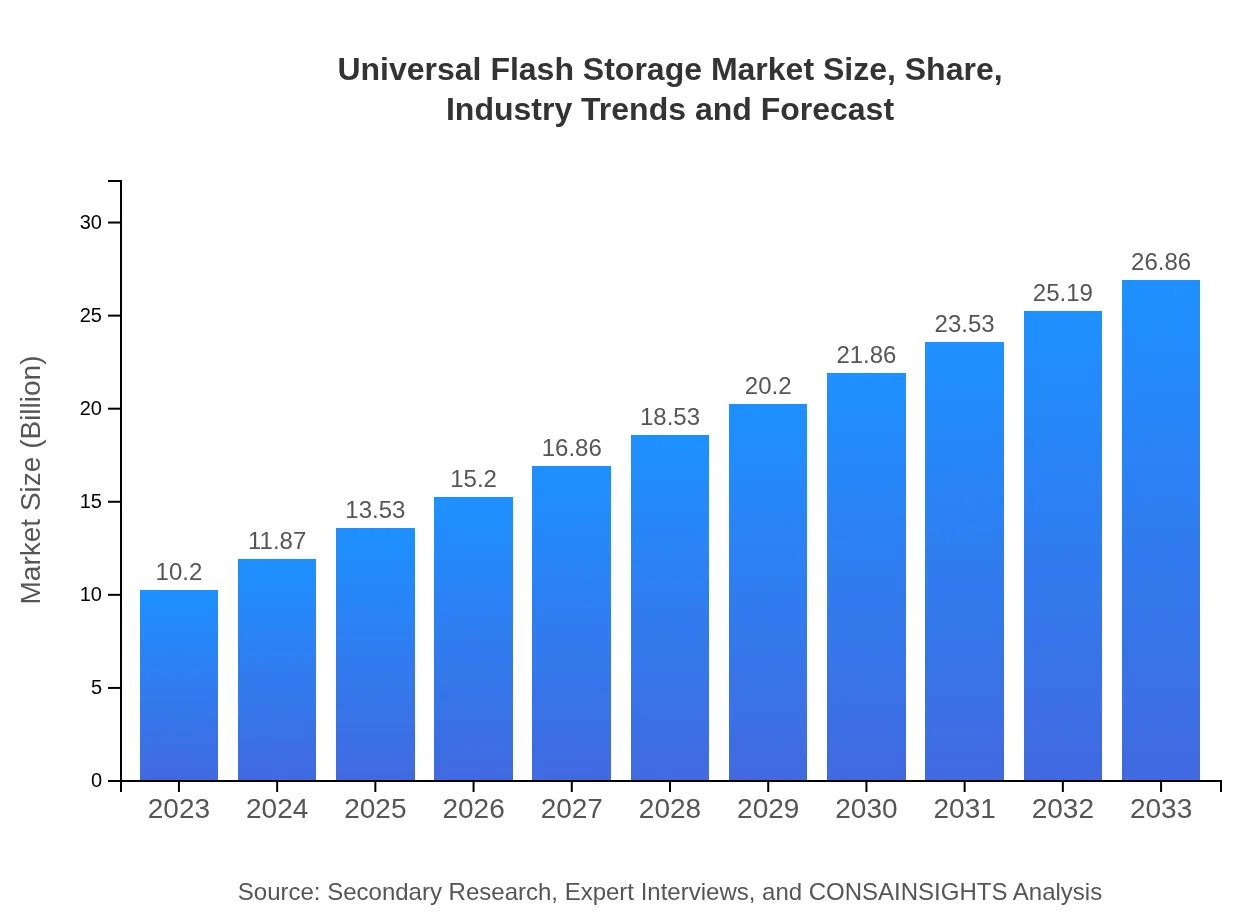

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.20 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $26.86 Billion |

| Top Companies | Samsung Electronics, Western Digital Corporation, Toshiba Corporation, SK Hynix |

| Last Modified Date | 31 January 2026 |

Universal Flash Storage Market Overview

Customize Universal Flash Storage Market Report market research report

- ✔ Get in-depth analysis of Universal Flash Storage market size, growth, and forecasts.

