Unmanned Composites Market Report

Published Date: 31 January 2026 | Report Code: unmanned-composites

Unmanned Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the unmanned composites market, including market trends, technological advancements, and growth forecasts from 2023 to 2033. It serves as a comprehensive guide for industry stakeholders seeking to navigate this dynamic landscape.

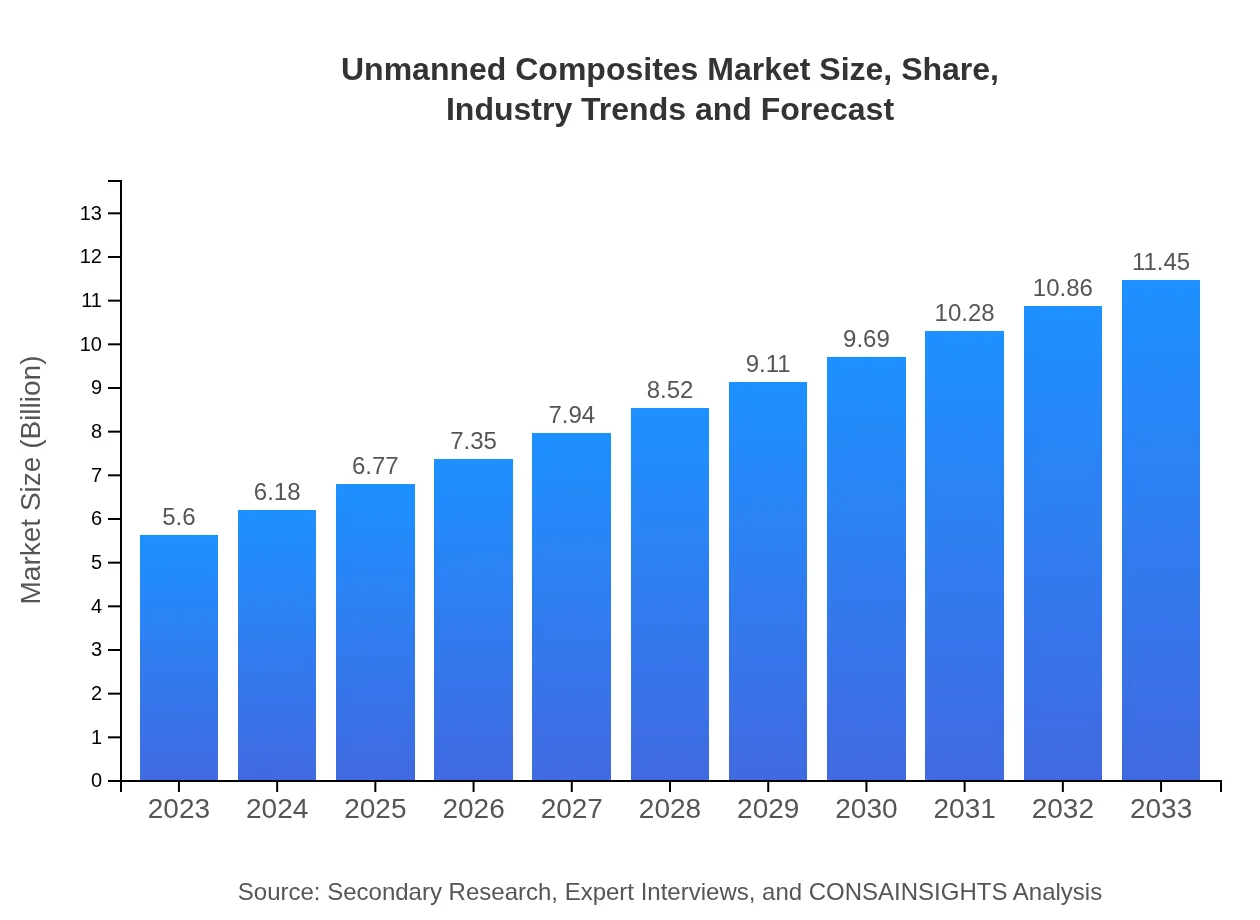

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Hexcel Corporation, Toray Industries, Teijin Limited, Cytec Solvay Group |

| Last Modified Date | 31 January 2026 |

Unmanned Composites Market Overview

Customize Unmanned Composites Market Report market research report

- ✔ Get in-depth analysis of Unmanned Composites market size, growth, and forecasts.

