Unmanned Traffic Management Market Report

Published Date: 03 February 2026 | Report Code: unmanned-traffic-management

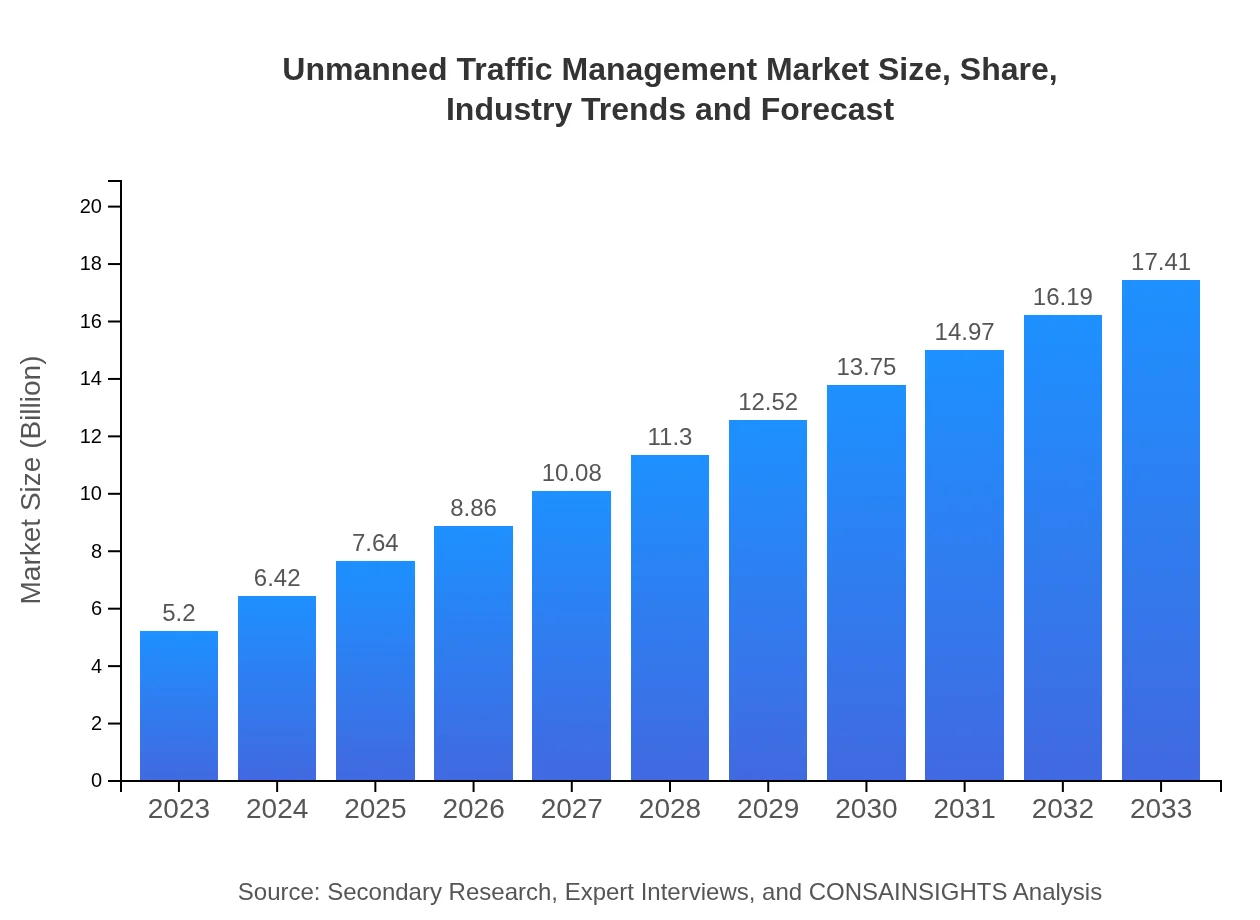

Unmanned Traffic Management Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report offers an in-depth analysis of the Unmanned Traffic Management industry, including market size forecasts and trends from 2023 to 2033. Insights cover critical market dynamics, segmentation, regional analysis, major players, and future trends.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $17.41 Billion |

| Top Companies | AirMap, Utopus Insights, Altitude Angel, Skyward, Unifly |

| Last Modified Date | 03 February 2026 |

Unmanned Traffic Management Market Overview

Customize Unmanned Traffic Management Market Report market research report

- ✔ Get in-depth analysis of Unmanned Traffic Management market size, growth, and forecasts.