- ✔ Understand Universal Flash Storage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Universal Flash Storage

What is the Market Size & CAGR of Universal Flash Storage market in 2023?

Universal Flash Storage Industry Analysis

Universal Flash Storage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Universal Flash Storage Market Analysis Report by Region

Europe Universal Flash Storage Market Report:

The European market for UFS stood at USD 3.22 billion in 2023 and is anticipated to grow to USD 8.48 billion by 2033. Adoption of advanced automotive technologies and significant contributions from major electronics manufacturers bolster growth in this region.Asia Pacific Universal Flash Storage Market Report:

In 2023, the Asia Pacific region accounted for a market size of USD 1.85 billion, which is projected to grow to USD 4.86 billion by 2033. The region's rapid technological advancements and a strong base of electronics manufacturers drive this growth, coupled with increasing demand for smartphones and IoT devices.North America Universal Flash Storage Market Report:

North America remains a significant market for UFS, with a size of USD 3.65 billion forecasted to expand to USD 9.62 billion by 2033. The region benefits from robust investments in tech innovations, increased digitalization, and a high demand for data-intensive applications.South America Universal Flash Storage Market Report:

South America is expected to see considerable growth in the UFS market, with a current size of USD 0.59 billion projected to reach USD 1.55 billion by 2033. The growing tech infrastructure and rising smartphone penetration are key drivers, despite economic challenges in the region.Middle East & Africa Universal Flash Storage Market Report:

The Middle East and Africa region is expected to experience growth from a market size of USD 0.89 billion in 2023 to USD 2.35 billion by 2033. The expanding telecommunications sector and rising demand for consumer electronics are primary growth drivers.Tell us your focus area and get a customized research report.