- ✔ Understand Unmanned Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unmanned Composites

What is the Market Size & CAGR of Unmanned Composites market in 2023?

Unmanned Composites Industry Analysis

Unmanned Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unmanned Composites Market Analysis Report by Region

Europe Unmanned Composites Market Report:

Europe's unmanned composites market is estimated at $1.65 billion in 2023, increasing to $3.37 billion by 2033. The presence of several key industry players and increased R&D investment in drone technology are major contributors.Asia Pacific Unmanned Composites Market Report:

The Asia Pacific region is anticipated to grow significantly, with a market size of $1.07 billion in 2023, forecasted to reach $2.19 billion by 2033. This growth is fueled by increasing military spending in countries like China and India, alongside a burgeoning commercial drone market.North America Unmanned Composites Market Report:

The North American market, valued at $2.03 billion in 2023, is expected to grow to $4.15 billion by 2033. The US dominates this market due to significant investment in defense applications and technological advancements.South America Unmanned Composites Market Report:

In South America, the unmanned composites market is projected to grow from $0.26 billion in 2023 to $0.53 billion by 2033. This growth is driven by the rising adoption of UAVs in agricultural practices and environmental monitoring.Middle East & Africa Unmanned Composites Market Report:

In the Middle East and Africa, the market is projected to grow from $0.59 billion in 2023 to $1.21 billion by 2033, supported by increasing defense budgets and the adoption of unmanned technologies in various sectors.Tell us your focus area and get a customized research report.