- ✔ Understand Unmanned Traffic Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Unmanned Traffic Management

What is the Market Size & CAGR of Unmanned Traffic Management market in 2023?

Unmanned Traffic Management Industry Analysis

Unmanned Traffic Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Unmanned Traffic Management Market Analysis Report by Region

Europe Unmanned Traffic Management Market Report:

Europe's Unmanned Traffic Management market is expected to flourish, rising from $1.45 billion in 2023 to $4.84 billion by 2033, at a CAGR of 13.19%. European nations are increasingly investing in regulating drone operations, thereby enhancing their UTM capabilities within urban and rural infrastructures.Asia Pacific Unmanned Traffic Management Market Report:

The Asia Pacific region is experiencing a heightened demand for Unmanned Traffic Management solutions, primarily driven by the rapid adoption of drones in countries like China and India. In 2023, the market size is projected at $1.05 billion and is expected to reach $3.51 billion by 2033, signifying a CAGR of 13.14%. A growing e-commerce sector and air delivery services are crucial to this growth trajectory.North America Unmanned Traffic Management Market Report:

North America stands as a leader in the UTM market, driven by extensive regulatory frameworks and technological advancements. The market was valued at $1.68 billion in 2023 and is predicted to grow to $5.64 billion by 2033, indicating a CAGR of 13.23%. The emphasis on goods delivery and public safety applications is fueling this growth.South America Unmanned Traffic Management Market Report:

In South America, the UTM market is still in its nascent stages but is projected to expand rapidly. With a market size of $0.38 billion in 2023, it is expected to increase to $1.27 billion by 2033, showing a CAGR of 13.14%. The agricultural sector significantly contributes to drone adoption and subsequent UTM developments.Middle East & Africa Unmanned Traffic Management Market Report:

The Middle East and Africa region is witnessing a gradual uptake of UTM systems, with a projected market size of $0.64 billion in 2023 and growth expected to $2.14 billion by 2033, reflecting a CAGR of 13.18%. The region's interest is mainly observed in surveillance and security applications facilitated by drone technologies.Tell us your focus area and get a customized research report.

Unmanned Traffic Management Market Analysis Government

Global Unmanned Traffic Management Market, By Government (2023 - 2033)

The government segment accounts for a market size of $2.90 billion in 2023 and is expected to grow to $9.72 billion by 2033. Governments play a critical governance role in developing and enforcing policies regulating drone usage.

Unmanned Traffic Management Market Analysis Military

Global Unmanned Traffic Management Market, By Military (2023 - 2033)

The military segment is projected to grow from $1.28 billion in 2023 to $4.29 billion by 2033. Applications in surveillance, reconnaissance, and logistical operations enhance military capabilities.

Unmanned Traffic Management Market Analysis Commercial

Global Unmanned Traffic Management Market, By Commercial (2023 - 2033)

Projected to expand from $0.51 billion in 2023 to $1.70 billion by 2033, this segment represents growing investments in commercial drone services for applications such as delivery and inspection.

Unmanned Traffic Management Market Analysis Individuals

Global Unmanned Traffic Management Market, By Individuals (2023 - 2033)

With a size of $0.51 billion in 2023 and expected growth to $1.69 billion by 2033, this sector involves private drone users for recreational and personal uses.

Unmanned Traffic Management Market Analysis Drones

Global Unmanned Traffic Management Market, By Drones (2023 - 2033)

The drone segment represents the largest share, moving from $3.44 billion in 2023 to an impressive $11.53 billion by 2033. This growth underscores the reliance on drones across various sectors.

Unmanned Traffic Management Market Analysis Software_solutions

Global Unmanned Traffic Management Market, By Software Solutions (2023 - 2033)

This segment is set to grow from $1.31 billion in 2023 to $4.37 billion by 2033, reflecting advancements in software technologies enhancing UTM systems.

Unmanned Traffic Management Market Analysis Sensors

Global Unmanned Traffic Management Market, By Sensors (2023 - 2033)

Sensors in this market category, valued at $0.45 billion in 2023, are projected to expand to $1.51 billion by 2033, critical for data collection and situational awareness.

Unmanned Traffic Management Market Analysis Public_safety

Global Unmanned Traffic Management Market, By Public Safety (2023 - 2033)

Rapid growth in this segment from $2.90 billion in 2023 to $9.72 billion by 2033 underlines the increasing use of drones for emergency and safety applications.

Unmanned Traffic Management Market Analysis Logistics

Global Unmanned Traffic Management Market, By Logistics (2023 - 2033)

Expected to grow from $1.28 billion in 2023 to $4.29 billion by 2033, this segment showcases the role of drones in delivering goods and services effectively.