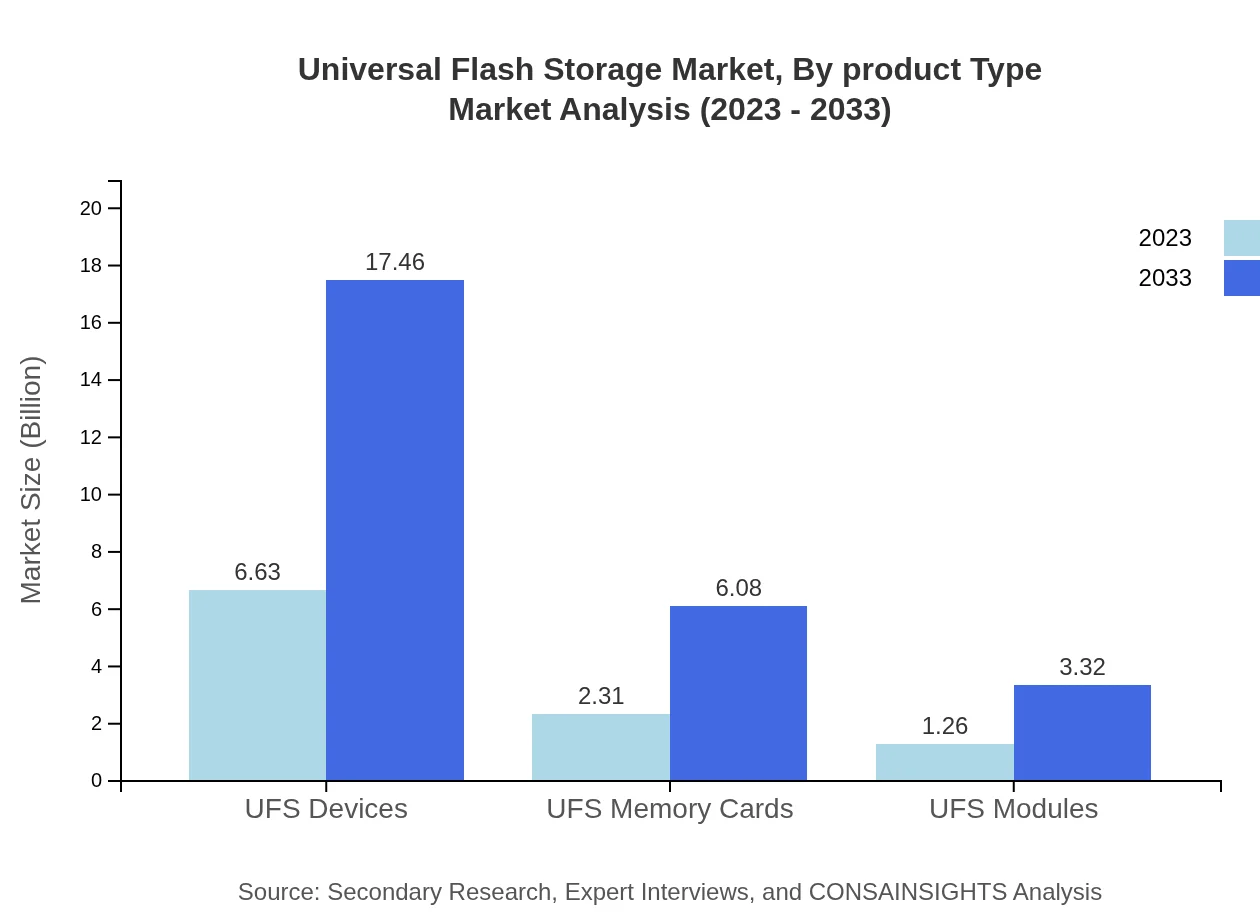

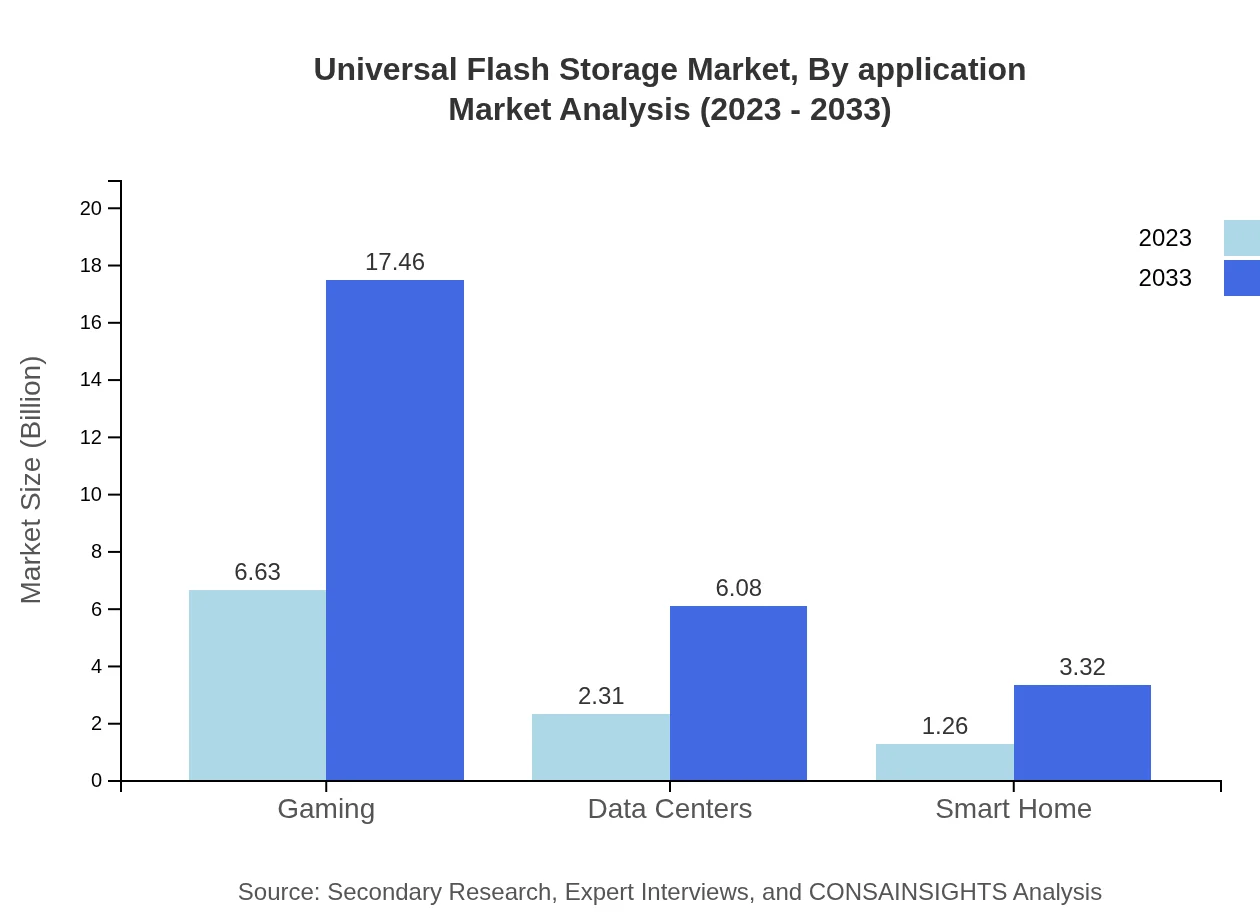

Universal Flash Storage Market Analysis By Product Type

UFS 2.0 was valued at USD 6.63 billion in 2023, projected to reach USD 17.46 billion by 2033, holding a 65% market share. UFS 3.0, with a market size of USD 2.31 billion in 2023, is expected to grow to USD 6.08 billion, maintaining a 22.65% share. UFS 3.1 is also gaining traction, expanding from USD 1.26 billion in 2023 to USD 3.32 billion, accounting for 12.35% of the market.