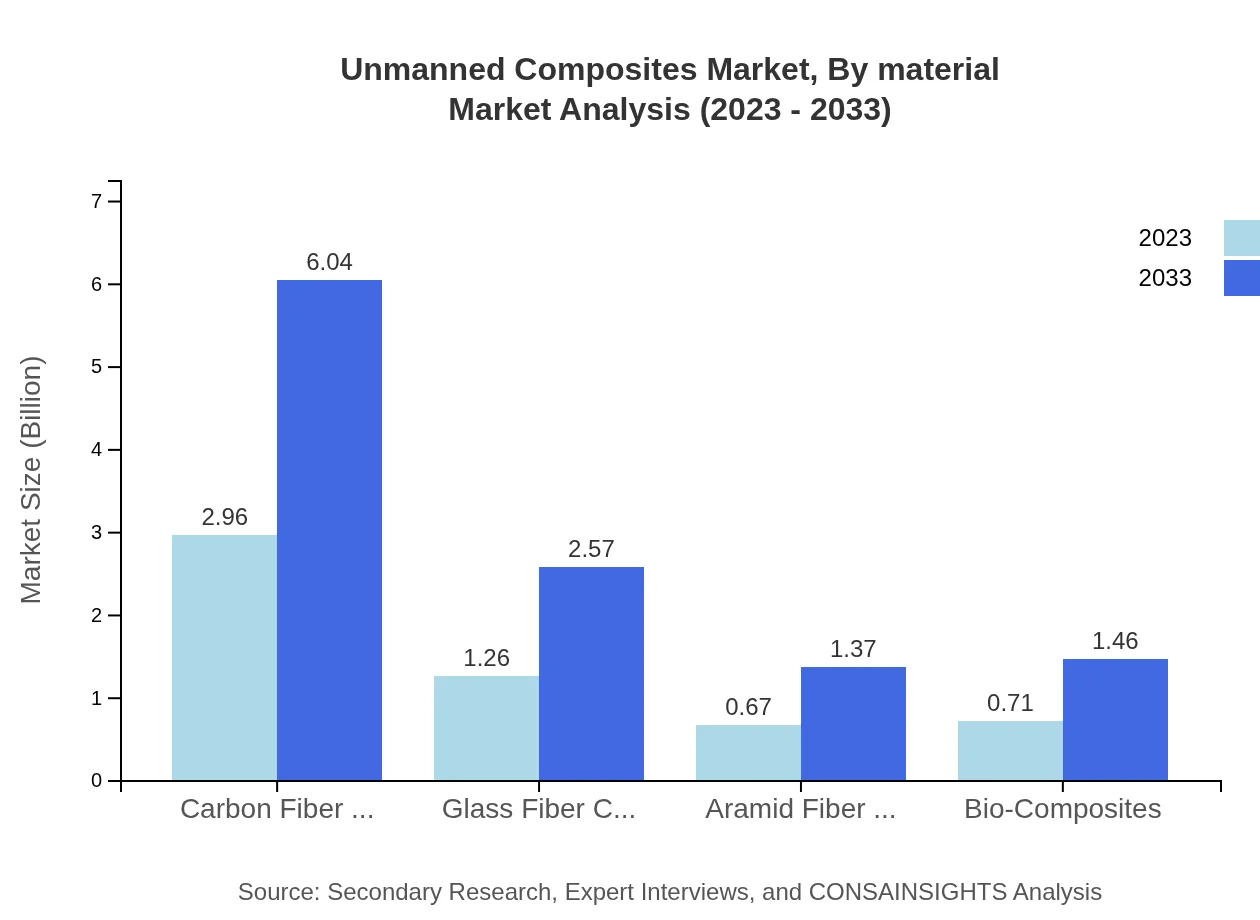

Unmanned Composites Market Analysis By Material

In 2023, carbon fiber composites dominate the unmanned composites market with a size of $2.96 billion, expected to grow to $6.04 billion by 2033. Carbon fiber accounts for 52.79% of the market share due to its superior strength and lightweight properties. Glass fiber, with a 22.48% share, is also significant, valued at $1.26 billion in 2023 and projected to reach $2.57 billion by 2033. Other materials include aramid fiber and bio-composites, which, while smaller in size, are gaining traction due to their unique properties.