Unmanned Traffic Management Market Analysis Agriculture

Global Unmanned Traffic Management Market, By Agriculture (2023 - 2033)

The agricultural segment is projected to grow from $0.51 billion in 2023 to $1.70 billion by 2033, driven by the adoption of drone technologies in farming practices.

Unmanned Traffic Management Market Analysis Centralized_architecture

Global Unmanned Traffic Management Market, By Centralized Architecture (2023 - 2033)

Centralized UTM architecture is prevalent, indicating a size of $4.36 billion in 2023, expected to grow to $14.61 billion by 2033, focusing on collaborative management of airspace.

Unmanned Traffic Management Market Analysis Decentralized_architecture

Global Unmanned Traffic Management Market, By Decentralized Architecture (2023 - 2033)

Projecting growth from $0.84 billion in 2023 to $2.80 billion by 2033 shows the rise of decentralized management approaches in UTM.

Unmanned Traffic Management Market Analysis Urban_infrastructure

Global Unmanned Traffic Management Market, By Urban Infrastructure (2023 - 2033)

Urban infrastructure needs are massively growing, forecasting an increase from $3.44 billion in 2023 to $11.53 billion by 2033.

Unmanned Traffic Management Market Analysis Rural_infrastructure

Global Unmanned Traffic Management Market, By Rural Infrastructure (2023 - 2033)

This segment is growing from $1.31 billion in 2023 to $4.37 billion by 2033. It highlights the need for integrating drones into rural plans and installation.

Unmanned Traffic Management Market Analysis Recreational_infrastructure

Global Unmanned Traffic Management Market, By Recreational Infrastructure (2023 - 2033)

Projected to grow from $0.45 billion in 2023 to $1.51 billion by 2033, this segment recognizes increasing interest in recreational drone uses.

Unmanned Traffic Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Unmanned Traffic Management Industry

AirMap:

AirMap provides airspace management software for drones, enhancing situational awareness and operational safety.Utopus Insights:

Utopus Insights focuses on data analytics for smart grid and UAV applications, improving operational efficiency.Altitude Angel:

Altitude Angel provides advanced UTM technology and services for safe integration of drones into controlled airspace.Skyward:

Skyward, a Verizon company, offers comprehensive UTM solutions that emphasize drone regulation and pilot management.Unifly:

Unifly offers UTM solutions enabling safe integration of drones into existing airspace management systems.We're grateful to work with incredible clients.

FAQs

What is the market size of unmanned Traffic Management?

The unmanned traffic management market is estimated to reach $5.2 billion by 2033, growing at a CAGR of 12.3%. This significant growth reflects increasing demand for advanced traffic solutions across various sectors, ensuring optimized traffic flow and safety.

What are the key market players or companies in the unmanned Traffic Management industry?

Key players in the unmanned traffic management market include leading technology firms and drone manufacturers. They focus on developing innovative software, sensor technology, and solutions that enhance traffic management and compliance with regulatory standards to facilitate efficient aerial traffic.

What are the primary factors driving the growth in the unmanned Traffic Management industry?

Key growth drivers for the unmanned traffic management market include rapid urbanization, increased drone usage for logistics, advancements in sensor technologies, and government initiatives to implement smart city solutions that focus on safety and efficiency in traffic management systems.

Which region is the fastest Growing in the unmanned Traffic Management?

Asia-Pacific is the fastest-growing region in the unmanned traffic management market, projected to reach $3.51 billion by 2033. Europe and North America will also see notable growth, with projected markets of $4.84 billion and $5.64 billion respectively in the same timeframe.

Does ConsaInsights provide customized market report data for the unmanned Traffic Management industry?

Yes, ConsaInsights offers customized market report data for the unmanned traffic management industry. Clients can request specific insights tailored to their needs, ensuring comprehensive and actionable intelligence that supports strategic decision-making and market positioning.

What deliverables can I expect from this unmanned Traffic Management market research project?

Deliverables from this market research project include detailed market analysis, segmentation data, competitor insights, growth forecasts, and strategic recommendations. These insights facilitate informed decision-making and strategic planning in the rapidly evolving unmanned traffic management landscape.

What are the market trends of unmanned Traffic Management?

Current trends in the unmanned traffic management market include increased adoption of drone technology, rapid advancements in AI and machine learning for traffic prediction, and emphasis on regulatory compliance. Collaboration between technology providers and city planners is also becoming vital for effective implementation.