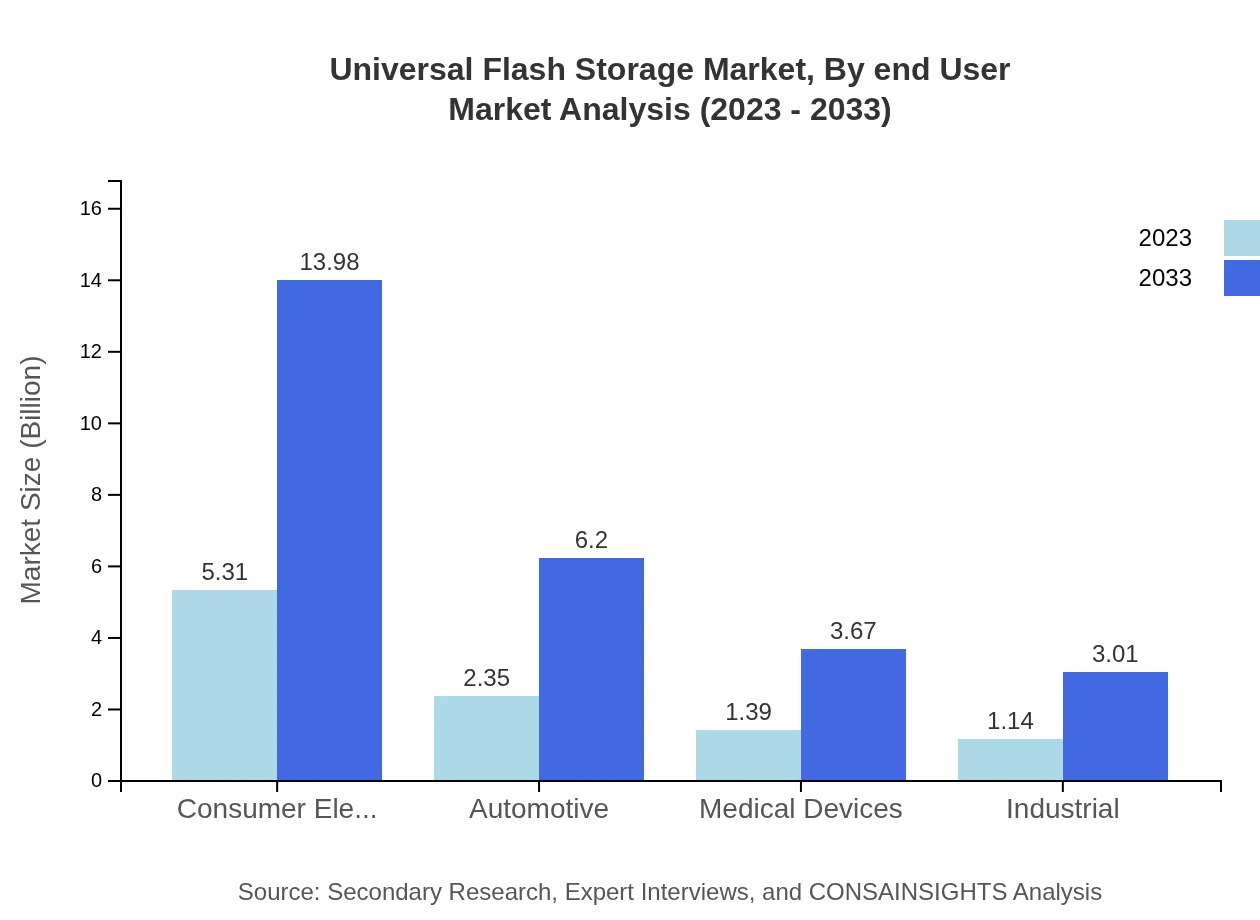

Universal Flash Storage Market Analysis By End User

The consumer electronics segment dominates the UFS market, valued at USD 5.31 billion in 2023, projected to grow to USD 13.98 billion by 2033, maintaining a 52.04% market share. The automotive segment will also expand significantly from USD 2.35 billion in 2023 to USD 6.20 billion, with a 23.08% market share, while the medical devices segment will increase from USD 1.39 billion to USD 3.67 billion, holding 13.66% of the market.