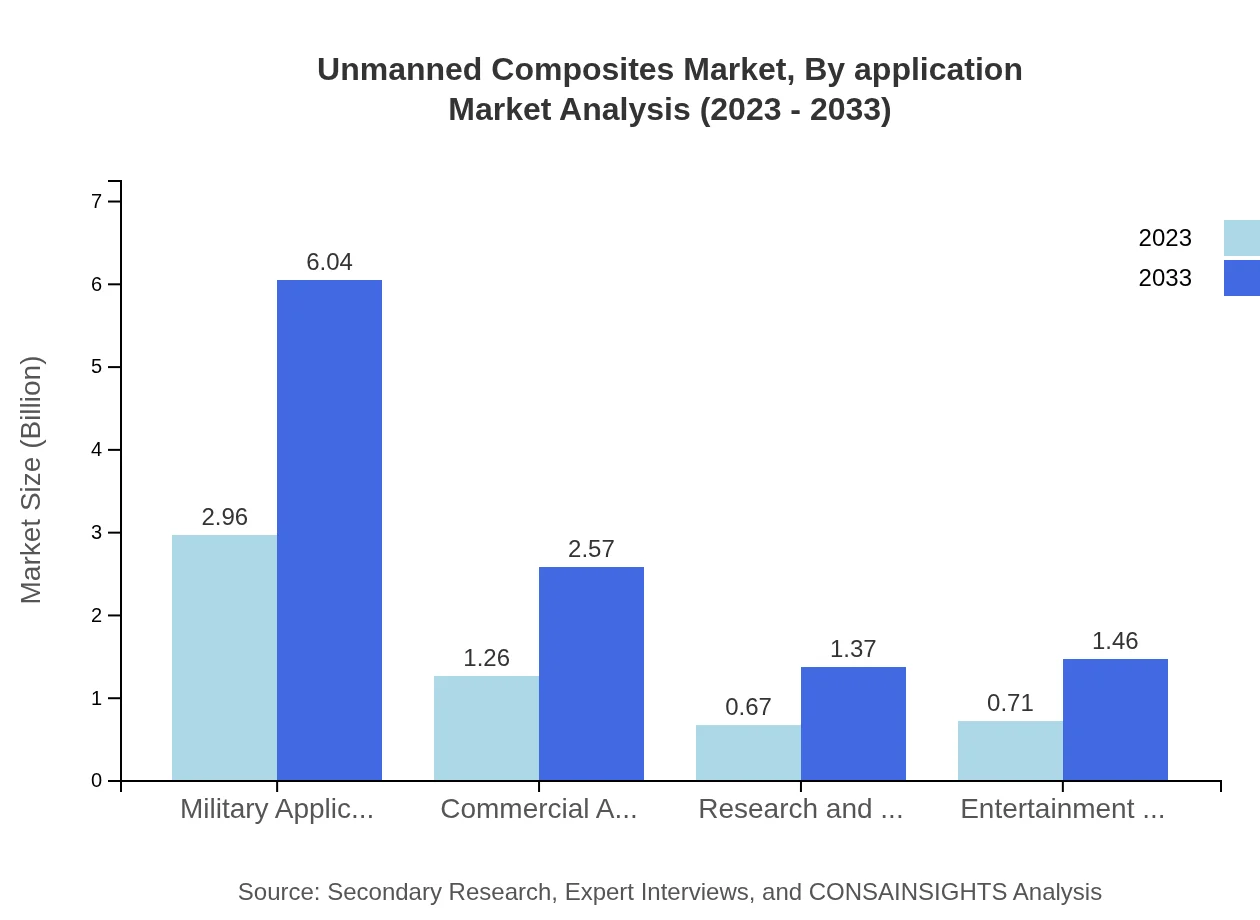

Unmanned Composites Market Analysis By Application

Military applications are forecasted to remain the largest sector, with a market value of $2.96 billion in 2023. This segment holds a 52.79% market share and is expected to grow as defense sectors invest in advanced technologies. Commercial applications, valued at $1.26 billion in 2023 (22.48% share), are rapidly expanding, particularly in logistics and aerial delivery services. Meanwhile, entertainment applications, valued at $0.71 billion with a 12.76% share, are also evolving as drones become common in media production.

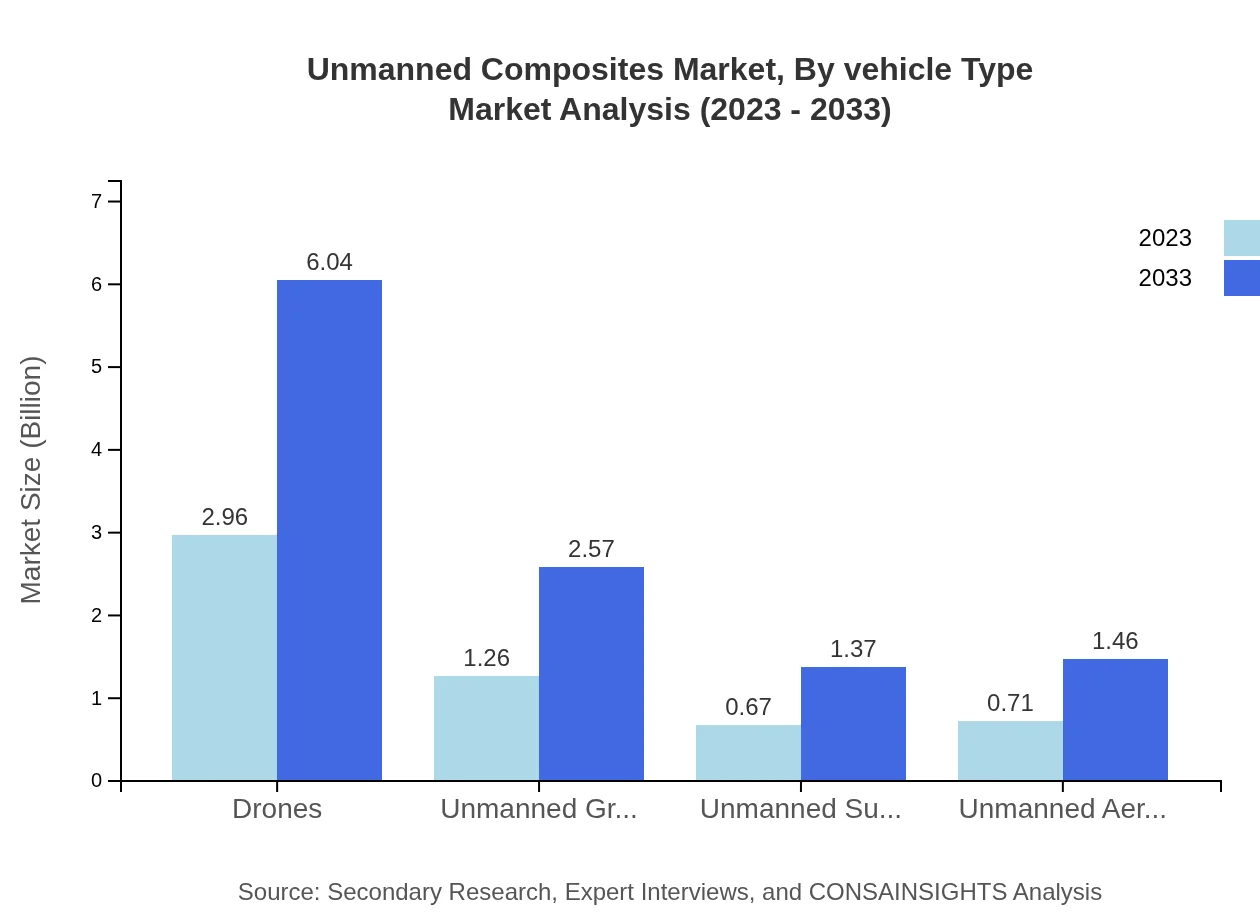

Unmanned Composites Market Analysis By Vehicle Type

The unmanned aerial vehicle market remains a key sub-segment of the unmanned composites landscape, with a market size of $0.71 billion in 2023 and projected to grow to $1.46 billion by 2033. Drones, embodying 52.79% of the market share, showcase robust growth driven by technological innovations. Additionally, unmanned ground and surface vehicles present significant opportunities, valued at $1.26 billion and $0.67 billion respectively, with growth projected in both segments.