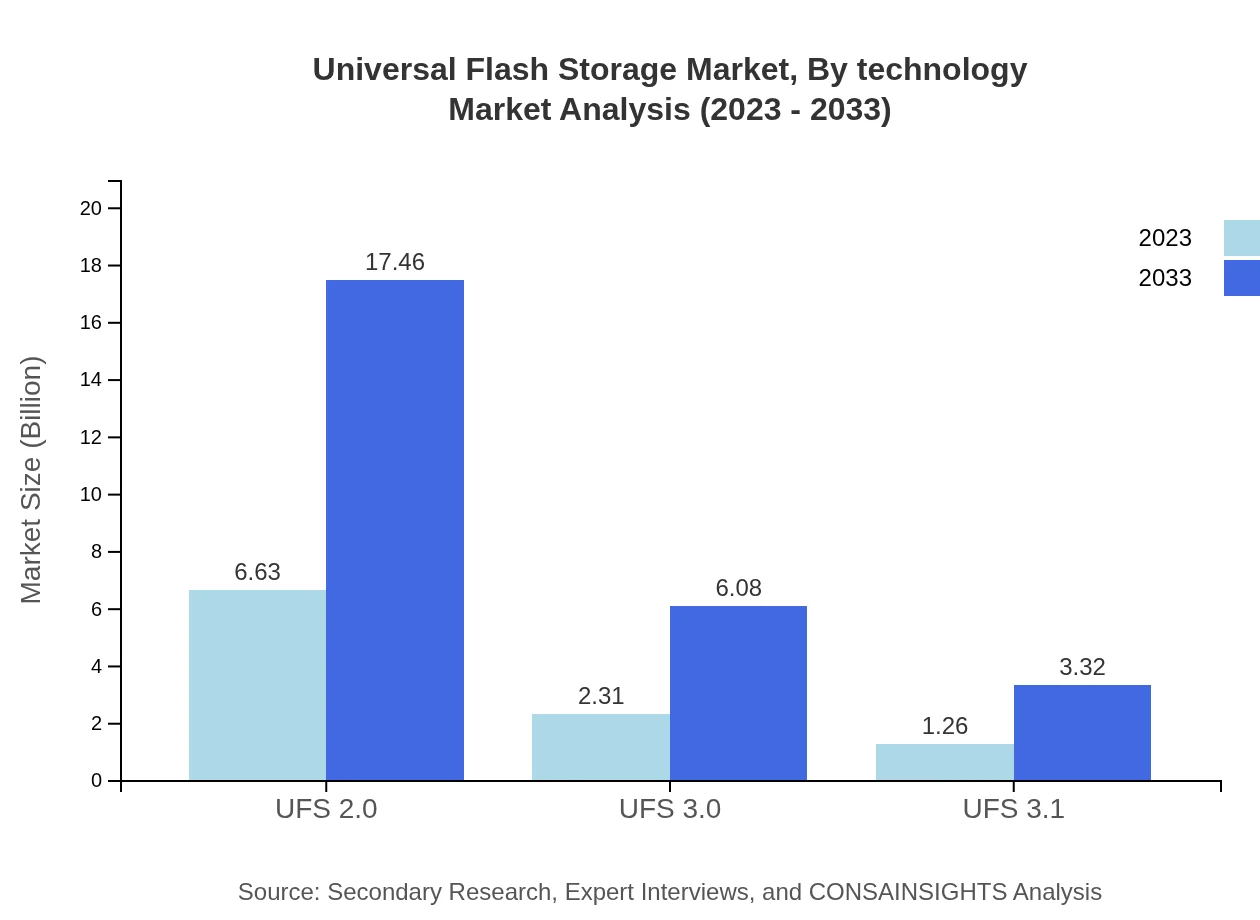

Universal Flash Storage Market Analysis By Technology

UFS technology continues to evolve, with UFS 3.1 emerging as the latest standard enhancing performance and efficiency. Innovations such as multi-threading and improved data management features are boosting overall market appeal. The integration of UFS in next-gen computing devices, 5G networks, and AI applications is anticipated to drive growth and innovation in the coming decade.

Universal Flash Storage Market Analysis By Application

Key applications of UFS technology span consumer electronics, automotive, gaming, data centers, smart home devices, and medical devices. In particular, gaming applications will continue to grow due to increasing demand for high-speed storage solutions, with the gaming sector forecast to increase from USD 6.63 billion in 2023 to USD 17.46 billion by 2033, representing a 65% market share.

Universal Flash Storage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Universal Flash Storage Industry

Samsung Electronics:

Samsung is a global leader in UFS technology, producing high-performance memory solutions for consumer electronics and automotive applications while investing significantly in R&D for next-gen storage technologies.Western Digital Corporation:

Known for its innovative storage solutions, Western Digital expands its portfolio in the UFS market, focusing on high-capacity memory for mobile devices and data centers.Toshiba Corporation:

Toshiba plays a crucial role in the UFS market, developing advanced storage solutions that address the increasing needs of electronic devices and automotive sectors.SK Hynix:

SK Hynix is a leading memory chip producer, extensively involved in the UFS segment, known for its cutting-edge technology and high-speed memory solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of universal Flash Storage?

The universal flash storage market size is projected to reach approximately $10.2 billion by 2033, growing at a CAGR of 9.8%. The growth reflects increasing demand for high-speed data storage solutions across consumer electronics, automotive, and industrial sectors.

What are the key market players or companies in this universal Flash Storage industry?

Key players in the universal flash storage industry include Samsung Electronics, Western Digital, SanDisk, Micron Technology, and Toshiba. These companies dominate the market by innovating storage solutions that cater to demands from various sectors such as consumer electronics and automotive.

What are the primary factors driving the growth in the universal Flash Storage industry?

Growth in the universal flash storage industry is driven by factors such as increased demand for high-speed data transfer in consumer electronics, the rise in automotive applications, and the expanding use of UFS technology in mobile devices and gaming consoles.

Which region is the fastest Growing in the universal Flash Storage?

The fastest-growing region in the universal flash storage market is expected to be North America. The market is projected to grow from $3.65 billion in 2023 to $9.62 billion by 2033, reflecting a robust demand across various technological applications.

Does ConsaInsights provide customized market report data for the universal Flash Storage industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the universal flash storage industry. This service ensures clients receive insights relevant to their market requirements, enhancing decision-making processes.

What deliverables can I expect from this universal Flash Storage market research project?

From the universal flash storage market research project, you can expect detailed reports containing market size forecasts, regional analysis, competitive landscape insights, and trend identification, providing a comprehensive overview to inform strategic decisions.

What are the market trends of universal Flash Storage?

Current trends in the universal flash storage market include the rise of UFS 3.1 technology, increasing adoption in gaming and data center applications, and a focus on enhancing data transfer speeds, reflecting the sector's alignment with technological innovation.