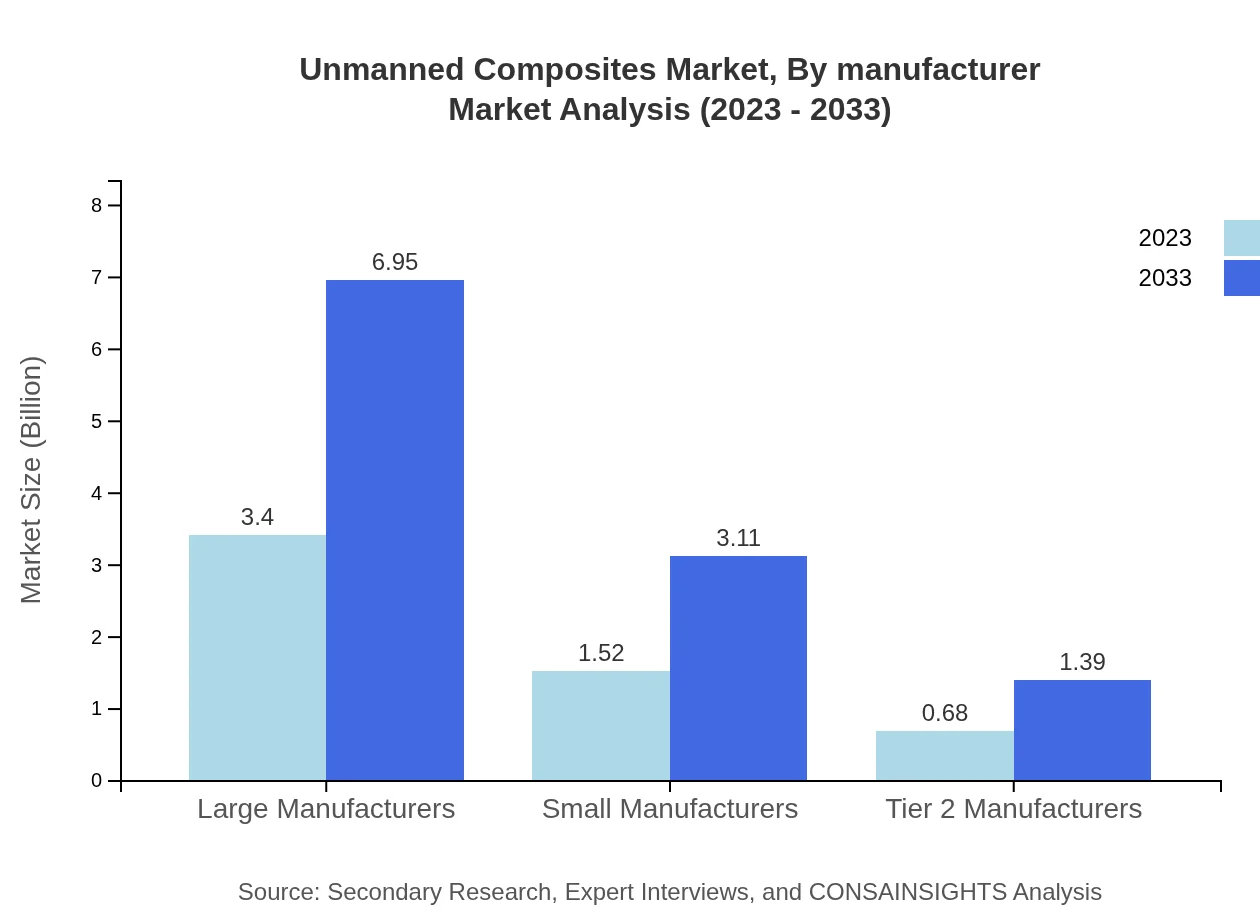

Unmanned Composites Market Analysis By Manufacturer

Large manufacturers command a significant portion of the market, valued at $3.40 billion in 2023, which is expected to increase to $6.95 billion by 2033, capturing 60.7% of the market share. Small manufacturers, while following their own growth trajectory, are expected to grow from $1.52 billion to $3.11 billion, holding a 27.14% share. Tier 2 manufacturers contribute 12.16% to the overall market, showing a specialization in niche applications and tailored composite solutions.

Unmanned Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unmanned Composites Industry

Hexcel Corporation:

A leading manufacturer of advanced composites, Hexcel specializes in innovative materials that meet the demanding requirements of the unmanned systems market across aerospace and defense.Toray Industries:

A major player in the fibers and textiles sector, Toray produces high-performance carbon fiber composites utilized in various unmanned applications, enhancing structural integrity and reducing weight.Teijin Limited:

Teijin is recognized for its development of advanced composites, particularly in the aerospace industry. Their innovations are pivotal for the growth of unmanned systems, focusing on lightweight and high-strength solutions.Cytec Solvay Group:

A global leader in specialty chemicals and advanced materials, Cytec plays a crucial role in producing composite materials that cater to the needs of the unmanned composites sector.We're grateful to work with incredible clients.

FAQs

What is the market size of unmanned Composites?

The unmanned composites market is projected to reach a size of $5.6 billion by 2033, growing at a CAGR of 7.2% from 2023. This growth reflects the increasing adoption of composite materials in the unmanned systems industry.

What are the key market players or companies in this unmanned Composites industry?

Key players in the unmanned composites market include major manufacturers specializing in advanced materials, such as Toray Industries, Hexcel Corporation, and Teijin Limited. These companies are at the forefront of innovation and development in composite technologies.

What are the primary factors driving the growth in the unmanned Composites industry?

Growth in the unmanned composites industry is driven by the rising demand for lightweight materials in aerospace, military applications, and advancements in composite manufacturing technologies, contributing significantly to performance enhancements and cost reductions.

Which region is the fastest Growing in the unmanned Composites?

The fastest-growing region in the unmanned composites market is North America, projected to grow from $2.03 billion in 2023 to $4.15 billion by 2033. This region benefits from significant investments in military Unmanned Aerial Vehicles (UAVs) and drone technology.

Does ConsaInsights provide customized market report data for the unmanned Composites industry?

Yes, Consainsights offers customized market report data tailored specifically for the unmanned composites industry. Clients can request detailed insights and analysis based on unique requirements to inform strategic decisions.

What deliverables can I expect from this unmanned Composites market research project?

Deliverables from the unmanned composites market research project typically include a comprehensive report, market size forecasts, trend analyses, competitive landscape assessments, and actionable insights specific to the unmanned composites sector.

What are the market trends of unmanned Composites?

Current trends in the unmanned composites market include increased reliance on carbon fiber composites, which hold a 52.79% market share. Additionally, there is a growing interest in bio-composites and advancements aimed at enhancing sustainability in manufacturing practices.